Key Insights

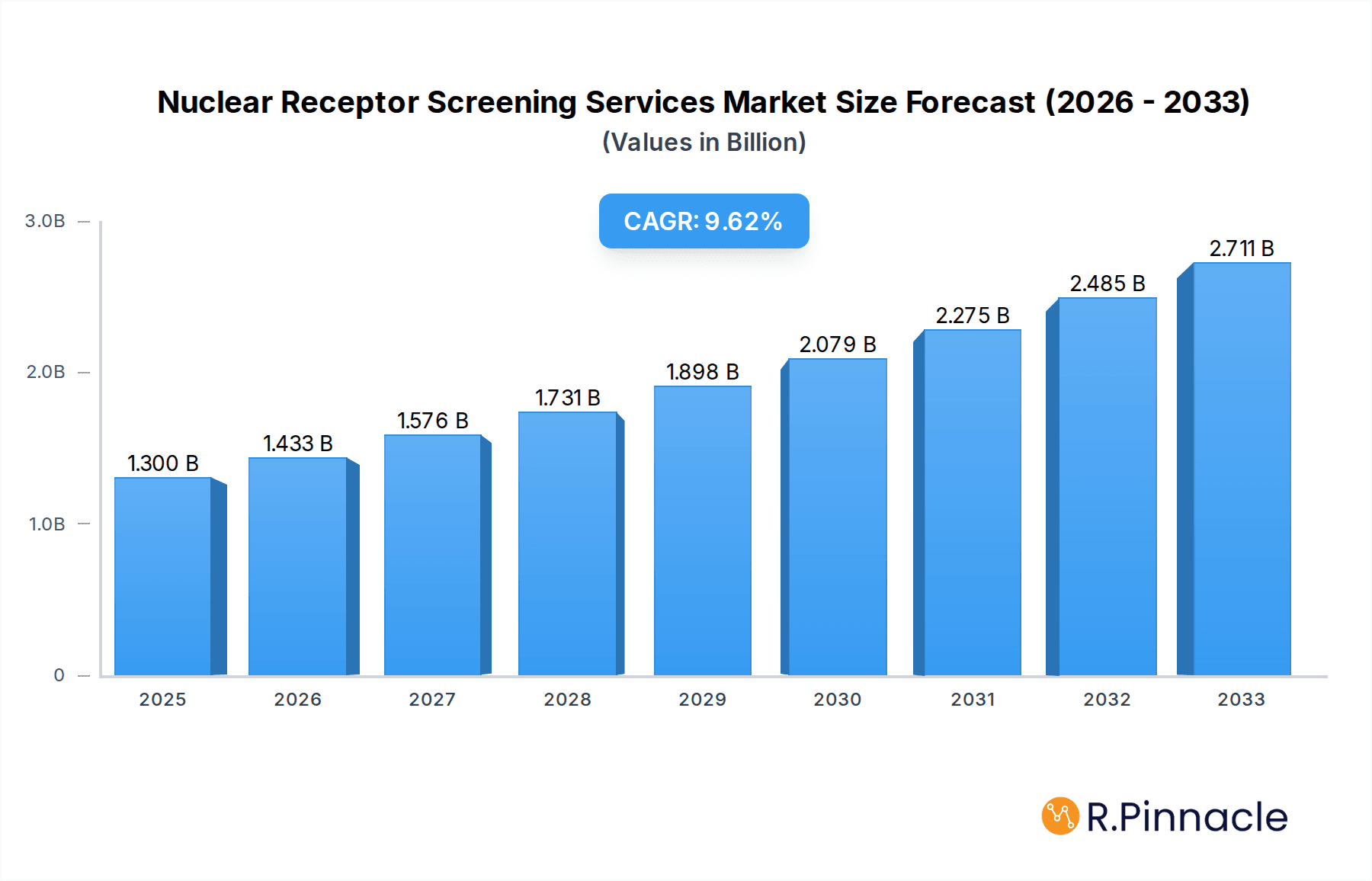

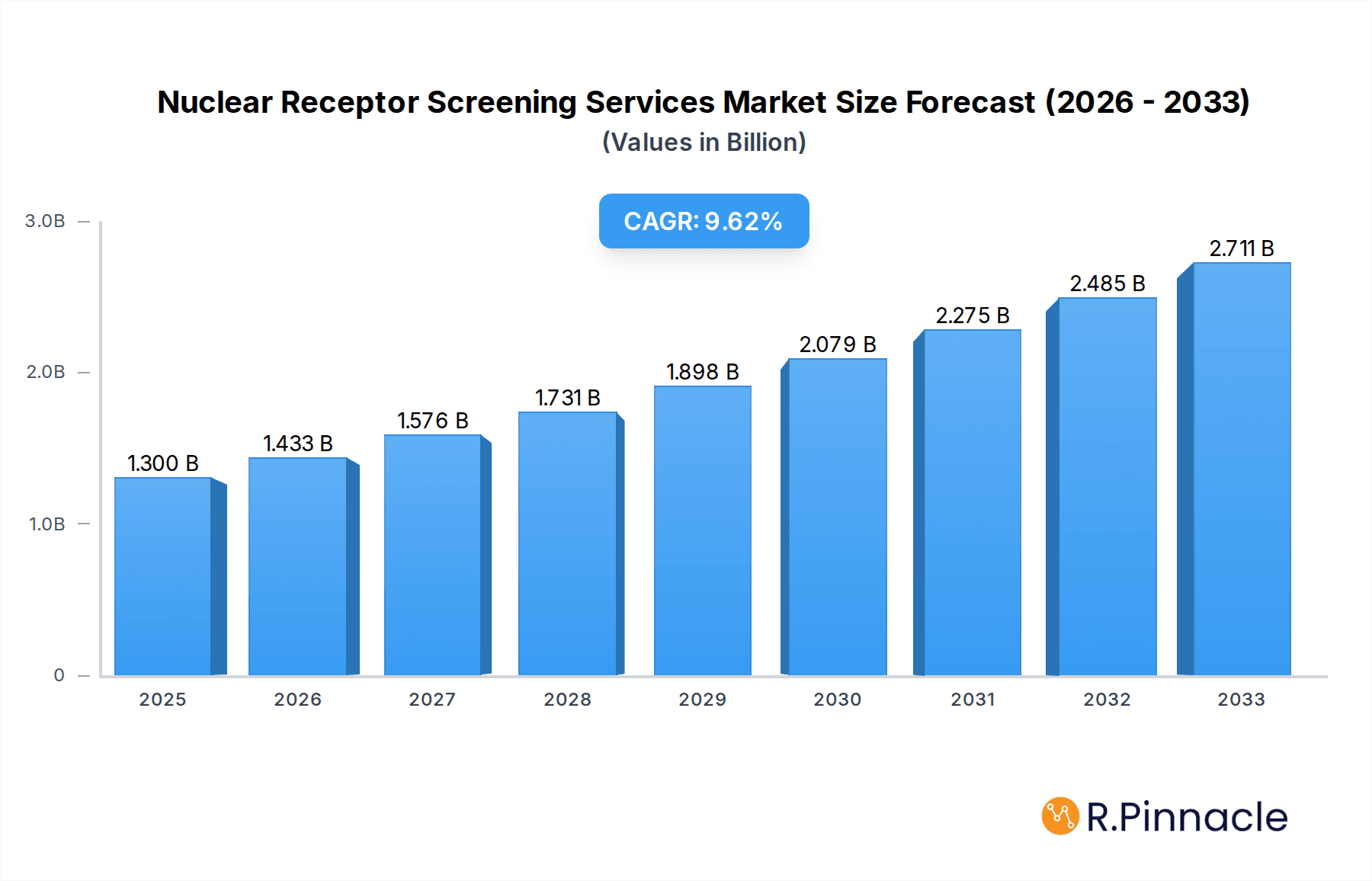

The Nuclear Receptor Screening Services market is poised for significant expansion, driven by the increasing demand for targeted therapies and personalized medicine. With a projected market size of $1300 million in 2025, the sector is anticipated to grow at a robust CAGR of 10.2% through 2033. This growth is fueled by the crucial role nuclear receptors play in various physiological processes and their involvement in numerous diseases, including cancer, metabolic disorders, and inflammatory conditions. The escalating investment in drug discovery and development, coupled with advancements in high-throughput screening technologies, is creating a fertile ground for market expansion. Furthermore, the growing emphasis on understanding drug mechanisms of action and identifying potential toxicological effects before clinical trials further underscores the importance of these services. Emerging economies are also contributing to this upward trajectory as pharmaceutical and biotechnology companies increasingly leverage these specialized screening capabilities.

Nuclear Receptor Screening Services Market Size (In Billion)

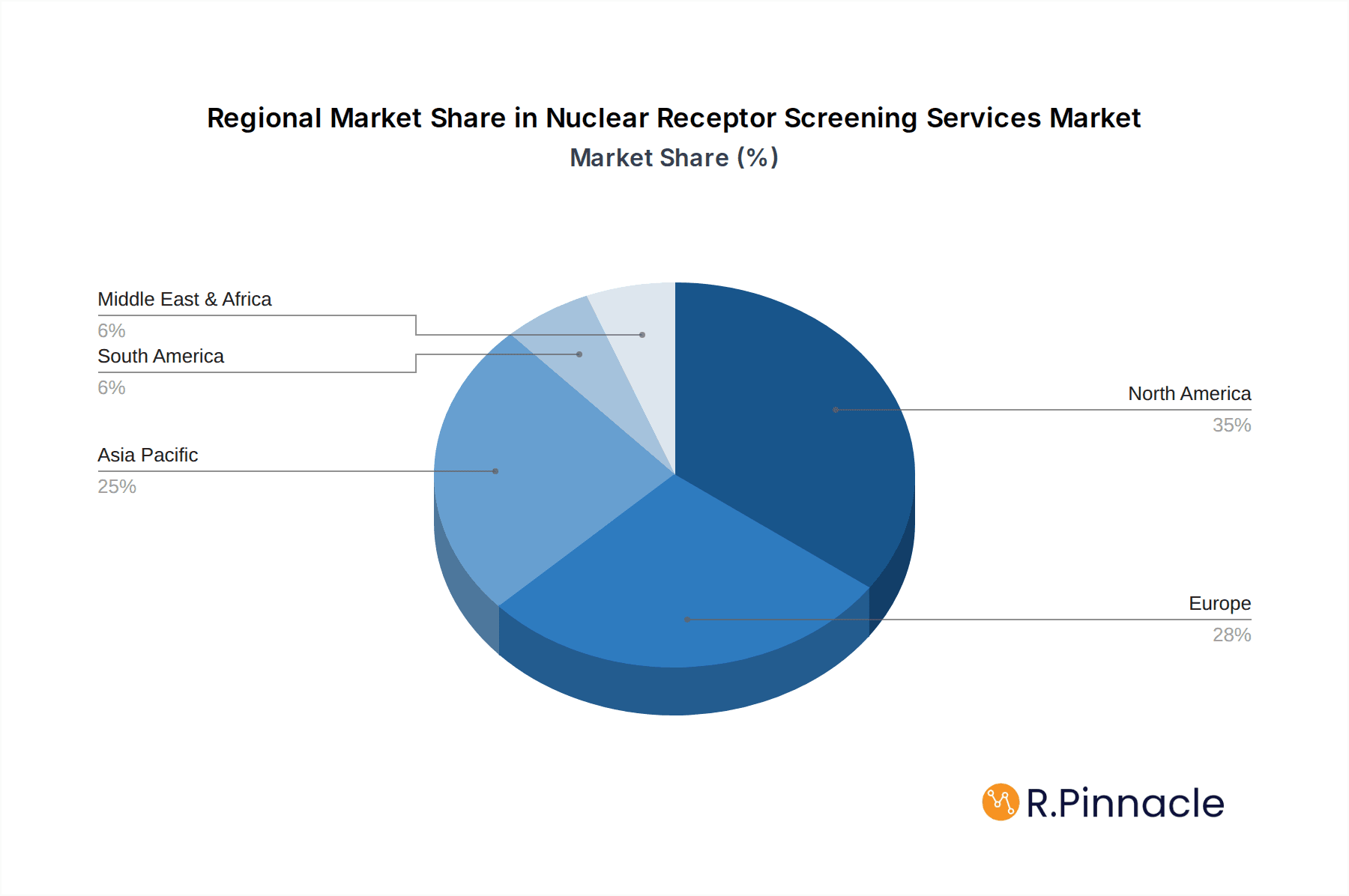

The market is segmented by application, with Drug Discovery and Development and Pharmacology and Toxicology Research emerging as key revenue generators. Within the types of assays, Reporter Gene Assays and Cell-Based Assays are witnessing substantial adoption due to their efficacy in deciphering nuclear receptor activity and signaling pathways. Key market players are actively investing in research and development to enhance their service portfolios and expand their geographical reach. North America, particularly the United States, currently leads the market, owing to the presence of major pharmaceutical companies and a strong R&D ecosystem. However, the Asia Pacific region, especially China and India, is expected to exhibit the fastest growth, driven by the expanding biopharmaceutical industry and increasing outsourcing of R&D activities. Innovations in assay development and data analysis are expected to further propel market growth, enabling more accurate and efficient identification of novel drug candidates.

Nuclear Receptor Screening Services Company Market Share

Here is your SEO-optimized, reader-centric report description for Nuclear Receptor Screening Services, crafted to boost search visibility and engage industry professionals:

This in-depth report provides a meticulous analysis of the global Nuclear Receptor Screening Services market, offering critical insights into its structure, dynamics, and future trajectory. Designed for researchers, pharmaceutical companies, biotechnology firms, and investors, this comprehensive study leverages high-ranking keywords to ensure maximum visibility and deliver actionable intelligence. Our analysis spans the historical period from 2019 to 2024, with a base year of 2025 and a detailed forecast extending from 2025 to 2033. Explore the evolving landscape of drug discovery, precision medicine, and therapeutic development through advanced nuclear receptor screening.

Nuclear Receptor Screening Services Market Structure & Innovation Trends

The Nuclear Receptor Screening Services market is characterized by a moderate to high level of concentration, with leading players investing heavily in research and development to drive innovation. Key drivers include the increasing demand for targeted therapies, a deeper understanding of nuclear receptor signaling pathways in various diseases, and advancements in high-throughput screening technologies. Regulatory frameworks from bodies like the FDA and EMA significantly influence service offerings and data integrity requirements. Product substitutes, such as phenotypic screening and advanced omics approaches, are emerging but direct nuclear receptor screening remains a crucial component of early-stage drug discovery. End-user demographics are primarily composed of pharmaceutical and biotechnology companies, academic research institutions, and contract research organizations (CROs). Merger and acquisition (M&A) activities, valued at an estimated xx million, are observed as companies seek to expand their service portfolios and market reach. The market share distribution highlights a competitive yet collaborative ecosystem.

Nuclear Receptor Screening Services Market Dynamics & Trends

The global Nuclear Receptor Screening Services market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This expansion is propelled by an escalating need for novel therapeutic targets and a deeper mechanistic understanding of diseases mediated by nuclear receptors. Technological disruptions, including the integration of artificial intelligence (AI) and machine learning (ML) in data analysis and assay development, are revolutionizing screening efficiency and predictive accuracy. Consumer preferences are shifting towards more personalized and precision medicine approaches, demanding highly specific and sensitive screening platforms. Competitive dynamics are intense, with service providers differentiating themselves through specialized assay development, comprehensive data reporting, and integrated drug discovery solutions. Market penetration is steadily increasing as more research programs recognize the indispensable role of nuclear receptor screening in identifying viable drug candidates. The market is witnessing a significant influx of investment driven by the promise of new drug classes targeting metabolic disorders, cancer, inflammation, and neurodegenerative diseases. Furthermore, the growing emphasis on drug repurposing and the identification of novel indications for existing compounds also contributes to sustained market demand. The increasing outsourcing of R&D activities by large pharmaceutical companies to specialized service providers further bolsters market expansion.

Dominant Regions & Segments in Nuclear Receptor Screening Services

North America currently dominates the Nuclear Receptor Screening Services market, driven by a strong presence of leading pharmaceutical and biotechnology companies, substantial R&D investments, and a well-established regulatory infrastructure that supports innovation. The United States, in particular, leads due to its vibrant life sciences ecosystem and a high concentration of academic research centers actively engaged in nuclear receptor biology.

Key Drivers of Dominance in North America:

- Robust R&D Investment: Significant government and private funding allocated to drug discovery and development.

- Advanced Technological Adoption: Early and widespread adoption of cutting-edge screening technologies and AI-driven analytics.

- Favorable Regulatory Environment: Streamlined regulatory pathways that encourage the development and approval of novel therapeutics.

- Presence of Major Pharmaceutical Hubs: Concentration of major pharmaceutical and biotechnology companies with extensive drug discovery pipelines.

Application Segment Dominance:

- Drug Discovery and Development: This segment is the largest and fastest-growing, fueled by the continuous pursuit of novel drug candidates targeting a wide array of diseases. Pharmaceutical companies rely heavily on nuclear receptor screening to identify modulators for nuclear receptors involved in metabolic diseases, cancer, inflammation, and endocrine disorders. The ability to efficiently screen large compound libraries and validate hit compounds makes this application paramount.

- Pharmacology and Toxicology Research: This segment also exhibits substantial growth, as researchers use nuclear receptor screening to understand the complex mechanisms of drug action, identify off-target effects, and assess potential toxicity. A deeper understanding of how compounds interact with nuclear receptors is crucial for ensuring drug safety and efficacy, as well as for investigating disease pathogenesis.

Type Segment Dominance:

- Reporter Gene Assays: These assays remain a foundational tool in nuclear receptor screening due to their simplicity, high-throughput capability, and direct measurement of transcriptional activity. They are widely used for initial screening of compound libraries and for characterizing the potency and efficacy of potential modulators. The cost-effectiveness and adaptability of reporter gene assays contribute to their widespread adoption.

- Cell-Based Assays: While reporter gene assays offer foundational insights, cell-based assays provide a more physiologically relevant context for nuclear receptor screening. These assays incorporate endogenous nuclear receptors and their natural co-regulators within cellular environments, offering a more comprehensive understanding of drug effects. The trend towards more complex and predictive in vitro models is driving the growth of sophisticated cell-based screening platforms.

Nuclear Receptor Screening Services Product Innovations

The market is witnessing significant product innovations aimed at enhancing the speed, sensitivity, and predictive power of nuclear receptor screening. These include the development of novel assay formats, such as homogeneous assays and high-content screening platforms, which reduce assay time and labor. Advancements in reporter systems and cell line engineering are enabling researchers to screen for nuanced nuclear receptor activities, including antagonist and inverse agonist identification. Competitive advantages are being gained through the integration of automation and AI for data analysis, leading to more efficient identification of promising drug candidates. These innovations are crucial for accelerating the preclinical stages of drug discovery and development.

Report Scope & Segmentation Analysis

This report meticulously segments the Nuclear Receptor Screening Services market into key categories to provide a granular understanding of its landscape.

Application Segmentation:

- Drug Discovery and Development: This segment, estimated to be worth xx million in 2025, is projected to grow at a CAGR of xx% through 2033. It encompasses the identification and validation of drug candidates targeting nuclear receptors for various therapeutic areas. Competitive dynamics are driven by the demand for novel drug targets and advanced screening technologies.

- Pharmacology and Toxicology Research: Valued at xx million in 2025, this segment is expected to expand at a CAGR of xx%. It focuses on understanding drug mechanisms, identifying off-target effects, and assessing compound safety profiles. Growth is fueled by increasing regulatory scrutiny and the need for comprehensive preclinical evaluation.

Type Segmentation:

- Reporter Gene Assays: With a market size of xx million in 2025 and a projected CAGR of xx%, these assays are a cornerstone for initial compound screening due to their efficiency and cost-effectiveness.

- Cell-Based Assays: This segment, estimated at xx million in 2025, is anticipated to grow at a CAGR of xx%. These assays offer greater physiological relevance and are crucial for validating findings from initial screens and understanding complex cellular responses to nuclear receptor modulation.

Key Drivers of Nuclear Receptor Screening Services Growth

The growth of the Nuclear Receptor Screening Services market is primarily driven by several key factors. Technological advancements, including the development of more sensitive and high-throughput screening platforms, are expanding the capabilities of service providers. The increasing prevalence of chronic diseases like diabetes, obesity, and cancer, many of which are modulated by nuclear receptors, fuels the demand for novel therapeutics. Furthermore, a growing understanding of nuclear receptor biology and its role in various physiological and pathological processes is uncovering new therapeutic targets. Government initiatives and increased funding for drug discovery and research, particularly in emerging economies, also contribute significantly to market expansion. The rising trend of outsourcing R&D activities by pharmaceutical companies to specialized CROs further propels the market.

Challenges in the Nuclear Receptor Screening Services Sector

Despite robust growth, the Nuclear Receptor Screening Services sector faces several challenges. High upfront investment costs for advanced screening technologies and infrastructure can be a barrier for smaller companies. Regulatory hurdles and the need for stringent quality control to meet global standards add complexity and time to service delivery. The development of highly specific and sensitive assays for all nuclear receptor subtypes, given their structural diversity, remains an ongoing scientific challenge. Furthermore, competition from alternative screening methods and the pressure to provide cost-effective solutions can impact profit margins. Supply chain disruptions for critical reagents and consumables can also pose a challenge, affecting project timelines.

Emerging Opportunities in Nuclear Receptor Screening Services

Emerging opportunities in the Nuclear Receptor Screening Services market are abundant. The growing interest in precision medicine and personalized therapeutics presents a significant opportunity for tailored nuclear receptor screening services. The application of AI and machine learning in data analysis and hit identification is rapidly evolving, offering enhanced efficiency and predictive power. The development of novel nuclear receptor modulators for rare diseases and orphan indications represents a nascent but promising market. Furthermore, the increasing focus on drug repurposing and the identification of new therapeutic uses for existing compounds, leveraging nuclear receptor interactions, opens up new avenues for growth. Expanding services into emerging geographical markets with growing pharmaceutical sectors also presents a strategic opportunity.

Leading Players in the Nuclear Receptor Screening Services Market

- INDIGO Biosciences

- Creative Biogene

- Creative Bioarray

- Orphagen Pharmaceuticals

- KMD Bioscience

- MedChemExpress

- Pharmaron

- WuXi AppTec

- Topscience

- Abace Biotechnology

- ICE Bioscience

Key Developments in Nuclear Receptor Screening Services Industry

- 2023: Increased adoption of AI/ML for drug target identification and lead optimization in nuclear receptor research.

- 2022: Launch of novel, highly sensitive cell-based assays for the screening of steroid hormone receptors.

- 2021: Significant investment in automation technologies by leading CROs to enhance throughput and efficiency.

- 2020: Growing demand for screening services focused on nuclear receptors involved in metabolic syndrome and diabetes.

- 2019: Advancements in CRISPR-based screening technologies enabling more precise manipulation of nuclear receptor signaling pathways.

Future Outlook for Nuclear Receptor Screening Services Market

The future outlook for the Nuclear Receptor Screening Services market is exceptionally promising, driven by continuous advancements in molecular biology, high-throughput screening, and data analytics. The increasing understanding of nuclear receptor roles in a vast spectrum of diseases, coupled with the ongoing quest for targeted therapies, will sustain and accelerate market growth. The integration of AI and machine learning is expected to revolutionize screening efficiency, predictive accuracy, and the identification of novel drug candidates. Emerging markets are anticipated to contribute significantly to global demand as R&D investments increase. Strategic collaborations between academic institutions, pharmaceutical companies, and service providers will foster innovation and accelerate the translation of research findings into clinical applications. The focus on personalized medicine and the development of orphan drugs will also open new avenues for specialized screening services.

Nuclear Receptor Screening Services Segmentation

-

1. Application

- 1.1. Drug Discovery and Development

- 1.2. Pharmacology and Toxicology Research

-

2. Types

- 2.1. Reporter Gene Assays

- 2.2. Cell-Based Assays

Nuclear Receptor Screening Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nuclear Receptor Screening Services Regional Market Share

Geographic Coverage of Nuclear Receptor Screening Services

Nuclear Receptor Screening Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nuclear Receptor Screening Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drug Discovery and Development

- 5.1.2. Pharmacology and Toxicology Research

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Reporter Gene Assays

- 5.2.2. Cell-Based Assays

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nuclear Receptor Screening Services Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drug Discovery and Development

- 6.1.2. Pharmacology and Toxicology Research

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Reporter Gene Assays

- 6.2.2. Cell-Based Assays

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nuclear Receptor Screening Services Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drug Discovery and Development

- 7.1.2. Pharmacology and Toxicology Research

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Reporter Gene Assays

- 7.2.2. Cell-Based Assays

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nuclear Receptor Screening Services Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drug Discovery and Development

- 8.1.2. Pharmacology and Toxicology Research

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Reporter Gene Assays

- 8.2.2. Cell-Based Assays

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nuclear Receptor Screening Services Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drug Discovery and Development

- 9.1.2. Pharmacology and Toxicology Research

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Reporter Gene Assays

- 9.2.2. Cell-Based Assays

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nuclear Receptor Screening Services Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drug Discovery and Development

- 10.1.2. Pharmacology and Toxicology Research

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Reporter Gene Assays

- 10.2.2. Cell-Based Assays

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 INDIGO Biosciences

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Creative Biogene

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Creative Bioarray

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Orphagen Pharmaceuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KMD Bioscience

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MedChemExpress

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pharmaron

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WuXi AppTec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Topscience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abace Biotechnology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ICE Bioscience

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 INDIGO Biosciences

List of Figures

- Figure 1: Global Nuclear Receptor Screening Services Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Nuclear Receptor Screening Services Revenue (million), by Application 2025 & 2033

- Figure 3: North America Nuclear Receptor Screening Services Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Nuclear Receptor Screening Services Revenue (million), by Types 2025 & 2033

- Figure 5: North America Nuclear Receptor Screening Services Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Nuclear Receptor Screening Services Revenue (million), by Country 2025 & 2033

- Figure 7: North America Nuclear Receptor Screening Services Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Nuclear Receptor Screening Services Revenue (million), by Application 2025 & 2033

- Figure 9: South America Nuclear Receptor Screening Services Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Nuclear Receptor Screening Services Revenue (million), by Types 2025 & 2033

- Figure 11: South America Nuclear Receptor Screening Services Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Nuclear Receptor Screening Services Revenue (million), by Country 2025 & 2033

- Figure 13: South America Nuclear Receptor Screening Services Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Nuclear Receptor Screening Services Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Nuclear Receptor Screening Services Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Nuclear Receptor Screening Services Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Nuclear Receptor Screening Services Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Nuclear Receptor Screening Services Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Nuclear Receptor Screening Services Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Nuclear Receptor Screening Services Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Nuclear Receptor Screening Services Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Nuclear Receptor Screening Services Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Nuclear Receptor Screening Services Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Nuclear Receptor Screening Services Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Nuclear Receptor Screening Services Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Nuclear Receptor Screening Services Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Nuclear Receptor Screening Services Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Nuclear Receptor Screening Services Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Nuclear Receptor Screening Services Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Nuclear Receptor Screening Services Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Nuclear Receptor Screening Services Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nuclear Receptor Screening Services Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Nuclear Receptor Screening Services Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Nuclear Receptor Screening Services Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Nuclear Receptor Screening Services Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Nuclear Receptor Screening Services Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Nuclear Receptor Screening Services Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Nuclear Receptor Screening Services Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Nuclear Receptor Screening Services Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Nuclear Receptor Screening Services Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Nuclear Receptor Screening Services Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Nuclear Receptor Screening Services Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Nuclear Receptor Screening Services Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Nuclear Receptor Screening Services Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Nuclear Receptor Screening Services Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Nuclear Receptor Screening Services Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Nuclear Receptor Screening Services Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Nuclear Receptor Screening Services Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Nuclear Receptor Screening Services Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Nuclear Receptor Screening Services Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nuclear Receptor Screening Services?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Nuclear Receptor Screening Services?

Key companies in the market include INDIGO Biosciences, Creative Biogene, Creative Bioarray, Orphagen Pharmaceuticals, KMD Bioscience, MedChemExpress, Pharmaron, WuXi AppTec, Topscience, Abace Biotechnology, ICE Bioscience.

3. What are the main segments of the Nuclear Receptor Screening Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1300 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nuclear Receptor Screening Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nuclear Receptor Screening Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nuclear Receptor Screening Services?

To stay informed about further developments, trends, and reports in the Nuclear Receptor Screening Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence