Key Insights

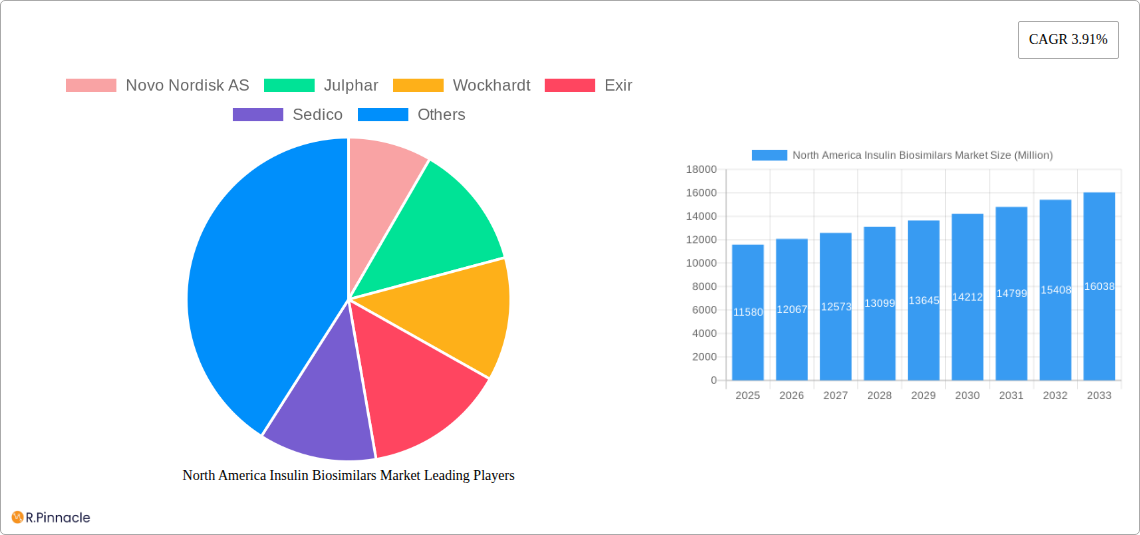

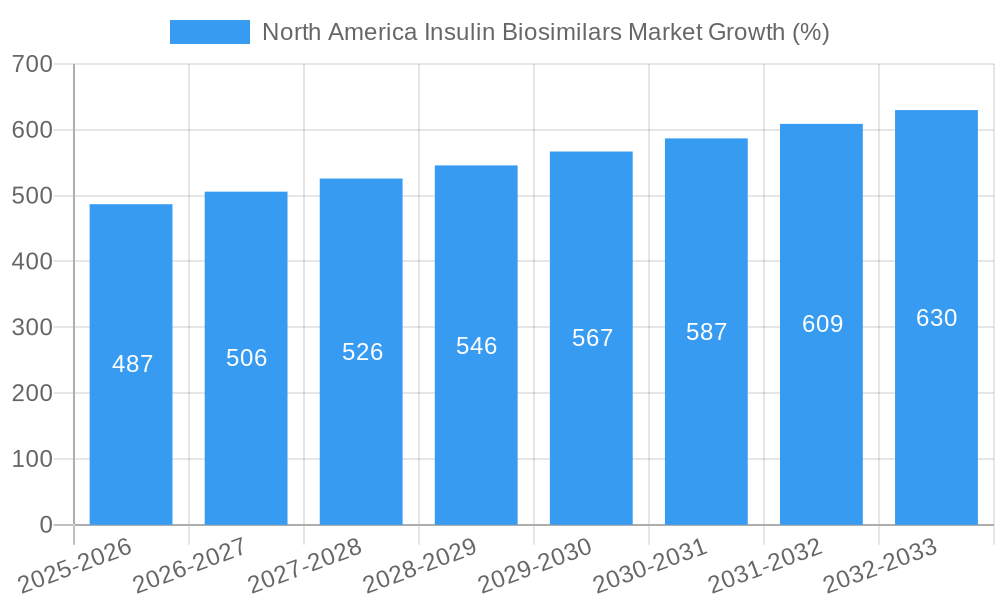

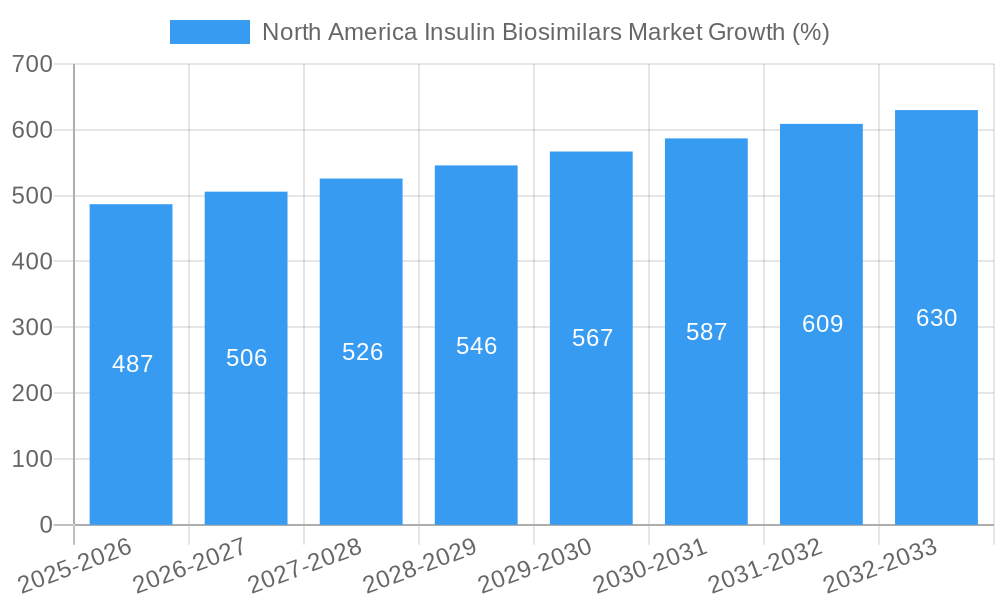

The North America insulin biosimilars market, valued at $11.58 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing prevalence of diabetes, particularly type 1 and type 2, fuels significant demand for insulin therapies. Biosimilars offer a cost-effective alternative to brand-name insulins, making them increasingly attractive to both patients and healthcare payers seeking to manage escalating healthcare costs. This cost advantage is further amplified by the growing number of patients requiring long-term insulin treatment. Furthermore, the market is witnessing a surge in the development and launch of innovative biosimilar formulations, including basal, bolus, and combination insulin products, catering to diverse patient needs and treatment regimens. This innovation is attracting significant investment from major pharmaceutical players, resulting in increased market competition and driving down prices. Regulatory approvals for new biosimilars are further accelerating market expansion. The market segmentation reveals a strong presence of both basal/long-acting and bolus/fast-acting insulin biosimilars, indicating a diversified product portfolio responding to various patient needs.

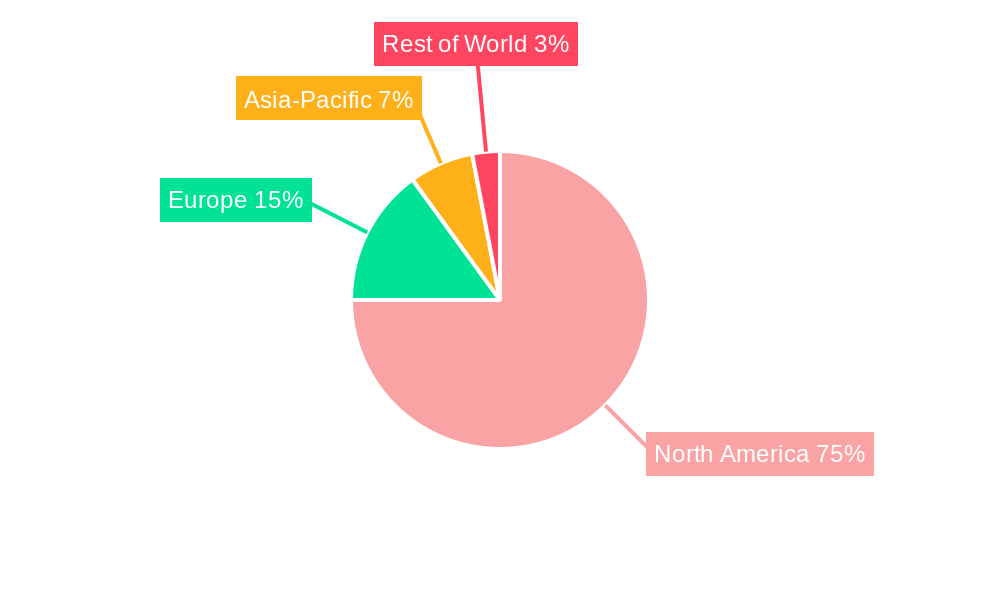

However, market growth isn't without challenges. Potential barriers include the perception of biosimilars' efficacy compared to originator products, despite regulatory assurances of bioequivalence. Concerns about potential substitution policies and physician hesitancy towards prescribing biosimilars can influence market adoption. Nevertheless, ongoing educational initiatives and the accumulation of real-world data demonstrating biosimilar safety and efficacy are gradually addressing these concerns. The continued expansion of the diabetic population, coupled with favorable pricing and technological advances, strongly suggests a positive outlook for the North American insulin biosimilars market throughout the forecast period (2025-2033), with a projected CAGR exceeding the provided 3.91%, driven by the factors mentioned above and further penetration of existing biosimilars. This growth will be particularly prominent within the United States, Canada, and Mexico, representing the bulk of the North American market.

North America Insulin Biosimilars Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America insulin biosimilars market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, and includes critical market data such as market size, growth rate (CAGR), and segment-wise analysis. The base year for this study is 2025.

North America Insulin Biosimilars Market Structure & Innovation Trends

This section analyzes the competitive landscape, examining market concentration, key innovation drivers, regulatory frameworks, and the impact of product substitutes and M&A activities. The report delves into the market share held by major players such as Novo Nordisk AS, Eli Lilly and Company, Sanofi S A, Biocon Limited, Pfizer Inc, and others. It explores the impact of mergers and acquisitions, providing insights into deal values and their effect on market consolidation. The regulatory environment impacting biosimilar development and approval is also examined, along with an assessment of the influence of end-user demographics on market growth. The report quantifies the market size in Millions and provides a clear picture of the current market structure and its evolution. For example, the xx% market share held by Novo Nordisk AS will be analyzed, along with the impact of a potential $xx Million M&A deal impacting the competitive landscape.

North America Insulin Biosimilars Market Dynamics & Trends

This section explores the key factors driving market growth, including technological advancements, evolving consumer preferences, and competitive dynamics. The report identifies the major growth drivers and provides insights into the changing market landscape. It includes a detailed examination of the compound annual growth rate (CAGR) and market penetration rate of insulin biosimilars within the North American market. The effect of technological disruptions, such as the development of novel delivery systems, is carefully considered, along with the influence of consumer preferences on the market. Competitive dynamics, including pricing strategies and market positioning by key players, are also thoroughly assessed. The report utilizes xx% as a predicted CAGR value for the specified forecast period. Analysis will also highlight the xx% increase in market penetration during a specific timeframe.

Dominant Regions & Segments in North America Insulin Biosimilars Market

This section identifies the leading regions and segments within the North American insulin biosimilars market. A detailed analysis is provided for each of the following drug segments: Basal or Long-acting Insulin; Basaglar (Insulin Glargine): Bolus or Fast-acting Insulin; Admelog (Insulin lispro): Traditional Human Insulin; Insuman: Combination Insulin; and Soliqua/Suliqua (Insulin glargine/Lixisenatide): Biosimilar Insulin.

- Key Drivers: The section will utilize bullet points to outline key drivers for each segment, including economic policies, healthcare infrastructure, and demographic trends.

- Dominance Analysis: Paragraphs will provide a detailed analysis of the dominance of specific regions or segments, explaining the underlying factors contributing to their market leadership. For instance, the report will explain why the Basal or Long-acting Insulin segment holds a dominant position, quantifying its market share (e.g., xx%) and explaining the factors driving this dominance.

North America Insulin Biosimilars Market Product Innovations

This section summarizes recent product developments and technological trends in the insulin biosimilars market. It highlights the competitive advantages of innovative products and their market fit. The analysis will cover improvements in delivery systems, formulation enhancements, and the emergence of novel biosimilar molecules. The section emphasizes the influence of technological advancements on market growth and competition.

Report Scope & Segmentation Analysis

This section provides a detailed overview of the report's scope and market segmentation.

- Basal or Long-acting Insulin: A paragraph dedicated to this segment includes market size projections (e.g., $xx Million in 2033), growth projections, and a competitive landscape analysis.

- Basaglar (Insulin Glargine): Bolus or Fast-acting Insulin: Similarly, this segment receives a dedicated paragraph covering market size, growth projections, and competitive dynamics.

- Admelog (Insulin lispro): Traditional Human Insulin: A paragraph details the market size, growth prospects, and competitive forces in this segment.

- Insuman: Combination Insulin: A dedicated paragraph describes the market size, projected growth, and competitive aspects of this combination insulin segment.

- Soliqua/Suliqua (Insulin glargine/Lixisenatide): Biosimilar Insulin: This segment's analysis will include market size, growth projections, and an assessment of the competitive landscape.

Key Drivers of North America Insulin Biosimilars Market Growth

This section identifies and analyzes the key factors driving the growth of the North America insulin biosimilars market. These drivers include technological advancements leading to improved biosimilar formulations, favorable regulatory policies promoting biosimilar adoption, and the increasing prevalence of diabetes. Specific examples of technological advancements and the impact of regulatory changes will be provided.

Challenges in the North America Insulin Biosimilars Market Sector

This section discusses the challenges and constraints faced by the North America insulin biosimilars market. These challenges include regulatory hurdles related to biosimilar approval, supply chain complexities, and intense competition from established insulin brands. The quantified impact of these challenges on market growth will be included. For example, the report may quantify the delay in biosimilar approvals causing a $xx Million revenue loss for a specific timeframe.

Emerging Opportunities in North America Insulin Biosimilars Market

This section highlights emerging trends and opportunities in the North America insulin biosimilars market. These opportunities include the expansion into new markets, the development of innovative delivery systems, and increasing consumer demand for more affordable insulin options.

Leading Players in the North America Insulin Biosimilars Market Market

- Novo Nordisk AS

- Julphar

- Wockhardt

- Exir

- Sedico

- Eli Lilly and Company

- Novo Nordisk A/S

- Other Companies

- Biocon Limited

- Pfizer Inc

- Sanofi S A

Key Developments in North America Insulin Biosimilars Market Industry

- November 2022: The FDA approved Rezvoglar, the second interchangeable insulin glargine biosimilar.

- June 2023: The FDA sanctioned Lantidra, an allogeneic pancreatic islet cellular therapy for type 1 diabetes.

Future Outlook for North America Insulin Biosimilars Market Market

This section presents a summary of the future outlook for the North America insulin biosimilars market, focusing on the growth potential and strategic opportunities. It will highlight the expected market size in 2033 (e.g., $xx Million) and emphasize the strategic opportunities for key players, including the potential for expansion into new segments and the development of innovative products. The continued rise of diabetes and the increasing demand for affordable insulin will be underscored as key growth accelerators.

North America Insulin Biosimilars Market Segmentation

-

1. Drug

- 1.1. Basal or Long-acting Insulin

- 1.2. Bolus or Fast-acting Insulin

- 1.3. Traditional Human Insulin

- 1.4. Combination Insulin

- 1.5. Biosimilar Insulin

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Insulin Biosimilars Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Insulin Biosimilars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Basal/Long Acting Insulins Holds The Highest Market Share in Current Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Basal or Long-acting Insulin

- 5.1.2. Bolus or Fast-acting Insulin

- 5.1.3. Traditional Human Insulin

- 5.1.4. Combination Insulin

- 5.1.5. Biosimilar Insulin

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. United States North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Basal or Long-acting Insulin

- 6.1.2. Bolus or Fast-acting Insulin

- 6.1.3. Traditional Human Insulin

- 6.1.4. Combination Insulin

- 6.1.5. Biosimilar Insulin

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. Canada North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Basal or Long-acting Insulin

- 7.1.2. Bolus or Fast-acting Insulin

- 7.1.3. Traditional Human Insulin

- 7.1.4. Combination Insulin

- 7.1.5. Biosimilar Insulin

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Rest of North America North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Basal or Long-acting Insulin

- 8.1.2. Bolus or Fast-acting Insulin

- 8.1.3. Traditional Human Insulin

- 8.1.4. Combination Insulin

- 8.1.5. Biosimilar Insulin

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. United States North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Insulin Biosimilars Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Novo Nordisk AS

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Julphar

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Wockhardt

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Exir

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sedico

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Eli Lilly and Company

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Novo Nordisk A/S

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Other Companie

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Biocon Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pfizer Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Sanofi S A

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Novo Nordisk AS

List of Figures

- Figure 1: North America Insulin Biosimilars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Insulin Biosimilars Market Share (%) by Company 2024

List of Tables

- Table 1: North America Insulin Biosimilars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Insulin Biosimilars Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Insulin Biosimilars Market Revenue Million Forecast, by Drug 2019 & 2032

- Table 4: North America Insulin Biosimilars Market Volume K Unit Forecast, by Drug 2019 & 2032

- Table 5: North America Insulin Biosimilars Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Insulin Biosimilars Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America Insulin Biosimilars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Insulin Biosimilars Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Insulin Biosimilars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Insulin Biosimilars Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Insulin Biosimilars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Insulin Biosimilars Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Insulin Biosimilars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Insulin Biosimilars Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Insulin Biosimilars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Insulin Biosimilars Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Insulin Biosimilars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Insulin Biosimilars Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Insulin Biosimilars Market Revenue Million Forecast, by Drug 2019 & 2032

- Table 20: North America Insulin Biosimilars Market Volume K Unit Forecast, by Drug 2019 & 2032

- Table 21: North America Insulin Biosimilars Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Insulin Biosimilars Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: North America Insulin Biosimilars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Insulin Biosimilars Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: North America Insulin Biosimilars Market Revenue Million Forecast, by Drug 2019 & 2032

- Table 26: North America Insulin Biosimilars Market Volume K Unit Forecast, by Drug 2019 & 2032

- Table 27: North America Insulin Biosimilars Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Insulin Biosimilars Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Insulin Biosimilars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Insulin Biosimilars Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America Insulin Biosimilars Market Revenue Million Forecast, by Drug 2019 & 2032

- Table 32: North America Insulin Biosimilars Market Volume K Unit Forecast, by Drug 2019 & 2032

- Table 33: North America Insulin Biosimilars Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Insulin Biosimilars Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Insulin Biosimilars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Insulin Biosimilars Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Insulin Biosimilars Market?

The projected CAGR is approximately 3.91%.

2. Which companies are prominent players in the North America Insulin Biosimilars Market?

Key companies in the market include Novo Nordisk AS, Julphar, Wockhardt, Exir, Sedico, Eli Lilly and Company, Novo Nordisk A/S, Other Companie, Biocon Limited, Pfizer Inc, Sanofi S A.

3. What are the main segments of the North America Insulin Biosimilars Market?

The market segments include Drug, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.58 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Basal/Long Acting Insulins Holds The Highest Market Share in Current Year.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

June 2023: The initial allogeneic (donor) pancreatic islet cellular therapy, Lantidra, has been sanctioned by the U.S. Food and Drug Administration. This treatment is derived from pancreatic cells of deceased donors and is intended for individuals with type 1 diabetes. Lantidra is specifically authorized for adults who struggle to achieve target glycated hemoglobin levels due to frequent severe hypoglycemia episodes, despite undergoing intensive diabetes management and education.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Insulin Biosimilars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Insulin Biosimilars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Insulin Biosimilars Market?

To stay informed about further developments, trends, and reports in the North America Insulin Biosimilars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence