Key Insights

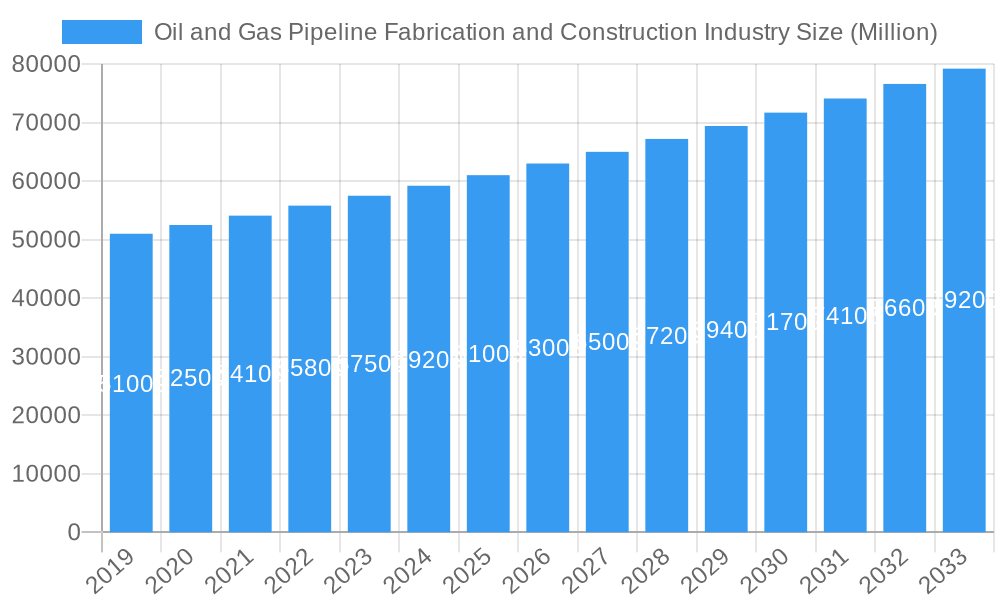

The global Oil and Gas Pipeline Fabrication and Construction industry is poised for steady expansion, projected to reach a market size of approximately USD 60 billion by 2025. With a Compound Annual Growth Rate (CAGR) exceeding 3.50% and a projected value unit of millions, the market is experiencing robust demand fueled by critical drivers such as the increasing global energy requirements and the ongoing expansion of oil and gas exploration and production activities worldwide. Significant investments are being channeled into developing new pipeline networks for both crude oil and natural gas transportation, facilitating efficient and safe delivery across vast geographical terrains. Furthermore, the imperative to upgrade and maintain aging infrastructure, coupled with the strategic development of cross-border pipelines to meet regional energy demands, are key contributors to this growth trajectory. Emerging markets, particularly in the Asia Pacific and Middle East and Africa regions, are demonstrating substantial potential due to rapid industrialization and growing energy consumption.

Oil and Gas Pipeline Fabrication and Construction Industry Market Size (In Billion)

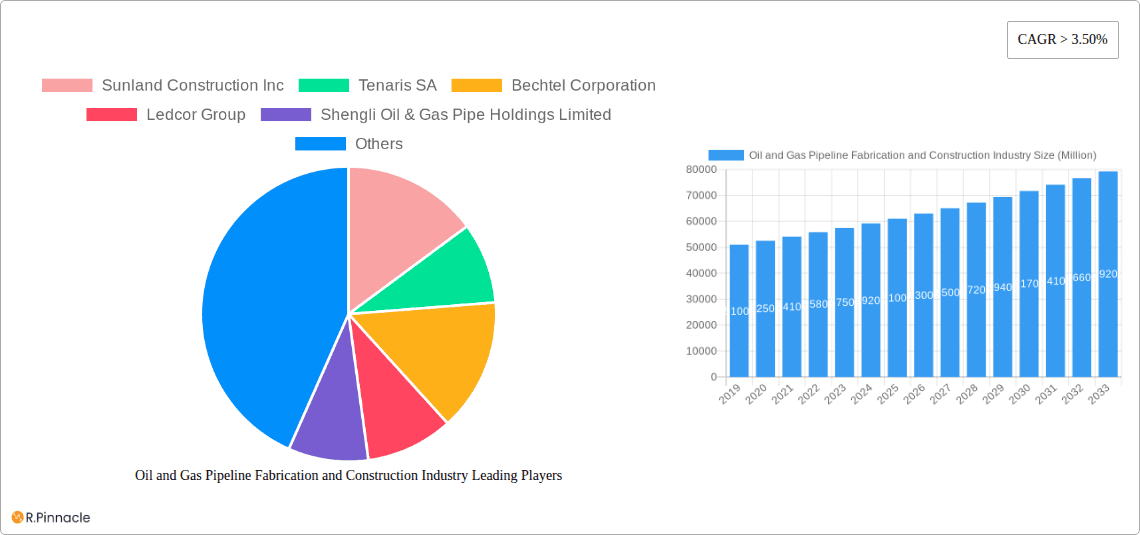

Despite the positive outlook, the industry faces certain restraints that could influence its growth rate. Stringent environmental regulations and the rising emphasis on sustainable energy sources are prompting a re-evaluation of traditional fossil fuel infrastructure projects. The high initial capital investment required for large-scale pipeline projects, along with the logistical complexities and potential geopolitical risks associated with international pipeline development, also present significant challenges. Nevertheless, advancements in fabrication technologies, the adoption of smart pipeline monitoring systems for enhanced safety and efficiency, and the continued global reliance on oil and gas for industrial and domestic purposes are expected to counterbalance these restraints. Key players such as Sunland Construction Inc, Tenaris SA, Bechtel Corporation, and Larsen & Toubro Limited are actively engaged in securing substantial contracts and innovating their service offerings to capitalize on the evolving market landscape. The industry is segmented primarily by application, with Oil and Gas being the dominant sectors.

Oil and Gas Pipeline Fabrication and Construction Industry Company Market Share

This in-depth market report provides a meticulously researched analysis of the global Oil and Gas Pipeline Fabrication and Construction industry. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this report offers critical insights for industry stakeholders, including fabricators, constructors, material suppliers, and investors. We delve into market structure, dynamics, dominant regions, product innovations, growth drivers, challenges, and emerging opportunities, supported by actionable intelligence and future projections.

Oil and Gas Pipeline Fabrication and Construction Industry Market Structure & Innovation Trends

The Oil and Gas Pipeline Fabrication and Construction industry exhibits a moderately concentrated market structure, characterized by the presence of both large, integrated players and a significant number of specialized regional fabricators and construction firms. Innovation is primarily driven by advancements in materials science, welding technologies, automated construction processes, and digital twin solutions for project management and integrity monitoring. Regulatory frameworks, particularly concerning environmental impact and safety standards, play a crucial role in shaping market entry and operational strategies. While direct product substitutes for pipelines are limited in core applications, the shift towards alternative energy sources and evolving energy infrastructure can influence long-term demand. End-user demographics are dominated by national and international oil and gas exploration and production companies, as well as midstream operators. Mergers and acquisitions (M&A) activities have been strategic, focusing on consolidating capabilities, expanding geographical reach, and acquiring specialized expertise. For instance, significant M&A deals in the past have seen valuations in the hundreds of millions to billions of dollars, reflecting the substantial capital investments in this sector. The market share distribution among the top players indicates a competitive landscape where strategic partnerships and technological prowess are key differentiators.

Oil and Gas Pipeline Fabrication and Construction Industry Market Dynamics & Trends

The Oil and Gas Pipeline Fabrication and Construction industry is projected to witness robust growth, driven by a confluence of factors that underscore the persistent demand for energy transport infrastructure. The global CAGR is estimated at a healthy XX% from 2025 to 2033, reflecting ongoing investments in both traditional oil and gas extraction and the expanding natural gas network. Technological disruptions are at the forefront, with the adoption of advanced welding techniques, non-destructive testing (NDT) methods, and robotic automation significantly improving efficiency, safety, and quality in fabrication and construction processes. These innovations not only reduce project timelines and costs but also enhance the integrity and lifespan of pipelines, crucial for operational reliability. Consumer preferences, dictated by energy security needs and the increasing demand for natural gas as a cleaner transition fuel, are pushing for expanded pipeline networks for both domestic consumption and international trade. Competitive dynamics are intensifying, with companies differentiating themselves through superior project management, innovative construction methodologies, and a strong focus on environmental, social, and governance (ESG) compliance. Market penetration is expanding in emerging economies where energy demand is rapidly rising, necessitating new pipeline infrastructure for exploration, production, and distribution. Furthermore, the ongoing need to maintain and upgrade existing pipeline networks, estimated to constitute a substantial portion of the market value, provides a steady revenue stream. The integration of digital technologies, such as IoT sensors for real-time monitoring and predictive maintenance, is becoming a critical differentiator, enabling operators to proactively address potential issues and optimize operational performance.

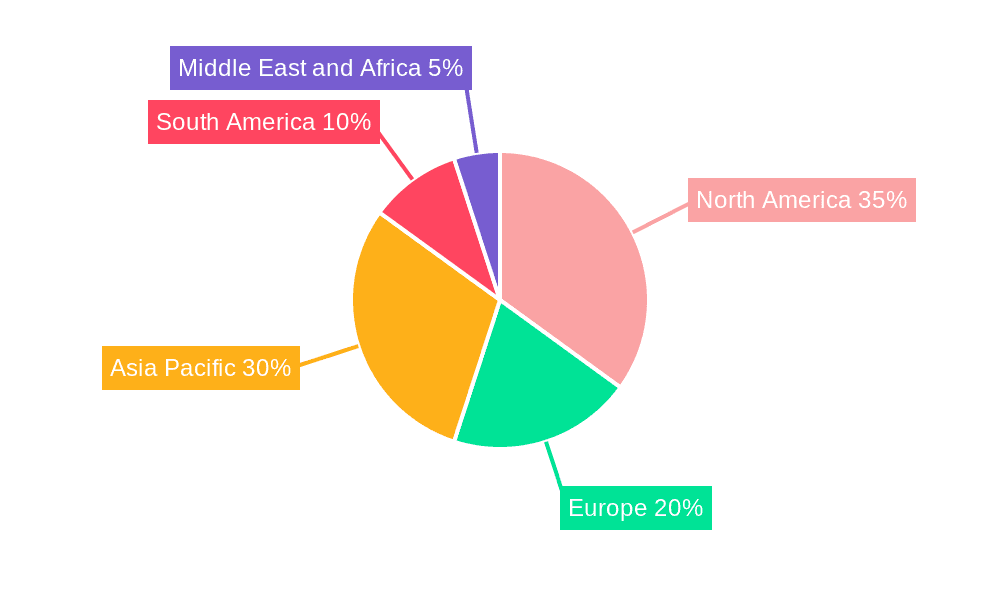

Dominant Regions & Segments in Oil and Gas Pipeline Fabrication and Construction Industry

The Gas segment is poised for significant dominance within the Oil and Gas Pipeline Fabrication and Construction industry, driven by global energy transition initiatives and the increasing reliance on natural gas as a cleaner fuel source. North America, particularly the United States and Canada, continues to be a leading region due to its extensive shale gas reserves and the ongoing development of its midstream infrastructure. Key drivers for this regional dominance include supportive economic policies aimed at energy independence, substantial government investment in critical infrastructure projects, and a well-established supply chain of specialized fabrication and construction companies.

- North America: The region benefits from mature oil and gas production, necessitating continuous investment in transmission and distribution pipelines. Favorable regulatory environments for energy development, coupled with technological advancements in horizontal drilling and hydraulic fracturing, have spurred demand for associated pipeline infrastructure. The large-scale LNG export terminals also require extensive pipeline networks for feedstock supply.

- Middle East: This region remains a powerhouse in oil and gas production, driving consistent demand for pipeline construction and maintenance for both domestic consumption and export. Economic diversification strategies often include substantial investments in energy infrastructure to support burgeoning industrial sectors and meet growing populations' energy needs.

- Asia-Pacific: Rapidly growing economies, particularly China and India, are experiencing a surge in energy demand. This fuels significant investments in both oil and gas pipeline networks to secure energy supplies and support industrial growth. Government initiatives promoting natural gas usage to combat air pollution are a major catalyst for pipeline expansion in this region.

The dominance of the Gas segment is further amplified by the strategic shift towards natural gas in many countries aiming to reduce carbon emissions. This translates into substantial projects for both cross-country transmission pipelines and intra-field gathering systems.

Oil and Gas Pipeline Fabrication and Construction Industry Product Innovations

Product innovations in the Oil and Gas Pipeline Fabrication and Construction industry are centered on enhancing pipeline integrity, durability, and operational efficiency. Advanced composite materials are gaining traction, offering superior corrosion resistance and reduced weight compared to traditional steel, leading to lower installation costs and extended service life. Smart coatings that self-heal or indicate structural stress are also under development. Furthermore, advancements in automated welding technologies and robotics are revolutionizing fabrication, ensuring higher precision and faster production. These innovations provide a competitive advantage by enabling quicker project completion, reduced environmental impact during construction, and improved long-term performance, ultimately lowering the total cost of ownership for pipeline operators.

Report Scope & Segmentation Analysis

This report segments the Oil and Gas Pipeline Fabrication and Construction Industry by Application, focusing on Oil and Gas. The Oil segment encompasses the fabrication and construction of pipelines dedicated to crude oil and refined petroleum products. Growth in this segment is driven by the need for transporting oil from extraction sites to refineries and distribution hubs, as well as maintaining and upgrading existing infrastructure. Market size for the Oil segment is projected to be approximately $XX Billion in 2025, with a CAGR of XX% during the forecast period.

The Gas segment, covering natural gas and associated liquids, is anticipated to exhibit higher growth due to increasing global demand for natural gas and the transition to cleaner energy sources. This includes pipelines for gathering, processing, transmission, and distribution of natural gas. Market size for the Gas segment is estimated at $XX Billion in 2025, with a robust CAGR of XX% during the forecast period. Competitive dynamics within each segment are influenced by regional demand, regulatory landscapes, and technological adoption rates.

Key Drivers of Oil and Gas Pipeline Fabrication and Construction Industry Growth

The Oil and Gas Pipeline Fabrication and Construction industry is propelled by several key drivers. Increasing Global Energy Demand: The perpetual need for energy to fuel economic growth and power industries worldwide necessitates robust pipeline networks for both fossil fuels and future energy carriers. Technological Advancements: Innovations in materials science, welding, construction automation, and digital monitoring solutions are enhancing efficiency, safety, and cost-effectiveness. Government Support and Infrastructure Investment: Many nations are prioritizing energy infrastructure development to ensure energy security and support economic expansion, leading to significant capital allocation for new pipeline projects and upgrades. Shift Towards Natural Gas: The global push for cleaner energy sources is driving substantial investment in natural gas infrastructure, including LNG terminals and extensive pipeline networks.

Challenges in the Oil and Gas Pipeline Fabrication and Construction Industry Sector

Despite robust growth, the Oil and Gas Pipeline Fabrication and Construction industry faces several challenges. Stringent Regulatory Hurdles and Environmental Concerns: Navigating complex environmental regulations, obtaining permits, and addressing public opposition related to land use and environmental impact can lead to significant project delays and increased costs. Supply Chain Volatility and Material Costs: Fluctuations in the prices of steel, a primary material, and disruptions in global supply chains can impact project budgets and timelines. Skilled Labor Shortages: The industry requires a highly skilled workforce for fabrication and construction, and a shortage of qualified personnel can hinder project execution. Geopolitical Instability and Project Financing: Political uncertainties in key resource-rich regions and the substantial capital required for mega-projects can impact investment decisions and project feasibility.

Emerging Opportunities in Oil and Gas Pipeline Fabrication and Construction Industry

Emerging opportunities in the Oil and Gas Pipeline Fabrication and Construction industry lie in the growing demand for hydrogen and carbon capture, utilization, and storage (CCUS) infrastructure. As the world transitions to a low-carbon economy, the development of dedicated hydrogen pipelines and networks for transporting captured CO2 presents significant new market potential. Furthermore, the digitalization of pipeline operations, including the implementation of AI-powered predictive maintenance and advanced monitoring systems, offers opportunities for service providers and technology developers. The expansion of LNG infrastructure in emerging markets also presents substantial project pipelines.

Leading Players in the Oil and Gas Pipeline Fabrication and Construction Industry Market

- Sunland Construction Inc

- Tenaris SA

- Bechtel Corporation

- Ledcor Group

- Shengli Oil & Gas Pipe Holdings Limited

- Barnard Construction Company Inc

- Snelson Companies Inc

- Larsen & Toubro Limited

- Gateway Pipeline LLC

- Pumpco Inc

Key Developments in Oil and Gas Pipeline Fabrication and Construction Industry Industry

- 2023/08: Tenaris SA announced a significant investment in expanding its OCTG manufacturing capacity to meet growing demand for upstream oil and gas exploration.

- 2023/06: Bechtel Corporation secured a major contract for the construction of a new LNG export terminal, highlighting continued investment in gas infrastructure.

- 2023/04: Shengli Oil & Gas Pipe Holdings Limited launched a new line of high-strength, corrosion-resistant steel pipes, aimed at enhancing pipeline longevity in harsh environments.

- 2023/01: Ledcor Group completed a major pipeline expansion project, demonstrating its capability in large-scale infrastructure development.

- 2022/11: Larsen & Toubro Limited secured multiple contracts for pipeline projects in the Middle East, reflecting regional growth in energy infrastructure.

- 2022/09: Barnard Construction Company Inc acquired a specialized fabrication company to enhance its service offerings in pipeline integrity management.

- 2022/07: Snelson Companies Inc showcased advancements in their automated welding technology, reducing construction times by an estimated XX%.

- 2022/05: Gateway Pipeline LLC secured funding for a new cross-country pipeline project, underscoring investor confidence in midstream infrastructure.

- 2022/03: Pumpco Inc reported significant growth in its pump station construction division, supporting the expansion of oil and gas transmission networks.

Future Outlook for Oil and Gas Pipeline Fabrication and Construction Industry Market

The future outlook for the Oil and Gas Pipeline Fabrication and Construction industry remains positive, driven by sustained energy demand and strategic investments in infrastructure modernization and expansion. The ongoing energy transition will see increased focus on natural gas pipelines and the burgeoning development of infrastructure for new energy carriers like hydrogen and for CCUS applications. Technological advancements in automation, digital twin technology, and advanced materials will continue to shape project execution, leading to greater efficiency and sustainability. Companies that can adapt to evolving regulatory landscapes, embrace digital transformation, and diversify their service offerings to include emerging energy solutions will be best positioned for long-term success in this dynamic market.

Oil and Gas Pipeline Fabrication and Construction Industry Segmentation

-

1. Application

- 1.1. Oil

- 1.2. Gas

Oil and Gas Pipeline Fabrication and Construction Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Oil and Gas Pipeline Fabrication and Construction Industry Regional Market Share

Geographic Coverage of Oil and Gas Pipeline Fabrication and Construction Industry

Oil and Gas Pipeline Fabrication and Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Investment in LNG Infrastructure4.; Rising Demand for LNG in Bunkering

- 3.2.2 Road Transportation

- 3.2.3 and Off-grid Power

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Supporting Infrastructure in the Regions such as the Middle East and Africa

- 3.4. Market Trends

- 3.4.1. Gas Segment to Record Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Pipeline Fabrication and Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oil and Gas Pipeline Fabrication and Construction Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil

- 6.1.2. Gas

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Oil and Gas Pipeline Fabrication and Construction Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil

- 7.1.2. Gas

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Oil and Gas Pipeline Fabrication and Construction Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil

- 8.1.2. Gas

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Oil and Gas Pipeline Fabrication and Construction Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil

- 9.1.2. Gas

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Oil and Gas Pipeline Fabrication and Construction Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil

- 10.1.2. Gas

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sunland Construction Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tenaris SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bechtel Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ledcor Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shengli Oil & Gas Pipe Holdings Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Barnard Construction Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Snelson Companies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Larsen & Toubro Limited*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gateway Pipeline LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pumpco Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sunland Construction Inc

List of Figures

- Figure 1: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: Europe Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Asia Pacific Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: Middle East and Africa Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Oil and Gas Pipeline Fabrication and Construction Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Oil and Gas Pipeline Fabrication and Construction Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Oil and Gas Pipeline Fabrication and Construction Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Pipeline Fabrication and Construction Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Oil and Gas Pipeline Fabrication and Construction Industry?

Key companies in the market include Sunland Construction Inc, Tenaris SA, Bechtel Corporation, Ledcor Group, Shengli Oil & Gas Pipe Holdings Limited, Barnard Construction Company Inc, Snelson Companies Inc, Larsen & Toubro Limited*List Not Exhaustive, Gateway Pipeline LLC, Pumpco Inc.

3. What are the main segments of the Oil and Gas Pipeline Fabrication and Construction Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in LNG Infrastructure4.; Rising Demand for LNG in Bunkering. Road Transportation. and Off-grid Power.

6. What are the notable trends driving market growth?

Gas Segment to Record Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Supporting Infrastructure in the Regions such as the Middle East and Africa.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Pipeline Fabrication and Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Pipeline Fabrication and Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Pipeline Fabrication and Construction Industry?

To stay informed about further developments, trends, and reports in the Oil and Gas Pipeline Fabrication and Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence