Key Insights

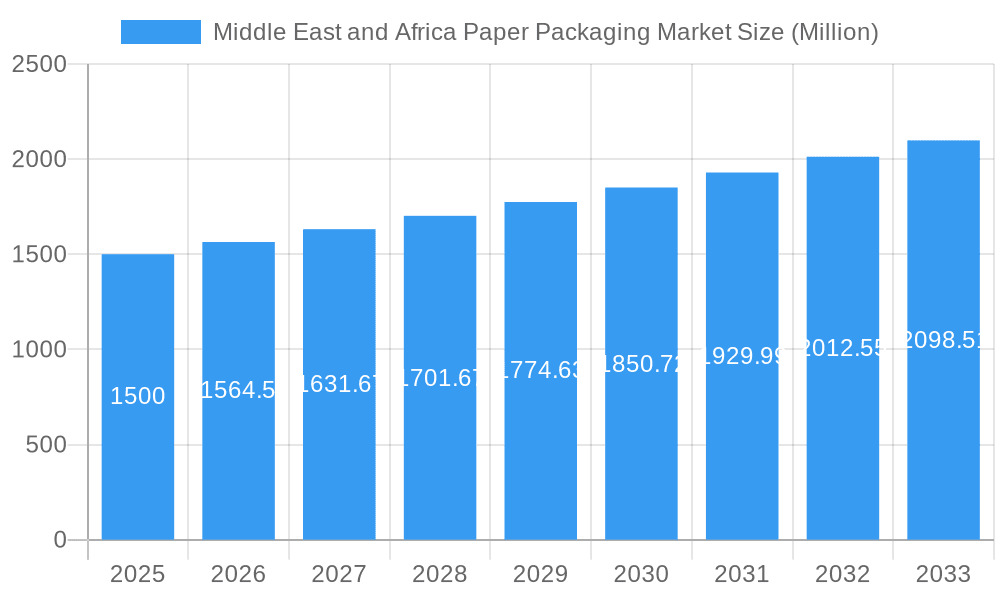

The Middle East and Africa paper packaging market, valued at approximately $30539.4 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.1% from 2025 to 2033. This expansion is fueled by several key factors, including the burgeoning food and beverage sector and rising consumer demand for packaged goods. Increased e-commerce activity necessitates efficient and reliable packaging solutions. Furthermore, advancements in sustainable and eco-friendly packaging technologies are gaining traction. Growth is particularly notable in Saudi Arabia and the UAE, driven by expanding retail infrastructure and significant investments in logistics and supply chain management. While challenges like raw material price fluctuations and competition from alternative materials exist, the overall market outlook remains positive, with significant potential for further expansion across diverse end-user industries such as personal care, home care, and electrical goods. Strategic expansion of regional manufacturing facilities and a focus on customization will contribute to the market’s trajectory.

Middle East and Africa Paper Packaging Market Market Size (In Billion)

The market segmentation reveals a diverse landscape, with folding cartons, corrugated boxes, and slotted containers dominating the product segment due to their versatility and cost-effectiveness. The food and beverage industry is the largest end-user segment, highlighting the crucial role of paper packaging in maintaining product quality and shelf life. Geographic variations in growth rates are expected, with countries experiencing rapid urbanization and economic development exhibiting higher potential. The competitive landscape features both international and regional players innovating and expanding their product portfolios to meet evolving consumer preferences. Strategic partnerships and mergers and acquisitions will shape competitive dynamics. Focusing on sustainability initiatives and enhancing supply chain efficiency will be critical for market players to maintain a competitive edge and capitalize on growth opportunities in the Middle East and Africa paper packaging market.

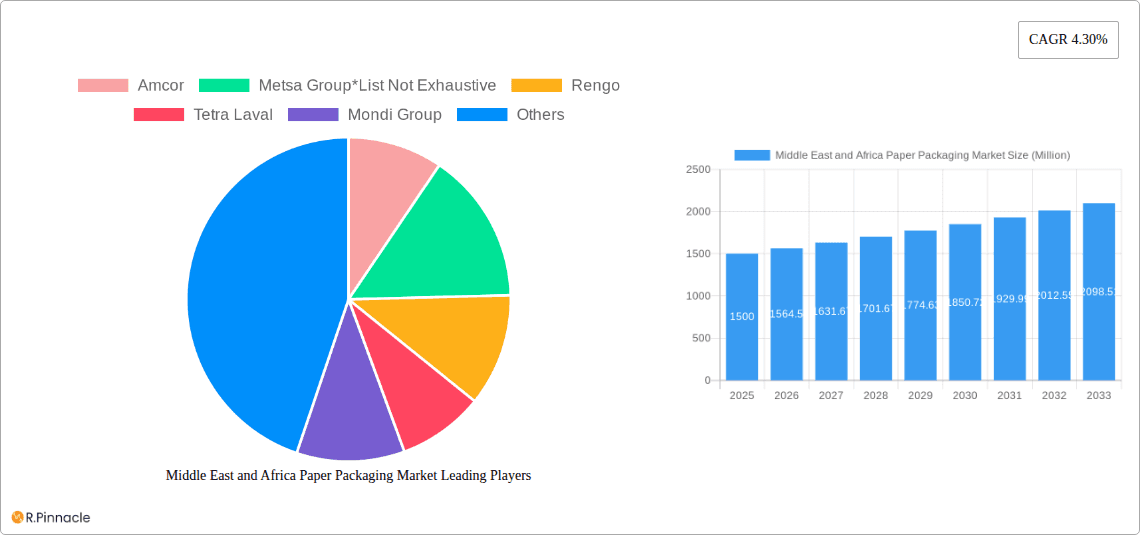

Middle East and Africa Paper Packaging Market Company Market Share

Middle East & Africa Paper Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa paper packaging market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. The study incorporates detailed segmentation by product type, end-user industry, and country, offering granular data for informed decision-making.

Middle East and Africa Paper Packaging Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Middle East and Africa paper packaging market, examining market concentration, innovation drivers, and regulatory influences. We delve into the impact of mergers and acquisitions (M&A) activity, identifying key trends and their implications for market participants.

The market is moderately concentrated, with key players holding significant market share. Amcor, Metsä Group, Rengo, Tetra Laval, Mondi Group, International Paper Company, Sappi Limited, Oji Paper, Graphic Packaging International Corporation, Smurfit Kappa, and DS Smith are prominent examples. However, the market also features numerous smaller players, particularly in regional markets. The estimated combined market share of the top 5 players in 2025 is approximately xx%. M&A activity has been moderate in recent years, with deal values totaling approximately $xx Million in the period 2019-2024. Innovation is driven by increasing demand for sustainable packaging solutions, advancements in printing technologies, and the need for enhanced product protection. Regulatory frameworks focusing on recyclability and sustainability are also significantly impacting market trends. The increasing use of plastic substitutes and the rising demand for eco-friendly packaging are shaping the market. End-user demographics are diverse, reflecting the varying economic development levels across the region.

Middle East and Africa Paper Packaging Market Market Dynamics & Trends

The Middle East and Africa paper packaging market is on a dynamic growth trajectory, fueled by a confluence of factors including burgeoning consumer demand, evolving regulatory landscapes, and a significant shift towards sustainable practices. The region's expanding economies, coupled with a growing middle class, are driving increased consumption across key sectors such as food and beverage, personal care and cosmetics, pharmaceuticals, and a rapidly accelerating e-commerce sector. These industries are increasingly relying on paper-based packaging solutions for their inherent sustainability, versatility, and aesthetic appeal.

Key market growth drivers include the rising demand for convenient and ready-to-eat food options, which necessitates robust and appealing packaging. The personal care and beauty sector's emphasis on premium and environmentally conscious branding further bolsters the demand for high-quality paper packaging. Furthermore, the exponential growth of e-commerce across the Middle East and Africa has created a substantial need for durable, protective, and lightweight packaging solutions that can withstand the rigors of shipping and logistics, while also offering a positive unboxing experience. Technological advancements, such as the adoption of advanced printing technologies for enhanced graphics and branding, the development of innovative barrier coatings for improved product protection, and the integration of smart packaging features for traceability and consumer engagement, are also significantly influencing market evolution. Consumer preferences are increasingly leaning towards sustainable, recyclable, and biodegradable packaging options, pushing manufacturers to invest in eco-friendly materials and production processes. The competitive landscape is characterized by both established global players and agile local manufacturers vying for market share, leading to continuous innovation and strategic collaborations.

The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% to 7.5% during the forecast period (2025-2033), a testament to its strong growth potential.

Dominant Regions & Segments in Middle East and Africa Paper Packaging Market

This section identifies the leading regions, countries, and segments within the Middle East and Africa paper packaging market. We provide a detailed analysis of the factors contributing to their dominance.

By Product:

- Corrugated Boxes: This segment holds the largest market share, driven by its versatility and cost-effectiveness across various industries.

- Folding Cartons: Strong growth is anticipated due to increasing demand from the food and beverage industry.

- Other Product Types: This segment includes specialized packaging solutions, exhibiting moderate growth due to niche applications.

By End-User Industry:

- Food & Beverage: This remains the dominant segment, driven by rising consumption and stringent packaging regulations.

- Personal Care & Home Care: This segment displays steady growth due to the increasing demand for convenient and attractive packaging.

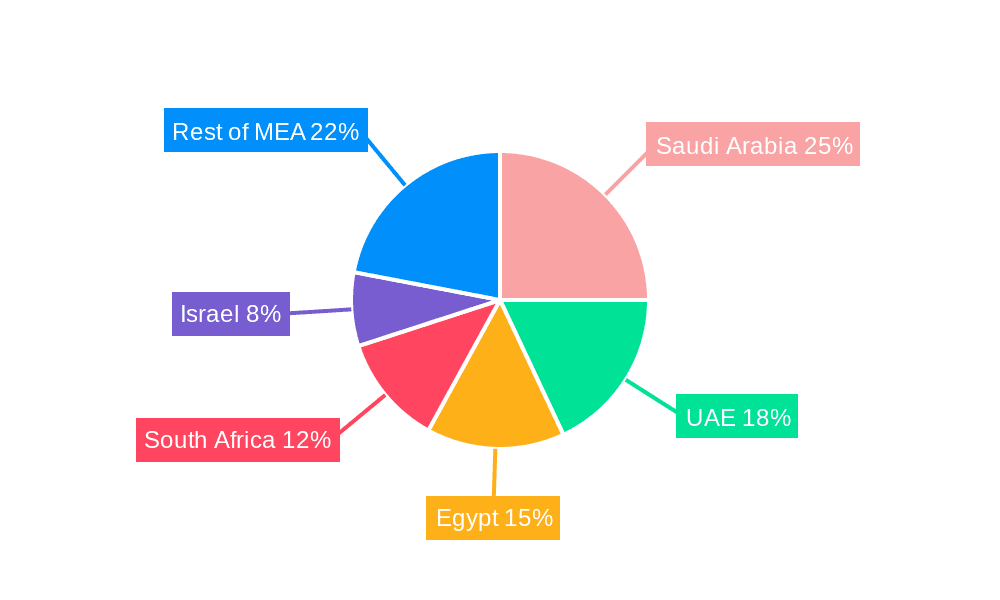

By Country:

- South Africa: This country holds the largest market share due to its well-established manufacturing base and robust economy.

- Saudi Arabia: Significant growth is expected due to investments in infrastructure and rising consumer spending.

- UAE: A substantial market, fueled by tourism, trade, and its role as a regional hub.

Key drivers for these dominant segments and regions include supportive government policies, burgeoning infrastructure development, and increasing disposable incomes.

Middle East and Africa Paper Packaging Market Product Innovations

Product innovation in the Middle East and Africa paper packaging market is predominantly centered on enhancing sustainability, functionality, and consumer appeal. Manufacturers are actively developing and deploying packaging solutions made from recycled paper, post-consumer waste, and rapidly renewable resources like bamboo and sugarcane bagasse, reducing reliance on virgin pulp. Advances in material science have led to the creation of lightweight yet durable paper packaging that offers superior protection for goods during transit, particularly for the burgeoning e-commerce sector. Furthermore, the development of advanced barrier coatings, often bio-based, is enabling paper packaging to effectively protect sensitive products like food and pharmaceuticals from moisture, oxygen, and other environmental factors, traditionally a challenge for paper-based solutions.

Printing technologies are also witnessing significant upgrades, with a growing emphasis on high-definition graphics, vibrant colors, and eco-friendly inks to enhance brand visibility and shelf appeal. The integration of smart packaging features is emerging as a key differentiator. This includes the incorporation of QR codes for product authentication, traceability, and access to detailed product information or promotional content. Augmented Reality (AR) enabled packaging is also gaining traction, offering immersive brand experiences and interactive content that resonates with tech-savvy consumers. Companies are increasingly offering highly customized packaging solutions, ranging from bespoke structural designs to tailored print finishes, to meet the unique requirements of diverse product categories and individual brand identities. This focus on bespoke solutions not only enhances product protection but also elevates the perceived value and brand story.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Middle East and Africa paper packaging market based on product type, end-user industry, and geography. Growth projections, market sizes, and competitive dynamics are discussed for each segment.

The market is segmented by product type (Folding Cartons, Corrugated Boxes, Slotted Containers, Die Cut Containers, Five Panel Folder Boxes, Setup Boxes, Other Product Types), end-user industry (Food, Beverage, Personal Care and Home Care, Electrical Goods, Other End-user Industries), and country (Saudi Arabia, Israel, United Arab Emirates, Egypt, South Africa, Others). Each segment's growth trajectory varies, reflecting the unique dynamics of each industry and geographical area. Market sizes are provided for each segment, along with estimates for the forecast period.

Key Drivers of Middle East and Africa Paper Packaging Market Growth

Growth in the Middle East and Africa paper packaging market is propelled by several key factors. The expanding food and beverage industry, coupled with rising consumer spending, fuels demand for attractive and functional packaging. Government initiatives promoting sustainable packaging solutions and increasing investments in infrastructure development further contribute to market expansion. Technological advancements such as automation and smart packaging enhance efficiency and product appeal, driving further growth.

Challenges in the Middle East and Africa Paper Packaging Market Sector

The Middle East and Africa paper packaging market faces several challenges. Fluctuations in raw material prices and supply chain disruptions impact profitability. Stringent environmental regulations necessitate the adoption of sustainable packaging solutions, posing technological and cost challenges. Intense competition from established players and the emergence of new entrants require companies to constantly innovate and optimize their offerings.

Emerging Opportunities in Middle East and Africa Paper Packaging Market

The Middle East and Africa paper packaging market is ripe with emerging opportunities, driven by evolving consumer demands and strategic industry shifts. The unprecedented growth of the e-commerce sector across the region presents a significant avenue for innovation in protective and aesthetically pleasing shipping solutions. As online retail continues to expand, the demand for robust, yet lightweight, paper-based packaging that can ensure product integrity during transit, while simultaneously offering a premium unboxing experience, is set to soar. The strong and growing consumer preference for sustainable and eco-friendly products is a pivotal opportunity. Companies that can offer verifiable biodegradable, recyclable, and compostable paper packaging solutions will be well-positioned to capture market share. This includes exploring novel materials and production processes that minimize environmental impact.

The increasing focus on health and wellness is fueling demand for safe and hygienic packaging in the food and beverage and pharmaceutical sectors, where paper packaging, when appropriately treated, offers a viable and often preferred alternative. The development and adoption of smart packaging technologies present another significant opportunity for differentiation and value creation. Features like QR codes for enhanced product traceability, authenticity verification, and direct consumer engagement (e.g., through loyalty programs or interactive content) can build stronger brand-consumer relationships and foster loyalty. Furthermore, government initiatives promoting local manufacturing and sustainable practices across the region could further stimulate investment and innovation in the paper packaging sector. The demand for customized and premium packaging solutions across various industries, including luxury goods and high-end food products, also presents a lucrative niche for specialized paper packaging providers.

Leading Players in the Middle East and Africa Paper Packaging Market Market

- Amcor

- Metsä Group

- Rengo

- Tetra Laval

- Mondi Group

- International Paper Company

- Sappi Limited

- Oji Paper

- Graphic Packaging International Corporation

- Smurfit Kappa

- DS Smith

Key Developments in Middle East and Africa Paper Packaging Market Industry

- 2022 Q4: Amcor launched an innovative range of sustainable paper-based packaging solutions specifically designed for the beverage sector, focusing on recyclability and reduced material usage.

- 2023 Q1: Smurfit Kappa announced significant investments in a new, state-of-the-art corrugated box manufacturing facility in South Africa, aiming to enhance its production capacity and service capabilities for the growing African market.

- 2023 Q2: Mondi Group revealed a strategic partnership with a prominent regional recycling company in the Middle East to bolster its collection and recycling infrastructure, thereby strengthening its commitment to circular economy principles in its sustainable packaging offerings.

- 2023 Q3: International Paper Company expanded its distribution network in key African markets, aiming to provide wider access to its diverse range of paper packaging products and technical support.

- 2024 Q1: Tetra Pak introduced advanced high-barrier paperboard solutions designed for increased shelf-life of sensitive food products, catering to the growing demand for convenient and safe packaged foods in the region.

Future Outlook for Middle East and Africa Paper Packaging Market Market

The future outlook for the Middle East and Africa paper packaging market remains positive, driven by ongoing economic growth, increasing consumer spending, and technological advancements. Continued investments in infrastructure and supportive government policies are expected to fuel further expansion. Companies that embrace sustainable packaging practices and invest in innovative solutions are poised to benefit from the long-term growth potential of the market. The increasing demand for customized and value-added packaging solutions will also contribute to the market's expansion.

Middle East and Africa Paper Packaging Market Segmentation

-

1. Product

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Slotted Containers

- 1.4. Die Cut Container

- 1.5. Five Panel Folder Boxes

- 1.6. Setup Boxes

- 1.7. Other Product Types

-

2. End-User Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal Care and Home Care

- 2.4. Electrical Goods

- 2.5. Other End-user Industries

Middle East and Africa Paper Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Paper Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Paper Packaging Market

Middle East and Africa Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Strong Demand from the Food and Beverage Sector

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Slotted Containers

- 5.1.4. Die Cut Container

- 5.1.5. Five Panel Folder Boxes

- 5.1.6. Setup Boxes

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal Care and Home Care

- 5.2.4. Electrical Goods

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Metsa Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rengo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tetra Laval

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Paper Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sappi Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oji Paper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Graphic Packaging International Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smurfit Kappa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DS Smith

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Paper Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Middle East and Africa Paper Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: Middle East and Africa Paper Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Paper Packaging Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Middle East and Africa Paper Packaging Market?

Key companies in the market include Amcor, Metsa Group*List Not Exhaustive, Rengo, Tetra Laval, Mondi Group, International Paper Company, Sappi Limited, Oji Paper, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith.

3. What are the main segments of the Middle East and Africa Paper Packaging Market?

The market segments include Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 30539.4 million as of 2022.

5. What are some drivers contributing to market growth?

; Strong Demand from the Food and Beverage Sector.

6. What are the notable trends driving market growth?

Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging.

7. Are there any restraints impacting market growth?

; Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence