Key Insights

The Peruvian oil and gas downstream sector, including refineries and petrochemical plants, offers a promising investment opportunity with robust growth potential. The market is projected to reach $3 billion by 2023, driven by a CAGR of 4.5%. Key growth catalysts include rising domestic energy consumption due to economic expansion and infrastructure development, especially in urban centers. Significant contributions are also expected from ongoing refinery infrastructure projects and strategic petrochemical investments. However, the sector is susceptible to imported crude oil price volatility and geopolitical uncertainties. Regulatory challenges and environmental considerations related to emissions and sustainability also pose potential constraints for long-term viability.

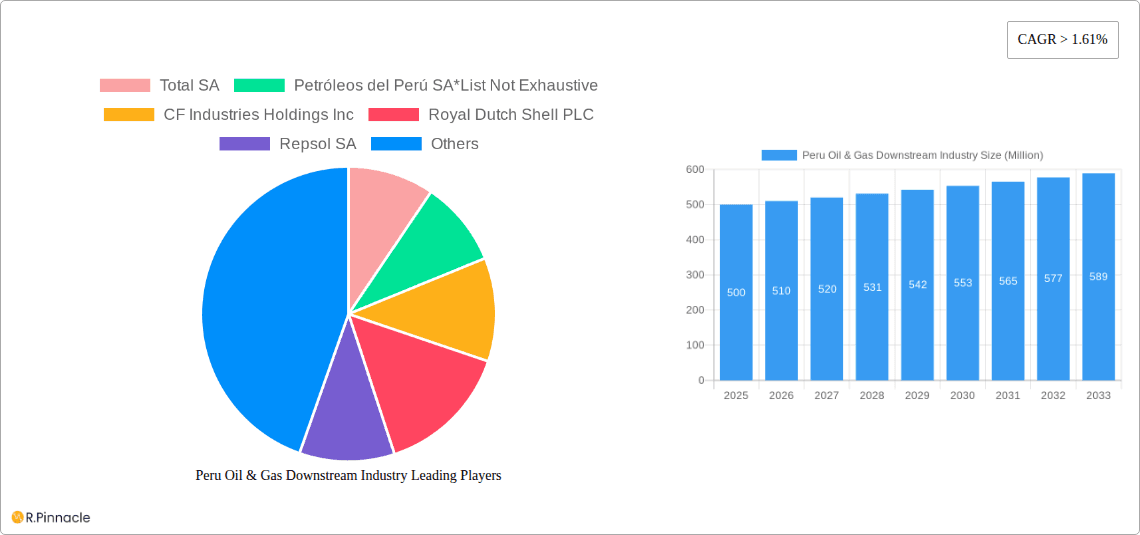

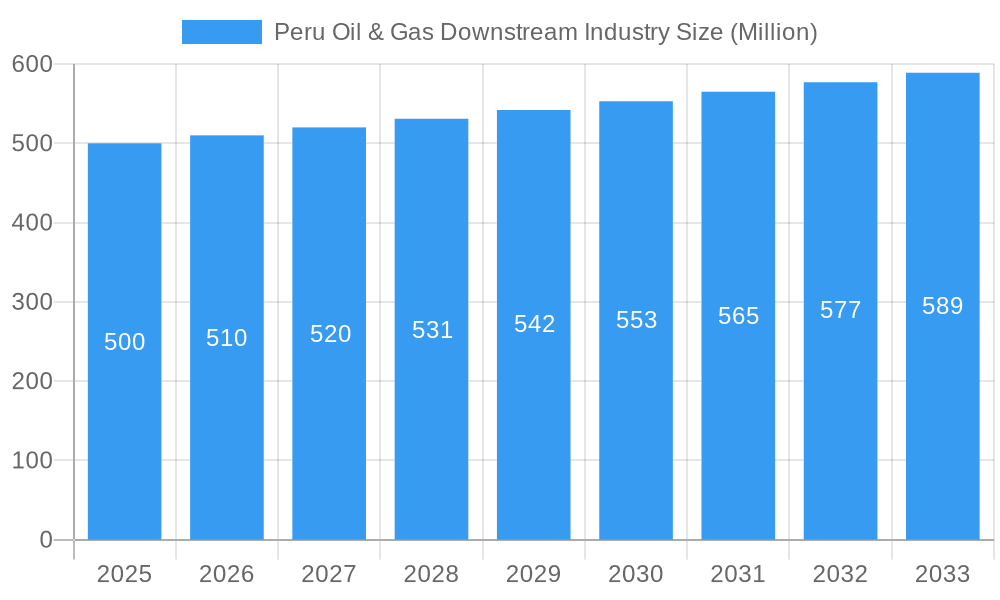

Peru Oil & Gas Downstream Industry Market Size (In Billion)

Major players such as Petróleos del Perú SA, Repsol SA, and TotalEnergies are actively involved in modernizing facilities, optimizing operations, and pursuing new investment avenues. The downstream sector's expansion is anticipated to continue, propelled by increasing demand for petrochemical derivatives like plastics. Government initiatives prioritizing energy security and diversification, alongside incentives for private investment, are expected to support further development. Addressing environmental impacts, simplifying regulations, and securing raw material supply chains will be vital for sustained growth. Strategic collaborations and the adoption of advanced, cleaner technologies will be instrumental in the sector's future success.

Peru Oil & Gas Downstream Industry Company Market Share

Peru Oil & Gas Downstream Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of Peru's oil & gas downstream industry, offering critical insights for strategic decision-making from 2019 to 2033. The study covers market structure, dynamics, key players, and future growth opportunities, incorporating data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). This report is essential for investors, industry professionals, and government agencies seeking to understand the current landscape and future trajectory of this vital sector.

Peru Oil & Gas Downstream Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of Peru's oil & gas downstream market. We examine market concentration, assessing the market share of key players such as Total SA, Petróleos del Perú SA, CF Industries Holdings Inc, Royal Dutch Shell PLC, and Repsol SA (list not exhaustive). The analysis incorporates data on M&A activity, including deal values (estimated at xx Million for the period), and identifies key innovation drivers, such as government policies promoting renewable energy integration and technological advancements in refinery processes. Regulatory frameworks influencing market dynamics, the impact of product substitutes (e.g., biofuels), and evolving end-user demographics are also examined.

- Market Concentration: Analysis of market share held by top 5 players.

- M&A Activity: Review of significant mergers and acquisitions, including deal values (xx Million).

- Innovation Drivers: Examination of technological advancements and policy incentives.

- Regulatory Landscape: Assessment of current regulations and their impact on the market.

Peru Oil & Gas Downstream Industry Market Dynamics & Trends

This section details the key factors driving market growth, technological disruptions, consumer preferences, and competitive dynamics within Peru's oil & gas downstream sector. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by factors such as increasing energy demand, government investments in infrastructure, and the adoption of new technologies to enhance efficiency. The analysis also considers the market penetration of different products and services, examining consumer behavior and shifts in energy consumption patterns. The competitive landscape is analyzed, highlighting the strategies employed by key players to maintain market share.

Dominant Regions & Segments in Peru Oil & Gas Downstream Industry

This section identifies the leading regions and segments within Peru's oil & gas downstream industry, focusing on Refineries and Petrochemicals Plants. Detailed analysis assesses the dominance of specific areas, considering factors such as existing infrastructure, planned projects, and economic policies.

Refineries:

- Existing Infrastructure: Capacity analysis of existing refineries, geographic distribution, and operational efficiency.

- Projects in Pipeline: Evaluation of planned refinery expansions and upgrades, timelines, and estimated investments (xx Million).

- Upcoming Projects: Assessment of future refinery projects, potential impact on market capacity, and associated challenges.

Petrochemicals Plants:

- Existing Infrastructure: Analysis of existing petrochemical plants, product types, and production capacity.

- Projects in Pipeline: Evaluation of planned petrochemical plant expansions and new projects, investment estimations (xx Million), and anticipated timelines.

- Upcoming Projects: Assessment of future petrochemical projects, their impact on the market, and potential challenges.

The Lima region is projected to be the dominant area for both refineries and petrochemical plants due to proximity to key markets and existing infrastructure. Detailed analysis includes factors influencing regional dominance, including economic policies, available infrastructure, and access to resources.

Peru Oil & Gas Downstream Industry Product Innovations

This section summarizes recent product developments, emphasizing technological advancements and their market applicability. Focus is on new fuels, improved refinery processes, and innovative petrochemical products, highlighting competitive advantages and market positioning. Trends such as biofuel integration and the development of higher-quality fuels are examined.

Report Scope & Segmentation Analysis

This report segments the Peru oil & gas downstream market by refinery type (e.g., capacity, location), petrochemical product type (e.g., plastics, fertilizers), and geographic region. Growth projections for each segment, market size (in Millions), and competitive dynamics are included. For example, the refinery segment is projected to grow at xx% CAGR, while the petrochemical segment is expected to see xx% CAGR over the forecast period. Competitive analysis within each segment highlights key players and their market strategies.

Key Drivers of Peru Oil & Gas Downstream Industry Growth

Key growth drivers include rising energy demand, government investment in infrastructure projects, technological advancements improving refinery efficiency (e.g., adoption of advanced process control systems), and supportive regulatory policies encouraging private investment.

Challenges in the Peru Oil & Gas Downstream Industry Sector

Significant challenges include regulatory hurdles related to environmental compliance and permitting, potential supply chain disruptions impacting raw material availability, and intense competition from both domestic and international players. These challenges might result in xx Million loss in revenue annually.

Emerging Opportunities in Peru Oil & Gas Downstream Industry

Emerging opportunities include the potential for growth in the biofuels sector, increased investment in petrochemical production to meet growing domestic demand, and potential for exporting refined products to neighboring countries.

Leading Players in the Peru Oil & Gas Downstream Industry Market

- Total SA

- Petróleos del Perú SA

- CF Industries Holdings Inc

- Royal Dutch Shell PLC

- Repsol SA

Key Developments in Peru Oil & Gas Downstream Industry Industry

- January 2023: Repsol SA announced a new investment in refinery upgrades (xx Million).

- June 2022: New environmental regulations were implemented impacting refinery operations.

- October 2021: A major petrochemical plant expansion project began.

Future Outlook for Peru Oil & Gas Downstream Industry Market

The Peru oil & gas downstream market is poised for significant growth driven by increasing domestic demand and strategic investments in infrastructure. Opportunities exist for both domestic and international players to capitalize on this growth, particularly within the biofuels and specialized petrochemical sectors. The projected market size for 2033 is estimated to be xx Million.

Peru Oil & Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Peru Oil & Gas Downstream Industry Segmentation By Geography

- 1. Peru

Peru Oil & Gas Downstream Industry Regional Market Share

Geographic Coverage of Peru Oil & Gas Downstream Industry

Peru Oil & Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Oil & Gas Downstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Petróleos del Perú SA*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CF Industries Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Repsol SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Peru Oil & Gas Downstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Peru Oil & Gas Downstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 2: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 3: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 5: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 6: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Oil & Gas Downstream Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Peru Oil & Gas Downstream Industry?

Key companies in the market include Total SA, Petróleos del Perú SA*List Not Exhaustive, CF Industries Holdings Inc, Royal Dutch Shell PLC, Repsol SA.

3. What are the main segments of the Peru Oil & Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Oil Refining Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Oil & Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Oil & Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Oil & Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Peru Oil & Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence