Key Insights

The global Port Wine market is projected to reach USD 148.3 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 2.9% through 2033. This growth is propelled by increasing consumer preference for premium and artisanal fortified wines, driven by evolving palates and an appreciation for traditional craftsmanship. Key growth drivers include rising disposable incomes in emerging economies and the expansion of global tourism, which fosters interest in regional specialties. Innovations such as flavored Port wines and convenient single-serving formats are attracting a wider demographic. The on-trade sector, including restaurants and bars, is expected to remain a significant contributor, supported by fine wine and culinary pairings.

Port Wine Market Market Size (In Million)

Market challenges include stringent regulations on alcoholic beverages, fluctuations in raw material costs, and the impact of climate change on grape yields. Despite these factors, the market is exhibiting resilience through product innovation and diversified distribution strategies. The off-trade segment, encompassing retail stores, is growing due to consumer demand for convenience and variety. Asia Pacific, with its growing middle class and increasing exposure to international trends, is identified as a key growth region, alongside mature markets in Europe and North America. Major market participants include Taylor's Port and Constellation Brands Inc., alongside various regional producers, competing through brand development, partnerships, and market expansion.

Port Wine Market Company Market Share

This report provides a comprehensive analysis of the global Port Wine Market, offering critical insights for industry stakeholders. Covering the historical period (2019-2024), a base year of 2025, and a forecast period up to 2033, the analysis examines market structure, dynamics, segmentation, and future growth prospects. Optimized for search visibility using keywords like "Port Wine Market," "fortified wine trends," "spirits market analysis," and "premium beverage growth," this report delivers actionable intelligence.

Port Wine Market Market Structure & Innovation Trends

The Port Wine Market exhibits a moderate to high concentration, with key players like Grupo Sogevinus Fine Wines and Taylor's Port holding significant market share. Innovation in this sector is primarily driven by evolving consumer preferences for premium and artisanal beverages, alongside advancements in winemaking techniques. Regulatory frameworks, particularly those pertaining to appellations of origin and labeling standards, play a crucial role in shaping market access and consumer trust. Product substitutes, including other fortified wines and premium spirits, present a continuous challenge, necessitating strategic differentiation. End-user demographics are shifting towards a more discerning consumer base, valuing quality, heritage, and unique flavor profiles. Mergers and acquisitions (M&A) activities are ongoing, with significant deal values observed in the premium beverage space, indicating consolidation and strategic expansion. For instance, the acquisition of Constellation Brands' wine and spirits portfolio by E&J Gallo Winery in January 2021, encompassing brands like Taylor, significantly reshaped market landscapes.

- Market Concentration: Moderate to High.

- Innovation Drivers: Premiumization, artisanal production, flavor profile innovation.

- Regulatory Impact: Appellation of origin, labeling standards, import/export regulations.

- Product Substitutes: Other fortified wines, premium spirits, craft cocktails.

- End-User Demographics: Growing segment of discerning consumers, aged 30-65, with higher disposable income.

- M&A Activity: Active, with significant deal values impacting market share.

Port Wine Market Market Dynamics & Trends

The Port Wine Market is experiencing robust growth, driven by several key factors. Rising disposable incomes across emerging economies are fueling demand for premium beverages, including Port wine and other fortified wines. A significant trend is the increasing consumer interest in unique and artisanal products, leading to a demand for limited-edition bottlings, single-vineyard selections, and wines with distinct aging characteristics. The globalization of taste preferences and the growing popularity of wine tourism are also contributing to market expansion. Technological disruptions, while less pronounced than in other industries, are emerging in areas like vineyard management, quality control, and direct-to-consumer (DTC) sales channels, enhancing operational efficiency and market reach. Consumer preferences are increasingly leaning towards healthier beverage options and sustainable production practices, influencing product development and marketing strategies. The competitive landscape is characterized by a mix of established legacy brands and agile new entrants, all vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. The CAGR is projected to be around 5.2% during the forecast period. Market penetration for premium Port wines is steadily increasing, particularly in North America and Asia-Pacific.

Dominant Regions & Segments in Port Wine Market

The European region continues to be the dominant force in the Port Wine Market, with Portugal and Spain leading production and consumption. Within Europe, the United Kingdom stands out as a key market for both Port and Sherry due to historical trade ties and a well-established appreciation for fortified wines. The United States represents a significant and growing market, particularly for premium Port wine varieties and innovative Vermouth offerings.

- Product Type Dominance:

- Port Wine: Remains the leading segment, driven by its rich heritage and established consumer base.

- Vermouth: Experiencing significant growth, fueled by the resurgence of cocktail culture and innovative product launches like Cuceilo's Dry Vermouth di Torino.

- Sherry: Holding a steady market share, with a niche but loyal consumer base.

- Distribution Channel Dominance:

- Off-trade (Supermarkets/Hypermarkets): The largest channel due to widespread accessibility and promotional activities.

- On-trade: Crucial for premium products and brand building, especially in fine-dining establishments and cocktail bars.

- Liquor Stores: A key channel for specialized wine and spirits, offering a curated selection.

Key drivers of dominance include strong economic policies supporting the beverage industry, robust infrastructure for production and distribution, and deep-rooted cultural traditions associated with wine consumption. The growing disposable income and a sophisticated palate in key markets further bolster the dominance of these segments and regions.

Port Wine Market Product Innovations

Recent product innovations in the Port Wine Market are centered around creating unique flavor profiles and catering to evolving consumer tastes. This includes the development of lighter, more versatile Port wine styles suitable for aperitif occasions and the introduction of aged Vermouths with complex botanical infusions. Companies are focusing on premiumization, offering limited-edition bottlings and single-vintage expressions that highlight the distinct terroir and craftsmanship involved. These innovations provide competitive advantages by appealing to a broader audience and differentiating brands in a crowded marketplace. Technological advancements in fermentation and aging processes are also enabling the creation of wines with enhanced stability and specific aromatic qualities, ensuring market fit and consumer satisfaction.

Report Scope & Segmentation Analysis

This report segments the Port Wine Market by Product Type and Distribution Channel, providing detailed analysis for each category.

Product Type:

- Port Wine: This segment is projected to grow at a CAGR of approximately 4.8% over the forecast period, driven by demand for traditional and premium varieties.

- Vermouth: Expected to witness the highest growth rate, estimated at 6.5% CAGR, due to the cocktail culture renaissance and innovative product introductions.

- Sherry: Forecasted to maintain a steady growth of around 3.9% CAGR, appealing to its established niche market.

- Other Product Types: This category encompasses a variety of fortified wines, with an anticipated CAGR of 4.5%.

Distribution Channel:

- On-trade: Experiencing a CAGR of 5.0%, driven by the recovery of the hospitality sector and a demand for premium experiences.

- Off-trade: The largest segment, with a projected CAGR of 5.3%, comprising Supermarkets/Hypermarkets, Liquor Stores, and Other Distribution Channels, offering convenience and accessibility.

Key Drivers of Port Wine Market Growth

The Port Wine Market's growth is propelled by a confluence of factors. Increasing global disposable incomes have elevated demand for premium and luxury beverages. The resurgence of cocktail culture has significantly boosted the popularity of Vermouth and other fortified wines as essential cocktail ingredients. Furthermore, a growing appreciation for heritage and artisanal products among consumers drives demand for authentic and high-quality Port wines. Technological advancements in viticulture and oenology contribute to improved quality and consistent production. Favorable economic policies in key producing and consuming regions also support market expansion.

Challenges in the Port Wine Market Sector

Despite its growth, the Port Wine Market faces several challenges. Stringent regulatory hurdles in various international markets can hinder market entry and expansion. Fluctuations in agricultural yields and climate change pose risks to supply chain stability and production costs. Intense competitive pressures from other wine categories and spirits necessitate continuous innovation and effective marketing. Rising production costs, including labor and raw materials, can impact profitability. Consumer perception regarding the perceived "old-fashioned" nature of some traditional Port wines needs to be addressed through modern marketing approaches.

Emerging Opportunities in Port Wine Market

Emerging opportunities in the Port Wine Market are abundant. The expansion of the premium spirits category presents a significant avenue for growth, with consumers seeking unique and high-quality fortified wines. The growing e-commerce landscape provides direct access to a global consumer base, facilitating brand building and sales. Increasing consumer interest in low-alcohol and no-alcohol alternatives could spur innovation in developing lighter or non-alcoholic fortified wine options. The Asian market, with its rapidly growing middle class and increasing adoption of Western beverage trends, represents a vast untapped potential. Strategic partnerships and collaborations can unlock new markets and consumer segments.

Leading Players in the Port Wine Market Market

- Grupo Sogevinus Fine Wines

- Liberty Wines Limited

- Backsberg

- Taylor's Port

- Mazuran's Vineyards Limited

- Vinbros & Company

- Contratto

- Albina & Hanna

- Constellation Brands Inc

- Vitivinicola Lombardo VAT

- Cuceilo Vermouth De Torino Italia

Key Developments in Port Wine Market Industry

- June 2022: The Italian Vermouth brand Cuceilo expanded its portfolio with the launch of Dry Vermouth di Torino, crafted to capture the essence of 'Golden Hour' and Italian Aperitivo Culture. With crisp notes of fresh Sicilian citrus, complemented by a light yet herbal bitterness, the brand's Dry Vermouth di Torino has been designed to highlight the most iconic of aperitif cocktails, the Martini.

- April 2021: Constellation Brands launched a dedicated business unit for fine wine and craft spirits. The new fine wine and craft spirits include High West Whisky, Casa Noble Tequila, Mi Campo, Copper & Kings, Nelson's Green Brier Distillery, and the Real McCoy.

- January 2021: E&J Gallo Winery completed the acquisition of five wineries and more than 30 wine brands from Constellation Brands Inc. The acquired brands include Arbor Mist, Black Box, Clos du Bois, Estancia, Franciscan, Hogue, Manischewitz, Mark West, Ravenswood, Taylor, Vendange, and Wild Horse.

Future Outlook for Port Wine Market Market

The future outlook for the Port Wine Market is highly optimistic, driven by sustained global economic growth and evolving consumer preferences. The trend towards premiumization and artisanal products is expected to continue, creating significant opportunities for high-quality Port wines and sophisticated Vermouth offerings. The expansion into emerging markets, particularly in Asia, will be a key growth accelerator. Innovations in product development, including unique flavor profiles and potentially sustainable or low-alcohol options, will capture new consumer segments. Strategic investments in marketing and distribution, especially through digital channels, will further enhance market reach and brand visibility, ensuring continued growth and profitability in the coming years.

Port Wine Market Segmentation

-

1. Product Type

- 1.1. Port Wine

- 1.2. Vermouth

- 1.3. Sherry

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Liquor Stores

- 2.2.3. Other Distribution Channels

Port Wine Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

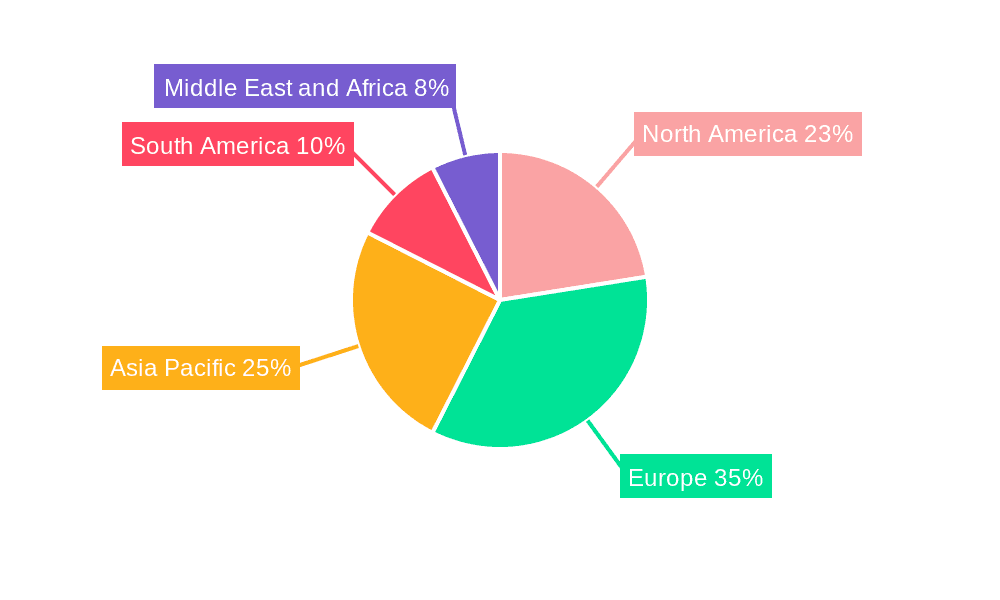

Port Wine Market Regional Market Share

Geographic Coverage of Port Wine Market

Port Wine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Premiumization Alcohol

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Port Wine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Port Wine

- 5.1.2. Vermouth

- 5.1.3. Sherry

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Liquor Stores

- 5.2.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Port Wine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Port Wine

- 6.1.2. Vermouth

- 6.1.3. Sherry

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Liquor Stores

- 6.2.2.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Port Wine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Port Wine

- 7.1.2. Vermouth

- 7.1.3. Sherry

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Liquor Stores

- 7.2.2.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Port Wine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Port Wine

- 8.1.2. Vermouth

- 8.1.3. Sherry

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Liquor Stores

- 8.2.2.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Port Wine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Port Wine

- 9.1.2. Vermouth

- 9.1.3. Sherry

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Liquor Stores

- 9.2.2.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Port Wine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Port Wine

- 10.1.2. Vermouth

- 10.1.3. Sherry

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Liquor Stores

- 10.2.2.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Grupo Sogevinus Fine Wines

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Liberty Wines Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Backsberg

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taylor's Port

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mazuran's Vineyards Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vinbros & Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Contratto

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Albina & Hanna

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Constellation Brands Inc*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vitivinicola Lombardo VAT

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cuceilo Vermouth De Torino Italia

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Grupo Sogevinus Fine Wines

List of Figures

- Figure 1: Global Port Wine Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Port Wine Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: North America Port Wine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Port Wine Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America Port Wine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Port Wine Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Port Wine Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Port Wine Market Revenue (million), by Product Type 2025 & 2033

- Figure 9: Europe Port Wine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Port Wine Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Port Wine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Port Wine Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Port Wine Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Port Wine Market Revenue (million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Port Wine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Port Wine Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Port Wine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Port Wine Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Port Wine Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Port Wine Market Revenue (million), by Product Type 2025 & 2033

- Figure 21: South America Port Wine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Port Wine Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 23: South America Port Wine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Port Wine Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America Port Wine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Port Wine Market Revenue (million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Port Wine Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Port Wine Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Port Wine Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Port Wine Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Port Wine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Port Wine Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Port Wine Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Port Wine Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Port Wine Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: Global Port Wine Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Port Wine Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Port Wine Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: Global Port Wine Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Port Wine Market Revenue million Forecast, by Country 2020 & 2033

- Table 14: Germany Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: France Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Russia Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Spain Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Port Wine Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global Port Wine Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Port Wine Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: India Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: China Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Japan Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Australia Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global Port Wine Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 30: Global Port Wine Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Port Wine Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Brazil Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Global Port Wine Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 36: Global Port Wine Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Port Wine Market Revenue million Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Port Wine Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Port Wine Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Port Wine Market?

Key companies in the market include Grupo Sogevinus Fine Wines, Liberty Wines Limited, Backsberg, Taylor's Port, Mazuran's Vineyards Limited, Vinbros & Company, Contratto, Albina & Hanna, Constellation Brands Inc*List Not Exhaustive, Vitivinicola Lombardo VAT, Cuceilo Vermouth De Torino Italia.

3. What are the main segments of the Port Wine Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 148.3 million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Increasing Demand for Premiumization Alcohol.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

June 2022: The Italian Vermouth brand Cuceilo expanded its portfolio with the launch of Dry Vermouth di Torino, crafted to capture the essence of 'Golden Hour' and Italian Aperitivo Culture. With crisp notes of fresh Sicilian citrus, complemented by a light yet herbal bitterness, the brand's Dry Vermouth di Torino has been designed to highlight the most iconic of aperitif cocktails, the Martini.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Port Wine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Port Wine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Port Wine Market?

To stay informed about further developments, trends, and reports in the Port Wine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence