Key Insights

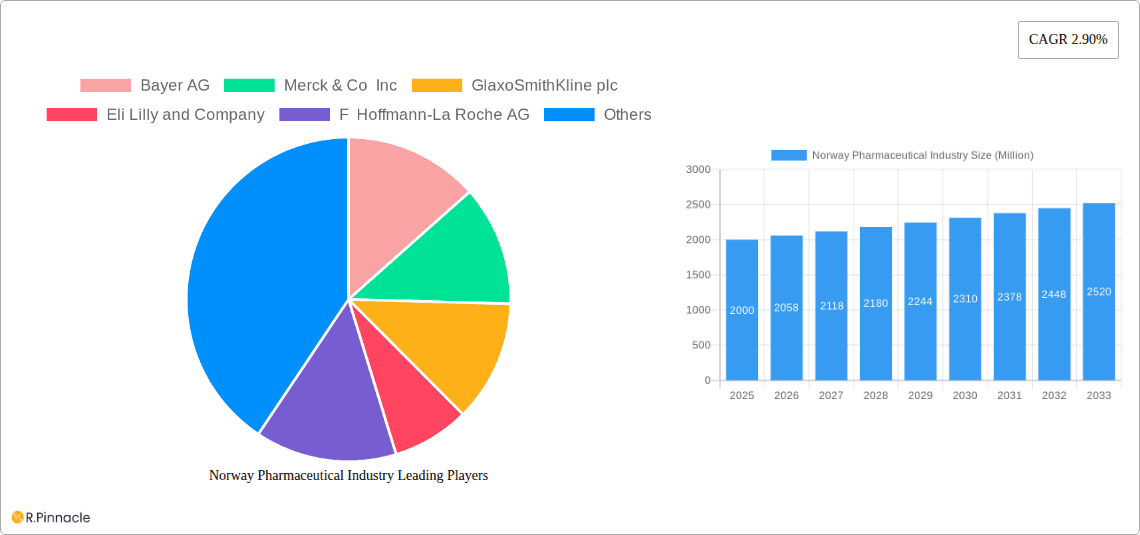

The Norwegian pharmaceutical market, estimated at 3.13 billion in 2025, is projected to grow at a CAGR of 2.31% from 2025 to 2033. Key growth drivers include an aging demographic, increased healthcare spending, and government support for pharmaceutical innovation. Major segments comprise prescription drugs, with significant contributions from cardiovascular, alimentary tract & metabolism, and nervous system therapeutics. The branded drug sector dominates, though generics are expected to expand due to cost efficiency and increased availability. Robust regulatory oversight ensures drug quality and fosters competition among key players like Bayer AG, Merck & Co Inc, and GlaxoSmithKline plc.

Norway Pharmaceutical Industry Market Size (In Billion)

Potential market constraints include pricing pressures from payers and stringent regulatory approval processes, which could impact profitability. The relatively smaller market size of Norway may also present challenges for global pharmaceutical corporations. Despite these factors, the Norwegian pharmaceutical industry's outlook remains favorable, driven by the demand for advanced treatments and a growing emphasis on preventive healthcare. Market performance will be shaped by technological advancements, evolving treatment modalities, and the macroeconomic climate. Strategic collaborations and M&A activities are anticipated to increase as companies aim to strengthen their market standing.

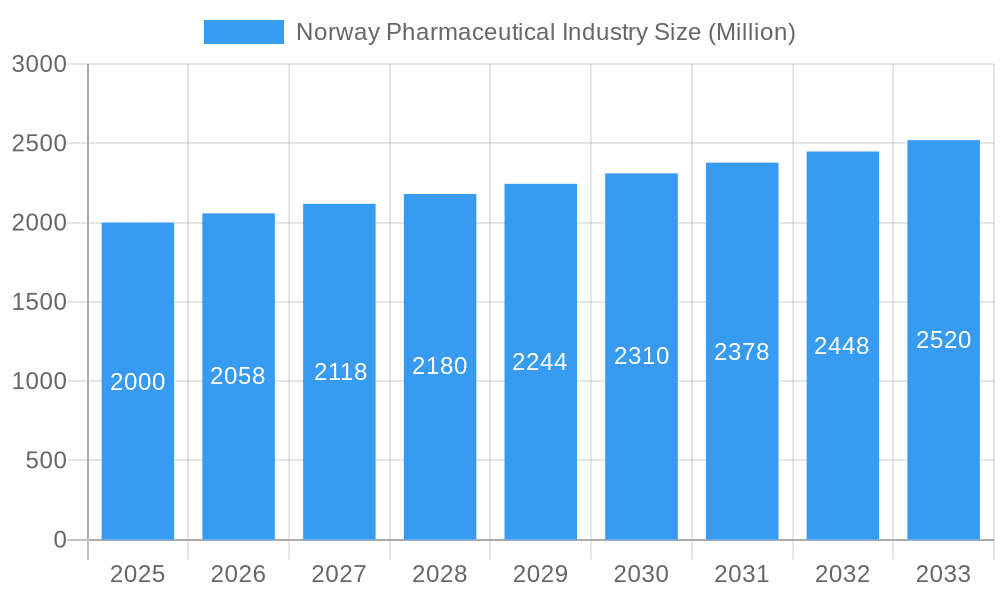

Norway Pharmaceutical Industry Company Market Share

Norway Pharmaceutical Market Analysis and Forecast (2025-2033)

This report offers an in-depth analysis of the Norway pharmaceutical industry, providing critical insights for industry stakeholders, investors, and decision-makers. The analysis covers the period from 2019 to 2033, with 2025 serving as the base year. It delivers actionable intelligence on market dynamics, growth catalysts, challenges, and future opportunities, utilizing historical data (2019-2024) to inform projections. The market size is estimated at 3.13 billion in 2025.

Norway Pharmaceutical Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Norwegian pharmaceutical market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. The report delves into the dynamics of mergers and acquisitions (M&A), providing insights into deal values and their impact on market structure. Major players like Bayer AG, Merck & Co Inc, GlaxoSmithKline plc, Eli Lilly and Company, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Bristol Myers Squibb Company, Boehringer Ingelheim, and Sanofi S A significantly shape the market.

- Market Concentration: The report quantifies the market share held by the top players, analyzing the level of concentration and the presence of any dominant firms. xx% of the market is estimated to be controlled by the top 5 players in 2025.

- Innovation Drivers: The report identifies key drivers of innovation, including R&D spending, government incentives, and collaborations between pharmaceutical companies and research institutions. An estimated xx Million is invested annually in R&D within the Norwegian pharmaceutical sector.

- Regulatory Framework: The analysis covers the impact of Norwegian regulatory policies on pharmaceutical innovation and market access. Specific regulations influencing drug approvals and pricing are discussed.

- Product Substitutes & End-User Demographics: The influence of generic drugs and over-the-counter (OTC) medications on market dynamics, as well as the demographic characteristics of the end-users, are examined. The aging population in Norway is expected to significantly drive demand for certain pharmaceutical products.

- M&A Activity: This section details recent M&A transactions in the Norwegian pharmaceutical industry, analyzing deal values and their strategic implications. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

Norway Pharmaceutical Industry Market Dynamics & Trends

This section explores the key factors driving growth and shaping the future of the Norway pharmaceutical market. It encompasses detailed analysis of market growth drivers, technological advancements, evolving consumer preferences, and the competitive intensity within the sector. The Compound Annual Growth Rate (CAGR) and market penetration rates for key segments are presented and analyzed to provide a comprehensive understanding of market evolution.

(This section will contain 600 words of detailed analysis regarding Market Growth Drivers, Technological Disruptions, Consumer Preferences, and Competitive Dynamics, including specific metrics like CAGR and market penetration.)

Dominant Regions & Segments in Norway Pharmaceutical Industry

This section identifies the leading regions and segments within the Norwegian pharmaceutical market. The analysis is categorized by drug type (Branded, Generic), prescription type (Prescription Drugs (Rx), OTC Drugs), and ATC/therapeutic class (Alimentary Tract and Metabolism, Blood and Blood Forming Organs, Cardiovascular System, Dermatologicals, Genito Urinary System and Sex Hormones, Systemic Hormonal Preparations, Antiinfectives For Systemic Use, Antineoplastic and Immunomodulating Agents, Musculo-Skeletal System, Nervous System, Antiparasitic Products, Insecticides and Repellents, Respiratory System, Sensory Organs, Others).

- Key Drivers:

- Economic Policies: Impact of government spending on healthcare and pharmaceutical pricing policies.

- Infrastructure: Availability of advanced healthcare facilities and distribution networks.

- Demographic Trends: Aging population and prevalence of chronic diseases.

(This section will contain 600 words of detailed dominance analysis for each segment using paragraphs and bullet points identifying key drivers.)

Norway Pharmaceutical Industry Product Innovations

This section summarizes recent product developments, highlighting key applications and competitive advantages of novel pharmaceutical products. Technological advancements shaping product innovation and market fit are specifically addressed.

(This section will contain 100-150 words of detailed analysis.)

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Norway pharmaceutical market based on drug type, prescription type, and ATC/therapeutic class. Each segment's growth projections, market size estimates, and competitive dynamics are detailed.

(This section will contain 100-150 words of detailed analysis per segment.)

Key Drivers of Norway Pharmaceutical Industry Growth

This section outlines the key factors driving the growth of the Norwegian pharmaceutical market, including technological advancements, economic factors, and regulatory influences.

(This section will contain 150 words of detailed analysis.)

Challenges in the Norway Pharmaceutical Industry Sector

This section discusses the key barriers and restraints hindering the growth of the Norwegian pharmaceutical market, including regulatory hurdles, supply chain disruptions, and competitive pressures.

(This section will contain 150 words of detailed analysis.)

Emerging Opportunities in Norway Pharmaceutical Industry

This section highlights emerging trends and opportunities in the Norway pharmaceutical market, focusing on new market segments, technological advancements, and changing consumer preferences.

(This section will contain 150 words of detailed analysis.)

Leading Players in the Norway Pharmaceutical Industry Market

Key Developments in Norway Pharmaceutical Industry

- November 2021: Hepro AS receives final approval for the Dosell pharmaceutical robot.

- September 2021: Launch of the Oslo Medicines Initiative, a public-private collaboration to improve medicine access.

Future Outlook for Norway Pharmaceutical Industry Market

This section summarizes the key growth accelerators and strategic opportunities anticipated in the Norwegian pharmaceutical market over the forecast period. The continued growth in the aging population and advancements in pharmaceutical technologies are expected to contribute significantly to market expansion.

(This section will contain 150 words of detailed analysis.)

Norway Pharmaceutical Industry Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Cardiovascular System

- 1.2. Dermatologicals

- 1.3. Genito Urinary System and Sex Hormones

- 1.4. Anti-infective for Systemic Use

- 1.5. Antineoplastic and Immunomodulating Agents

- 1.6. Musculoskeletal System

- 1.7. Nervous System

- 1.8. Respiratory System

- 1.9. Other ATC/Therapeutic Classes

-

2. Drug Type

- 2.1. Branded

- 2.2. Generic

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. Over the Counter (OTC) Drugs

Norway Pharmaceutical Industry Segmentation By Geography

- 1. Norway

Norway Pharmaceutical Industry Regional Market Share

Geographic Coverage of Norway Pharmaceutical Industry

Norway Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Good Societal and Economical Conditions; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Rules

- 3.4. Market Trends

- 3.4.1. Prescription Drugs Segment in Norway is Expected to Witness a Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Cardiovascular System

- 5.1.2. Dermatologicals

- 5.1.3. Genito Urinary System and Sex Hormones

- 5.1.4. Anti-infective for Systemic Use

- 5.1.5. Antineoplastic and Immunomodulating Agents

- 5.1.6. Musculoskeletal System

- 5.1.7. Nervous System

- 5.1.8. Respiratory System

- 5.1.9. Other ATC/Therapeutic Classes

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. Over the Counter (OTC) Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GlaxoSmithKline plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eli Lilly and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 F Hoffmann-La Roche AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AstraZeneca plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AbbVie Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bristol Myers Squibb Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Norway Pharmaceutical Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Pharmaceutical Industry Share (%) by Company 2025

List of Tables

- Table 1: Norway Pharmaceutical Industry Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 2: Norway Pharmaceutical Industry Volume K Unit Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 3: Norway Pharmaceutical Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 4: Norway Pharmaceutical Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 5: Norway Pharmaceutical Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 6: Norway Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 7: Norway Pharmaceutical Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Norway Pharmaceutical Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Norway Pharmaceutical Industry Revenue billion Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 10: Norway Pharmaceutical Industry Volume K Unit Forecast, by ATC/Therapeutic Class 2020 & 2033

- Table 11: Norway Pharmaceutical Industry Revenue billion Forecast, by Drug Type 2020 & 2033

- Table 12: Norway Pharmaceutical Industry Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 13: Norway Pharmaceutical Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 14: Norway Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 15: Norway Pharmaceutical Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Norway Pharmaceutical Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Pharmaceutical Industry?

The projected CAGR is approximately 2.31%.

2. Which companies are prominent players in the Norway Pharmaceutical Industry?

Key companies in the market include Bayer AG, Merck & Co Inc, GlaxoSmithKline plc, Eli Lilly and Company, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Bristol Myers Squibb Company, Boehringer Ingelheim, Sanofi S A .

3. What are the main segments of the Norway Pharmaceutical Industry?

The market segments include ATC/Therapeutic Class, Drug Type, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Good Societal and Economical Conditions; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs Segment in Norway is Expected to Witness a Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Rules.

8. Can you provide examples of recent developments in the market?

In November 2021, Hepro AS has last issued final approval of the new version of Dosell and has officially approved the pharmaceutical robot in its entirety for the Norwegian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Norway Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence