Key Insights

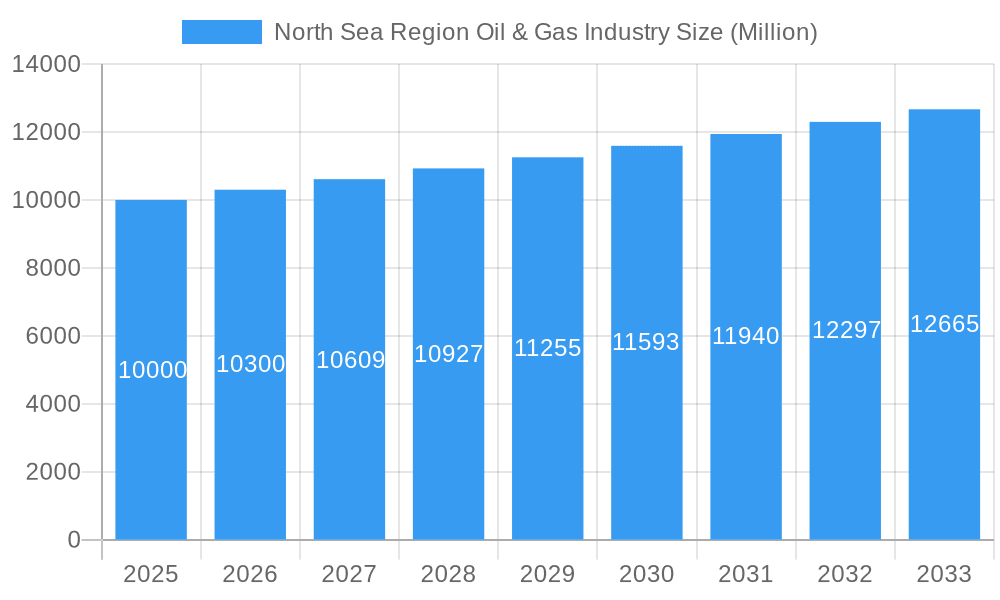

The North Sea oil and gas industry, a vital component of the global energy landscape, is navigating the energy transition with strategic adaptation. The market is projected to experience a Compound Annual Growth Rate (CAGR) of

North Sea Region Oil & Gas Industry Market Size (In Billion)

The global energy transition presents a significant challenge and opportunity for the North Sea oil and gas sector. Increased investment in Carbon Capture, Utilization, and Storage (CCUS) technologies is crucial for mitigating environmental impacts and extending asset lifecycles. Diversification into renewable energy sources, integrated with existing operations, will ensure long-term sustainability. While regulatory pressures intensify, they also foster innovation and investment in cleaner technologies, creating new market segments. The future success of the North Sea oil and gas industry hinges on effective navigation of the energy transition through strategic adaptations, technological advancements, and a commitment to environmental responsibility. Based on provided data, the market size is estimated to be approximately

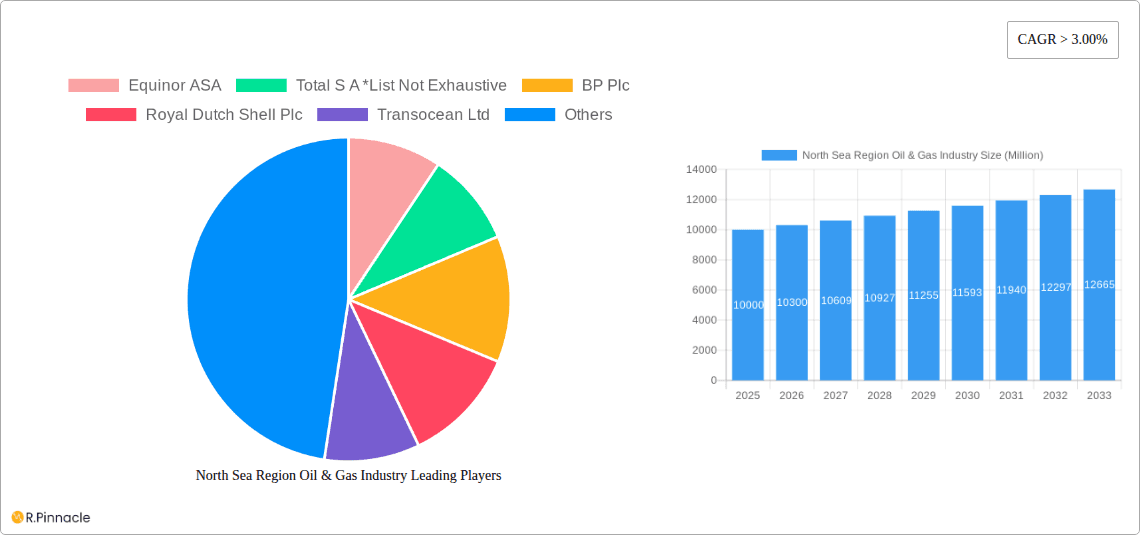

North Sea Region Oil & Gas Industry Company Market Share

This comprehensive report offers in-depth analysis of the North Sea oil and gas industry, providing critical insights for strategic decision-making across upstream, midstream, and downstream sectors. Covering the period from 2019 to 2033, with a base year of 2024, this report delivers data-driven forecasts and identifies key trends, market structure, leading players, and emerging opportunities while addressing industry challenges.

North Sea Region Oil & Gas Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the North Sea oil and gas industry, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, and M&A activities. The market is characterized by a high level of concentration, with major players such as Equinor ASA, Total S.A., BP Plc, Royal Dutch Shell Plc, and others holding significant market share. The combined market share of the top five companies is estimated at 65% in 2025. Innovation is driven by the need for enhanced oil recovery techniques, reduced operational costs, and environmental regulations. M&A activity has been significant, with deal values totaling approximately $xx Million in the historical period (2019-2024). The regulatory framework, while supportive of industry growth, is increasingly focused on environmental sustainability and operational safety. Competition from renewable energy sources is also emerging as a key factor impacting market dynamics.

- Market Concentration: Highly concentrated, with top 5 players holding ~65% market share in 2025.

- Innovation Drivers: Enhanced oil recovery, cost reduction, environmental regulations.

- M&A Activity (2019-2024): Total deal value estimated at $xx Million.

- Regulatory Framework: Focus on sustainability and safety.

- Product Substitutes: Growing competition from renewable energy sources.

North Sea Region Oil & Gas Industry Market Dynamics & Trends

The North Sea oil and gas market is experiencing a period of significant transformation. Growth is driven by factors such as increasing global energy demand, albeit tempered by efforts to transition towards cleaner energy sources. Technological advancements in exploration and production are improving efficiency and driving down costs. However, fluctuating oil and gas prices remain a significant challenge. Consumer preferences are shifting towards more sustainable energy solutions, placing pressure on the industry to adapt. The competitive landscape is intense, with major players vying for market share through strategic partnerships, technological innovation, and mergers and acquisitions. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be around 2%, with market penetration expected to remain relatively stable. The industry is facing increasing pressure to reduce its carbon footprint through initiatives such as carbon capture and storage (CCS).

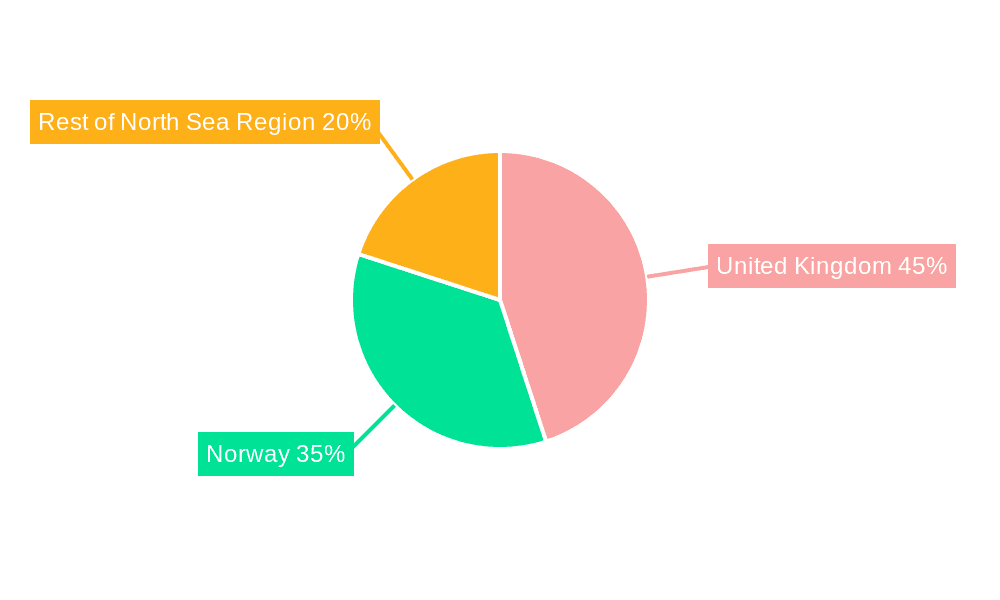

Dominant Regions & Segments in North Sea Region Oil & Gas Industry

The UK remains the dominant region in the North Sea oil and gas industry, accounting for approximately 60% of the total production in 2025. This dominance is attributed to several factors, including a well-established infrastructure, favorable government policies, and access to significant reserves. However, Norway is a close second and continues to be a major player.

Key Drivers for UK dominance:

- Established Infrastructure: Extensive pipeline networks and processing facilities.

- Favorable Government Policies: Supportive regulatory framework, tax incentives.

- Significant Reserves: Abundant oil and gas deposits in the North Sea.

The Upstream sector dominates the North Sea oil and gas market, currently holding an estimated 55% market share in 2025, followed by midstream at 30% and downstream at 15%. This is primarily due to the significant investments in exploration and production activities in recent years.

North Sea Region Oil & Gas Industry Product Innovations

Recent innovations focus on enhanced oil recovery techniques, including advanced drilling technologies and improved reservoir management practices. The industry is also increasingly adopting digitalization and automation to enhance operational efficiency and reduce costs. These innovations are leading to improved production yields, reduced environmental impact, and enhanced safety measures. The market fit for these innovations is strong, driven by the industry's need to maintain profitability in a challenging price environment.

Report Scope & Segmentation Analysis

This report segments the North Sea oil and gas market into three key sectors: Upstream, Midstream, and Downstream. The Upstream segment comprises exploration, drilling, and production; the Midstream segment includes transportation, storage, and processing; and the Downstream segment covers refining, marketing, and distribution. Growth projections for each segment are based on current market trends, anticipated investments, and expected production volumes. Competitive dynamics within each segment are analyzed to provide a comprehensive understanding of market opportunities and challenges. Market sizes are projected to reach XX Million for Upstream, XX Million for Midstream, and XX Million for Downstream by 2033.

Key Drivers of North Sea Region Oil & Gas Industry Growth

Growth in the North Sea oil and gas industry is driven by several factors. Technological advancements in exploration and production are increasing efficiency and reserves. Government policies and incentives also support the industry's development. Furthermore, continued global demand for energy, particularly natural gas, remains a major driver. The ongoing energy transition, however, presents both challenges and opportunities for sustainable growth.

Challenges in the North Sea Region Oil & Gas Industry Sector

The North Sea oil and gas industry faces significant challenges. Fluctuating oil and gas prices represent a substantial risk to profitability. Environmental regulations and the increasing pressure for decarbonization are imposing significant operational costs. Furthermore, competition from renewable energy sources is intensifying. These challenges require proactive adaptation and investment in sustainable practices. The industry is facing increased scrutiny regarding its environmental impact, potentially affecting future investment and license approvals. The impact of these factors on market growth is estimated at xx%.

Emerging Opportunities in North Sea Region Oil & Gas Industry

Opportunities exist in the development of carbon capture and storage (CCS) technologies, as well as exploration of new reserves. Growing demand for natural gas, particularly in the transition to cleaner energy, also presents significant opportunities for the sector. Moreover, the ongoing push for digitalization and automation creates avenues for increased efficiency and reduced operating costs.

Leading Players in the North Sea Region Oil & Gas Industry Market

- Equinor ASA

- Total S.A.

- BP Plc

- Royal Dutch Shell Plc

- Transocean Ltd

- Baker Hughes Company

- Halliburton Company

- Seadrill Ltd

- Schlumberger Limited

- Valaris PLC

(List Not Exhaustive)

Key Developments in North Sea Region Oil & Gas Industry Industry

- 2022 Q4: Equinor ASA announces significant investment in offshore wind energy.

- 2023 Q1: BP Plc commits to significant carbon reduction targets.

- 2023 Q2: A major merger between two midstream companies is announced.

- 2024 Q3: New regulations on methane emissions are implemented.

Future Outlook for North Sea Region Oil & Gas Industry Market

The future of the North Sea oil and gas industry is likely to involve a combination of continued production of oil and gas alongside a significant shift towards renewable energy sources and carbon reduction initiatives. The industry's capacity to adapt to these changes and to capitalize on the opportunities presented by new technologies and markets will be crucial in ensuring its long-term viability. The market is projected to experience moderate growth, driven by a combination of factors. Strategic alliances and investments in emerging technologies will be key to sustained success in the years to come.

North Sea Region Oil & Gas Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

North Sea Region Oil & Gas Industry Segmentation By Geography

- 1. United Kingdom

- 2. Norway

- 3. Rest of North Sea Region

North Sea Region Oil & Gas Industry Regional Market Share

Geographic Coverage of North Sea Region Oil & Gas Industry

North Sea Region Oil & Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North Sea Region Oil & Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. Norway

- 5.2.3. Rest of North Sea Region

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. United Kingdom North Sea Region Oil & Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Norway North Sea Region Oil & Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Rest of North Sea Region North Sea Region Oil & Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Equinor ASA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Total S A *List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 BP Plc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Royal Dutch Shell Plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Transocean Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Baker Hughes Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Halliburton Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Seadrill Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Schlumberger Limited

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Valaris PLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Equinor ASA

List of Figures

- Figure 1: Global North Sea Region Oil & Gas Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United Kingdom North Sea Region Oil & Gas Industry Revenue (billion), by Sector 2025 & 2033

- Figure 3: United Kingdom North Sea Region Oil & Gas Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 4: United Kingdom North Sea Region Oil & Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: United Kingdom North Sea Region Oil & Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Norway North Sea Region Oil & Gas Industry Revenue (billion), by Sector 2025 & 2033

- Figure 7: Norway North Sea Region Oil & Gas Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 8: Norway North Sea Region Oil & Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Norway North Sea Region Oil & Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Rest of North Sea Region North Sea Region Oil & Gas Industry Revenue (billion), by Sector 2025 & 2033

- Figure 11: Rest of North Sea Region North Sea Region Oil & Gas Industry Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Rest of North Sea Region North Sea Region Oil & Gas Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Rest of North Sea Region North Sea Region Oil & Gas Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 4: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 6: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 8: Global North Sea Region Oil & Gas Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North Sea Region Oil & Gas Industry?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the North Sea Region Oil & Gas Industry?

Key companies in the market include Equinor ASA, Total S A *List Not Exhaustive, BP Plc, Royal Dutch Shell Plc, Transocean Ltd, Baker Hughes Company, Halliburton Company, Seadrill Ltd, Schlumberger Limited, Valaris PLC.

3. What are the main segments of the North Sea Region Oil & Gas Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 40 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Upstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North Sea Region Oil & Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North Sea Region Oil & Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North Sea Region Oil & Gas Industry?

To stay informed about further developments, trends, and reports in the North Sea Region Oil & Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence