Key Insights

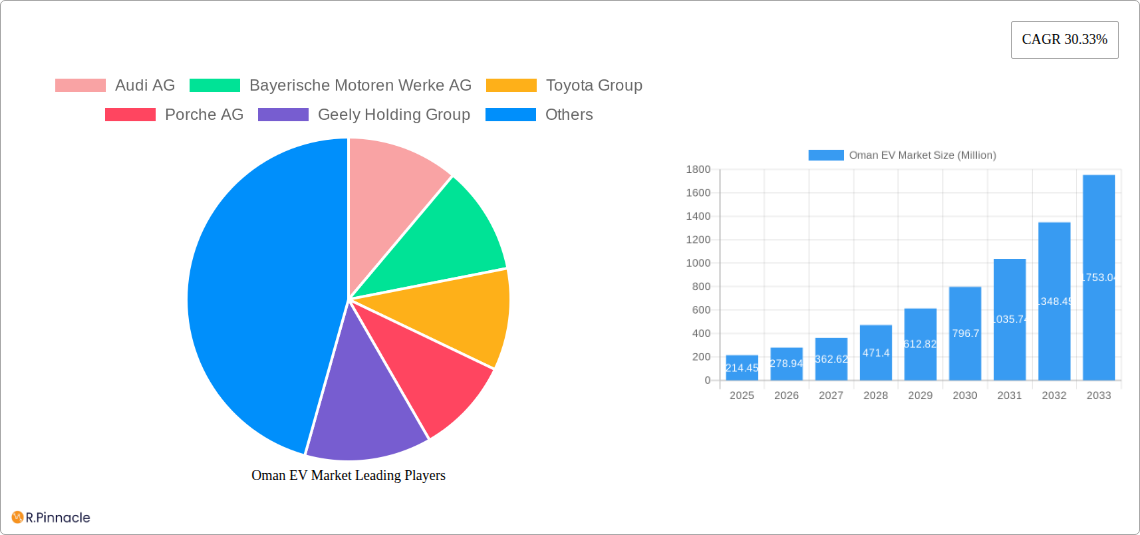

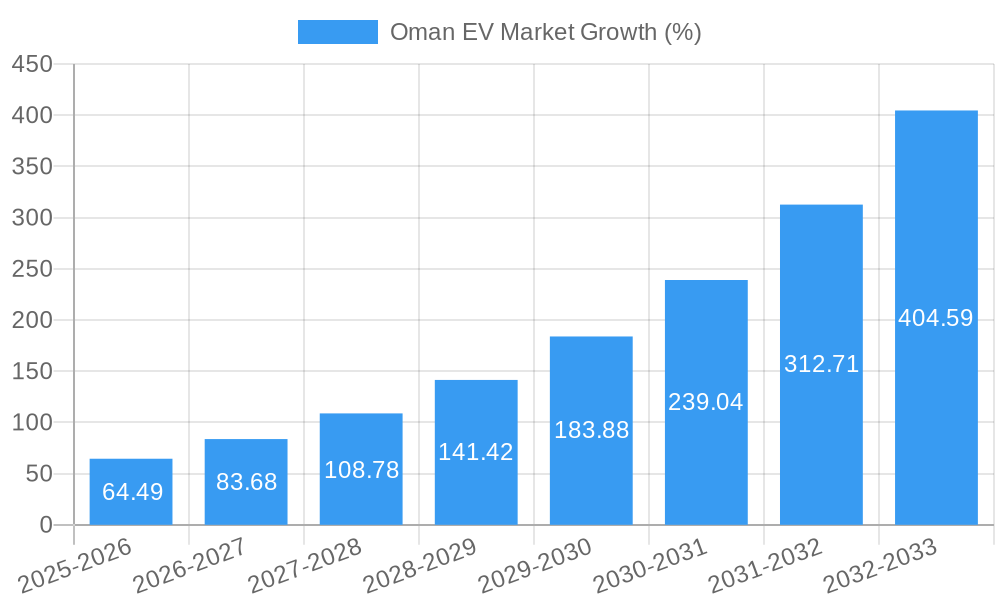

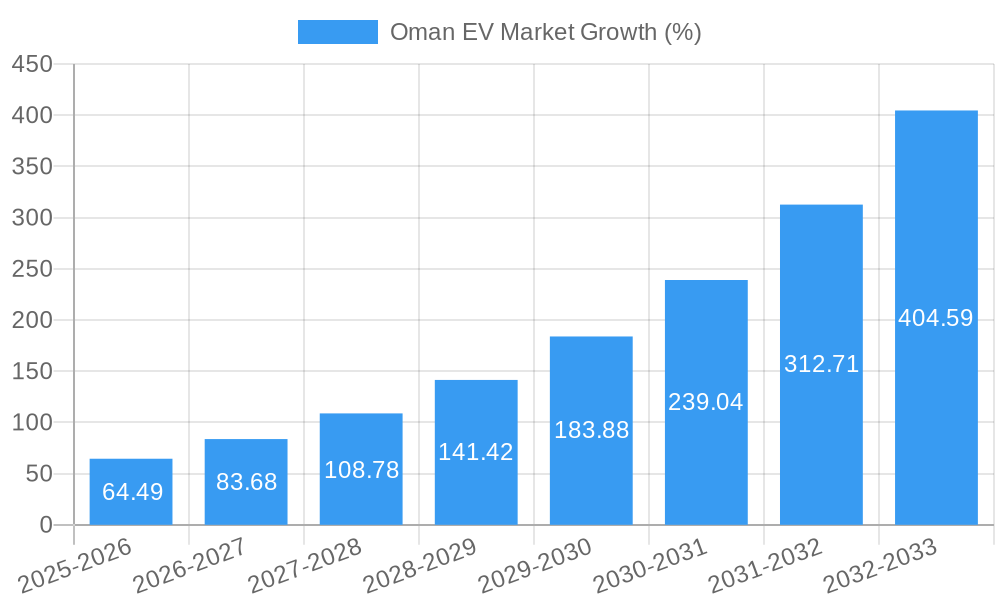

The Oman EV market, valued at $214.45 million in 2025, is poised for substantial growth, exhibiting a robust Compound Annual Growth Rate (CAGR) of 30.33% from 2025 to 2033. This expansion is driven by several key factors. Government initiatives promoting sustainable transportation, including subsidies and tax incentives for electric vehicles, are significantly boosting adoption. Rising fuel prices and increasing environmental awareness among consumers are further fueling demand. Infrastructure development, such as the expansion of charging stations across the country, is also playing a crucial role in facilitating EV adoption. The presence of major automotive players like Audi, BMW, Toyota, Porsche, and Mercedes-Benz, among others, indicates a strong commitment to the Oman EV market. These manufacturers are introducing a diverse range of EV models catering to various consumer preferences and price points. While challenges such as limited charging infrastructure in certain areas and high initial purchase costs persist, the overall market outlook remains optimistic due to the strong governmental support and increasing consumer interest in eco-friendly mobility solutions.

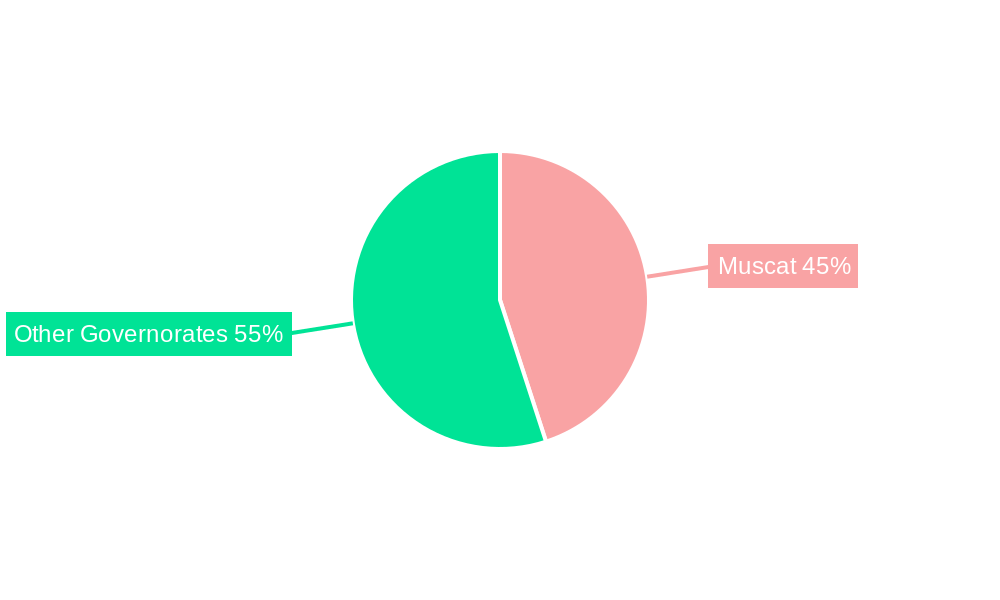

The market segmentation within Oman likely reflects a preference for compact and SUV models, given regional driving conditions and family needs. The forecast period (2025-2033) will likely see a shift towards larger battery capacities and improved charging technologies, enhancing consumer confidence and range anxiety mitigation. The projected growth necessitates further investment in charging infrastructure and public awareness campaigns to fully realize the market's potential. Specific regional data within Oman (e.g., Muscat vs. other governorates) will further reveal nuanced market dynamics and inform targeted strategies for manufacturers and investors. The competitive landscape, with established global players competing alongside potentially emerging local players, ensures a dynamic and rapidly evolving market.

Oman EV Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman EV market, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report delves into market structure, dynamics, key players, and future growth prospects. The report leverages extensive data analysis and incorporates recent key industry developments to provide actionable intelligence for strategic decision-making. Expect detailed segmentation, market sizing (in Millions), and CAGR projections to support your business strategies.

Oman EV Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment shaping the Oman EV market. We examine market concentration, highlighting the market share of key players like Audi AG, Bayerische Motoren Werke AG, Toyota Group, Porche AG, Geely Holding Group, Mercedes-Benz AG, Chevrolet, Mazda, Tata Group, and Volvo Group (list not exhaustive). The report also assesses the impact of mergers and acquisitions (M&A) activities, providing an overview of deal values and their influence on market dynamics. Innovation drivers, such as government incentives and technological advancements, are explored, along with an analysis of product substitutes and end-user demographics. The regulatory framework, including its impact on market growth and investment, is comprehensively evaluated.

- Market Concentration: xx% dominated by top 5 players in 2024.

- M&A Activity: Total M&A deal value in 2024 estimated at xx Million.

- Innovation Drivers: Government subsidies, technological advancements in battery technology.

- Regulatory Framework: Analysis of existing policies and their effect on market expansion.

Oman EV Market Market Dynamics & Trends

This section dives deep into the market's growth trajectory, examining key drivers, technological disruptions, consumer preferences, and competitive dynamics. We provide a detailed analysis of the Compound Annual Growth Rate (CAGR) and market penetration rates for the forecast period (2025-2033). The influence of factors such as rising fuel prices, environmental concerns, and government support for electric vehicles are meticulously examined. The report also analyses evolving consumer preferences, including their impact on vehicle choice and demand. Finally, we assess the intensity of competition and the strategies employed by key market participants.

- CAGR (2025-2033): xx%

- Market Penetration (2025): xx%

- Key Growth Drivers: Increasing fuel prices, government incentives, environmental awareness.

- Technological Disruptions: Advancements in battery technology, charging infrastructure development.

Dominant Regions & Segments in Oman EV Market

This section identifies the leading regions and segments within the Oman EV market. We analyze the key drivers contributing to their dominance, including economic policies, infrastructure development, and consumer demand. A detailed analysis is provided, focusing on factors responsible for the outperformance of specific regions or segments. The analysis may incorporate data from different geographical areas within Oman to identify specific pockets of high growth.

- Dominant Region: Muscat (due to higher disposable incomes and infrastructure development)

- Key Drivers for Dominant Region: Government initiatives, improved charging infrastructure, and higher adoption among affluent consumers.

- Dominant Segment: Passenger Vehicles (initially) with significant growth anticipated in commercial vehicle segments thereafter.

- Key Drivers for Dominant Segment: High demand and government focus on public transportation.

Oman EV Market Product Innovations

This section summarizes recent product developments, highlighting key technological advancements and their market impact. We analyze the competitive advantages offered by innovative products, focusing on factors such as performance, efficiency, and affordability. This overview includes an analysis of emerging technologies and their potential disruption of the current market.

Recent innovations include the introduction of new e-SUV models by VinFast, and the expansion of electric buses through the partnership of Bahwan Automobiles and JBM. These innovations demonstrate a push towards more sustainable transportation options in Oman.

Report Scope & Segmentation Analysis

This report segments the Oman EV market across various parameters to provide a granular view. These segments include vehicle type (passenger cars, commercial vehicles, two-wheelers), battery type (lithium-ion, etc.), charging infrastructure (public, private), and power output range. Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed to aid strategic planning.

- Passenger Cars: Market size xx Million in 2025, projected to reach xx Million by 2033. High competition, significant growth potential.

- Commercial Vehicles: Market size xx Million in 2025, expected to grow significantly due to government initiatives.

- Charging Infrastructure: Significant investments planned in public charging networks, driving market expansion.

Key Drivers of Oman EV Market Growth

Several factors are driving the growth of the Oman EV market. Government policies promoting EV adoption, including subsidies and tax breaks, are a key catalyst. The rising cost of fuel and increasing environmental awareness among consumers are also contributing to the market's expansion. Furthermore, advancements in battery technology and charging infrastructure are enhancing the viability and attractiveness of electric vehicles.

Challenges in the Oman EV Market Sector

Despite the positive growth outlook, the Oman EV market faces certain challenges. The high initial cost of EVs compared to conventional vehicles remains a significant barrier. Limited charging infrastructure in certain areas poses a range anxiety concern for potential buyers. Furthermore, the development and maintenance of reliable supply chains can be complex, creating potential disruptions to market growth.

Emerging Opportunities in Oman EV Market

The Oman EV market presents substantial growth opportunities. The expansion of charging infrastructure, particularly in less-developed areas, presents a significant business prospect. The government's continued focus on promoting sustainable transportation creates favorable conditions for new market entrants. Moreover, innovations in battery technology and the emergence of new vehicle designs will further drive market growth and open further opportunities for businesses.

Leading Players in the Oman EV Market Market

- Audi AG

- Bayerische Motoren Werke AG

- Toyota Group

- Porche AG

- Geely Holding Group

- Mercedes-Benz AG

- Chevrolet

- Mazda

- Tata Group

- Volvo Group

- *List Not Exhaustive

Key Developments in Oman EV Market Industry

- July 2023: Oman Oil Marketing Company (OOMCO) partnered with Synergy Investment LLC to establish Electric Vehicles One (EVO) for developing Oman's EV infrastructure.

- February 2024: VinFast Auto signed a dealer agreement with Bahwan Automobiles Trading LLC (BAT) for EV distribution in Oman, planning 13 stores by 2027.

- March 2024: Bahwan Automobiles and Trading LLC (BAT) partnered with JBM Electric Vehicles (P) Ltd. to introduce electric buses in Oman.

Future Outlook for Oman EV Market Market

The Oman EV market is poised for significant growth driven by government support, technological advancements, and rising consumer demand for sustainable transportation. Strategic investments in charging infrastructure and continued innovation in EV technology will be crucial in shaping the market's future trajectory. The market's potential for substantial expansion is evident, creating lucrative opportunities for both established and emerging players.

Oman EV Market Segmentation

-

1. Vehicle Type

- 1.1. Two-wheeler

- 1.2. Passenger Car

- 1.3. Commercial Vehicle

-

2. Propulsion Type

- 2.1. Battery Electric Vehicle (BEV)

- 2.2. Hybrid Electric Vehicle (HEV)

- 2.3. Plug-In Hybrid Electric Vehicle (PHEV)

-

3. Battery Type

- 3.1. Lithium Iron Phosphate Battery (LFP)

- 3.2. Nickel Manganese Cobalt (NMC)

- 3.3. Other Battery Types

-

4. Range

- 4.1. Upto 150 km

- 4.2. 151-300 km

- 4.3. Above 300 km

-

5. Drive Type

- 5.1. All-wheel Drive

- 5.2. Front-wheel Drive

- 5.3. Rear-wheel Drive

-

6. Battery Capacity

- 6.1. Less than 20 kWh

- 6.2. 20-40 kWh

- 6.3. 40-60 kWh

- 6.4. 60-100 kWh

- 6.5. Above 100 kWh

-

7. End-User

- 7.1. Shared Mobility Providers

- 7.2. Government Organizations

- 7.3. Personal Users

Oman EV Market Segmentation By Geography

- 1. Oman

Oman EV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 30.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Emphasis on Sustainable Fuels is Driving the Market

- 3.3. Market Restrains

- 3.3.1. The Growing Emphasis on Sustainable Fuels is Driving the Market

- 3.4. Market Trends

- 3.4.1. The Passenger Car Segment is Leading the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman EV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-wheeler

- 5.1.2. Passenger Car

- 5.1.3. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicle (BEV)

- 5.2.2. Hybrid Electric Vehicle (HEV)

- 5.2.3. Plug-In Hybrid Electric Vehicle (PHEV)

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lithium Iron Phosphate Battery (LFP)

- 5.3.2. Nickel Manganese Cobalt (NMC)

- 5.3.3. Other Battery Types

- 5.4. Market Analysis, Insights and Forecast - by Range

- 5.4.1. Upto 150 km

- 5.4.2. 151-300 km

- 5.4.3. Above 300 km

- 5.5. Market Analysis, Insights and Forecast - by Drive Type

- 5.5.1. All-wheel Drive

- 5.5.2. Front-wheel Drive

- 5.5.3. Rear-wheel Drive

- 5.6. Market Analysis, Insights and Forecast - by Battery Capacity

- 5.6.1. Less than 20 kWh

- 5.6.2. 20-40 kWh

- 5.6.3. 40-60 kWh

- 5.6.4. 60-100 kWh

- 5.6.5. Above 100 kWh

- 5.7. Market Analysis, Insights and Forecast - by End-User

- 5.7.1. Shared Mobility Providers

- 5.7.2. Government Organizations

- 5.7.3. Personal Users

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Audi AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayerische Motoren Werke AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toyota Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Porche AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Geely Holding Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes-Benz AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chevrolet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mazda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tata Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Volvo Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Audi AG

List of Figures

- Figure 1: Oman EV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman EV Market Share (%) by Company 2024

List of Tables

- Table 1: Oman EV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman EV Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Oman EV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Oman EV Market Volume Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Oman EV Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 6: Oman EV Market Volume Million Forecast, by Propulsion Type 2019 & 2032

- Table 7: Oman EV Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 8: Oman EV Market Volume Million Forecast, by Battery Type 2019 & 2032

- Table 9: Oman EV Market Revenue Million Forecast, by Range 2019 & 2032

- Table 10: Oman EV Market Volume Million Forecast, by Range 2019 & 2032

- Table 11: Oman EV Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 12: Oman EV Market Volume Million Forecast, by Drive Type 2019 & 2032

- Table 13: Oman EV Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 14: Oman EV Market Volume Million Forecast, by Battery Capacity 2019 & 2032

- Table 15: Oman EV Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Oman EV Market Volume Million Forecast, by End-User 2019 & 2032

- Table 17: Oman EV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 18: Oman EV Market Volume Million Forecast, by Region 2019 & 2032

- Table 19: Oman EV Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 20: Oman EV Market Volume Million Forecast, by Vehicle Type 2019 & 2032

- Table 21: Oman EV Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 22: Oman EV Market Volume Million Forecast, by Propulsion Type 2019 & 2032

- Table 23: Oman EV Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 24: Oman EV Market Volume Million Forecast, by Battery Type 2019 & 2032

- Table 25: Oman EV Market Revenue Million Forecast, by Range 2019 & 2032

- Table 26: Oman EV Market Volume Million Forecast, by Range 2019 & 2032

- Table 27: Oman EV Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 28: Oman EV Market Volume Million Forecast, by Drive Type 2019 & 2032

- Table 29: Oman EV Market Revenue Million Forecast, by Battery Capacity 2019 & 2032

- Table 30: Oman EV Market Volume Million Forecast, by Battery Capacity 2019 & 2032

- Table 31: Oman EV Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 32: Oman EV Market Volume Million Forecast, by End-User 2019 & 2032

- Table 33: Oman EV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Oman EV Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman EV Market?

The projected CAGR is approximately 30.33%.

2. Which companies are prominent players in the Oman EV Market?

Key companies in the market include Audi AG, Bayerische Motoren Werke AG, Toyota Group, Porche AG, Geely Holding Group, Mercedes-Benz AG, Chevrolet, Mazda, Tata Group, Volvo Group*List Not Exhaustive.

3. What are the main segments of the Oman EV Market?

The market segments include Vehicle Type, Propulsion Type, Battery Type, Range, Drive Type, Battery Capacity, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 214.45 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Emphasis on Sustainable Fuels is Driving the Market.

6. What are the notable trends driving market growth?

The Passenger Car Segment is Leading the Market.

7. Are there any restraints impacting market growth?

The Growing Emphasis on Sustainable Fuels is Driving the Market.

8. Can you provide examples of recent developments in the market?

March 2024: Bahwan Automobiles and Trading LLC (BAT) announced a partnership with India’s JBM Electric Vehicles (P) Ltd. to introduce a new portfolio of electric buses in Oman. The agreement was signed at the MENA Transport Congress & Exhibition 2024 in Dubai. The collaboration marks BAT’s strategic expansion into the electric vehicle (EV) market and JBM’s entry into the MEA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman EV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman EV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman EV Market?

To stay informed about further developments, trends, and reports in the Oman EV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence