Key Insights

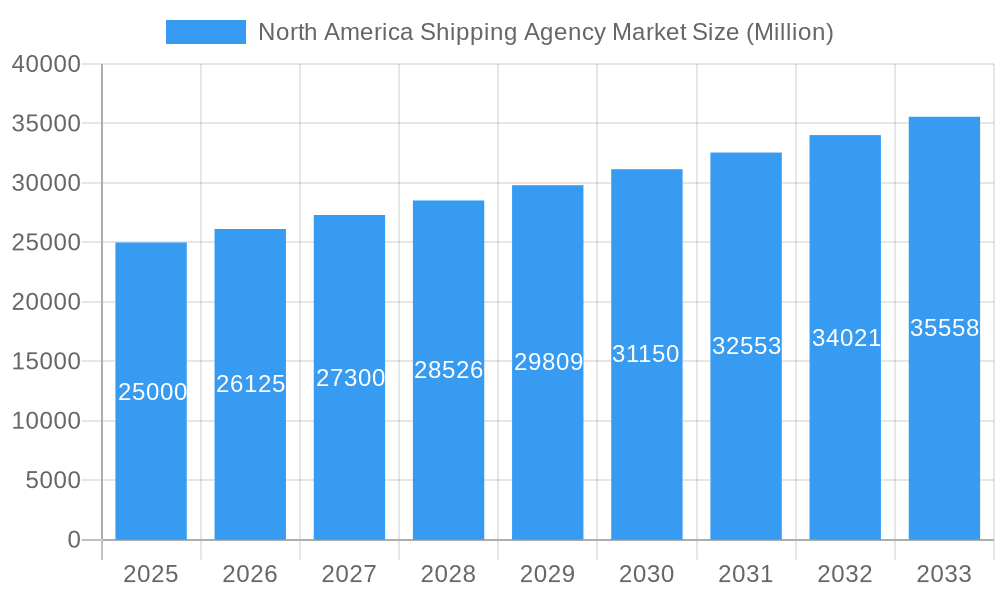

The North American shipping agency market, valued at $7.29 billion in the base year 2025, is projected for substantial growth with a Compound Annual Growth Rate (CAGR) of 15.32% through 2033. This expansion is propelled by escalating global trade volumes, particularly between North America and Asia, and the increasing demand for efficient shipping logistics. Evolving regulatory frameworks, encompassing environmental standards and security mandates, further underscore the necessity for specialized agency expertise. Advancements in digitalization and automation are optimizing operational efficiencies, contributing to market momentum. Key market segments include Port Agencies and Cargo Agencies, serving both shipowners and lessees. The competitive environment features established multinational corporations and agile regional entities, offering a diverse spectrum of services.

North America Shipping Agency Market Market Size (In Billion)

Key growth catalysts include the surge in e-commerce, driving demand for effective last-mile delivery, and the growing prominence of container shipping. Potential market restraints involve fuel price volatility and global economic uncertainties, alongside competitive pressures and the potential emergence of new market entrants. Strategic initiatives such as specializing in niche markets, adopting advanced technologies, and forging strategic alliances will be pivotal for agencies to overcome challenges and leverage significant growth prospects in the North American shipping industry.

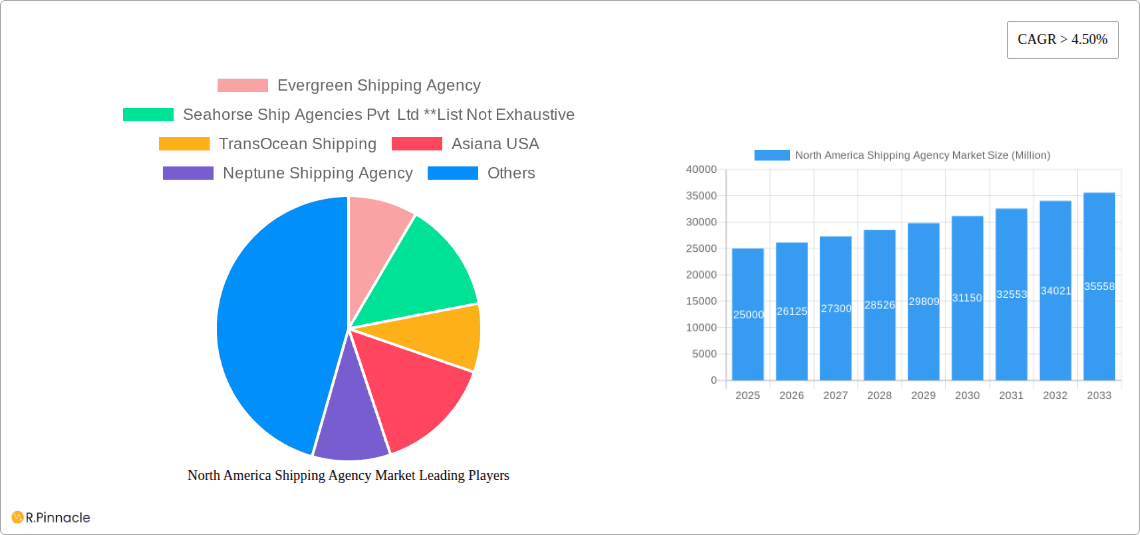

North America Shipping Agency Market Company Market Share

North America Shipping Agency Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Shipping Agency market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024.

North America Shipping Agency Market Structure & Innovation Trends

The North American Shipping Agency market exhibits a moderately concentrated structure, with key players holding significant market share. Evergreen Shipping Agency, Seahorse Ship Agencies Pvt Ltd, TransOcean Shipping, Asiana USA, Neptune Shipping Agency, North American Shipping Agencies (NASA), Lighthouse Shipping Agency Inc, GAC North America, United Shipping, and Moran Shipping Agency are prominent players, although the market is not limited to these entities. Market share data for 2025 estimates that the top five players collectively hold approximately xx% of the market, with Evergreen Shipping Agency estimated to command a leading xx% share.

Innovation is driven by the need for enhanced efficiency, automation, and digitalization within shipping operations. Regulatory frameworks, such as those governing port security and environmental compliance, significantly influence market dynamics. The rise of digital platforms and data analytics is transforming how agencies manage cargo, track shipments, and interact with clients. Product substitutes, such as direct-to-shipper arrangements, present competitive pressures. End-user demographics, primarily comprising large corporations, SMEs, and individual shippers, dictate demand variations. M&A activity within the sector is moderate; however, recent years have witnessed consolidation deals with values reaching an estimated xx Million in aggregate. For example, a recent merger between two medium-sized agencies resulted in a combined entity controlling xx% of the regional market.

- Market Concentration: Moderately concentrated

- Top 5 Player Market Share (2025 Estimate): xx%

- Recent M&A Deal Values (Aggregate): xx Million

North America Shipping Agency Market Dynamics & Trends

The North America Shipping Agency market is experiencing robust growth, driven by increasing global trade volumes, expansion of e-commerce, and the rise of containerization. Technological disruptions, such as the adoption of blockchain technology for enhanced transparency and security in shipping documentation, are reshaping market dynamics. Shippers increasingly prioritize streamlined processes, cost-effectiveness, and reliable service. Competitive dynamics are intense, with agencies focusing on differentiation strategies through specialized services, technology adoption, and strategic partnerships. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration by digital platforms is expected to increase from xx% in 2025 to xx% by 2033. This growth is primarily fueled by the increasing adoption of digital solutions by shipping agencies and the growing demand for efficient and transparent shipping processes. However, challenges such as geopolitical uncertainty, supply chain disruptions, and fluctuating fuel prices could impact growth trajectory.

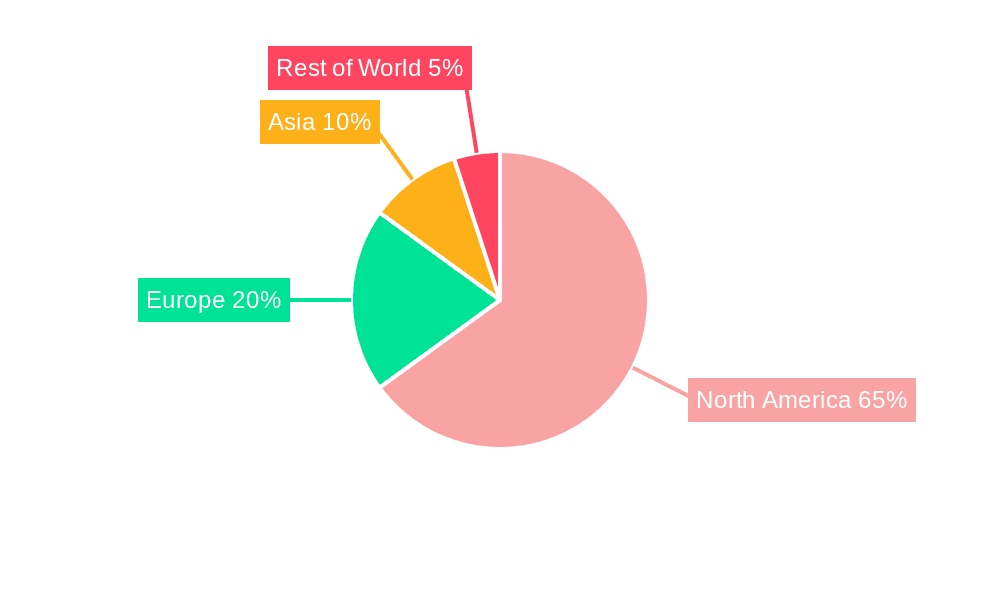

Dominant Regions & Segments in North America Shipping Agency Market

The West Coast region of North America, encompassing major ports like Los Angeles and Long Beach, currently dominates the market, driven by significant import-export activities. However, the East Coast is witnessing substantial growth due to infrastructure development and strategic investments.

By Type:

- Port Agency: This segment holds the largest market share, owing to its indispensable role in facilitating vessel operations. Key drivers include increasing port throughput, stringent regulatory compliance, and demand for specialized port services.

- Cargo Agency: This segment experiences steady growth, driven by the increasing volume of international trade and the rising demand for efficient cargo handling and documentation.

- Charter Agency: This segment demonstrates moderate growth, influenced by fluctuations in global shipping rates and charter demand.

- Others: This segment includes specialized agencies offering niche services, with growth tied to specific market demands.

By Application:

- Shipowners: This segment constitutes a major portion of the market, as shipowners rely heavily on agencies for comprehensive shipping support.

- Lessee: This segment is characterized by diverse needs, influenced by the specific requirements of the chartered vessels and cargo types.

Key drivers in the dominant regions include robust port infrastructure, favorable economic policies, and strategic geographic location.

North America Shipping Agency Market Product Innovations

Recent innovations focus on digital solutions, including advanced shipment tracking systems, online booking platforms, and data analytics tools that optimize logistics and enhance visibility. These technologies enhance efficiency, improve transparency, and streamline communications among stakeholders. Agencies are leveraging these advancements to offer competitive advantages, such as faster turnaround times, reduced errors, and improved cost control. The market is seeing a shift toward integrated platforms that provide end-to-end solutions for shippers, encompassing all aspects of the shipping process.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the North America Shipping Agency market by type (Port Agency, Cargo Agency, Charter Agency, Others) and application (Shipowner, Lessee). Each segment is analyzed in terms of its size, growth projections, and competitive dynamics. The Port Agency segment is projected to experience substantial growth, driven by increasing container volumes and infrastructure investments. The Cargo Agency segment is expected to maintain consistent growth, fueled by expanding global trade. The Charter Agency segment's growth will be influenced by global shipping rates. The Others segment will reflect the evolving demands for specialized services. By application, the Shipowner segment will continue to be a significant revenue contributor, while the Lessee segment will experience growth tied to charter activities.

Key Drivers of North America Shipping Agency Market Growth

Several factors contribute to the market's growth:

- Rising Global Trade: Increased international trade leads to higher demand for shipping agency services.

- E-commerce Expansion: The boom in e-commerce drives significant volumes of smaller shipments, impacting agency demand.

- Technological Advancements: Adoption of digital technologies enhances efficiency and expands services.

- Infrastructure Development: Investments in ports and logistics infrastructure further stimulate growth.

Challenges in the North America Shipping Agency Market Sector

The North American Shipping Agency market faces challenges:

- Regulatory Compliance: Stringent regulations related to security, environmental protection, and trade compliance add complexity and costs.

- Supply Chain Disruptions: Global events and logistical bottlenecks can significantly impact operational efficiency.

- Intense Competition: The market is competitive, requiring agencies to differentiate their services and adapt to changing dynamics.

Emerging Opportunities in North America Shipping Agency Market

Opportunities exist in:

- Specialised Services: Offering niche services catering to specific industries or cargo types.

- Digital Transformation: Implementing innovative digital technologies to streamline operations and offer enhanced services.

- Strategic Partnerships: Collaborating with other logistics players to create comprehensive service offerings.

Leading Players in the North America Shipping Agency Market Market

- Evergreen Shipping Agency

- Seahorse Ship Agencies Pvt Ltd

- TransOcean Shipping

- Asiana USA

- Neptune Shipping Agency

- North American Shipping Agencies (NASA)

- Lighthouse Shipping Agency Inc

- GAC North America

- United Shipping

- Moran Shipping Agency

Key Developments in North America Shipping Agency Market Industry

- Jan 2023: GAC North America launches a new digital platform for streamlined cargo management.

- May 2022: Merger between two smaller agencies expands regional market share.

- Oct 2021: Neptune Shipping Agency implements a new environmental compliance program.

Future Outlook for North America Shipping Agency Market Market

The North America Shipping Agency market is poised for continued growth, driven by global trade expansion, technological advancements, and infrastructure improvements. Agencies that embrace digital transformation, offer specialized services, and forge strategic partnerships will be well-positioned to capture significant market share. The long-term outlook remains positive, with growth potential exceeding xx Million by 2033.

North America Shipping Agency Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Shipowner

- 2.2. Lessee

North America Shipping Agency Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Shipping Agency Market Regional Market Share

Geographic Coverage of North America Shipping Agency Market

North America Shipping Agency Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Increase Marintime Trade Boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Shipping Agency Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Shipowner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Evergreen Shipping Agency

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seahorse Ship Agencies Pvt Ltd **List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TransOcean Shipping

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asiana USA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neptune Shipping Agency

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 North American Shipping Agencies (NASA)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lighthouse Shipping Agency Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GAC North America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 United Shipping

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Moran Shipping Agency

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Evergreen Shipping Agency

List of Figures

- Figure 1: North America Shipping Agency Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Shipping Agency Market Share (%) by Company 2025

List of Tables

- Table 1: North America Shipping Agency Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Shipping Agency Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Shipping Agency Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Shipping Agency Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Shipping Agency Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: North America Shipping Agency Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Shipping Agency Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Shipping Agency Market?

The projected CAGR is approximately 15.32%.

2. Which companies are prominent players in the North America Shipping Agency Market?

Key companies in the market include Evergreen Shipping Agency, Seahorse Ship Agencies Pvt Ltd **List Not Exhaustive, TransOcean Shipping, Asiana USA, Neptune Shipping Agency, North American Shipping Agencies (NASA), Lighthouse Shipping Agency Inc, GAC North America, United Shipping, Moran Shipping Agency.

3. What are the main segments of the North America Shipping Agency Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.29 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Increase Marintime Trade Boosting the market.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Shipping Agency Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Shipping Agency Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Shipping Agency Market?

To stay informed about further developments, trends, and reports in the North America Shipping Agency Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence