Key Insights

The North American construction market, valued at $2.46 trillion in 2025, is projected to experience robust growth, driven by several key factors. Significant government investments in infrastructure projects, particularly in transportation and energy, are fueling demand. The ongoing recovery from the pandemic, coupled with a sustained increase in housing demand across both the residential and commercial sectors, further contributes to market expansion. Growth is particularly strong in the United States, benefiting from a robust economy and increasing urbanization. Canada also shows significant potential, fueled by its resource-rich economy and ongoing infrastructure development initiatives. While rising material costs and labor shortages present challenges, technological advancements like Building Information Modeling (BIM) and prefabrication are enhancing efficiency and mitigating some of these constraints. The market is segmented by country (United States and Canada, primarily), sector (commercial, residential, industrial, infrastructure, and energy/utilities), and construction type (additions, demolition, and new construction). This segmentation reveals a diverse market with opportunities spread across various sub-sectors. The competitive landscape is dominated by major players like Aecon Group Inc., D.R. Horton Inc., and Lennar Corporation, alongside numerous regional and specialized contractors. The forecast period (2025-2033) anticipates continued expansion, albeit at a potentially moderating pace as certain factors (such as inflation) may influence growth trajectories. The market's resilience and diverse growth drivers suggest a positive outlook for the foreseeable future.

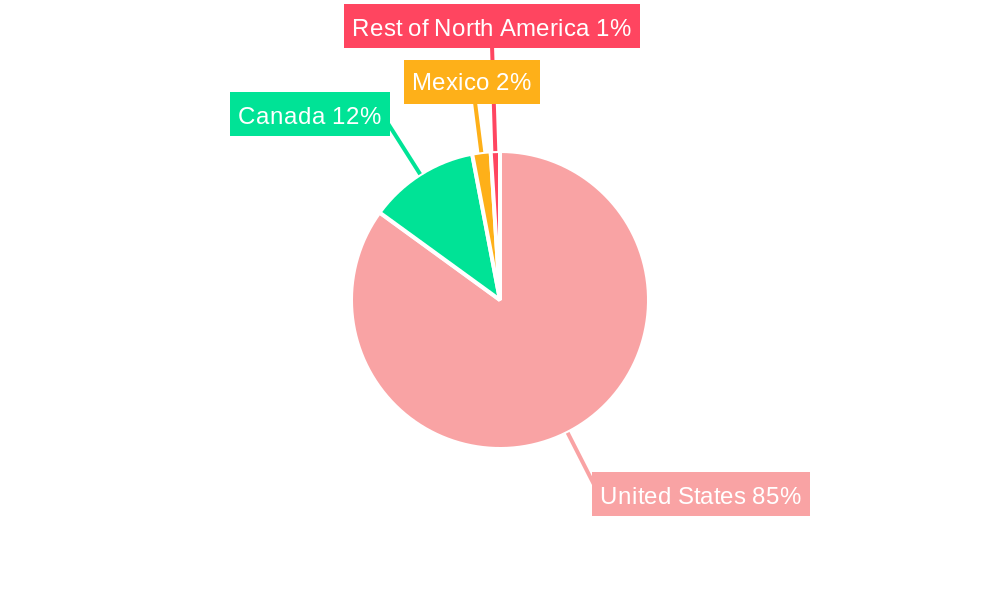

The consistent 4.82% CAGR projected through 2033 indicates sustained market expansion. While specific regional breakdowns beyond the US and Canada are absent, a reasonable assumption given North America's dominance in the provided data would suggest a significantly smaller market share for Mexico and the Rest of North America. The sector breakdown highlights the importance of residential and commercial construction, while the infrastructure segment is poised for growth due to ongoing government initiatives. The construction type segment indicates that new constructions will likely drive the majority of the market's expansion. However, the increasing prevalence of renovations and additions, combined with necessary demolition projects, demonstrates the variety of construction activities contributing to the overall market size. Analyzing the listed companies provides valuable insight into the key players shaping the market's dynamics and competitive landscape. Further research into specific market segments and regional trends would offer a more granular understanding of this expansive market.

North America Construction Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America construction market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report forecasts market trends, identifies key players, and explores emerging opportunities across diverse segments.

North America Construction Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North American construction market, examining market concentration, innovation drivers, regulatory frameworks, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller regional players. Market share varies significantly by segment and region, with a few dominant players in specific sectors. The estimated market size in 2025 is xx Million.

- Market Concentration: The market exhibits moderate concentration, with a few large players holding significant market share, particularly in segments like residential and infrastructure construction. Smaller companies specialize in niche areas or regional markets.

- Innovation Drivers: Technological advancements (e.g., Building Information Modeling (BIM), modular construction, 3D printing) are driving innovation, alongside stricter environmental regulations and a push for sustainable building practices.

- Regulatory Frameworks: Varying building codes and regulations across different states and provinces significantly impact construction projects' costs and timelines. Permitting processes and environmental regulations add to complexity.

- Product Substitutes: Alternative building materials and construction methods are emerging, posing both challenges and opportunities for traditional players. Prefabricated components and modular construction are gaining traction.

- End-User Demographics: The changing demographics of North America, including population growth and urbanization, are shaping demand for various types of construction.

- M&A Activities: The construction industry witnesses frequent M&A activity, driven by a desire to expand market reach, gain access to new technologies, and achieve economies of scale. Deal values have fluctuated in recent years, ranging from xx Million to xx Million for significant acquisitions.

North America Construction Market Dynamics & Trends

The North American construction market displays strong growth dynamics, propelled by several key factors. The estimated Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%. Market penetration for specific technologies, such as BIM, is steadily increasing, driven by efficiency gains and cost savings.

- Market Growth Drivers: Robust economic growth, population growth, increasing urbanization, and substantial investments in infrastructure projects fuel market expansion. Government initiatives for infrastructure development further boost growth.

- Technological Disruptions: Advancements in construction technology such as BIM, prefabrication, and 3D printing are transforming construction processes, enhancing productivity, and improving project outcomes.

- Consumer Preferences: The growing emphasis on sustainable and green building practices is reshaping consumer preferences, pushing the adoption of eco-friendly materials and designs.

- Competitive Dynamics: Intense competition among construction companies necessitates strategic partnerships, innovation, and efficient project management to achieve a competitive edge. Price competitiveness and project delivery timelines are significant factors.

Dominant Regions & Segments in North America Construction Market

The United States dominates the North American construction market due to its larger economy, substantial infrastructure investments, and significant residential construction activity. However, Canada's robust infrastructure spending contributes to a strong presence in the overall market.

- By Country:

- United States: Dominates the market due to its size and economic strength, with significant activity in residential and commercial sectors.

- Canada: Strong infrastructure investments and a growing economy drive considerable construction activity.

- By Sector:

- Residential Construction: A significant segment fueled by population growth and urbanization.

- Commercial Construction: Driven by economic expansion, with office spaces, retail developments, and hospitality projects leading the way.

- Industrial Construction: Growing demand for industrial and logistics facilities supports this segment's expansion.

- Infrastructure (Transportation) Construction: Government initiatives and substantial investments contribute to considerable growth.

- Energy and Utilities Construction: Expansion of renewable energy sources and upgrades to existing infrastructure drive activity.

- By Construction Type:

- New Constructions: The majority of market activity is focused on new construction projects.

- Additions and renovations: A considerable segment driven by the existing building stock.

- Demolition: A supporting segment necessary for redevelopment projects.

North America Construction Market Product Innovations

The construction market is witnessing significant technological advancements. The increasing adoption of Building Information Modeling (BIM) and the rise of modular and prefabricated construction methods enhance efficiency and sustainability. Digital twins and 3D printing are also emerging, offering new possibilities for design, construction, and project management. These innovations enhance productivity, improve quality, and reduce project timelines and costs.

Report Scope & Segmentation Analysis

This report segments the North American construction market by country (United States and Canada), sector (Residential, Commercial, Industrial, Infrastructure, Energy & Utilities), and construction type (New Constructions, Additions, Demolition). Each segment's market size, growth projections, and competitive landscape are analyzed, offering comprehensive insights into market dynamics. The estimated market size for 2025 is xx Million, with projections for 2033 reaching xx Million. Competitive dynamics vary significantly across segments.

Key Drivers of North America Construction Market Growth

Several factors drive the growth of the North American construction market. Firstly, substantial government investments in infrastructure projects, such as road expansions and public transit systems, are essential. Secondly, continuous population growth and urbanization create a sustained demand for residential and commercial buildings. Thirdly, technological advancements enhance efficiency and productivity, reducing construction times and costs. Lastly, a recovering economy supports growth across various sectors.

Challenges in the North America Construction Market Sector

The North American construction market faces challenges such as material price volatility, leading to cost overruns. Labor shortages further constrain capacity, causing delays. Supply chain disruptions, particularly following the pandemic, have impacted project schedules and costs. Furthermore, stringent environmental regulations add complexity and potentially increase project costs. These factors collectively impact project profitability and overall market growth.

Emerging Opportunities in North America Construction Market

The increasing adoption of sustainable building practices and green construction materials presents a significant opportunity. The growing use of prefabrication and modular construction techniques offers efficiency gains and cost savings. Investing in technology-driven solutions, such as Building Information Modeling (BIM) and digital twins, streamlines project management and improves outcomes. The development of resilient infrastructure to address climate change is another growing opportunity.

Leading Players in the North America Construction Market Market

- Aecon Group Inc

- D R Horton Inc

- Graham Income Trust

- Hochteif USA Inc

- Lennar Corporation

- PulteGroup Inc

- Kiewit Corporation

- Tutor Perini Corporation

- PCL Construction Group Inc

- Toll Brothers Inc

- Kajima U S A Inc

- The Whiting-Turner Contracting Company

- Hensel Phelps Construction Co

- SNC-Lavalin Construction Inc

- NVR Inc

Key Developments in North America Construction Market Industry

- June 2023: AXA XL launched the Sustainability Circle, a network promoting sustainable construction practices and risk management.

- April 2023: Greystar opened a modular construction facility, focusing on sustainable and affordable housing, employing 170 full-time employees.

Future Outlook for North America Construction Market Market

The North American construction market's future outlook is positive, driven by continued infrastructure investment, population growth, and technological innovation. The focus on sustainability, coupled with advancements in construction technologies, will shape market dynamics in the coming years, presenting significant opportunities for companies that embrace innovation and adapt to evolving market demands. The market is poised for steady growth, presenting lucrative prospects for investors and industry players alike.

North America Construction Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition and New Constructions

North America Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend

- 3.3. Market Restrains

- 3.3.1. Interests and Financing; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction Segment Holds the Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition and New Constructions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. United States North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Aecon Group Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 D R Horton Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Graham Income Trust

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hochteif USA Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lennar Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PulteGroup Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kiewit Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tutor Perini Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PCL Construction Group Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Toll Brothers Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kajima U S A Inc **List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 The Whiting-Turner Contracting Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Hensel Phelps Construction Co

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 SNC-Lavalin Construction Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 NVR Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Aecon Group Inc

List of Figures

- Figure 1: North America Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Construction Market Share (%) by Company 2024

List of Tables

- Table 1: North America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: North America Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: North America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: North America Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: North America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Construction Market?

The projected CAGR is approximately 4.82%.

2. Which companies are prominent players in the North America Construction Market?

Key companies in the market include Aecon Group Inc, D R Horton Inc, Graham Income Trust, Hochteif USA Inc, Lennar Corporation, PulteGroup Inc, Kiewit Corporation, Tutor Perini Corporation, PCL Construction Group Inc, Toll Brothers Inc, Kajima U S A Inc **List Not Exhaustive, The Whiting-Turner Contracting Company, Hensel Phelps Construction Co, SNC-Lavalin Construction Inc, NVR Inc.

3. What are the main segments of the North America Construction Market?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend.

6. What are the notable trends driving market growth?

Residential Construction Segment Holds the Major Share in the Market.

7. Are there any restraints impacting market growth?

Interests and Financing; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2023: AXA XL's North American construction insurance business launched the Sustainability Circle. It is a network comprising 21 leaders in the sustainable construction industry. The goal of the initiative is to assist clients achieve their sustainability goals and enhance their construction risk management efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Construction Market?

To stay informed about further developments, trends, and reports in the North America Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence