Key Insights

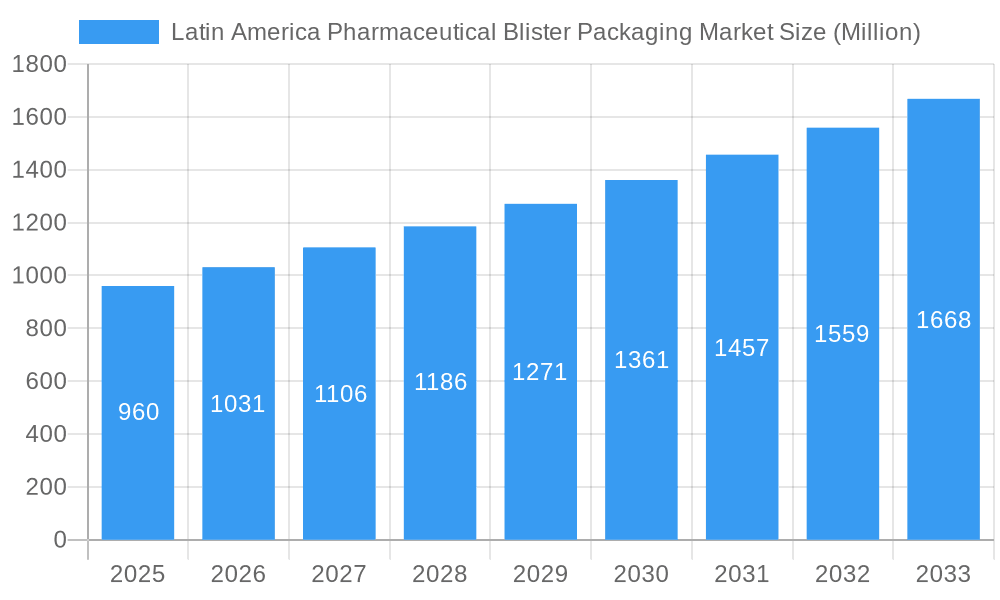

The Latin American pharmaceutical blister packaging market, valued at $960 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.30% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases and a growing elderly population across the region are boosting demand for pharmaceutical products, consequently driving the need for efficient and secure packaging solutions like blister packs. Secondly, stringent regulatory requirements regarding drug safety and tamper-evidence are pushing pharmaceutical companies to adopt advanced blister packaging technologies. This includes a shift towards materials like plastic offering better barrier properties and enhanced product protection, as well as the adoption of innovative technologies like cold forming for improved speed and efficiency. Furthermore, the rising focus on brand building and consumer convenience is increasing demand for aesthetically appealing and easy-to-use blister packs. Growth is particularly strong in countries experiencing rapid economic development and expanding healthcare infrastructure, such as Mexico, Brazil, and Argentina.

Latin America Pharmaceutical Blister Packaging Market Market Size (In Million)

However, the market faces certain challenges. Fluctuations in raw material prices, particularly for plastics and aluminum, can impact production costs and profitability. Additionally, environmental concerns related to plastic waste are prompting a gradual shift towards more sustainable packaging options, such as paper-based blisters, which, although environmentally preferable, may present some performance trade-offs. Competition among established players like Amcor Limited, Constantia Flexibles, and WestRock Company, as well as the emergence of smaller, regional players, creates a dynamic and competitive landscape. To sustain growth, companies are focusing on developing innovative, sustainable, and cost-effective blister packaging solutions tailored to the specific needs of the Latin American pharmaceutical market. This involves leveraging technological advancements, strengthening supply chains, and prioritizing environmental responsibility.

Latin America Pharmaceutical Blister Packaging Market Company Market Share

Latin America Pharmaceutical Blister Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America Pharmaceutical Blister Packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and key players, ultimately forecasting future growth opportunities. The market is projected to reach xx Million by 2033.

Latin America Pharmaceutical Blister Packaging Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Latin American pharmaceutical blister packaging market. The market exhibits a moderately concentrated structure, with key players holding significant market share. Amcor Limited, Constantia Flexibles, WestRock Company, Klockner Pentaplast Group, Sonoco Products Company, Competent Packaging Industries Inc, Uflex Limited, and Tekni-Plex Inc are some of the leading players, though the market also features several smaller, regional players. Mergers and acquisitions (M&A) are a significant factor, with deal values varying considerably depending on the size and strategic importance of the target company. Recent M&A activity reflects a trend toward consolidation and expansion into key regional markets. For example, the xx Million acquisition of M8 Pharmaceuticals by Acino International AG in September 2023 significantly broadened Acino's presence in Brazil and Mexico.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% market share in 2024.

- Innovation Drivers: Growing demand for sustainable packaging, increasing focus on enhanced product protection, and the need for tamper-evident features drive innovation.

- Regulatory Frameworks: Stringent regulations concerning drug safety and environmental compliance influence packaging choices and material selection.

- Product Substitutes: While blister packaging dominates, alternative packaging formats such as sachets and pouches are gaining traction for specific applications.

- End-User Demographics: The growth is largely driven by the increasing demand for pharmaceuticals across various therapeutic segments.

- M&A Activities: Recent transactions indicate a strong interest in market consolidation and expansion into high-growth segments.

Latin America Pharmaceutical Blister Packaging Market Dynamics & Trends

The Latin American pharmaceutical blister packaging market demonstrates robust growth, driven by several key factors. The increasing prevalence of chronic diseases, rising healthcare expenditure, and expanding pharmaceutical production capabilities fuel market expansion. Technological advancements, such as the introduction of recyclable blister films, are further driving growth. Consumer preferences are shifting towards eco-friendly and sustainable packaging options. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative niche players. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various therapeutic segments.

Dominant Regions & Segments in Latin America Pharmaceutical Blister Packaging Market

Brazil and Mexico represent the largest pharmaceutical markets in Latin America and, consequently, the most significant consumers of blister packaging. This dominance is fueled by factors like a large and growing population, increasing healthcare spending, and a robust pharmaceutical manufacturing base. Within the material segments, plastic maintains a dominant share due to its cost-effectiveness and versatility, though there's growing interest in sustainable alternatives like recycled plastics and paper-based options. Cold forming technology holds the largest share in the technology segment due to its high production efficiency and cost-effectiveness.

- Key Drivers for Brazil and Mexico:

- Strong economic growth

- Robust healthcare infrastructure

- Growing pharmaceutical production

- High prevalence of chronic diseases.

- Material Segment: Plastic dominates due to cost-effectiveness, but sustainable alternatives (recycled plastics, paper) are gaining traction.

- Technology Segment: Cold forming dominates due to efficiency and cost-effectiveness, but thermoforming remains significant for specialized applications.

Latin America Pharmaceutical Blister Packaging Market Product Innovations

Significant advancements are occurring in material science, with a clear focus on sustainability. Recyclable and bio-based materials are gaining prominence, meeting increasing consumer demand for environmentally friendly solutions. For instance, TekniPlex Healthcare's introduction of a 30% post-consumer recycled content pharmaceutical-grade blister film highlights this trend. The development of improved barrier properties and tamper-evident features also enhances product safety and security, meeting regulatory requirements and increasing consumer confidence.

Report Scope & Segmentation Analysis

This report segments the Latin America pharmaceutical blister packaging market by material (Plastic, Paper, Aluminum) and technology (Cold Forming, Thermoformed). Each segment is analyzed based on market size, growth projections, and competitive dynamics. Plastic dominates due to its versatility and cost-effectiveness, projecting xx Million by 2033. Paper-based packaging is witnessing growth driven by sustainability concerns, expected to reach xx Million by 2033. Aluminum, though niche, holds a steady market share, predicted at xx Million by 2033. Cold forming is the leading technology segment due to its efficiency, reaching xx Million by 2033, while thermoforming caters to specialized applications, projected at xx Million by 2033.

Key Drivers of Latin America Pharmaceutical Blister Packaging Market Growth

The market's growth is propelled by a confluence of factors. The rise in chronic diseases necessitates increased pharmaceutical consumption, directly impacting packaging demand. Government initiatives promoting healthcare access and affordability stimulate market growth. Technological advancements in packaging materials and manufacturing processes, including sustainable alternatives, also drive expansion.

Challenges in the Latin America Pharmaceutical Blister Packaging Market Sector

The market faces challenges such as fluctuating raw material prices and supply chain disruptions. Strict regulatory compliance requirements can increase production costs. Intense competition among numerous packaging suppliers, both established and emerging, also presents challenges. These factors collectively impose constraints on the market’s expansion.

Emerging Opportunities in Latin America Pharmaceutical Blister Packaging Market

The increasing adoption of sustainable packaging solutions presents significant opportunities. The development of innovative materials with improved barrier properties and enhanced functionalities opens new avenues for growth. Furthermore, expansion into niche therapeutic segments and untapped markets within Latin America offers considerable potential for expansion.

Leading Players in the Latin America Pharmaceutical Blister Packaging Market Market

- Amcor Limited

- Constantia Flexibles

- WestRock Company

- Klockner Pentaplast Group

- Sonoco Products Company

- Competent Packaging Industries Inc

- Uflex Limited

- Tekni-Plex Inc

Key Developments in Latin America Pharmaceutical Blister Packaging Market Industry

- September 2023: Acino International AG acquired M8 Pharmaceuticals, expanding its presence in Brazil and Mexico.

- January 2024: TekniPlex Healthcare partnered with Alpek Polyester to introduce a fully recyclable, 30% post-consumer recycled content pharmaceutical-grade blister film.

Future Outlook for Latin America Pharmaceutical Blister Packaging Market Market

The Latin America pharmaceutical blister packaging market is poised for continued growth, fueled by sustained demand from the pharmaceutical sector and the increasing focus on sustainable packaging options. Strategic partnerships, technological advancements, and expansion into emerging markets will be key drivers for future growth. The market's future trajectory suggests significant opportunities for innovation and expansion within the region.

Latin America Pharmaceutical Blister Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Aluminum

-

2. Technology

- 2.1. Cold Forming

- 2.2. Thermoformed

Latin America Pharmaceutical Blister Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Pharmaceutical Blister Packaging Market Regional Market Share

Geographic Coverage of Latin America Pharmaceutical Blister Packaging Market

Latin America Pharmaceutical Blister Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Geriatric Population and Prevalence of Diseases; New Product Innovations with Sustainable Materials

- 3.3. Market Restrains

- 3.3.1. Growing Geriatric Population and Prevalence of Diseases; New Product Innovations with Sustainable Materials

- 3.4. Market Trends

- 3.4.1. Plastic is Widely Used for Blister Packaging in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Cold Forming

- 5.2.2. Thermoformed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Constantia Flexibles

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WestRock Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klockner Pentaplast Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Competent Packaging Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Uflex Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tekni-Plex Inc *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Amcor Limited

List of Figures

- Figure 1: Latin America Pharmaceutical Blister Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Pharmaceutical Blister Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Latin America Pharmaceutical Blister Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Latin America Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Latin America Pharmaceutical Blister Packaging Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 5: Latin America Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Pharmaceutical Blister Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Latin America Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 8: Latin America Pharmaceutical Blister Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 9: Latin America Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Latin America Pharmaceutical Blister Packaging Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 11: Latin America Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Pharmaceutical Blister Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Chile Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Colombia Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Peru Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Peru Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Venezuela Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Venezuela Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Ecuador Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Ecuador Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Bolivia Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Bolivia Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Paraguay Latin America Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Paraguay Latin America Pharmaceutical Blister Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Pharmaceutical Blister Packaging Market?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the Latin America Pharmaceutical Blister Packaging Market?

Key companies in the market include Amcor Limited, Constantia Flexibles, WestRock Company, Klockner Pentaplast Group, Sonoco Products Company, Competent Packaging Industries Inc, Uflex Limited, Tekni-Plex Inc *List Not Exhaustive.

3. What are the main segments of the Latin America Pharmaceutical Blister Packaging Market?

The market segments include Material, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Geriatric Population and Prevalence of Diseases; New Product Innovations with Sustainable Materials.

6. What are the notable trends driving market growth?

Plastic is Widely Used for Blister Packaging in the Region.

7. Are there any restraints impacting market growth?

Growing Geriatric Population and Prevalence of Diseases; New Product Innovations with Sustainable Materials.

8. Can you provide examples of recent developments in the market?

January 2024: TekniPlex Healthcare partnered with PET industry company Alpek Polyester to introduce the world’s first 30% post-consumer recycled content pharmaceutical-grade blister film with Alpek’s Octal rDPET Sheet technology. The blister film is also fully recyclable. Combined with TekniPlex’s polyester lidding Teknilid Push, the film plus lidding blister system is fully recyclable in the polyester recycling stream where recycling infrastructure exists.September 2023: Acino International AG, a pharmaceutical company headquartered in Zurich, announced that it entered into a contract to acquire M8 Pharmaceuticals (M8), a fast-growing specialty biopharmaceutical company headquartered in Mexico City that focuses on licensing, marketing, and distributing innovative and established medicines in Mexico and Brazil. Acino will enter the two largest pharmaceutical markets in Latin America through this acquisition, significantly extending its geographic footprint and bolstering its position in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Pharmaceutical Blister Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Pharmaceutical Blister Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Pharmaceutical Blister Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Pharmaceutical Blister Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence