Key Insights

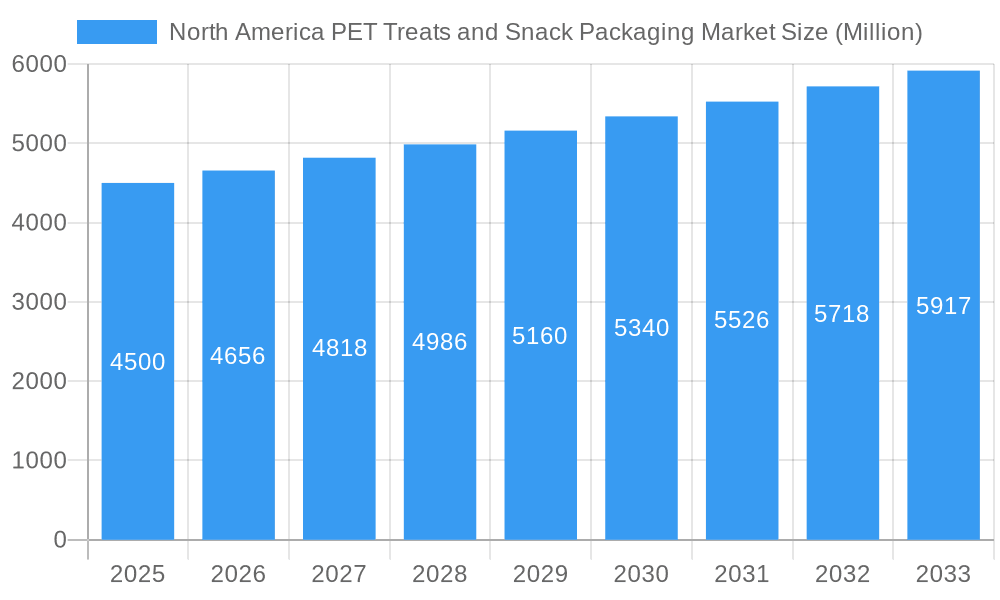

The North American PET Treats and Snack Packaging Market is poised for significant expansion, projected to reach $12.35 billion by 2025. This growth is fueled by the accelerating pet humanization trend, where consumers increasingly view pets as family, driving demand for premium, high-quality, and convenient packaging. Enhanced willingness to invest in specialized packaging that guarantees product freshness, safety, and superior shelf appeal underpins this market's trajectory. Furthermore, the proliferation of diverse pet food offerings, including specialized diets, necessitates a wider array of packaging formats and materials. Technological innovations, such as advanced barrier properties, sustainable material development, and smart packaging solutions, are key market drivers. The projected Compound Annual Growth Rate (CAGR) of 7.65% signifies sustained consumer interest and robust industry investment.

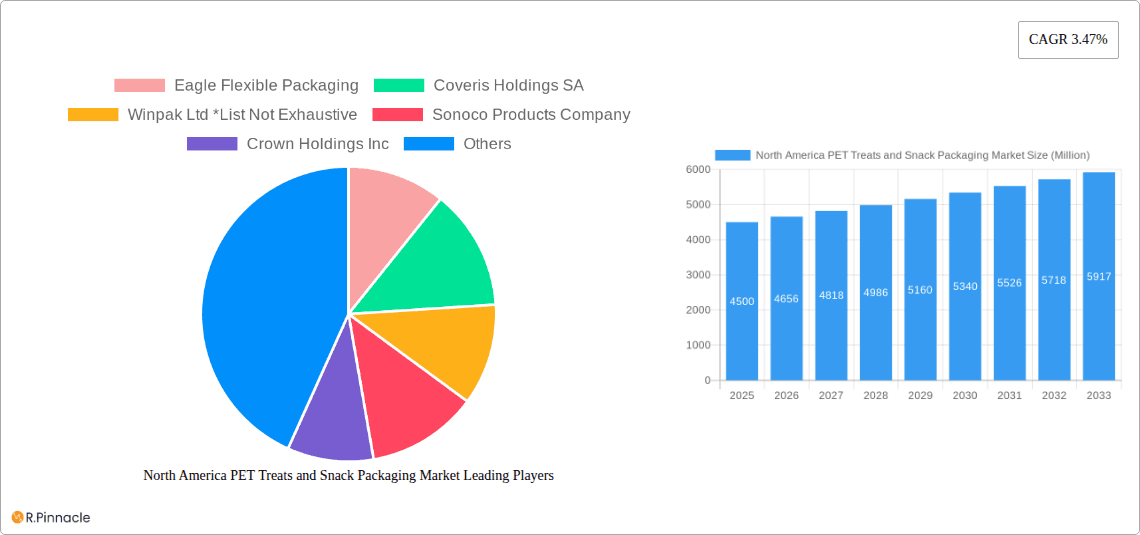

North America PET Treats and Snack Packaging Market Market Size (In Billion)

Flexible packaging, particularly bags and pouches, dominates the market due to their convenience, cost-efficiency, and product integrity. However, rigid formats like plastic bottles, containers, metal cans, and folding cartons retain substantial market share, especially for premium product positioning. A notable shift towards recyclable and compostable materials reflects growing environmental awareness among consumers and manufacturers, propelling the industry toward sustainable practices. Leading companies are prioritizing research and development to introduce innovative packaging solutions that enhance product shelf life, consumer convenience, and brand differentiation. This strategic focus, coupled with a growing pet population and rising disposable incomes allocated to pet care, ensures the North American PET Treats and Snack Packaging Market's continued and substantial growth through the forecast period.

North America PET Treats and Snack Packaging Market Company Market Share

North America PET Treats and Snack Packaging Market Analysis: Unlocking Growth & Innovation (2019-2033)

This comprehensive report delves into the dynamic North America PET Treats and Snack Packaging Market, offering deep insights and actionable strategies for industry stakeholders. From understanding the intricate market structure and identifying key innovation trends to analyzing prevailing market dynamics, dominant regional landscapes, and crucial growth drivers, this report provides a 360-degree view. We meticulously dissect product innovations, examine emerging opportunities, and highlight critical challenges, culminating in a robust future outlook for this rapidly evolving sector. Leverage our expert analysis, backed by extensive data and forecasting from the Base Year 2025 through the Forecast Period 2025–2033, to navigate the competitive terrain and capitalize on burgeoning market potential.

North America PET Treats and Snack Packaging Market Market Structure & Innovation Trends

The North America PET Treats and Snack Packaging Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized regional players vying for market share. The market share distribution is dynamic, influenced by continuous innovation and strategic acquisitions. Key innovation drivers include the demand for sustainable packaging solutions, enhanced product shelf-life, convenient and portion-controlled packaging, and the integration of smart packaging technologies for traceability and consumer engagement. Regulatory frameworks, particularly concerning food safety and environmental impact, play a significant role in shaping product development and market entry strategies. The threat of product substitutes, such as bulk packaging or alternative preservation methods for pet treats and snacks, is present but largely mitigated by the convenience and specific functionalities offered by dedicated PET packaging. End-user demographics, characterized by an increasing humanization of pets and a growing disposable income for pet care, are a primary catalyst for market expansion. Mergers and Acquisition (M&A) activities are ongoing, with deal values ranging from tens of millions to hundreds of millions of dollars, as companies aim to consolidate market positions, acquire technological capabilities, and expand their product portfolios. For instance, strategic acquisitions in flexible packaging and barrier technology have been prominent.

North America PET Treats and Snack Packaging Market Market Dynamics & Trends

The North America PET Treats and Snack Packaging Market is propelled by a confluence of robust growth drivers, significant technological disruptions, evolving consumer preferences, and intense competitive dynamics. The burgeoning pet humanization trend continues to be a primary growth accelerator, with pet owners increasingly treating their companions as family members and investing in premium and specialized food products, including treats and snacks. This directly translates into a higher demand for sophisticated and visually appealing packaging that reflects the quality and perceived benefits of these premium offerings. The market penetration of specialized pet food, particularly for niche dietary needs and health-conscious pets, is on a steady rise, further stimulating the need for tailored packaging solutions. Technologically, advancements in material science are leading to the development of more sustainable, recyclable, and compostable packaging options, responding to growing environmental consciousness among consumers and stricter regulations. Innovations in barrier technologies are crucial for extending the shelf-life of perishable pet treats and snacks, reducing spoilage, and maintaining product freshness, thereby appealing to both consumers and manufacturers. The integration of smart packaging features, such as QR codes for traceability and interactive content, is also gaining traction, offering a competitive edge and enhancing consumer engagement.

Competitive dynamics are characterized by strategic collaborations, product differentiation through unique designs and functionalities, and aggressive pricing strategies. Companies are investing heavily in research and development to introduce innovative packaging formats that offer enhanced convenience, such as resealable pouches and single-serve portions, catering to the busy lifestyles of pet owners. The demand for visually appealing packaging that stands out on retail shelves is also a key trend, with manufacturers focusing on high-quality printing and graphics. The Compound Annual Growth Rate (CAGR) for this market is projected to be in the range of 5-7% over the forecast period, driven by these multifaceted factors. The increasing adoption of e-commerce for pet supplies also necessitates robust and protective packaging that can withstand the rigmarole of online distribution, further influencing packaging design and material choices. Furthermore, the growing awareness about the nutritional value and ingredient sourcing of pet food is extending to the packaging, with consumers seeking transparency and reassurance regarding the origin and safety of the packaging materials themselves. This intricate interplay of economic, technological, and social factors paints a picture of a dynamic and expanding market.

Dominant Regions & Segments in North America PET Treats and Snack Packaging Market

The United States stands as the dominant region within the North America PET Treats and Snack Packaging Market, driven by a combination of substantial pet ownership, high disposable income allocated to pet care, and a mature pet food industry. The economic policies fostering consumer spending on premium pet products, coupled with a well-established retail and e-commerce infrastructure, further solidify its leading position.

Within the Material segmentation, Plastic is the dominant material type.

- Drivers for Plastic Dominance:

- Versatility and Durability: Plastic offers excellent barrier properties against moisture, oxygen, and light, crucial for maintaining the freshness and shelf-life of pet treats and snacks.

- Cost-Effectiveness: Compared to some alternatives, plastic packaging often provides a more economical solution for high-volume production.

- Design Flexibility: Plastic allows for a wide range of shapes, sizes, and printing capabilities, enabling visually appealing and branded packaging.

- Growth in Flexible Packaging: The increasing popularity of pouches and bags, predominantly made from plastic films, significantly contributes to its market share.

In terms of Product Type, Bags and Pouches command the largest market share.

- Dominance of Bags and Pouches:

- Convenience: Resealable options and lightweight nature make them highly convenient for consumers.

- Shelf Appeal: They offer ample surface area for branding and detailed product information, crucial for attracting pet owners.

- Cost Efficiency: Often more cost-effective to produce and transport than rigid packaging formats.

- Adaptability: Suitable for a wide variety of treat and snack formats, from single-ingredient jerky to multi-component biscuits.

The Food Type segment showcasing the most significant dominance is Dry Food.

- Drivers for Dry Food Dominance:

- Widespread Availability: Dry treats and snacks are the most common form of pet consumables.

- Extended Shelf-Life: Dry products are inherently more stable, requiring less intensive barrier properties than wet food.

- Packaging Suitability: Dry goods are well-suited for bags, pouches, and other common packaging formats.

For Pet Animal Type, Canine (Dog) pets represent the largest segment.

- Dominance of Canine Segment:

- Higher Pet Ownership: Dogs are the most popular pet animal in North America.

- Extensive Treat Market: The market for dog treats and snacks is vast and diverse, catering to various needs and preferences.

- Dedicated Product Development: Manufacturers heavily invest in developing specialized treats and packaging for dogs.

North America PET Treats and Snack Packaging Market Product Innovations

Product innovations in the North America PET Treats and Snack Packaging Market are centered on enhancing convenience, sustainability, and consumer appeal. This includes the development of advanced multi-layer flexible packaging with improved barrier properties to extend shelf-life, alongside the introduction of resealable closures and single-serving formats for enhanced portability and portion control. A significant trend is the adoption of recyclable and compostable plastic materials, as well as the incorporation of post-consumer recycled (PCR) content, addressing growing environmental concerns. Innovations in printing technologies are also enabling higher-resolution graphics and interactive features, such as QR codes for product traceability and engagement. These developments offer competitive advantages by meeting evolving consumer demands for eco-friendly and user-friendly packaging solutions.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the North America PET Treats and Snack Packaging Market, segmented across Material (Plastic, Paper and Paperboard, Metal), Product Type (Bags, Pouches, Plastic Bottles and Containers, Metal Cans, Folding Cartoons, Other Product Types), Food Type (Dry Food, Wet Food, Other Food Type), and Pet Animal Type (Canine (Dog), Feline (Cat), Other Pet Animal Types). The Plastic segment, particularly pouches and bags, is projected to lead due to its versatility and cost-effectiveness. The Canine segment is expected to exhibit strong growth driven by high pet ownership and expenditure. Each segment’s market size and growth projections are detailed, alongside an analysis of competitive dynamics within these distinct categories, providing a granular understanding of market potential and strategic positioning.

Key Drivers of North America PET Treats and Snack Packaging Market Growth

The North America PET Treats and Snack Packaging Market is propelled by several key drivers. The increasing humanization of pets, leading to higher spending on premium and specialized treats, is a primary economic driver. Technological advancements in sustainable packaging materials, such as recyclable plastics and biodegradable alternatives, are crucial for meeting environmental regulations and consumer demand. The rise of e-commerce for pet supplies necessitates robust and attractive packaging that can withstand shipping and enhance online appeal. Furthermore, evolving consumer preferences for convenience, portion control, and visually appealing packaging formats directly influence product development and market expansion, supported by favorable regulatory frameworks promoting food safety and packaging innovation.

Challenges in the North America PET Treats and Snack Packaging Market Sector

Despite robust growth, the North America PET Treats and Snack Packaging Market faces several challenges. The rising cost of raw materials, particularly petroleum-based plastics, can impact profit margins. Stringent regulatory compliance regarding food safety and material disposal adds complexity and cost to product development and manufacturing. The ongoing pressure to develop truly sustainable and scalable recyclable or compostable packaging solutions for a diverse range of products remains a significant hurdle. Furthermore, intense competition among packaging manufacturers can lead to pricing pressures and the need for continuous innovation to maintain market share, alongside potential supply chain disruptions that can affect material availability and lead times.

Emerging Opportunities in North America PET Treats and Snack Packaging Market

Emerging opportunities in the North America PET Treats and Snack Packaging Market are abundant. The growing demand for premium, natural, and organic pet treats presents an opportunity for specialized packaging that emphasizes these attributes. Innovations in smart packaging, incorporating features like temperature indicators or authentication seals, can enhance product integrity and consumer trust. The expansion of the pet food market in developing regions within North America, coupled with the increasing adoption of e-commerce, opens new avenues for market penetration. Furthermore, advancements in bio-based and biodegradable packaging materials offer a significant opportunity to address sustainability concerns and capture market share from traditional plastic packaging.

Leading Players in the North America PET Treats and Snack Packaging Market Market

- Eagle Flexible Packaging

- Coveris Holdings SA

- Winpak Ltd

- Sonoco Products Company

- Crown Holdings Inc

- Graphic Packaging International Inc

- Trivium Packaging

- Amcor PLC

- Mondi PLC

- America Packaging Corporation

- ProAmpac LLC

- Berry Global Inc

- Silgan Holdings Inc

- Excel Packaging Corp

Key Developments in North America PET Treats and Snack Packaging Market Industry

- 2024: Launch of innovative compostable flexible packaging solutions for pet treats by several key players, responding to increasing environmental consciousness.

- 2024: Increased adoption of advanced barrier technologies in pouches to extend the shelf-life of wet pet food snacks.

- 2023: Strategic partnerships formed between packaging manufacturers and pet food brands to develop co-branded, sustainable packaging initiatives.

- 2023: Significant investment in R&D for post-consumer recycled (PCR) content in rigid PET containers for pet snacks.

- 2022: Introduction of smart packaging features, such as QR codes for ingredient transparency and provenance, gaining traction for premium pet treats.

Future Outlook for North America PET Treats and Snack Packaging Market Market

The future outlook for the North America PET Treats and Snack Packaging Market is exceptionally positive, driven by sustained growth in pet ownership and an increasing willingness among consumers to invest in high-quality pet food products. Innovations in sustainable packaging materials and the expansion of e-commerce channels will continue to shape market dynamics. Strategic opportunities lie in developing advanced, functional packaging that caters to specific dietary needs and promotes product differentiation. The market is poised for continued expansion, with a strong emphasis on eco-friendly solutions and enhanced consumer engagement, promising significant returns for agile and innovative players.

North America PET Treats and Snack Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Metal

-

2. Product Type

- 2.1. Bags

- 2.2. Pouches

- 2.3. Plastic Bottles and Containers

- 2.4. Metal Cans

- 2.5. Folding Cartoons

- 2.6. Other Product Types

-

3. Food Type

- 3.1. Dry Food

- 3.2. Wet Food

- 3.3. Other Food Type

-

4. Pet Animal Type

- 4.1. Canine (Dog)

- 4.2. Feline (Cat)

- 4.3. Other Pet Animal Types

North America PET Treats and Snack Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America PET Treats and Snack Packaging Market Regional Market Share

Geographic Coverage of North America PET Treats and Snack Packaging Market

North America PET Treats and Snack Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market

- 3.3. Market Restrains

- 3.3.1. Rising Operational Costs; Growing Usage of Substitute Products (Plastic)

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America PET Treats and Snack Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bags

- 5.2.2. Pouches

- 5.2.3. Plastic Bottles and Containers

- 5.2.4. Metal Cans

- 5.2.5. Folding Cartoons

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Food Type

- 5.3.1. Dry Food

- 5.3.2. Wet Food

- 5.3.3. Other Food Type

- 5.4. Market Analysis, Insights and Forecast - by Pet Animal Type

- 5.4.1. Canine (Dog)

- 5.4.2. Feline (Cat)

- 5.4.3. Other Pet Animal Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eagle Flexible Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coveris Holdings SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Winpak Ltd *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Crown Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Graphic Packaging International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trivium Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 America Packaging Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ProAmpac LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Berry Global Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Silgan Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Excel Packaging Corp

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Eagle Flexible Packaging

List of Figures

- Figure 1: North America PET Treats and Snack Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America PET Treats and Snack Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 4: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Pet Animal Type 2020 & 2033

- Table 5: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Food Type 2020 & 2033

- Table 9: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Pet Animal Type 2020 & 2033

- Table 10: North America PET Treats and Snack Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America PET Treats and Snack Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America PET Treats and Snack Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America PET Treats and Snack Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America PET Treats and Snack Packaging Market?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the North America PET Treats and Snack Packaging Market?

Key companies in the market include Eagle Flexible Packaging, Coveris Holdings SA, Winpak Ltd *List Not Exhaustive, Sonoco Products Company, Crown Holdings Inc, Graphic Packaging International Inc, Trivium Packaging, Amcor PLC, Mondi PLC, America Packaging Corporation, ProAmpac LLC, Berry Global Inc, Silgan Holdings Inc, Excel Packaging Corp.

3. What are the main segments of the North America PET Treats and Snack Packaging Market?

The market segments include Material, Product Type, Food Type, Pet Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco-friendly Products; Rising Demand from the Food and Beverage Market.

6. What are the notable trends driving market growth?

Plastic Packaging is expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Rising Operational Costs; Growing Usage of Substitute Products (Plastic).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America PET Treats and Snack Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America PET Treats and Snack Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America PET Treats and Snack Packaging Market?

To stay informed about further developments, trends, and reports in the North America PET Treats and Snack Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence