Key Insights

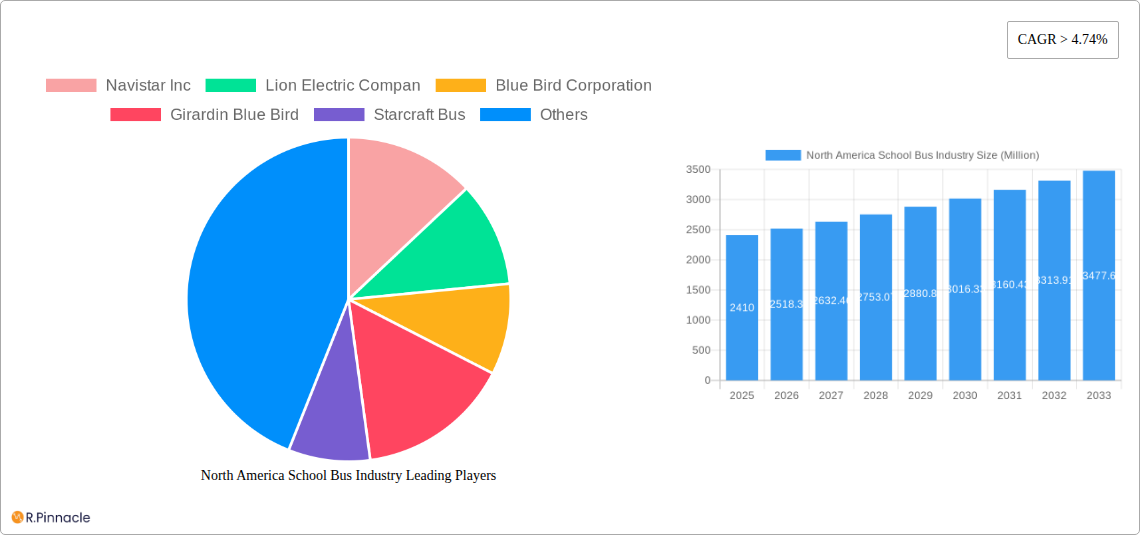

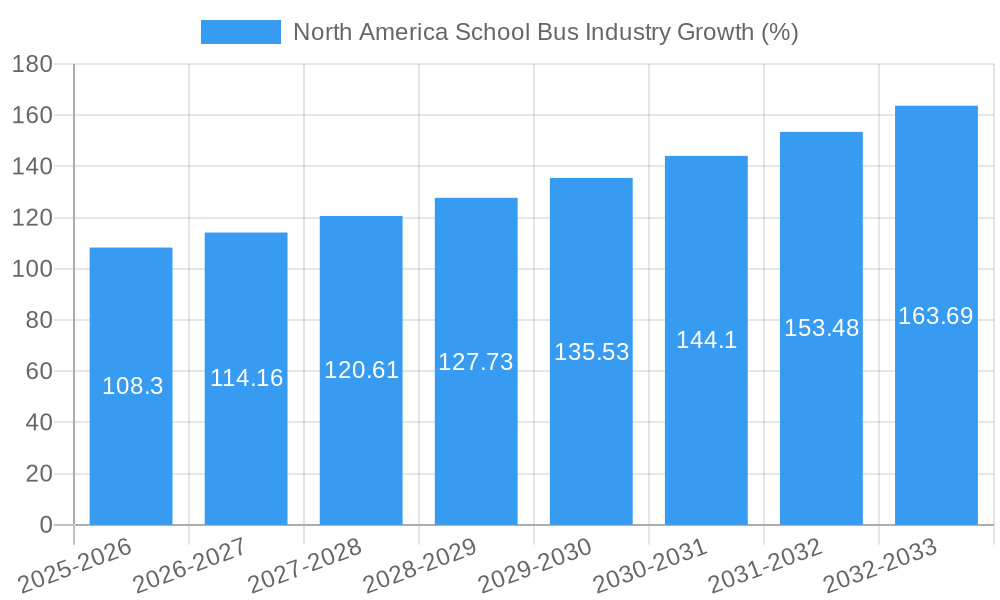

The North American school bus industry, valued at $2.41 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4.74% from 2025 to 2033. This expansion is driven by several key factors. Increasing student enrollment, particularly in rapidly growing regions of the United States, necessitates a larger fleet of school buses. Furthermore, a growing emphasis on student safety and the implementation of stricter regulations regarding bus maintenance and technology are fueling demand for newer, more technologically advanced vehicles. The shift towards electric and alternative fuel school buses, spurred by environmental concerns and government incentives, is another significant driver, leading to increased investment and innovation within the sector. The market segmentation reveals a strong preference for Type C and Type D buses, reflecting the need for larger capacity vehicles to accommodate sizable student populations. Competition is fierce, with established players like Navistar Inc., Lion Electric Co., and Blue Bird Corporation vying for market share alongside smaller, specialized manufacturers. Despite these positive trends, challenges remain. Fluctuations in fuel prices, the high initial cost of electric buses, and potential supply chain disruptions represent some key restraints on market growth.

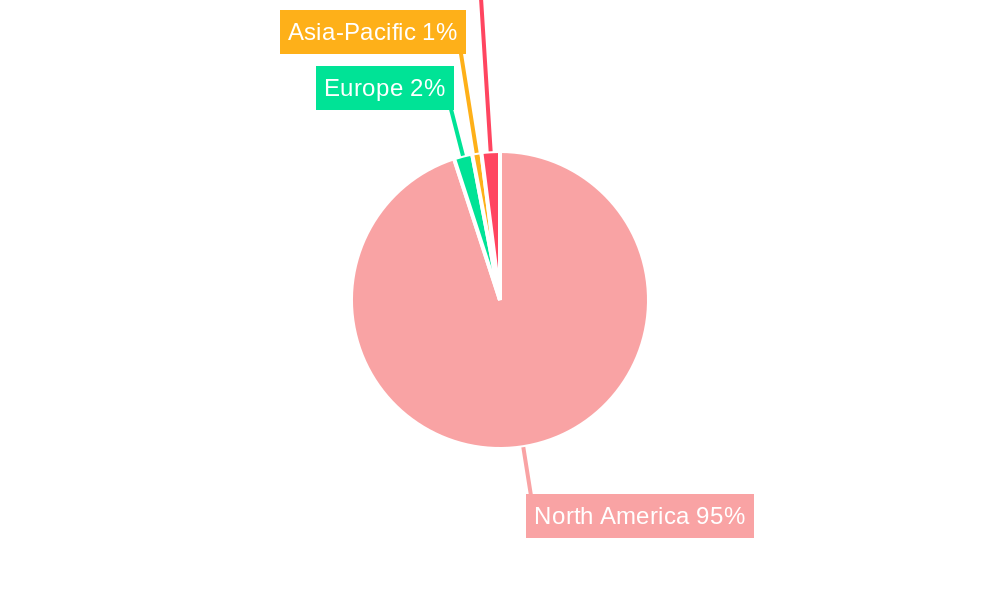

The regional breakdown indicates that the United States constitutes the largest market within North America, driven by its large school-age population and extensive school transportation infrastructure. Canada and Mexico also contribute significantly, although at a smaller scale. The forecast period (2025-2033) anticipates continued market expansion, with potential acceleration in growth as technological advancements in electric vehicle technology become more cost-effective and widely accessible. This growth trajectory is further supported by ongoing government initiatives promoting sustainable transportation and improving school safety standards. Overall, the North American school bus market presents a compelling investment opportunity, characterized by consistent growth, technological innovation, and a commitment to safer and more environmentally friendly transportation solutions for students.

North America School Bus Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America school bus industry, offering invaluable insights for industry professionals, investors, and policymakers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research, incorporating key developments and trends to deliver actionable strategies for navigating this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

North America School Bus Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the North America school bus market. The industry is moderately consolidated, with key players including Navistar Inc, Lion Electric Co, Blue Bird Corporation, Girardin Blue Bird, Starcraft Bus, Trans Tech, Collins Bus Corporation, and Daimler AG (Thomas Built Buses) holding significant market share. Market share data reveals a xx% market share for Blue Bird and a xx% for Thomas Built Buses in 2025.

- Market Concentration: The market exhibits moderate concentration, with the top five players accounting for approximately xx% of total revenue in 2025.

- Innovation Drivers: The push for zero-emission vehicles, advancements in safety technologies, and evolving government regulations are primary drivers of innovation.

- Regulatory Frameworks: Stringent safety standards, emission regulations (e.g., increasingly stricter EPA standards), and funding programs for electric school buses significantly influence market dynamics.

- Product Substitutes: While limited, alternative transportation solutions for school children, such as ride-sharing services, pose a niche competitive threat.

- End-User Demographics: The report analyzes student population demographics, school district budgets, and transportation policies to assess market demand.

- M&A Activities: The past five years have witnessed xx Million in M&A activity, primarily focused on strategic acquisitions to enhance technological capabilities and expand market reach. Recent examples include Lion Electric Co's acquisition of smaller bus companies.

North America School Bus Industry Market Dynamics & Trends

This section delves into the key factors driving market growth, technological disruptions, and competitive dynamics within the North America school bus industry. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several key factors.

The increasing adoption of electric school buses is a significant trend, driven by environmental concerns and government incentives. The market penetration of electric school buses is currently at xx% and is projected to reach xx% by 2033. Technological advancements, such as improved battery technology and charging infrastructure, are further accelerating this growth. Consumer preferences for safer and more environmentally friendly transportation options are also influencing market demand. Intense competition among manufacturers is leading to continuous product innovations and price optimization.

Dominant Regions & Segments in North America School Bus Industry

This section highlights the leading regions, countries, and segments within the North America school bus market.

Dominant Region: The xx region dominates the market due to factors such as higher school-age population, increased government funding for school transportation, and favorable regulatory environment.

- Key Drivers in the Dominant Region:

- High school-age population: xx Million students require school transportation in the region.

- Government funding: xx Million in annual government funding specifically allocated to school bus procurements.

- Favorable infrastructure: Well-developed road networks supporting efficient school bus routes.

Dominant Segments:

- Powertrain: The IC Engine segment currently holds the largest market share (xx%), followed by the Electric segment which is exhibiting substantial growth (CAGR of xx%).

- Bus Type: Type C buses dominate the market due to their widespread applicability and affordability. Type D buses also represent a substantial segment, catering to specific transportation needs. The “Other Types” segment is expected to experience modest growth, driven by specialized applications.

North America School Bus Industry Product Innovations

The school bus industry is witnessing rapid product innovation, particularly in the area of electric buses. Manufacturers are focusing on enhancing battery technology, improving charging infrastructure, and incorporating advanced safety features such as advanced driver-assistance systems (ADAS) and improved child safety technologies. These innovations are aimed at enhancing operational efficiency, reducing environmental impact, and improving overall safety. The market fit for electric school buses is steadily improving, driven by government mandates and falling battery costs.

Report Scope & Segmentation Analysis

This report segments the North America school bus market based on powertrain (IC Engine, Electric), and bus type (Type C, Type D, Other Types).

Powertrain: The IC Engine segment is expected to decline at a CAGR of xx% while the Electric segment is projected to achieve a significant CAGR of xx%. The competitive landscape is defined by major players competing on technology, pricing, and after-sales services.

Bus Type: Type C buses, accounting for xx% of the market in 2025, are projected to retain a significant market share, driven by their versatility. Type D buses hold a xx% market share and will grow moderately. The “Other Types” category includes specialized buses and will experience limited growth.

Key Drivers of North America School Bus Industry Growth

Several key factors are driving the growth of the North America school bus industry:

- Growing school-age population: The continuous rise in the school-age population fuels the demand for school buses.

- Government regulations and safety standards: Stringent safety and emission regulations drive the adoption of advanced vehicles and technologies.

- Government funding and incentives: Government initiatives and grants aimed at electrifying school bus fleets are pushing market growth.

- Technological advancements: Innovations in electric powertrains, battery technology, and safety features are propelling market expansion.

Challenges in the North America School Bus Industry Sector

The North America school bus industry faces various challenges:

- High upfront costs of electric buses: The initial investment for electric buses remains a significant barrier for many school districts.

- Supply chain disruptions: Global supply chain challenges can impact the availability of components and lead to production delays.

- Competition: Intense competition among manufacturers puts pressure on pricing and profitability.

- Driver shortages: A shortage of qualified school bus drivers presents an operational hurdle for many districts.

Emerging Opportunities in North America School Bus Industry

The North America school bus industry presents numerous opportunities:

- Growth of the electric bus segment: The market for electric school buses is poised for significant expansion.

- Integration of advanced technologies: The incorporation of ADAS and other advanced technologies offers considerable potential.

- Expansion into rural markets: Providing school bus services in underserved rural areas presents opportunities for growth.

- Focus on alternative fuels: Exploration of alternative fuels such as hydrogen or propane can offer diversification opportunities.

Leading Players in the North America School Bus Industry Market

- Navistar Inc

- Lion Electric Co

- Blue Bird Corporation

- Girardin Blue Bird

- Starcraft Bus

- Trans Tech

- Collins Bus Corporation

- Daimler AG (Thomas Built Buses)

Key Developments in North America School Bus Industry Industry

October 2023: Blue Bird delivers its 1,500th electric school bus and inaugurates its EV build-up center in Georgia, targeting 5,000 annual electric bus production. This significantly boosts their commitment to zero-emission transportation and increases their market share in the electric bus segment.

November 2023: Lion Electric secures a provisional purchase order for 50 LionC all-electric school buses from Highland Electric Fleets, showcasing growing demand for electric school buses and partnerships within the sector.

November 2022: Lion Electric commences production of its zero-emission LionC school bus in Joliet, Illinois, expanding its manufacturing footprint and increasing its competitive presence in the US market.

October 2022: Thomas Built Buses delivers its 200th electric school bus to Monroe County Public Schools, demonstrating significant progress in electric bus adoption and highlighting the growing commitment to sustainable school transportation.

March 2022: Thomas Built Buses and Highland Electric Fleets expand their partnership to reduce costs and accelerate electric school bus adoption, highlighting the collaborative efforts to drive market growth.

Future Outlook for North America School Bus Industry Market

The North America school bus industry is poised for continued growth, driven by increasing demand for safer, more environmentally friendly, and technologically advanced vehicles. Government initiatives promoting electrification, coupled with technological advancements in battery technology and charging infrastructure, will fuel this expansion. Strategic partnerships and collaborations between manufacturers and service providers will further drive market growth and innovation. The focus on sustainable transportation solutions and the incorporation of advanced safety features will shape the future of the industry.

North America School Bus Industry Segmentation

-

1. Powertrain

- 1.1. IC Engine

- 1.2. Electric

-

2. Bus Type

- 2.1. Type C

- 2.2. Type D

- 2.3. Other Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America School Bus Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America School Bus Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric School Buses

- 3.3. Market Restrains

- 3.3.1. Uncertainty of The Global Pandemic

- 3.4. Market Trends

- 3.4.1. The Industry’s Shift Toward the Adoption of Electric School Buses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Powertrain

- 5.1.1. IC Engine

- 5.1.2. Electric

- 5.2. Market Analysis, Insights and Forecast - by Bus Type

- 5.2.1. Type C

- 5.2.2. Type D

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Powertrain

- 6. United States North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Powertrain

- 6.1.1. IC Engine

- 6.1.2. Electric

- 6.2. Market Analysis, Insights and Forecast - by Bus Type

- 6.2.1. Type C

- 6.2.2. Type D

- 6.2.3. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Powertrain

- 7. Canada North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Powertrain

- 7.1.1. IC Engine

- 7.1.2. Electric

- 7.2. Market Analysis, Insights and Forecast - by Bus Type

- 7.2.1. Type C

- 7.2.2. Type D

- 7.2.3. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Powertrain

- 8. Rest of North America North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Powertrain

- 8.1.1. IC Engine

- 8.1.2. Electric

- 8.2. Market Analysis, Insights and Forecast - by Bus Type

- 8.2.1. Type C

- 8.2.2. Type D

- 8.2.3. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Powertrain

- 9. United States North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America School Bus Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Navistar Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Lion Electric Compan

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Blue Bird Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Girardin Blue Bird

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Starcraft Bus

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Trans Tech

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Collins Bus Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Daimler AG (Thomas Built Buses)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Navistar Inc

List of Figures

- Figure 1: North America School Bus Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America School Bus Industry Share (%) by Company 2024

List of Tables

- Table 1: North America School Bus Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America School Bus Industry Revenue Million Forecast, by Powertrain 2019 & 2032

- Table 3: North America School Bus Industry Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 4: North America School Bus Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America School Bus Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America School Bus Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America School Bus Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America School Bus Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America School Bus Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America School Bus Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America School Bus Industry Revenue Million Forecast, by Powertrain 2019 & 2032

- Table 12: North America School Bus Industry Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 13: North America School Bus Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America School Bus Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America School Bus Industry Revenue Million Forecast, by Powertrain 2019 & 2032

- Table 16: North America School Bus Industry Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 17: North America School Bus Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America School Bus Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America School Bus Industry Revenue Million Forecast, by Powertrain 2019 & 2032

- Table 20: North America School Bus Industry Revenue Million Forecast, by Bus Type 2019 & 2032

- Table 21: North America School Bus Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America School Bus Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America School Bus Industry?

The projected CAGR is approximately > 4.74%.

2. Which companies are prominent players in the North America School Bus Industry?

Key companies in the market include Navistar Inc, Lion Electric Compan, Blue Bird Corporation, Girardin Blue Bird, Starcraft Bus, Trans Tech, Collins Bus Corporation, Daimler AG (Thomas Built Buses).

3. What are the main segments of the North America School Bus Industry?

The market segments include Powertrain, Bus Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric School Buses.

6. What are the notable trends driving market growth?

The Industry’s Shift Toward the Adoption of Electric School Buses.

7. Are there any restraints impacting market growth?

Uncertainty of The Global Pandemic.

8. Can you provide examples of recent developments in the market?

October 2023: Blue Bird achieved a milestone by delivering its 1,500th electric, zero-emission school bus to Modesto City Schools in California. Recently, the company marked the inauguration of its Electric Vehicle (EV) Build-up Center in Georgia, aiming to boost its long-term production capacity to 5,000 electric school buses annually. This expansion underscores Blue Bird's commitment to advancing zero-emission school buses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America School Bus Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America School Bus Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America School Bus Industry?

To stay informed about further developments, trends, and reports in the North America School Bus Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence