Key Insights

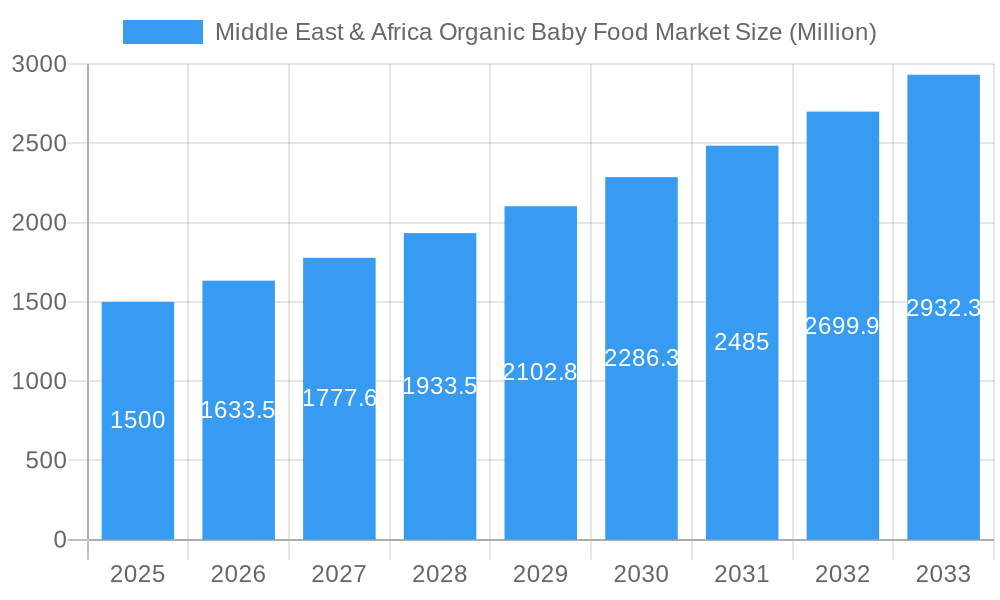

The Middle East & Africa organic baby food market is poised for significant expansion, propelled by heightened parental health awareness, rising disposable incomes, and a distinct shift towards natural and wholesome infant nutrition. Growing understanding of organic food's health advantages, such as minimized exposure to pesticides and harmful chemicals, further fuels market growth. The region's substantial population, coupled with high birth rates in key economies like Saudi Arabia and the UAE, directly contributes to this expansion. Primary market segments encompass milk formula and prepared baby food, with supermarkets and hypermarkets currently dominating distribution. However, the burgeoning popularity of online grocery shopping indicates a strong future growth trajectory for e-commerce channels. Despite challenges like higher pricing and regional product availability constraints, increased consumer education and new market entrants are expected to mitigate these factors. The projected CAGR of 7.08%, with a market size of 406.6 million by 2025, highlights a compelling growth opportunity for established and emerging brands in this dynamic sector.

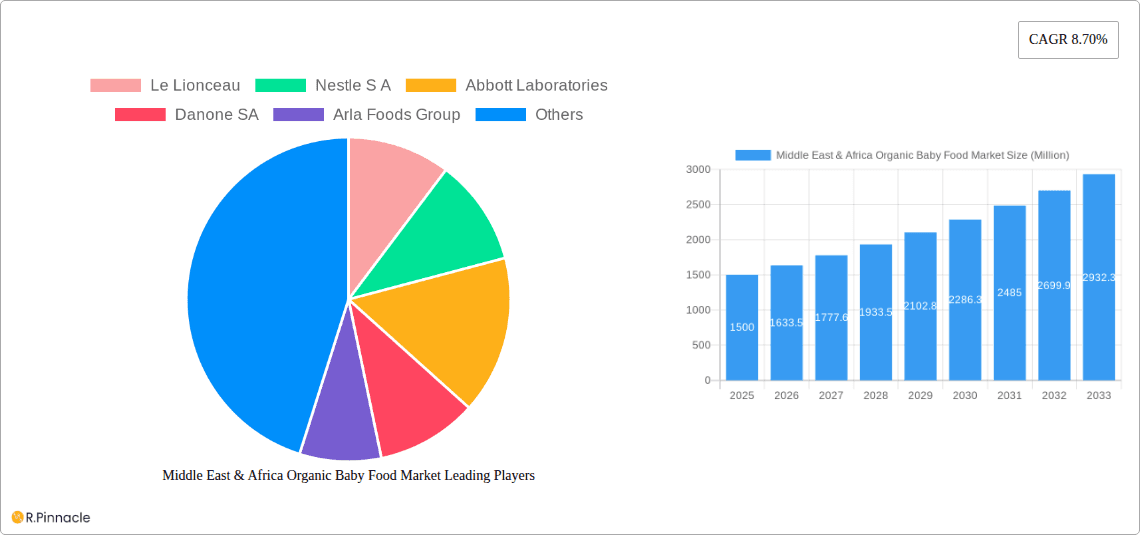

Middle East & Africa Organic Baby Food Market Market Size (In Million)

The competitive environment is characterized by a dynamic interplay between global leaders and regional contenders. While established companies leverage brand recognition and extensive distribution, agile smaller firms are capturing niche segments by focusing on specialized dietary needs and unique organic offerings. A growing demand for supply chain transparency and traceability is also influencing the market, with consumers seeking detailed information on sourcing and production. Future growth drivers include government initiatives promoting healthy eating and the enhancement of retail infrastructure in developing regions across the Middle East and Africa. This market presents a substantial opportunity for companies committed to providing high-quality, safe, and ethically produced organic baby food.

Middle East & Africa Organic Baby Food Market Company Market Share

Middle East & Africa Organic Baby Food Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East & Africa organic baby food market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future outlook, empowering informed decision-making. The report leverages extensive data and expert analysis to deliver actionable intelligence, detailing market segmentation, key players, growth drivers, and emerging trends. Expect detailed forecasts, revealing the significant opportunities within this rapidly evolving market.

Middle East & Africa Organic Baby Food Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Middle East & Africa organic baby food market. Market concentration is assessed, examining the market share held by key players such as Nestle S.A., Abbott Laboratories, Danone SA, and Arla Foods Group, amongst others. The report explores innovation drivers, including consumer demand for healthier options and technological advancements in food processing. Regulatory frameworks impacting the market are detailed, along with an analysis of product substitutes and their influence. End-user demographics are examined to understand consumption patterns and preferences. Finally, the report includes an overview of recent mergers and acquisitions (M&A) activities within the industry, including deal values where available (xx Million).

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The exact figures are detailed within the full report.

- Innovation Drivers: Growing consumer awareness of health and wellness is a primary driver, along with technological advancements in organic food processing and packaging.

- Regulatory Framework: Varying regulations across the region influence product standards and labeling requirements.

- Product Substitutes: Conventional baby food remains a key substitute, posing competitive pressure on organic options.

- M&A Activity: Several M&A activities have been observed in recent years, with deal values ranging from xx Million to xx Million (detailed within the full report).

Middle East & Africa Organic Baby Food Market Dynamics & Trends

This section delves into the market's dynamic growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. It presents a comprehensive overview of market size and growth projections, including the Compound Annual Growth Rate (CAGR) and market penetration rate across different segments. The impact of technological advancements, such as improved preservation techniques and online retail expansion, on market dynamics is thoroughly examined. Consumer preferences are analyzed, highlighting the increasing demand for convenience, specific nutritional benefits, and ethically sourced products. Competitive dynamics are explored, detailing the strategies employed by key players to maintain their market position and capture new opportunities.

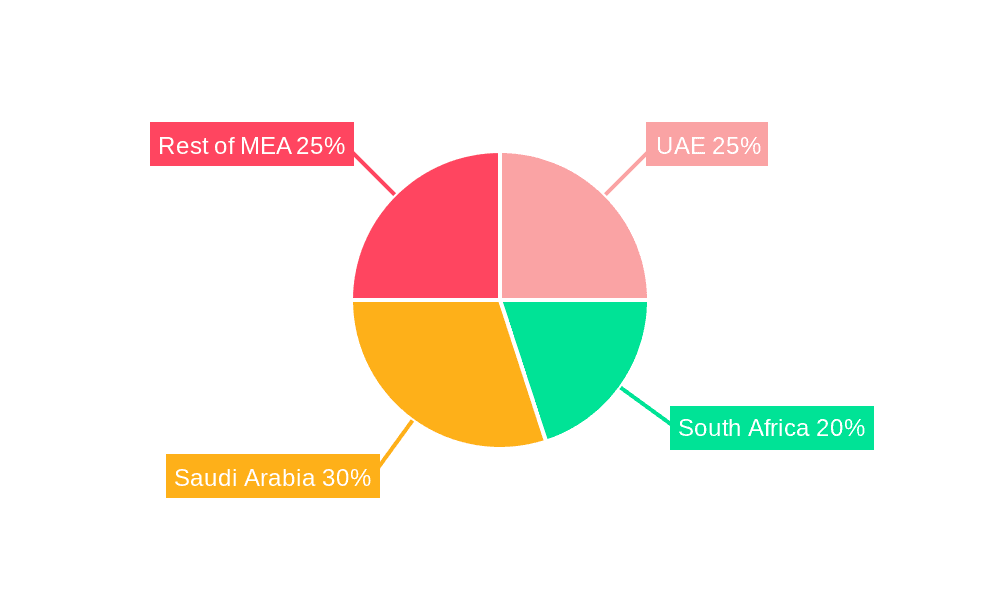

Dominant Regions & Segments in Middle East & Africa Organic Baby Food Market

This section identifies the leading regions, countries, and market segments within the Middle East & Africa organic baby food market. A detailed analysis pinpoints the dominant distribution channels (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other Distribution Channels) and product types (Milk Formula, Prepared Baby Food, Dried Baby Food, Others). Key drivers contributing to the dominance of specific regions and segments are explored using bullet points:

Dominant Region/Country: [Detailed analysis within the full report will identify the dominant region/country based on market size and growth].

Dominant Distribution Channel: Supermarkets/Hypermarkets are projected to maintain dominance, supported by factors such as:

- Extensive reach and established infrastructure.

- Growing consumer preference for organized retail.

- Increased availability of organic baby food products.

Dominant Product Type: [Detailed analysis within the full report will identify the dominant product type based on market size and growth].

Middle East & Africa Organic Baby Food Market Product Innovations

This section summarizes recent product developments, highlighting their applications and competitive advantages. The report emphasizes technological trends that drive innovation within the organic baby food sector, analyzing their market fit and impact on consumer preferences. New product functionalities, packaging innovations, and sustainable sourcing initiatives are also covered.

Report Scope & Segmentation Analysis

This report segments the Middle East & Africa organic baby food market by distribution channel and product type, providing detailed analysis and growth projections for each segment.

By Distribution Channel:

- Supermarkets/Hypermarkets: This segment is expected to experience [growth projection] during the forecast period, driven by [competitive dynamics].

- Convenience Stores: This segment is expected to experience [growth projection] during the forecast period, driven by [competitive dynamics].

- Online Stores: This segment is expected to experience significant [growth projection] due to increasing internet penetration and e-commerce adoption.

- Other Distribution Channels: This segment accounts for [market size] and is expected to grow at a [growth rate].

By Product Type:

- Milk Formula: This segment holds the largest market share currently, with [market size] in 2025 and projected growth of [growth projection].

- Prepared Baby Food: This segment is anticipated to witness [growth projection] driven by [competitive dynamics].

- Dried Baby Food: This segment represents [market size] in 2025 and is likely to grow at [growth projection].

- Others: This segment encompasses [description of other products] and is projected to reach [market size] by 2033.

Key Drivers of Middle East & Africa Organic Baby Food Market Growth

Several factors contribute to the growth of the Middle East & Africa organic baby food market. These include increasing consumer awareness of health and wellness, rising disposable incomes in certain regions, and supportive government policies promoting organic farming. Technological advancements in food processing and packaging also play a crucial role. The growing preference for convenient, ready-to-eat baby food options further drives market expansion.

Challenges in the Middle East & Africa Organic Baby Food Market Sector

The market faces challenges such as the relatively high price of organic baby food compared to conventional options, limiting accessibility for lower-income families. Supply chain complexities and maintaining consistent quality across the region also pose challenges. Furthermore, stringent regulatory requirements and potential competition from both established and emerging players can create obstacles to growth.

Emerging Opportunities in Middle East & Africa Organic Baby Food Market

The report identifies several emerging opportunities within the market. These include the expansion into untapped markets within the region, leveraging technological advancements such as online sales and subscription models, and catering to specific consumer preferences such as halal and kosher certifications. Further market penetration can be achieved through product diversification and strategic partnerships with retailers and distributors.

Leading Players in the Middle East & Africa Organic Baby Food Market Market

- Le Lionceau

- Nestle S A

- Abbott Laboratories

- Danone SA

- Arla Foods Group

- Hero Group

- Hipp Gmbh & Co

- Campbell Soup Company (Plum Organics)

- Amara Organic Foods

- Nascens Enterprises Private Limited (Happa Foods)

- List Not Exhaustive

Key Developments in Middle East & Africa Organic Baby Food Market Industry

- February 2020: Arla Foods launched its Arla Baby&Me Organic range in the UAE, including infant milk formulas and porridges.

- May 2020: Mimmo Organics expanded its presence in the Gulf region with wafers, pasta, and juices.

Future Outlook for Middle East & Africa Organic Baby Food Market Market

The Middle East & Africa organic baby food market exhibits strong growth potential, driven by increasing health consciousness, rising disposable incomes, and favorable government regulations. Strategic investments in product innovation, supply chain optimization, and expansion into new markets will be crucial for success. The increasing penetration of e-commerce presents significant opportunities for growth in the coming years. The market is poised for continued expansion, with significant opportunities for both established and emerging players.

Middle East & Africa Organic Baby Food Market Segmentation

-

1. Product Type

- 1.1. Milk Formula

- 1.2. Prepared Baby Food

- 1.3. Dried Baby Food

- 1.4. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Rest of Middle East and Africa

Middle East & Africa Organic Baby Food Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle East & Africa Organic Baby Food Market Regional Market Share

Geographic Coverage of Middle East & Africa Organic Baby Food Market

Middle East & Africa Organic Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Fortified Organic Baby Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Milk Formula

- 5.1.2. Prepared Baby Food

- 5.1.3. Dried Baby Food

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle East & Africa Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Milk Formula

- 6.1.2. Prepared Baby Food

- 6.1.3. Dried Baby Food

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle East & Africa Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Milk Formula

- 7.1.2. Prepared Baby Food

- 7.1.3. Dried Baby Food

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa Middle East & Africa Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Milk Formula

- 8.1.2. Prepared Baby Food

- 8.1.3. Dried Baby Food

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Le Lionceau

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nestle S A

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Abbott Laboratories

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Danone SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Arla Foods Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hero Group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Hipp Gmbh & Co

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Campbell Soup Company (Plum Organics)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Amara Organic Foods

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Nascens Enterprises Private Limited (Happa Foods)*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Le Lionceau

List of Figures

- Figure 1: Middle East & Africa Organic Baby Food Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa Organic Baby Food Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 3: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Geography 2020 & 2033

- Table 7: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Region 2020 & 2033

- Table 9: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 11: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Geography 2020 & 2033

- Table 15: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Country 2020 & 2033

- Table 17: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 19: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Geography 2020 & 2033

- Table 23: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Country 2020 & 2033

- Table 25: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 26: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 27: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Geography 2020 & 2033

- Table 31: Middle East & Africa Organic Baby Food Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Middle East & Africa Organic Baby Food Market Volume K Ton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Organic Baby Food Market?

The projected CAGR is approximately 7.08%.

2. Which companies are prominent players in the Middle East & Africa Organic Baby Food Market?

Key companies in the market include Le Lionceau, Nestle S A, Abbott Laboratories, Danone SA, Arla Foods Group, Hero Group, Hipp Gmbh & Co, Campbell Soup Company (Plum Organics), Amara Organic Foods, Nascens Enterprises Private Limited (Happa Foods)*List Not Exhaustive.

3. What are the main segments of the Middle East & Africa Organic Baby Food Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 406.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Rise in Demand for Fortified Organic Baby Food.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In February 2020, Arla Foods, a leading international dairy company has introduced its range of Arla Baby&Me Organic milk supplements and other food products to the UAE market. The products launched include Infant Milk Formulas, Multi-grain porridges for 4 months and above children, and Fruit and vegetable porridges/pouches for 6 months and above children.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Ton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Organic Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Organic Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Organic Baby Food Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Organic Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence