Key Insights

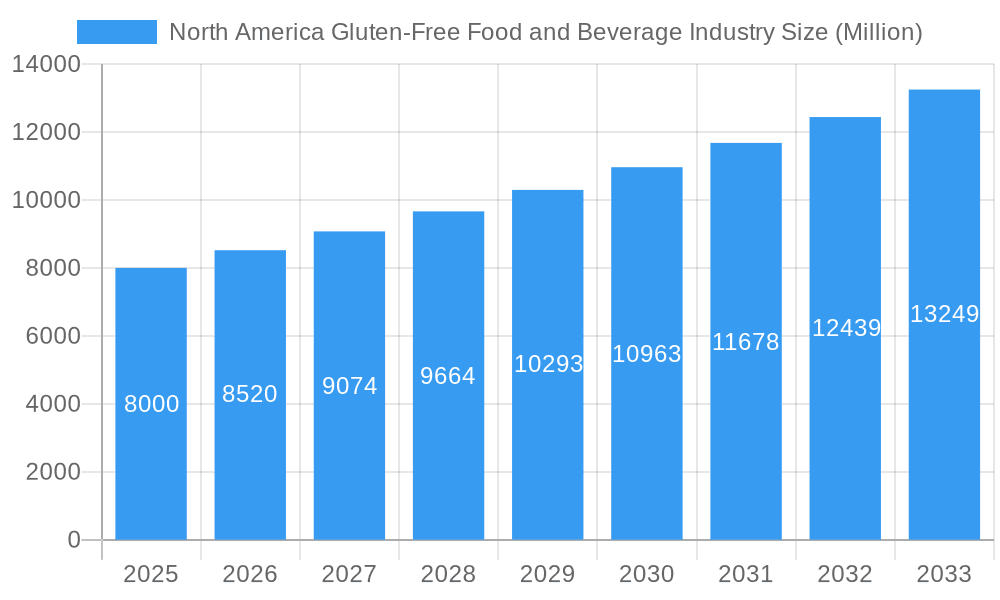

The North American gluten-free food and beverage market, valued at approximately $6.28 billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. This expansion is primarily attributed to the increasing prevalence of celiac disease and non-celiac gluten sensitivity, driving demand for specialized alternatives. Growing consumer awareness regarding the potential health benefits of gluten-free diets, such as improved digestion, also significantly contributes to market growth. Continuous product innovation by manufacturers, introducing diverse and appealing gluten-free options across categories like baked goods, beverages, and meat alternatives, further fuels market dynamism. Major industry players are actively investing in research and development to expand their gluten-free portfolios, capitalizing on this significant growth opportunity. The United States, in particular, represents a substantial portion of the North American market due to heightened consumer awareness and purchasing power.

North America Gluten-Free Food and Beverage Industry Market Size (In Billion)

Market segmentation highlights beverages, bread products, and cookies & snacks as key contributors to the North American gluten-free market share. However, notable growth is anticipated across all segments, with dairy/dairy substitutes and meat/meat substitutes showing particularly strong expansion, influenced by rising vegan and vegetarian lifestyles. Key market restraints include the higher cost of gluten-free products compared to conventional options and consumer concerns regarding the nutritional profile of some gluten-free alternatives. Despite these challenges, the overall market outlook remains exceptionally positive, with substantial growth projected throughout the forecast period, propelled by sustained consumer demand and ongoing industry innovation. The significant involvement of established food corporations underscores the market's long-term viability and its potential for continued expansion.

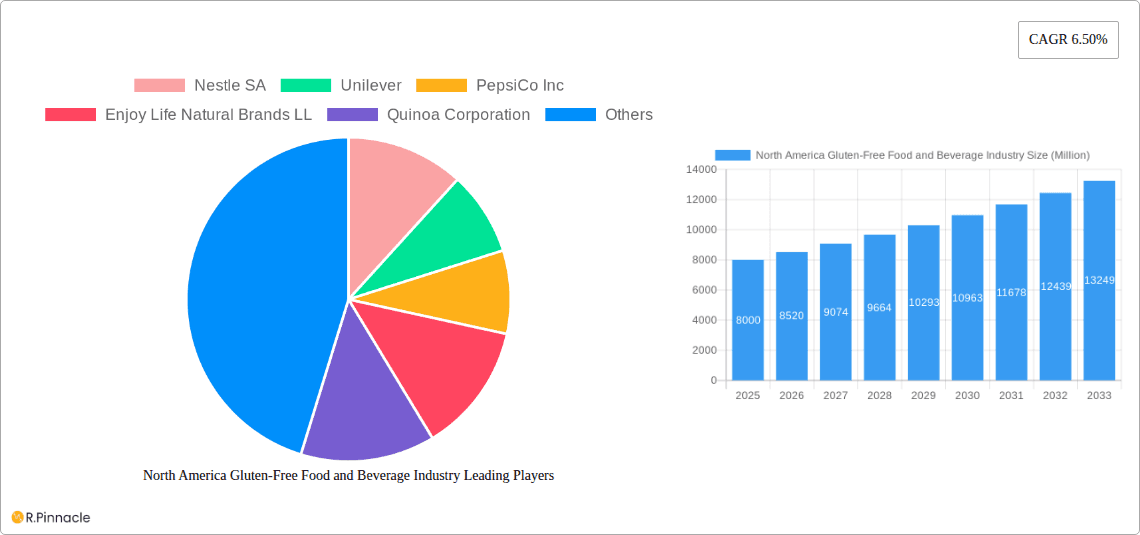

North America Gluten-Free Food and Beverage Industry Company Market Share

North America Gluten-Free Food and Beverage Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America gluten-free food and beverage industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a robust understanding of market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive data analysis to present a clear picture of this rapidly evolving market.

North America Gluten-Free Food and Beverage Industry Market Structure & Innovation Trends

This section analyzes the market concentration, identifying key players like Nestle SA, Unilever, PepsiCo Inc, Enjoy Life Natural Brands LL, Quinoa Corporation, Hain Celestial Group Inc, Amy's Kitchen Inc, and Raisio PLC. We assess their market share and examine the impact of mergers and acquisitions (M&A) activities on market structure. The report also explores innovation drivers, including consumer demand for healthier options and technological advancements in gluten-free ingredient production. Regulatory frameworks impacting the industry are examined, along with a discussion of product substitutes and end-user demographics. Estimated M&A deal values for the period are included, revealing the level of investment in the sector. For example, the consolidation of smaller players through acquisitions might be highlighted, influencing market concentration. The report also includes data on market share percentages for key players in 2025 and projected changes during the forecast period.

North America Gluten-Free Food and Beverage Industry Market Dynamics & Trends

This section delves into the market's dynamic landscape, analyzing factors influencing its growth. We explore the Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) and the projected CAGR for the forecast period (2025-2033). Market penetration rates for different product segments are presented, illustrating the adoption of gluten-free products across various consumer groups. The analysis examines technological disruptions, like the introduction of novel gluten-free ingredients or improved processing techniques, and how these impact the market. Furthermore, evolving consumer preferences and dietary trends, such as increased awareness of celiac disease and gluten sensitivity, are discussed. Competitive dynamics, including pricing strategies, brand positioning, and product differentiation, are also analyzed, highlighting the competitive intensity of the market. Specific examples of successful product launches and marketing campaigns are also included.

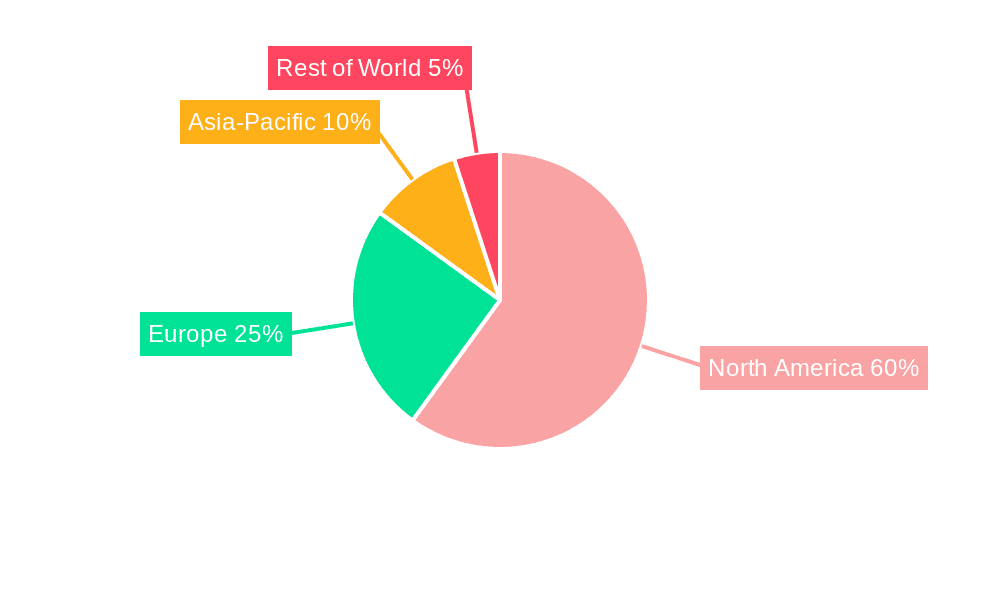

Dominant Regions & Segments in North America Gluten-Free Food and Beverage Industry

This section identifies the leading regions and segments within the North American gluten-free food and beverage market. A detailed dominance analysis is provided, explaining the reasons behind the success of specific regions or product types. Growth drivers are listed using bullet points, offering clarity and ease of understanding.

Leading Segment Analysis (Example – this will be fully detailed in the report):

- Bread Products: This segment is expected to be a significant contributor to overall market growth, driven by continuous innovation in gluten-free bread formulations and increasing consumer demand for convenient and palatable options.

- Key Drivers:

- Increasing awareness of gluten intolerance and celiac disease.

- Growing demand for convenient and healthy food options.

- Advancements in gluten-free baking technology.

- Favorable government policies promoting the consumption of healthy food.

(This section will repeat this structure for each segment: Beverages, Cookies and Snacks, Condiments, Seasonings, and Spreads, Dairy/Dairy Substitutes, Meat/Meat Substitutes, Other Gluten-free Products). Each segment will have a dedicated paragraph analyzing its performance and factors driving its success, with specific data points like market size in Millions for 2025 and projected growth rates.

North America Gluten-Free Food and Beverage Industry Product Innovations

This section summarizes recent product developments, highlighting technological trends such as the use of novel ingredients, improved processing techniques, and the development of products that closely mimic the taste and texture of traditional gluten-containing foods. The report will analyze the competitive advantages offered by these innovations and their market fit based on consumer preferences and demand.

Report Scope & Segmentation Analysis

This section details the scope of the report, outlining all market segmentations by Product Type: Beverages, Bread Products, Cookies and Snacks, Condiments, Seasonings, and Spreads, Dairy/Dairy Substitutes, Meat/Meat Substitutes, and Other Gluten-free Products. Each segment will have a paragraph detailing its growth projections, market size (in Millions) for 2025, and competitive dynamics. For example, the "Beverages" segment might describe the growth of gluten-free beer and other alcoholic beverages, the "Dairy/Dairy Substitutes" segment might describe the competition between soy-based and other plant-based alternatives, and so on.

Key Drivers of North America Gluten-Free Food and Beverage Industry Growth

This section outlines the key factors driving the growth of the North American gluten-free food and beverage industry. It will analyze technological advancements in gluten-free ingredient production, economic factors like increased disposable income and consumer spending on health and wellness, and regulatory changes that support the industry's growth.

Challenges in the North America Gluten-Free Food and Beverage Industry Sector

This section discusses the challenges facing the industry, including regulatory hurdles, supply chain issues (e.g., sourcing of raw materials), and the competitive pressures from established and emerging players. The impact of these challenges on market growth will be quantified where possible, using data such as cost increases or market share losses.

Emerging Opportunities in North America Gluten-Free Food and Beverage Industry

This section highlights emerging trends and opportunities, including new market segments, technological innovations, and evolving consumer preferences. For example, the increasing demand for functional gluten-free foods or the expansion into new geographical markets will be discussed.

Leading Players in the North America Gluten-Free Food and Beverage Industry Market

- Nestle SA

- Unilever

- PepsiCo Inc

- Enjoy Life Natural Brands LL

- Quinoa Corporation

- Hain Celestial Group Inc

- Amy's Kitchen Inc

- Raisio PLC

Key Developments in North America Gluten-Free Food and Beverage Industry Industry

- This section will include a bullet-point list of key developments, such as new product launches, mergers and acquisitions, and regulatory changes, each with the date (year/month) of the event and an explanation of its impact on market dynamics. (Example: "October 2024: Nestle SA launched a new line of gluten-free frozen pizzas, expanding its presence in the frozen food market.") The number of bullet points will depend on available data.

Future Outlook for North America Gluten-Free Food and Beverage Industry Market

This section summarizes the future market potential, highlighting growth accelerators and strategic opportunities for industry players. The continued expansion of the gluten-free market, driven by increasing awareness of gluten intolerance and the development of innovative products, will be a key focus. Specific growth projections and market size estimations for 2033 (in Millions) will be provided.

North America Gluten-Free Food and Beverage Industry Segmentation

-

1. Product Type

- 1.1. Beverages

- 1.2. Bread Products

- 1.3. Cookies and Snacks

- 1.4. Condiments, Seasonings, and Spreads

- 1.5. Dairy/Dairy Substitutes

- 1.6. Meat/Meat Substitutes

- 1.7. Other Gluten-free Products

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

North America Gluten-Free Food and Beverage Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Gluten-Free Food and Beverage Industry Regional Market Share

Geographic Coverage of North America Gluten-Free Food and Beverage Industry

North America Gluten-Free Food and Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Gluten-free Food and Beverage Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverages

- 5.1.2. Bread Products

- 5.1.3. Cookies and Snacks

- 5.1.4. Condiments, Seasonings, and Spreads

- 5.1.5. Dairy/Dairy Substitutes

- 5.1.6. Meat/Meat Substitutes

- 5.1.7. Other Gluten-free Products

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.4. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beverages

- 6.1.2. Bread Products

- 6.1.3. Cookies and Snacks

- 6.1.4. Condiments, Seasonings, and Spreads

- 6.1.5. Dairy/Dairy Substitutes

- 6.1.6. Meat/Meat Substitutes

- 6.1.7. Other Gluten-free Products

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.2.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beverages

- 7.1.2. Bread Products

- 7.1.3. Cookies and Snacks

- 7.1.4. Condiments, Seasonings, and Spreads

- 7.1.5. Dairy/Dairy Substitutes

- 7.1.6. Meat/Meat Substitutes

- 7.1.7. Other Gluten-free Products

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.2.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beverages

- 8.1.2. Bread Products

- 8.1.3. Cookies and Snacks

- 8.1.4. Condiments, Seasonings, and Spreads

- 8.1.5. Dairy/Dairy Substitutes

- 8.1.6. Meat/Meat Substitutes

- 8.1.7. Other Gluten-free Products

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.2.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Gluten-Free Food and Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beverages

- 9.1.2. Bread Products

- 9.1.3. Cookies and Snacks

- 9.1.4. Condiments, Seasonings, and Spreads

- 9.1.5. Dairy/Dairy Substitutes

- 9.1.6. Meat/Meat Substitutes

- 9.1.7. Other Gluten-free Products

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.2.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Unilever

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 PepsiCo Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Enjoy Life Natural Brands LL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Quinoa Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hain Celestial Group Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amy's Kitchen Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raisio PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: North America Gluten-Free Food and Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Gluten-Free Food and Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 3: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 5: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Region 2020 & 2033

- Table 7: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 9: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 11: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

- Table 13: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 15: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 17: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

- Table 19: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 21: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 23: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

- Table 25: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Product Type 2020 & 2033

- Table 27: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Geography 2020 & 2033

- Table 29: North America Gluten-Free Food and Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Gluten-Free Food and Beverage Industry Volume K Ton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gluten-Free Food and Beverage Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the North America Gluten-Free Food and Beverage Industry?

Key companies in the market include Nestle SA, Unilever, PepsiCo Inc, Enjoy Life Natural Brands LL, Quinoa Corporation, Hain Celestial Group Inc, Amy's Kitchen Inc, Raisio PLC.

3. What are the main segments of the North America Gluten-Free Food and Beverage Industry?

The market segments include Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Increasing Demand for Gluten-free Food and Beverage Products.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Ton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gluten-Free Food and Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gluten-Free Food and Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gluten-Free Food and Beverage Industry?

To stay informed about further developments, trends, and reports in the North America Gluten-Free Food and Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence