Key Insights

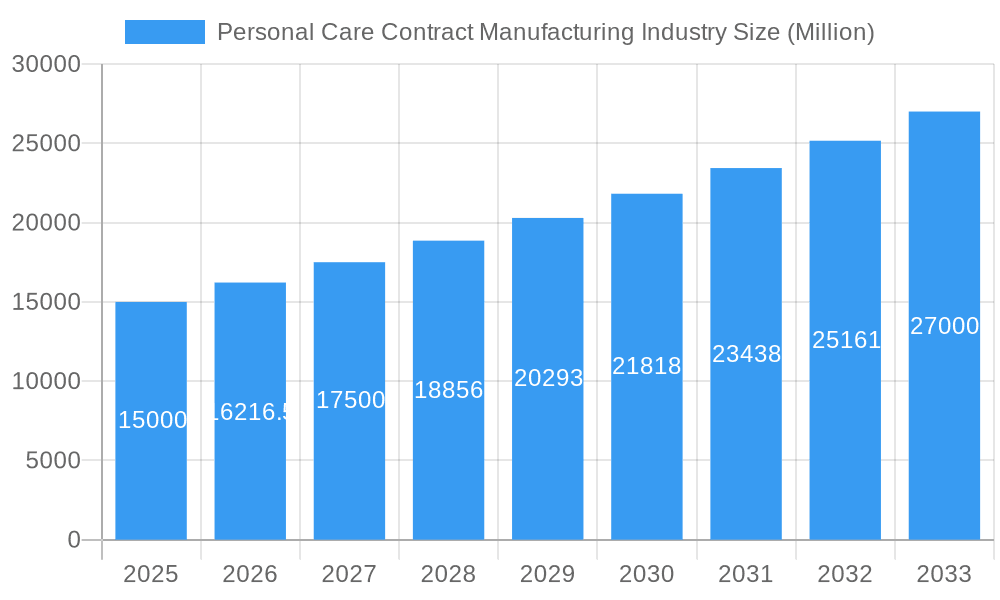

The global personal care contract manufacturing market is experiencing robust growth, driven by increasing demand for personalized and specialized cosmetic and personal care products. The market's expansion is fueled by several factors, including the rising popularity of natural and organic ingredients, the growing prevalence of e-commerce, and the increasing need for brands to outsource manufacturing to focus on core competencies like marketing and brand building. A compound annual growth rate (CAGR) of 8.11% from 2019 to 2024 suggests a significant market expansion, and this growth is expected to continue throughout the forecast period (2025-2033). The market segmentation reveals strong performance across various service types, including R&D and formulation, manufacturing, and packaging. Within product types, skincare, hair care, and makeup & cosmetics dominate the market share, indicating strong consumer preference for these categories. Key players in the industry, such as PLZ Corp, McBride PLC, and Intercos SPA, are strategically investing in research and development, capacity expansion, and mergers and acquisitions to maintain their competitive edge and cater to the evolving consumer demands. Geographical expansion is another significant driver, with regions like Asia-Pacific demonstrating considerable growth potential due to rising disposable incomes and a burgeoning middle class.

Personal Care Contract Manufacturing Industry Market Size (In Billion)

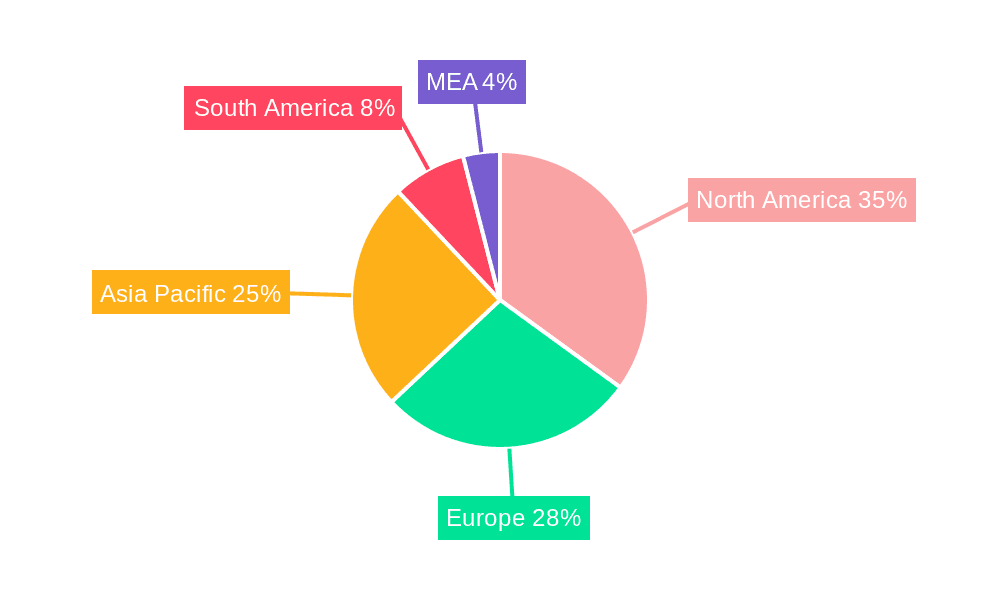

The North American market currently holds a significant share, primarily driven by established brands and advanced manufacturing capabilities. However, the Asia-Pacific region is projected to exhibit the fastest growth, surpassing other regions in the coming years. This is attributed to the region's rapid economic growth and evolving consumer preferences. Despite the positive outlook, the market faces certain restraints, including stringent regulatory requirements and increasing raw material costs. However, industry players are proactively addressing these challenges through efficient supply chain management and innovative product development strategies. The continuous innovation in sustainable and eco-friendly packaging is anticipated to further shape the market landscape. The projected market size for 2025, based on a reasonable estimation considering the provided CAGR and market dynamics, will likely be in the billions of dollars, with continued upward trajectory throughout the forecast period.

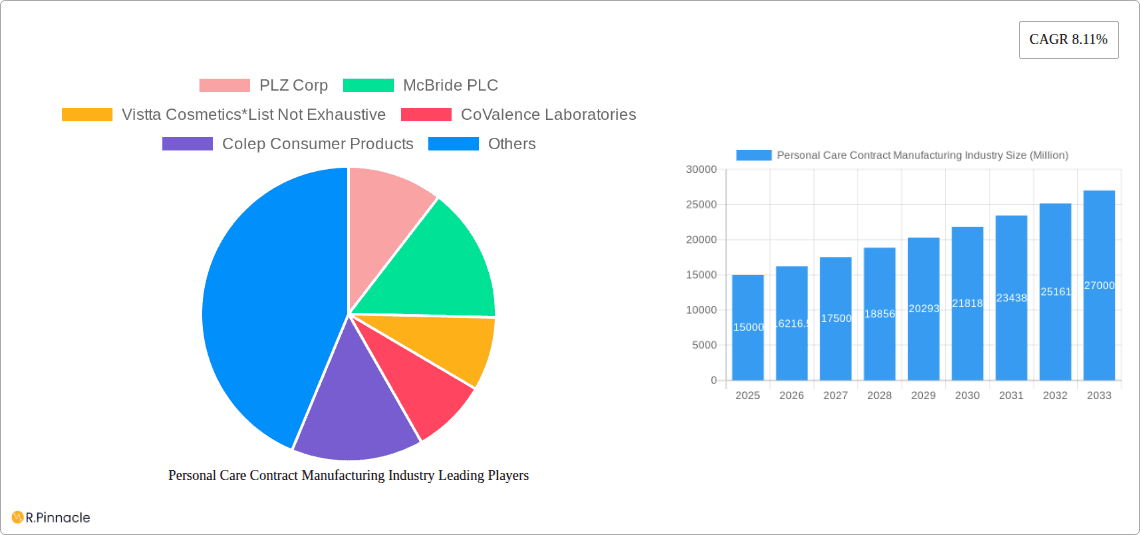

Personal Care Contract Manufacturing Industry Company Market Share

This comprehensive report provides an in-depth analysis of the global Personal Care Contract Manufacturing industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report presents a detailed overview of market size, segmentation, growth drivers, challenges, and future opportunities. The report incorporates data from key players such as PLZ Corp, McBride PLC, Vistta Cosmetics, CoValence Laboratories, Colep Consumer Products, ALBEA SA, Fareva Group, Powerpack Cosmetics, Intercos SPA, Voyant Beauty, Hair Styling Applications SpA, FORMULA CORP, Clarion Cosmetics, and HCT Group, among others. The market is segmented by service type (R&D and Formulation, Manufacturing, Packaging & Allied Services) and product type (Skin care, Hair care, Make-up & Cosmetics, Other Product Types). The report projects a market value exceeding XX Million by 2033.

Personal Care Contract Manufacturing Industry Market Structure & Innovation Trends

This section analyzes the market structure, focusing on concentration, innovation, regulations, substitutes, demographics, and M&A activity. The industry exhibits a moderately concentrated structure with a few large players holding significant market share. For example, the top 5 players collectively hold approximately XX% of the market in 2025, estimated to increase to XX% by 2033. Innovation is driven primarily by consumer demand for natural, sustainable, and personalized products. Stringent regulatory frameworks regarding ingredients and safety standards influence manufacturing practices and product development. The increasing demand for eco-friendly and sustainable packaging solutions is significantly impacting innovation. Substitutes include in-house manufacturing by large personal care brands, though contract manufacturing often offers cost and flexibility advantages. The end-user demographic is diverse, ranging from millennials and Gen Z prioritizing sustainable choices to older generations focused on efficacy and specific skincare needs. M&A activities, illustrated by recent transactions like TruArcPartners' investment in Trademark Cosmetics (TCI), are significant, driving consolidation and expansion within the sector. These deals typically involve valuations in the range of XX Million to XX Million.

- Market concentration: Top 5 players hold XX% in 2025, projected to be XX% in 2033.

- M&A deal values: Range from XX Million to XX Million.

- Key regulatory factors: Ingredient safety, sustainability regulations.

- Innovation drivers: Consumer demand for natural, sustainable, and personalized products.

Personal Care Contract Manufacturing Industry Market Dynamics & Trends

The Personal Care Contract Manufacturing market is experiencing robust growth, driven by several key factors. The CAGR during the forecast period (2025-2033) is projected to be XX%, significantly fueled by rising disposable incomes globally and increased consumer spending on personal care products. Technological advancements in formulation, manufacturing processes (such as automation), and packaging solutions are enhancing efficiency and reducing costs. Evolving consumer preferences toward natural, organic, and ethically sourced ingredients are also driving market expansion. The market witnesses intense competition, with established players focusing on innovation and strategic partnerships to maintain market share. Market penetration is high in developed economies and is rapidly growing in emerging markets.

Dominant Regions & Segments in Personal Care Contract Manufacturing Industry

The global personal care contract manufacturing landscape is currently shaped by leading regions and dynamic market segments. North America maintains a strong market presence, bolstered by its mature infrastructure, robust regulatory frameworks, and high consumer expenditure on premium personal care items. Europe and the Asia-Pacific region are also significant players, with distinct growth drivers. Within the segments:

- By Service Type: Manufacturing continues to be the largest segment, driven by the high volume production needs of global brands. Packaging & Allied Services represent a substantial portion, reflecting the critical role of attractive and functional product presentation. While R&D and Formulation services command a smaller, yet vital, market share, they are indispensable for driving innovation and developing cutting-edge products.

- By Product Type: Skincare products, particularly those addressing anti-aging concerns and other specialized needs, dominate the market. The demand for innovative formulations and active ingredients continues to fuel this segment's growth. Hair care and make-up & cosmetics follow closely, with evolving trends and consumer preferences influencing their market share.

- Regional Nuances:

- North America: Characterized by sustained consumer demand, a well-established and predictable regulatory infrastructure, and a strong focus on product innovation.

- Europe: Driven by high disposable incomes, a growing consumer preference for ethically sourced and sustainable products, and a significant market for premium and luxury personal care items.

- Asia-Pacific: Experiencing rapid economic growth, a burgeoning middle class, and a marked increase in consumer spending on a wide array of personal care products, creating substantial market expansion opportunities.

Personal Care Contract Manufacturing Industry Product Innovations

The industry constantly innovates, leveraging technological advancements like AI-driven formulation optimization, 3D printing for packaging, and sustainable material sourcing. These innovations improve product quality, reduce costs, and cater to specific consumer needs such as hypoallergenic and personalized products. The focus remains on developing environmentally friendly and cruelty-free products that appeal to the ethically conscious consumer.

Report Scope & Segmentation Analysis

This report comprehensively segments the market by service type (R&D and Formulation, Manufacturing, Packaging & Allied Services) and product type (Skin care, Hair care, Make-up & Cosmetics, Other Product Types). Each segment's growth projections, market size, and competitive dynamics are analyzed, providing insights into market opportunities and potential challenges. For instance, the Skincare segment is projected to grow at a CAGR of XX% during the forecast period.

Key Drivers of Personal Care Contract Manufacturing Industry Growth

The personal care contract manufacturing sector is experiencing robust growth, propelled by a confluence of strategic and market-driven factors:

- Increasing Consumer Spending Power: Rising disposable incomes globally translate directly into higher consumer expenditure on personal care products, from everyday essentials to premium treatments.

- Technological Advancements: Continuous innovation in formulation science, advanced manufacturing processes, and sophisticated packaging solutions enable contract manufacturers to offer enhanced product quality, efficiency, and novel product features.

- Demand for Sustainable and Ethical Products: A significant surge in consumer preference for natural, organic, vegan, cruelty-free, and environmentally sustainable personal care products is a primary growth catalyst, pushing manufacturers to adopt greener practices.

- E-commerce and Digital Transformation: The exponential growth of e-commerce and direct-to-consumer (DTC) sales channels provides contract manufacturers with new avenues for market penetration and allows brands to scale production more flexibly.

- Favorable Regulatory Environments and Incentives: Certain regions offer supportive regulatory landscapes and incentives that encourage investment and expansion in manufacturing capabilities, attracting more brands to outsource their production.

- Brand Outsourcing Strategies: An increasing number of personal care brands, from startups to established players, are strategically outsourcing their manufacturing and packaging to specialized contract manufacturers to focus on core competencies like R&D, marketing, and brand building, while benefiting from expertise and economies of scale.

Challenges in the Personal Care Contract Manufacturing Industry Sector

Despite its growth trajectory, the personal care contract manufacturing industry navigates several significant challenges:

- Stringent Regulatory Compliance: Adhering to evolving and diverse international regulations concerning ingredient safety, efficacy claims, labeling, and manufacturing practices (e.g., GMP standards) remains a complex and costly undertaking.

- Supply Chain Volatility: Fluctuations in the prices of raw materials, coupled with geopolitical factors and logistical complexities, can lead to unpredictable costs and potential supply chain disruptions, impacting production timelines and profitability.

- Intense Market Competition: The industry is characterized by a crowded marketplace with numerous contract manufacturers vying for contracts. This often leads to price pressures and the need for continuous differentiation through specialized services or superior quality.

- Balancing Cost-Effectiveness with Quality and Sustainability: Meeting demanding quality standards, stringent safety protocols, and growing consumer expectations for sustainable practices while maintaining cost-competitiveness is a perpetual challenge.

- Rapidly Evolving Consumer Preferences: Consumer tastes and trends in personal care change quickly. Contract manufacturers must be agile enough to adapt to new product demands, ingredient preferences, and aesthetic styles with minimal lead times.

- Intellectual Property Protection: Safeguarding proprietary formulations and product designs entrusted to them by clients is a critical concern for contract manufacturers, requiring robust data security and confidentiality protocols.

Emerging Opportunities in Personal Care Contract Manufacturing Industry

The personal care contract manufacturing industry is ripe with opportunities for forward-thinking and adaptive players:

- Personalized and Custom Solutions: The growing demand for bespoke skincare, haircare, and other personal care products presents a significant opportunity for manufacturers skilled in developing and producing tailored formulations and unique product experiences.

- Expansion into High-Growth Emerging Markets: Developing economies in Asia, Africa, and Latin America offer substantial untapped potential due to their rapidly expanding middle classes and increasing disposable incomes, creating new markets for contract manufacturing services.

- Investment in Sustainable and Eco-Friendly Manufacturing: Brands and consumers alike are prioritizing environmentally conscious products. Contract manufacturers that invest in renewable energy, waste reduction, biodegradable packaging, and ethical sourcing can gain a competitive edge.

- Leveraging Digital Technologies and Automation: Implementing advanced technologies such as AI for formulation optimization, IoT for supply chain visibility, and robotics for efficient production can significantly enhance operational efficiency, quality control, and customer service.

- Specialization in Niche and Emerging Product Categories: Focusing on specialized segments like clean beauty, medical-grade skincare, men's grooming, or pet care products allows manufacturers to carve out unique market positions and cater to specific, growing demands.

- Partnerships and Collaborations: Collaborating with ingredient suppliers, technology providers, and research institutions can foster innovation and enable contract manufacturers to offer more comprehensive and advanced service packages.

Leading Players in the Personal Care Contract Manufacturing Industry Market

The personal care contract manufacturing market is populated by a dynamic array of companies, each contributing unique capabilities and market reach. Some of the prominent players include:

- PLZ Corp

- McBride PLC

- Vistta Cosmetics

- CoValence Laboratories

- Colep Consumer Products

- ALBEA SA

- Fareva Group

- Powerpack Cosmetics

- Intercos SPA

- Voyant Beauty

- Hair Styling Applications SpA

- FORMULA CORP

- Clarion Cosmetics

- HCT Group

Key Developments in Personal Care Contract Manufacturing Industry Industry

- April 2023: TruArcPartners' investment in Trademark Cosmetics (TCI) signals a strategic move towards consolidation and expansion in the market. This investment highlights the industry's focus on M&A to expand capacity and market reach.

- February 2023: BASF's showcase of innovative personal care solutions at PCHi underscores the ongoing focus on sustainable and healthy beauty products, driving demand for contract manufacturers capable of supporting such initiatives. Their commitment to sustainable practices also influences their choice of partners, promoting similar commitments within the supply chain.

Future Outlook for Personal Care Contract Manufacturing Industry Market

The Personal Care Contract Manufacturing market is poised for continued growth, driven by factors such as increased consumer spending, technological advancements, and the growing demand for sustainable and personalized products. Strategic partnerships, mergers, and acquisitions will continue to reshape the competitive landscape. Companies that can adapt to evolving consumer preferences, incorporate sustainable practices, and leverage innovative technologies will be well-positioned for success.

Personal Care Contract Manufacturing Industry Segmentation

-

1. Service Type

- 1.1. R&D & Formulation

- 1.2. Manufacturing

- 1.3. Packaging & Allied Services

-

2. Product Type

- 2.1. Skin Care

- 2.2. Hair Care

- 2.3. Make-up & Cosmetics

- 2.4. Other Product Types

Personal Care Contract Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 4. Australia and New Zealand

- 5. Rest of the World

Personal Care Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Personal Care Contract Manufacturing Industry

Personal Care Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Skin Care Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. R&D & Formulation

- 5.1.2. Manufacturing

- 5.1.3. Packaging & Allied Services

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Skin Care

- 5.2.2. Hair Care

- 5.2.3. Make-up & Cosmetics

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. R&D & Formulation

- 6.1.2. Manufacturing

- 6.1.3. Packaging & Allied Services

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Skin Care

- 6.2.2. Hair Care

- 6.2.3. Make-up & Cosmetics

- 6.2.4. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. R&D & Formulation

- 7.1.2. Manufacturing

- 7.1.3. Packaging & Allied Services

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Skin Care

- 7.2.2. Hair Care

- 7.2.3. Make-up & Cosmetics

- 7.2.4. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. R&D & Formulation

- 8.1.2. Manufacturing

- 8.1.3. Packaging & Allied Services

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Skin Care

- 8.2.2. Hair Care

- 8.2.3. Make-up & Cosmetics

- 8.2.4. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. R&D & Formulation

- 9.1.2. Manufacturing

- 9.1.3. Packaging & Allied Services

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Skin Care

- 9.2.2. Hair Care

- 9.2.3. Make-up & Cosmetics

- 9.2.4. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of the World Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. R&D & Formulation

- 10.1.2. Manufacturing

- 10.1.3. Packaging & Allied Services

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Skin Care

- 10.2.2. Hair Care

- 10.2.3. Make-up & Cosmetics

- 10.2.4. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PLZ Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 McBride PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vistta Cosmetics*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CoValence Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colep Consumer Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ALBEA SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fareva Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powerpack Cosmetics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intercos SPA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Voyant Beauty

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hair Styling Applications SpA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FORMULA CORP

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Clarion Cosmetics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HCT Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 PLZ Corp

List of Figures

- Figure 1: Global Personal Care Contract Manufacturing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Care Contract Manufacturing Industry?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Personal Care Contract Manufacturing Industry?

Key companies in the market include PLZ Corp, McBride PLC, Vistta Cosmetics*List Not Exhaustive, CoValence Laboratories, Colep Consumer Products, ALBEA SA, Fareva Group, Powerpack Cosmetics, Intercos SPA, Voyant Beauty, Hair Styling Applications SpA, FORMULA CORP, Clarion Cosmetics, HCT Group.

3. What are the main segments of the Personal Care Contract Manufacturing Industry?

The market segments include Service Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages.

6. What are the notable trends driving market growth?

Skin Care Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

April 2023: TruArcPartners, a private equity fund, invested in Trademark Cosmetics (TCI) to pursue continuous expansion and support brand partner success through organic initiatives and strategic mergers and acquisitions (M&A). TCI's formulation and production capabilities and strong customer-service focus proved important in its growth and will be the primary driver for future progress and expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Personal Care Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Personal Care Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Personal Care Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Personal Care Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence