Key Insights

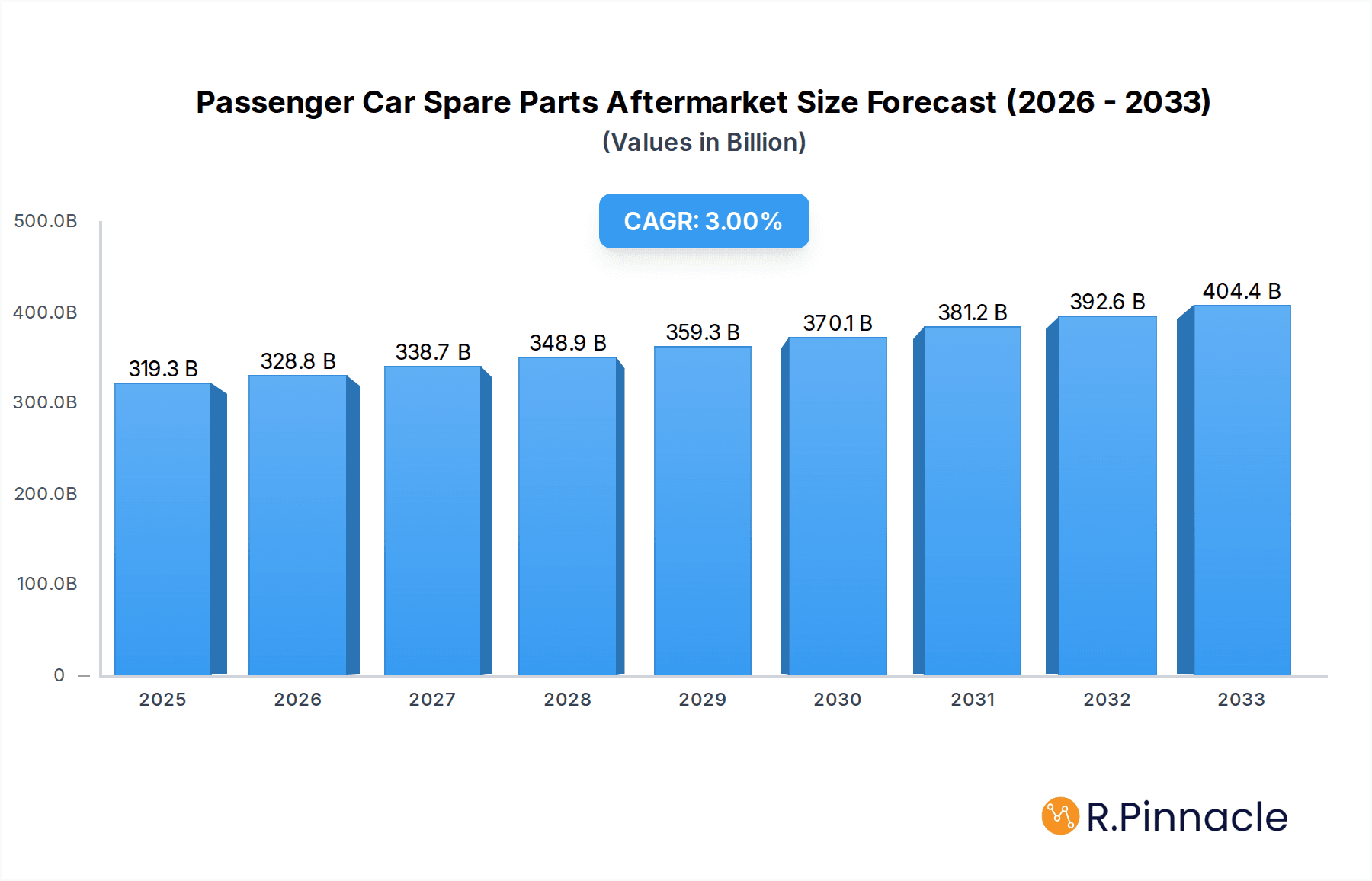

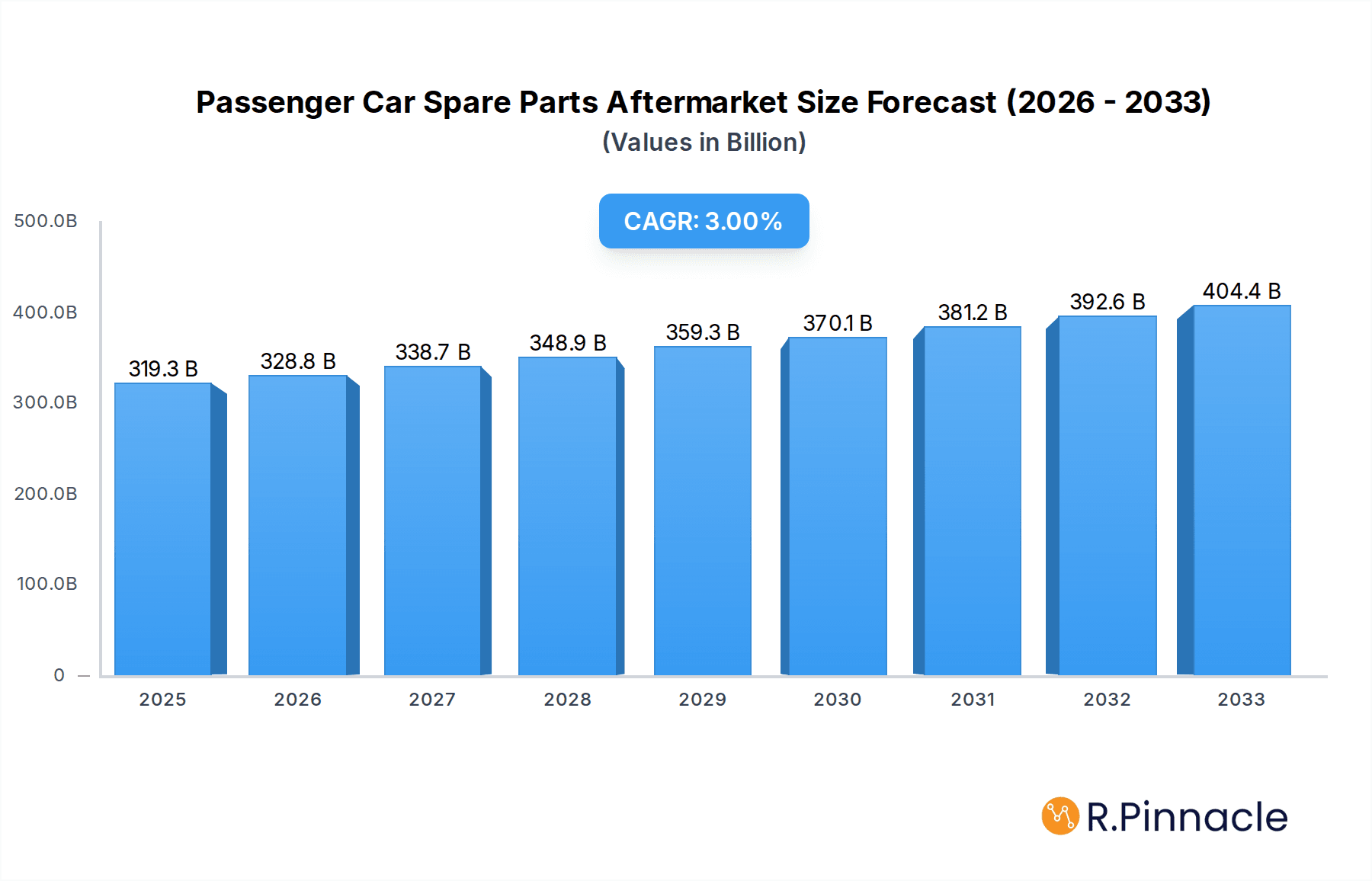

The Passenger Car Spare Parts Aftermarket is poised for robust expansion, with a current market size estimated at 319,260 million USD. This sector is projected to witness a steady Compound Annual Growth Rate (CAGR) of 3% over the forecast period of 2025-2033, underscoring its sustained momentum. The aftermarket's growth is primarily fueled by an aging global vehicle parc, where an increasing number of passenger cars are moving beyond their warranty periods, necessitating regular maintenance and replacement of parts. Furthermore, rising consumer awareness regarding vehicle safety and performance, coupled with a desire to extend the lifespan of their vehicles, acts as a significant catalyst. The increasing complexity of modern vehicles, incorporating advanced electronics and sophisticated powertrain systems, also drives demand for specialized and high-quality spare parts. Economic factors such as disposable income and the accessibility of affordable, yet reliable, aftermarket parts contribute to this positive market trajectory.

Passenger Car Spare Parts Aftermarket Market Size (In Billion)

Key trends shaping the Passenger Car Spare Parts Aftermarket include the growing adoption of electric vehicles (EVs), which, while having fewer traditional mechanical parts, are creating new opportunities in areas like battery components and specialized electronic systems. The rise of e-commerce platforms is revolutionizing the distribution of spare parts, offering greater convenience and wider selection to consumers. Moreover, technological advancements are leading to the development of more durable and efficient parts. However, challenges persist, including the proliferation of counterfeit parts that pose safety risks and undermine legitimate businesses, and evolving regulations that may impact the types of parts available. Intense competition among established global players and emerging regional manufacturers also defines the market landscape, pushing for innovation and competitive pricing. Despite these headwinds, the fundamental demand for reliable and accessible passenger car spare parts ensures a promising outlook for the aftermarket.

Passenger Car Spare Parts Aftermarket Company Market Share

Passenger Car Spare Parts Aftermarket: Comprehensive Market Insights & Forecast (2019-2033)

This in-depth report provides a detailed analysis of the global Passenger Car Spare Parts Aftermarket, offering crucial insights for stakeholders including manufacturers, distributors, suppliers, and investors. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report leverages high-ranking keywords to ensure maximum search visibility and reader engagement within the automotive aftermarket industry. We delve into market structure, dynamics, regional dominance, product innovations, key drivers, challenges, emerging opportunities, and the competitive landscape, presenting actionable intelligence supported by quantifiable data and expert analysis.

Passenger Car Spare Parts Aftermarket Market Structure & Innovation Trends

The Passenger Car Spare Parts Aftermarket is characterized by a moderately concentrated market structure, with leading players like Bosch, Continental, Mahler, Tenneco, ZF, Alpine Electronics, Pioneer Corporation, DENSO, Hella, KYB, SMP, SKF, and BorgWarner holding significant market share, estimated in the hundreds of millions for top entities. Innovation is a critical driver, fueled by advancements in electric vehicle (EV) technology, connected car features, and the increasing demand for high-performance and durable parts. Regulatory frameworks, particularly concerning emissions and safety standards, continuously shape product development and aftermarket service requirements. The threat of product substitutes is increasing with the rise of remanufactured parts and the growing DIY repair segment, though genuine OEM and high-quality aftermarket parts maintain a strong foothold. End-user demographics are evolving, with a growing segment of younger, tech-savvy consumers and a larger aging vehicle parc driving demand. Mergers and acquisitions (M&A) activities are significant, with deal values often reaching hundreds of millions, consolidating market share and expanding product portfolios to meet evolving aftermarket needs.

Passenger Car Spare Parts Aftermarket Market Dynamics & Trends

The Passenger Car Spare Parts Aftermarket is poised for substantial growth, driven by a confluence of accelerating factors. The increasing global vehicle parc, estimated to exceed hundreds of millions, coupled with the aging of these vehicles, directly translates into a higher demand for replacement parts. This trend is further amplified by the growing awareness among vehicle owners regarding the importance of regular maintenance and timely replacement of worn-out components to ensure vehicle longevity and safety, contributing to a projected CAGR of xx%. Technological disruptions are a paramount force, with the proliferation of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) introducing new categories of spare parts and services, such as battery components and sensor replacements, creating significant market penetration opportunities. The shift towards sustainable and eco-friendly solutions is also influencing consumer preferences, favoring energy-efficient parts and remanufactured components, further driving market penetration. Competitive dynamics are intensifying, with traditional OEM suppliers facing increased competition from independent aftermarket manufacturers and service providers. The rise of e-commerce platforms has democratized access to a wider array of spare parts, empowering consumers with more choices and often more competitive pricing, reshaping distribution channels and consumer purchasing habits. The increasing complexity of modern vehicles necessitates specialized diagnostic tools and skilled technicians, creating opportunities for training programs and advanced aftermarket service providers. The ongoing pursuit of cost-effectiveness by consumers, especially during economic downturns, continues to fuel the demand for affordable, yet reliable, aftermarket solutions. Furthermore, the growing trend of vehicle customization and performance enhancement also contributes to aftermarket demand, as owners seek specialized parts to upgrade their vehicles. The report anticipates a market size in the hundreds of millions for the forecast period.

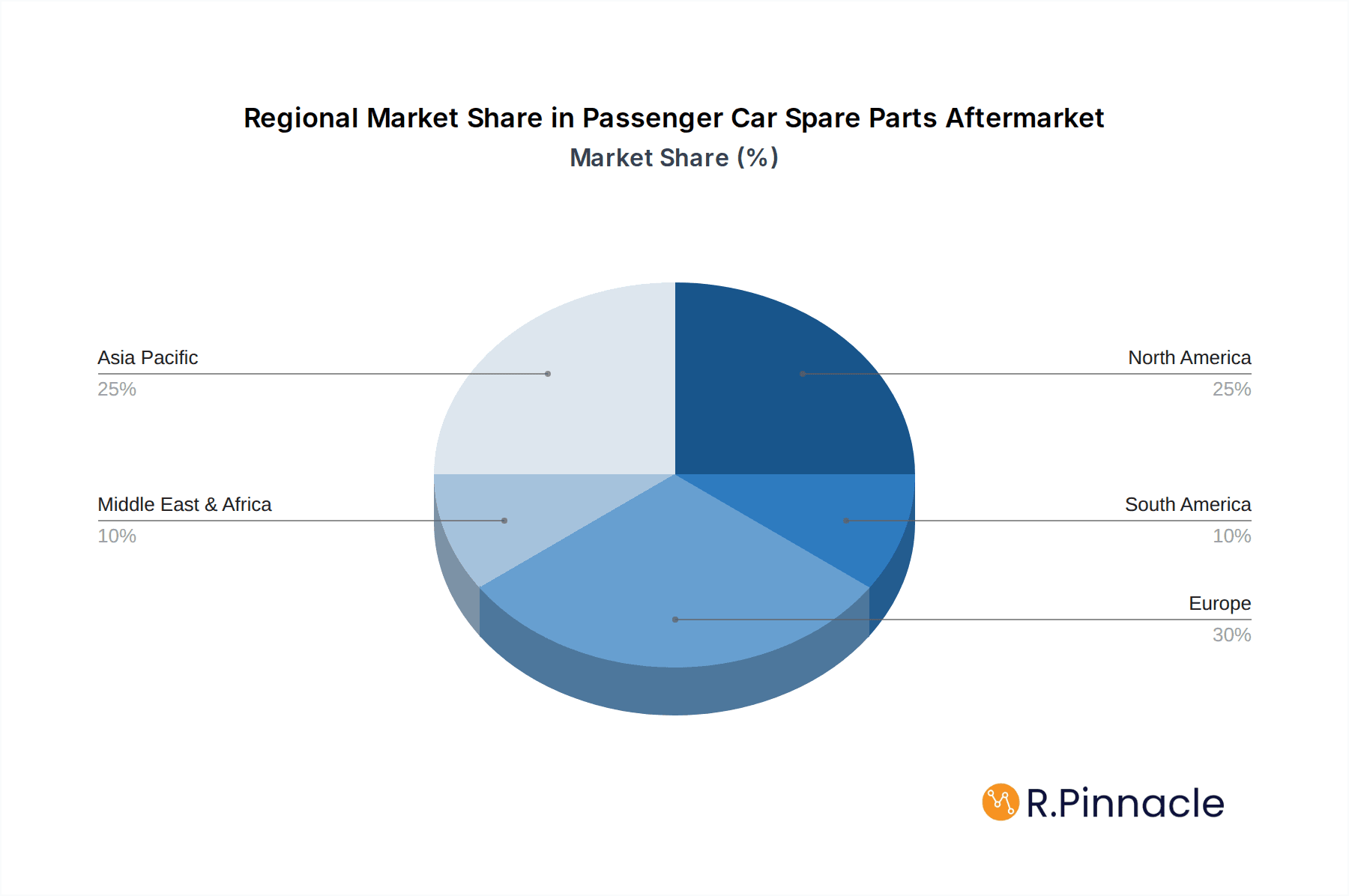

Dominant Regions & Segments in Passenger Car Spare Parts Aftermarket

North America currently holds a dominant position in the Passenger Car Spare Parts Aftermarket, driven by its extensive vehicle parc, high disposable incomes, and a culture that values vehicle maintenance and customization. Within North America, the United States leads, supported by robust economic policies that favor automotive manufacturing and a well-established aftermarket infrastructure. The dominance is further propelled by a strong demand for SUV and MPV parts, reflecting consumer preferences for larger vehicles. Regulatory frameworks in the region, while stringent on safety and emissions, also foster a competitive aftermarket by allowing for the sale of certified independent parts. The segment of Powertrain and Chassis Parts, along with Body Parts, exhibits particularly strong demand due to the high mileage and age of vehicles in operation, contributing to hundreds of millions in segment revenue.

Key drivers for this regional dominance include:

- Economic Stability: A strong and stable economy ensures consumers have the disposable income for vehicle maintenance and repairs.

- Vehicle Parc Age: A significant proportion of the North American vehicle fleet is aging, necessitating regular replacement of critical components.

- Consumer Preferences: A strong preference for SUVs and MPVs translates into higher demand for related spare parts.

- Aftermarket Infrastructure: A well-developed network of independent repair shops and parts distributors facilitates accessibility and competition.

The "Powertrain and Chassis Parts" segment is a significant contributor to the aftermarket's value, driven by the need for regular replacement of components like brakes, suspension systems, and engine parts. The "Body Parts" segment also sees substantial demand due to wear and tear, minor accidents, and cosmetic enhancements, with market sizes in the hundreds of millions.

Passenger Car Spare Parts Aftermarket Product Innovations

Product innovations in the Passenger Car Spare Parts Aftermarket are primarily focused on enhancing durability, performance, and sustainability. Advancements in materials science are leading to lighter and stronger body parts and chassis components, while sophisticated diagnostic capabilities are being integrated into electronic parts and lighting systems. The burgeoning EV market is spurring innovation in battery management systems, electric motor components, and thermal management solutions, offering distinct competitive advantages. These developments aim to improve fuel efficiency, reduce emissions, and extend vehicle lifespan.

Report Scope & Segmentation Analysis

The scope of this report encompasses the global Passenger Car Spare Parts Aftermarket, segmented by Application and Type.

Application:

- Sedan: This segment is projected to maintain steady growth, driven by its enduring popularity and the need for routine maintenance. Market sizes are estimated in the hundreds of millions.

- SUV: Expected to experience robust growth due to increasing consumer preference for larger vehicles and their associated wear and tear. Market sizes are substantial, in the hundreds of millions.

- MPV: This segment will see consistent demand, particularly in emerging markets, with market sizes in the hundreds of millions.

Type:

- Body Parts: High demand driven by accident repairs and aesthetic modifications, with significant market share in the hundreds of millions.

- Lighting & Electronic: Growing demand fueled by advanced features, safety regulations, and the increasing complexity of vehicle electronics, with market sizes in the hundreds of millions.

- Interior Components: Steady demand for replacement parts like upholstery, dashboard elements, and climate control systems, contributing to market sizes in the hundreds of millions.

- Powertrain and Chassis Parts: A core segment with consistent high demand due to essential wear and tear and performance needs, holding a substantial portion of the market in the hundreds of millions.

- Battery: Critical for all vehicles, with increasing demand for EV batteries and related components, representing a significant growth area with market sizes in the hundreds of millions.

- Others: This category encompasses miscellaneous parts and accessories, contributing to the overall market volume in the hundreds of millions.

Key Drivers of Passenger Car Spare Parts Aftermarket Growth

The Passenger Car Spare Parts Aftermarket is propelled by several key drivers. The escalating global vehicle parc and the aging of existing fleets are primary factors, necessitating more frequent part replacements. Technological advancements, particularly in EVs and connected car features, are creating new product categories and repair demands. Increasingly stringent safety and emission regulations mandate the use of compliant and high-quality replacement parts. Furthermore, the growing emphasis on vehicle longevity and performance, coupled with economic considerations favoring repair over replacement, contributes significantly to sustained market growth. The expansion of e-commerce platforms also enhances accessibility and price competitiveness for aftermarket parts.

Challenges in the Passenger Car Spare Parts Aftermarket Sector

Despite robust growth prospects, the Passenger Car Spare Parts Aftermarket faces several challenges. Counterfeit parts pose a significant threat, compromising vehicle safety and brand reputation, with estimated losses in the hundreds of millions annually. Supply chain disruptions, as witnessed in recent years, can lead to parts shortages and price volatility. The rapid evolution of automotive technology, especially in the EV sector, demands continuous investment in research and development and workforce training, which can be a barrier for smaller players. Intense price competition among numerous aftermarket providers can also impact profit margins. Navigating diverse and evolving regulatory landscapes across different regions adds another layer of complexity.

Emerging Opportunities in Passenger Car Spare Parts Aftermarket

The Passenger Car Spare Parts Aftermarket is ripe with emerging opportunities. The exponential growth of the electric vehicle market presents a massive opportunity for specialized EV components, charging infrastructure parts, and battery repair/replacement services, with market potential in the hundreds of millions. The increasing integration of telematics and IoT in vehicles is paving the way for predictive maintenance solutions and remote diagnostics, creating new service-based revenue streams. The demand for sustainable and eco-friendly aftermarket solutions, such as remanufactured parts and bio-based lubricants, is on the rise. Furthermore, the expansion of emerging economies with growing vehicle ownership offers significant untapped market potential. The development of advanced driver-assistance systems (ADAS) also necessitates specialized sensors and calibration services, creating niche market opportunities.

Leading Players in the Passenger Car Spare Parts Aftermarket Market

- Bosch

- Continental

- Mahler

- Tenneco

- ZF

- Alpine Electronics

- Pioneer Corporation

- DENSO

- Hella

- KYB

- SMP

- SKF

- BorgWarner

Key Developments in Passenger Car Spare Parts Aftermarket Industry

- 2023/Q4: Major players like Bosch and DENSO announce significant investments in EV component production to meet escalating demand.

- 2024/Q1: Continental expands its ADAS sensor portfolio, responding to the growing market for advanced safety features.

- 2024/Q2: Tenneco enhances its aftermarket suspension solutions with new product lines focused on enhanced ride comfort and durability.

- 2024/Q3: BorgWarner acquires a leading supplier of EV thermal management systems, strengthening its position in the rapidly evolving EV aftermarket.

- 2024/Q4: SKF launches an innovative range of bearings designed for higher efficiency and longer lifespan in next-generation vehicle architectures.

- 2025/Q1: Hella introduces an expanded range of intelligent lighting solutions, incorporating advanced connectivity and adaptive features.

- 2025/Q2: ZF invests in advanced remanufacturing technologies to promote sustainability within its aftermarket offerings.

- 2025/Q3: KYB introduces advanced shock absorber technology for SUVs, catering to the growing demand for enhanced off-road and on-road performance.

- 2025/Q4: SMP unveils new engine management components optimized for fuel efficiency and emissions control, aligning with global environmental mandates.

- 2026/Q1: Pioneer Corporation expands its in-car entertainment and connectivity solutions, integrating cutting-edge digital features.

- 2026/Q2: Mahler focuses on lightweight material innovations for interior components, enhancing vehicle aesthetics and sustainability.

- 2026/Q3: Alpine Electronics enhances its aftermarket navigation and infotainment systems with AI-powered features for a more intuitive user experience.

Future Outlook for Passenger Car Spare Parts Aftermarket Market

The future outlook for the Passenger Car Spare Parts Aftermarket is exceptionally bright, projected to witness sustained and robust growth. The accelerating transition to electric vehicles will be a primary growth accelerator, creating a burgeoning demand for EV-specific components and specialized repair services. Continued advancements in vehicle technology, including autonomous driving features and enhanced connectivity, will further diversify the aftermarket product and service landscape. The increasing focus on sustainability and the circular economy will drive demand for remanufactured and eco-friendly parts. Strategic opportunities lie in leveraging digital platforms for enhanced customer engagement, developing innovative solutions for vehicle diagnostics and repair, and expanding into emerging geographic markets. The market is expected to reach hundreds of millions in value over the forecast period.

Passenger Car Spare Parts Aftermarket Segmentation

-

1. Application

- 1.1. Sedan

- 1.2. SUV

- 1.3. MPV

-

2. Type

- 2.1. Body Parts

- 2.2. Lighting & Electronic

- 2.3. Interior Components

- 2.4. Powertrain and Chassis Parts

- 2.5. Battery

- 2.6. Others

Passenger Car Spare Parts Aftermarket Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Passenger Car Spare Parts Aftermarket Regional Market Share

Geographic Coverage of Passenger Car Spare Parts Aftermarket

Passenger Car Spare Parts Aftermarket REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passenger Car Spare Parts Aftermarket Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sedan

- 5.1.2. SUV

- 5.1.3. MPV

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Body Parts

- 5.2.2. Lighting & Electronic

- 5.2.3. Interior Components

- 5.2.4. Powertrain and Chassis Parts

- 5.2.5. Battery

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Passenger Car Spare Parts Aftermarket Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sedan

- 6.1.2. SUV

- 6.1.3. MPV

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Body Parts

- 6.2.2. Lighting & Electronic

- 6.2.3. Interior Components

- 6.2.4. Powertrain and Chassis Parts

- 6.2.5. Battery

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Passenger Car Spare Parts Aftermarket Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sedan

- 7.1.2. SUV

- 7.1.3. MPV

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Body Parts

- 7.2.2. Lighting & Electronic

- 7.2.3. Interior Components

- 7.2.4. Powertrain and Chassis Parts

- 7.2.5. Battery

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Passenger Car Spare Parts Aftermarket Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sedan

- 8.1.2. SUV

- 8.1.3. MPV

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Body Parts

- 8.2.2. Lighting & Electronic

- 8.2.3. Interior Components

- 8.2.4. Powertrain and Chassis Parts

- 8.2.5. Battery

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Passenger Car Spare Parts Aftermarket Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sedan

- 9.1.2. SUV

- 9.1.3. MPV

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Body Parts

- 9.2.2. Lighting & Electronic

- 9.2.3. Interior Components

- 9.2.4. Powertrain and Chassis Parts

- 9.2.5. Battery

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Passenger Car Spare Parts Aftermarket Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sedan

- 10.1.2. SUV

- 10.1.3. MPV

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Body Parts

- 10.2.2. Lighting & Electronic

- 10.2.3. Interior Components

- 10.2.4. Powertrain and Chassis Parts

- 10.2.5. Battery

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bosch

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Continental

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mahler

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tenneco

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alpine Electronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pioneer Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DENSO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hella

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KYB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SMP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SKF

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BorgWarner

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Bosch

List of Figures

- Figure 1: Global Passenger Car Spare Parts Aftermarket Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Passenger Car Spare Parts Aftermarket Revenue (million), by Application 2025 & 2033

- Figure 3: North America Passenger Car Spare Parts Aftermarket Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Passenger Car Spare Parts Aftermarket Revenue (million), by Type 2025 & 2033

- Figure 5: North America Passenger Car Spare Parts Aftermarket Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Passenger Car Spare Parts Aftermarket Revenue (million), by Country 2025 & 2033

- Figure 7: North America Passenger Car Spare Parts Aftermarket Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Passenger Car Spare Parts Aftermarket Revenue (million), by Application 2025 & 2033

- Figure 9: South America Passenger Car Spare Parts Aftermarket Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Passenger Car Spare Parts Aftermarket Revenue (million), by Type 2025 & 2033

- Figure 11: South America Passenger Car Spare Parts Aftermarket Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Passenger Car Spare Parts Aftermarket Revenue (million), by Country 2025 & 2033

- Figure 13: South America Passenger Car Spare Parts Aftermarket Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Passenger Car Spare Parts Aftermarket Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Passenger Car Spare Parts Aftermarket Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Passenger Car Spare Parts Aftermarket Revenue (million), by Type 2025 & 2033

- Figure 17: Europe Passenger Car Spare Parts Aftermarket Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Passenger Car Spare Parts Aftermarket Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Passenger Car Spare Parts Aftermarket Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue (million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Passenger Car Spare Parts Aftermarket Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Passenger Car Spare Parts Aftermarket Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Passenger Car Spare Parts Aftermarket Revenue (million), by Type 2025 & 2033

- Figure 29: Asia Pacific Passenger Car Spare Parts Aftermarket Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Passenger Car Spare Parts Aftermarket Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Passenger Car Spare Parts Aftermarket Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Type 2020 & 2033

- Table 3: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Type 2020 & 2033

- Table 12: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Type 2020 & 2033

- Table 18: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Type 2020 & 2033

- Table 30: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Type 2020 & 2033

- Table 39: Global Passenger Car Spare Parts Aftermarket Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Passenger Car Spare Parts Aftermarket Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Car Spare Parts Aftermarket?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Passenger Car Spare Parts Aftermarket?

Key companies in the market include Bosch, Continental, Mahler, Tenneco, ZF, Alpine Electronics, Pioneer Corporation, DENSO, Hella, KYB, SMP, SKF, BorgWarner.

3. What are the main segments of the Passenger Car Spare Parts Aftermarket?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 319260 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passenger Car Spare Parts Aftermarket," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passenger Car Spare Parts Aftermarket report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passenger Car Spare Parts Aftermarket?

To stay informed about further developments, trends, and reports in the Passenger Car Spare Parts Aftermarket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence