Key Insights

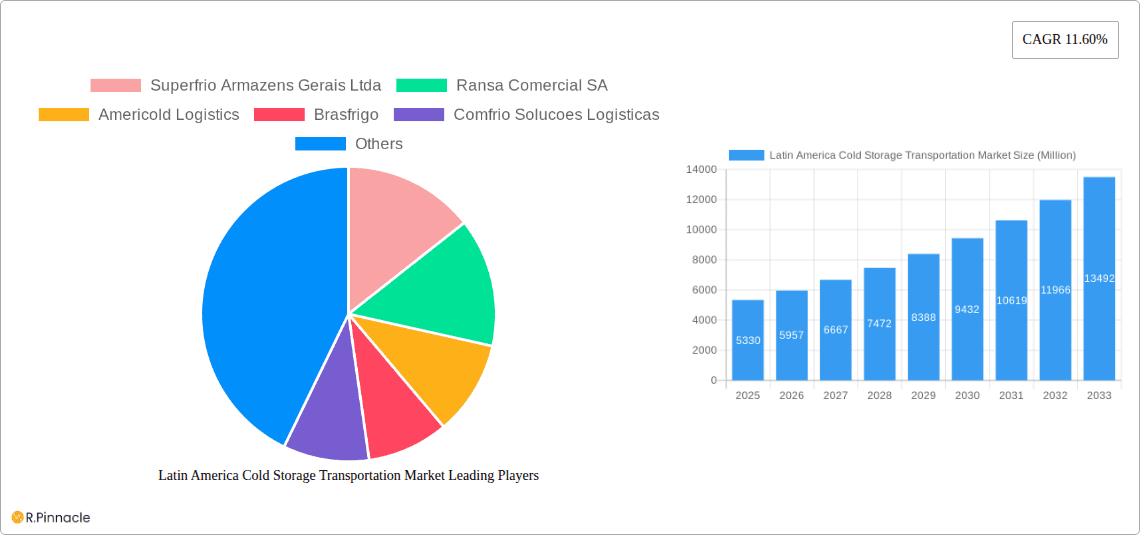

The Latin American cold storage and transportation market, valued at $5.33 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.60% from 2025 to 2033. This surge is driven by several key factors. The burgeoning food and beverage industry, particularly the increasing demand for processed foods, dairy products, and fresh produce, necessitates efficient cold chain solutions to maintain product quality and extend shelf life. Furthermore, the growth of e-commerce and the rising middle class are fueling demand for faster and more reliable delivery of temperature-sensitive goods. Expansion of the pharmaceutical sector, especially biopharmaceuticals, requiring stringent temperature control during transport and storage, also significantly contributes to market growth. Brazil, Mexico, and Chile represent the largest markets within Latin America, benefiting from robust infrastructure investments and increasing adoption of advanced cold chain technologies. However, challenges remain, including inconsistent infrastructure in some regions, high energy costs impacting operational expenses, and the need for improved regulatory frameworks to ensure food safety and quality standards. The market is witnessing a shift towards integrated cold chain solutions, with companies offering bundled services encompassing storage, transportation, and value-added services like order management and labeling. This integrated approach optimizes efficiency and reduces costs for clients across the food and pharmaceutical industries.

Latin America Cold Storage Transportation Market Market Size (In Billion)

Growth within specific segments is expected to vary. The refrigerated transportation segment will likely experience faster growth compared to cold storage due to the increasing demand for timely deliveries. Within end-user segments, the processed food and pharmaceutical sectors are anticipated to drive significant growth due to their strict temperature requirements and substantial investment in cold chain infrastructure. Technological advancements, including the adoption of IoT sensors for real-time temperature monitoring and advanced fleet management systems, will further shape market dynamics, promoting efficiency and reducing waste. Competition is intensifying, with both established players and new entrants vying for market share. The market is expected to consolidate further, with larger companies strategically acquiring smaller regional players to expand their geographical footprint and service offerings. Sustainable cold chain practices, such as the use of eco-friendly refrigerants and energy-efficient technologies, will also gain traction driven by growing environmental concerns and regulatory pressures.

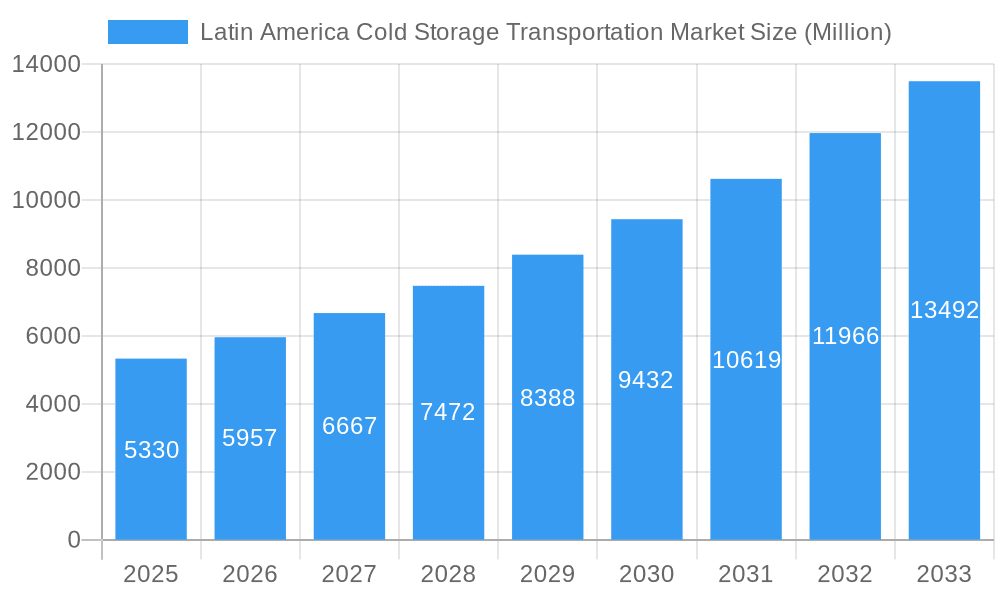

Latin America Cold Storage Transportation Market Company Market Share

Latin America Cold Storage Transportation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America cold storage transportation market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth projections. The study encompasses detailed segmentations by service, temperature, end-user, and country, providing granular data for informed strategic planning.

Latin America Cold Storage Transportation Market Structure & Innovation Trends

The Latin American cold storage transportation market exhibits a moderately concentrated structure, with key players such as Superfrio Armazens Gerais Ltda, Ransa Comercial SA, Americold Logistics, Brasfrigo, Comfrio Solucoes Logisticas, and Qualianz holding significant market share. However, numerous smaller regional players contribute to a dynamic competitive landscape. Market share data for 2025 estimates xx% for the top 5 players, with the remainder shared amongst numerous smaller operators.

Innovation is driven by increasing demand for efficient and reliable cold chain solutions, spurred by growing consumer preference for fresh produce and processed foods. Regulatory frameworks, while varied across countries, are generally focused on food safety and quality standards, pushing for improved infrastructure and technology adoption. Product substitutes, such as improved packaging and preservation techniques, pose a competitive challenge, yet also fuel innovation in enhanced cold storage technologies. M&A activity, as illustrated by recent acquisitions (detailed in the Key Developments section), underscores consolidation trends within the market, with deal values exceeding xx Million in the past two years.

- Market Concentration: Moderately concentrated with significant regional players.

- Innovation Drivers: Growing demand for fresh produce, food safety regulations, and competitive pressures.

- Regulatory Landscape: Varied across countries, but generally focused on food safety and quality.

- M&A Activity: Significant consolidation trends, with deal values exceeding xx Million in recent years.

- End-User Demographics: Shifting consumer preferences towards convenience and higher quality food products.

Latin America Cold Storage Transportation Market Dynamics & Trends

The Latin American cold storage transportation market is experiencing robust growth, driven by expanding food processing and retail sectors, rising disposable incomes, and a growing middle class with increased demand for high-quality food products. Technological advancements, such as automated warehousing systems, GPS tracking, and temperature monitoring devices, are transforming operational efficiency and enhancing supply chain visibility. Consumer preferences are shifting towards fresher, higher-quality products, demanding greater investment in cold chain infrastructure.

Competitive dynamics are intense, with established players facing competition from smaller, agile companies and new entrants. The market is witnessing increased focus on value-added services such as order management, blast freezing, and labeling, enhancing the overall customer experience. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is projected to be xx%, with market penetration in key segments expected to increase significantly.

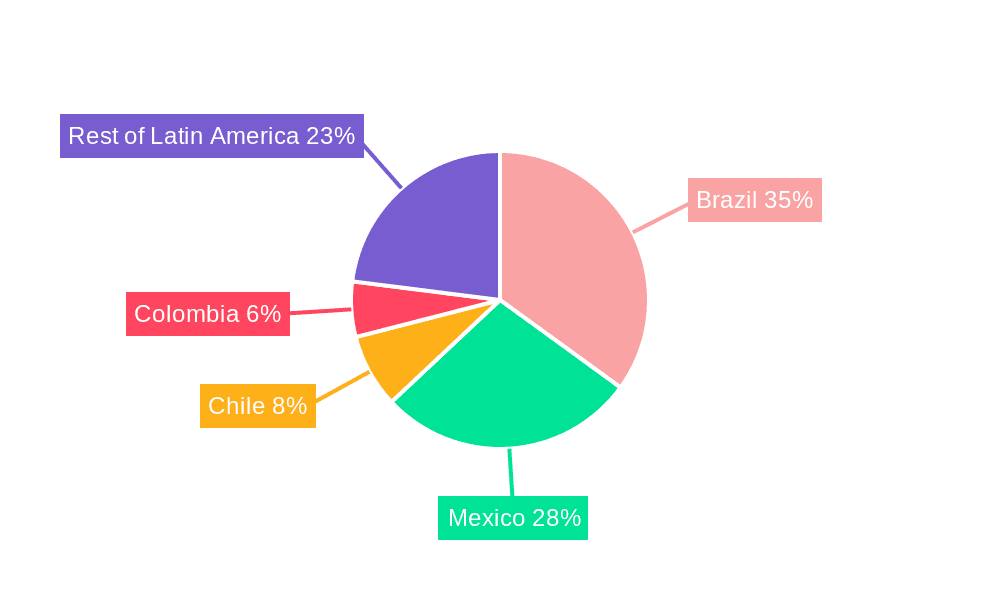

Dominant Regions & Segments in Latin America Cold Storage Transportation Market

-

By Country: Brazil and Mexico continue to lead the Latin America cold storage transportation market, driven by their robust economies, dense populations, and extensive food processing industries. Chile and Colombia are emerging as significant regional hubs, attracting investments due to their strategic locations and growing economies. The expansion of organized retail and increasing food processing activities in these dominant countries further fuels the demand for sophisticated cold chain solutions.

-

By Service: Cold storage/refrigerated warehousing remains the largest segment, essential for maintaining product integrity throughout the supply chain. Refrigerated transportation is experiencing accelerated growth, spurred by advancements in logistics technology and the increasing need for efficient last-mile delivery. Value-added services, including inventory management and cross-docking, are also gaining prominence as businesses seek comprehensive supply chain solutions to minimize spoilage and optimize operations.

-

By Temperature: The frozen segment commands a significant market share, a testament to the high demand for frozen foods and the critical need to preserve perishable goods over extended periods. The chilled segment also exhibits strong growth, catering to products requiring less extreme but still precise temperature control, such as fresh produce, dairy, and certain pharmaceuticals.

-

By End User: Fruits and vegetables constitute the leading end-user segment, followed closely by dairy products, meat, and seafood. The processed food sector is witnessing considerable expansion, influenced by changing consumer lifestyles and increasing urbanization. Furthermore, the pharmaceutical sector is becoming increasingly significant, with a growing emphasis on temperature-controlled logistics to ensure the efficacy and safety of sensitive medications and vaccines.

Brazil's market dominance is deeply rooted in its vast agricultural output and a highly developed food processing industry. Mexico's strategic proximity to the US market, coupled with a burgeoning domestic demand, significantly contributes to its substantial market share. Supportive government policies, consistent investment in cold chain infrastructure development, and the adoption of advanced technologies are pivotal factors propelling growth in these leading economies. Other countries, such as Chile and Colombia, are actively attracting investment owing to their advantageous geographic positions and expanding economic landscapes.

Latin America Cold Storage Transportation Market Product Innovations

Innovations in the Latin America cold storage transportation market are predominantly focused on enhancing operational efficiency, improving precise temperature control, and integrating cutting-edge technologies for superior supply chain management. Modern cold storage facilities are increasingly incorporating automation for streamlined inventory management and efficient order fulfillment. The pervasive integration of IoT sensors and advanced data analytics enables real-time monitoring of temperature and humidity levels, allowing for proactive interventions to mitigate spoilage and uphold product quality. This technological advancement directly addresses the escalating demand for enhanced product traceability and robust food safety protocols across the region.

Report Scope & Segmentation Analysis

This report offers an in-depth analysis of the Latin America cold storage transportation market, with detailed segmentation across the following key areas:

-

By Service: The market is segmented into Cold Storage/Refrigerated Warehousing, Refrigerated Transportation, and Value-added Services. Growth projections for these segments are influenced by diverse factors, including the pace of infrastructure development, evolving consumer preferences, and the adoption of new logistics technologies.

-

By Temperature: The segmentation includes Chilled, Frozen, and Ambient temperature zones. The frozen segment is projected to exhibit significant growth potential, driven by the sustained and increasing demand for a wide array of frozen food products.

-

By End User: Key end-user segments analyzed include Fruits and Vegetables, Dairy Products, Fish, Meat, and Seafood, Processed Food, Pharmaceutical, Bakery and Confectionery, and Other End Users. Each segment displays distinct growth dynamics shaped by prevailing consumption patterns, regulatory landscapes, and emerging market trends.

-

By Country: The report provides a granular analysis by country, focusing on Mexico, Brazil, Chile, Colombia, and the Rest of Latin America. Market size and competitive intensity vary considerably across these nations, reflecting differences in economic development, regulatory environments, and the maturity of their respective cold chain infrastructures.

Key Drivers of Latin America Cold Storage Transportation Market Growth

The sustained growth of the Latin America cold storage transportation market is propelled by a confluence of influential factors:

-

Expanding Food Processing & Retail: The proliferation of organized retail chains and the continuous expansion of food processing activities are directly increasing the demand for specialized cold storage and refrigerated transportation services.

-

Rising Disposable Incomes: As disposable incomes rise across the region, particularly among the growing middle class, there is a discernible increase in the demand for higher-quality food products, including more sophisticated imported and temperature-sensitive items.

-

Technological Advancements: The integration of automation, the Internet of Things (IoT), and advanced data analytics is revolutionizing the cold chain by significantly enhancing operational efficiency, improving traceability, and reducing product loss.

-

Government Initiatives: Supportive government policies, coupled with substantial investments in infrastructure development and cold chain modernization, are actively fostering the growth and expansion of the cold chain sector in numerous Latin American countries.

Challenges in the Latin America Cold Storage Transportation Market Sector

The market faces challenges like:

Inadequate Infrastructure: In certain regions, outdated infrastructure and limited cold chain networks hinder efficient transportation and storage.

High Energy Costs: Operating and maintaining cold storage facilities can be expensive due to fluctuating energy prices.

Supply Chain Disruptions: Climate change, geopolitical events, and pandemic-related issues can cause significant supply chain disruptions.

Regulatory Complexity: Differences in regulations across countries can complicate operations and compliance.

Emerging Opportunities in Latin America Cold Storage Transportation Market

Opportunities exist in:

Value-Added Services: Expansion of value-added services like blast freezing, packaging, and labeling caters to evolving consumer needs.

Technological Integration: Adoption of advanced technologies like AI and blockchain improves efficiency and traceability.

Sustainable Practices: Implementation of eco-friendly practices, including renewable energy and reduced emissions, will appeal to environmentally conscious stakeholders.

Expansion into Underserved Markets: Investment in cold chain infrastructure in less developed regions unlocks significant market potential.

Leading Players in the Latin America Cold Storage Transportation Market Market

- Superfrio Armazens Gerais Ltda

- Ransa Comercial SA

- Americold Logistics

- Brasfrigo

- Comfrio Solucoes Logisticas

- Qualianz

- Frialsa Frigorificos SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Localfrio

- 3 Other Companies (Key Information/Overview)

Key Developments in Latin America Cold Storage Transportation Market Industry

June 2023: Canadian Pacific's partnership to co-host American warehouse facilities on its network signifies a significant expansion of integrated cold chain solutions in the US-Mexico corridor.

November 2022: Emergent Cold LatAm's acquisition of a distribution facility in Recife, Brazil, expands its footprint in a key market and demonstrates growth in the sector.

October 2022: The expansion of a temperature-controlled facility in Panama City, Panama, reflects the growing demand for cold storage capacity in Central America.

Future Outlook for Latin America Cold Storage Transportation Market Market

The Latin America cold storage transportation market is poised for substantial future expansion, fueled by ongoing economic development, increasing urbanization, and the dynamic evolution of consumer preferences. Strategic investments in advanced infrastructure, the continuous adoption of technological innovations, and the increasing emphasis on sustainable operational practices will collectively shape the market's future trajectory. Significant opportunities exist for market players to capitalize on the burgeoning e-commerce sector, the rapid growth of food delivery platforms, and the escalating consumer demand for processed and convenient food options. The market is anticipated to witness robust growth, with leading companies strategically focusing on optimizing efficiency, driving innovation, and embracing sustainability to maintain their competitive edge in this dynamic landscape.

Latin America Cold Storage Transportation Market Segmentation

-

1. Service

- 1.1. Cold Storage/Refrigerated Warehousing

- 1.2. Refrigerated Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Seafood

- 3.4. Processed Food

- 3.5. Pharmaceutical (Includes Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other End Users

Latin America Cold Storage Transportation Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Cold Storage Transportation Market Regional Market Share

Geographic Coverage of Latin America Cold Storage Transportation Market

Latin America Cold Storage Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in E-commerce4.; Healthcare Sector is the market

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Lack of Temperature- Controlled Warehouses

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Demand for Perishable Goods the warehousing space is growing in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Cold Storage Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Cold Storage/Refrigerated Warehousing

- 5.1.2. Refrigerated Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Seafood

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Includes Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ransa Comercial SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americold Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brasfrigo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comfrio Solucoes Logisticas

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qualianz**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)6 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers and Technology Providers for the Cold Chain Industry

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frialsa Frigorificos SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Localfrio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Latin America Cold Storage Transportation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Cold Storage Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Latin America Cold Storage Transportation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Latin America Cold Storage Transportation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Cold Storage Transportation Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Latin America Cold Storage Transportation Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Ransa Comercial SA, Americold Logistics, Brasfrigo, Comfrio Solucoes Logisticas, Qualianz**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)6 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers and Technology Providers for the Cold Chain Industry, Frialsa Frigorificos SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Localfrio.

3. What are the main segments of the Latin America Cold Storage Transportation Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in E-commerce4.; Healthcare Sector is the market.

6. What are the notable trends driving market growth?

Increasing Consumer Demand for Perishable Goods the warehousing space is growing in the region.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Lack of Temperature- Controlled Warehouses.

8. Can you provide examples of recent developments in the market?

June 2023: Canadian Pacific announced a strategic partnership to co-host American warehouse facilities on Canadian Pacific's (CPKC) network. Supported by rail transportation, the goal is to construct the first facility on CPKC's network in Kansas City (Mo.), Kansas, to combine cold storage and added-value services with accelerated intermodal transport solutions connecting key markets in the U.S., Midwest, and Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Cold Storage Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Cold Storage Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Cold Storage Transportation Market?

To stay informed about further developments, trends, and reports in the Latin America Cold Storage Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence