Key Insights

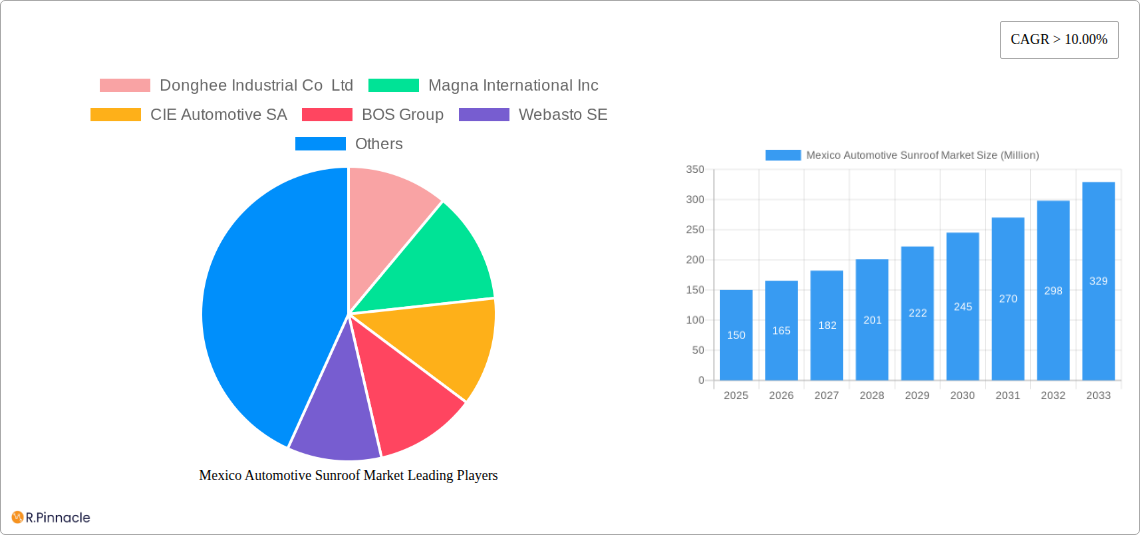

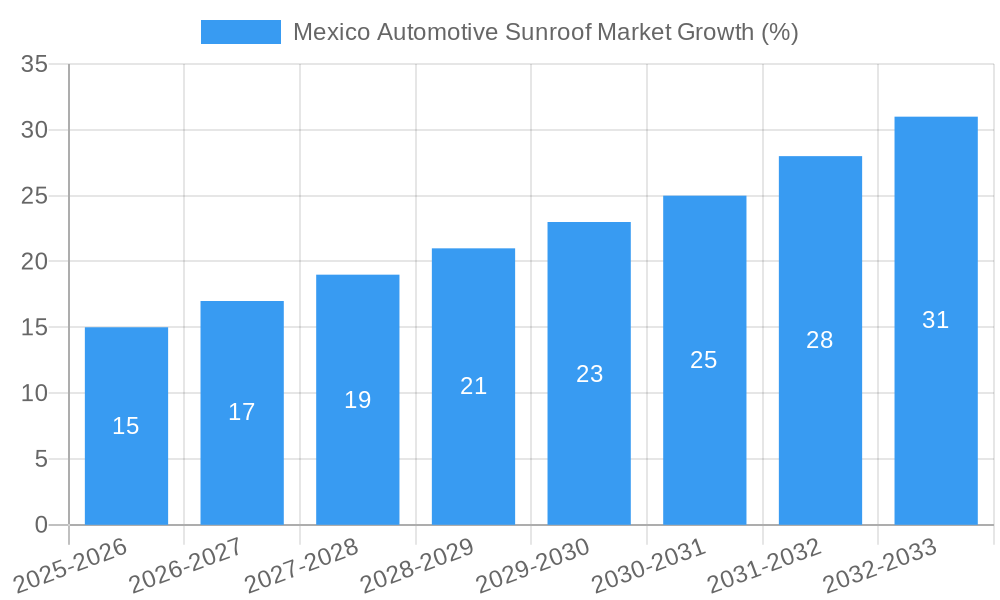

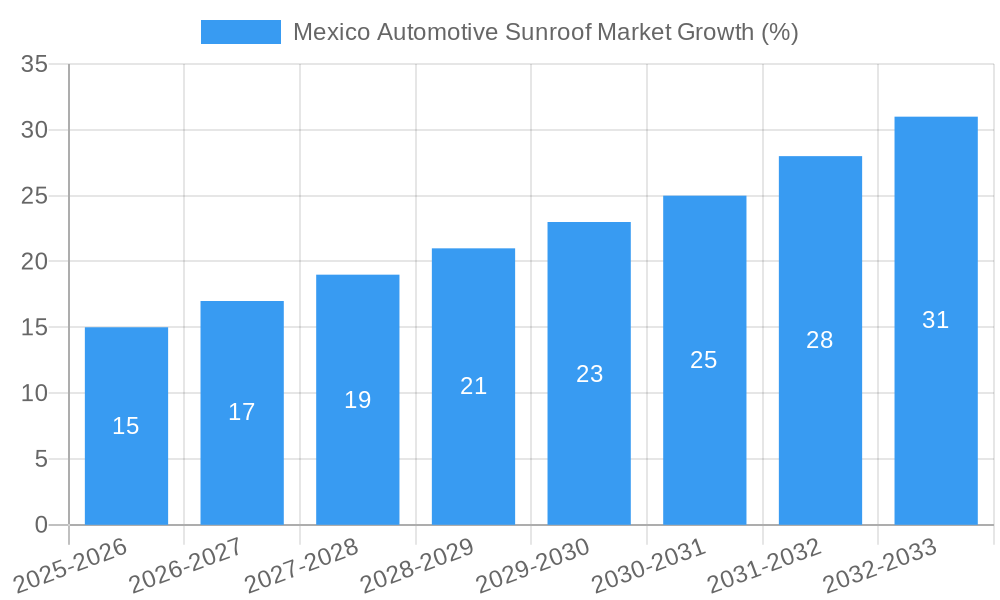

The Mexico automotive sunroof market is experiencing robust growth, driven by increasing demand for premium vehicles and rising consumer preference for enhanced comfort and aesthetics. The market's Compound Annual Growth Rate (CAGR) exceeding 10% from 2019-2024 indicates a significant upward trajectory, projected to continue through 2033. This expansion is fueled by several key factors, including the growing popularity of panoramic sunroofs, technological advancements leading to lighter and more efficient sunroof systems, and the increasing production of luxury and SUV vehicles in Mexico. The segment comprising built-in sunroofs currently holds the largest market share, attributed to its integration into standard vehicle designs and widespread affordability compared to tilt-and-slide and panoramic options. However, the tilt-and-slide and panoramic sunroof segments are projected to witness faster growth rates, driven by their enhanced features and increasing consumer preference for advanced functionalities. Key players like Magna International Inc., Webasto SE, and Inalfa Roof Systems Group BV are strategically investing in research and development to enhance product offerings and expand their market footprint in Mexico. Competition is expected to intensify with the entry of new players and the expansion of existing ones.

Material type significantly influences market segmentation. Glass sunroofs maintain a substantial market share due to their durability, transparency, and aesthetic appeal. Fabric sunroofs cater to a niche market, driven by their lightweight nature and cost-effectiveness. However, technological innovations are likely to expand the adoption of lightweight, high-strength materials in both glass and fabric sunroof segments, further fueling market expansion. While challenges remain, such as potential material cost fluctuations and economic downturns affecting consumer spending, the long-term growth prospects of the Mexico automotive sunroof market appear robust, given the prevailing positive automotive production trends and consumer demand within the region. The market’s concentration will continue to be influenced by the strategies of established multinational companies and their ability to innovate and adapt to changing consumer preferences.

Mexico Automotive Sunroof Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico Automotive Sunroof Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to deliver accurate market sizing and growth projections, highlighting key trends, challenges, and opportunities.

Mexico Automotive Sunroof Market Market Structure & Innovation Trends

The Mexico automotive sunroof market exhibits a moderately consolidated structure, with key players like Magna International Inc, Webasto SE, and Inalfa Roof Systems Group BV holding significant market share. However, several smaller players also contribute significantly to the overall market volume. Market share data indicates that Magna International Inc holds an estimated xx% market share in 2025, while Webasto SE holds approximately xx%. The remaining market share is distributed among other players, reflecting a competitive landscape.

Innovation in the sector is driven by the increasing demand for advanced features such as panoramic sunroofs and integrated sunshade systems. Stringent safety regulations and fuel efficiency standards also impact innovation, leading to the development of lighter and more aerodynamic sunroof designs. The regulatory framework, while generally supportive of automotive manufacturing, occasionally presents challenges related to emissions standards and safety testing. Product substitutes, such as fixed glass roofs and traditional sun visors, maintain a presence but are less popular than sunroofs due to their limitations. End-user demographics show a strong preference for sunroofs among higher-income consumer segments.

M&A activities have played a relatively limited role in shaping the market structure in recent years. However, deal values observed between 2019-2024 ranged from $xx Million to $xx Million, indicating potential future consolidation. The strategic focus has largely been on internal organic growth and product diversification.

Mexico Automotive Sunroof Market Market Dynamics & Trends

The Mexico automotive sunroof market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the expanding automotive industry in Mexico, rising disposable incomes leading to increased demand for luxury features, and growing preference for enhanced vehicle aesthetics and comfort.

Technological disruptions are transforming the market, with the integration of smart features and advanced materials gaining traction. Consumers increasingly favor sunroofs with automated controls, integrated lighting, and enhanced noise reduction features. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative products and services. Market penetration of sunroofs is increasing steadily, driven by affordability and appealing features, particularly in the higher vehicle segments. By 2033, the market penetration is estimated to reach xx%.

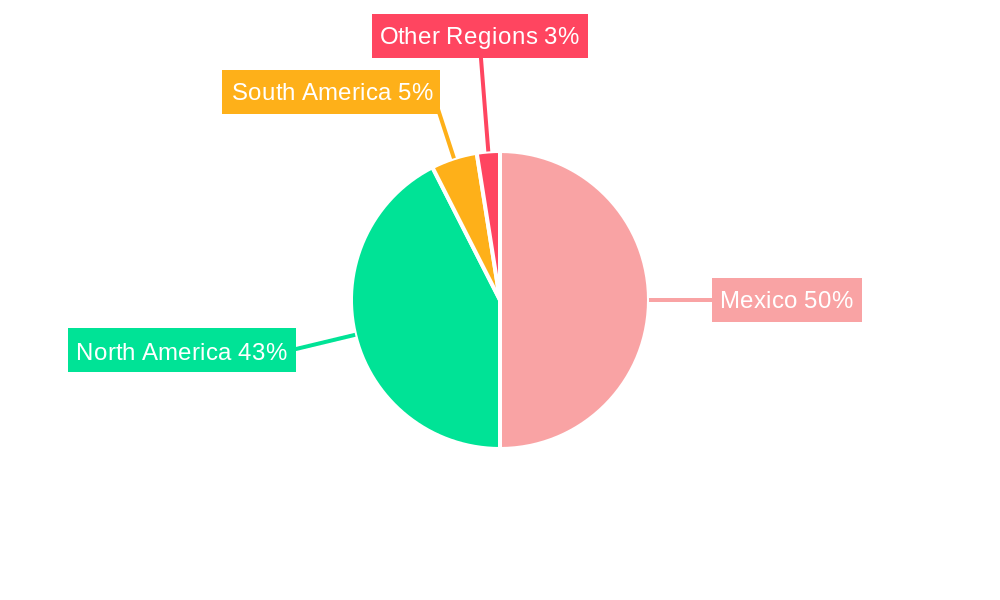

Dominant Regions & Segments in Mexico Automotive Sunroof Market

The dominant region within the Mexico automotive sunroof market is Central Mexico, encompassing key automotive manufacturing hubs. Key drivers for this dominance include well-established automotive supply chains, government incentives for the automotive sector, and a concentration of automotive assembly plants.

- Economic Policies: Government incentives and tax breaks for automotive manufacturing stimulate sunroof adoption.

- Infrastructure: Well-developed infrastructure ensures efficient logistics and distribution of sunroofs.

Among material types, glass dominates the market due to its durability, aesthetic appeal, and UV protection capabilities. In terms of sunroof types, the tilt and slide sunroof segment holds the largest market share, followed by the built-in sunroof and panoramic sunroof, which show promising growth potential due to growing customer preference for a wider viewing experience. Further analysis reveals that the glass material segment shows higher growth compared to the fabric one, mainly driven by superior performance in terms of heat insulation and durability.

Mexico Automotive Sunroof Market Product Innovations

Recent product innovations focus on lightweight materials (e.g., carbon fiber reinforced polymers), enhanced sound insulation, and smart features such as integrated sunshades and voice-activated controls. These innovations address consumer preferences for improved comfort, aesthetics, and energy efficiency, while enhancing the competitive landscape. These improvements lead to increased vehicle value and enhanced user experience. The market is moving towards more sophisticated and integrated sunroof systems, incorporating technology beyond simple opening and closing mechanisms.

Report Scope & Segmentation Analysis

This report segments the Mexico automotive sunroof market by material type (glass, fabric) and sunroof type (built-in, tilt and slide, panoramic). The glass segment is expected to dominate due to its superior properties, while the tilt and slide segment will continue to be the most popular type. Each segment displays unique growth trajectories and competitive dynamics, with glass exhibiting a higher CAGR and market size than fabric, while tilt and slide sunroofs maintain the largest market share due to their versatility and relatively lower price point. Market sizes for all segments are included in the detailed report.

Key Drivers of Mexico Automotive Sunroof Market Growth

Growth is primarily driven by the expansion of the Mexican automotive industry, rising consumer disposable incomes boosting demand for luxury vehicle features, and the increasing preference for enhanced vehicle aesthetics and comfort. Government initiatives promoting domestic automotive manufacturing further stimulate market growth. Technological advancements contributing to lighter, safer, and more feature-rich sunroofs are also key growth drivers.

Challenges in the Mexico Automotive Sunroof Market Sector

Challenges include potential supply chain disruptions impacting material availability and production costs, fluctuating raw material prices, and intense competition from established and emerging players. Furthermore, the economic stability of Mexico and potential trade policy changes might influence market growth. The volatility in the global automotive market adds complexity to accurate forecasting.

Emerging Opportunities in Mexico Automotive Sunroof Market

Emerging opportunities include the growing demand for electric and hybrid vehicles, which present potential for sunroofs optimized for energy efficiency and integrating renewable energy technologies. Furthermore, the growing popularity of SUVs and crossovers creates an expanding market for larger and more sophisticated sunroof systems. The development of custom designs tailored to specific vehicle models also represents a notable opportunity.

Leading Players in the Mexico Automotive Sunroof Market Market

- Magna International Inc

- Webasto SE

- CIE Automotive SA

- BOS Group

- Aisin Seiki Co Ltd

- Automotive Sunroof-Customcraft (ASC) Inc

- Yachiyo Industry Co Ltd

- Inteva Products

- Inalfa Roof Systems Group BV

- Donghee Industrial Co Ltd

Key Developments in Mexico Automotive Sunroof Market Industry

- 2022 Q4: Magna International Inc. announces a new lightweight sunroof design for enhanced fuel efficiency.

- 2023 Q1: Webasto SE launches a new panoramic sunroof with integrated solar panels.

- 2024 Q3: A joint venture between Inalfa Roof Systems Group BV and a Mexican company is established to expand manufacturing capacity.

- Further developments included in the full report.

Future Outlook for Mexico Automotive Sunroof Market Market

The Mexico automotive sunroof market is poised for sustained growth, driven by continuous technological advancements, rising consumer demand, and the expansion of the domestic automotive industry. Strategic investments in research and development, focusing on innovation and product diversification, will be crucial for success in this dynamic market. The incorporation of sustainable materials and smart features is anticipated to further shape future growth trends.

Mexico Automotive Sunroof Market Segmentation

-

1. Material Type

- 1.1. Glass

- 1.2. Fabric

-

2. Sunroof Type

- 2.1. Built-in Sunroof

- 2.2. Tilt and slide sunroof

- 2.3. Panoramic Sunroof

Mexico Automotive Sunroof Market Segmentation By Geography

- 1. Mexico

Mexico Automotive Sunroof Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Sedan sales driving the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Glass

- 5.1.2. Fabric

- 5.2. Market Analysis, Insights and Forecast - by Sunroof Type

- 5.2.1. Built-in Sunroof

- 5.2.2. Tilt and slide sunroof

- 5.2.3. Panoramic Sunroof

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Donghee Industrial Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Magna International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CIE Automotive SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BOS Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Webasto SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aisin Seiki Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Automotive Sunroof-Customcraft (ASC) Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yachiyo Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inteva Products

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inalfa Roof Systems Group BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Donghee Industrial Co Ltd

List of Figures

- Figure 1: Mexico Automotive Sunroof Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Automotive Sunroof Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Automotive Sunroof Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Automotive Sunroof Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Mexico Automotive Sunroof Market Revenue Million Forecast, by Sunroof Type 2019 & 2032

- Table 4: Mexico Automotive Sunroof Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Automotive Sunroof Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Automotive Sunroof Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Mexico Automotive Sunroof Market Revenue Million Forecast, by Sunroof Type 2019 & 2032

- Table 8: Mexico Automotive Sunroof Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Automotive Sunroof Market?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Mexico Automotive Sunroof Market?

Key companies in the market include Donghee Industrial Co Ltd, Magna International Inc, CIE Automotive SA, BOS Group, Webasto SE, Aisin Seiki Co Ltd, Automotive Sunroof-Customcraft (ASC) Inc, Yachiyo Industry Co Ltd, Inteva Products, Inalfa Roof Systems Group BV.

3. What are the main segments of the Mexico Automotive Sunroof Market?

The market segments include Material Type, Sunroof Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Sedan sales driving the Market Demand.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Automotive Sunroof Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Automotive Sunroof Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Automotive Sunroof Market?

To stay informed about further developments, trends, and reports in the Mexico Automotive Sunroof Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence