Key Insights

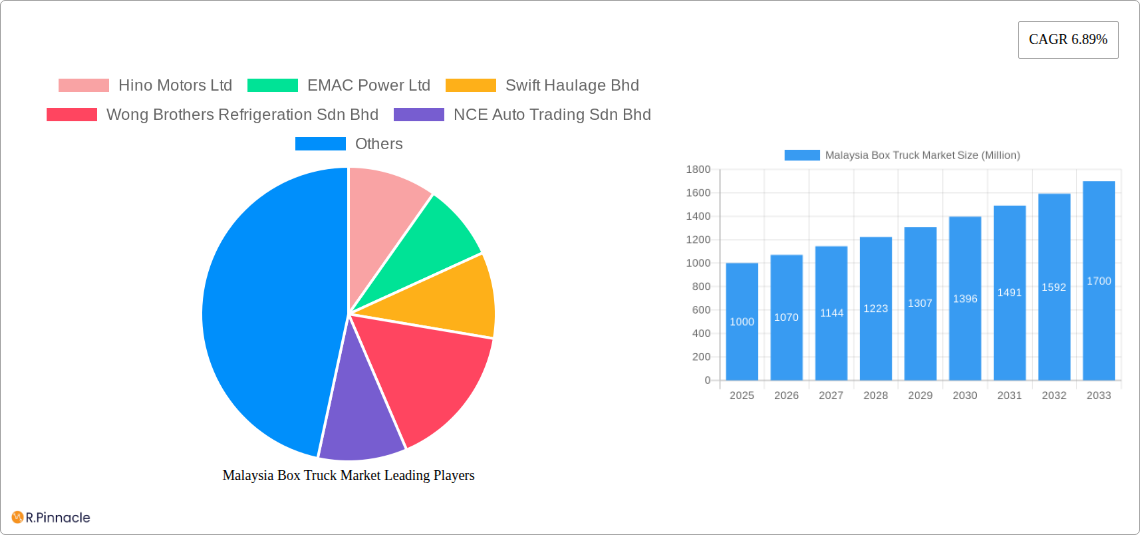

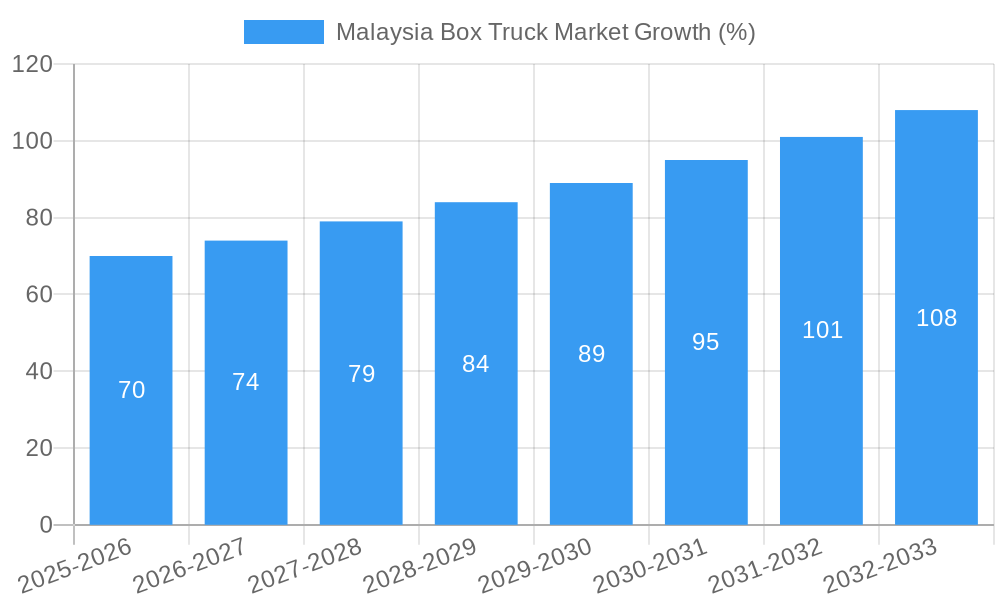

The Malaysia box truck market, valued at approximately RM 1 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.89% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector and the resulting surge in last-mile delivery services are significantly boosting demand for efficient and reliable box trucks. Furthermore, improvements in infrastructure and the expansion of logistics networks across Malaysia are creating favorable conditions for market growth. The increasing adoption of refrigerated box trucks for the transportation of perishable goods, particularly in the food and beverage sector, is another contributing factor. Finally, government initiatives aimed at modernizing the transportation sector and promoting sustainable logistics practices are fostering investments in newer, more efficient box truck technologies, including electric vehicles.

However, the market also faces certain challenges. Fluctuations in fuel prices can impact operational costs for businesses relying on Internal Combustion Engine (ICE) vehicles. Moreover, the relatively high initial investment associated with electric box trucks might hinder wider adoption, particularly among smaller businesses. Despite these restraints, the long-term outlook for the Malaysia box truck market remains positive, driven by sustained economic growth, a flourishing e-commerce landscape, and the increasing focus on efficient and sustainable logistics solutions. Key players such as Hino Motors Ltd, Tata Motors Limited, and Mitsubishi Fuso Truck and Bus Corporation are well-positioned to capitalize on these opportunities. Segmentation analysis reveals a strong preference for refrigerated box trucks in the food delivery sector, highlighting a significant market niche ripe for further development.

This comprehensive report provides a detailed analysis of the Malaysia box truck market, offering invaluable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Benefit from our in-depth analysis of market size, segmentation, competitive landscape, and future trends.

Malaysia Box Truck Market Structure & Innovation Trends

The Malaysian box truck market exhibits a moderately fragmented structure, with several key players competing for market share. Market concentration is relatively low, with no single dominant player holding a significant majority. Innovation is driven primarily by the increasing demand for efficient and sustainable logistics solutions, leading to the adoption of electric vehicles and advanced telematics systems. The regulatory framework, including emission standards and safety regulations, plays a significant role in shaping market trends. Product substitutes, such as smaller delivery vans or third-party logistics services, pose a competitive challenge. The end-user demographic is diverse, encompassing various industries such as food and beverage, e-commerce, and manufacturing. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging approximately xx Million in recent years.

- Key Players Market Share (Estimated 2025): Hino Motors Ltd (15%), Isuzu Motors Ltd (12%), Mitsubishi Fuso Truck and Bus Corporation (10%), Others (63%)

- Recent M&A Activity: While specific deal values are unavailable, several smaller acquisitions have been observed in the past few years, primarily focused on consolidation within the logistics sector.

Malaysia Box Truck Market Market Dynamics & Trends

The Malaysian box truck market is experiencing robust growth, driven by the expansion of e-commerce, rising urbanization, and improvements in infrastructure. Technological disruptions, such as the introduction of electric vehicles and advanced driver-assistance systems (ADAS), are reshaping the market landscape. Consumer preferences are shifting towards fuel-efficient, environmentally friendly, and technologically advanced vehicles. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative solutions. The Compound Annual Growth Rate (CAGR) for the market is projected to be xx% during the forecast period (2025-2033). Market penetration of electric box trucks is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions & Segments in Malaysia Box Truck Market

The Klang Valley region dominates the Malaysian box truck market due to its high population density, thriving e-commerce sector, and well-developed infrastructure. Within the market segmentation, the non-refrigerated box truck segment holds the largest market share, driven by the demand from general freight transportation. However, the refrigerated segment is experiencing faster growth fueled by the expanding food delivery industry. IC Engine vehicles currently dominate the propulsion type segment, but the electric segment is poised for significant growth due to government incentives and environmental concerns. Last-mile delivery is a key application area, witnessing rapid expansion due to the increasing popularity of online shopping.

- Key Drivers for Klang Valley Dominance: High population density, robust e-commerce activity, efficient logistics infrastructure.

- Refrigerated Segment Growth Drivers: Increasing demand for temperature-sensitive goods transportation, expansion of the cold chain logistics industry.

- Electric Segment Growth Drivers: Government incentives for electric vehicle adoption, growing environmental awareness among businesses.

Malaysia Box Truck Market Product Innovations

Recent product innovations focus on enhancing fuel efficiency, incorporating advanced safety features, and integrating telematics for better fleet management. The integration of electric powertrains is a significant trend, responding to environmental concerns and government regulations. These innovations are improving operational efficiency and lowering the total cost of ownership, enhancing market fit for various applications.

Report Scope & Segmentation Analysis

This report segments the Malaysian box truck market based on vehicle type (refrigerated, non-refrigerated), propulsion type (IC engine, electric), and application type (food delivery, last-mile delivery, others). Each segment is analyzed based on its market size, growth projections, and competitive dynamics. The non-refrigerated segment is the largest, while the electric segment is projected to show the highest growth rate. Food delivery and last-mile delivery are the dominant application segments.

Key Drivers of Malaysia Box Truck Market Growth

The Malaysian box truck market is driven by several factors, including:

- E-commerce Boom: The rapid growth of online shopping significantly boosts demand for efficient delivery solutions.

- Infrastructure Development: Investments in roads and logistics infrastructure facilitate smoother transportation.

- Government Initiatives: Policies supporting the adoption of electric vehicles and improvements in logistics are stimulating market growth.

Challenges in the Malaysia Box Truck Market Sector

The market faces challenges including:

- High Fuel Prices: Fluctuations in fuel costs impact operational expenses for businesses.

- Supply Chain Disruptions: Global supply chain disruptions affect the availability of vehicles and parts.

- Driver Shortages: A shortage of qualified drivers restricts the efficient operation of logistics services.

Emerging Opportunities in Malaysia Box Truck Market

- Electric Vehicle Adoption: The increasing adoption of electric box trucks presents significant opportunities for manufacturers and infrastructure providers.

- Technological Advancements: Integration of advanced telematics and autonomous driving technologies offers potential for increased efficiency.

- Last-Mile Delivery Solutions: The continued growth of e-commerce will drive innovation and expansion in this segment.

Leading Players in the Malaysia Box Truck Market Market

- Hino Motors Ltd

- EMAC Power Ltd

- Swift Haulage Bhd

- Wong Brothers Refrigeration Sdn Bhd

- NCE Auto Trading Sdn Bhd

- JK Schelkis offShore Sdn Bhd

- Traton Group

- Tata Motors Limited

- Mitsubishi Fuso Truck and Bus Corporation

- T R K Bangkok Industry & Exporter Co Ltd

- UD Trucks Corp

- A-Plus Manufacturing Sdn Bhd

- Isuzu Motors Ltd

- Chop Yong Cheong (CYC)

Key Developments in Malaysia Box Truck Market Industry

- December 2021: Swift Haulage Bhd announced expansion plans, strengthening its position in the market.

- August 2022: Swift Haulage Bhd partnered with Volvo Trucks Malaysia to introduce electric commercial vehicles, signifying a move towards sustainable logistics.

Future Outlook for Malaysia Box Truck Market Market

The Malaysian box truck market is poised for continued growth, driven by e-commerce expansion, infrastructure development, and the adoption of electric vehicles. Strategic opportunities exist for players who can offer innovative, sustainable, and cost-effective solutions to meet the evolving demands of the logistics industry. The market's future is bright, with significant potential for expansion and innovation.

Malaysia Box Truck Market Segmentation

-

1. Vehicle Type

- 1.1. Refrigerated

- 1.2. Non-Refrigerated

-

2. Propulsion Type

- 2.1. IC Engine

- 2.2. Electric

-

3. Application Type

- 3.1. Food Delivery

- 3.2. Last Mile Delivery

- 3.3. Others

Malaysia Box Truck Market Segmentation By Geography

- 1. Malaysia

Malaysia Box Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Fast Food is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increase in the Online Food Deliveries May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Demand for Sustainable Transport to Propel the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Box Truck Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Refrigerated

- 5.1.2. Non-Refrigerated

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Food Delivery

- 5.3.2. Last Mile Delivery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hino Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EMAC Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Swift Haulage Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wong Brothers Refrigeration Sdn Bhd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NCE Auto Trading Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JK Schelkis offShore Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Traton Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motors Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Fuso Truck and Bus Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 T R K Bangkok Industry & Exporter Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 UD Trucks Corp

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 A-Plus Manufacturing Sdn Bhd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Isuzu Motors Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Chop Yong Cheong (CYC)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Hino Motors Ltd

List of Figures

- Figure 1: Malaysia Box Truck Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Box Truck Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Box Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Box Truck Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Malaysia Box Truck Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Malaysia Box Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 5: Malaysia Box Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Box Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Malaysia Box Truck Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Malaysia Box Truck Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 9: Malaysia Box Truck Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 10: Malaysia Box Truck Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Box Truck Market?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Malaysia Box Truck Market?

Key companies in the market include Hino Motors Ltd, EMAC Power Ltd, Swift Haulage Bhd, Wong Brothers Refrigeration Sdn Bhd, NCE Auto Trading Sdn Bhd, JK Schelkis offShore Sdn Bhd, Traton Group, Tata Motors Limited, Mitsubishi Fuso Truck and Bus Corporation, T R K Bangkok Industry & Exporter Co Ltd, UD Trucks Corp, A-Plus Manufacturing Sdn Bhd, Isuzu Motors Ltd, Chop Yong Cheong (CYC).

3. What are the main segments of the Malaysia Box Truck Market?

The market segments include Vehicle Type, Propulsion Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Fast Food is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Demand for Sustainable Transport to Propel the Demand.

7. Are there any restraints impacting market growth?

Increase in the Online Food Deliveries May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Swift Haulage Bhd, a major logistics service provider, announced international cooperation and MoU with Volvo Trucks Malaysto to introduce electric commercial vehicles in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Box Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Box Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Box Truck Market?

To stay informed about further developments, trends, and reports in the Malaysia Box Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence