Key Insights

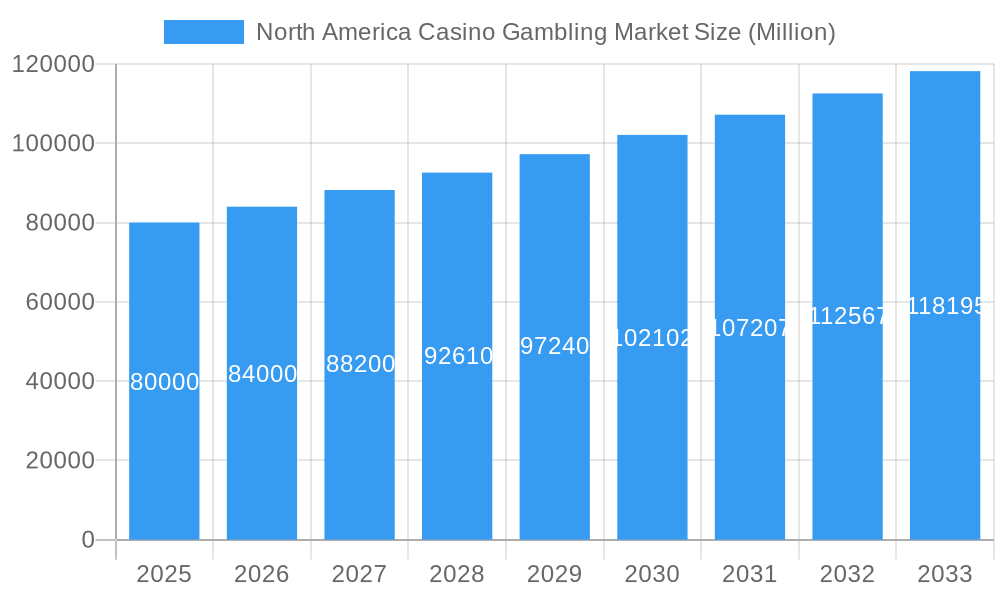

The North American casino gambling market, a dynamic sector fueled by technological advancements and evolving player preferences, is experiencing robust growth. With a Compound Annual Growth Rate (CAGR) exceeding 5% from 2019-2033, the market's value is projected to significantly expand throughout the forecast period (2025-2033). This expansion is driven by several key factors: the increasing popularity of online casino gaming, particularly among younger demographics; the rise of mobile casino apps offering convenient and accessible gameplay; and continuous innovation in game technology, including live dealer games and immersive virtual reality experiences. Furthermore, strategic partnerships between established casino operators and technology providers are streamlining operations and enhancing the overall player experience. The market segmentation reveals a diverse player base, ranging from casual players seeking entertainment to high-stakes recreational and professional gamblers. Live casinos, baccarat, blackjack, poker, and slots remain dominant segments, attracting a substantial portion of market revenue. The geographical distribution shows that the United States, Canada, and Mexico constitute the core of the North American market, each contributing significantly to overall market size. However, regulatory changes and responsible gambling initiatives, while crucial for maintaining a sustainable market, could potentially act as minor restraints on growth in some regions.

North America Casino Gambling Market Market Size (In Billion)

While specific market size figures for the base year (2025) and beyond are not explicitly provided, a logical estimation considering the given CAGR and assuming a 2025 market size of $80 billion (a reasonable estimation for the North American casino gambling market, encompassing both land-based and online segments) suggests substantial expansion. For example, a 5% CAGR would result in a 2026 market size exceeding $84 billion, and this trajectory will continue, propelled by the aforementioned market drivers. This growth, however, is not uniform across all segments. Online casino games, given their convenience, are poised for a higher growth rate than traditional land-based casinos, indicating a shift in consumer preferences and the evolution of the gaming landscape. Competition among established operators and new entrants further intensifies market dynamics, demanding continuous adaptation and innovation to maintain market share. The North American casino gambling market is thus predicted to experience considerable growth and transformation in the coming years.

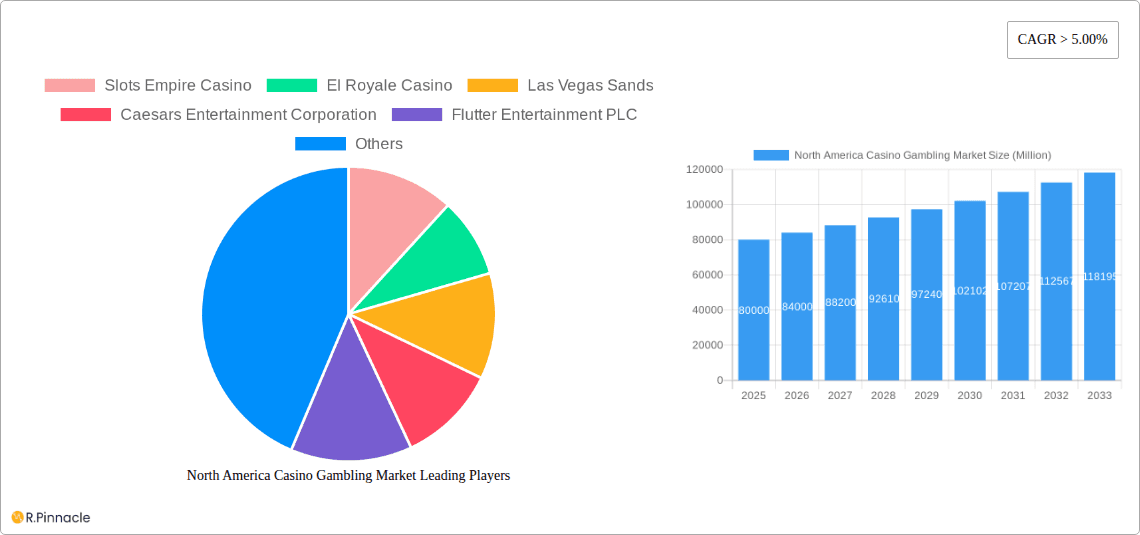

North America Casino Gambling Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America casino gambling market, offering valuable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, growth drivers, and future trends. The report covers key segments including various game types (Live Casino, Baccarat, Blackjack, Poker, Slots, Others) and player types (Casual, Recreational, Professional), providing a granular understanding of this lucrative market. The market is expected to reach xx Million by 2033.

North America Casino Gambling Market Market Structure & Innovation Trends

The North American casino gambling market exhibits a complex structure characterized by both established giants and emerging players. Market concentration is moderate, with a few dominant players like Las Vegas Sands and Caesars Entertainment Corporation holding significant market share, but numerous smaller operators and online platforms actively competing. The market share of the top 5 players is estimated at 45% in 2025. Innovation is primarily driven by technological advancements in online gaming, mobile platforms, and virtual reality (VR) integration. Regulatory frameworks vary significantly across different states and provinces, impacting market access and operational strategies. Product substitutes, such as online sports betting and other forms of entertainment, pose a competitive challenge. End-user demographics are diversifying, with younger generations increasingly engaging with online casino platforms. Mergers and acquisitions (M&A) are frequent, reflecting industry consolidation and expansion efforts. In 2024, the total value of M&A deals in the North American Casino Gambling market was estimated at $xx Million.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Drivers: Technological advancements in online and mobile gaming, VR/AR integration.

- Regulatory Frameworks: Vary significantly across jurisdictions, impacting market access.

- Product Substitutes: Online sports betting and other forms of entertainment.

- End-User Demographics: Diversifying, with growing engagement from younger generations.

- M&A Activity: Frequent, indicating industry consolidation and expansion.

North America Casino Gambling Market Market Dynamics & Trends

The North American casino gambling market is experiencing robust growth, driven by factors such as increasing disposable incomes, rising popularity of online gaming, and the legalization of online gambling in several jurisdictions. Technological disruptions, including the rise of mobile gaming and virtual reality experiences, are transforming consumer preferences and creating new revenue streams. The market is highly competitive, with established operators facing pressure from new entrants and innovative online platforms. Consumer preferences are shifting towards more convenient and personalized gaming experiences, leading to increased demand for mobile-friendly platforms and personalized game offerings. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various demographics and geographical regions. The market penetration rate is expected to reach xx% by 2033.

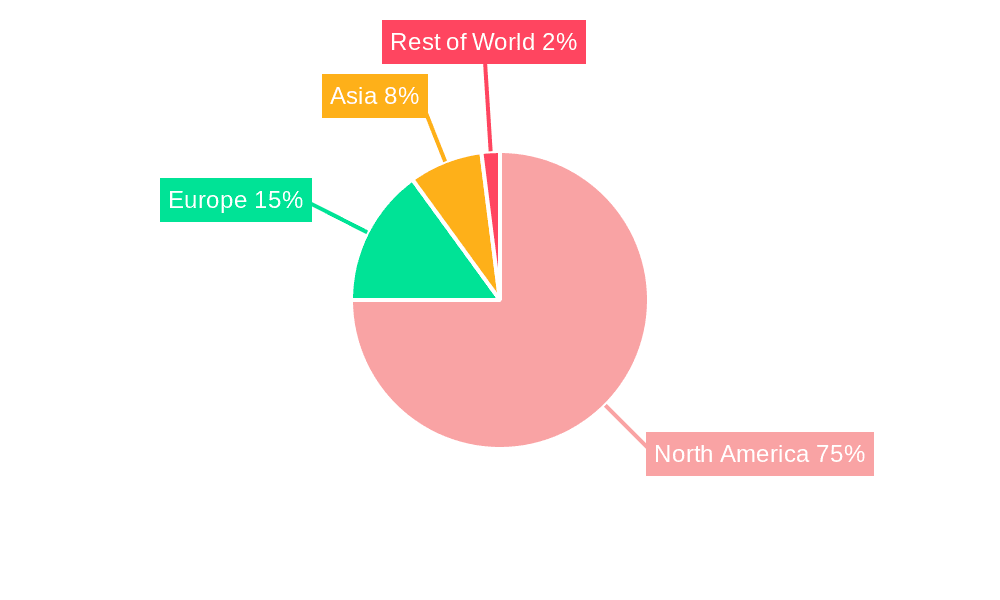

Dominant Regions & Segments in North America Casino Gambling Market

The North American casino gambling market is geographically diverse, with significant variations in regulatory environments and consumer preferences across different regions. Nevada and New Jersey remain leading states for traditional casinos, while Pennsylvania and New Jersey lead in online gambling.

By Type:

- Slots: Dominates the market due to its broad appeal and ease of play. Growth is fuelled by technological advancements and the introduction of innovative game features.

- Online Casino: Experiencing rapid growth driven by increasing internet penetration and smartphone adoption.

- Live Casino: Shows strong growth potential driven by the realistic gaming experience it offers.

By Player Type:

- Casual Players: Form the largest segment, contributing significantly to the market's overall revenue.

- Recreational Players: Represent a substantial portion of the market, exhibiting consistent engagement.

- Professional Players: While a smaller segment, they influence market trends and dynamics.

Key drivers for regional dominance include favorable economic policies, well-developed infrastructure, and supportive regulatory environments.

North America Casino Gambling Market Product Innovations

The North American casino gambling market is witnessing continuous product innovation, driven by technological advancements and evolving consumer preferences. New game features, improved user interfaces, and the integration of virtual reality (VR) and augmented reality (AR) technologies are enhancing the overall gaming experience. The development of mobile-first gaming platforms and personalized game recommendations is catering to the preferences of younger demographics. These innovations create competitive advantages by attracting and retaining players, driving market growth.

Report Scope & Segmentation Analysis

This report segments the North American casino gambling market by type (Live Casino, Baccarat, Blackjack, Poker, Slots, Others) and by player type (Casual, Recreational, Professional). Each segment is analyzed in detail, providing insights into its growth projections, market size, and competitive dynamics. The report projects significant growth for online segments driven by increasing internet penetration and technological advancements. The casual player segment will continue to drive significant market revenue due to its vast size and consistent engagement. Competitive dynamics are characterized by intense competition, with both established players and new entrants vying for market share.

Key Drivers of North America Casino Gambling Market Growth

Several factors fuel the growth of the North American casino gambling market. Technological advancements in online and mobile gaming platforms enhance convenience and accessibility. Favorable regulatory changes in several jurisdictions have expanded market access. Increasing disposable incomes and a rising preference for entertainment experiences further drive market expansion. The integration of innovative features and technologies like VR and AR continues to attract a broader player base.

Challenges in the North America Casino Gambling Market Sector

The North American casino gambling market faces several challenges. Strict regulatory frameworks and licensing requirements can hinder market entry and expansion. Supply chain disruptions can impact the availability of gaming equipment and software. Intense competition from both established and new players creates pricing pressures and necessitates continuous innovation to retain market share. The risk of addiction and responsible gaming concerns require proactive measures to mitigate potential negative impacts.

Emerging Opportunities in North America Casino Gambling Market

Several emerging opportunities exist in the North American casino gambling market. The expansion of online and mobile gaming into new jurisdictions presents significant growth potential. The integration of blockchain technology and cryptocurrencies could create new payment options and enhance security. The increasing adoption of virtual and augmented reality technologies provides opportunities for immersive and engaging gaming experiences. Personalized gaming recommendations and loyalty programs can further enhance player retention and engagement.

Leading Players in the North America Casino Gambling Market Market

- Las Vegas Sands

- Caesars Entertainment Corporation

- Flutter Entertainment PLC

- DraftKings (Golden Nugget)

- 888 Holding PLC

- Evolution Gaming

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Aristocrat

- Slots Empire Casino

- El Royale Casino

- BoVegas

- Cherry Gold Casino

- Wild Casino (Note: Links may not be available for all companies. This list is not exhaustive.)

Key Developments in North America Casino Gambling Market Industry

- August 2023: Golden Nugget Online Gaming launched its online and mobile casino in Pennsylvania, featuring over 500 slots and table games powered by DraftKings technology. This expansion significantly increased market competition in Pennsylvania and showcased the growing integration of online and mobile platforms.

- October 2023: Merkur, a casino games developer, partnered with Gaming Arts to develop and supply casino games across North America. This collaboration expands the offerings of both companies and potentially introduces innovative game content to the North American market.

Future Outlook for North America Casino Gambling Market Market

The future of the North American casino gambling market looks bright, fueled by continuous technological advancements, expanding regulatory acceptance, and the evolving preferences of consumers. The ongoing integration of mobile and online platforms, combined with innovations in VR/AR technology, will continue to drive market growth and attract new players. Strategic partnerships and acquisitions will further shape the competitive landscape. Responsible gaming initiatives will be crucial for sustainable growth and long-term success. The market is poised for significant expansion, with substantial opportunities for players who can adapt to changing trends and leverage technological advancements.

North America Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Casino Gambling Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Casino Gambling Market Regional Market Share

Geographic Coverage of North America Casino Gambling Market

North America Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Regulations are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Online Sector is Dominating the North America Casino Gambling Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Slots Empire Casino

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 El Royale Casino

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Las Vegas Sands

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Caesars Entertainment Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Flutter Entertainment PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 DraftKings (Golden Nugget)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Stars Group Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 BoVegas

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 888 Holding PLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Evolution Gaming

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 MGM Resorts International (Borgata Hotel Casino & Spa)

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Aristocrat**List Not Exhaustive

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Cherry Gold Casino

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Wild Casino

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 Slots Empire Casino

List of Figures

- Figure 1: North America Casino Gambling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Casino Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: North America Casino Gambling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: North America Casino Gambling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: North America Casino Gambling Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: North America Casino Gambling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: North America Casino Gambling Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Casino Gambling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Casino Gambling Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Casino Gambling Market?

Key companies in the market include Slots Empire Casino, El Royale Casino, Las Vegas Sands, Caesars Entertainment Corporation, Flutter Entertainment PLC, DraftKings (Golden Nugget), The Stars Group Inc, BoVegas, 888 Holding PLC, Evolution Gaming, MGM Resorts International (Borgata Hotel Casino & Spa), Aristocrat**List Not Exhaustive, Cherry Gold Casino, Wild Casino.

3. What are the main segments of the North America Casino Gambling Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market.

6. What are the notable trends driving market growth?

Online Sector is Dominating the North America Casino Gambling Market.

7. Are there any restraints impacting market growth?

Government Regulations are Restraining the Market.

8. Can you provide examples of recent developments in the market?

October 2023: Merkur, a casino games developer and subsidiary of The Gauselmann Group, entered into an agreement with Gaming Arts. The collaboration will likely focus on the development and supply of casino games for casinos across North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Casino Gambling Market?

To stay informed about further developments, trends, and reports in the North America Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence