Key Insights

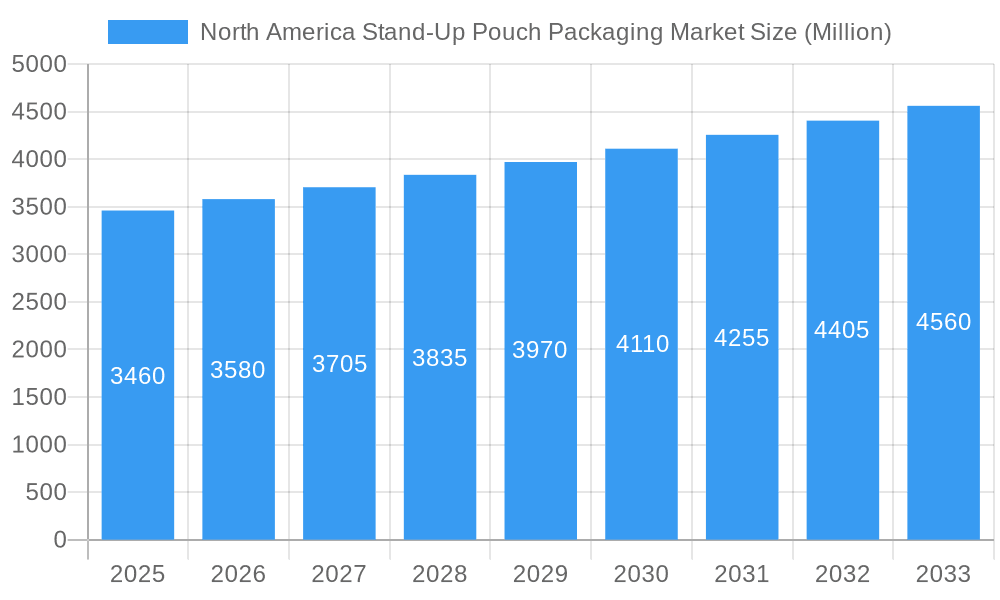

The North America stand-up pouch packaging market, valued at $3.46 billion in 2025, is projected to experience steady growth, driven by increasing consumer demand for convenient and sustainable packaging solutions. The market's Compound Annual Growth Rate (CAGR) of 3.48% from 2025 to 2033 indicates a consistent expansion, fueled by several key factors. The rising popularity of single-serve and on-the-go food and beverage products is a major catalyst, as stand-up pouches offer excellent portability and product preservation. Furthermore, the increasing adoption of sustainable packaging materials, such as bioplastics, is driving growth within the segment. The food and beverage sector remains the dominant end-user, but growth is also observed in medical and pharmaceutical packaging due to stand-up pouches' ability to maintain product sterility and extend shelf life. Within the material types, plastic remains the leading choice due to its versatility and cost-effectiveness, but the demand for eco-friendly alternatives, including paper-based and bioplastic pouches, is continuously increasing. The geographic distribution shows the United States as the largest market, followed by Canada, with potential growth in Mexico and the rest of North America. Competitive pressures from established players like Amcor PLC and Sonoco Products Company, as well as innovative smaller companies, further shape the market landscape, encouraging advancements in packaging technology and material science.

North America Stand-Up Pouch Packaging Market Market Size (In Billion)

The market's growth trajectory is expected to be influenced by factors including fluctuating raw material prices and evolving consumer preferences for more eco-conscious packaging options. However, the inherent advantages of stand-up pouches – superior barrier properties, reduced material usage compared to rigid containers, and enhanced shelf appeal – are expected to outweigh these challenges. This consistent demand, coupled with continuous innovation in pouch design and functionality, positions the North America stand-up pouch packaging market for continued, albeit moderate, expansion throughout the forecast period. Further segmentation analysis would reveal more granular insights into specific material types and end-use applications within this dynamic sector.

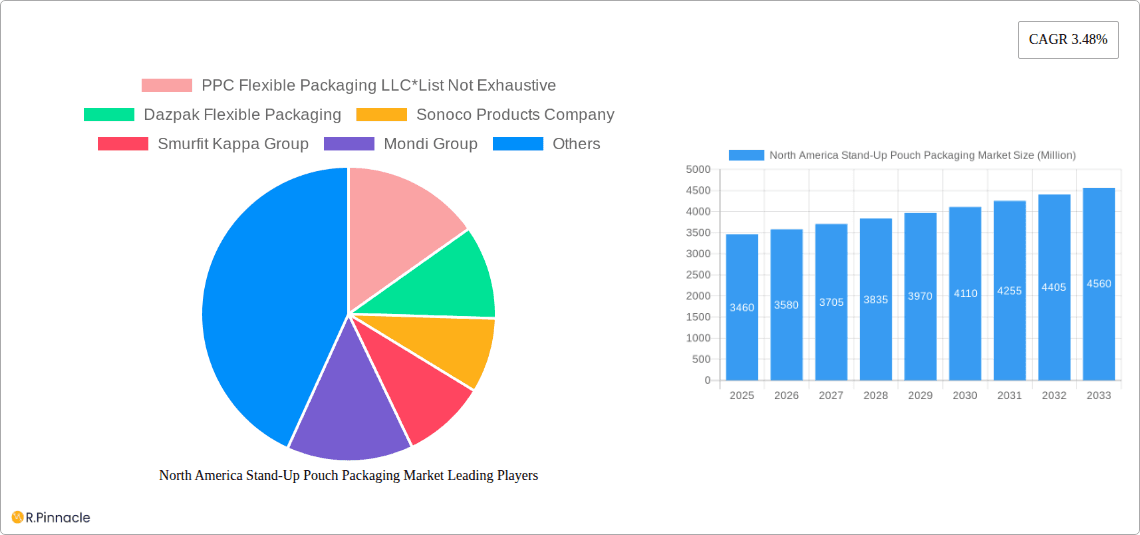

North America Stand-Up Pouch Packaging Market Company Market Share

North America Stand-Up Pouch Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America stand-up pouch packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report unveils the market's structure, dynamics, and future outlook. The market is segmented by pack type, material type, end-user, and country (United States and Canada). The report features a projected market value of xx Million by 2033, highlighting significant growth opportunities.

North America Stand-Up Pouch Packaging Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects influencing the North American stand-up pouch packaging market. The market is moderately concentrated, with key players such as Amcor PLC, Sonoco Products Company, and ProAmpac LLC holding significant market share (exact figures available in the full report). Innovation is driven by the increasing demand for sustainable packaging solutions, with a notable shift towards recyclable and compostable materials.

- Market Concentration: The market exhibits moderate concentration, with top 5 players holding approximately xx% of the market share in 2025.

- Innovation Drivers: Sustainability concerns, advancements in barrier technologies, and evolving consumer preferences are key innovation drivers.

- Regulatory Frameworks: Regulations concerning food safety, material recyclability, and labeling significantly impact market dynamics.

- Product Substitutes: Rigid packaging and other flexible packaging formats pose competitive pressure.

- M&A Activities: The recent acquisition of StePac by PPC Flexible Packaging in February 2023 exemplifies the strategic consolidation within the industry. The deal valued at xx Million demonstrates the desire to expand market share and product offerings. Further M&A activities are expected in the coming years.

- End-User Demographics: Growth is fuelled by the changing consumption patterns across food, beverages, and other end-use segments.

North America Stand-Up Pouch Packaging Market Dynamics & Trends

The North American stand-up pouch packaging market is experiencing robust growth, driven by several key factors. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033). Increased consumer demand for convenient and portable packaging, coupled with the rising popularity of single-serve and on-the-go products, significantly fuels market expansion. Technological advancements in material science, allowing for improved barrier properties and enhanced sustainability, are further bolstering market growth. The increasing adoption of e-commerce further expands the market for stand-up pouches, offering better protection during transit. Competitive dynamics are shaped by ongoing innovation, mergers and acquisitions, and the introduction of sustainable solutions. The market penetration of stand-up pouches in the food and beverage industry is anticipated to reach xx% by 2033.

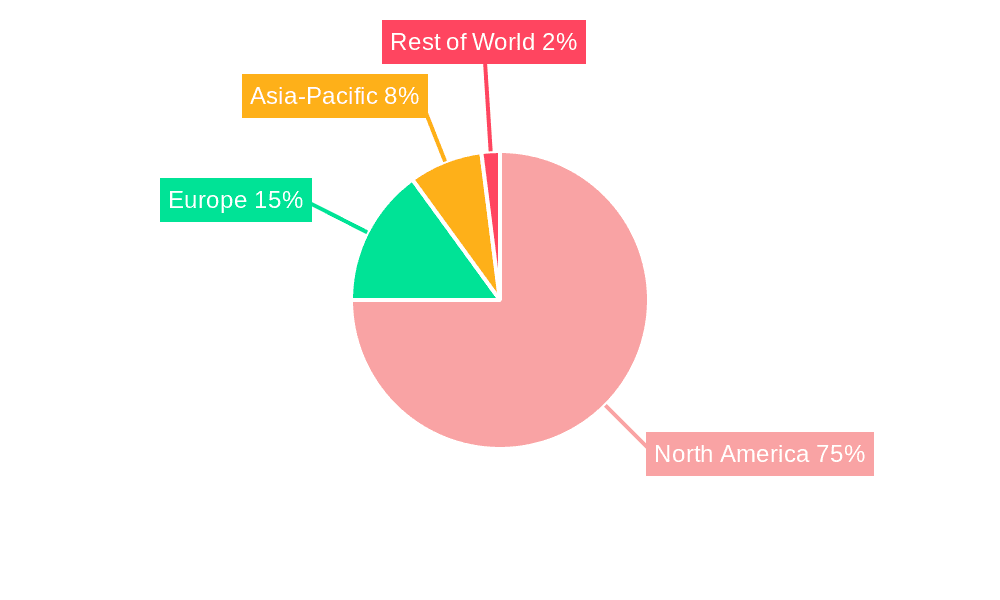

Dominant Regions & Segments in North America Stand-Up Pouch Packaging Market

The North American stand-up pouch packaging market is characterized by robust growth, with the United States leading the charge. This dominance is fueled by a combination of factors: a highly affluent consumer base with substantial discretionary spending, the maturity and dynamism of its food and beverage sectors, and a well-established ecosystem of advanced packaging manufacturers and technological innovators. Canada, while representing a smaller market share, remains a significant and steadily growing contributor, largely propelled by the increasing consumer preference for convenient and portable packaging solutions.

By Country:

- United States: The economic powerhouse of North America, its market leadership is underpinned by extensive consumer spending power, a sophisticated and resilient supply chain, and the significant presence of global leaders in packaging manufacturing. These companies consistently invest in research and development, driving innovation in materials and functionality.

- Canada: Though its market size is more modest compared to its southern neighbor, Canada presents a landscape of consistent and promising growth. The demand for stand-up pouches is escalating, driven by a growing population that values convenience and a lifestyle that favors on-the-go consumption of various products.

By Pack Type:

- Standard: This enduring segment continues to command the largest market share. Its widespread adoption is a testament to its inherent versatility, cost-effectiveness, and suitability for a broad spectrum of products.

- Retort: The retort pouch segment is experiencing a particularly strong upward trajectory. This growth is directly attributable to its exceptional ability to withstand high temperatures during sterilization, making it an ideal choice for shelf-stable food products that require extended shelf life without refrigeration.

- Aseptic: The aseptic pouch segment is also expanding significantly. Its key advantage lies in its capacity to preserve product integrity and extend shelf life by preventing microbial contamination, crucial for sensitive products like dairy, juices, and pharmaceuticals.

By Material Type:

- Plastic: Plastics, including Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), and increasingly, bioplastics, form the dominant material category. Their inherent flexibility, cost-efficiency, and excellent barrier properties make them highly sought after. The burgeoning adoption of bioplastics is a key growth driver, aligning with increasing environmental consciousness.

- Metal/Foil: Metalized or foil-lined pouches offer unparalleled barrier properties against light, oxygen, and moisture. This makes them indispensable for highly sensitive products that require maximum protection to maintain freshness and quality.

- Paper: The paper-based segment is witnessing a notable surge in adoption. This trend is directly linked to escalating global concerns about environmental sustainability and the growing consumer and regulatory demand for more eco-friendly packaging alternatives.

By End-User:

- Food: The food industry remains the largest and most influential end-user segment. The relentless demand for convenient, single-serving, and shelf-stable food products, from snacks and meals to pet food, fuels this segment's consistent expansion.

- Beverages: The beverages sector is demonstrating robust growth, with a notable shift towards stand-up pouches for a variety of drinks. Juices, smoothies, specialty coffees, teas, and functional beverages are increasingly opting for this packaging format due to its portability and consumer appeal.

- Medical and Pharmaceutical: This segment is experiencing steady growth, driven by the critical need for safe, secure, and tamper-evident packaging for medications, medical devices, and diagnostic kits. The ability of stand-up pouches to protect sensitive contents and ensure product integrity is highly valued.

North America Stand-Up Pouch Packaging Market Product Innovations

Recent innovations focus on sustainability and improved barrier properties. ProAmpac's launch of ProActive PCR retort pouches, containing up to 30% post-consumer recycled (PCR) material, exemplifies this trend. These pouches cater to the increasing demand for eco-friendly packaging solutions in the food industry, specifically for shelf-stable ready-to-eat products demanding high-heat resistance and barrier properties. Other innovations include advancements in material science, leading to lighter weight, more durable, and recyclable pouches.

Report Scope & Segmentation Analysis

This report comprehensively segments the North American stand-up pouch packaging market by pack type (standard, aseptic, retort, others), material type (plastic, metal/foil, paper), end-user (food, beverages, medical and pharmaceutical, pet food, home and personal care, others), and country (United States, Canada). Each segment's growth projections, market size, and competitive landscape are analyzed in detail. Growth rates and market size for each segment are detailed in the complete report.

Key Drivers of North America Stand-Up Pouch Packaging Market Growth

Several factors drive market growth, including:

- Increased demand for convenient and portable packaging: Consumers increasingly prefer single-serve and on-the-go products.

- Technological advancements in material science: Innovations lead to improved barrier properties and sustainability.

- Growth of e-commerce: Stand-up pouches offer better protection during transit.

- Growing consumer preference for sustainable packaging: Demand for eco-friendly solutions is propelling the market.

Challenges in the North America Stand-Up Pouch Packaging Market Sector

The market faces challenges such as:

- Fluctuations in raw material prices: Impacting production costs and profitability.

- Stringent regulatory requirements: Compliance costs can be significant.

- Intense competition: From both established and emerging players.

Emerging Opportunities in North America Stand-Up Pouch Packaging Market

Emerging opportunities include:

- Expansion into new markets: Untapped potential exists in certain end-use segments.

- Development of innovative packaging solutions: Addressing specific needs of various industries.

- Focus on sustainability: Providing eco-friendly and recyclable options.

Leading Players in the North America Stand-Up Pouch Packaging Market Market

- PPC Flexible Packaging LLC

- Dazpak Flexible Packaging

- Sonoco Products Company

- Smurfit Kappa Group

- Mondi Group

- Amcor PLC

- Clondalkin Group

- Glenroy Inc

- ProAmpac LLC

- Sealed Air Corporation

- Huhtamaki Oyj

Key Developments in North America Stand-Up Pouch Packaging Market Industry

- November 2023: ProAmpac launched its ProActive PCR retort pouches, a sustainable alternative to conventional retort options, containing up to 30% PCR material.

- February 2023: PPC Flexible Packaging acquired StePac, strengthening its market position and expanding its sustainable packaging solutions.

Future Outlook for North America Stand-Up Pouch Packaging Market Market

The North American stand-up pouch packaging market is poised for continued growth, driven by several factors, including the rising demand for sustainable packaging, ongoing product innovation, and the expansion of e-commerce. The market’s focus on sustainability and advancements in barrier technologies will shape future growth. Strategic acquisitions and partnerships will further consolidate the market, leading to greater efficiency and innovation. The market's potential remains high, with ample opportunities for growth and development.

North America Stand-Up Pouch Packaging Market Segmentation

-

1. Pack Type

- 1.1. Standard

- 1.2. Aseptic

- 1.3. Retort

- 1.4. Other Pack Types

-

2. Material Type

- 2.1. Plastic (PE, PP, PVC, EVOH, Bio-Plastics)

- 2.2. Metal/Foil

- 2.3. Paper

-

3. End User

- 3.1. Food

- 3.2. Beverages

- 3.3. Medical and Pharmaceutical

- 3.4. Pet Food

- 3.5. Home and Personal Care

- 3.6. Other End Users

North America Stand-Up Pouch Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Stand-Up Pouch Packaging Market Regional Market Share

Geographic Coverage of North America Stand-Up Pouch Packaging Market

North America Stand-Up Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Demand for Food and Beverage Expected to Grow in North America

- 3.2.2 thereby Contributing to the Market Growth; Standard Pouches Offer a High Level of Convenience (Available in Zipper

- 3.2.3 Slider

- 3.2.4 Spout Packs

- 3.2.5 Etc.) and Require Less Material Volumes as Compared to Alternative

- 3.3. Market Restrains

- 3.3.1. Addition of Sealing Process that Consumes Space and Resources

- 3.4. Market Trends

- 3.4.1. Standard Pack Type Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Stand-Up Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Pack Type

- 5.1.1. Standard

- 5.1.2. Aseptic

- 5.1.3. Retort

- 5.1.4. Other Pack Types

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic (PE, PP, PVC, EVOH, Bio-Plastics)

- 5.2.2. Metal/Foil

- 5.2.3. Paper

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Pet Food

- 5.3.5. Home and Personal Care

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Pack Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PPC Flexible Packaging LLC*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dazpak Flexible Packaging

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Smurfit Kappa Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Clondalkin Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Glenroy Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ProAmpac LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sealed Air Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huhtamaki Oyj

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 PPC Flexible Packaging LLC*List Not Exhaustive

List of Figures

- Figure 1: North America Stand-Up Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Stand-Up Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Pack Type 2020 & 2033

- Table 2: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Pack Type 2020 & 2033

- Table 6: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Stand-Up Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Stand-Up Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Stand-Up Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Stand-Up Pouch Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Stand-Up Pouch Packaging Market?

The projected CAGR is approximately 3.48%.

2. Which companies are prominent players in the North America Stand-Up Pouch Packaging Market?

Key companies in the market include PPC Flexible Packaging LLC*List Not Exhaustive, Dazpak Flexible Packaging, Sonoco Products Company, Smurfit Kappa Group, Mondi Group, Amcor PLC, Clondalkin Group, Glenroy Inc, ProAmpac LLC, Sealed Air Corporation, Huhtamaki Oyj.

3. What are the main segments of the North America Stand-Up Pouch Packaging Market?

The market segments include Pack Type, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Food and Beverage Expected to Grow in North America. thereby Contributing to the Market Growth; Standard Pouches Offer a High Level of Convenience (Available in Zipper. Slider. Spout Packs. Etc.) and Require Less Material Volumes as Compared to Alternative.

6. What are the notable trends driving market growth?

Standard Pack Type Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Addition of Sealing Process that Consumes Space and Resources.

8. Can you provide examples of recent developments in the market?

November 2023 - ProAmpac launched its ProActive PCR retort pouches, a sustainable alternative to conventional retort options. ProActive PCR Retort pouches are designed to reduce virgin plastics usage and contain up to 30% post-consumer recycled (PCR) material by mass. ProActive PCR Retort pouches are specifically designed for products such as shelf-stable ready-to-eat proteins, which demand ultra-high barrier and high-heat resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Stand-Up Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Stand-Up Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Stand-Up Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the North America Stand-Up Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence