Key Insights

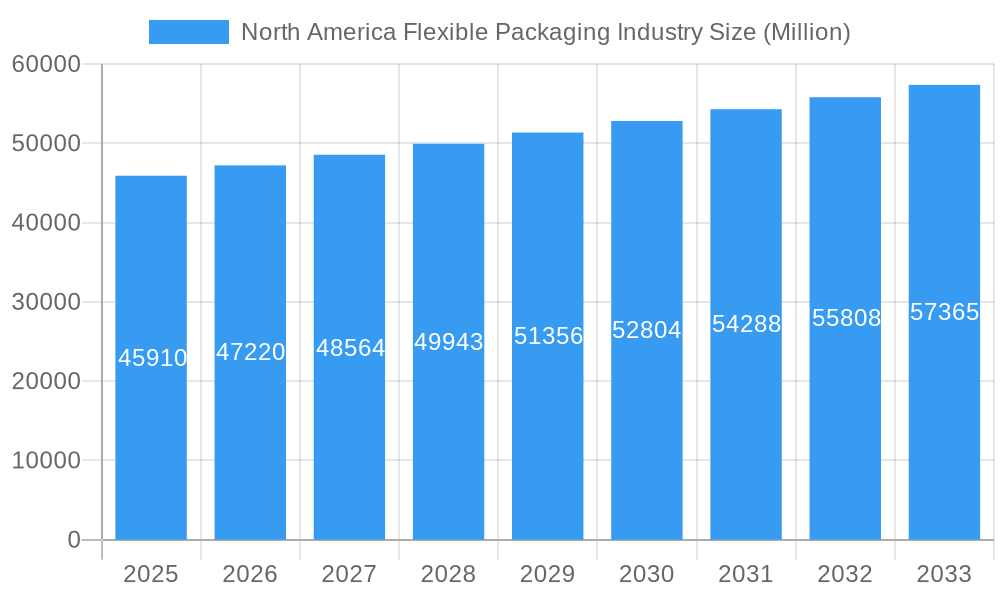

The North American flexible packaging market, valued at $45.91 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for convenient and shelf-stable food and beverage products fuels the need for flexible packaging solutions like pouches, bags, and films. Furthermore, the rising adoption of e-commerce and the subsequent surge in online grocery shopping contribute significantly to market expansion. Consumer preference for lightweight, recyclable, and sustainable packaging options is another major driver, pushing manufacturers to innovate and offer eco-friendly alternatives. Growth in the household and personal care sectors, alongside the increasing use of flexible packaging in non-food applications, further strengthens market prospects. While fluctuating raw material prices and concerns regarding plastic waste pose challenges, technological advancements in material science and improved recycling infrastructure are mitigating these restraints. The market is segmented by material type (plastics, paper, aluminum foil, etc.), product type (pouches, bags, films, etc.), and end-user industry (food, beverages, household care, etc.), offering various opportunities for specialized players. Competition within the market is intense, with major players like Amcor, Berry Global, and Sealed Air continuously innovating and expanding their product portfolios to cater to diverse consumer and industry needs.

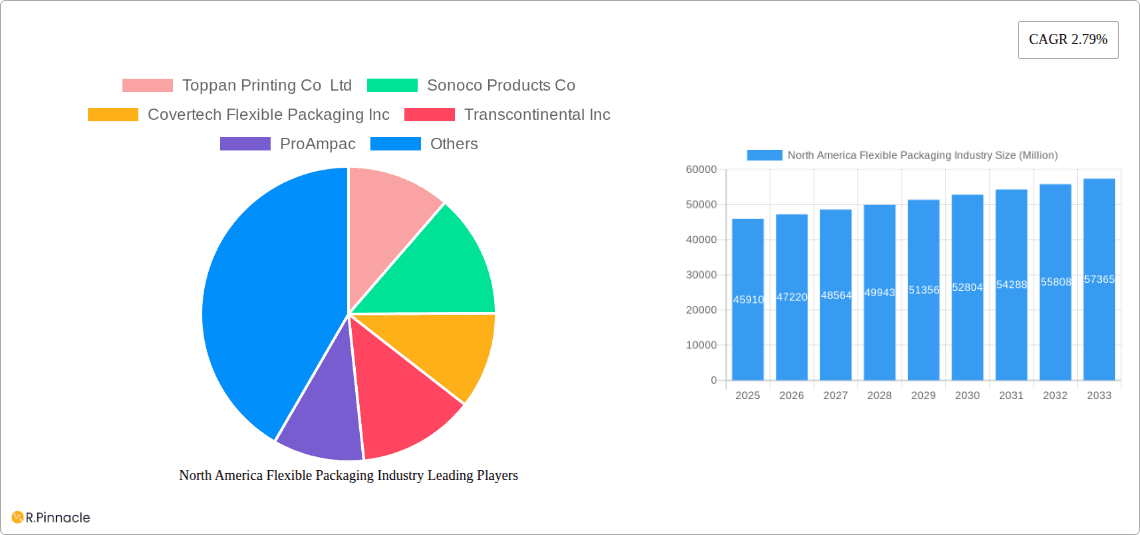

North America Flexible Packaging Industry Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 2.79% suggests a continuous, albeit moderate, expansion of the North American flexible packaging market throughout the forecast period (2025-2033). This growth is expected to be relatively consistent across various segments, with potential variations depending on specific material type adoption rates and end-user industry growth. The United States, being the largest economy in North America, is anticipated to dominate the regional market share, followed by Canada. However, Mexico's growing manufacturing sector and expanding consumer base are likely to contribute to a faster growth rate within the region compared to the overall North American average. Future market dynamics will depend largely on the success of sustainable packaging initiatives, technological improvements in barrier properties and recyclability, and the overall economic stability of North America.

North America Flexible Packaging Industry Company Market Share

North America Flexible Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American flexible packaging industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this dynamic sector. The report utilizes a robust methodology incorporating extensive primary and secondary research, providing accurate market sizing and forecasting. The total market value is predicted to reach xx Million by 2033.

North America Flexible Packaging Industry Market Structure & Innovation Trends

The North American flexible packaging industry is characterized by a dynamic and evolving market structure. Analysis of the competitive landscape reveals a moderately consolidated market, where major players like Amcor PLC, Berry Global Inc., and Sealed Air Corp. exert significant influence on the industry's trajectory. These leading companies, alongside a substantial number of agile smaller players, collectively contribute to the market's vibrancy. Key innovation drivers are prominently focused on enhancing sustainability through the development of recyclable and compostable materials, advancements in automation to improve efficiency and reduce waste, and breakthroughs in material science enabling lighter, stronger, and more functional packaging. Regulatory influences, particularly from bodies like the FDA and evolving recyclability standards, are shaping product development and material choices. The market is also observing considerable M&A activity, driven by strategic objectives such as bolstering sustainability initiatives and expanding product portfolios. In the past five years, this activity is estimated to have reached a value of approximately [Insert Specific Deal Value] Million USD, with deals specifically aimed at acquiring companies with advanced eco-friendly technologies or expanding into high-growth application areas. The threat from substitute products, primarily rigid packaging and alternative materials, necessitates continuous innovation. Furthermore, evolving end-user demographics, with a growing preference for convenience and environmentally conscious products, are directly impacting demand patterns.

- Market Concentration: Moderately Consolidated, with key players holding significant market share.

- Innovation Drivers: Sustainability (eco-friendly materials), Automation (efficiency, waste reduction), Material Science Advancements (performance, functionality).

- Regulatory Frameworks: Compliance with FDA regulations and adherence to emerging recyclability and circular economy standards are crucial.

- Product Substitutes: Competition from rigid packaging and other material formats requires ongoing differentiation through innovation.

- M&A Activity: Significant activity focused on sustainability, market expansion, and technology acquisition, with an estimated [Insert Specific Deal Value] Million USD in deal value over the last five years.

North America Flexible Packaging Industry Market Dynamics & Trends

This section explores the key factors shaping market growth, including technological advancements, shifting consumer preferences, and competitive dynamics. We analyze the Compound Annual Growth Rate (CAGR) and market penetration of various product segments and end-user industries, providing a clear understanding of current and future trends. We examine the rise of sustainable packaging solutions and the influence of e-commerce on packaging demand. The market is expected to experience significant growth driven by factors such as increasing demand for convenient and sustainable packaging solutions, and technological advancements. The CAGR for the forecast period (2025-2033) is estimated at xx%.

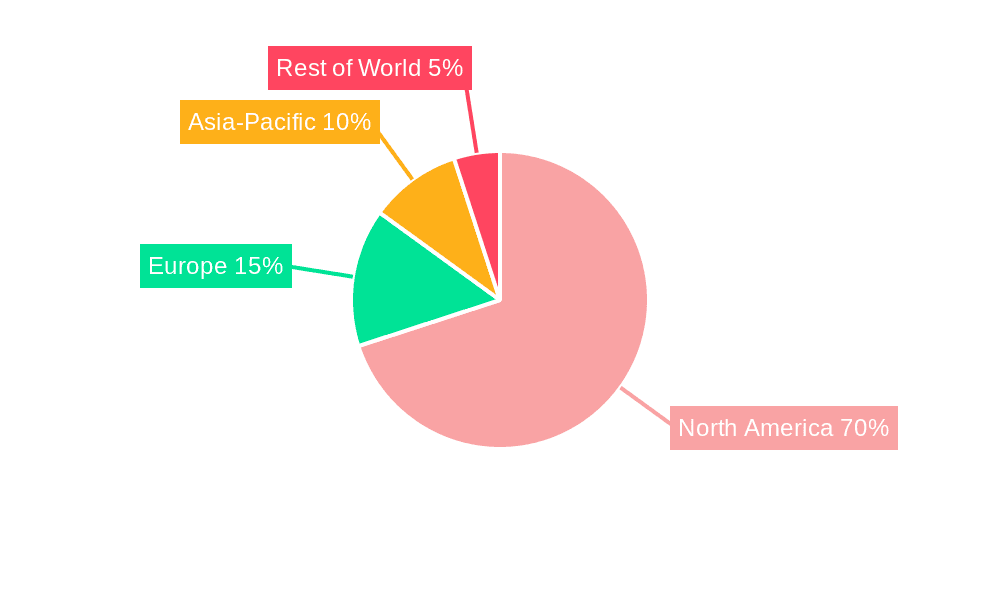

Dominant Regions & Segments in North America Flexible Packaging Industry

This section dissects the North American flexible packaging market by identifying its most influential regions, countries, material types, product categories, and end-user industries. The dominance within each segment is meticulously analyzed, considering factors such as robust economic policies, sophisticated infrastructure supporting manufacturing and distribution, and prevailing consumer behavior and preferences. The United States stands as the largest market, propelled by its expansive food and beverage sectors and its leadership in advanced packaging technologies. Canada is experiencing consistent growth, with significant contributions from the food and personal care industries. In terms of materials, plastics continue to lead due to their inherent versatility and cost-effectiveness, though there's a pronounced upward trend in the adoption of paper and aluminum foil as sustainable alternatives gain traction. Among product types, pouches are the most prevalent, finding extensive application across diverse sectors, closely followed by bags and films. The food and beverage industry remains the paramount end-user segment, owing to the sheer volume of products requiring flexible packaging. The household and personal care segment also emerges as a substantial driver of market expansion.

- By Country: The United States leads, driven by strong food & beverage demand and advanced packaging infrastructure. Canada shows steady growth, particularly in food and personal care.

- By Material Type: Plastics dominate; however, sustainable alternatives like paper and aluminum foil are experiencing accelerated growth due to rising environmental consciousness.

- By Product Type: Pouches are the leading product type, widely adopted across various applications, with bags and films closely following.

- By End-User Industry: The food and beverage industry represents the largest segment. The household and personal care sector is also a significant contributor to market growth.

North America Flexible Packaging Industry Product Innovations

Recent product developments focus on sustainability and enhanced functionality. The introduction of recyclable and compostable materials, along with improved barrier properties and convenience features, are driving innovation. Key technological trends include advancements in flexible packaging printing, barrier film technologies, and automated packaging systems. These innovations meet growing consumer demand for eco-friendly and convenient packaging solutions.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the North American flexible packaging market. The market is meticulously segmented by country (United States, Canada), material type (Plastics, Paper, Aluminum Foil, Other Types), product type (Pouches, Bags, Films and Wraps, Other Product Types), and end-user industry (Food, Beverages, Household and Personal Care, Other End-User Industries). Each segment is presented with detailed growth projections, precise market size estimates, and thorough competitive analysis. The market is projected to experience a Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR]% during the forecast period of 2025-2033, with particularly robust expansion anticipated within the sustainable packaging solutions sub-segment.

Key Drivers of North America Flexible Packaging Industry Growth

The North American flexible packaging market's growth is driven by factors such as the increasing demand for convenient and lightweight packaging, the rising popularity of e-commerce, and the growing focus on sustainable and eco-friendly packaging solutions. Technological advancements in materials and manufacturing processes further contribute to market expansion. Government regulations promoting sustainability also play a crucial role.

Challenges in the North America Flexible Packaging Industry Sector

The North American flexible packaging sector navigates several significant challenges. These include the inherent volatility of raw material prices, the increasing stringency of environmental regulations which mandate changes in material composition and end-of-life management, and pervasive intense competition that pressures pricing and margins. Furthermore, widespread supply chain disruptions, exacerbated by global events, continue to pose risks. The growing adoption of alternative packaging materials, some offering unique sustainability benefits, also presents a competitive challenge. The financial impact of adapting to new environmental mandates is substantial, with the estimated cost of compliance with new regulations potentially reaching [Insert Specific Cost] Million USD annually by 2030.

Emerging Opportunities in North America Flexible Packaging Industry

Opportunities exist in developing sustainable and eco-friendly packaging solutions, leveraging advanced printing technologies, and catering to the growing demand for customized packaging in e-commerce. Expanding into new markets, such as medical and pharmaceutical packaging, presents further potential.

Leading Players in the North America Flexible Packaging Industry Market

- Toppan Printing Co Ltd

- Sonoco Products Co

- Covertech Flexible Packaging Inc

- Transcontinental Inc

- ProAmpac

- American Packaging Corporation

- Cascades Flexible Packaging

- St Johns Packaging

- Emmerson Packaging

- Amcor PLC

- Novolex Holdings Inc

- Mondi PLC

- Sealed Air Corp

- Constantia Flexibles

- Tetra Pak International SA

- Berry Global Inc

- Printpack Inc

- Winpak Limited

- Sigma Plastics Group Inc

- Sit Group SpA

Key Developments in North America Flexible Packaging Industry

- October 2022: Berry Global and Printpack partnered to create sustainable packaging solutions, launching the Preserve PE PCR recyclable polyethylene pouch with 30% post-consumer recycled content.

- December 2022: Amcor PLC announced a five-year contract with ExxonMobil to source certified-circular polyethylene, aiming for 30% recycled material in its portfolio by 2030.

Future Outlook for North America Flexible Packaging Industry Market

The North American flexible packaging market is on a trajectory for sustained and robust growth, primarily fueled by the escalating global demand for sustainable and innovative packaging solutions. Strategic alliances and partnerships will be pivotal in driving this expansion, fostering collaboration on new technologies and market access. Continuous technological advancements, particularly in areas like advanced barrier properties, smart packaging, and lightweighting, will remain a critical success factor. Furthermore, strategic expansion into nascent or underserved market segments will contribute significantly to future growth. The overarching commitment to sustainability and circular economy principles is not merely a trend but will fundamentally shape the industry's innovation landscape and drive long-term economic prosperity in the coming years.

North America Flexible Packaging Industry Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Bi-orientated Polypropylene (BOPP)

- 1.1.3. Cast Polypropylene (CPP)

- 1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 1.1.5. Other Types (PVC, PA, Bioplastics)

- 1.2. Paper

- 1.3. Aluminium Foil

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Frozen & Chilled Food

- 3.1.2. Meat, Poultry & Fish

- 3.1.3. Fruits & Vegetables

- 3.1.4. Bakery & Confectionary

- 3.1.5. Dried & Ready Meals

- 3.1.6. Pet Food

- 3.1.7. Other Food Products

- 3.2. Beverages

- 3.3. Tobacco

- 3.4. Cosmetics & Personal Care

- 3.5. Other End-user Industries

-

3.1. Food

North America Flexible Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Flexible Packaging Industry Regional Market Share

Geographic Coverage of North America Flexible Packaging Industry

North America Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. The Increased Demand for Convenient Packaging to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Bi-orientated Polypropylene (BOPP)

- 5.1.1.3. Cast Polypropylene (CPP)

- 5.1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 5.1.1.5. Other Types (PVC, PA, Bioplastics)

- 5.1.2. Paper

- 5.1.3. Aluminium Foil

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Frozen & Chilled Food

- 5.3.1.2. Meat, Poultry & Fish

- 5.3.1.3. Fruits & Vegetables

- 5.3.1.4. Bakery & Confectionary

- 5.3.1.5. Dried & Ready Meals

- 5.3.1.6. Pet Food

- 5.3.1.7. Other Food Products

- 5.3.2. Beverages

- 5.3.3. Tobacco

- 5.3.4. Cosmetics & Personal Care

- 5.3.5. Other End-user Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toppan Printing Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Covertech Flexible Packaging Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Transcontinental Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ProAmpac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cascades Flexible Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Johns Packaging*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emmerson Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novolex Holdings Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mondi PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sealed Air Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra Pak International SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Berry Global Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Printpack Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Winpak Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sigma Plastics Group Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Sit Group SpA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Toppan Printing Co Ltd

List of Figures

- Figure 1: North America Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: North America Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: North America Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Packaging Industry?

The projected CAGR is approximately 2.79%.

2. Which companies are prominent players in the North America Flexible Packaging Industry?

Key companies in the market include Toppan Printing Co Ltd, Sonoco Products Co, Covertech Flexible Packaging Inc, Transcontinental Inc, ProAmpac, American Packaging Corporation, Cascades Flexible Packaging, St Johns Packaging*List Not Exhaustive, Emmerson Packaging, Amcor PLC, Novolex Holdings Inc, Mondi PLC, Sealed Air Corp, Constantia Flexibles, Tetra Pak International SA, Berry Global Inc, Printpack Inc, Winpak Limited, Sigma Plastics Group Inc, Sit Group SpA.

3. What are the main segments of the North America Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

The Increased Demand for Convenient Packaging to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Concerns Regarding the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

December 2022: Amcor PLC, a global leader in developing and producing packaging solutions, has announced a five-year contract with ExxonMobil to purchase certified-circular polyethylene material in support of its target to achieve 30% recycled material across its portfolio by 2030. Amcor plans to leverage this material across its global portfolio, focusing on the healthcare and food industries, which are needed to meet stringent safety requirements for recycled plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence