Key Insights

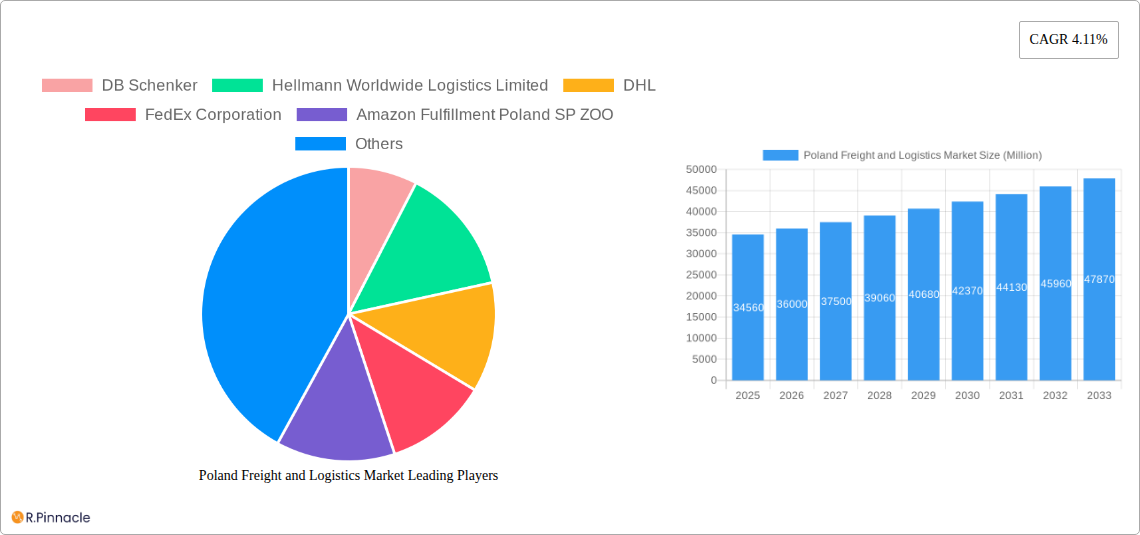

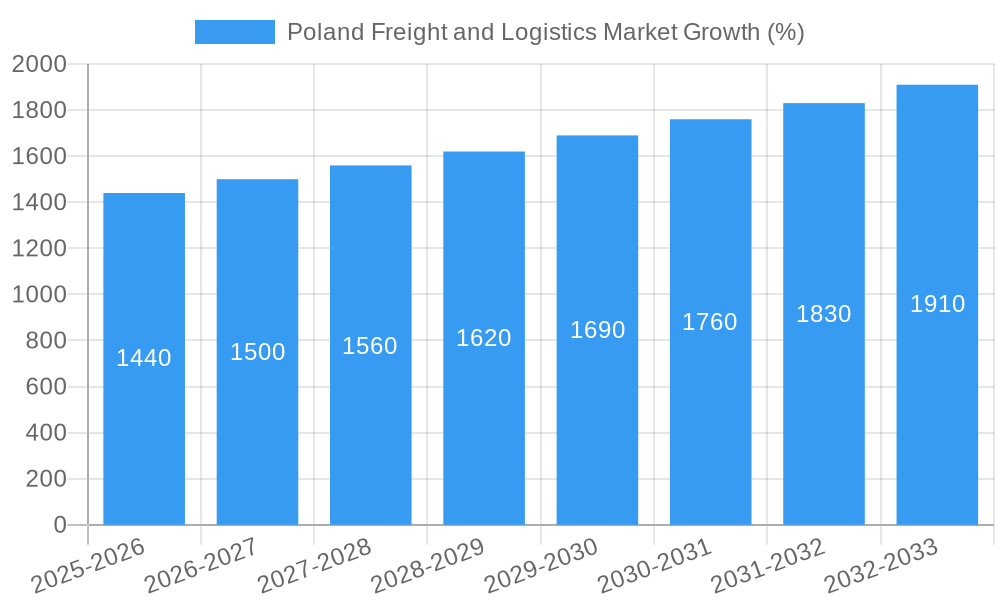

The Poland freight and logistics market, valued at €34.56 billion in 2025, is projected to experience robust growth, driven by the country's strategic geographical location within the European Union, expanding e-commerce sector, and increasing industrial activity. The compound annual growth rate (CAGR) of 4.11% from 2025 to 2033 indicates a steady expansion, fueled by several key factors. Growth in sectors like manufacturing and automotive, construction, and oil & gas contributes significantly to the market's dynamism. The rise of e-commerce necessitates efficient and reliable last-mile delivery solutions, further stimulating demand for warehousing, freight forwarding, and value-added logistics services. While infrastructure limitations and potential fluctuations in global economic conditions pose some challenges, the ongoing investments in infrastructure development and Poland's integration within the EU's logistics network are expected to mitigate these restraints. The market is segmented by function (freight transport, rail freight forwarding, warehousing, and value-added services) and end-user industry (construction, oil & gas and quarrying, agriculture, fishing, and forestry, manufacturing and automotive, distributive trade, telecommunications, and others). Key players such as DB Schenker, DHL, FedEx, and Kuehne + Nagel are intensely competing for market share, deploying advanced technologies and expanding service offerings to cater to evolving customer needs. The forecast period (2025-2033) promises sustained growth, with a projected market expansion exceeding €45 billion by 2033, based on the provided CAGR.

The competitive landscape is characterized by a mix of global giants and domestic players. This blend ensures a dynamic market with various service offerings and price points. However, maintaining a competitive edge requires continuous investment in technology, operational efficiency, and skilled workforce development. The ongoing digital transformation within the logistics sector is further shaping the market landscape, with increasing adoption of advanced technologies like blockchain, AI, and IoT enhancing transparency, traceability, and overall efficiency. Focus on sustainability initiatives and the adoption of environmentally friendly logistics solutions is also gaining momentum, influencing the strategic decisions of both large and small businesses within the Polish freight and logistics industry. This trend is anticipated to further shape the market's trajectory in the coming years.

Poland Freight and Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland freight and logistics market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth potential. The analysis leverages extensive data and expert insights to deliver actionable intelligence for informed decision-making.

Poland Freight and Logistics Market Market Structure & Innovation Trends

This section delves into the competitive landscape of the Polish freight and logistics market, analyzing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report assesses the market share of key players such as DB Schenker, Hellmann Worldwide Logistics Limited, DHL, FedEx Corporation, Amazon Fulfillment Poland SP ZOO, Dachser, Kuehne + Nagel International AG, CEVA Logistics, Lotos Kolej SP ZOO, FIEGE Logistics, PKP Cargo S A, and Gefco, among others. The analysis also includes a detailed examination of smaller players, such as Geodis, Rhenus Logistics, Poczta Polska S A, DSV, and LOT Polish Airlines.

- Market Concentration: The Polish freight and logistics market exhibits a [xx]% concentration ratio, with the top 5 players holding an estimated [xx]% market share in 2025.

- Innovation Drivers: Technological advancements like automation, IoT, and AI are driving innovation, alongside government initiatives promoting sustainable logistics.

- Regulatory Framework: The report analyzes the impact of EU regulations and Polish-specific laws on market operations and competitiveness.

- Product Substitutes: The analysis considers the impact of substitute services and modes of transport on market dynamics.

- End-User Demographics: The report segments the end-user market, providing insights into sector-specific needs and growth potentials.

- M&A Activities: The report examines recent M&A activity, including deal values and their implications for market consolidation, with specific examples like the Macquarie Asset Management acquisition of a last-mile logistics facility (detailed in the Key Developments section). The total value of M&A deals in the sector during the historical period is estimated at [xx] Million.

Poland Freight and Logistics Market Market Dynamics & Trends

This section analyzes market growth drivers, technological disruptions, consumer preferences, and competitive dynamics within the Polish freight and logistics sector. The report projects a Compound Annual Growth Rate (CAGR) of [xx]% during the forecast period (2025-2033), driven by factors such as [detailed explanation of drivers including e-commerce growth, industrial expansion, infrastructure development, and government policies]. The report further investigates market penetration rates for various segments and the impact of emerging technologies on market structure and competition. Specific examples of technological disruptions will be examined, including the adoption of autonomous vehicles, blockchain technology, and big data analytics. The changing consumer preferences toward speed, reliability, and sustainability in logistics services will also be explored. The influence of external factors such as geopolitical events and economic fluctuations on market growth will also be considered.

Dominant Regions & Segments in Poland Freight and Logistics Market

This section identifies the leading regions and segments within the Polish freight and logistics market based on both function (Freight Transport, Rail Freight Forwarding, Warehousing, Value-added Services) and end-user (Construction, Oil & Gas and Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, Distributive Trade, Telecommunications, Other End Users (Pharmaceutical and F&B)).

Leading Regions: [Analysis of regional dominance, highlighting key factors such as infrastructure, economic activity, and proximity to major transportation hubs. e.g., Warsaw and surrounding areas are expected to maintain dominance due to superior infrastructure and economic activity].

Dominant Segments:

By Function: [Detailed analysis of the leading segment, justifying dominance based on factors like market size, growth rate, and key drivers. For example, warehousing might be highlighted due to the growth of e-commerce and the need for efficient storage and distribution.]

By End-User: [Detailed analysis of the leading end-user segment, justifying dominance based on factors like industry growth, logistics needs, and spending patterns. For example, manufacturing and automotive might be the dominant segment, given Poland's strong manufacturing base.]

Key Drivers (Bullet Points):

- Strong economic growth in Poland

- Increasing e-commerce activity

- Development of modern infrastructure (roads, railways, airports)

- Government support for logistics sector development

- Growing demand for efficient supply chain solutions

Poland Freight and Logistics Market Product Innovations

This section summarizes recent product developments and technological advancements within the Polish freight and logistics sector. Key innovations include the adoption of [Specific examples of innovative solutions, including advanced tracking systems, optimized routing software, and the increased use of automation technologies in warehousing and transportation]. These innovations enhance efficiency, improve delivery times, and address growing demand for sustainable logistics solutions, improving market fit and competitiveness.

Report Scope & Segmentation Analysis

This report analyzes the Poland freight and logistics market across various segments.

By Function: Freight Transport, Rail Freight Forwarding, Warehousing, Value-added Services. Each segment's growth projection, market size (in Million), and competitive landscape are analyzed.

By End User: Construction, Oil & Gas and Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, Distributive Trade, Telecommunications, Other End Users (Pharmaceutical and F&B). Each segment's specific market dynamics and future outlook are discussed, including their respective market sizes (in Million) and growth projections.

Key Drivers of Poland Freight and Logistics Market Growth

The Polish freight and logistics market is driven by several factors: robust economic growth fueling increased trade, significant government investment in infrastructure development, the expanding e-commerce sector boosting demand for last-mile delivery services, and the adoption of innovative technologies such as automation and IoT for improved efficiency and cost-effectiveness. The development of sustainable logistics solutions is also a major driver, reflecting a growing global focus on environmental concerns.

Challenges in the Poland Freight and Logistics Market Sector

The sector faces challenges including [xx] Million in lost revenue due to infrastructure limitations, a shortage of skilled labor impacting operational efficiency, and increasing fuel prices and fluctuating exchange rates affecting profitability. Furthermore, intense competition and regulatory hurdles add to the operational complexities of navigating the market.

Emerging Opportunities in Poland Freight and Logistics Market

The market presents significant opportunities in areas such as last-mile delivery solutions tailored to the growing e-commerce sector, the expansion of cold chain logistics to accommodate the increasing demand for temperature-sensitive goods, and the adoption of sustainable logistics practices to meet growing environmental regulations. The integration of advanced technologies like AI and blockchain also offers untapped potential for improving efficiency and transparency throughout the supply chain.

Leading Players in the Poland Freight and Logistics Market Market

- DB Schenker

- Hellmann Worldwide Logistics Limited

- DHL

- FedEx Corporation

- Amazon Fulfillment Poland SP ZOO

- Dachser

- Kuehne + Nagel International AG

- CEVA Logistics

- Lotos Kolej SP ZOO

- FIEGE Logistics

- PKP Cargo S A

- Gefco

- Geodis

- Rhenus Logistics

- Poczta Polska S A

- DSV

- LOT Polish Airlines

Key Developments in Poland Freight and Logistics Market Industry

- August 2022: Macquarie Asset Management acquired a 15,900m2 last-mile logistics facility near Warsaw Airport, boosting capacity in a key transportation hub.

- January 2022: LTG Cargo's Polish subsidiary purchased four new Gama 111Ed locomotives from PESA Bydgoszcz, enhancing rail freight transport capabilities.

Future Outlook for Poland Freight and Logistics Market Market

The Poland freight and logistics market is poised for continued growth, driven by a combination of economic expansion, technological advancements, and supportive government policies. The focus on sustainable logistics and the increasing integration of innovative technologies will shape the future landscape, creating lucrative opportunities for market participants who can adapt and innovate to meet the evolving needs of businesses and consumers. The market is projected to reach [xx] Million by 2033, offering significant potential for both domestic and international players.

Poland Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

-

1.1. Freight Transport

-

2. End User

- 2.1. Construction

- 2.2. Oil & Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Telecommunications

- 2.7. Other End Users (Pharmaceutical and F&B)

Poland Freight and Logistics Market Segmentation By Geography

- 1. Poland

Poland Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. Rise in Total Warehousing Space in Poland

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Freight and Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil & Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Telecommunications

- 5.2.7. Other End Users (Pharmaceutical and F&B)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistics Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon Fulfillment Poland SP ZOO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dachser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel International AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lotos Kolej SP ZOO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FIEGE Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PKP Cargo S A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gefco**List Not Exhaustive 6 3 List of Other Logistics Player

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Geodis

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Rhenus Logistics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Poczta Polska S A

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 DSV

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 LOT Polish Airlines

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Poland Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Freight and Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Poland Freight and Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Poland Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Poland Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Poland Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: Poland Freight and Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Poland Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Freight and Logistics Market?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the Poland Freight and Logistics Market?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics Limited, DHL, FedEx Corporation, Amazon Fulfillment Poland SP ZOO, Dachser, Kuehne + Nagel International AG, CEVA Logistics, Lotos Kolej SP ZOO, FIEGE Logistics, PKP Cargo S A, Gefco**List Not Exhaustive 6 3 List of Other Logistics Player, Geodis, Rhenus Logistics, Poczta Polska S A, DSV, LOT Polish Airlines.

3. What are the main segments of the Poland Freight and Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

Rise in Total Warehousing Space in Poland.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Macquarie Asset Management agrees to acquire Last Mile Logistics Facility in Poland. The 15,900m2 last-mile logistics facility, which consists of three buildings, is adjacent to Warsaw Airport, one of Poland's major transportation and logistics hubs, and has easy access to the city center and major expressways. The complex has been given a "Very Good" grade under BREEAM's sustainable building certification program and is fully leased to seven local and international tenants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the Poland Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence