Key Insights

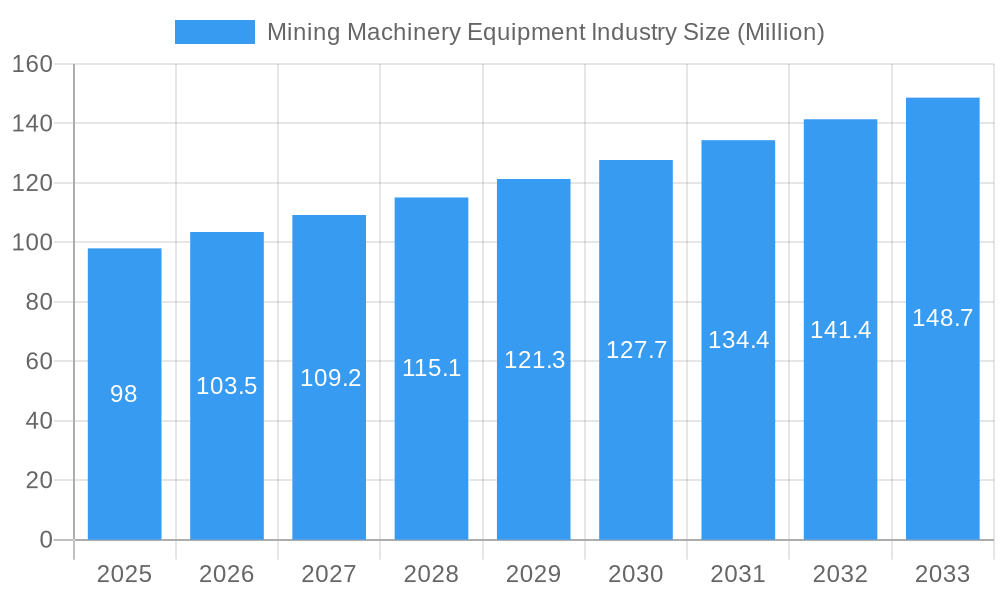

The global mining machinery equipment market, valued at $98 million in 2025, is projected to experience robust growth, driven by increasing global demand for minerals and metals, coupled with technological advancements in automation and electrification. The market's Compound Annual Growth Rate (CAGR) of 5.12% from 2025 to 2033 indicates a significant expansion, fueled by the rising adoption of electric vehicles (EVs) which necessitates the mining of critical minerals like lithium and cobalt. Further expansion is anticipated from the increasing focus on sustainable mining practices and the implementation of advanced technologies to enhance efficiency and safety in mining operations. This includes the integration of data analytics, AI, and remote operation capabilities. Significant regional variations are expected, with North America and Asia-Pacific likely to dominate the market share due to substantial mining activities and investments in these regions. The segmentation by powertrain type (IC Engine Vehicle vs. Electric Vehicle) will see a gradual shift towards electric-powered equipment as sustainability concerns intensify and technology matures. Similarly, the segment focusing on underground mining equipment is likely to witness faster growth compared to surface mining equipment due to increasing depths of mining operations. The key players, including Atlas Copco, Liebherr Group, Hitachi Construction Machinery, Sandvik, Caterpillar, and Komatsu, are expected to play a significant role in shaping market trends through innovations in equipment design and technological advancements. Competition is expected to remain high, with companies focusing on developing efficient and sustainable solutions to meet the evolving needs of the mining industry.

Mining Machinery Equipment Industry Market Size (In Million)

The growth trajectory of the mining machinery equipment market will depend heavily on factors such as global economic conditions, governmental regulations on mining activities, and fluctuating commodity prices. Potential restraints could include high initial investment costs for advanced equipment, fluctuating raw material prices, and challenges in adapting to stricter environmental regulations. Nevertheless, the overall long-term outlook remains positive, considering the continuing global demand for raw materials and the ongoing drive towards more efficient and sustainable mining practices. Technological innovation will be a crucial factor in mitigating some of these challenges and unlocking further market growth. The shift towards automation and the development of sophisticated equipment designed for specific mining applications will be key drivers of market expansion in the years to come.

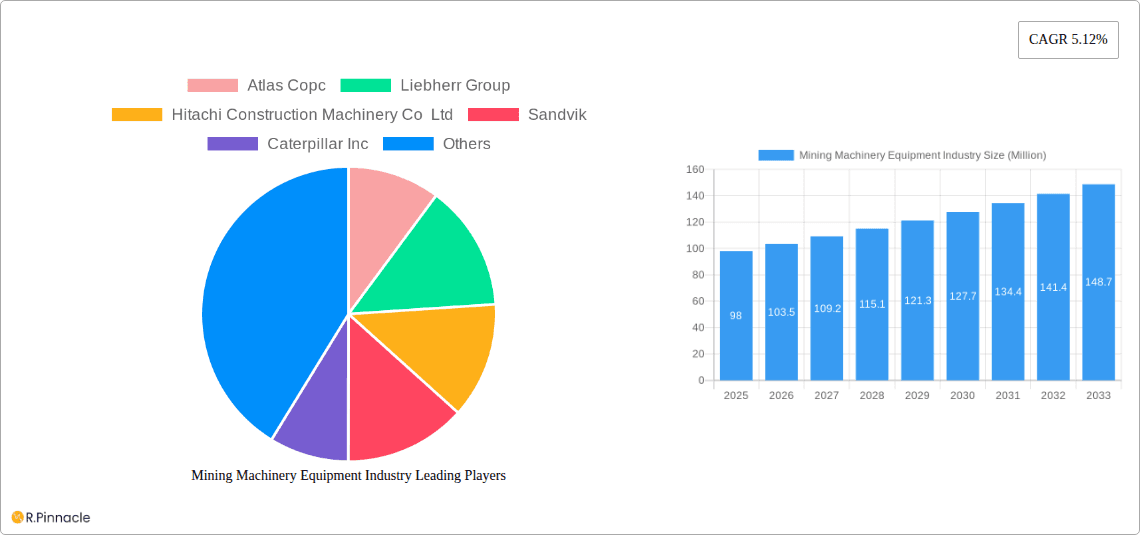

Mining Machinery Equipment Industry Company Market Share

Mining Machinery Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global mining machinery equipment industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive market research to deliver actionable intelligence on market size, growth drivers, challenges, and future outlook. The total market value in 2025 is estimated at $XX Million.

Mining Machinery Equipment Industry Market Structure & Innovation Trends

The global mining machinery equipment market is moderately concentrated, with key players such as Atlas Copco, Liebherr Group, Hitachi Construction Machinery Co. Ltd, Sandvik, Caterpillar Inc, and Komatsu Ltd holding significant market share. In 2025, these companies collectively accounted for an estimated xx% of the total market. Innovation is driven by the demand for increased efficiency, safety, and sustainability in mining operations. Stringent environmental regulations and the increasing adoption of automation and digital technologies are also major drivers. The market sees considerable M&A activity; for instance, the acquisition of Gelsenkirchen GGH Group by Komatsu in December 2022 valued at $XX Million signifies a key strategic move.

- Market Concentration: Moderately concentrated, with top six players holding xx% market share in 2025.

- Innovation Drivers: Increased efficiency, safety, sustainability, automation, and digitalization.

- Regulatory Frameworks: Stringent environmental regulations impacting equipment design and operations.

- Product Substitutes: Limited, but advancements in alternative mining methods pose a potential long-term threat.

- End-User Demographics: Primarily large-scale mining companies, with a growing segment of smaller, independent operators.

- M&A Activity: Significant activity, exemplified by Komatsu's acquisition of Gelsenkirchen GGH Group in December 2022 for $XX Million.

Mining Machinery Equipment Industry Market Dynamics & Trends

The mining machinery equipment market is projected to experience robust growth during the forecast period (2025-2033), driven by increasing global demand for minerals and metals, coupled with ongoing investments in mining infrastructure. The compound annual growth rate (CAGR) is estimated to be xx% from 2025 to 2033. Technological disruptions, such as the increasing adoption of electric vehicles (EVs) in mining operations and advanced automation systems, are reshaping the industry landscape. Consumer preferences are shifting towards more sustainable and efficient equipment, placing pressure on manufacturers to innovate and adapt. Intense competition among established players and the emergence of new entrants are further shaping market dynamics. Market penetration of electric mining equipment is expected to reach xx% by 2033.

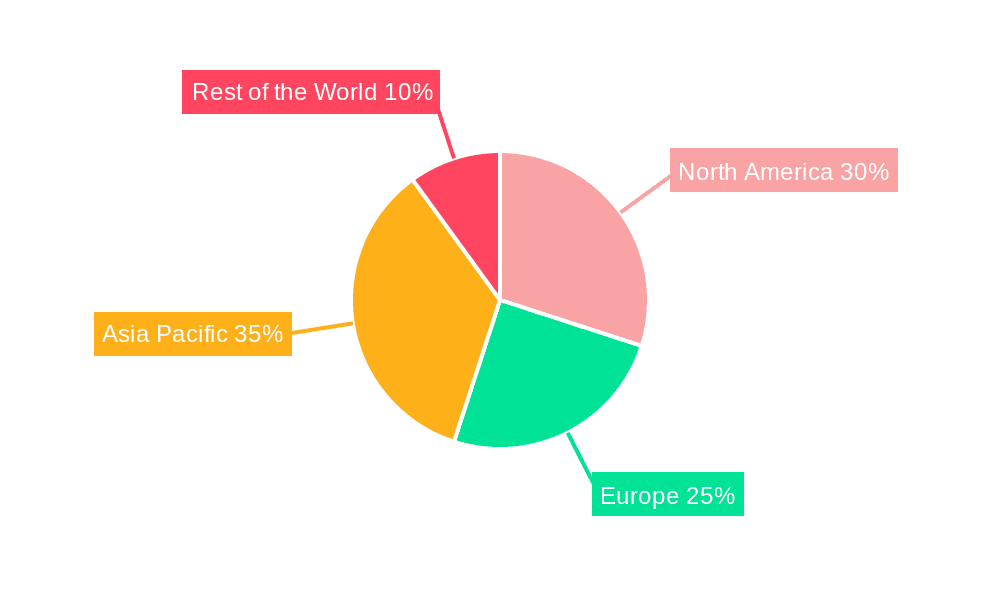

Dominant Regions & Segments in Mining Machinery Equipment Industry

The Asia-Pacific region is projected to be the dominant market for mining machinery equipment during the forecast period. China, Australia, and India are expected to be key contributors to this growth, driven by robust economic growth and large-scale mining projects.

- Leading Region: Asia-Pacific

- Key Drivers (Asia-Pacific): Strong economic growth, substantial investments in mining infrastructure, and government support for mining development.

- Dominant Segments:

- Powertrain Type: IC Engine Vehicles currently dominate, but Electric Vehicles are showing significant growth.

- Equipment Type: Surface mining equipment holds the largest market share, followed by underground mining equipment and mineral processing equipment.

- Application: Metal mining currently accounts for the largest share, followed by mineral mining and coal mining.

Mining Machinery Equipment Industry Product Innovations

The Mining Machinery Equipment Industry is at the forefront of innovation, continuously pushing boundaries to enhance operational efficiency, bolster safety protocols, and champion environmental sustainability. A significant wave of advancements is centered on the integration of electric-powered mining vehicles, heralding a transition away from traditional diesel engines. Complementing this shift are the burgeoning autonomous haulage systems, which leverage artificial intelligence and advanced connectivity to optimize material movement and reduce human exposure to hazardous environments. Furthermore, the industry is investing heavily in sophisticated sensor technologies, enabling real-time data acquisition for improved monitoring, predictive maintenance, and precise control over complex operations. These cutting-edge innovations are not merely technological upgrades; they are strategic imperatives that offer distinct competitive advantages by substantially reducing operational expenditures, elevating overall productivity, and significantly minimizing the environmental footprint of mining activities.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the global mining machinery equipment market to provide a granular understanding of its dynamics. The segmentation is based on key parameters including powertrain type, encompassing both traditional Internal Combustion (IC) engine vehicles and the rapidly growing electric vehicle segment. Further, the market is dissected by equipment type, distinguishing between surface mining equipment, underground mining equipment, and mineral processing equipment, each with its own unique demands and growth trajectories. The application-based segmentation categorizes the market into metal mining, mineral mining, and coal mining, highlighting the specific machinery needs of each sector. For each identified segment, this report delivers in-depth analyses of growth projections, current market size, and the intricate competitive landscape. For instance, the electric vehicle segment is poised for substantial expansion, propelled by an increasing global awareness of environmental issues and the implementation of stringent government regulations promoting cleaner mining practices. Concurrently, the underground mining equipment segment is projected to exhibit consistent growth, driven by the escalating demand for resources necessitating deeper and more complex mining operations.

Key Drivers of Mining Machinery Equipment Industry Growth

Growth in the mining machinery equipment industry is fueled by several factors, including rising global demand for minerals and metals, increasing investments in mining infrastructure development, technological advancements leading to improved efficiency and productivity, and government support for mining activities in several regions. The increasing adoption of automation and digital technologies also plays a significant role.

Challenges in the Mining Machinery Equipment Industry Sector

The Mining Machinery Equipment Industry operates within a complex and dynamic environment, facing a spectrum of significant challenges. Volatility in global commodity prices directly impacts demand for mining operations and, consequently, the procurement of machinery. Furthermore, increasingly stringent environmental regulations worldwide necessitate substantial investments in compliance, adding to operational costs and potentially slowing down project timelines. The intricate nature of global supply chains presents another hurdle, with disruptions capable of impacting production schedules and delivery commitments for essential equipment. Moreover, the industry is characterized by intense competition, with a mix of well-established global players and agile new entrants vying for market share, which can exert downward pressure on pricing and necessitate continuous innovation to maintain competitive advantage.

Emerging Opportunities in Mining Machinery Equipment Industry

Emerging opportunities include the growing demand for sustainable and eco-friendly mining equipment, the increasing adoption of digital technologies such as AI and IoT for improved operational efficiency and safety, and the expansion of mining activities in emerging economies.

Leading Players in the Mining Machinery Equipment Industry Market

Key Developments in Mining Machinery Equipment Industry Industry

- December 2022: Komatsu, a global leader in mining equipment, significantly bolstered its underground mining machinery capabilities with the strategic acquisition of the Germany-based GGH Group. This move is anticipated to solidify Komatsu's presence and operational reach within the mining sectors of Europe, South Africa, and India, offering enhanced solutions and support to these key regions.

- August 2022: Epiroc, a prominent provider of mining and infrastructure solutions, entered into a pivotal strategic agreement with AARD Mining Equipment, a respected South African manufacturer of mining machinery. This collaboration is designed to foster innovation and drive improvements in both productivity and sustainability across the mining sector, leveraging the combined expertise and product portfolios of both companies.

Future Outlook for Mining Machinery Equipment Industry Market

The future of the mining machinery equipment market looks promising, driven by ongoing technological advancements, increasing demand for minerals and metals, and investments in sustainable mining practices. Strategic partnerships, focused innovation, and adapting to changing regulatory landscapes will be crucial for players seeking to capitalize on future growth opportunities. The market is expected to continue its expansion, driven by the ongoing need for efficient and sustainable mining solutions globally.

Mining Machinery Equipment Industry Segmentation

-

1. Type

- 1.1. Surface Mining Equipment

- 1.2. Underground Mining Equipment

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engine Vehicle

- 3.2. Electric Vehicle

Mining Machinery Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Mining Machinery Equipment Industry Regional Market Share

Geographic Coverage of Mining Machinery Equipment Industry

Mining Machinery Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Rise in Use of Telematics in the Mining Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mining Machinery Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining Equipment

- 5.1.2. Underground Mining Equipment

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engine Vehicle

- 5.3.2. Electric Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Mining Machinery Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Surface Mining Equipment

- 6.1.2. Underground Mining Equipment

- 6.1.3. Mineral Processing Equipment

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Metal Mining

- 6.2.2. Mineral Mining

- 6.2.3. Coal Mining

- 6.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 6.3.1. IC Engine Vehicle

- 6.3.2. Electric Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Mining Machinery Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Surface Mining Equipment

- 7.1.2. Underground Mining Equipment

- 7.1.3. Mineral Processing Equipment

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Metal Mining

- 7.2.2. Mineral Mining

- 7.2.3. Coal Mining

- 7.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 7.3.1. IC Engine Vehicle

- 7.3.2. Electric Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Mining Machinery Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Surface Mining Equipment

- 8.1.2. Underground Mining Equipment

- 8.1.3. Mineral Processing Equipment

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Metal Mining

- 8.2.2. Mineral Mining

- 8.2.3. Coal Mining

- 8.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 8.3.1. IC Engine Vehicle

- 8.3.2. Electric Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Mining Machinery Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Surface Mining Equipment

- 9.1.2. Underground Mining Equipment

- 9.1.3. Mineral Processing Equipment

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Metal Mining

- 9.2.2. Mineral Mining

- 9.2.3. Coal Mining

- 9.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 9.3.1. IC Engine Vehicle

- 9.3.2. Electric Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Atlas Copc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Liebherr Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hitachi Construction Machinery Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sandvik

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Caterpillar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Komatsu Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Atlas Copc

List of Figures

- Figure 1: Global Mining Machinery Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Mining Machinery Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Mining Machinery Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Mining Machinery Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Mining Machinery Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Mining Machinery Equipment Industry Revenue (Million), by Powertrain Type 2025 & 2033

- Figure 7: North America Mining Machinery Equipment Industry Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 8: North America Mining Machinery Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Mining Machinery Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Mining Machinery Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Mining Machinery Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Mining Machinery Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Mining Machinery Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Mining Machinery Equipment Industry Revenue (Million), by Powertrain Type 2025 & 2033

- Figure 15: Europe Mining Machinery Equipment Industry Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 16: Europe Mining Machinery Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Mining Machinery Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Mining Machinery Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Mining Machinery Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Mining Machinery Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Mining Machinery Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Mining Machinery Equipment Industry Revenue (Million), by Powertrain Type 2025 & 2033

- Figure 23: Asia Pacific Mining Machinery Equipment Industry Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 24: Asia Pacific Mining Machinery Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Mining Machinery Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Mining Machinery Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Mining Machinery Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Mining Machinery Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Rest of the World Mining Machinery Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Mining Machinery Equipment Industry Revenue (Million), by Powertrain Type 2025 & 2033

- Figure 31: Rest of the World Mining Machinery Equipment Industry Revenue Share (%), by Powertrain Type 2025 & 2033

- Figure 32: Rest of the World Mining Machinery Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Mining Machinery Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 4: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 8: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 15: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 24: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Powertrain Type 2020 & 2033

- Table 33: Global Mining Machinery Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Mining Machinery Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mining Machinery Equipment Industry?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Mining Machinery Equipment Industry?

Key companies in the market include Atlas Copc, Liebherr Group, Hitachi Construction Machinery Co Ltd, Sandvik, Caterpillar Inc, Komatsu Ltd.

3. What are the main segments of the Mining Machinery Equipment Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 98 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Rise in Use of Telematics in the Mining Industry.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

December 2022: Komatsu announced the expansion of its underground mining equipment business with the acquisition of the Germany-based Gelsenkirchen GGH Group. This acquisition will boost the company's foothold in Europe, South Africa, and India's mining sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mining Machinery Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mining Machinery Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mining Machinery Equipment Industry?

To stay informed about further developments, trends, and reports in the Mining Machinery Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence