Key Insights

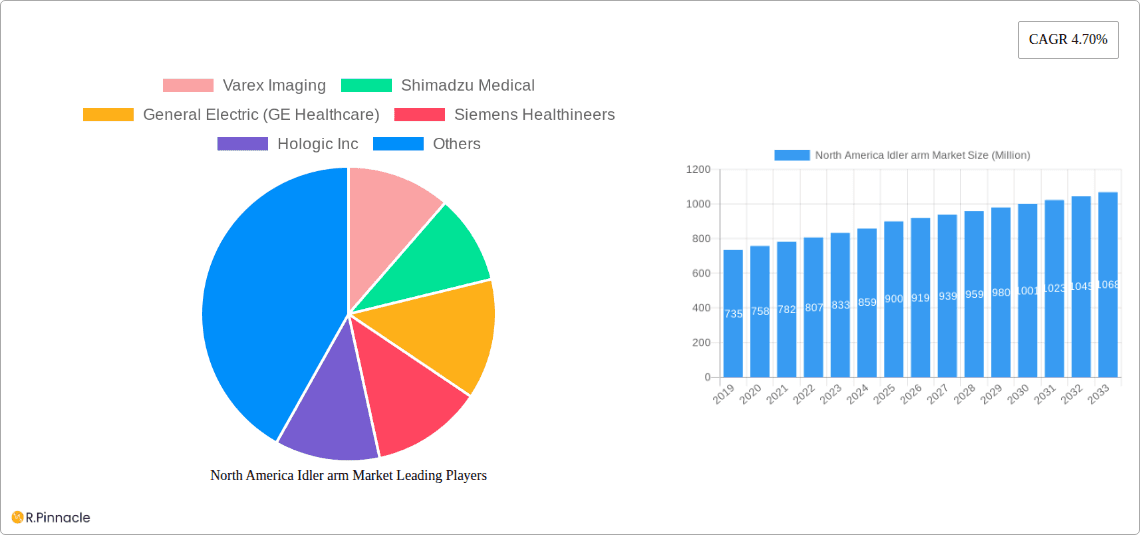

The North America Idler Arm Market is poised for steady expansion, projected to reach a market size of $900 million by 2025, with a CAGR of 4.70% expected to drive growth through 2033. This robust trajectory is primarily fueled by increasing demand for advanced diagnostic imaging solutions across various medical specialties. Cardiology and Orthopedics and Trauma are anticipated to be key application segments, driven by the rising prevalence of cardiovascular diseases and an aging population susceptible to orthopedic injuries. The ongoing technological advancements in C-arm systems, including the development of more compact and versatile mini C-arms for point-of-care diagnostics, are also significant growth catalysts. Furthermore, the growing adoption of these imaging devices in outpatient settings and smaller clinics is broadening market reach and contributing to overall market value.

North America Idler arm Market Market Size (In Million)

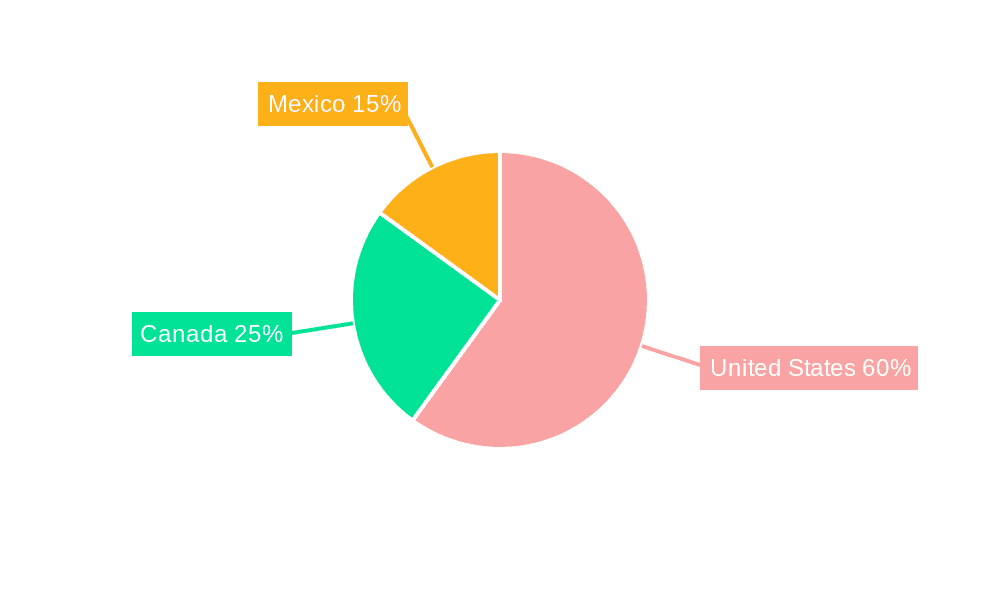

While the market exhibits strong growth potential, certain factors could influence its pace. The high initial investment cost associated with sophisticated C-arm systems and the need for specialized training for operating personnel may pose as restraints in certain segments of the market. However, the increasing awareness and emphasis on early disease detection and minimally invasive surgical procedures are expected to largely offset these challenges. Geographically, the United States is expected to dominate the North American market due to its advanced healthcare infrastructure, higher healthcare spending, and early adoption of new technologies. Canada and Mexico are also anticipated to witness significant growth, driven by expanding healthcare access and increasing investments in medical imaging equipment. The market is characterized by the presence of several key players, fostering a competitive environment focused on product innovation and market penetration.

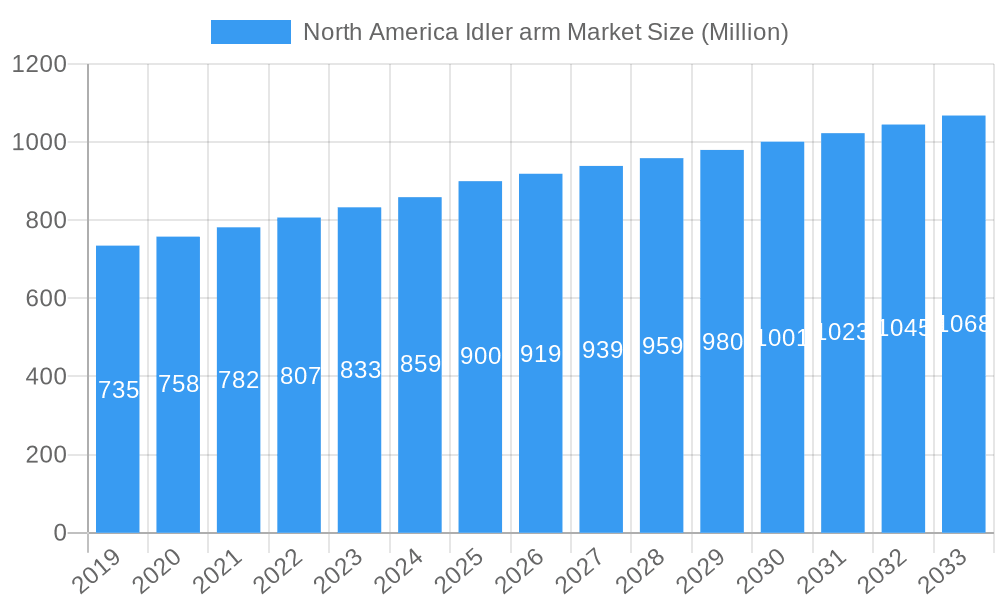

North America Idler arm Market Company Market Share

This in-depth market research report provides a detailed analysis of the North America Idler Arm Market, offering strategic insights and actionable intelligence for industry stakeholders. The report covers the historical period from 2019 to 2024, with the base year and estimated year as 2025, and projects market trends through 2033. Leveraging high-ranking keywords such as "North America C-Arm Market," "Idler Arm Technology," "Medical Imaging Devices," and "Interventional Radiology," this report is designed to boost search visibility and engage professionals in the medical imaging and healthcare sectors.

North America Idler Arm Market Market Structure & Innovation Trends

The North America Idler Arm Market exhibits a moderately concentrated structure, with key players like Siemens Healthineers, GE Healthcare, and Philips Healthcare dominating market share. Innovation is primarily driven by advancements in imaging technology, such as the integration of Artificial Intelligence (AI) and 3D mapping for enhanced procedural outcomes. Regulatory frameworks, particularly FDA approvals, play a crucial role in market entry and product adoption. While direct product substitutes for idler arms are limited within the C-arm ecosystem, advancements in alternative imaging modalities could indirectly influence long-term market dynamics. End-user demographics are increasingly focused on hospitals, specialized clinics, and diagnostic centers, emphasizing the need for efficient, high-resolution imaging solutions. Merger and acquisition (M&A) activities are strategically aimed at expanding product portfolios and geographical reach, with estimated deal values in the range of tens to hundreds of millions.

North America Idler Arm Market Market Dynamics & Trends

The North America Idler Arm Market is experiencing robust growth, fueled by the increasing prevalence of chronic diseases, the rising demand for minimally invasive surgical procedures, and continuous technological advancements in medical imaging. The aging population across the United States, Canada, and Mexico is a significant demographic driver, necessitating sophisticated diagnostic and interventional tools. The market is witnessing a CAGR of approximately 7.5% during the forecast period. Technological disruptions, such as the miniaturization of components and enhanced robotic integration, are transforming the capabilities of idler arm systems, leading to improved precision and patient comfort. Consumer preferences are shifting towards advanced, user-friendly systems that offer superior image quality, reduced radiation exposure, and streamlined workflows. Competitive dynamics are characterized by intense R&D investments, strategic partnerships, and product differentiation based on performance, cost-effectiveness, and application versatility. Market penetration is high in established healthcare systems, with significant growth potential in underserved regions and emerging clinical applications. The increasing adoption of digital health solutions and the growing emphasis on value-based healthcare are further shaping market trends, pushing manufacturers to deliver innovative and cost-efficient idler arm solutions.

Dominant Regions & Segments in North America Idler Arm Market

The United States stands as the dominant region in the North America Idler Arm Market, accounting for an estimated 70% of the market share. This dominance is propelled by a highly developed healthcare infrastructure, significant investments in medical research and technology, and a large patient population with a high incidence of conditions requiring advanced imaging. Economic policies favoring healthcare innovation and robust reimbursement frameworks further bolster the U.S. market.

Within the Type segmentation, Mobile C-Arms, particularly Full-Size C-Arms, are experiencing substantial growth. This is driven by their versatility in operating rooms, intensive care units, and emergency departments, allowing for immediate diagnostic and interventional capabilities at the patient's bedside. The ability of mobile units to adapt to various clinical settings and procedures provides a significant advantage.

In terms of Application, Orthopedics and Trauma represent the largest segment. The increasing rates of sports-related injuries, degenerative bone conditions, and the growing number of orthopedic surgeries necessitate high-quality intraoperative imaging provided by idler arm systems. This segment is supported by technological advancements that enable precise visualization of bone structures and implants.

- Key Drivers for U.S. Dominance:

- High per capita healthcare expenditure.

- Presence of leading medical device manufacturers and research institutions.

- Favorable regulatory environment for medical technology adoption.

- Widespread adoption of minimally invasive procedures.

- Key Drivers for Mobile C-Arms:

- Enhanced flexibility and accessibility in diverse clinical settings.

- Reduced need for patient transport, improving workflow efficiency.

- Technological advancements in image quality and radiation dose reduction.

- Key Drivers for Orthopedics and Trauma Application:

- Rising incidence of musculoskeletal disorders.

- Growing demand for advanced surgical techniques.

- Continuous innovation in orthopedic implants and instrumentation.

Canada and Mexico represent growing markets with increasing adoption rates, driven by improving healthcare infrastructure and a rising awareness of advanced medical imaging technologies.

North America Idler Arm Market Product Innovations

Product innovations in the North America Idler Arm Market are centered on enhancing imaging clarity, reducing radiation exposure, and improving user experience. Companies are actively developing systems with AI-powered image processing for better visualization of complex anatomical structures and pathologies. Furthermore, miniaturization and ergonomic design are key focus areas, leading to more compact and maneuverable C-arm systems, particularly beneficial for mobile applications and space-constrained environments. These innovations offer competitive advantages by improving procedural accuracy, shortening procedure times, and enhancing patient and clinician safety.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America Idler Arm Market, segmented by Type, Application, and Geography. The Type segmentation includes Fixed C-Arms and Mobile C-Arms (further divided into Full-Size C-Arms and Mini C-Arms). The Application segmentation covers Cardiology, Gastroenterology, Neurology, Orthopedics and Trauma, Radiology/Oncology, and Other Applications. Geographically, the market is analyzed across the United States, Canada, and Mexico. The United States is projected to maintain its leading position, driven by technological adoption and healthcare spending. Mobile C-Arms are expected to witness the highest growth rate within the Type segment, while Orthopedics and Trauma will continue to be a dominant application.

Key Drivers of North America Idler Arm Market Growth

The growth of the North America Idler Arm Market is primarily driven by the escalating prevalence of chronic diseases and age-related conditions, which necessitate sophisticated diagnostic and interventional imaging. The increasing adoption of minimally invasive surgical procedures across various specialties, such as cardiology and orthopedics, is another significant growth catalyst. Technological advancements, including the integration of AI for enhanced image processing and improved workflow efficiency, are further propelling market expansion. Supportive government initiatives and favorable reimbursement policies for advanced medical imaging technologies in the U.S. and Canada also contribute to market growth.

Challenges in the North America Idler Arm Market Sector

Despite the positive growth trajectory, the North America Idler Arm Market faces several challenges. High initial acquisition costs for advanced C-arm systems can be a barrier for smaller healthcare facilities and those in budget-constrained regions. Stringent regulatory approval processes for new medical devices can lead to extended product launch timelines. Furthermore, intense competition among market players necessitates continuous innovation and cost optimization, putting pressure on profit margins. Supply chain disruptions and the availability of skilled radiographers and interventional specialists can also pose operational challenges.

Emerging Opportunities in North America Idler Arm Market

Emerging opportunities in the North America Idler Arm Market lie in the development of next-generation imaging technologies, such as hybrid systems that combine multiple imaging modalities for comprehensive diagnostics. The growing demand for point-of-care imaging solutions in emergency and remote settings presents significant potential for mobile and portable C-arm systems. Furthermore, the increasing focus on outpatient surgical centers and diagnostic imaging clinics opens new avenues for market expansion. The integration of cloud-based platforms for remote diagnostics and data analysis also presents a promising growth area, enhancing accessibility and collaboration among healthcare professionals.

Leading Players in the North America Idler Arm Market Market

- Varex Imaging

- Shimadzu Medical

- General Electric (GE Healthcare)

- Siemens Healthineers

- Hologic Inc

- Allengers

- Philips Healthcare

- AADCO Medical Inc

- DMS Imaging

- Ziehm Imaging GmbH

- Canon Medical Systems Corporation

- Turner Imaging Systems

Key Developments in North America Idler Arm Market Industry

- July 2022: Siemens Healthineers received approval from the Food and Drug Administration (FDA) for the ARTIS icono ceiling, a ceiling-mounted c-arm angiography system designed for a wide range of routine and advanced procedures in interventional radiology (IR) and cardiology. This development enhances the company's portfolio in interventional imaging.

- January 2022: Philips integrated cloud-based artificial intelligence (AI) and 3D mapping into its mobile c-arm system series, Zenition, to enhance workflow efficiency and improve endovascular treatment outcomes. This innovation underscores the trend towards AI-driven medical imaging solutions.

Future Outlook for North America Idler Arm Market Market

The future outlook for the North America Idler Arm Market is highly promising, driven by sustained demand for advanced medical imaging solutions and continuous technological innovation. The increasing integration of AI and robotics is expected to revolutionize interventional procedures, leading to improved patient outcomes and operational efficiencies. The market is poised for further growth with the expanding applications in emerging medical fields and the increasing adoption of telehealth and remote diagnostic services. Strategic partnerships and collaborations among key players will be crucial for leveraging new opportunities and navigating the evolving healthcare landscape, ensuring continued market expansion and the delivery of cutting-edge medical imaging technology.

North America Idler arm Market Segmentation

-

1. Type

- 1.1. Fixed C-Arms

-

1.2. Mobile C-Arms

- 1.2.1. Full-Size C-Arms

- 1.2.2. Mini C-Arms

-

2. Application

- 2.1. Cardiology

- 2.2. Gastroenterology

- 2.3. Neurology

- 2.4. Orthopedics and Trauma

- 2.5. Radiology/Oncology

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Idler arm Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Idler arm Market Regional Market Share

Geographic Coverage of North America Idler arm Market

North America Idler arm Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population and Increasing Incidence of Chronic Diseases; Advancements in Maneuverability and Imaging Capabilities; Increasing Areas of Application of C-Arm

- 3.3. Market Restrains

- 3.3.1. High Procedural and Equipment Costs; Low Replacement Rates of C-Arm Systems

- 3.4. Market Trends

- 3.4.1. C-Arm Application in Cardiology is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Idler arm Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed C-Arms

- 5.1.2. Mobile C-Arms

- 5.1.2.1. Full-Size C-Arms

- 5.1.2.2. Mini C-Arms

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Gastroenterology

- 5.2.3. Neurology

- 5.2.4. Orthopedics and Trauma

- 5.2.5. Radiology/Oncology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Idler arm Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed C-Arms

- 6.1.2. Mobile C-Arms

- 6.1.2.1. Full-Size C-Arms

- 6.1.2.2. Mini C-Arms

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Gastroenterology

- 6.2.3. Neurology

- 6.2.4. Orthopedics and Trauma

- 6.2.5. Radiology/Oncology

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Idler arm Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed C-Arms

- 7.1.2. Mobile C-Arms

- 7.1.2.1. Full-Size C-Arms

- 7.1.2.2. Mini C-Arms

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Gastroenterology

- 7.2.3. Neurology

- 7.2.4. Orthopedics and Trauma

- 7.2.5. Radiology/Oncology

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Idler arm Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed C-Arms

- 8.1.2. Mobile C-Arms

- 8.1.2.1. Full-Size C-Arms

- 8.1.2.2. Mini C-Arms

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Gastroenterology

- 8.2.3. Neurology

- 8.2.4. Orthopedics and Trauma

- 8.2.5. Radiology/Oncology

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Varex Imaging

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Shimadzu Medical

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Electric (GE Healthcare)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Siemens Healthineers

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hologic Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Allengers

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Philips Healthcare

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AADCO Medical Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 DMS Imaging

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ziehm Imaging GmbH

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Canon Medical Systems Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Turner Imaging Systems

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Varex Imaging

List of Figures

- Figure 1: North America Idler arm Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Idler arm Market Share (%) by Company 2025

List of Tables

- Table 1: North America Idler arm Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Idler arm Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Idler arm Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Idler arm Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Idler arm Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Idler arm Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Idler arm Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Idler arm Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Idler arm Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Idler arm Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: North America Idler arm Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Idler arm Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Idler arm Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Idler arm Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: North America Idler arm Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Idler arm Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Idler arm Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the North America Idler arm Market?

Key companies in the market include Varex Imaging, Shimadzu Medical, General Electric (GE Healthcare), Siemens Healthineers, Hologic Inc, Allengers, Philips Healthcare, AADCO Medical Inc, DMS Imaging, Ziehm Imaging GmbH, Canon Medical Systems Corporation, Turner Imaging Systems.

3. What are the main segments of the North America Idler arm Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population and Increasing Incidence of Chronic Diseases; Advancements in Maneuverability and Imaging Capabilities; Increasing Areas of Application of C-Arm.

6. What are the notable trends driving market growth?

C-Arm Application in Cardiology is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Procedural and Equipment Costs; Low Replacement Rates of C-Arm Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Siemens Healthineers received approval from the Food and Drug Administration (FDA) for the ARTIS icono ceiling, a ceiling-mounted c-arm angiography system designed for a wide range of routine and advanced procedures in interventional radiology (IR) and cardiology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Idler arm Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Idler arm Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Idler arm Market?

To stay informed about further developments, trends, and reports in the North America Idler arm Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence