Key Insights

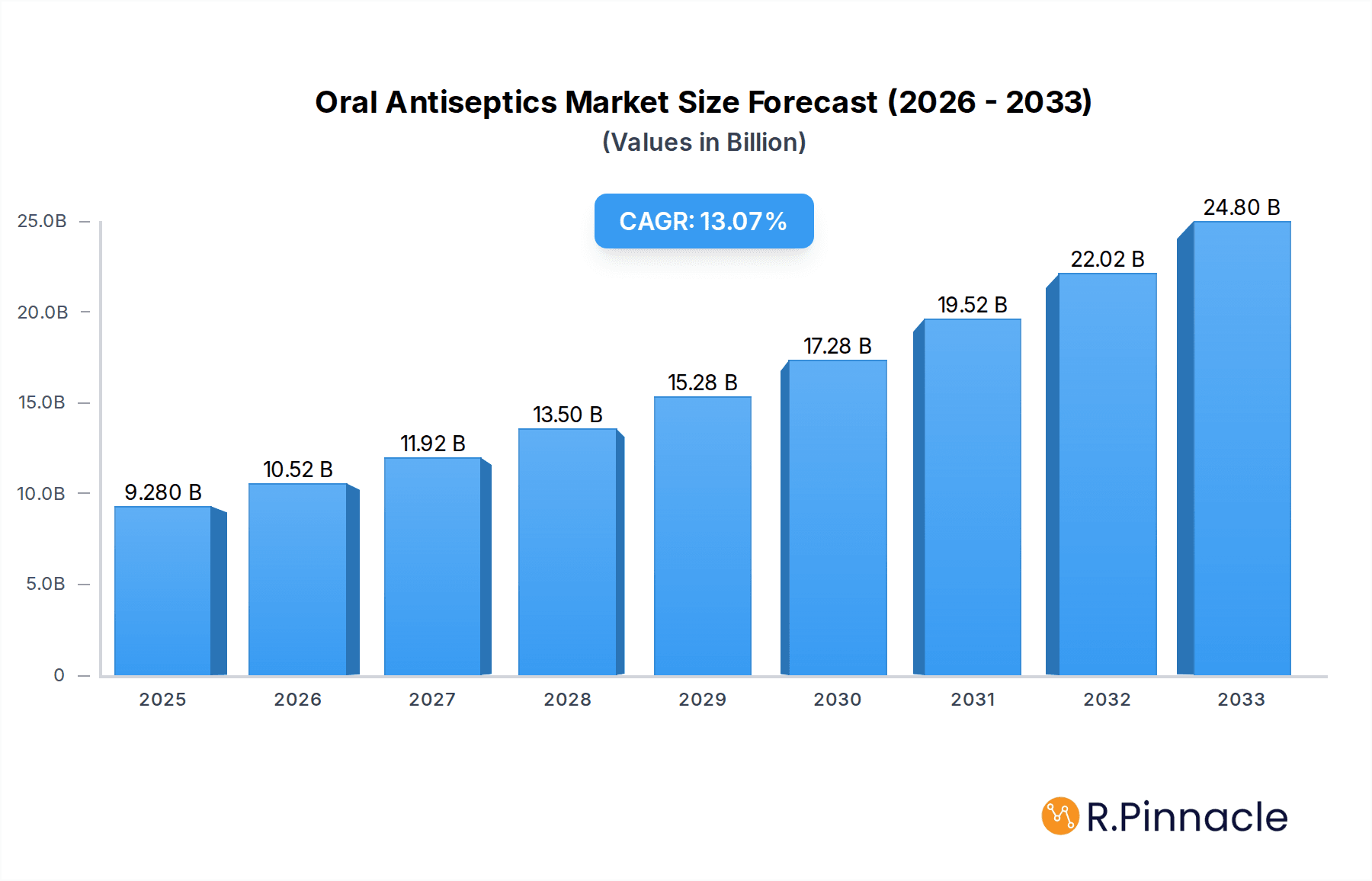

The global Oral Antiseptics Market is poised for significant expansion, with a projected market size of USD 9.28 billion in 2025 and an impressive Compound Annual Growth Rate (CAGR) of 13.33% during the forecast period of 2025-2033. This robust growth is primarily fueled by an escalating awareness of oral hygiene's critical role in overall health, coupled with the increasing prevalence of oral health issues such as gingivitis, periodontitis, and dental caries. Furthermore, advancements in antiseptic formulations, offering enhanced efficacy and patient compliance, are also contributing to market acceleration. The growing demand for convenient and effective oral care solutions, including readily available over-the-counter (OTC) products, further underpins this positive market trajectory.

Oral Antiseptics Market Market Size (In Billion)

Key market drivers include a rising disposable income, leading to greater consumer spending on premium oral care products, and a proactive approach to preventative healthcare. The widespread adoption of antiseptic mouthwashes and sprays for post-operative care and general oral sanitation is also a significant contributor. Emerging economies, particularly in the Asia Pacific region, present substantial growth opportunities due to improving healthcare infrastructure and increasing access to advanced oral care solutions. While the market is experiencing robust growth, potential restraints such as the perceived side effects of certain antiseptic ingredients and the availability of alternative oral hygiene practices could temper growth. However, continuous research and development in creating safer and more effective antiseptic solutions are expected to mitigate these challenges, ensuring sustained market expansion.

Oral Antiseptics Market Company Market Share

Here's an SEO-optimized, reader-centric report description for the Oral Antiseptics Market, designed for immediate use:

This comprehensive Oral Antiseptics Market Report offers in-depth analysis and strategic insights into the global market for oral antiseptic products. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report provides an unparalleled understanding of market dynamics, growth drivers, and competitive landscapes. Industry professionals will gain actionable intelligence on key trends, technological advancements, and emerging opportunities within the oral care and infection control sectors. The report delves into market structure, segmentation, challenges, and the strategic initiatives of leading players, making it an indispensable resource for market participants aiming to navigate and capitalize on this evolving market.

Oral Antiseptics Market Market Structure & Innovation Trends

The Oral Antiseptics Market exhibits a moderately concentrated structure, driven by continuous innovation and stringent regulatory frameworks governing product safety and efficacy. Key innovation drivers include the development of novel formulations that offer broader spectrum antimicrobial activity, reduced irritation, and enhanced patient compliance. Regulatory bodies worldwide play a crucial role in shaping market entry and product claims, necessitating rigorous clinical trials and adherence to quality standards. The presence of effective product substitutes, such as basic mouthwashes and traditional oral hygiene practices, presents a competitive challenge, although specialized antiseptic solutions are gaining traction for specific medical applications and advanced oral care needs. End-user demographics are diverse, encompassing general consumers seeking improved oral hygiene, healthcare professionals addressing infection prevention, and patients undergoing medical procedures. Mergers and acquisitions (M&A) activities are anticipated to shape the market landscape, with estimated M&A deal values contributing to industry consolidation and expansion. The market share distribution among key players is influenced by their research and development investments and strategic partnerships.

Oral Antiseptics Market Market Dynamics & Trends

The Oral Antiseptics Market is experiencing robust growth, propelled by a confluence of factors including rising awareness of oral hygiene's impact on overall health, increasing prevalence of oral diseases such as gingivitis and periodontitis, and a growing demand for effective infection control solutions in healthcare settings. The market penetration of advanced oral antiseptic formulations is steadily increasing, driven by technological disruptions in product development. Innovations such as the creation of alcohol-free formulations, sustained-release antiseptic agents, and combined antimicrobial and anti-inflammatory products are significantly influencing consumer preferences and clinical adoption. The CAGR of the oral antiseptics market is projected to be strong, reflecting these positive trends. Consumer preferences are shifting towards products offering comprehensive oral health benefits beyond mere freshening, including preventative care against bacterial infections and improved gum health. Competitive dynamics within the market are intense, with established global players and emerging regional manufacturers vying for market share through product differentiation, strategic pricing, and extensive distribution networks. The rising incidence of healthcare-associated infections (HAIs) is also a critical driver, compelling healthcare facilities to adopt superior antiseptic solutions for patient care and procedural hygiene. Furthermore, the expanding geriatric population, more susceptible to oral health issues, contributes significantly to market demand. The increasing disposable income in developing economies is also fostering greater access to and demand for advanced oral care products.

Dominant Regions & Segments in Oral Antiseptics Market

North America currently dominates the Oral Antiseptics Market, propelled by a highly developed healthcare infrastructure, strong consumer awareness regarding oral health, and significant investments in research and development. The United States, in particular, represents a substantial market due to its advanced healthcare systems and high per capita healthcare expenditure. Favorable economic policies supporting healthcare innovation and robust regulatory frameworks that ensure product quality contribute to this regional dominance.

- Formulation: Chlorhexidine is a leading formulation within the oral antiseptics market. Its broad-spectrum antimicrobial activity and proven efficacy against a wide range of oral pathogens make it a preferred choice for prescription-based oral rinses and surgical site preparations. The ongoing research into novel delivery systems for chlorhexidine further solidifies its market position.

- Type: Solutions represent the most prominent product type in the oral antiseptics market. Liquid solutions are versatile, widely accepted by consumers and healthcare professionals, and allow for easy application in various settings, including home care and clinical environments. The development of concentrated and ready-to-use solutions caters to diverse user needs.

- Application: Surgeries are a significant application area for oral antiseptics. Pre-operative and post-operative use of antiseptic solutions plays a crucial role in preventing surgical site infections, particularly in dental and maxillofacial surgeries. The increasing volume of surgical procedures globally directly correlates with the demand for these essential antiseptic products.

Other regions like Europe and Asia Pacific are exhibiting strong growth trajectories, driven by increasing healthcare spending, a growing emphasis on preventive healthcare, and a burgeoning middle class with greater purchasing power for premium oral care products. The economic policies in these regions are increasingly aligned with promoting healthcare access and innovation, further stimulating market expansion.

Oral Antiseptics Market Product Innovations

Product innovation in the Oral Antiseptics Market is focused on developing safer, more effective, and user-friendly antiseptic solutions. Key advancements include the creation of alcohol-free formulations to mitigate potential irritation and adverse effects, alongside sustained-release technologies that provide prolonged antimicrobial action. Novel combinations of active ingredients are being explored to target a broader spectrum of pathogens and address specific oral health concerns such as plaque reduction, gingivitis prevention, and post-operative healing. These innovations offer competitive advantages by addressing unmet clinical needs and enhancing patient compliance and satisfaction, thereby driving market adoption.

Report Scope & Segmentation Analysis

This report segments the Oral Antiseptics Market based on Formulation, Type, and Application.

- Formulation: The market is analyzed across Alcohols, Chlorhexidine, Iodine, and Other Formulations. Each segment's growth is projected based on its unique efficacy profile, application scope, and market adoption rates.

- Type: Segmentation by Type includes Solutions, Swab Sticks, and Wipes. Solutions are expected to maintain their dominant share due to their widespread use, while swab sticks and wipes cater to specialized applications and convenience-seeking consumers.

- Application: The market is examined across Surgeries, Injection, and Other Applications. The surgeries segment is driven by the need for robust infection control, while the injection segment addresses a critical point of entry for pathogens. Other applications encompass general oral hygiene and therapeutic uses.

Key Drivers of Oral Antiseptics Market Growth

Several key drivers are propelling the Oral Antiseptics Market forward. The increasing global incidence of oral diseases like gingivitis and periodontitis necessitates effective antimicrobial interventions. Growing health consciousness among consumers, emphasizing preventive healthcare and improved oral hygiene, is a significant factor. Furthermore, the escalating rates of healthcare-associated infections (HAIs) in clinical settings are driving the demand for potent antiseptic solutions for patient care and procedural safety. Technological advancements in formulation development, leading to more efficacious and patient-friendly products, also contribute substantially.

Challenges in the Oral Antiseptics Market Sector

Despite strong growth prospects, the Oral Antiseptics Market faces several challenges. Stringent regulatory approval processes can prolong time-to-market for new products and increase development costs. The availability of over-the-counter (OTC) mouthwashes and traditional oral hygiene practices poses a competitive restraint, especially in price-sensitive markets. Supply chain disruptions, amplified by global events, can impact the availability and cost of raw materials. Additionally, concerns regarding potential antimicrobial resistance and the need for responsible usage of antiseptic agents require ongoing research and consumer education.

Emerging Opportunities in Oral Antiseptics Market

Emerging opportunities in the Oral Antiseptics Market are ripe for exploration. The development of novel, targeted antiseptic formulations for specific oral pathogens presents a significant avenue for innovation. The growing demand for natural and organic oral care products is creating a niche for plant-based antiseptic ingredients. Furthermore, the expanding healthcare markets in developing economies, coupled with rising disposable incomes, offer substantial untapped potential. The increasing use of antiseptics in medical devices and specialized wound care applications also presents new market avenues.

Leading Players in the Oral Antiseptics Market Market

Kimberly-Clark Becton Dickinson and Company Reckitt Benckiser Group PLC Schelke & Mayr GmbH Sage Products LLC 3M Company Sirmaxo Chemicals Pvt Ltd Purdue Pharma L P Johnson & Johnson Ecolab Inc B Braun Melsungen AG PSK Pharma Pvt Ltd

Key Developments in Oral Antiseptics Market Industry

- March 2022: PDI Healthcare launched novel, innovative disinfectants, Sani-24 Germicidal Disposable Wipe, Sani-HyPerCide Germicidal Disposable Wipe, and Sani-HyPerCide Germicidal Spray, to help infection prevention professionals in the fight against rising healthcare-associated infections (HAIs).

- January 2022: ESTA Technology launched ULTRABloom foam hand sanitizer, which is alcohol-free and provides protection against bacteria, yeast, viruses, fungi, and mould.

Future Outlook for Oral Antiseptics Market Market

The future outlook for the Oral Antiseptics Market is exceptionally promising, fueled by persistent demand for advanced infection control solutions and the growing emphasis on preventative oral healthcare. Continued innovation in formulations, focusing on enhanced efficacy, reduced side effects, and patient convenience, will be a key growth accelerator. The expansion of healthcare access in emerging economies, coupled with increasing consumer awareness, is expected to drive significant market penetration. Strategic collaborations and acquisitions among key players are likely to further shape the competitive landscape, fostering market consolidation and global reach. The increasing recognition of oral health's link to systemic well-being will solidify the role of oral antiseptics in comprehensive healthcare strategies.

Oral Antiseptics Market Segmentation

-

1. Formulation

- 1.1. Alcohols

- 1.2. Chlorhexidine

- 1.3. Iodine

- 1.4. Other Formulations

-

2. Type

- 2.1. Solutions

- 2.2. Swab Sticks

- 2.3. Wipes

-

3. Application

- 3.1. Surgeries

- 3.2. Injection

- 3.3. Other Applications

Oral Antiseptics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Oral Antiseptics Market Regional Market Share

Geographic Coverage of Oral Antiseptics Market

Oral Antiseptics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Hospital-acquired Infections; Increasing Number of Surgeries

- 3.3. Market Restrains

- 3.3.1. Side effects and risk of Permeability

- 3.4. Market Trends

- 3.4.1. Alcohols Segment is Expected to Dominate the Skin Antiseptic Products Market over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oral Antiseptics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Formulation

- 5.1.1. Alcohols

- 5.1.2. Chlorhexidine

- 5.1.3. Iodine

- 5.1.4. Other Formulations

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solutions

- 5.2.2. Swab Sticks

- 5.2.3. Wipes

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Surgeries

- 5.3.2. Injection

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Formulation

- 6. North America Oral Antiseptics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Formulation

- 6.1.1. Alcohols

- 6.1.2. Chlorhexidine

- 6.1.3. Iodine

- 6.1.4. Other Formulations

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solutions

- 6.2.2. Swab Sticks

- 6.2.3. Wipes

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Surgeries

- 6.3.2. Injection

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Formulation

- 7. Europe Oral Antiseptics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Formulation

- 7.1.1. Alcohols

- 7.1.2. Chlorhexidine

- 7.1.3. Iodine

- 7.1.4. Other Formulations

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solutions

- 7.2.2. Swab Sticks

- 7.2.3. Wipes

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Surgeries

- 7.3.2. Injection

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Formulation

- 8. Asia Pacific Oral Antiseptics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Formulation

- 8.1.1. Alcohols

- 8.1.2. Chlorhexidine

- 8.1.3. Iodine

- 8.1.4. Other Formulations

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solutions

- 8.2.2. Swab Sticks

- 8.2.3. Wipes

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Surgeries

- 8.3.2. Injection

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Formulation

- 9. Middle East and Africa Oral Antiseptics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Formulation

- 9.1.1. Alcohols

- 9.1.2. Chlorhexidine

- 9.1.3. Iodine

- 9.1.4. Other Formulations

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solutions

- 9.2.2. Swab Sticks

- 9.2.3. Wipes

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Surgeries

- 9.3.2. Injection

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Formulation

- 10. South America Oral Antiseptics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Formulation

- 10.1.1. Alcohols

- 10.1.2. Chlorhexidine

- 10.1.3. Iodine

- 10.1.4. Other Formulations

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solutions

- 10.2.2. Swab Sticks

- 10.2.3. Wipes

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Surgeries

- 10.3.2. Injection

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Formulation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kimberly-Clark

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton Dickinson and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Reckitt Benckiser Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schelke & Mayr GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sage Products LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sirmaxo Chemicals Pvt Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Purdue Pharma L P

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ecolab Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 B Braun Melsungen AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PSK Pharma Pvt Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Kimberly-Clark

List of Figures

- Figure 1: Global Oral Antiseptics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Oral Antiseptics Market Revenue (billion), by Formulation 2025 & 2033

- Figure 3: North America Oral Antiseptics Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 4: North America Oral Antiseptics Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Oral Antiseptics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Oral Antiseptics Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Oral Antiseptics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Oral Antiseptics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Oral Antiseptics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Oral Antiseptics Market Revenue (billion), by Formulation 2025 & 2033

- Figure 11: Europe Oral Antiseptics Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 12: Europe Oral Antiseptics Market Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Oral Antiseptics Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Oral Antiseptics Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Oral Antiseptics Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Oral Antiseptics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Oral Antiseptics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Oral Antiseptics Market Revenue (billion), by Formulation 2025 & 2033

- Figure 19: Asia Pacific Oral Antiseptics Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 20: Asia Pacific Oral Antiseptics Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Asia Pacific Oral Antiseptics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Oral Antiseptics Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Oral Antiseptics Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Oral Antiseptics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Oral Antiseptics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Oral Antiseptics Market Revenue (billion), by Formulation 2025 & 2033

- Figure 27: Middle East and Africa Oral Antiseptics Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 28: Middle East and Africa Oral Antiseptics Market Revenue (billion), by Type 2025 & 2033

- Figure 29: Middle East and Africa Oral Antiseptics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Oral Antiseptics Market Revenue (billion), by Application 2025 & 2033

- Figure 31: Middle East and Africa Oral Antiseptics Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Oral Antiseptics Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Oral Antiseptics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Oral Antiseptics Market Revenue (billion), by Formulation 2025 & 2033

- Figure 35: South America Oral Antiseptics Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 36: South America Oral Antiseptics Market Revenue (billion), by Type 2025 & 2033

- Figure 37: South America Oral Antiseptics Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: South America Oral Antiseptics Market Revenue (billion), by Application 2025 & 2033

- Figure 39: South America Oral Antiseptics Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Oral Antiseptics Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Oral Antiseptics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oral Antiseptics Market Revenue billion Forecast, by Formulation 2020 & 2033

- Table 2: Global Oral Antiseptics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Oral Antiseptics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Oral Antiseptics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Oral Antiseptics Market Revenue billion Forecast, by Formulation 2020 & 2033

- Table 6: Global Oral Antiseptics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Oral Antiseptics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Oral Antiseptics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Oral Antiseptics Market Revenue billion Forecast, by Formulation 2020 & 2033

- Table 13: Global Oral Antiseptics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Oral Antiseptics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Oral Antiseptics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Oral Antiseptics Market Revenue billion Forecast, by Formulation 2020 & 2033

- Table 23: Global Oral Antiseptics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Oral Antiseptics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Oral Antiseptics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Oral Antiseptics Market Revenue billion Forecast, by Formulation 2020 & 2033

- Table 33: Global Oral Antiseptics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Oral Antiseptics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Global Oral Antiseptics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Oral Antiseptics Market Revenue billion Forecast, by Formulation 2020 & 2033

- Table 40: Global Oral Antiseptics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Oral Antiseptics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 42: Global Oral Antiseptics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Oral Antiseptics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oral Antiseptics Market?

The projected CAGR is approximately 13.33%.

2. Which companies are prominent players in the Oral Antiseptics Market?

Key companies in the market include Kimberly-Clark, Becton Dickinson and Company, Reckitt Benckiser Group PLC, Schelke & Mayr GmbH, Sage Products LLC, 3M Company, Sirmaxo Chemicals Pvt Ltd *List Not Exhaustive, Purdue Pharma L P, Johnson & Johnson, Ecolab Inc, B Braun Melsungen AG, PSK Pharma Pvt Ltd.

3. What are the main segments of the Oral Antiseptics Market?

The market segments include Formulation, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Hospital-acquired Infections; Increasing Number of Surgeries.

6. What are the notable trends driving market growth?

Alcohols Segment is Expected to Dominate the Skin Antiseptic Products Market over the Forecast Period.

7. Are there any restraints impacting market growth?

Side effects and risk of Permeability.

8. Can you provide examples of recent developments in the market?

In March 2022, PDI Healthcare launched novel, innovative disinfectants, Sani-24 Germicidal Disposable Wipe, Sani-HyPerCide Germicidal Disposable Wipe, and Sani-HyPerCide Germicidal Spray, to help infection prevention professionals in the fight against rising healthcare-associated infections (HAIs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oral Antiseptics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oral Antiseptics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oral Antiseptics Market?

To stay informed about further developments, trends, and reports in the Oral Antiseptics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence