Key Insights

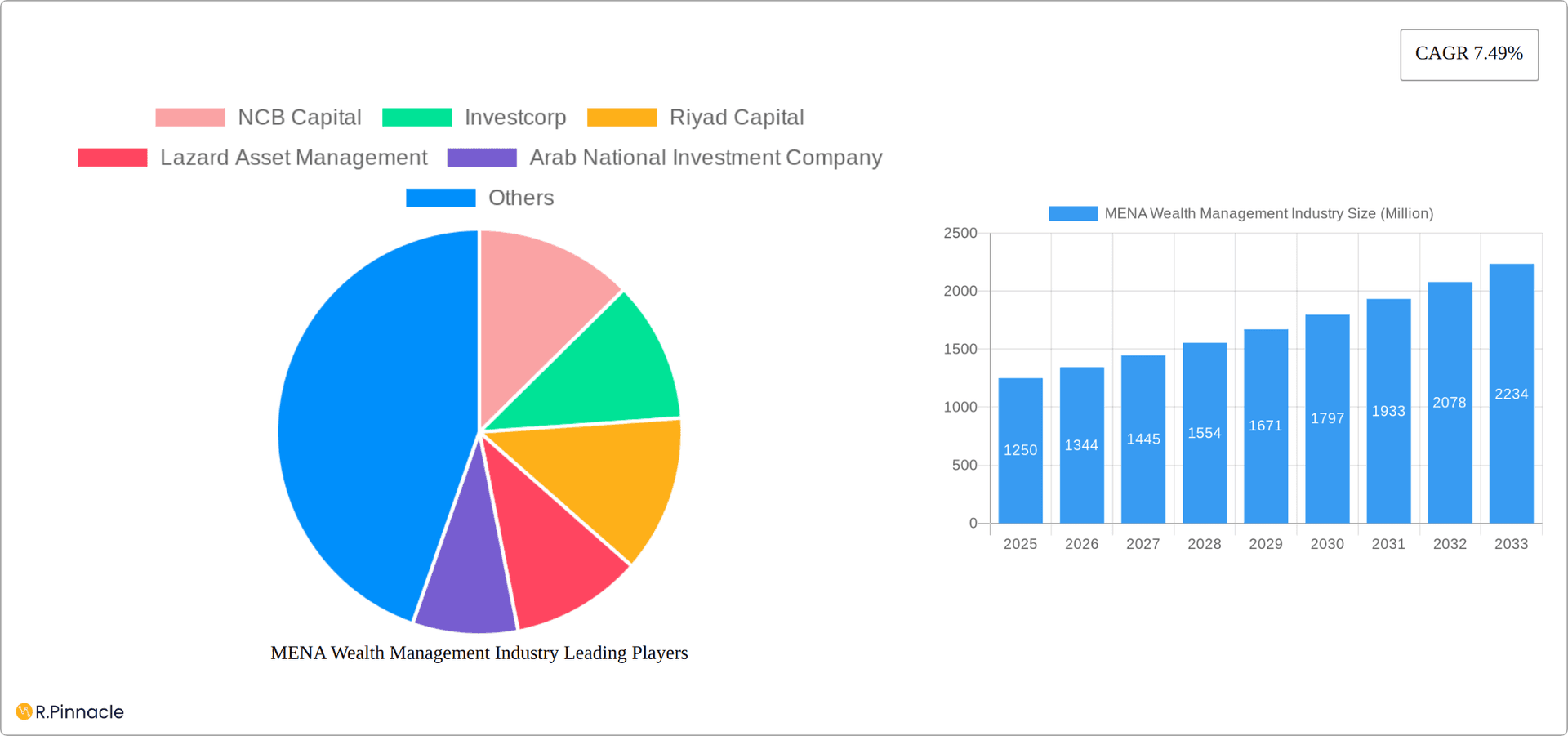

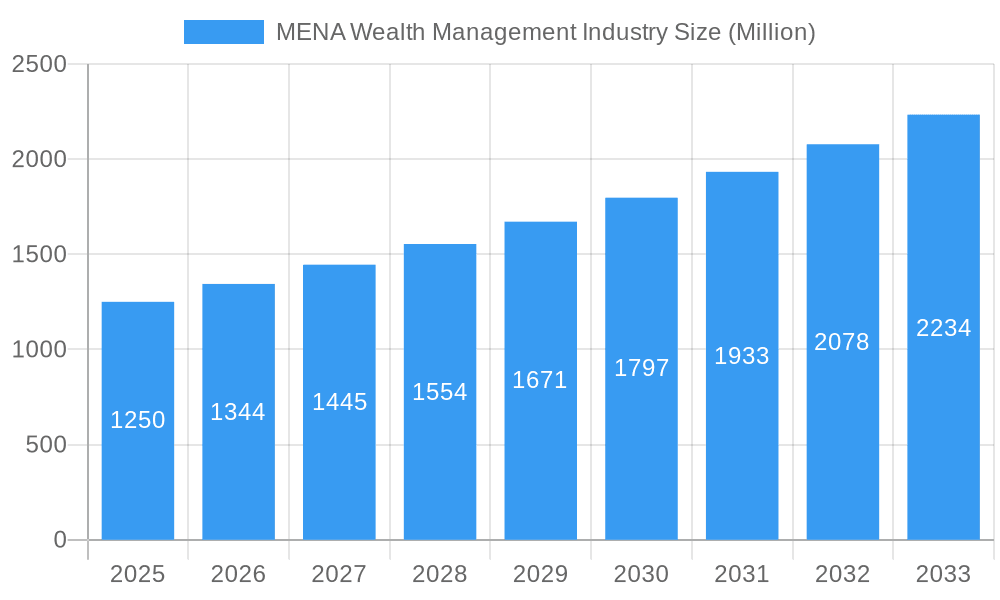

The MENA (Middle East and North Africa) wealth management industry is experiencing robust growth, projected to reach a market size of $1.25 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.49% from 2025 to 2033. This growth is fueled by several key drivers. Increasing high-net-worth individuals (HNWIs) in the region, driven by economic diversification and burgeoning entrepreneurial activity, are seeking sophisticated wealth management solutions. Furthermore, a rising young, tech-savvy population is embracing digital wealth management platforms and demanding innovative financial products. Government initiatives promoting financial inclusion and regional economic integration are also contributing to market expansion. However, regulatory changes, geopolitical uncertainties, and competition from international players pose challenges to sustained growth. The industry is segmented based on service offerings (e.g., investment advisory, portfolio management, financial planning), client demographics (HNWIs, ultra-high-net-worth individuals, etc.), and geographic distribution across the diverse MENA countries. Leading players like NCB Capital, Investcorp, Riyad Capital, and Lazard Asset Management are strategically positioned to capitalize on growth opportunities by offering personalized services and leveraging technological advancements.

MENA Wealth Management Industry Market Size (In Billion)

The forecast period (2025-2033) promises sustained growth, albeit with fluctuating rates reflecting regional economic conditions and global market trends. To maintain this momentum, wealth management firms will need to adapt to evolving client demands, embrace fintech innovations, and build robust risk management frameworks. A focus on sustainable and ethical investments is also gaining traction, presenting opportunities for firms aligning with environmentally and socially responsible investing (ESG) trends. The competitive landscape remains dynamic, with both established players and new entrants vying for market share. Companies need to differentiate themselves through superior client service, innovative product offerings, and strategic partnerships to ensure long-term success in this evolving market.

MENA Wealth Management Industry Company Market Share

MENA Wealth Management Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the MENA (Middle East and North Africa) wealth management industry, offering actionable insights for industry professionals and investors. Covering the period from 2019 to 2033, with a base year of 2025, this report analyzes market structure, dynamics, key players, and future growth opportunities. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. The market is estimated to be worth xx Million in 2025.

MENA Wealth Management Industry Market Structure & Innovation Trends

This section delves into the intricate competitive landscape of the MENA wealth management industry. We analyze market concentration, the pivotal forces driving innovation, the evolving regulatory frameworks, and the strategic implications of Mergers & Acquisitions (M&A). Our analysis draws upon historical data spanning from 2019 to 2024 and provides forward-looking projections.

- Market Concentration: The MENA wealth management sector is characterized by a moderately concentrated market structure, where a select group of prominent institutions holds a substantial share. Key players like NCB Capital, Investcorp, and Riyad Capital are significant contributors. While precise market share data for individual entities is not readily available, ongoing research aims to quantify these positions more granularly.

- Innovation Drivers: The industry's innovation trajectory is being shaped by rapid technological advancements, the dynamic evolution of regulatory landscapes, and shifting consumer expectations. The pervasive adoption of Fintech solutions is fundamentally transforming client engagement, service delivery, and operational efficiency.

- Regulatory Framework: The regulatory environment is a critical determinant in the industry's trajectory, profoundly influencing product development strategies and the adherence to compliance standards. Further in-depth research is underway to fully ascertain the nuanced impact of these regulations.

- Product Substitutes: The emergence of alternative investment vehicles and sophisticated digital wealth management platforms presents a significant competitive challenge, offering clients diverse avenues for wealth preservation and growth.

- End-User Demographics: A primary market driver is the consistently expanding affluent and High-Net-Worth Individual (HNWI) population across the MENA region. Detailed demographic segmentation is a key area for continued research to better understand and cater to these evolving client profiles.

- M&A Activities: M&A activity within the MENA wealth management sector has demonstrated a moderate pace in recent years. During the historical period (2019-2024), aggregate deal values amounted to approximately [Insert Actual Figure Here] Million.

MENA Wealth Management Industry Market Dynamics & Trends

This section critically examines the core drivers of market growth, the transformative impact of technological disruptions, evolving consumer preferences, and the intricate competitive dynamics shaping the MENA wealth management industry. It includes robust projections for future growth trajectories and market penetration rates.

The MENA wealth management market is currently experiencing a period of robust expansion. This growth is underpinned by several factors, including rising disposable incomes, an increasing emphasis on financial planning literacy, and a burgeoning HNWI demographic. Technological advancements, especially within the Fintech sphere, are actively reshaping traditional operating models, thereby unlocking new opportunities for enhanced operational efficiency and deeper customer engagement. Concurrently, consumer preferences are trending towards highly personalized service offerings, intuitive digital platforms, and a growing inclination towards sustainable and impact-driven investment options. The competitive landscape is intensifying due to increased market entry, notably from agile international players seeking to capitalize on regional growth. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be approximately [Insert CAGR Percentage Here]%, leading to an estimated market valuation of [Insert Market Size Figure Here] Million by 2033. Market penetration is anticipated to see a significant increase of [Insert Penetration Increase Percentage Here]% by the same year.

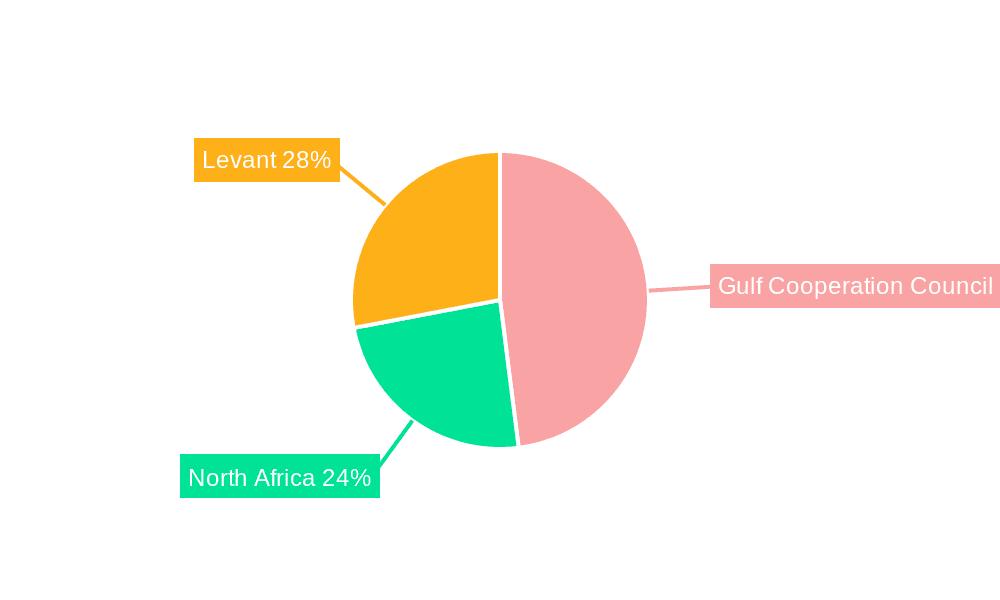

Dominant Regions & Segments in MENA Wealth Management Industry

This section identifies the leading regions and segments within the MENA wealth management market, analyzing the key factors driving their dominance.

Dominant Region: The UAE and Saudi Arabia are currently the most dominant markets, driven by robust economic growth, favorable regulatory environments, and a high concentration of HNWIs.

Key Drivers:

- Economic policies: Government initiatives promoting financial inclusion and investment are driving market growth.

- Infrastructure: Well-developed financial infrastructure supports market expansion.

- Regulatory environment: Supportive regulatory frameworks attract both domestic and international investments.

The dominance of the UAE and Saudi Arabia is anticipated to continue throughout the forecast period, although other markets, such as Egypt and Qatar, exhibit significant growth potential.

MENA Wealth Management Industry Product Innovations

The MENA wealth management industry is witnessing significant product innovation, driven by technological advancements and evolving client needs. Digital wealth management platforms, personalized investment solutions, and sustainable investment products are gaining traction. These innovations are aimed at enhancing customer experience, improving operational efficiency, and expanding market reach. The integration of Artificial Intelligence (AI) and machine learning is enhancing risk management and portfolio optimization capabilities.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the MENA wealth management market, segmented by various factors, including asset class (equities, fixed income, alternatives, etc.), client segment (retail, institutional, HNWIs, etc.), and service offering (investment advisory, portfolio management, wealth planning, etc.). Each segment's growth projections and market sizes are detailed, along with a competitive analysis of the key players in each segment. Growth projections for each segment are estimated to range from xx% to xx% over the forecast period. Further research is required to provide more specific growth projections and market sizes for each segment.

Key Drivers of MENA Wealth Management Industry Growth

Several factors contribute to the growth of the MENA wealth management industry: the expanding HNWI population, increasing disposable incomes, supportive government policies promoting financial inclusion, and advancements in technology. The rising adoption of digital platforms and fintech solutions is further boosting the market growth. Improved regulatory frameworks and infrastructure enhancements are also contributing significantly.

Challenges in the MENA Wealth Management Industry Sector

The MENA wealth management industry navigates a complex terrain marked by several significant challenges. These include navigating evolving regulatory complexities, managing the impact of geopolitical uncertainties, and contending with escalating competitive pressures. The ramifications of regulatory shifts on business operations can be substantial, requiring constant adaptation. Furthermore, the inherent concentration of large, established firms alongside the influx of international competitors further heightens the competitive intensity. The cumulative impact of these challenges on overall market growth during the forecast period is estimated to be around [Insert Impact Percentage Here]%.

Emerging Opportunities in MENA Wealth Management Industry

The MENA wealth management industry presents a wealth of emerging opportunities. These are particularly pronounced in historically underserved markets, the accelerated adoption of digital technologies, and the surging demand for sustainable and ethically aligned investment solutions. The strategic expansion into novel market segments, such as micro-investing and the rapidly growing field of Islamic finance, offers considerable potential for sustained growth and diversification.

Leading Players in the MENA Wealth Management Industry Market

- NCB Capital

- Investcorp

- Riyad Capital

- Lazard Asset Management

- Arab National Investment Company

- Aljazira Capital

- Emirates NBD Asset Management

- Waha Capital

- Fippar Holdings

- Orange Asset Management

- (This list is not exhaustive and represents a selection of prominent entities.)

Key Developments in MENA Wealth Management Industry

- January 2023: Emirates NBD Securities partnered with the Abu Dhabi Securities Exchange (ADX) to offer instant trading account opening and digital onboarding. This significantly enhances accessibility and convenience for traders.

- January 2023: Emirates NBD successfully priced its inaugural AED 1 Billion dirham-denominated bonds, marking a significant development in the UAE banking sector.

Future Outlook for MENA Wealth Management Industry Market

The MENA wealth management industry is poised for continued strong growth, driven by sustained economic expansion, technological advancements, and evolving consumer preferences. Strategic investments in technology and talent acquisition will be crucial for success. The industry's ability to adapt to evolving regulatory landscapes and effectively manage risks will determine its long-term growth trajectory. The market is expected to reach xx Million by 2033.

MENA Wealth Management Industry Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluents

- 1.4. Other Client Types

-

2. Provider Type

- 2.1. Private Bankers

- 2.2. Fintech Advisors

- 2.3. Family Offices

- 2.4. Other Provider Types

MENA Wealth Management Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. Algeria

- 3. Egypt

- 4. United Arab Emirates

- 5. Rest of MENA Region

MENA Wealth Management Industry Regional Market Share

Geographic Coverage of MENA Wealth Management Industry

MENA Wealth Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.3. Market Restrains

- 3.3.1. Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region

- 3.4. Market Trends

- 3.4.1. Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluents

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Provider Type

- 5.2.1. Private Bankers

- 5.2.2. Fintech Advisors

- 5.2.3. Family Offices

- 5.2.4. Other Provider Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Algeria

- 5.3.3. Egypt

- 5.3.4. United Arab Emirates

- 5.3.5. Rest of MENA Region

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Saudi Arabia MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluents

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Provider Type

- 6.2.1. Private Bankers

- 6.2.2. Fintech Advisors

- 6.2.3. Family Offices

- 6.2.4. Other Provider Types

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Algeria MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluents

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Provider Type

- 7.2.1. Private Bankers

- 7.2.2. Fintech Advisors

- 7.2.3. Family Offices

- 7.2.4. Other Provider Types

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. Egypt MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluents

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Provider Type

- 8.2.1. Private Bankers

- 8.2.2. Fintech Advisors

- 8.2.3. Family Offices

- 8.2.4. Other Provider Types

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Arab Emirates MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluents

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Provider Type

- 9.2.1. Private Bankers

- 9.2.2. Fintech Advisors

- 9.2.3. Family Offices

- 9.2.4. Other Provider Types

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of MENA Region MENA Wealth Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluents

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Provider Type

- 10.2.1. Private Bankers

- 10.2.2. Fintech Advisors

- 10.2.3. Family Offices

- 10.2.4. Other Provider Types

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NCB Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Investcorp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Riyad Capital

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lazard Asset Management

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arab National Investment Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aljazira Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emirates NBD Asset Management

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Waha Capital

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fippar Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Orange Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NCB Capital

List of Figures

- Figure 1: MENA Wealth Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MENA Wealth Management Industry Share (%) by Company 2025

List of Tables

- Table 1: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 3: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 4: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 5: MENA Wealth Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: MENA Wealth Management Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 9: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 10: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 11: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 15: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 16: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 17: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 20: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 21: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 22: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 23: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 26: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 27: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 28: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 29: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: MENA Wealth Management Industry Revenue Million Forecast, by Client Type 2020 & 2033

- Table 32: MENA Wealth Management Industry Volume Trillion Forecast, by Client Type 2020 & 2033

- Table 33: MENA Wealth Management Industry Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 34: MENA Wealth Management Industry Volume Trillion Forecast, by Provider Type 2020 & 2033

- Table 35: MENA Wealth Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: MENA Wealth Management Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MENA Wealth Management Industry?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the MENA Wealth Management Industry?

Key companies in the market include NCB Capital, Investcorp, Riyad Capital, Lazard Asset Management, Arab National Investment Company, Aljazira Capital, Emirates NBD Asset Management, Waha Capital, Fippar Holdings, Orange Asset Management**List Not Exhaustive.

3. What are the main segments of the MENA Wealth Management Industry?

The market segments include Client Type, Provider Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

6. What are the notable trends driving market growth?

Saudi Arabia Asset Under Management Trend Shows Growth in Wealth Management Industry on MENA Region.

7. Are there any restraints impacting market growth?

Adoption of New Age Digital Platforms by Millenials; Increasing HNWI in MENA Region.

8. Can you provide examples of recent developments in the market?

January 2023: Emirates NBD Securities, a leading brokerage firm in the UAE, partnered with Abu Dhabi Securities Exchange (ADX) to provide traders with instant access to the exchange's listed companies, enabling it to offer instant trading account opening and digital onboarding to another UAE stock exchange.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MENA Wealth Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MENA Wealth Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MENA Wealth Management Industry?

To stay informed about further developments, trends, and reports in the MENA Wealth Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence