Key Insights

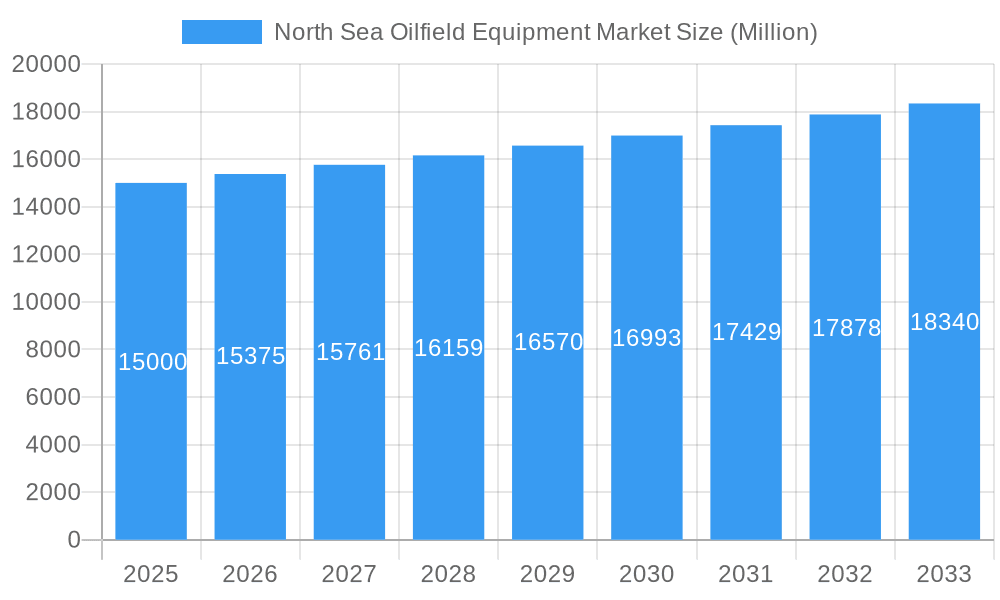

The North Sea oilfield equipment market is projected for robust growth, with a projected Compound Annual Growth Rate (CAGR) of 5.9%. This expansion is driven by critical factors including the modernization of aging infrastructure and ongoing exploration for new reserves. The market is anticipated to reach a size of 137.71 billion by 2025. Key growth catalysts include the increasing demand for advanced drilling and production technologies aimed at boosting efficiency and resource optimization, alongside the imperative for adopting sustainable solutions due to stringent environmental regulations. The market is segmented by equipment type, covering drilling, production, and auxiliary equipment. Major industry participants such as Superior Energy Services, Herrenknecht, National Oilwell Varco, Schlumberger, Tenaris, Weatherford, Baker Hughes, and Halliburton are leading the market through their technological prowess and established global presence.

North Sea Oilfield Equipment Market Market Size (In Billion)

Despite challenges posed by volatile oil prices and geopolitical uncertainties, the long-term outlook for the North Sea oilfield equipment market remains positive, supported by the persistent global demand for energy and continuous technological innovation. The regional market concentration aligns with significant oil and gas operations in the UK, Norway, and Denmark. Governmental policies and investments in renewable energy are also expected to influence technology adoption rates and overall market trajectory.

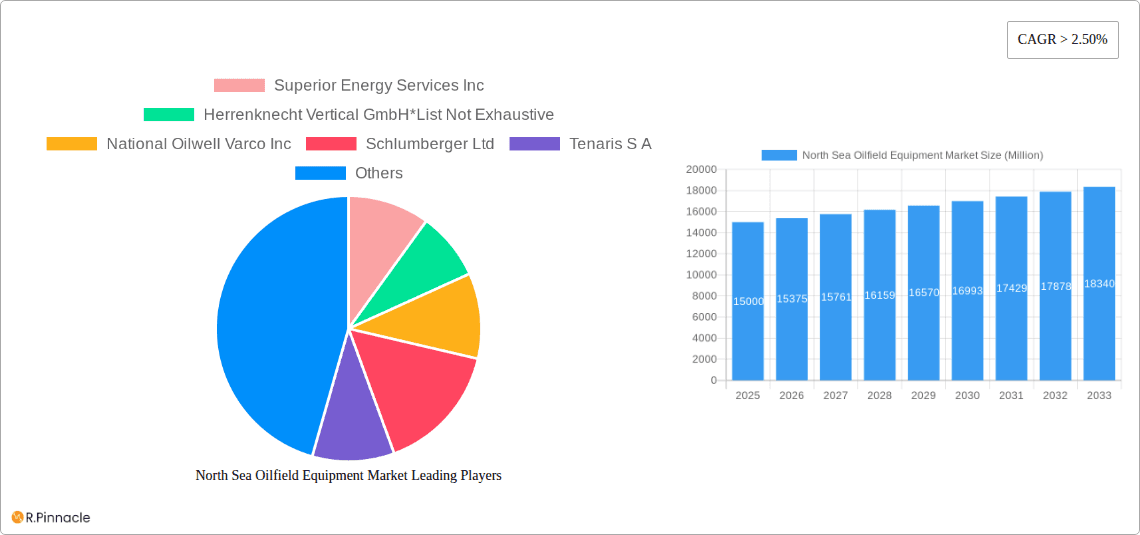

North Sea Oilfield Equipment Market Company Market Share

The North Sea's considerable oil and gas reserves continue to stimulate demand for specialized equipment, even as some mature fields experience declining production. Enhanced oil recovery (EOR) techniques and new field developments are key contributors to sustained market growth. The drilling equipment segment is a significant revenue driver due to ongoing needs for infrastructure upgrades and replacements. Concurrently, the production equipment segment is poised for substantial expansion, driven by efforts to maximize output from existing resources and newly discovered reserves. This strategic focus necessitates investment in innovation, particularly in automation and digitalization, by key market players. The market's consolidated nature, characterized by strategic mergers and acquisitions aimed at acquiring new technologies and expanding market reach, will likely impact pricing and market dynamics throughout the forecast period. Thorough analysis of governmental policies, including environmental regulations and tax incentives, is crucial for accurate forecasting and strategic planning in this dynamic sector.

North Sea Oilfield Equipment Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North Sea oilfield equipment market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report leverages extensive data analysis and expert insights to forecast market trends and identify lucrative opportunities within this dynamic sector. Projected market values are in Millions.

North Sea Oilfield Equipment Market Structure & Innovation Trends

The North Sea oilfield equipment market exhibits a moderately concentrated structure, with key players like Schlumberger Ltd, Baker Hughes Company, Halliburton Company, National Oilwell Varco Inc, Tenaris S A, Weatherford International PLC, Superior Energy Services Inc, and Herrenknecht Vertical GmbH holding significant market share. However, the presence of numerous smaller, specialized companies contributes to a competitive landscape. Market share dynamics are influenced by technological advancements, M&A activity, and evolving regulatory frameworks. Innovation is driven by the need for improved efficiency, reduced environmental impact, and enhanced safety in offshore operations. Recent M&A deals, while not publicly disclosed in full detail, suggest a total value exceeding xx Million in the past five years. This consolidation trend is expected to continue, shaping the market's competitive dynamics.

- Market Concentration: Moderately concentrated, with significant players holding substantial shares, but also a large number of smaller competitors.

- Innovation Drivers: Demand for enhanced efficiency, reduced environmental footprint, and improved safety standards.

- Regulatory Frameworks: Stringent regulations concerning safety, environmental protection, and operational standards heavily influence market dynamics.

- Product Substitutes: Limited direct substitutes, but technological advancements lead to continuous improvement of existing equipment.

- End-User Demographics: Primarily major oil and gas operators and their associated service providers.

- M&A Activities: Significant M&A activity observed, with deal values exceeding xx Million over the past five years.

North Sea Oilfield Equipment Market Dynamics & Trends

The North Sea oilfield equipment market is characterized by a fluctuating growth trajectory influenced by several factors. The historical period (2019-2024) witnessed a period of relative stability followed by a surge in demand driven by rising oil prices and renewed exploration efforts. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological disruptions, such as the adoption of automation and digitalization, are significantly impacting market penetration and efficiency. Consumer preferences are increasingly shifting towards environmentally friendly and sustainable solutions. Competitive dynamics are shaped by technological innovation, pricing strategies, and strategic partnerships.

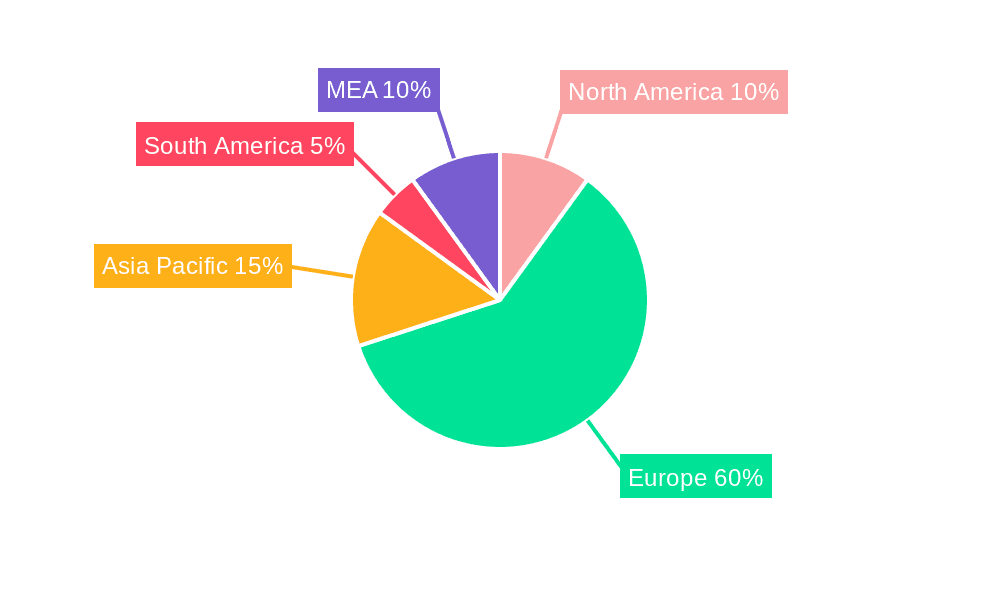

Dominant Regions & Segments in North Sea Oilfield Equipment Market

The Norwegian sector of the North Sea is currently the dominant region within the market, driven by significant oil and gas reserves and substantial investments in exploration and production activities. This dominance is reinforced by supportive government policies and a well-established infrastructure.

- Key Drivers in Norway:

- Supportive government policies promoting oil and gas exploration and production.

- Well-developed infrastructure supporting offshore operations.

- Significant oil and gas reserves within Norwegian waters.

- Robust investment in new exploration and development projects.

Drilling equipment constitutes the largest segment within the North Sea oilfield equipment market, accounting for xx% of the overall market share in 2025. This dominance is attributed to the continuous need for drilling new wells and maintaining existing infrastructure. Production equipment follows closely, with other equipment types representing a smaller, but still important, segment. The market is expected to see robust growth across all segments, driven by factors such as increasing demand, technological innovation, and the development of new fields.

North Sea Oilfield Equipment Market Product Innovations

Recent innovations focus on automation, remote operation, enhanced data analytics, and improved efficiency. New drilling technologies, subsea production systems, and advanced monitoring equipment are improving safety, reducing operational costs, and enhancing environmental performance. The market is experiencing a notable shift towards digitalization, with integrated systems and real-time data analysis becoming increasingly prevalent. This innovation enhances decision-making and optimizes resource allocation. The adoption of these technologies will continue to fuel market growth and shape the competitive landscape.

Report Scope & Segmentation Analysis

This report comprehensively segments the North Sea oilfield equipment market based on equipment type:

Drilling Equipment: This segment encompasses various drilling rigs, tools, and related equipment crucial for new well construction. It is projected to experience substantial growth driven by continuous exploration activities and the need for improved drilling technologies. Competitive dynamics are influenced by technological innovation and cost optimization strategies.

Production Equipment: This segment includes a wide array of subsea and surface equipment used to extract, process, and transport hydrocarbons. It is anticipated to witness steady growth, fueled by demand from existing and new production fields. Technological advancements in subsea processing and automation are key competitive drivers.

Other Equipment Types: This segment encompasses a wide range of equipment used in maintenance, inspection, and other crucial operations. This segment is expected to benefit from the growing focus on operational efficiency and enhanced safety protocols. Competitive factors include cost-effectiveness, reliability, and ease of maintenance.

Key Drivers of North Sea Oilfield Equipment Market Growth

Several key factors are driving the growth of the North Sea oilfield equipment market. These include increasing investments in exploration and production activities, rising oil and gas prices, technological advancements (automation and digitalization), and supportive government regulations within the region, particularly in Norway. The need for enhanced operational efficiency and improved safety measures is also propelling demand for sophisticated equipment. The Trell & Trine project (USD 700 Million investment) exemplifies significant investment driving market expansion.

Challenges in the North Sea Oilfield Equipment Market Sector

The North Sea oilfield equipment market faces several challenges, including volatile oil prices, stringent environmental regulations, and the high cost of operations in harsh offshore environments. Supply chain disruptions can significantly impact production and delivery timelines. Intense competition among established players and new entrants further complicates the market landscape, creating pricing pressure and impacting profitability.

Emerging Opportunities in North Sea Oilfield Equipment Market

Emerging opportunities lie in the growing adoption of advanced technologies such as AI, machine learning, and robotics to enhance efficiency and optimize operations. Demand for sustainable and environmentally friendly solutions presents another significant opportunity for market players. Further exploration and development of new oil and gas reserves within the North Sea region will also drive market growth. Finally, focus on decommissioning aging infrastructure will create a new opportunity for specialized equipment and services.

Leading Players in the North Sea Oilfield Equipment Market Market

- Superior Energy Services Inc

- Herrenknecht Vertical GmbH

- National Oilwell Varco Inc

- Schlumberger Ltd

- Tenaris S A

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

Key Developments in North Sea Oilfield Equipment Market Industry

- August 2022: Aker BP's Trell & Trine project (USD 700 Million investment) signals significant investment in the North Sea, driving demand for equipment.

- August 2022: C-Kore Systems' successful subsea testing campaign highlights the growing demand for advanced subsea technologies.

- May 2022: Equinor's extended contracts with Baker Hughes, Halliburton, and Schlumberger underscore the importance of long-term partnerships and ongoing demand for services.

Future Outlook for North Sea Oilfield Equipment Market Market

The North Sea oilfield equipment market is poised for continued growth, driven by ongoing investment in exploration and production, technological advancements, and increasing demand for improved efficiency and sustainability. Strategic partnerships, technological innovation, and a focus on cost optimization will be key to success in this competitive market. The potential for new discoveries and the ongoing need for maintenance and upgrades to existing infrastructure will sustain robust growth for the foreseeable future.

North Sea Oilfield Equipment Market Segmentation

-

1. Equipment Type

- 1.1. Drilling Equipment

- 1.2. Production Equipment

- 1.3. Other Equipment Types

North Sea Oilfield Equipment Market Segmentation By Geography

- 1. United Kingdom

- 2. Norway

- 3. Rest of North Sea Region

North Sea Oilfield Equipment Market Regional Market Share

Geographic Coverage of North Sea Oilfield Equipment Market

North Sea Oilfield Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Development of Gas Reserves and Advanced Technology

- 3.2.2 Tools

- 3.2.3 and Equipment4.; Increasing Investment in the Oilfield Services across World

- 3.3. Market Restrains

- 3.3.1 4.; The Volatile Oil Prices Over the Recent Period

- 3.3.2 Owing to the Supply-Demand Gap

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Gas Sector Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North Sea Oilfield Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Drilling Equipment

- 5.1.2. Production Equipment

- 5.1.3. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Norway

- 5.2.3. Rest of North Sea Region

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. United Kingdom North Sea Oilfield Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Drilling Equipment

- 6.1.2. Production Equipment

- 6.1.3. Other Equipment Types

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Norway North Sea Oilfield Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Drilling Equipment

- 7.1.2. Production Equipment

- 7.1.3. Other Equipment Types

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Rest of North Sea Region North Sea Oilfield Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Drilling Equipment

- 8.1.2. Production Equipment

- 8.1.3. Other Equipment Types

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Superior Energy Services Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Herrenknecht Vertical GmbH*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 National Oilwell Varco Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Schlumberger Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tenaris S A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Weatherford International PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Baker Hughes Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Halliburton Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Superior Energy Services Inc

List of Figures

- Figure 1: Global North Sea Oilfield Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United Kingdom North Sea Oilfield Equipment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 3: United Kingdom North Sea Oilfield Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: United Kingdom North Sea Oilfield Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 5: United Kingdom North Sea Oilfield Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Norway North Sea Oilfield Equipment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 7: Norway North Sea Oilfield Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: Norway North Sea Oilfield Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Norway North Sea Oilfield Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Rest of North Sea Region North Sea Oilfield Equipment Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 11: Rest of North Sea Region North Sea Oilfield Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 12: Rest of North Sea Region North Sea Oilfield Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Rest of North Sea Region North Sea Oilfield Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 2: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 4: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 6: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 8: Global North Sea Oilfield Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North Sea Oilfield Equipment Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the North Sea Oilfield Equipment Market?

Key companies in the market include Superior Energy Services Inc, Herrenknecht Vertical GmbH*List Not Exhaustive, National Oilwell Varco Inc, Schlumberger Ltd, Tenaris S A, Weatherford International PLC, Baker Hughes Company, Halliburton Company.

3. What are the main segments of the North Sea Oilfield Equipment Market?

The market segments include Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 137.71 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Development of Gas Reserves and Advanced Technology. Tools. and Equipment4.; Increasing Investment in the Oilfield Services across World.

6. What are the notable trends driving market growth?

Increasing Investments in Gas Sector Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

4.; The Volatile Oil Prices Over the Recent Period. Owing to the Supply-Demand Gap.

8. Can you provide examples of recent developments in the market?

In August 2022, Norwegian oil and gas company Aker BP submitted a plan for development and operation (PDO) of the Trell & Trine offshore project in the North Sea to the Ministry of Petroleum and Energy (MPE). The project comprises a planned investment of about USD 700 million. The Trell & Trine development is designed with three wells and two new subsea installations to be tied back to existing infrastructure on East Kameleon and further to the Alvheim FPSO. The production is scheduled to start in the first quarter of 2025, and the development is planned to be carried out in cooperation with Aker BP's alliance partners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North Sea Oilfield Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North Sea Oilfield Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North Sea Oilfield Equipment Market?

To stay informed about further developments, trends, and reports in the North Sea Oilfield Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence