Key Insights

The North American traffic signal recognition market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 11.35%. This growth is underpinned by the accelerating integration of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies, which are critically dependent on accurate traffic signal detection. Furthermore, evolving government mandates prioritizing road safety and accident reduction are significantly stimulating demand for these advanced recognition systems. The market is segmented by detection methodology (color, shape, and feature-based) and vehicle classification (passenger and commercial). While passenger vehicles currently lead market share, the commercial vehicle segment is anticipated to witness considerable growth, propelled by fleet management efficiencies and enhanced safety imperatives for larger vehicles. Ongoing innovations in computer vision and artificial intelligence are continually refining the precision and dependability of traffic signal recognition, facilitating broader deployment across diverse vehicle types. The seamless integration with connected vehicle ecosystems further amplifies system capabilities, enabling real-time traffic insights and predictive navigation. Leading market participants, including Toshiba, HELLA, Continental, Tesla, Bosch, Mobileye, DENSO, and Ford, are actively investing in research and development and forging strategic alliances to secure their competitive positions.

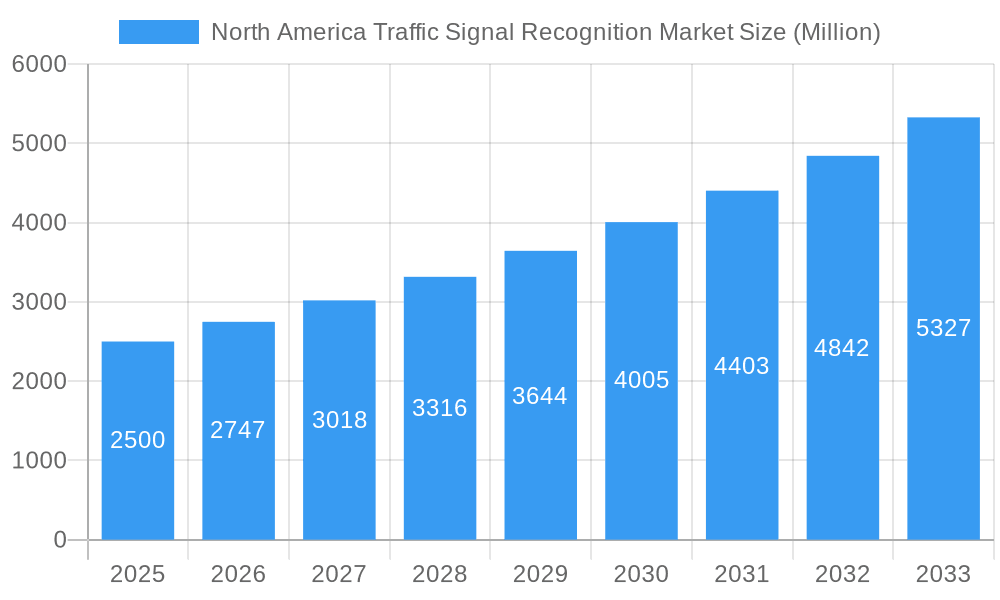

North America Traffic Signal Recognition Market Market Size (In Billion)

The North American region, comprising the United States, Canada, and Mexico, constitutes a key segment of the global traffic signal recognition landscape. Substantial investments in Intelligent Transportation Systems (ITS) across these territories further invigorate market expansion. While initial investment costs and potential cybersecurity concerns present challenges, the overall market trajectory remains highly favorable. The sustained development of sophisticated algorithms, advancements in sensor technology, and the escalating demand for secure and efficient transportation solutions are expected to surpass these impediments. The development of resilient and dependable solutions capable of performing under varied lighting, weather, and signal configurations will be paramount for sustained market growth over the forecast period. The estimated market size for North America is $11.3 billion in the base year of 2025.

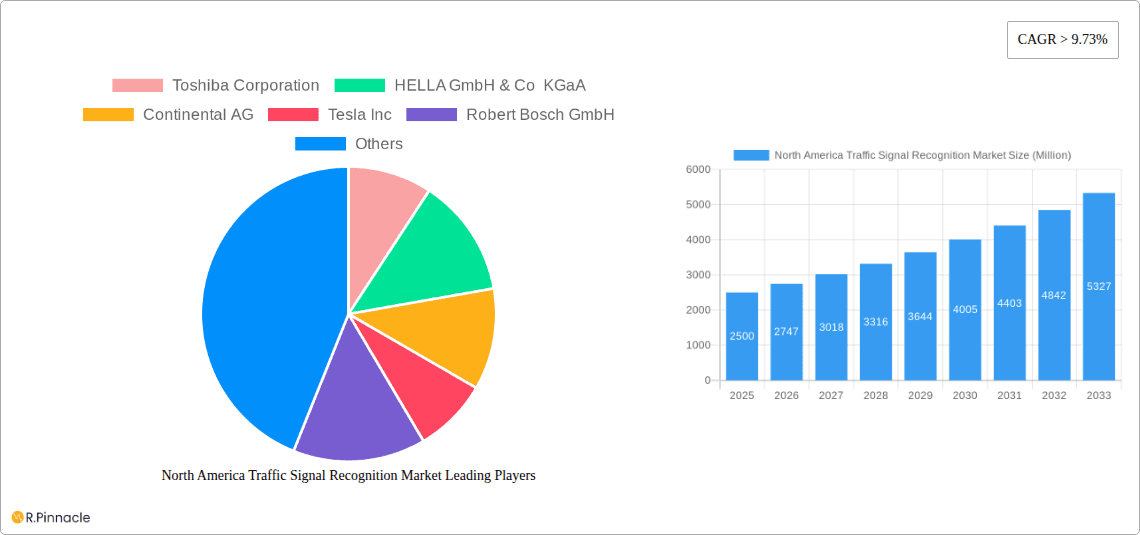

North America Traffic Signal Recognition Market Company Market Share

North America Traffic Signal Recognition Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Traffic Signal Recognition market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report meticulously examines market dynamics, technological advancements, and competitive landscapes to provide a clear understanding of this rapidly evolving sector.

North America Traffic Signal Recognition Market Market Structure & Innovation Trends

The North America Traffic Signal Recognition market exhibits a moderately concentrated structure, with key players like Toshiba Corporation, HELLA GmbH & Co KGaA, Continental AG, Tesla Inc, Robert Bosch GmbH, Mobileye Corporation, DENSO Corporation, and Ford Motor Company holding significant market share. Precise market share data for 2024 is unavailable (xx%), but the competitive landscape suggests a relatively even distribution among the top players. Innovation is primarily driven by advancements in AI, computer vision, and sensor technologies, leading to improved accuracy, reliability, and cost-effectiveness of traffic signal recognition systems. Regulatory frameworks, such as those promoting autonomous driving, are significantly impacting market growth. Product substitutes, such as GPS-based navigation systems, pose a competitive threat, although their limitations in certain scenarios maintain the demand for traffic signal recognition. The end-user demographic is primarily comprised of automotive manufacturers, Tier-1 suppliers, and technology companies involved in ADAS (Advanced Driver-Assistance Systems) and autonomous vehicle development. M&A activity has been moderate, with deal values estimated at approximately xx Million in the last five years, reflecting strategic partnerships aimed at bolstering technological capabilities and market reach.

- Market Concentration: Moderately concentrated

- Innovation Drivers: AI, Computer Vision, Sensor Technology

- Regulatory Impact: Significant influence from autonomous driving regulations

- M&A Activity (2019-2024): Estimated at xx Million

North America Traffic Signal Recognition Market Market Dynamics & Trends

The North America Traffic Signal Recognition market is experiencing robust growth, driven by several factors. The increasing adoption of ADAS and autonomous vehicles is a major catalyst, with traffic signal recognition becoming a critical component for safe and efficient autonomous navigation. Technological advancements, particularly in deep learning and edge computing, are enhancing the accuracy and processing speed of these systems. Consumer preference for advanced safety features is fueling demand, while competitive dynamics among leading players are driving innovation and price reductions. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Regions & Segments in North America Traffic Signal Recognition Market

While precise regional breakdowns are unavailable for all segments, early projections suggest that the California and Texas will be leading regions in the North America Traffic Signal Recognition Market. This dominance is primarily due to the presence of major automotive manufacturers, technology companies, and supportive regulatory frameworks.

Segment Dominance:

- Type: Feature-based detection is projected to hold the largest market share due to its superior accuracy and ability to handle diverse traffic signal designs.

- Vehicle Type: Passenger cars are currently the dominant segment, driven by the high volume of passenger vehicle production and sales. However, the commercial vehicle segment is expected to witness significant growth due to increasing demand for advanced safety features in commercial fleets.

Key Drivers:

- California: Strong technological innovation ecosystem, supportive government policies promoting autonomous driving.

- Texas: Large automotive manufacturing presence, robust infrastructure development.

North America Traffic Signal Recognition Market Product Innovations

Recent product innovations focus on enhancing the accuracy and robustness of traffic signal recognition systems. Improved algorithms based on deep learning and computer vision are enabling systems to reliably recognize signals under challenging conditions, such as poor visibility or obstructed views. The integration of these systems with other ADAS features is creating a synergistic effect, enhancing overall vehicle safety and automation capabilities. Miniaturization and reduced power consumption are also key trends, making these technologies more accessible for diverse applications.

Report Scope & Segmentation Analysis

This report segments the North America Traffic Signal Recognition market based on Type (Color-based Detection, Shape-based Detection, Feature-based Detection) and Vehicle Type (Passenger Cars, Commercial Vehicles). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. For example, the color-based detection segment is expected to show steady growth, driven by its relative simplicity and cost-effectiveness; however, the feature-based detection segment shows the most potential for growth due to its superior performance in varying conditions. The passenger car segment holds a larger market share currently, but the commercial vehicle segment is anticipated to witness faster growth due to increasing safety regulations.

Key Drivers of North America Traffic Signal Recognition Market Growth

The market's growth is fueled by several key factors: the rising adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles; continuous technological advancements in AI, computer vision, and sensor technologies; supportive government regulations promoting road safety and autonomous driving; and increasing consumer demand for vehicles equipped with advanced safety features.

Challenges in the North America Traffic Signal Recognition Market Sector

Challenges include high initial investment costs associated with implementing and integrating these systems; potential cybersecurity risks related to connected vehicle technology; the need for robust and reliable infrastructure supporting signal recognition functionality; and the necessity for standardization to ensure interoperability among different systems and vehicle manufacturers.

Emerging Opportunities in North America Traffic Signal Recognition Market

Emerging opportunities lie in the development of more sophisticated and integrated systems capable of handling diverse traffic signal configurations; integration with other vehicle sensors to create more comprehensive situational awareness; the expansion into new market segments, such as motorcycles and bicycles; and increased focus on improving system reliability and robustness in adverse weather conditions.

Leading Players in the North America Traffic Signal Recognition Market Market

- Toshiba Corporation

- HELLA GmbH & Co KGaA

- Continental AG

- Tesla Inc

- Robert Bosch GmbH

- Mobileye Corporation

- DENSO Corporation

- Ford Motor Company

Key Developments in North America Traffic Signal Recognition Market Industry

- January 2023: Continental and Ambarella, Inc. announced a strategic partnership to jointly develop AI-based hardware and software solutions for assisted and automated driving (AD), signifying a significant boost in the technological advancements within the market.

- May 2022: NI and key partners deployed a fleet of vehicles for ADAS/autonomous driving testing, highlighting the increasing emphasis on data-driven development and validation within the industry.

Future Outlook for North America Traffic Signal Recognition Market Market

The future of the North America Traffic Signal Recognition market appears bright. Continued advancements in AI and sensor technology, coupled with rising demand for autonomous vehicles and enhanced safety features, will drive significant market growth in the coming years. Strategic partnerships and collaborations between technology companies and automotive manufacturers will further accelerate innovation and adoption of these essential systems. The market is poised for significant expansion, creating lucrative opportunities for companies specializing in traffic signal recognition technology.

North America Traffic Signal Recognition Market Segmentation

-

1. Type

- 1.1. Color-based Detection

- 1.2. Shape-based Detection

- 1.3. Feature-based Detection

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

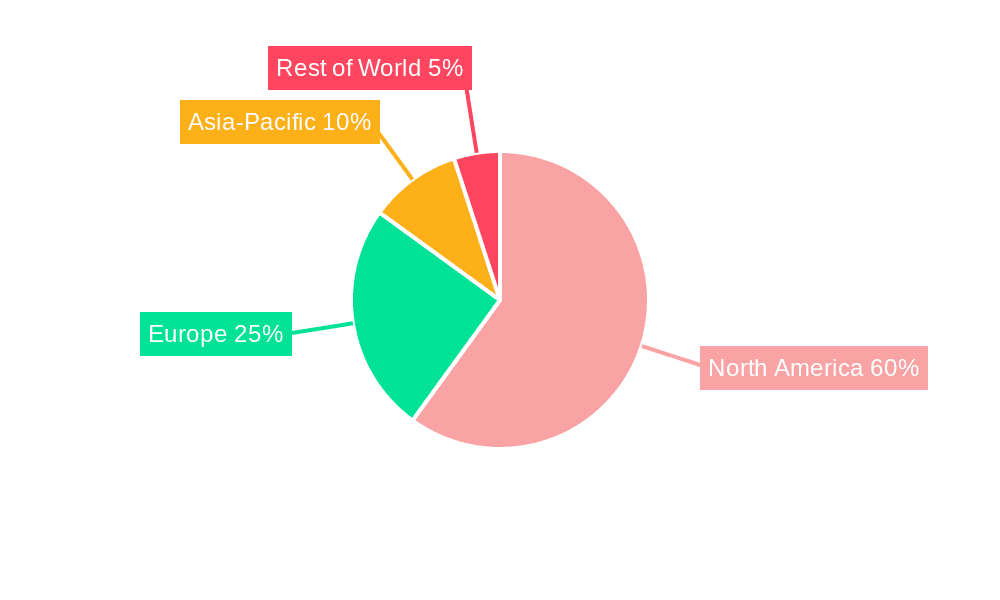

North America Traffic Signal Recognition Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Traffic Signal Recognition Market Regional Market Share

Geographic Coverage of North America Traffic Signal Recognition Market

North America Traffic Signal Recognition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments And Regulatory Bodies In North America Are Placing A Significant Emphasis On Improving Road Safety; Others

- 3.3. Market Restrains

- 3.3.1. High Implementation Costs; Others

- 3.4. Market Trends

- 3.4.1. Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Traffic Signal Recognition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Color-based Detection

- 5.1.2. Shape-based Detection

- 5.1.3. Feature-based Detection

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Traffic Signal Recognition Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Color-based Detection

- 6.1.2. Shape-based Detection

- 6.1.3. Feature-based Detection

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Traffic Signal Recognition Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Color-based Detection

- 7.1.2. Shape-based Detection

- 7.1.3. Feature-based Detection

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Traffic Signal Recognition Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Color-based Detection

- 8.1.2. Shape-based Detection

- 8.1.3. Feature-based Detection

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Toshiba Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 HELLA GmbH & Co KGaA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Continental AG

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Tesla Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Robert Bosch GmbH

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Mobileye Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 DENSO Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ford Motor Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Toshiba Corporation

List of Figures

- Figure 1: North America Traffic Signal Recognition Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Traffic Signal Recognition Market Share (%) by Company 2025

List of Tables

- Table 1: North America Traffic Signal Recognition Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Traffic Signal Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Traffic Signal Recognition Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Traffic Signal Recognition Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Traffic Signal Recognition Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Traffic Signal Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: North America Traffic Signal Recognition Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Traffic Signal Recognition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Traffic Signal Recognition Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Traffic Signal Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: North America Traffic Signal Recognition Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Traffic Signal Recognition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Traffic Signal Recognition Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Traffic Signal Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: North America Traffic Signal Recognition Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Traffic Signal Recognition Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Traffic Signal Recognition Market?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the North America Traffic Signal Recognition Market?

Key companies in the market include Toshiba Corporation, HELLA GmbH & Co KGaA, Continental AG, Tesla Inc, Robert Bosch GmbH, Mobileye Corporation, DENSO Corporation, Ford Motor Company.

3. What are the main segments of the North America Traffic Signal Recognition Market?

The market segments include Type, Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Governments And Regulatory Bodies In North America Are Placing A Significant Emphasis On Improving Road Safety; Others.

6. What are the notable trends driving market growth?

Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

High Implementation Costs; Others.

8. Can you provide examples of recent developments in the market?

January 2023: Continental and Ambarella, Inc. announced a strategic partnership to jointly develop scalable, end-to-end hardware and software solutions based on artificial intelligence (AI) for assisted and automated driving (AD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Traffic Signal Recognition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Traffic Signal Recognition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Traffic Signal Recognition Market?

To stay informed about further developments, trends, and reports in the North America Traffic Signal Recognition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence