Key Insights

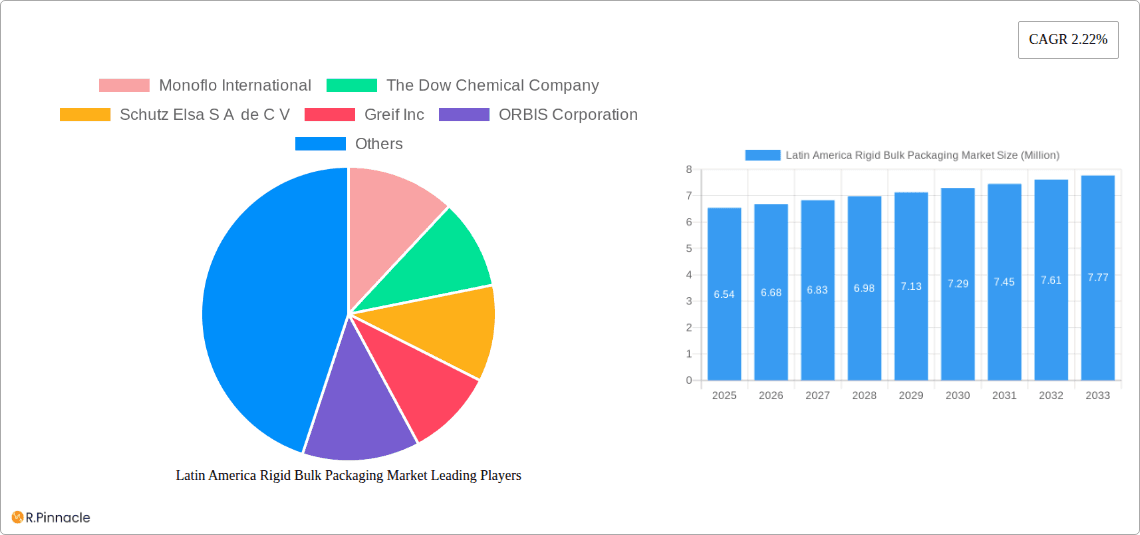

The Latin America Rigid Bulk Packaging Market is poised for steady expansion, projected to reach a valuation of $6.54 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 2.22% during the forecast period of 2025-2033. The market's trajectory is significantly influenced by robust demand across key end-user industries. The Food & Beverage sector, a cornerstone of Latin America's economy, necessitates high-volume, safe, and hygienic packaging solutions for its extensive product distribution networks. Similarly, the Pharmaceutical and Chemical industries require specialized rigid bulk packaging that meets stringent regulatory standards for containment and safe transportation of sensitive materials, acting as a strong market driver. The growing industrialization and manufacturing output across nations like Brazil, Mexico, and Colombia further bolster the demand for industrial bulk containers and drums for efficient material handling and supply chain management.

Latin America Rigid Bulk Packaging Market Market Size (In Million)

Further analysis reveals that trends such as increasing adoption of sustainable packaging materials, including recycled plastics and metals, are shaping market dynamics. While the market benefits from these drivers, certain restraints, such as fluctuating raw material prices for plastics and metals, can present challenges. However, the inherent advantages of rigid bulk packaging – durability, reusability, and superior product protection – continue to drive its adoption. Innovations in material science and packaging design are also contributing to market evolution, with companies focusing on lighter yet stronger solutions. The diverse range of product segments, from drums and pails to industrial bulk containers and bulk boxes, caters to a broad spectrum of applications, ensuring sustained market relevance and opportunity for growth in the coming years.

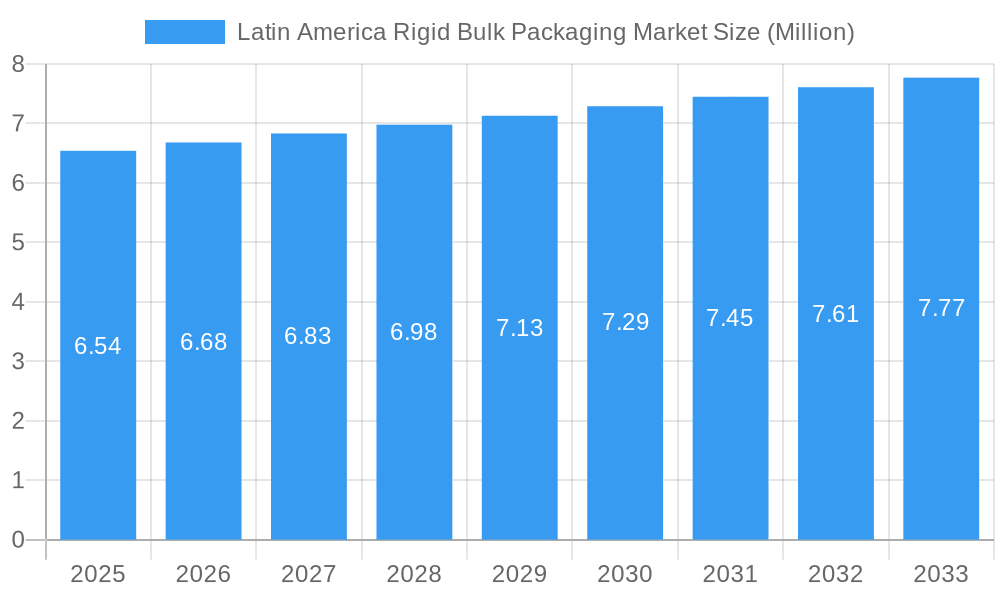

Latin America Rigid Bulk Packaging Market Company Market Share

Latin America Rigid Bulk Packaging Market: Comprehensive Growth & Strategic Insights 2019–2033

Unlock the future of rigid bulk packaging in Latin America with this in-depth market analysis. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights into market dynamics, segmentation, innovation trends, and competitive landscapes. Essential for stakeholders seeking to capitalize on the burgeoning demand for durable, reliable, and sustainable packaging solutions across industrial, food & beverage, and pharmaceutical sectors. Identify untapped opportunities and navigate challenges with data-driven strategies.

Latin America Rigid Bulk Packaging Market Market Structure & Innovation Trends

The Latin America rigid bulk packaging market exhibits a moderately concentrated structure, with key players like Greif Inc., Mauser Packaging Solutions, and The Dow Chemical Company holding significant market shares. Innovation is primarily driven by the increasing demand for enhanced product protection, sustainability features, and operational efficiency. Regulatory frameworks, particularly concerning environmental impact and product safety, are evolving, influencing material choices and design specifications. While direct product substitutes are limited for bulk packaging, advancements in flexible packaging for certain applications and innovative reusability models present indirect competitive pressures. End-user demographics are shifting towards industries with higher growth potential, such as e-commerce fulfillment and specialized chemical handling. Mergers and acquisitions (M&A) activity is a strategic tool for market expansion and portfolio enhancement, with recent deal values estimated in the hundreds of millions of US dollars as companies consolidate to gain economies of scale and broader regional reach. This dynamic landscape necessitates a keen understanding of emerging technologies and shifting consumer and industrial preferences to maintain a competitive edge.

Latin America Rigid Bulk Packaging Market Market Dynamics & Trends

The Latin America rigid bulk packaging market is poised for robust expansion, fueled by a confluence of dynamic market growth drivers, disruptive technological advancements, evolving consumer preferences, and intense competitive dynamics. The escalating demand for efficient and secure transportation and storage of goods across diverse industries, including food & beverage, pharmaceutical, and industrial sectors, acts as a primary catalyst. Economic growth and industrialization across key Latin American economies contribute significantly to this demand, driving the need for reliable packaging solutions like industrial bulk containers and drums. Technological innovations are playing a pivotal role, with a growing emphasis on lightweight yet durable materials, such as advanced plastics and composites, offering enhanced performance and reduced transportation costs. The push towards sustainability is a major trend, pushing manufacturers to develop recyclable, reusable, and eco-friendly packaging options, aligning with global environmental mandates and increasing consumer awareness. This has led to a surge in the adoption of materials like HDPE and advanced metal alloys.

Consumer preferences are increasingly influencing packaging design, with a growing demand for packaging that ensures product integrity, extends shelf life, and offers ease of handling and dispensing. This is particularly evident in the food and beverage sector, where hygiene and safety are paramount. The competitive landscape is characterized by strategic investments in capacity expansion, product innovation, and geographical reach. Companies are focusing on optimizing their supply chains and offering value-added services to differentiate themselves. Market penetration of advanced rigid bulk packaging solutions is steadily increasing as businesses recognize the long-term cost benefits and operational efficiencies they offer. The Compound Annual Growth Rate (CAGR) for the Latin America rigid bulk packaging market is estimated to be in the range of 5% to 7% during the forecast period, reflecting strong underlying growth potential. Disruptions in raw material supply chains and fluctuating commodity prices, while posing challenges, also drive innovation in material sourcing and manufacturing processes. The digital transformation within the packaging industry, including the adoption of smart packaging technologies for track-and-trace capabilities and enhanced inventory management, is another significant trend shaping the market's trajectory.

Dominant Regions & Segments in Latin America Rigid Bulk Packaging Market

The Latin America rigid bulk packaging market's dominance is significantly influenced by its regional economic powerhouses and the specific needs of its burgeoning industries. Brazil stands out as the leading region, driven by its vast industrial base, significant agricultural output, and a well-established food and beverage sector. Government initiatives promoting industrial growth and infrastructure development further bolster Brazil's position. Mexico follows closely, leveraging its strong manufacturing sector, particularly in automotive and electronics, which heavily relies on industrial bulk containers for component transportation and storage. Argentina's substantial agricultural exports also contribute to its demand for robust packaging solutions.

Within the Material segment, Plastic leads the market by a considerable margin. Its versatility, durability, and cost-effectiveness make it the preferred choice for a wide array of applications. High-Density Polyethylene (HDPE) is particularly dominant in the production of drums, pails, and industrial bulk containers due to its excellent chemical resistance and impact strength. Metal packaging, primarily steel and aluminum, holds a significant share, especially for applications requiring extreme durability and barrier properties, such as in the chemical and petrochemical industries. Wood packaging, though less dominant, remains relevant for specific heavy-duty industrial applications and agricultural products where its natural properties are advantageous.

In terms of Product, Industrial Bulk Containers (IBCs) are the most dominant category. Their reusability, stackability, and efficient space utilization make them ideal for transporting liquids and solids in large volumes. The demand for UN-certified IBCs for hazardous materials is a key growth driver. Drums and pails follow, catering to a broad spectrum of industrial and consumer goods packaging needs. Bulk boxes, especially for the food and agricultural sectors, also represent a substantial segment.

The End-user Industry landscape is led by the Industrial sector, encompassing chemicals, petrochemicals, manufacturing, and automotive. These industries require robust and safe packaging for raw materials, intermediates, and finished goods. The Food & Beverage industry is another major contributor, demanding hygienic, safe, and often temperature-controlled packaging solutions for a wide range of products. The Pharmaceutical and Chemical sector, while a smaller segment in terms of volume, generates high-value demand due to stringent regulatory requirements and the need for specialized, high-performance packaging. The "Other End-user Industries" segment, including agriculture, personal care, and electronics, also contributes to the overall market growth. Key drivers for this segment dominance include:

- Economic Policies: Favorable trade agreements and industrial development policies in countries like Brazil and Mexico.

- Infrastructure Development: Investments in ports, logistics networks, and warehousing facilities are crucial for efficient bulk packaging distribution.

- Technological Adoption: Increased adoption of advanced manufacturing techniques and material science innovations.

- Sustainability Initiatives: Growing pressure from governments and consumers for eco-friendly packaging solutions.

- Market Growth in Key Sectors: Expansion of manufacturing, food processing, and chemical industries.

Latin America Rigid Bulk Packaging Market Product Innovations

Product innovation in the Latin America rigid bulk packaging market centers on enhancing sustainability, performance, and cost-effectiveness. Manufacturers are actively developing lighter yet stronger plastic IBCs and drums made from recycled or bio-based materials, aiming to reduce environmental impact and transportation emissions. Advancements in metal packaging focus on thinner gauges with improved strength and barrier properties, alongside enhanced corrosion resistance. Innovations in bulk boxes include improved folding mechanisms for easier assembly and disassembly, and designs optimized for better airflow and temperature control in food applications. The competitive advantage lies in offering solutions that meet stringent safety regulations, reduce operational costs for end-users through reusability and lighter weights, and align with growing environmental consciousness.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Latin America rigid bulk packaging market, segmented by Material (Plastic, Metal, Wood, Other Materials), Product (Industrial Bulk Containers, Drums, Pails, Bulk Boxes, Other Bulk Containers), and End-user Industry (Food, Beverage, Industrial, Pharmaceutical and Chemical, Other End-user Industries). The Plastic segment is projected to maintain its dominance with a CAGR of approximately 6.5%, driven by its widespread use in IBCs and drums. The Industrial Bulk Containers product category is expected to witness a CAGR of around 6%, fueled by demand in the chemical and F&B sectors. The Industrial end-user industry segment will continue to lead, with an estimated CAGR of 7%, due to ongoing manufacturing expansion.

Key Drivers of Latin America Rigid Bulk Packaging Market Growth

Several key drivers are propelling the growth of the Latin America rigid bulk packaging market. Economically, increasing industrialization and trade activities across the region necessitate robust packaging solutions for the safe and efficient transportation of goods. Technological advancements in material science, such as the development of lighter, stronger, and more sustainable plastics and composites, are enhancing product performance and reducing costs. Regulatory frameworks, while sometimes posing challenges, also drive innovation by mandating safer and more environmentally friendly packaging practices. For example, stricter regulations on hazardous material transport are increasing demand for certified IBCs. Furthermore, the expanding e-commerce sector and growing consumer demand for packaged goods, especially in the food and beverage and pharmaceutical industries, directly fuel the need for reliable bulk packaging.

Challenges in the Latin America Rigid Bulk Packaging Market Sector

Despite its growth trajectory, the Latin America rigid bulk packaging market faces several challenges. Volatility in raw material prices, particularly for plastics and metals, can impact manufacturing costs and profit margins. Inadequate or developing infrastructure in certain sub-regions can hinder efficient logistics and distribution networks, leading to increased lead times and costs. Stringent and sometimes inconsistent regulatory environments across different countries can create compliance complexities for manufacturers. Furthermore, the competitive pressure from emerging localized players and the ongoing global trend towards lightweighting and material reduction pose a continuous challenge to traditional rigid packaging solutions. Supply chain disruptions, exacerbated by geopolitical factors and natural events, can also impede production and delivery timelines.

Emerging Opportunities in Latin America Rigid Bulk Packaging Market

Significant emerging opportunities exist within the Latin America rigid bulk packaging market. The growing demand for sustainable and circular economy solutions presents a prime area for growth, with opportunities in developing and marketing reusable packaging systems, recycled content packaging, and biodegradable or compostable rigid packaging. The increasing focus on product safety and traceability in the pharmaceutical and chemical industries creates opportunities for smart packaging solutions with integrated tracking and monitoring capabilities. Expansion into less developed but rapidly industrializing countries within Latin America offers untapped market potential. Furthermore, the development of specialized rigid packaging for niche applications, such as sterile medical supplies or high-value specialty chemicals, represents a high-growth segment.

Leading Players in the Latin America Rigid Bulk Packaging Market Market

- Monoflo International

- The Dow Chemical Company

- Schutz Elsa S A de C V

- Greif Inc

- ORBIS Corporation

- Rheem Chilena SpA

- Mauser Packaging Solutions

- ALPLA Group

Key Developments in Latin America Rigid Bulk Packaging Market Industry

- September 2023: Mauser Packaging Solutions expanded its production capabilities recently through investments in the manufacture of composite intermediate bulk containers (IBCs) in its Toluca, Mexico facility. A new line focused on IBC cage production was installed in the facility to support the manufacturing of UN-certified 275-gallon composite IBCs in the region.

- June 2022: Greif, Inc., a renowned provider of industrial packaging products, unveiled the launch of high-performance industrial cans in the Brazilian market, which are suitable for packaging agrochemicals, chemicals, flavors, fragrances, and beverages. The reduced weight allows for up to 7% more cans per pallet and 6.7% more warehouse storage capacity. The lighter weight reduces collection costs for recycling as well.

Future Outlook for Latin America Rigid Bulk Packaging Market Market

The future outlook for the Latin America rigid bulk packaging market is exceptionally promising, driven by sustained economic development, increasing industrial output, and a growing emphasis on sustainability. The market is expected to witness continuous innovation, with a significant shift towards advanced materials offering enhanced performance and reduced environmental footprints. The adoption of Industry 4.0 technologies, including automation and digitalization in manufacturing and supply chain management, will further optimize operational efficiency and product quality. Strategic investments in expanding production capacities and geographical reach by leading players will shape the competitive landscape. The increasing demand for specialized packaging solutions catering to sensitive industries like pharmaceuticals and food will unlock new avenues for growth. Overall, the market is well-positioned for robust and sustained expansion in the coming years, presenting lucrative opportunities for stakeholders.

Latin America Rigid Bulk Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Metal

- 1.3. Wood

- 1.4. Other Materials

-

2. Product

- 2.1. Industrial Bulk Containers

- 2.2. Drums

- 2.3. Pails

- 2.4. Bulk Boxes

- 2.5. Other Bulk Containers

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Industrial

- 3.4. Pharmaceutical and Chemical

- 3.5. Other End-user Industries

Latin America Rigid Bulk Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Rigid Bulk Packaging Market Regional Market Share

Geographic Coverage of Latin America Rigid Bulk Packaging Market

Latin America Rigid Bulk Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Food and Agricultural Exports from Latin America4.; Construction and Infrastructural Activity Aids Market Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Severe Inflation and Increased Price of Raw Material May Dent the Market Growth

- 3.4. Market Trends

- 3.4.1. Robust Food and Beverage Production Aids the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Rigid Bulk Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Wood

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Industrial Bulk Containers

- 5.2.2. Drums

- 5.2.3. Pails

- 5.2.4. Bulk Boxes

- 5.2.5. Other Bulk Containers

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Industrial

- 5.3.4. Pharmaceutical and Chemical

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Monoflo International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dow Chemical Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schutz Elsa S A de C V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Greif Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ORBIS Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rheem Chilena SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mauser Packaging Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALPLA Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Monoflo International

List of Figures

- Figure 1: Latin America Rigid Bulk Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Rigid Bulk Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Latin America Rigid Bulk Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Rigid Bulk Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Rigid Bulk Packaging Market?

The projected CAGR is approximately 2.22%.

2. Which companies are prominent players in the Latin America Rigid Bulk Packaging Market?

Key companies in the market include Monoflo International, The Dow Chemical Company, Schutz Elsa S A de C V, Greif Inc, ORBIS Corporation, Rheem Chilena SpA, Mauser Packaging Solutions, ALPLA Group.

3. What are the main segments of the Latin America Rigid Bulk Packaging Market?

The market segments include Material, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.54 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Food and Agricultural Exports from Latin America4.; Construction and Infrastructural Activity Aids Market Growth.

6. What are the notable trends driving market growth?

Robust Food and Beverage Production Aids the Market.

7. Are there any restraints impacting market growth?

4.; Severe Inflation and Increased Price of Raw Material May Dent the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2023 - Mauser Packaging Solutions expanded its production capabilities recently through investments in the manufacture of composite intermediate bulk containers (IBCs) in its Toluca, Mexico facility. A new line focused on IBC cage production was installed in the facility to support the manufacturing of UN-certified 275-gallon composite IBCs in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Rigid Bulk Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Rigid Bulk Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Rigid Bulk Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Rigid Bulk Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence