Key Insights

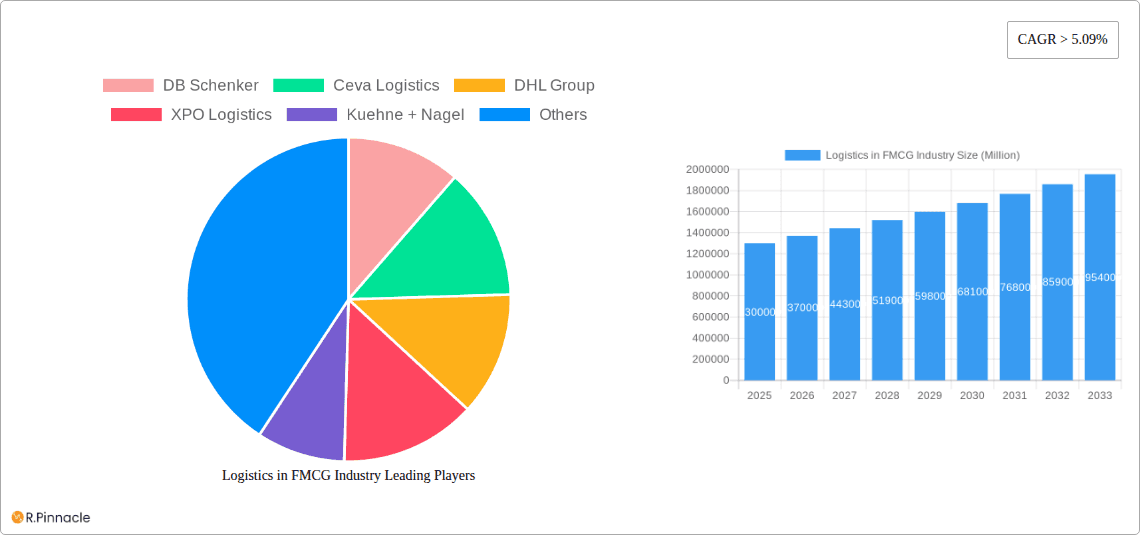

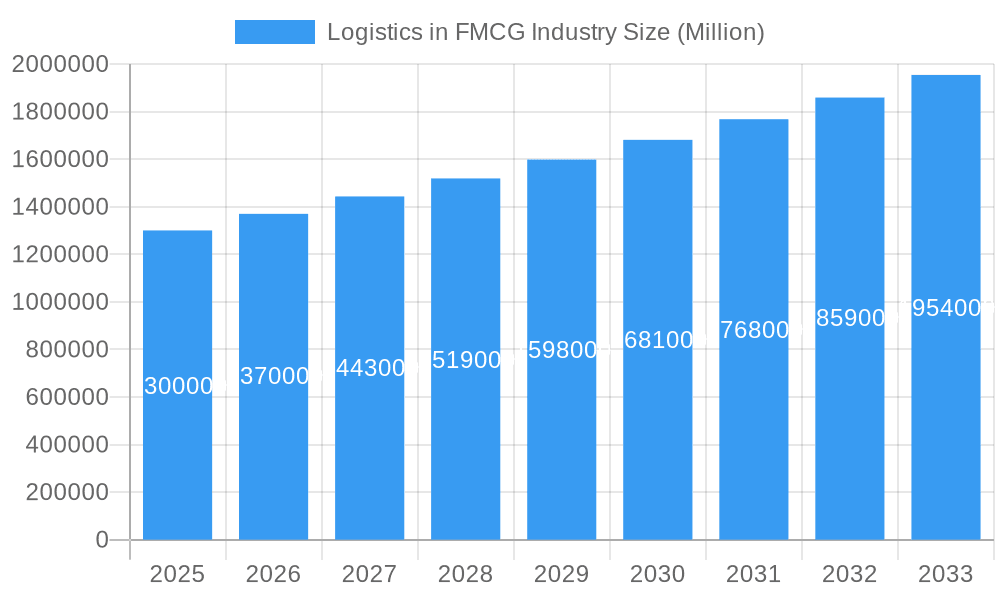

The global logistics market for Fast-Moving Consumer Goods (FMCG) is experiencing robust growth, projected to reach $1.30 trillion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 5.09% from 2025 to 2033. This expansion is fueled by several key factors. E-commerce continues its explosive growth, demanding efficient and reliable last-mile delivery solutions. Simultaneously, increasing consumer expectations for faster and more convenient delivery options are driving innovation in logistics technologies, such as automated warehousing, advanced analytics for inventory management, and sophisticated route optimization software. The growing adoption of omnichannel strategies by FMCG companies necessitates flexible and scalable logistics solutions capable of managing diverse distribution channels, from physical stores to online platforms. Furthermore, globalization and the increasing complexity of supply chains are pushing companies to seek optimized logistics partners that can handle international shipping, customs clearance, and regulatory compliance. The segment of transportation services, followed by warehousing and distribution, accounts for a significant portion of the market.

Logistics in FMCG Industry Market Size (In Million)

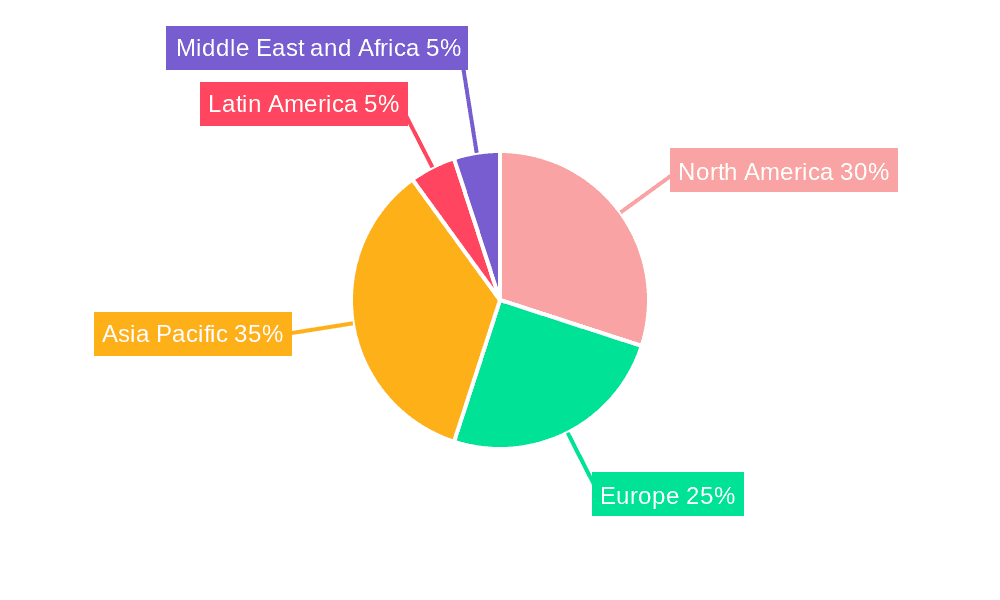

Competition within the FMCG logistics sector is intense, with major players like DB Schenker, Ceva Logistics, DHL Group, XPO Logistics, Kuehne + Nagel, and Penske Logistics vying for market share. These companies are strategically investing in technology and expanding their service offerings to gain a competitive edge. The industry also faces challenges, such as rising fuel costs, labor shortages, and the increasing complexity of regulatory compliance. However, the overall outlook remains positive, driven by sustained growth in e-commerce, the evolving needs of FMCG manufacturers and retailers, and the ongoing digital transformation of the logistics sector itself. Regional variations exist; while North America and Europe represent substantial markets, the Asia-Pacific region exhibits particularly strong growth potential given its burgeoning middle class and expanding e-commerce infrastructure.

Logistics in FMCG Industry Company Market Share

Logistics in FMCG Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Logistics in FMCG Industry market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this dynamic sector. The report leverages extensive data analysis to forecast market trends and offers actionable strategies for success in a rapidly evolving landscape. Key players like DB Schenker, Ceva Logistics, DHL Group, XPO Logistics, Kuehne + Nagel, Penske Logistics, C.H. Robinson, Bolloré Logistics, Kenco Logistics, FM Logistic, Rhenus Logistics, DSV, and Hellmann Worldwide Logistics are analyzed for their market positioning and strategies. The report value is xx Million.

Logistics in FMCG Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the FMCG logistics market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activity. We delve into the market share held by key players such as DB Schenker, DHL, and Kuehne + Nagel, estimating their combined market share at approximately 40% in 2025. The report also investigates the impact of mergers and acquisitions (M&A), with total M&A deal values in the FMCG logistics sector estimated at $xx Million in 2024.

- Market Concentration: High concentration among major players, leading to strategic alliances and partnerships.

- Innovation Drivers: Technological advancements (e.g., AI, IoT), increasing demand for efficient supply chains, and growing e-commerce.

- Regulatory Frameworks: Impact of evolving regulations on transportation, warehousing, and data privacy.

- Product Substitutes: The rise of alternative logistics solutions and their influence on market share.

- End-User Demographics: Analysis of shifting consumer preferences and their effects on demand for FMCG products and logistics services.

- M&A Activities: Evaluation of recent mergers and acquisitions, their motivations, and their impact on market dynamics.

Logistics in FMCG Industry Market Dynamics & Trends

This section explores the key factors shaping the FMCG logistics market, encompassing growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), driven by factors such as rising e-commerce penetration and increasing demand for faster delivery. Market penetration of advanced logistics technologies is anticipated to reach xx% by 2033.

(Paragraph detailing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, including specific metrics like CAGR and market penetration will be included here - 600 words)

Dominant Regions & Segments in Logistics in FMCG Industry

This section identifies the leading regions and segments within the FMCG logistics market. Analysis indicates that [Region Name] is the dominant region, driven by [Specific reasons for dominance]. The Food and Beverage segment shows the highest market share among product categories. Transportation services constitute the largest share of the service segment.

- Key Drivers (By Region):

- [Region Name]: Strong economic growth, robust infrastructure development, favorable government policies.

- [Other Regions]: (Similar bullet points for other significant regions)

- Key Drivers (By Segment):

- By Product Category:

- Food and Beverage: High demand, perishable nature requiring specialized logistics.

- Personal Care: Growing consumer demand for hygiene and beauty products.

- Household Care: Essential goods driving consistent demand.

- Other Consumables: Diverse range impacting logistical needs.

- By Service:

- Transportation: Essential for timely delivery of FMCG goods.

- Warehousing: Need for efficient storage and distribution.

- Distribution: Crucial for reaching end consumers efficiently.

- Inventory Management: Optimization for minimizing costs and maximizing efficiency.

- Other Value-added Services: Increasing demand for specialized services.

- By Product Category:

(Paragraphs providing detailed dominance analysis will be included here - 600 words)

Logistics in FMCG Industry Product Innovations

(Paragraph summarizing product developments, applications, and competitive advantages, emphasizing technological trends and market fit – 100-150 words)

Report Scope & Segmentation Analysis

This report segments the FMCG logistics market by product category (Food and Beverage, Personal Care, Household Care, Other Consumables) and by service (Transportation, Warehousing, Distribution, Inventory Management, Other Value-added Services). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail.

(Paragraph per segment detailing growth projections, market sizes, and competitive dynamics – 100-150 words total)

Key Drivers of Logistics in FMCG Industry Growth

(Paragraphs or lists outlining growth drivers, focusing on technological, economic, and regulatory factors with specific examples – 150 words)

Challenges in the Logistics in FMCG Industry Sector

(Paragraph or list form discussing barriers and restraints, addressing regulatory hurdles, supply chain issues, and competitive pressures with quantifiable impacts – 150 words)

Emerging Opportunities in Logistics in FMCG Industry

(Paragraphs or lists highlighting emerging trends and opportunities, focusing on new markets, technologies, or consumer preferences – 150 words)

Leading Players in the Logistics in FMCG Industry Market

- DB Schenker

- Ceva Logistics

- DHL Group

- XPO Logistics

- Kuehne + Nagel

- Penske Logistics

- C.H. Robinson

- Bolloré Logistics

- Kenco Logistics

- FM Logistic

- Rhenus Logistics

- DSV

- Hellmann Worldwide Logistics

Key Developments in Logistics in FMCG Industry Industry

- August 2023: Reliance Retail expanded its store count by 3,300, reaching a total of 18,040 stores with a combined area of 65.6 million square feet. This expansion significantly increases the demand for efficient logistics solutions.

- July 2023: Swiggy's acquisition of LYNK Logistics marks a major shift in the FMCG logistics landscape, integrating food delivery with a robust B2B retail distribution network. This signifies increased competition and potential disruption in the market.

Future Outlook for Logistics in FMCG Industry Market

(Paragraph summarizing growth accelerators, focusing on future market potential and strategic opportunities – 150 words)

Logistics in FMCG Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

Logistics in FMCG Industry Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. Latin America

- 5. Middle East and Africa

Logistics in FMCG Industry Regional Market Share

Geographic Coverage of Logistics in FMCG Industry

Logistics in FMCG Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising consumer demand for fast and efficient delivery4.; The need for streamlined supply chain operations

- 3.3. Market Restrains

- 3.3.1. 4.; High trasnportation costs4.; Complexity of managing perishable goods

- 3.4. Market Trends

- 3.4.1. Growing Penetration of E-commerce Demands Efficient Logistics Operations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics in FMCG Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Logistics in FMCG Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Household Care

- 6.2.4. Other Consumables

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. North America Logistics in FMCG Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Household Care

- 7.2.4. Other Consumables

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Logistics in FMCG Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Household Care

- 8.2.4. Other Consumables

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Logistics in FMCG Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by Product Category

- 9.2.1. Food and Beverage

- 9.2.2. Personal Care

- 9.2.3. Household Care

- 9.2.4. Other Consumables

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Logistics in FMCG Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by Product Category

- 10.2.1. Food and Beverage

- 10.2.2. Personal Care

- 10.2.3. Household Care

- 10.2.4. Other Consumables

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ceva Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 XPO Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kuehne + Nagel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Penske Logistics**List Not Exhaustive 6 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 C H Robinson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bollore Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kenco Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FM Logistic

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rhenus Logistics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DSV

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hellmann Worlwide Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global Logistics in FMCG Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Logistics in FMCG Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: Asia Pacific Logistics in FMCG Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: Asia Pacific Logistics in FMCG Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 5: Asia Pacific Logistics in FMCG Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 6: Asia Pacific Logistics in FMCG Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Logistics in FMCG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Logistics in FMCG Industry Revenue (Million), by Service 2025 & 2033

- Figure 9: North America Logistics in FMCG Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: North America Logistics in FMCG Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 11: North America Logistics in FMCG Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 12: North America Logistics in FMCG Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Logistics in FMCG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Logistics in FMCG Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe Logistics in FMCG Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Logistics in FMCG Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 17: Europe Logistics in FMCG Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 18: Europe Logistics in FMCG Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Logistics in FMCG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Logistics in FMCG Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Latin America Logistics in FMCG Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Latin America Logistics in FMCG Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 23: Latin America Logistics in FMCG Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 24: Latin America Logistics in FMCG Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Logistics in FMCG Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Logistics in FMCG Industry Revenue (Million), by Service 2025 & 2033

- Figure 27: Middle East and Africa Logistics in FMCG Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East and Africa Logistics in FMCG Industry Revenue (Million), by Product Category 2025 & 2033

- Figure 29: Middle East and Africa Logistics in FMCG Industry Revenue Share (%), by Product Category 2025 & 2033

- Figure 30: Middle East and Africa Logistics in FMCG Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Logistics in FMCG Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logistics in FMCG Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Logistics in FMCG Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: Global Logistics in FMCG Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Logistics in FMCG Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Logistics in FMCG Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 6: Global Logistics in FMCG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Logistics in FMCG Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Logistics in FMCG Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 9: Global Logistics in FMCG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Logistics in FMCG Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Logistics in FMCG Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 12: Global Logistics in FMCG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Logistics in FMCG Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Logistics in FMCG Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: Global Logistics in FMCG Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Logistics in FMCG Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global Logistics in FMCG Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 18: Global Logistics in FMCG Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics in FMCG Industry?

The projected CAGR is approximately > 5.09%.

2. Which companies are prominent players in the Logistics in FMCG Industry?

Key companies in the market include DB Schenker, Ceva Logistics, DHL Group, XPO Logistics, Kuehne + Nagel, Penske Logistics**List Not Exhaustive 6 3 Other Companie, C H Robinson, Bollore Logistics, Kenco Logistics, FM Logistic, Rhenus Logistics, DSV, Hellmann Worlwide Logistics.

3. What are the main segments of the Logistics in FMCG Industry?

The market segments include Service, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.30 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising consumer demand for fast and efficient delivery4.; The need for streamlined supply chain operations.

6. What are the notable trends driving market growth?

Growing Penetration of E-commerce Demands Efficient Logistics Operations.

7. Are there any restraints impacting market growth?

4.; High trasnportation costs4.; Complexity of managing perishable goods.

8. Can you provide examples of recent developments in the market?

August 2023: Reliance Retail expanded its store count by 3,300 reaching a total of 18,040 stores with a combined area of 65.6 million square feet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics in FMCG Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics in FMCG Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics in FMCG Industry?

To stay informed about further developments, trends, and reports in the Logistics in FMCG Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence