Key Insights

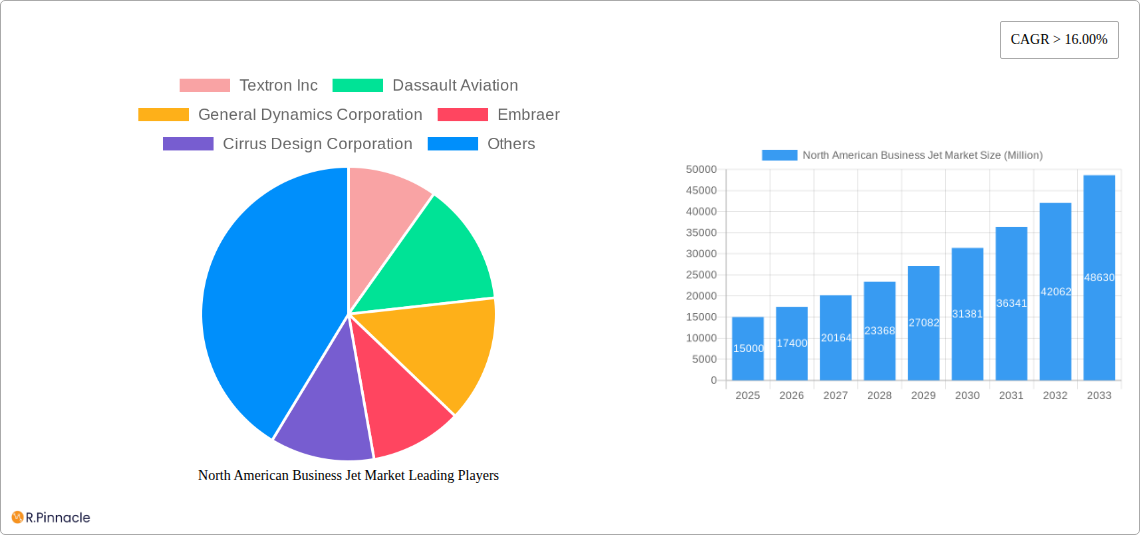

The North American business jet market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 16% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a recovering economy and increased corporate investment are fueling demand for efficient and luxurious private air travel. Secondly, technological advancements in aircraft design, leading to improved fuel efficiency and enhanced performance, are making business jets more attractive. Furthermore, the increasing preference for personalized travel experiences, bypassing the hassles of commercial flights, significantly contributes to market growth. Segment-wise, the large jet category commands a substantial share, driven by high-net-worth individuals and corporations seeking greater comfort and capacity. The United States remains the dominant market within North America, followed by Canada and Mexico, reflecting the region’s strong economic activity and established business aviation infrastructure. However, regulatory changes and increasing operating costs pose potential restraints on market expansion. Competition among established players like Textron, Dassault, General Dynamics, Embraer, Cirrus Design, Pilatus, Bombardier, and Honda is fierce, leading to innovation and price optimization.

The forecast for 2025-2033 indicates continued market expansion, influenced by the factors mentioned above. Assuming a market size of $15 billion in 2025, the CAGR of 16% translates to substantial growth over the forecast period. This necessitates strategic adaptations by manufacturers to stay ahead of the curve, including focusing on sustainability initiatives to align with evolving environmental concerns, and incorporating innovative technologies to enhance the overall customer experience. The long-term outlook remains positive, with potential for further market expansion driven by new market entrants and sustained economic progress across North America. This vibrant market presents significant opportunities for investors and stakeholders alike.

This comprehensive report provides an in-depth analysis of the North American business jet market, covering the period from 2019 to 2033. It offers valuable insights for industry professionals, investors, and stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The report leverages extensive data analysis to forecast market trends and provide actionable recommendations.

North American Business Jet Market Structure & Innovation Trends

The North American business jet market exhibits a moderately concentrated structure, with key players like Textron Inc, Dassault Aviation, General Dynamics Corporation, Embraer, and Bombardier Inc holding significant market share. Market share fluctuates based on product launches, M&A activity, and overall economic conditions. Innovation is driven by increasing demand for enhanced cabin comfort, fuel efficiency, and advanced avionics. Regulatory frameworks, such as those concerning emissions and safety, significantly impact market dynamics. Product substitutes, such as commercial airline services, pose a competitive threat, particularly for shorter flights. End-user demographics are shifting towards younger, tech-savvy business professionals and high-net-worth individuals. M&A activity within the sector remains significant, with deal values varying depending on the size and strategic importance of the acquired company. For example, in the past five years, M&A deal values averaged approximately xx Million, significantly impacting market consolidation and competitive landscapes.

North American Business Jet Market Market Dynamics & Trends

The North American business jet market is characterized by a complex interplay of factors influencing its growth trajectory. The historical period (2019-2024) witnessed a CAGR of xx%, driven by factors such as robust economic growth in certain sectors, rising disposable incomes among high-net-worth individuals, and technological advancements resulting in improved aircraft performance and passenger experience. However, the market also experienced fluctuations due to global economic downturns and the impact of events such as the COVID-19 pandemic. The forecast period (2025-2033) is projected to exhibit a CAGR of xx%, with market penetration expected to reach xx% by 2033. Consumer preferences are increasingly geared towards sustainable aviation practices, prompting manufacturers to invest in fuel-efficient designs and alternative propulsion technologies. Technological disruptions, particularly in areas such as autonomous flight and advanced materials, will continue shaping the market landscape. Competitive dynamics are marked by fierce competition among established players and the emergence of new entrants focusing on niche segments.

Dominant Regions & Segments in North American Business Jet Market

The United States remains the dominant market in North America, accounting for the largest share of business jet sales and operations. This dominance is attributed to several factors:

- Robust economic conditions: A strong economy fuels demand for private aviation services among businesses and high-net-worth individuals.

- Extensive airport infrastructure: A well-developed network of airports catering to private aviation supports operations.

- Favorable regulatory environment: Relatively less stringent regulations compared to some other regions facilitate business jet operations.

Among body types, the Light Jet segment is currently the largest, benefiting from relatively lower acquisition costs and operational expenses making it accessible to a wider range of businesses and individual owners. However, the Mid-Size Jet segment is anticipated to witness significant growth, driven by the increasing demand for larger cabin space and enhanced amenities among high-net-worth individuals and corporations. While Canada and Mexico also contribute significantly, their market shares remain comparatively smaller. The “Rest of North America” segment represents a smaller, albeit growing, market characterized by niche applications and specific regional demands.

North American Business Jet Market Product Innovations

Recent product innovations within the North American business jet market are largely focused on improving fuel efficiency, enhancing passenger comfort, and integrating advanced technologies such as improved avionics and connectivity solutions. Manufacturers are actively pursuing designs that incorporate sustainable materials and technologies, aiming to reduce environmental impact. Competition is driving innovation, with manufacturers striving to offer superior features, performance, and cost-effectiveness to attract customers. The integration of artificial intelligence and machine learning is transforming aspects like predictive maintenance and flight optimization.

Report Scope & Segmentation Analysis

This report segments the North American business jet market based on body type (Large Jet, Light Jet, Mid-Size Jet) and country (Canada, Mexico, United States, Rest of North America). Each segment's growth projections, market sizes (in Million), and competitive dynamics are analyzed thoroughly. The Light Jet segment is projected to grow at a CAGR of xx% during the forecast period, while the Mid-Size Jet segment is projected to experience even faster growth at xx%. Large Jet segments growth is projected at xx%. The United States will continue to dominate the market share throughout the forecast period, with consistent growth in all three jet categories. Canada and Mexico are expected to experience moderate growth, reflecting their own economic factors.

Key Drivers of North American Business Jet Market Growth

Several factors drive the growth of the North American business jet market: Firstly, the increasing wealth concentration amongst individuals and corporations fuels the demand for faster and more convenient travel. Secondly, technological improvements continue to enhance fuel efficiency and passenger comfort, leading to a rise in market appeal. Thirdly, supportive regulatory environments in certain regions simplify the operational aspects of private jets. Lastly, expansion in business travel and tourism creates more opportunities for private jet charters and fractional ownership models.

Challenges in the North American Business Jet Market Sector

The North American business jet market faces several challenges, including the volatile nature of fuel prices, which significantly impact operational costs. Supply chain disruptions and component shortages can lead to production delays and increased costs. Furthermore, stringent environmental regulations, aimed at reducing carbon emissions, are placing pressures on manufacturers to develop more sustainable technologies. Intense competition among established players further limits profit margins for all companies involved.

Emerging Opportunities in North American Business Jet Market

The market presents numerous opportunities, including the rising demand for fractional ownership and charter services, which makes private air travel more accessible. The development of advanced sustainable aviation fuels and electric propulsion technologies offers significant potential for growth and reduced environmental impact. Finally, emerging markets in the “Rest of North America” and expansion into new customer segments promise untapped growth potential for visionary companies.

Leading Players in the North American Business Jet Market Market

- Textron Inc

- Dassault Aviation

- General Dynamics Corporation

- Embraer

- Cirrus Design Corporation

- Pilatus Aircraft Ltd

- Bombardier Inc

- Honda Motor Co Ltd

Key Developments in North American Business Jet Market Industry

- June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at St. Louis Downtown Airport, representing a USD 28.5 Million capital investment. This expansion signifies Gulfstream's commitment to enhancing its production capacity and meeting growing market demand.

- June 2023: Gulfstream Aerospace Corp. announced that the super-midsize Gulfstream G280 has been cleared for operations at France’s Airport of the Gulf of Saint-Tropez. This expansion of operational capabilities highlights the aircraft's versatility and enhances its market appeal.

- October 2023: Textron Aviation announced a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, with options for 16 additional aircraft. This deal underscores strong market demand for Cessna Citation jets and indicates potential growth in the private jet charter segment.

Future Outlook for North American Business Jet Market Market

The North American business jet market is poised for continued growth, driven by sustained economic expansion in key sectors, increasing affluence, and ongoing technological advancements focused on improving fuel efficiency and customer experience. Strategic partnerships, mergers, and acquisitions are anticipated to further shape the market landscape, while the integration of new technologies will open avenues for enhancing operational efficiency and cost-effectiveness, creating an exciting outlook for this industry.

North American Business Jet Market Segmentation

-

1. Body Type

- 1.1. Large Jet

- 1.2. Light Jet

- 1.3. Mid-Size Jet

North American Business Jet Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Business Jet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing preferences for private travel and the rising HNWI population are driving the demand for business jets in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Business Jet Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Large Jet

- 5.1.2. Light Jet

- 5.1.3. Mid-Size Jet

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. United States North American Business Jet Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North American Business Jet Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North American Business Jet Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North American Business Jet Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Textron Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dassault Aviation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Dynamics Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Embraer

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cirrus Design Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pilatus Aircraft Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bombardier Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Honda Motor Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Textron Inc

List of Figures

- Figure 1: North American Business Jet Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North American Business Jet Market Share (%) by Company 2024

List of Tables

- Table 1: North American Business Jet Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North American Business Jet Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: North American Business Jet Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North American Business Jet Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North American Business Jet Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 10: North American Business Jet Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North American Business Jet Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Business Jet Market?

The projected CAGR is approximately > 16.00%.

2. Which companies are prominent players in the North American Business Jet Market?

Key companies in the market include Textron Inc, Dassault Aviation, General Dynamics Corporation, Embraer, Cirrus Design Corporation, Pilatus Aircraft Ltd, Bombardier Inc, Honda Motor Co Ltd.

3. What are the main segments of the North American Business Jet Market?

The market segments include Body Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing preferences for private travel and the rising HNWI population are driving the demand for business jets in the region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Textron Aviation announced that it entered a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, with options for 16 additional aircraft. Fly Alliance is expected to use the aircraft for its luxury private jet charter operations. It expected the delivery of the first aircraft, an XLS Gen2, in 2023.June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at St. Louis Downtown Airport. With this latest expansion, Gulfstream expects to increase operations at the site while modernizing its existing spaces by adding new, state-of-the-art equipment and tooling, representing a total capital investment of USD 28.5 million.June 2023: Gulfstream Aerospace Corp. announced the super-midsize Gulfstream G280 has been cleared for operations at France’s Airport of the Gulf of Saint-Tropez located in La Môle. The aircraft recently flew several takeoff and landing demonstrations at the short-field airport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Business Jet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Business Jet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Business Jet Market?

To stay informed about further developments, trends, and reports in the North American Business Jet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence