Key Insights

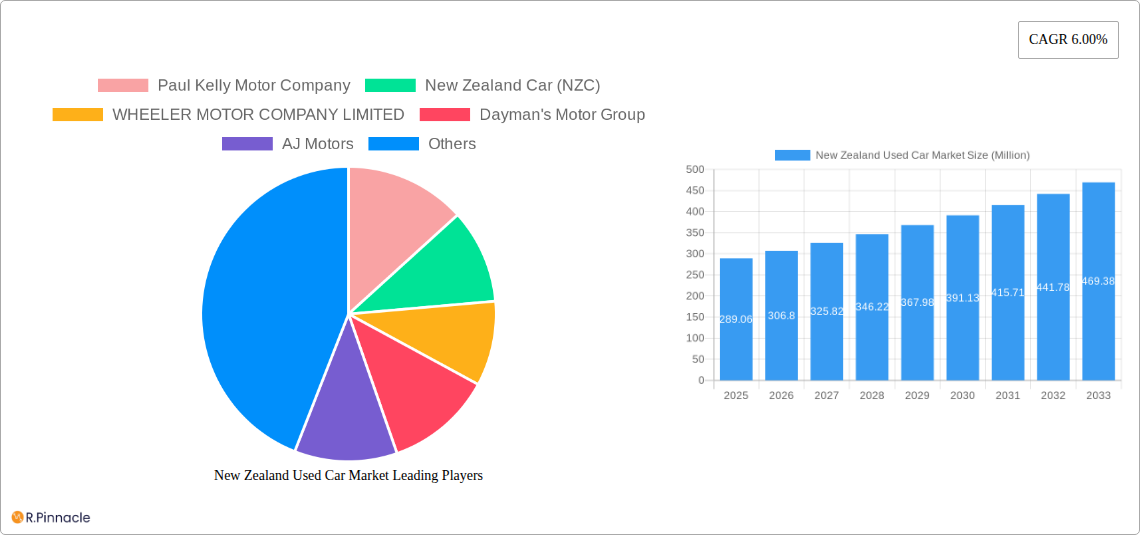

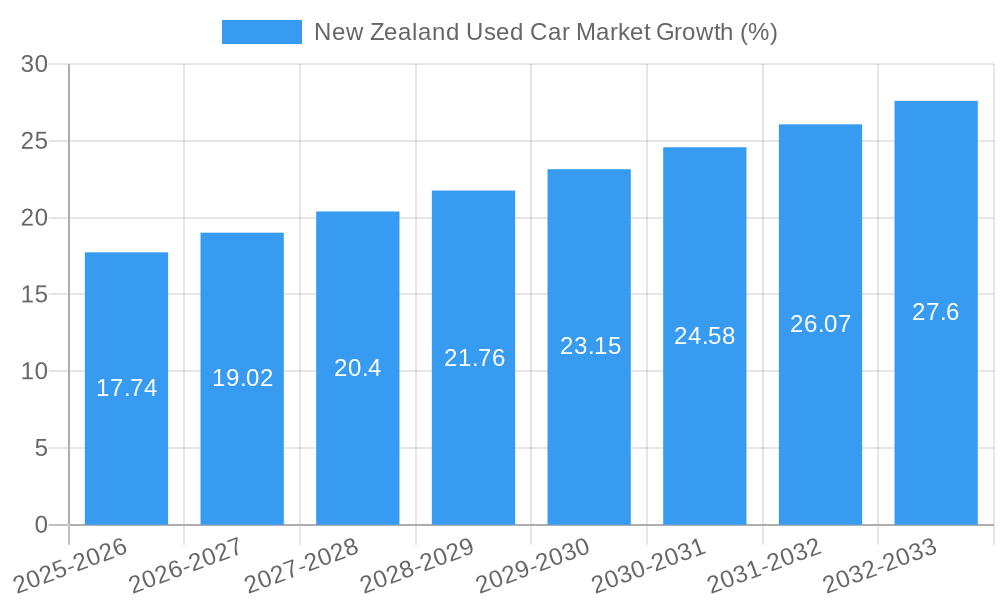

The New Zealand used car market, valued at NZD 289.06 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 6% from 2025 to 2033. This growth is fueled by several key factors. Increasing vehicle ownership, particularly amongst younger demographics entering the driver market, coupled with rising affordability concerns and a preference for pre-owned vehicles over new purchases contribute significantly to market expansion. Furthermore, the diverse range of vehicle types available, encompassing hatchbacks, sedans, SUVs, and MUVs, caters to a broad spectrum of consumer needs and preferences. The market is segmented by vendor type (organized and unorganized dealerships) and fuel type (gasoline, diesel, electric, and alternative fuels), reflecting evolving consumer demands and environmental considerations. The presence of established players like Paul Kelly Motor Company, Turners Automotive Group, and AutoTrader, alongside numerous independent dealerships, indicates a competitive landscape characterized by both large-scale operations and smaller, localized businesses. The market’s growth is likely influenced by factors such as used car import regulations, government incentives impacting fuel type choices, and the overall economic health of New Zealand.

The forecast period, spanning 2025 to 2033, anticipates a significant increase in market size driven by sustained consumer demand. However, potential restraints could include fluctuating used car import costs, economic downturns impacting consumer spending, and the ongoing transition to electric vehicles which could impact demand for older gasoline and diesel models. The ongoing interplay between these driving forces and potential constraints will shape the future trajectory of the New Zealand used car market, making continuous monitoring of economic and environmental factors critical to forecasting accuracy. The organized sector is likely to gain market share during the forecast period, driven by growing consumer confidence in established dealerships offering better warranties and financing options compared to unorganized channels.

New Zealand Used Car Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the New Zealand used car market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to provide a clear picture of the market's current state and projected trajectory. The total market size is predicted to reach xx Million by 2033.

New Zealand Used Car Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the New Zealand used car market. The market is characterized by a mix of large organized dealerships and numerous smaller, independent vendors.

Market Concentration: Turners Automotive Group, Turners Automotive Group, and other major players like Andrew Simms Group hold significant market share, though the exact figures are unavailable and further investigation is needed. The market demonstrates moderate concentration, with several large players competing alongside numerous smaller dealerships and independent sellers. Data from 2024 shows an estimated market share of xx% for the top 5 players.

Innovation Drivers: Technological advancements such as online marketplaces (AutoTrader, Autoport) and the increasing adoption of electric and alternative fuel vehicles are driving innovation. The government's Clean Car initiative also pushes innovation by encouraging the sale of lower-emission vehicles.

Regulatory Framework: Government regulations concerning vehicle emissions and safety standards significantly influence market dynamics. The Clean Car Fee/Rebate scheme, introduced in May 2023, is a prime example.

Product Substitutes: Public transportation and ride-sharing services are indirect substitutes, though their impact on the used car market is relatively limited in the forecast period.

End-User Demographics: The market caters to a diverse range of consumers, from young drivers to families and businesses. The average age and income levels of buyers are crucial factors influencing purchasing decisions.

M&A Activities: The New Zealand used car market has witnessed several mergers and acquisitions in recent years (eg. Andrew Simms Group's collaboration with BYD). The total value of M&A deals in the last 5 years is estimated at xx Million.

New Zealand Used Car Market Market Dynamics & Trends

The New Zealand used car market exhibits robust growth driven by factors such as rising population, increasing urbanization, and growing consumer demand for personal transportation. Technological disruptions, particularly the rise of online marketplaces and mobile apps, have significantly changed the buying and selling experience, increasing transparency and convenience. Consumer preferences are shifting towards fuel-efficient and environmentally friendly vehicles (Electric and Alternative fuel vehicles). This is partly fuelled by government initiatives like the Clean Car Discount. The market is witnessing increasing competition among various players, leading to innovative pricing strategies and customer service offerings. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be xx%, with market penetration rates for EVs expected to increase significantly.

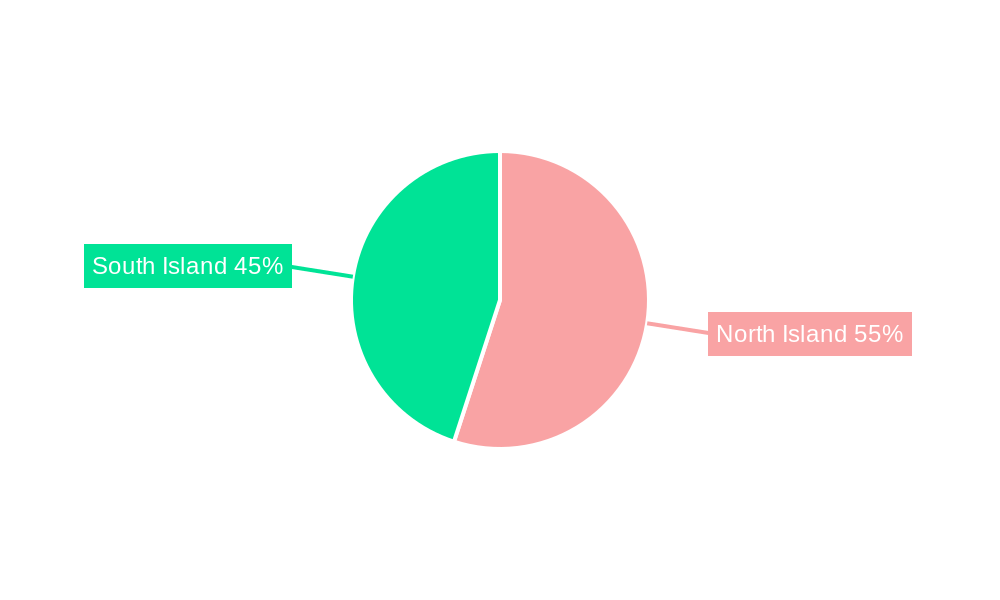

Dominant Regions & Segments in New Zealand Used Car Market

The Auckland region is the most dominant due to high population density and economic activity, followed by other major urban centres.

Vehicle Type: SUVs currently dominate the market, followed by hatchbacks and sedans. The increasing popularity of SUVs is attributed to their versatility and space. MUVs show steady growth, driven by growing family sizes.

Vendor Type: Organized dealers like Turners Automotive Group, Turners Automotive Group, and Paul Kelly Motor Company hold a greater share compared to the unorganized sector.

Fuel Type: Gasoline vehicles remain the dominant fuel type, although the share of diesel and electric vehicles is gradually increasing, driven by rising environmental awareness and government incentives. Alternative fuel vehicles are still niche.

Key Drivers:

Economic Growth: Rising disposable incomes and improved living standards fuel demand for personal vehicles.

Government Policies: Incentive programs and emission regulations influence consumer choices and market trends.

New Zealand Used Car Market Product Innovations

The market is witnessing innovative developments, including the increasing availability of electric and hybrid vehicles, the integration of advanced safety features, and the rise of online platforms for vehicle sales and financing. These innovations enhance consumer experience and address growing environmental concerns. The increased focus on vehicle history reports and transparent pricing contribute to greater consumer trust and market efficiency.

Report Scope & Segmentation Analysis

This report segments the New Zealand used car market across various parameters:

Vehicle Type: Hatchback, Sedan, SUV, MUV. Growth projections and market size vary across segments, with SUVs showing the highest growth.

Vendor Type: Organized and Unorganized. Organized dealers are expected to maintain a larger market share.

Fuel Type: Gasoline, Diesel, Electric, Alternative Fuel Vehicles. The electric vehicle segment is anticipated to experience the highest growth rate.

Key Drivers of New Zealand Used Car Market Growth

Key growth drivers include rising disposable incomes, increasing urbanization, technological advancements (online marketplaces), government incentives (Clean Car scheme), and a growing preference for SUVs and fuel-efficient vehicles.

Challenges in the New Zealand Used Car Market Sector

Challenges include supply chain disruptions, fluctuations in used car prices, stringent emission regulations, increasing competition, and the need to adapt to evolving consumer preferences (toward electric vehicles). These factors can negatively affect market stability and profitability.

Emerging Opportunities in New Zealand Used Car Market

Emerging opportunities lie in the growing demand for electric and alternative fuel vehicles, the expansion of online platforms, the increasing need for vehicle maintenance and repair services, and the potential for innovative financing options. These represent significant growth prospects for market players.

Leading Players in the New Zealand Used Car Market Market

- Paul Kelly Motor Company

- New Zealand Car (NZC)

- WHEELER MOTOR COMPANY LIMITED

- Dayman's Motor Group

- AJ Motors

- Andrew Simms Group

- Turners Automotive Group

- AutoTrader

- Autoport

- Morrison Motor Group

Key Developments in New Zealand Used Car Market Industry

May 2023: The New Zealand Government launched the Clean Car Fee/Rebate scheme to reduce vehicle emissions from imported used cars. This significantly impacts the market by influencing consumer preference towards lower-emission vehicles.

August 2023: Andrew Simms Group collaborated with BYD Co. Ltd., strengthening its brand presence and expanding its electric vehicle offerings. This collaboration highlights the growing significance of electric vehicles in the New Zealand market.

Future Outlook for New Zealand Used Car Market Market

The New Zealand used car market is poised for continued growth driven by sustained economic growth, population increase, and the ongoing shift towards electric and alternative fuel vehicles. Strategic partnerships, technological innovation, and effective adaptation to changing regulations will be crucial for success in this dynamic market. The market is expected to show xx% growth over the next decade.

New Zealand Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Alternative Fuel Vehicles

New Zealand Used Car Market Segmentation By Geography

- 1. New Zealand

New Zealand Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Sales Channel Witnessed Significant Market Growth

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Hatchback Cars witnessing major growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Alternative Fuel Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Paul Kelly Motor Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 New Zealand Car (NZC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WHEELER MOTOR COMPANY LIMITED

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dayman's Motor Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AJ Motors

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Andrew Simms Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turners Automotive Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AutoTrader

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autoport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Morrison Motor Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paul Kelly Motor Company

List of Figures

- Figure 1: New Zealand Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Zealand Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: New Zealand Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Zealand Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: New Zealand Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: New Zealand Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: New Zealand Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: New Zealand Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: New Zealand Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: New Zealand Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 9: New Zealand Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: New Zealand Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Used Car Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the New Zealand Used Car Market?

Key companies in the market include Paul Kelly Motor Company, New Zealand Car (NZC), WHEELER MOTOR COMPANY LIMITED, Dayman's Motor Group, AJ Motors, Andrew Simms Grou, Turners Automotive Group, AutoTrader, Autoport, Morrison Motor Group.

3. What are the main segments of the New Zealand Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 289.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Online Sales Channel Witnessed Significant Market Growth.

6. What are the notable trends driving market growth?

Hatchback Cars witnessing major growth.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Andrew Simms, one of the leading dealer groups in New Zealand, collaborated with BYD Co. Ltd. Through this collaboration, the Andrew Simms Group enhanced their brand value across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Used Car Market?

To stay informed about further developments, trends, and reports in the New Zealand Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence