Key Insights

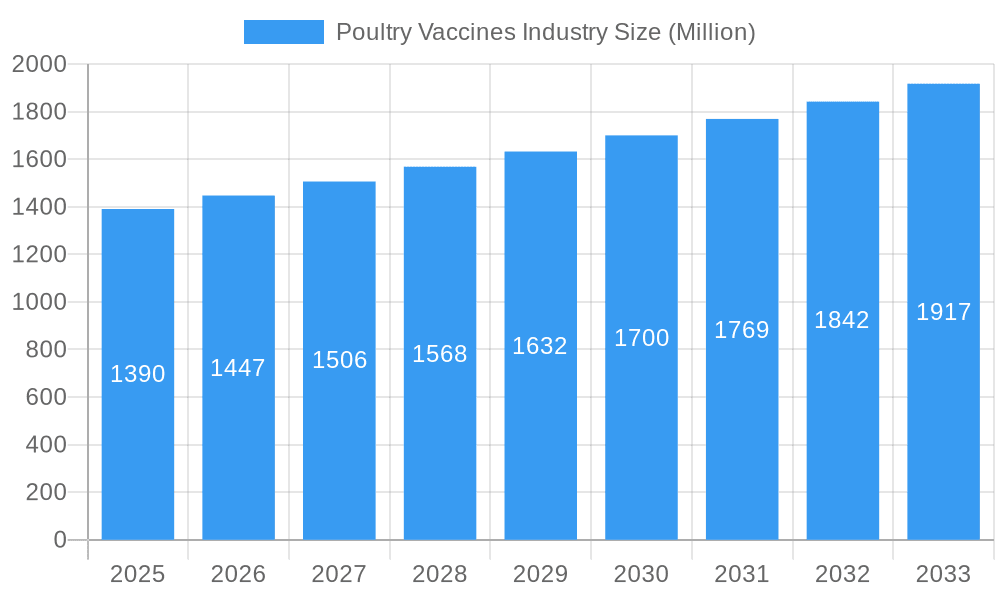

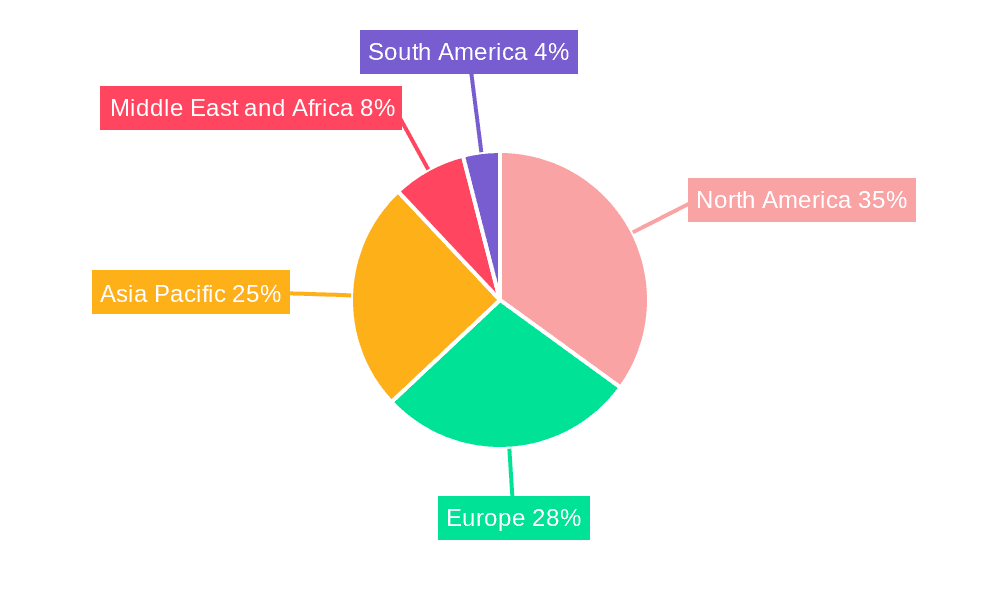

The global poultry vaccines market, valued at $1.39 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.20% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for poultry products globally, coupled with a rising global population, necessitates enhanced poultry health management practices to ensure food security and prevent disease outbreaks. Secondly, the continuous emergence of novel avian diseases and the ever-present threat of highly pathogenic avian influenza (HPAI) are driving the adoption of advanced and effective poultry vaccines. The shift towards intensive farming systems, while increasing efficiency, also raises the risk of rapid disease spread, further stimulating vaccine demand. Finally, technological advancements in vaccine development, such as the creation of more effective recombinant and live attenuated vaccines, are contributing to market growth. Significant regional variations exist, with North America and Europe currently holding larger market shares due to established poultry industries and robust regulatory frameworks. However, rapid growth is anticipated in the Asia-Pacific region, driven by the burgeoning poultry sector in countries like China and India.

Poultry Vaccines Industry Market Size (In Billion)

Market segmentation reveals that the demand for vaccines against specific poultry diseases like Avian Influenza and Newcastle Disease is exceptionally high, reflecting their significant economic and public health impacts. The market is further categorized by vaccine technology, with recombinant and inactivated vaccines holding prominent positions due to their proven efficacy and safety profiles. Key players in the market, including Elanco, Zoetis, Boehringer Ingelheim, and Merck, are constantly investing in research and development to improve existing vaccines and develop novel solutions to combat emerging poultry diseases. The competitive landscape is characterized by both large multinational corporations and smaller regional players, leading to innovation and price competitiveness. Future market growth will depend on factors such as disease prevalence, government regulations, and advancements in vaccine technology. The increasing focus on biosecurity measures and sustainable poultry farming practices will also influence market trajectory.

Poultry Vaccines Industry Company Market Share

This in-depth report provides a comprehensive analysis of the global poultry vaccines market, offering invaluable insights for industry professionals, investors, and researchers. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth projections, presenting actionable intelligence for strategic decision-making. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Poultry Vaccines Industry Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The global poultry vaccine market is moderately concentrated, with several major players holding significant market share. However, smaller companies specializing in niche technologies or geographic regions also contribute significantly to the overall market structure.

- Market Leaders: Elanco, Zoetis Inc, Boehringer Ingelheim International GmbH, Merck & Co Inc hold a significant portion of the market share, estimated at approximately xx% collectively in 2024.

- Innovation Drivers: The ongoing emergence of novel poultry diseases and the increasing demand for more efficacious and cost-effective vaccines are major drivers of innovation. Research and development focused on next-generation vaccine technologies, such as recombinant and mRNA vaccines, are accelerating market growth.

- Regulatory Frameworks: Stringent regulatory approvals and licensing procedures vary across different regions, impacting the speed of product launches and market entry strategies for new players. Compliance with evolving regulatory guidelines is essential for maintaining market presence.

- M&A Activities: The poultry vaccines market has witnessed several significant mergers and acquisitions in recent years, with deal values reaching xx Million in total during the historical period. Consolidation is expected to continue as larger companies seek to expand their product portfolios and geographical reach. These mergers aim to leverage economies of scale and enhance research capabilities, furthering market dominance of major players.

Poultry Vaccines Industry Market Dynamics & Trends

The global poultry vaccines market is experiencing robust growth, driven by factors such as the rising global poultry population, increasing demand for poultry products, and a growing awareness of the importance of disease prevention in poultry farming. The market is characterized by a high degree of competition, with companies constantly striving to develop new and improved vaccines to meet the evolving needs of poultry producers.

- Growth Drivers: Rising global poultry production, increasing prevalence of poultry diseases, government initiatives promoting poultry health, and growing awareness regarding biosecurity measures contribute significantly to market growth. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033).

- Technological Disruptions: Advancements in vaccine technology, such as the development of recombinant and mRNA vaccines, are changing the landscape. These newer technologies offer improved efficacy, safety, and ease of administration, significantly impacting market penetration.

- Consumer Preferences: Poultry producers increasingly prefer vaccines that provide broad-spectrum protection, are easy to administer, and have minimal impact on bird performance. This preference is pushing innovation toward improved delivery systems and vaccine formulations.

- Competitive Dynamics: Intense competition among established players leads to constant innovation, product differentiation, and strategic partnerships to expand market share. Price competitiveness also plays a crucial role in market dynamics.

Dominant Regions & Segments in Poultry Vaccines Industry

The Asia-Pacific region dominates the global poultry vaccines market, driven by large poultry populations, rapid economic growth, and increasing investment in the poultry industry. North America and Europe also hold significant market shares.

- By Disease: Avian Influenza holds a substantial market share due to its widespread occurrence and devastating economic impacts. Marek's Disease and Newcastle disease also represent significant segments.

- By Technology: Live Attenuated Vaccines (LAVs) currently dominate the market due to their proven efficacy and cost-effectiveness. However, there is a significant increase in the adoption of Recombinant Vaccines due to their improved safety profile and targeted efficacy.

Key Drivers (Asia-Pacific):

- Rapid growth of the poultry industry.

- Increasing disposable incomes and rising meat consumption.

- Government support for poultry farming.

- Development of robust infrastructure.

Dominance Analysis: The Asia-Pacific region's dominance is attributed to a confluence of factors including substantial poultry populations and escalating demands for poultry products fueled by expanding economies and rising middle classes. Government regulations and support also play a vital role.

Poultry Vaccines Industry Product Innovations

Recent years have witnessed significant advancements in poultry vaccine technology. The development of multivalent vaccines, which offer protection against multiple diseases simultaneously, has gained popularity. Furthermore, the focus on improving vaccine efficacy, safety, and ease of administration continues to drive innovation. Recombinant vaccines, characterized by enhanced safety and targeted antigen delivery, are gaining traction, while the exploration of mRNA vaccine technology presents promising future potential. These innovative products effectively cater to evolving market demands, enhancing poultry health and boosting farm efficiency.

Report Scope & Segmentation Analysis

This report segments the poultry vaccines market by disease (Bronchitis, Avian Influenza, Newcastle disease, Marek's Disease, Others) and by technology (Recombinant Vaccines, Inactivated Vaccines, Live Attenuated Vaccines (LAV), Others). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The market size for each segment is projected to witness substantial growth throughout the forecast period, driven by specific factors within each segment. For instance, the avian influenza segment's growth is spurred by the increasing prevalence of outbreaks.

Key Drivers of Poultry Vaccines Industry Growth

The poultry vaccines market is propelled by several key factors. The growing global poultry population and increasing demand for poultry products are primary drivers. Furthermore, rising consumer awareness regarding poultry health and disease prevention is promoting vaccine adoption. Stringent regulations and governmental initiatives supporting biosecurity measures also contribute to market expansion.

Challenges in the Poultry Vaccines Industry Sector

The poultry vaccines industry faces several challenges. The high cost of research and development, coupled with stringent regulatory approvals, can hinder market entry for new players. Furthermore, the emergence of antibiotic-resistant strains and the potential for vaccine failure pose significant hurdles. Maintaining a stable cold chain for vaccine distribution also adds complexity, especially in regions with limited infrastructure. The total impact of these challenges on market growth is estimated at approximately xx Million annually.

Emerging Opportunities in Poultry Vaccines Industry

The poultry vaccine market presents lucrative opportunities. The development and adoption of novel vaccine technologies like mRNA and recombinant vaccines hold immense potential. Furthermore, the increasing focus on disease surveillance and biosecurity provides opportunities for specialized vaccines and services. Expanding into emerging markets with high poultry production rates offers further growth avenues.

Leading Players in the Poultry Vaccines Industry Market

- Elanco

- Zoetis Inc

- Boehringer Ingelheim International GmbH

- Biovac

- Merck & Co Inc

- Dechra Pharmaceuticals PLC

- Ceva Santé Animale

- Phibro Animal Health Corporation

- Venky's Limited

- Hester Biosciences Limited

Key Developments in Poultry Vaccines Industry

- June 2023: MSD Animal Health (Merck & Co. Inc.) received European Commission approval for INNOVAX-ILT-IBD, a multivalent HVT vaccine offering protection against ILT, IBD, and MD. This approval significantly impacts the market by introducing a superior product with broader protection.

- May 2023: The USDA initiated trials to evaluate the effectiveness of various vaccines against the highly pathogenic avian influenza (HPAI) outbreak, impacting the market by creating a significant demand for effective vaccines to counter the extensive bird flu epidemic.

Future Outlook for Poultry Vaccines Industry Market

The poultry vaccines market is poised for substantial growth over the coming years. Continued innovation in vaccine technology, coupled with increasing awareness of poultry health, will drive market expansion. The rising demand for safe and effective vaccines in both developed and developing countries creates a favorable market outlook, promising significant growth in the coming decade.

Poultry Vaccines Industry Segmentation

-

1. Disease

- 1.1. Bronchitis

- 1.2. Avian Influenza

- 1.3. Newcastle disease

- 1.4. Marek's Disease

- 1.5. Others

-

2. Technology

- 2.1. Recombinant Vaccines

- 2.2. Inactivated Vaccines

- 2.3. Live Attenuated Vaccines (LAV)

- 2.4. Others

Poultry Vaccines Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Poultry Vaccines Industry Regional Market Share

Geographic Coverage of Poultry Vaccines Industry

Poultry Vaccines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Poultry and Zoonotic Diseases; Widened Focus on Food Safety

- 3.3. Market Restrains

- 3.3.1. Use of Counterfeit Medicine; Increasing Costs of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. The Segment for Avian Influenza is Expected to Lead the Market in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Poultry Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 5.1.1. Bronchitis

- 5.1.2. Avian Influenza

- 5.1.3. Newcastle disease

- 5.1.4. Marek's Disease

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Recombinant Vaccines

- 5.2.2. Inactivated Vaccines

- 5.2.3. Live Attenuated Vaccines (LAV)

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 6. North America Poultry Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease

- 6.1.1. Bronchitis

- 6.1.2. Avian Influenza

- 6.1.3. Newcastle disease

- 6.1.4. Marek's Disease

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Recombinant Vaccines

- 6.2.2. Inactivated Vaccines

- 6.2.3. Live Attenuated Vaccines (LAV)

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Disease

- 7. Europe Poultry Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease

- 7.1.1. Bronchitis

- 7.1.2. Avian Influenza

- 7.1.3. Newcastle disease

- 7.1.4. Marek's Disease

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Recombinant Vaccines

- 7.2.2. Inactivated Vaccines

- 7.2.3. Live Attenuated Vaccines (LAV)

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Disease

- 8. Asia Pacific Poultry Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease

- 8.1.1. Bronchitis

- 8.1.2. Avian Influenza

- 8.1.3. Newcastle disease

- 8.1.4. Marek's Disease

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Recombinant Vaccines

- 8.2.2. Inactivated Vaccines

- 8.2.3. Live Attenuated Vaccines (LAV)

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Disease

- 9. Middle East and Africa Poultry Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disease

- 9.1.1. Bronchitis

- 9.1.2. Avian Influenza

- 9.1.3. Newcastle disease

- 9.1.4. Marek's Disease

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Recombinant Vaccines

- 9.2.2. Inactivated Vaccines

- 9.2.3. Live Attenuated Vaccines (LAV)

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Disease

- 10. South America Poultry Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disease

- 10.1.1. Bronchitis

- 10.1.2. Avian Influenza

- 10.1.3. Newcastle disease

- 10.1.4. Marek's Disease

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Recombinant Vaccines

- 10.2.2. Inactivated Vaccines

- 10.2.3. Live Attenuated Vaccines (LAV)

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Disease

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Elanco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zoetis Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Boehringer Ingelheim International GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Biovac

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck & Co Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dechra Pharmaceuticals PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ceva Santé Animale

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phibro Animal Health Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Venky's Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hester Biosciences Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Elanco

List of Figures

- Figure 1: Global Poultry Vaccines Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Poultry Vaccines Industry Revenue (Million), by Disease 2025 & 2033

- Figure 3: North America Poultry Vaccines Industry Revenue Share (%), by Disease 2025 & 2033

- Figure 4: North America Poultry Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Poultry Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Poultry Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Poultry Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Poultry Vaccines Industry Revenue (Million), by Disease 2025 & 2033

- Figure 9: Europe Poultry Vaccines Industry Revenue Share (%), by Disease 2025 & 2033

- Figure 10: Europe Poultry Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Poultry Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Poultry Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Poultry Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Poultry Vaccines Industry Revenue (Million), by Disease 2025 & 2033

- Figure 15: Asia Pacific Poultry Vaccines Industry Revenue Share (%), by Disease 2025 & 2033

- Figure 16: Asia Pacific Poultry Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 17: Asia Pacific Poultry Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Asia Pacific Poultry Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Poultry Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Poultry Vaccines Industry Revenue (Million), by Disease 2025 & 2033

- Figure 21: Middle East and Africa Poultry Vaccines Industry Revenue Share (%), by Disease 2025 & 2033

- Figure 22: Middle East and Africa Poultry Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 23: Middle East and Africa Poultry Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Middle East and Africa Poultry Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Poultry Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Poultry Vaccines Industry Revenue (Million), by Disease 2025 & 2033

- Figure 27: South America Poultry Vaccines Industry Revenue Share (%), by Disease 2025 & 2033

- Figure 28: South America Poultry Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: South America Poultry Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: South America Poultry Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Poultry Vaccines Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Poultry Vaccines Industry Revenue Million Forecast, by Disease 2020 & 2033

- Table 2: Global Poultry Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Poultry Vaccines Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Poultry Vaccines Industry Revenue Million Forecast, by Disease 2020 & 2033

- Table 5: Global Poultry Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Poultry Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Poultry Vaccines Industry Revenue Million Forecast, by Disease 2020 & 2033

- Table 11: Global Poultry Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Poultry Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Poultry Vaccines Industry Revenue Million Forecast, by Disease 2020 & 2033

- Table 20: Global Poultry Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global Poultry Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Poultry Vaccines Industry Revenue Million Forecast, by Disease 2020 & 2033

- Table 29: Global Poultry Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 30: Global Poultry Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Poultry Vaccines Industry Revenue Million Forecast, by Disease 2020 & 2033

- Table 35: Global Poultry Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 36: Global Poultry Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Poultry Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poultry Vaccines Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Poultry Vaccines Industry?

Key companies in the market include Elanco, Zoetis Inc *List Not Exhaustive, Boehringer Ingelheim International GmbH, Biovac, Merck & Co Inc, Dechra Pharmaceuticals PLC, Ceva Santé Animale, Phibro Animal Health Corporation, Venky's Limited, Hester Biosciences Limited.

3. What are the main segments of the Poultry Vaccines Industry?

The market segments include Disease, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Poultry and Zoonotic Diseases; Widened Focus on Food Safety.

6. What are the notable trends driving market growth?

The Segment for Avian Influenza is Expected to Lead the Market in the Coming Years.

7. Are there any restraints impacting market growth?

Use of Counterfeit Medicine; Increasing Costs of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

June 2023: MSD Animal Health, a subsidiary of Merck & Co. Inc. located in Rahway, New Jersey, announced the approval of INNOVAX-ILT-IBD by the European Commission. This HVT vaccine, which consists of two constructs, offers extended protection against infectious laryngotracheitis (ILT), infectious bursal disease (IBD), and Marek's disease (MD). As part of the centralized approval process, all European Union countries where INNOVAX-ILT-IBD was authorized revised their national registrations accordingly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poultry Vaccines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poultry Vaccines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poultry Vaccines Industry?

To stay informed about further developments, trends, and reports in the Poultry Vaccines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence