Key Insights

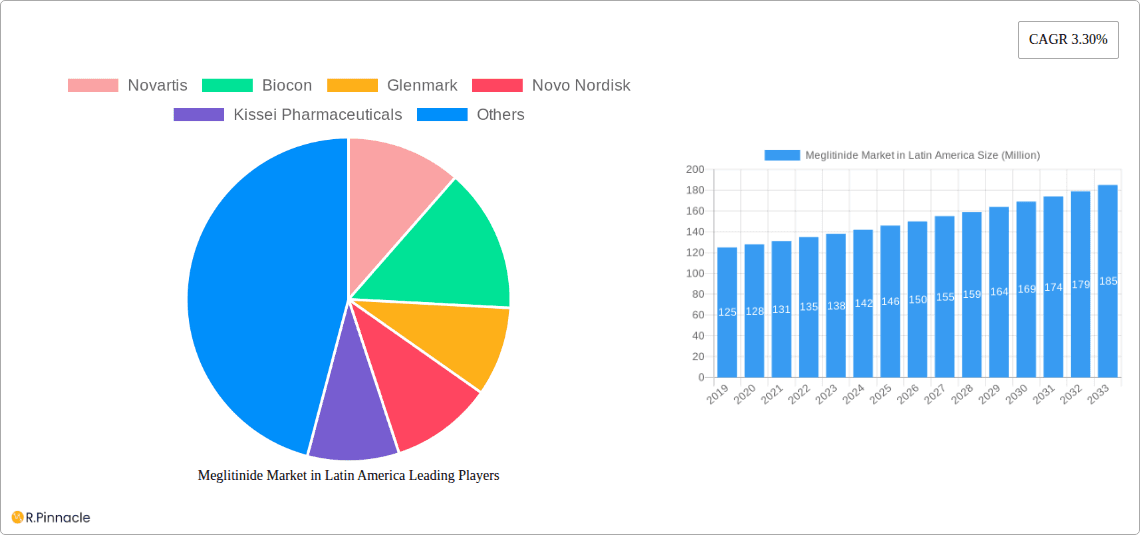

The Latin American Meglitinide market is projected to expand to approximately $47.1 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 3.9%. This growth is propelled by the rising incidence of type 2 diabetes, attributed to lifestyle shifts, escalating obesity, and an aging demographic. Brazil leads the regional market, followed by Mexico, with the "Rest of Latin America" segment exhibiting strong development potential. Increased awareness of meglitinides for managing postprandial hyperglycemia among healthcare providers and patients further fuels market growth. Strategic initiatives by industry leaders, including new product introductions and expanded distribution, are anticipated to boost demand.

Meglitinide Market in Latin America Market Size (In Billion)

Despite a positive growth outlook, market expansion faces challenges from competing antidiabetic drug classes, such as SGLT2 inhibitors and GLP-1 receptor agonists, which offer broader therapeutic benefits. Stringent regulatory environments and pricing constraints in select Latin American nations may also impede market penetration. Nevertheless, the rapid onset of action and favorable safety profile of meglitinides, particularly for specific patient groups, will ensure their continued market relevance. The growing emphasis on personalized medicine and the development of combination therapies are key trends poised to shape the future of the meglitinide market in Latin America, fostering innovation and addressing diverse patient requirements.

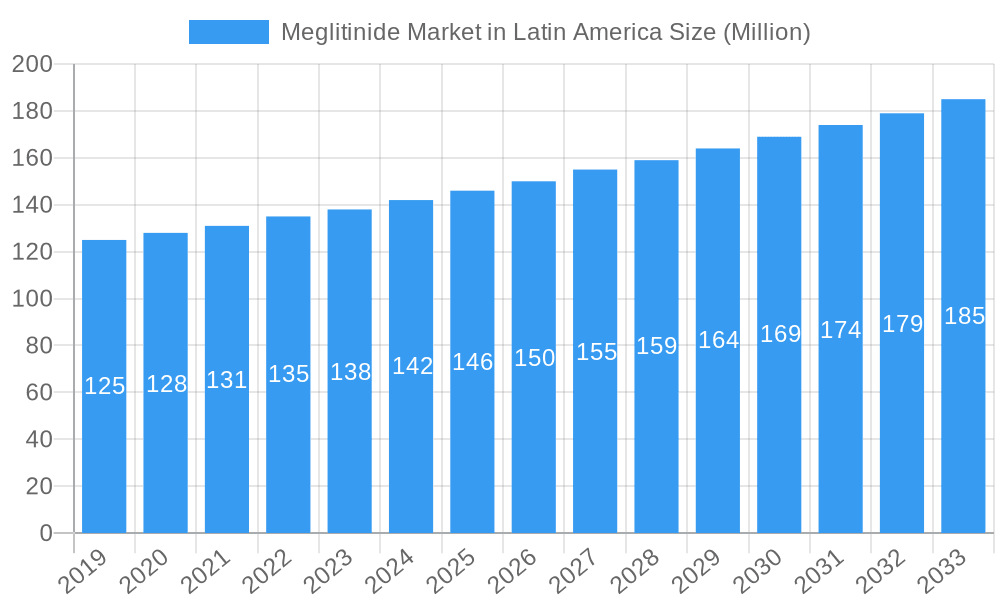

Meglitinide Market in Latin America Company Market Share

Meglitinide Market in Latin America: Comprehensive Market Research Report 2024-2033

Gain unparalleled insights into the evolving Latin American meglitinide market with this in-depth report. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this analysis is essential for pharmaceutical manufacturers, investors, and healthcare providers seeking to understand market dynamics, identify opportunities, and navigate challenges in the region. Our research leverages high-ranking keywords to ensure maximum visibility and provides actionable intelligence for strategic decision-making. The report is meticulously structured for clarity and immediate application, requiring no further modification.

Meglitinide Market in Latin America Market Structure & Innovation Trends

The Latin American meglitinide market exhibits a moderate concentration, with key players like Novartis, Biocon, Glenmark, Novo Nordisk, Kissei Pharmaceuticals, and Boehringer Ingelheim actively participating. Innovation is primarily driven by ongoing clinical trials and the exploration of new therapeutic applications for meglitinides, particularly in managing type 2 diabetes. Regulatory frameworks across Latin American countries, while varying, are generally evolving to accommodate novel drug approvals and healthcare advancements. Product substitutes, including other oral antidiabetic agents and insulin therapies, present a competitive landscape that necessitates continuous product differentiation. End-user demographics are predominantly adults diagnosed with type 2 diabetes, with a growing emphasis on patient adherence and improved glycemic control. Merger and acquisition (M&A) activities are anticipated to remain strategic, focusing on market consolidation and expansion into emerging economies within the region. For instance, the M&A deal value in the broader diabetes therapeutics sector has seen significant investments in recent years, indicating a healthy appetite for strategic partnerships. The market share for meglitinides within the overall antidiabetic drug market is estimated at approximately 5% in the base year of 2025.

Meglitinide Market in Latin America Market Dynamics & Trends

The Latin American meglitinide market is poised for significant expansion, fueled by a confluence of escalating type 2 diabetes prevalence, rising healthcare expenditures, and increasing patient awareness. The growing burden of chronic diseases, including diabetes, across Latin America is a primary growth driver. As the population ages and lifestyle-related health issues become more prominent, the demand for effective and accessible diabetes management solutions, such as meglitinides, is set to surge. Technological disruptions, while not as rapid as in some other pharmaceutical sectors, are subtly shaping the market through advancements in drug delivery mechanisms and the development of more patient-friendly formulations. Consumer preferences are increasingly leaning towards oral antidiabetic medications due to their convenience and reduced administration complexity compared to injectable therapies. This trend directly benefits the meglitinide class. Competitive dynamics are characterized by a blend of established global pharmaceutical giants and burgeoning local players, all vying for market share through product innovation, strategic pricing, and robust distribution networks. The market penetration of meglitinides is currently estimated at 40% of the target patient population and is projected to grow steadily. The compound annual growth rate (CAGR) for the meglitinide market in Latin America is projected to be approximately 6.5% during the forecast period. Furthermore, the increasing focus on diabetes management programs and government initiatives aimed at curbing the rising incidence of diabetes are creating a more conducive environment for market growth. The economic development and improving healthcare infrastructure in several Latin American nations are also contributing to the increased accessibility and affordability of meglitinide medications. The shift towards personalized medicine and the growing understanding of individual patient responses to different antidiabetic drugs may also lead to more tailored prescribing patterns for meglitinides.

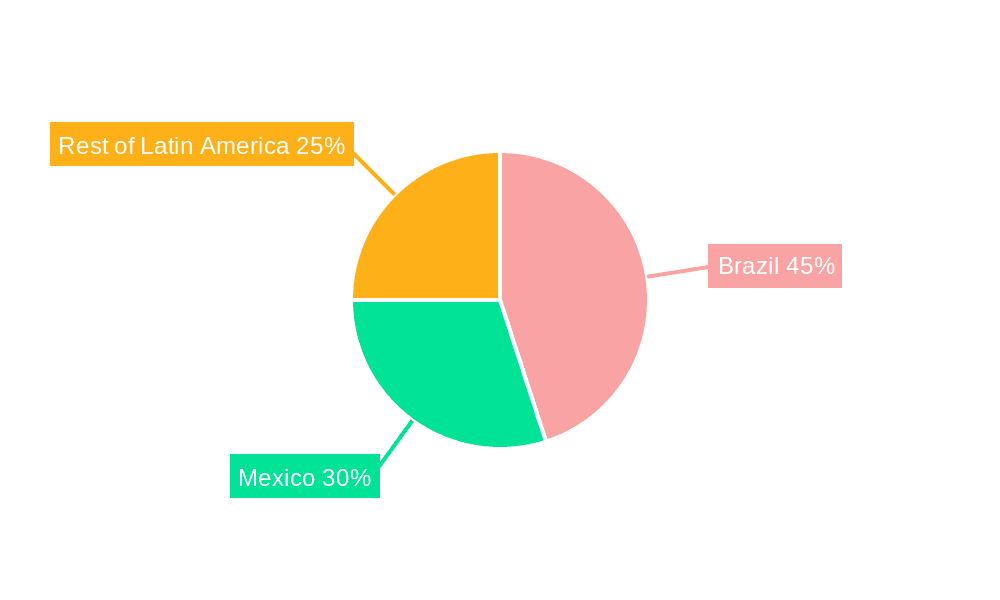

Dominant Regions & Segments in Meglitinide Market in Latin America

Within the Latin American meglitinide market, Brazil emerges as the dominant region, driven by its large population, significant prevalence of type 2 diabetes, and a well-established healthcare infrastructure. The country's substantial investments in public health programs and a growing disposable income among its populace further bolster the demand for antidiabetic medications, including meglitinides.

- Brazil's Dominance:

- High Diabetes Prevalence: Brazil has one of the highest rates of type 2 diabetes in Latin America, creating a vast patient pool.

- Healthcare Spending: Government and private sector spending on healthcare is robust, facilitating access to advanced treatments.

- Market Access: Favorable reimbursement policies and a developed pharmaceutical distribution network enable wider product reach.

- Economic Policies: Supportive economic policies and a strong focus on public health initiatives contribute to market growth.

Mexico stands as another key market, characterized by a rapidly growing diabetic population and a burgeoning pharmaceutical industry. The increasing adoption of modern treatment protocols and the presence of leading pharmaceutical companies contribute to its significant market share.

- Mexico's Growth Factors:

- Rising Diabetes Incidence: Similar to Brazil, Mexico faces a significant and growing challenge with type 2 diabetes.

- Technological Adoption: The country is increasingly adopting advanced diagnostic and treatment technologies.

- Competitive Landscape: A dynamic market with both multinational and domestic pharmaceutical players drives innovation and market penetration.

The Rest of Latin America segment, encompassing countries like Argentina, Colombia, Chile, and Peru, represents a burgeoning market with substantial untapped potential. As healthcare systems in these nations mature and economic conditions improve, the demand for effective diabetes management solutions is expected to accelerate.

- Rest of Latin America Potential:

- Emerging Economies: Rapid economic development in several nations is improving healthcare affordability.

- Increasing Awareness: Growing public and medical awareness about diabetes management is a key driver.

- Untapped Market Share: Significant opportunities exist for market penetration and growth for meglitinide manufacturers.

In terms of drug segments, the Meglitinides drug class itself is the focal point of this report, comprising a specific group of oral antidiabetic medications. Their market presence is directly influenced by the prevalence of type 2 diabetes and physician preference for their unique mechanism of action, which stimulates insulin secretion.

Meglitinide Market in Latin America Product Innovations

Product innovations in the Latin American meglitinide market are characterized by a focus on enhancing patient convenience and efficacy. While radical new meglitinide molecules are less frequent, there's an emphasis on developing combination therapies that integrate meglitinides with other antidiabetic agents to achieve better glycemic control and address multiple facets of diabetes management. These innovations aim to offer synergistic benefits, improve patient adherence through simplified treatment regimens, and provide a competitive edge in a crowded market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Meglitinide Market in Latin America, segmented by Drug: Meglitinides and Geography: Brazil, Mexico, and Rest of Latin America. For the Meglitinides segment, the report details market size, growth projections, and competitive dynamics specific to this drug class within the broader antidiabetic landscape. Projections for this segment indicate a stable growth trajectory, driven by its established role in type 2 diabetes management. The geographical segmentation offers granular insights into each region's market potential, regulatory environment, and key market drivers. Brazil is projected to maintain its leadership position, followed by Mexico and then the Rest of Latin America, which presents significant untapped growth opportunities.

Key Drivers of Meglitinide Market in Latin America Growth

The growth of the meglitinide market in Latin America is propelled by several key factors. The escalating global and regional prevalence of type 2 diabetes, directly linked to changing lifestyles and increasing obesity rates, creates a substantial patient pool requiring effective management. Economic development across several Latin American countries is leading to increased healthcare expenditure and improved access to medications. Furthermore, a growing awareness among both patients and healthcare professionals regarding the benefits of meglitinides, particularly their rapid onset of action and flexibility in mealtime dosing, is contributing to their adoption.

Challenges in the Meglitinide Market in Latin America Sector

Despite the promising growth, the meglitinide market in Latin America faces certain challenges. Stringent regulatory approval processes in some countries can lead to prolonged market entry timelines. The presence of numerous alternative antidiabetic drug classes and the increasing availability of biosimilars and generics exert significant pricing pressure. Supply chain complexities and logistical hurdles in certain remote areas can also impede market penetration.

Emerging Opportunities in Meglitinide Market in Latin America

Emerging opportunities in the Latin American meglitinide market lie in the development of novel fixed-dose combination therapies that enhance patient compliance and therapeutic outcomes. The increasing focus on preventative healthcare and early intervention for diabetes presents a chance to capture market share by targeting nascent diabetic populations. Furthermore, strategic partnerships with local healthcare providers and government bodies can facilitate market access and foster greater adoption of meglitinide treatments across diverse socioeconomic groups.

Leading Players in the Meglitinide Market in Latin America Market

- Novartis

- Biocon

- Glenmark

- Novo Nordisk

- Kissei Pharmaceuticals

- Boehringer Ingelheim

Key Developments in Meglitinide Market in Latin America Industry

- March 2023: A Randomized, Open-Label, Controlled, Parallel-group, Multicenter Trial is being conducted to evaluate the efficacy and safety of INS068 once daily (QD) in subjects with type 2 diabetes not adequately controlled with oral antidiabetic drugs compared to insulin Glargine QD for 26+26 weeks. This development indicates ongoing research into novel treatments for type 2 diabetes, potentially impacting the broader antidiabetic market.

- January 2023: OXJournal reviewed the effects of meglitinides as a class of oral medications for treating type 2 diabetes, especially in young adults. This review highlights the continued scientific interest in meglitinides and their potential application in specific patient demographics, potentially influencing prescribing patterns.

Future Outlook for Meglitinide Market in Latin America Market

The future outlook for the meglitinide market in Latin America is characterized by sustained growth, driven by the persistent rise in type 2 diabetes prevalence and increasing healthcare investments. The market is expected to benefit from advancements in drug formulation and combination therapies, leading to improved patient outcomes and adherence. Strategic collaborations and a focus on emerging economies within the region will be crucial for market expansion. The ongoing research and development efforts, as evidenced by clinical trials and scientific reviews, will continue to shape the competitive landscape and ensure the continued relevance of meglitinides in diabetes management.

Meglitinide Market in Latin America Segmentation

-

1. Drug

- 1.1. Meglitinides

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Meglitinide Market in Latin America Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Meglitinide Market in Latin America Regional Market Share

Geographic Coverage of Meglitinide Market in Latin America

Meglitinide Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Latin America Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. Brazil Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Meglitinides

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. Mexico Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Meglitinides

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Rest of Latin America Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Meglitinides

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Novartis

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Biocon

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Glenmark

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Novo Nordisk

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kissei Pharmaceuticals

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Boehringer Ingelheim

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Novartis

List of Figures

- Figure 1: Meglitinide Market in Latin America Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Meglitinide Market in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 2: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 3: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Meglitinide Market in Latin America Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Meglitinide Market in Latin America Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 8: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 9: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Meglitinide Market in Latin America Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Meglitinide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 14: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 15: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Meglitinide Market in Latin America Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Meglitinide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 20: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 21: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Meglitinide Market in Latin America Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Meglitinide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meglitinide Market in Latin America?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Meglitinide Market in Latin America?

Key companies in the market include Novartis, Biocon, Glenmark, Novo Nordisk, Kissei Pharmaceuticals, Boehringer Ingelheim.

3. What are the main segments of the Meglitinide Market in Latin America?

The market segments include Drug, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Latin America Region.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: A Randomized, Open-Label, Controlled, Parallel-group, Multicenter Trial is being conducted to evaluate the efficacy and safety of INS068 once daily (QD) in subjects with type 2 diabetes not adequately controlled with oral antidiabetic drugs compared to insulin Glargine QD for 26+26 weeks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meglitinide Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meglitinide Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meglitinide Market in Latin America?

To stay informed about further developments, trends, and reports in the Meglitinide Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence