Key Insights

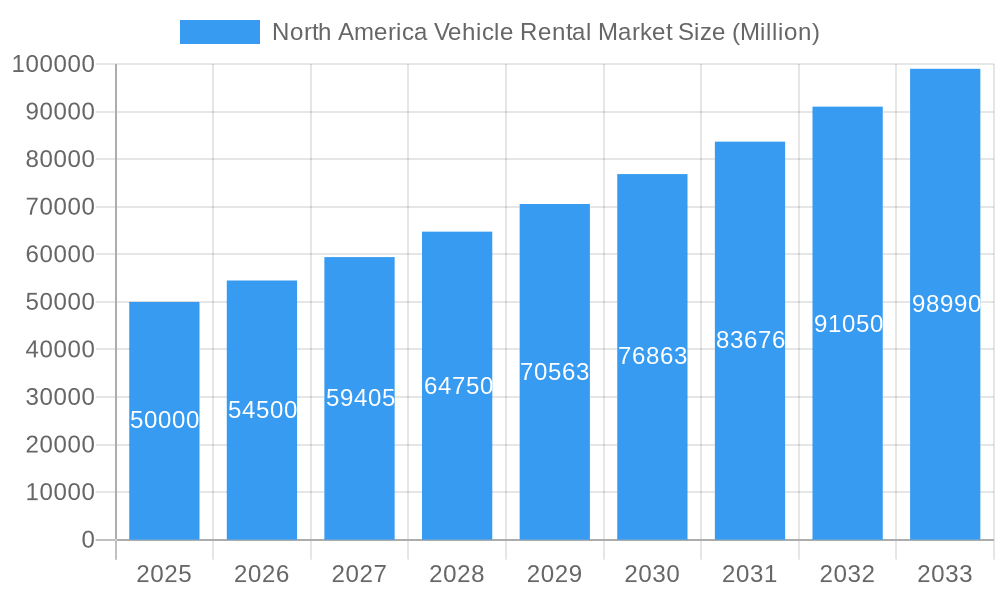

The North American vehicle rental market is projected to reach $48.55 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.6% from 2025 to 2033. This growth is primarily driven by robust tourism sectors in the United States and Canada, increased business travel, and the convenience of rental vehicles for various purposes. The proliferation of online booking platforms has further enhanced accessibility and adoption rates. The market is segmented by vehicle type (luxury, economy, MPVs), application (local, outstation), rental duration (short-term, long-term), and booking type (online, offline). Key geographical segments include the United States, Canada, and Rest of North America. Leading companies such as Enterprise Holdings Inc., Hertz Corporation, and Avis Budget Group Inc. are actively influencing the market through strategic expansions and technological innovations.

North America Vehicle Rental Market Market Size (In Billion)

Challenges to market expansion include fluctuations in fuel prices, potential impacts of economic downturns on consumer spending, and increasing competition from ride-sharing services. Despite these factors, the long-term outlook for the North American vehicle rental market remains positive. Factors such as ongoing infrastructure development, expanding tourism, and the increasing adoption of online rental solutions will continue to fuel growth. Opportunities are expected to arise from the growing demand for luxury vehicles and long-term rental solutions. A future emphasis on sustainable and technologically advanced vehicles is anticipated to align with evolving environmental concerns and consumer preferences.

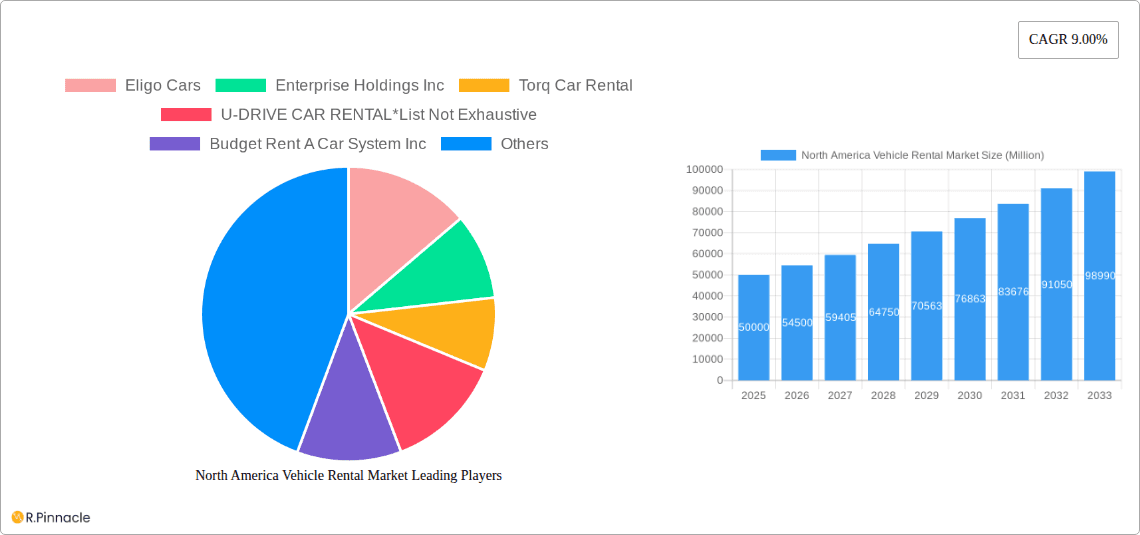

North America Vehicle Rental Market Company Market Share

This comprehensive report offers an in-depth analysis of the North American vehicle rental market, providing critical insights for industry stakeholders, investors, and strategists. The analysis covers the period from 2019 to 2033, with a specific focus on 2025, detailing market trends, competitive landscape, and future growth prospects. Market segmentation includes vehicle type, application, rental duration, booking type, and geographic regions (United States, Canada, Rest of North America). The report examines the market share and strategies of key players including Enterprise Holdings Inc., Hertz Corporation, and Avis Budget Group Inc.

North America Vehicle Rental Market Structure & Innovation Trends

The North American vehicle rental market exhibits a moderately concentrated structure, with a few major players holding significant market share. Enterprise Holdings Inc, Hertz Corporation, and Avis Budget Group Inc. are prominent examples, although the exact market share distribution varies across segments. The market is characterized by continuous innovation driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes.

Key aspects analyzed:

- Market Concentration: Analysis of market share held by top players.

- Innovation Drivers: Focus on technological advancements like connected car technologies and the adoption of electric vehicles (EVs).

- Regulatory Frameworks: Examination of regulations impacting the industry, including emissions standards and safety regulations.

- Product Substitutes: Assessment of alternative transportation modes, such as ride-sharing services and public transportation.

- End-User Demographics: Exploration of demographic trends influencing rental patterns, including age, income, and travel preferences.

- M&A Activities: Analysis of recent mergers and acquisitions (M&A) with deal values, impacting market consolidation and competitive landscape. For instance, Hertz's USD 4.2 Billion deal to purchase 100,000 Tesla EVs significantly impacted the market.

North America Vehicle Rental Market Market Dynamics & Trends

The North America vehicle rental market demonstrates a robust growth trajectory, driven by several key factors. The increasing popularity of road trips, coupled with the convenience of rental vehicles, fuels demand. Technological disruptions, such as the rise of online booking platforms and the integration of connected car technologies, are transforming the customer experience and operational efficiency. Consumer preferences are shifting towards diverse vehicle types, including luxury cars, SUVs, and EVs, necessitating continuous fleet diversification by rental companies. Competitive dynamics are intense, with players focusing on pricing strategies, loyalty programs, and service enhancements to gain market share. The CAGR for the forecast period (2025-2033) is projected at xx%, with significant market penetration anticipated in underserved areas.

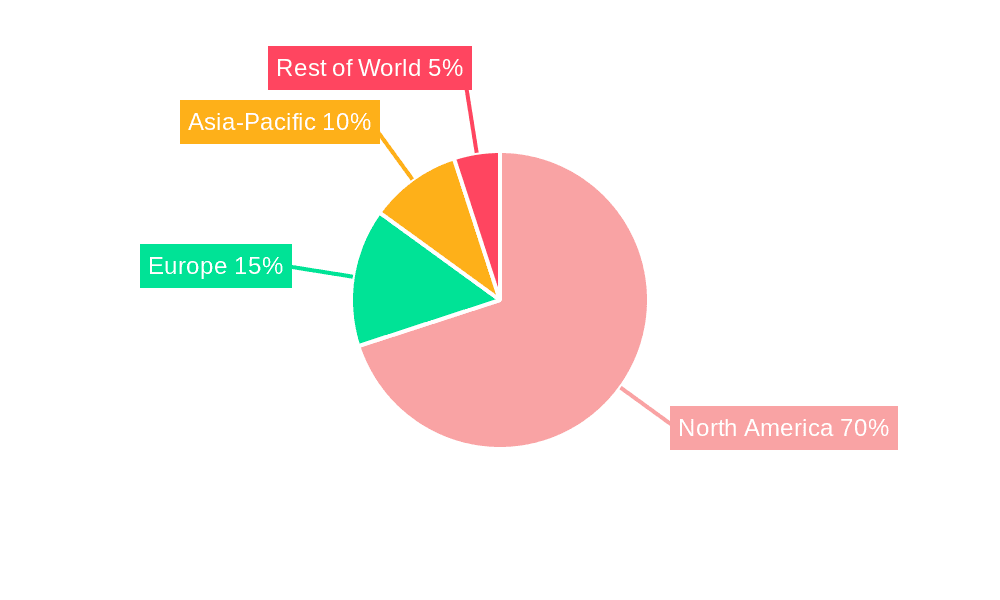

Dominant Regions & Segments in North America Vehicle Rental Market

The United States represents the largest segment within the North American vehicle rental market, owing to its extensive road network, robust tourism sector, and high vehicle ownership. Within the segment breakdown:

- By Vehicle Type: Economy cars currently dominate, followed by SUVs/MPVs. Luxury car rentals show moderate growth.

- By Application Type: Local usage constitutes the largest segment, while outstation rentals are also significant.

- By Rental Duration: Short-term rentals hold the majority of the market share.

- By Booking Type: Online booking is experiencing rapid growth, surpassing offline booking.

Key Drivers:

- United States: Strong tourism, extensive highway infrastructure, and a large population drive demand.

- Canada: Growing tourism and a relatively high per capita income contribute to market growth.

North America Vehicle Rental Market Product Innovations

The North American vehicle rental market is witnessing significant product innovations. The introduction of electric vehicles (EVs) into rental fleets reflects a move towards sustainability and caters to environmentally conscious consumers. Connected car technologies enhance the rental experience with features like remote access, real-time vehicle tracking, and personalized in-car entertainment. These innovations aim to provide enhanced convenience, efficiency, and cost-effectiveness for rental companies and customers. The market fit of these innovations is exceptionally strong given increasing consumer demand for eco-friendly options and technology-driven services.

Report Scope & Segmentation Analysis

This report segments the North American vehicle rental market comprehensively:

- By Vehicle Type: Economy Cars, Luxury Cars, Multi-Purpose Vehicles (MPVs), Others. Growth projections vary significantly across segments, with EVs expected to see particularly strong growth.

- By Application Type: Local Usage, Outstation, Others. Market size and competitive dynamics are analyzed for each application.

- By Rental Duration: Short Term, Long Term. Long-term rentals present a growing market opportunity.

- By Booking Type: Online Booking, Offline Booking. Online booking platforms are transforming the market.

- By Country: United States, Canada, Rest of North America. The United States dominates, followed by Canada.

Each segment’s growth is analyzed, along with detailed market size estimations and competitive landscapes.

Key Drivers of North America Vehicle Rental Market Growth

Several factors contribute to the growth of the North American vehicle rental market:

- Tourism Growth: The increase in domestic and international tourism fuels demand for rental cars.

- Technological Advancements: Connected car technology and EV adoption are enhancing the customer experience and fleet efficiency.

- Rising Disposable Incomes: Increased disposable incomes allow more people to afford rental vehicles.

- Improved Infrastructure: Expansion of road networks and airports facilitates greater travel.

Challenges in the North America Vehicle Rental Market Sector

The North American vehicle rental market faces challenges, including:

- Fluctuating Fuel Prices: Fuel price volatility affects rental costs and profitability.

- Supply Chain Disruptions: Global supply chain issues can impact vehicle availability.

- Intense Competition: The market is highly competitive, with established players and new entrants vying for market share.

- Regulatory Changes: Changes in environmental regulations may impact fleet composition and operating costs.

Emerging Opportunities in North America Vehicle Rental Market

The North American vehicle rental market presents several emerging opportunities:

- Sustainable Transportation: Growing demand for eco-friendly vehicles (EVs) offers significant growth potential.

- Subscription-Based Models: Subscription models can provide predictable revenue streams for rental companies.

- Expansion into Underserved Markets: Reaching smaller towns and rural areas can unlock new customer bases.

- Technological Integration: Further integration of technology for personalized services and enhanced customer experience.

Leading Players in the North America Vehicle Rental Market Market

- Eligo Cars

- Enterprise Holdings Inc

- Torq Car Rental

- U-DRIVE CAR RENTAL

- Budget Rent A Car System Inc

- Hertz Corporation

- Sixt SE

- Europcar Mobility Group

- Dollar Rent A Car Inc

- Avis Budget Group Inc

Key Developments in North America Vehicle Rental Market Industry

- June 2022: Hertz's USD 4.2 billion deal to purchase 100,000 Tesla EVs significantly impacts the EV segment and sets a precedent for industry adoption.

- September 2021: Enterprise Holdings' collaboration with Microsoft to integrate connected car technology enhances customer experience and operational efficiency.

- October 2021: Enterprise Holdings' acquisition of Walker Vehicle Rentals expands its commercial vehicle rental segment.

Future Outlook for North America Vehicle Rental Market Market

The North American vehicle rental market is poised for continued growth, driven by increasing tourism, technological advancements, and evolving consumer preferences. The shift towards electric vehicles, the adoption of subscription models, and the expansion into underserved markets present significant opportunities for growth. Strategic partnerships, technological innovation, and efficient operations will be crucial for companies to succeed in this dynamic market.

North America Vehicle Rental Market Segmentation

-

1. Vehicle Type

- 1.1. Luxury Cars

- 1.2. Economy Cars

- 1.3. Multi Purpose Vehicles (MPV)

- 1.4. Others

-

2. Application Type

- 2.1. Local Usage

- 2.2. Outstation

- 2.3. Others

-

3. Rental Duration

- 3.1. Short term

- 3.2. Long term

-

4. Booking type

- 4.1. Online booking

- 4.2. Offline booking

North America Vehicle Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vehicle Rental Market Regional Market Share

Geographic Coverage of North America Vehicle Rental Market

North America Vehicle Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Construction Industry

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost of Construction Equipment

- 3.4. Market Trends

- 3.4.1. Short term Rental Segment of Market Expected to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicle Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Luxury Cars

- 5.1.2. Economy Cars

- 5.1.3. Multi Purpose Vehicles (MPV)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Local Usage

- 5.2.2. Outstation

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Rental Duration

- 5.3.1. Short term

- 5.3.2. Long term

- 5.4. Market Analysis, Insights and Forecast - by Booking type

- 5.4.1. Online booking

- 5.4.2. Offline booking

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Eligo Cars

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enterprise Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Torq Car Rental

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U-DRIVE CAR RENTAL*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Budget Rent A Car System Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hertz Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sixt SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Europcar Mobility Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dollar Rent A Car Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avis Budget Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Eligo Cars

List of Figures

- Figure 1: North America Vehicle Rental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Vehicle Rental Market Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicle Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Vehicle Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: North America Vehicle Rental Market Revenue billion Forecast, by Rental Duration 2020 & 2033

- Table 4: North America Vehicle Rental Market Revenue billion Forecast, by Booking type 2020 & 2033

- Table 5: North America Vehicle Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Vehicle Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: North America Vehicle Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: North America Vehicle Rental Market Revenue billion Forecast, by Rental Duration 2020 & 2033

- Table 9: North America Vehicle Rental Market Revenue billion Forecast, by Booking type 2020 & 2033

- Table 10: North America Vehicle Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Vehicle Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Vehicle Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Vehicle Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicle Rental Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the North America Vehicle Rental Market?

Key companies in the market include Eligo Cars, Enterprise Holdings Inc, Torq Car Rental, U-DRIVE CAR RENTAL*List Not Exhaustive, Budget Rent A Car System Inc, Hertz Corporation, Sixt SE, Europcar Mobility Group, Dollar Rent A Car Inc, Avis Budget Group Inc.

3. What are the main segments of the North America Vehicle Rental Market?

The market segments include Vehicle Type, Application Type, Rental Duration, Booking type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Construction Industry.

6. What are the notable trends driving market growth?

Short term Rental Segment of Market Expected to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

High Maintenance Cost of Construction Equipment.

8. Can you provide examples of recent developments in the market?

In June 2022, Hertz Company announced a USD 4.2 billion deal to purchase 100,000 Tesla fully electric vehicles (EVs) by the end of 2022 set off a race among rental car agencies. Hertz did not state the overall number of vehicles in its fleet so it's unknown how many Teslas are available in the more than 30 markets currently offering EVs, which now also include the first of the 65,000 Polestar 2s - an EV brand jointly owned by Volvo and its Chinese parent Geely which has planned to go public through a SPAC deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicle Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicle Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicle Rental Market?

To stay informed about further developments, trends, and reports in the North America Vehicle Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence