Key Insights

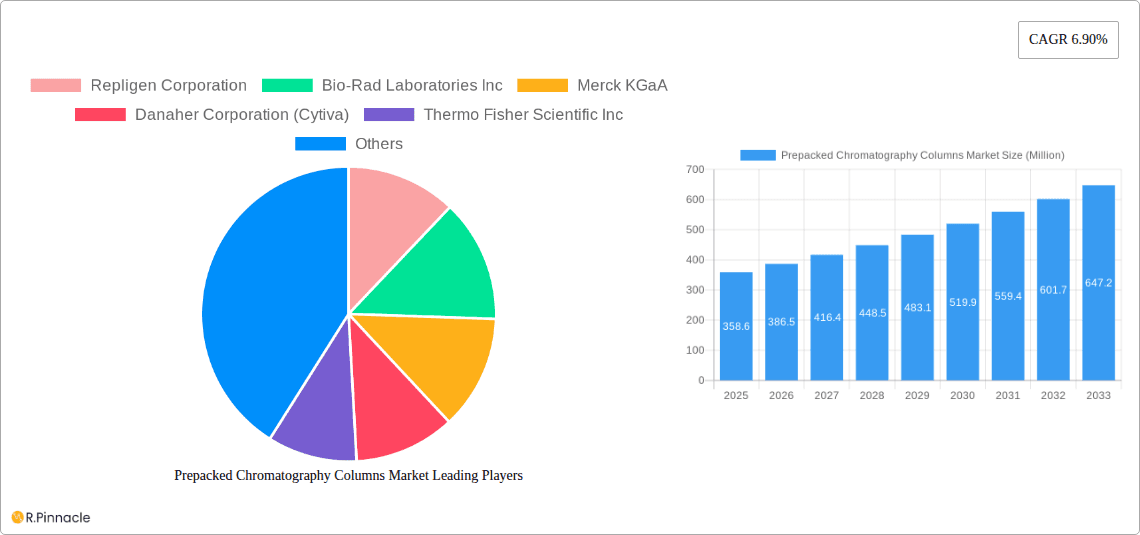

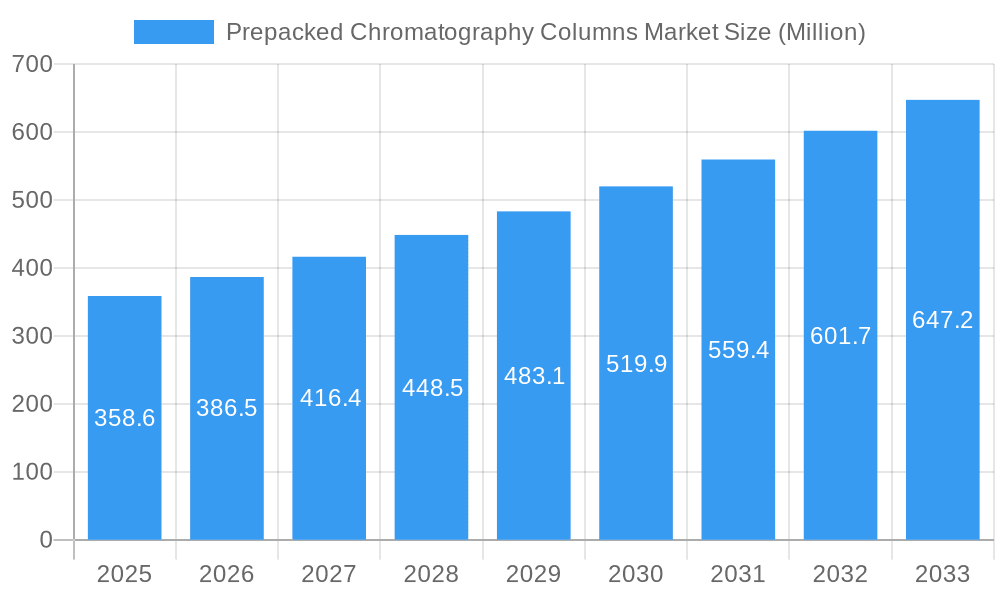

The global Prepacked Chromatography Columns Market is poised for significant expansion, projected to reach an estimated $358.6 million in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 7.9% from 2019 to 2033, indicating sustained demand and increasing adoption of these advanced separation solutions. A primary driver for this market surge is the escalating need for efficient and reliable purification techniques within the pharmaceutical and biopharmaceutical industries. The continuous development of novel therapeutics, including biologics and biosimilars, necessitates high-resolution purification processes that prepacked columns excel at providing, minimizing manual labor and reducing processing times. Furthermore, the increasing investments in academic research and the development of sophisticated analytical methods also contribute to market expansion, as researchers rely on these columns for precise sample preparation and analysis.

Prepacked Chromatography Columns Market Market Size (In Million)

The market is characterized by a diverse range of resin types, with Affinity and Ion Exchange resins leading in adoption due to their high selectivity and capacity for a wide array of biomolecules. The volume segment, particularly those between 10-1000 ml and above 1000 ml, is expected to witness substantial growth, reflecting the increasing scale of biopharmaceutical manufacturing. While the market is predominantly driven by the pharmaceutical and biopharmaceutical sectors, academic research institutions are also emerging as significant contributors to demand. The competitive landscape features established players such as Repligen Corporation, Bio-Rad Laboratories Inc., Merck KGaA, and Danaher Corporation (Cytiva), who are actively engaged in product innovation and strategic collaborations to capture market share. Despite the strong growth trajectory, potential restraints could include the high initial cost of some advanced prepacked column technologies and the need for specialized training for optimal utilization, although these are being mitigated by technological advancements and increasing market familiarity.

Prepacked Chromatography Columns Market Company Market Share

Prepacked Chromatography Columns Market Market Structure & Innovation Trends

The prepacked chromatography columns market exhibits a moderately consolidated structure, with leading players like Repligen Corporation, Bio-Rad Laboratories Inc., Merck KGaA, Danaher Corporation (Cytiva), and Thermo Fisher Scientific Inc. holding significant market shares. Innovation is a primary driver, fueled by the continuous demand for faster, more efficient, and cost-effective purification processes in biopharmaceutical manufacturing. Regulatory frameworks, particularly those governing drug safety and efficacy, indirectly influence product development and market entry. Product substitutes, while present in the form of traditional hand-packed columns and alternative separation techniques, are increasingly being challenged by the convenience and performance of prepacked solutions. End-user demographics are heavily skewed towards the pharmaceutical and biopharmaceutical industries, with academic research forming a secondary, albeit growing, segment. Mergers and acquisitions (M&A) activity is expected to remain robust as larger players seek to expand their product portfolios and geographical reach. For instance, the M&A landscape in recent years has seen deals valued in the tens to hundreds of millions, solidifying the dominance of key entities.

- Market Concentration: Moderate to High, dominated by a few key global players.

- Innovation Drivers: Demand for efficiency, speed, cost reduction, and high purity in bioseparations.

- Regulatory Influence: Indirect impact through stringent drug development and manufacturing guidelines.

- Product Substitutes: Traditional hand-packed columns, alternative separation technologies.

- End-User Demographics: Predominantly pharmaceutical and biopharmaceutical, with academic research as a notable segment.

- M&A Activities: Ongoing, driven by portfolio expansion and market consolidation.

Prepacked Chromatography Columns Market Market Dynamics & Trends

The global prepacked chromatography columns market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This robust expansion is underpinned by several key growth drivers. The escalating demand for biopharmaceuticals, including monoclonal antibodies, recombinant proteins, and vaccines, is a primary catalyst. The complexity and increasing scale of biologics manufacturing necessitate advanced purification technologies, where prepacked columns offer significant advantages in terms of reproducibility, speed, and reduced labor costs compared to manual packing. Technological disruptions, such as the development of novel chromatography resins with higher binding capacities and improved selectivity, are continuously enhancing the performance and applicability of prepacked columns across a wider range of biomolecules. Advancements in automation and continuous manufacturing processes within the biopharmaceutical industry further bolster the adoption of prepacked solutions, as they seamlessly integrate into these sophisticated workflows.

Consumer preferences are increasingly shifting towards solutions that offer ease of use, validated performance, and a reduced risk of error. Prepacked chromatography columns directly address these needs, minimizing variability associated with manual column packing and ensuring consistent results. This is particularly crucial in the highly regulated pharmaceutical environment, where reproducibility is paramount. Competitive dynamics are characterized by intense innovation and strategic partnerships among key players. Companies are investing heavily in research and development to introduce next-generation prepacked columns tailored for specific applications and scales, from early-stage research to large-scale commercial manufacturing. The market penetration of prepacked columns is steadily increasing across all end-user segments, driven by their proven ability to accelerate drug development timelines and improve overall process economics.

Furthermore, the growing emphasis on process intensification and single-use technologies in biomanufacturing indirectly fuels the demand for prepacked columns. These columns offer a convenient and disposable solution, aligning with the trend towards reducing cross-contamination risks and simplifying downstream processing. The market penetration is also boosted by the increasing prevalence of chronic diseases globally, which drives the demand for advanced biologic therapies, subsequently increasing the need for efficient purification methods. The development of smaller, benchtop prepacked columns for early-stage drug discovery and research further broadens the market reach, engaging a wider spectrum of users. The increasing adoption of high-throughput screening techniques in drug discovery also contributes to the demand for rapid and reliable purification solutions.

In summary, the prepacked chromatography columns market is experiencing dynamic growth driven by the burgeoning biopharmaceutical sector, continuous technological innovation, evolving consumer preferences for convenience and reliability, and strategic competitive maneuvering. The market penetration is expected to reach new heights as prepacked columns become an indispensable tool in modern bioprocessing.

Dominant Regions & Segments in Prepacked Chromatography Columns Market

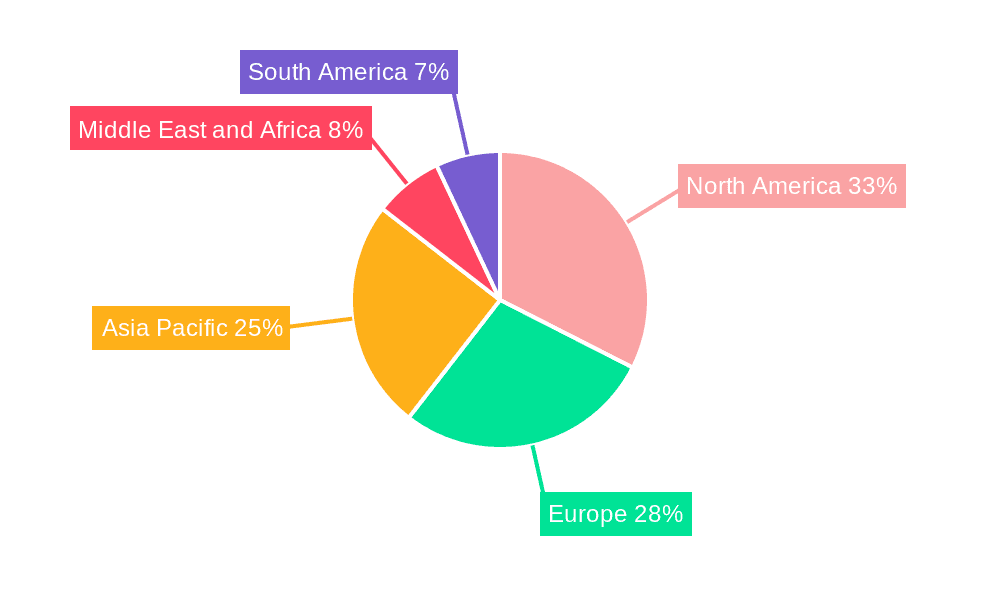

The prepacked chromatography columns market is currently dominated by North America, particularly the United States, driven by a robust pharmaceutical and biotechnology industry, significant R&D expenditure, and a high concentration of leading biopharmaceutical companies. The region benefits from favorable government policies supporting innovation and drug development, coupled with advanced healthcare infrastructure that drives demand for novel therapeutics.

Resin Type Dominance:

- Affinity Chromatography: This segment holds a significant share due to its high specificity and efficiency in purifying target biomolecules, particularly recombinant proteins and antibodies. The growing pipeline of biologics requiring targeted purification strategies fuels its dominance.

- Ion Exchange Chromatography: This remains a crucial segment, especially for the purification of charged biomolecules. Its versatility and cost-effectiveness for intermediate purification steps contribute to its sustained demand.

- Other Resin Types: This category, including hydrophobic interaction and size exclusion chromatography, is experiencing steady growth as researchers and manufacturers seek specialized solutions for complex purification challenges.

Volume Type Dominance:

- 10-1000 ml: This volume range currently dominates the market, catering to the needs of process development, pilot-scale manufacturing, and smaller commercial production runs. Its versatility makes it a go-to choice for a wide array of applications.

- Above 1000 ml: This segment is witnessing rapid growth, driven by the increasing scale of commercial biopharmaceutical manufacturing. As blockbuster biologics gain market traction, the demand for larger-scale purification solutions escalates.

- Below 10 ml: This segment, primarily serving research and early-stage discovery, is also experiencing consistent demand due to the expanding landscape of academic research and preclinical drug development.

End-user Dominance:

- Pharmaceutical and Biopharmaceutical Industry: This is the largest and most influential end-user segment. The relentless pursuit of new drug therapies, coupled with stringent quality control requirements, makes prepacked chromatography columns an essential component of their manufacturing processes. The increasing investment in biologics and biosimilars further solidifies this dominance.

- Academic Research: This segment represents a significant and growing market. Universities and research institutions utilize prepacked columns for basic research, drug discovery, and method development, contributing to the overall market expansion.

- Other End-users: This includes contract manufacturing organizations (CMOs), diagnostic companies, and food and beverage industries that employ chromatography for quality control and product purification. While smaller in scope, these segments offer diversification and future growth potential.

The dominance of North America is further supported by strong intellectual property protection, a skilled workforce, and a supportive venture capital ecosystem that fosters innovation in the life sciences. The presence of major pharmaceutical and biopharmaceutical companies, including Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., and Danaher Corporation (Cytiva), in this region significantly contributes to market leadership. Europe, with its established pharmaceutical sector and growing bioprocessing capabilities, is also a key player. The Asia-Pacific region, particularly China and India, is emerging as a significant growth market, driven by increasing investments in biotechnology and a rising demand for affordable biopharmaceuticals. Economic policies in these regions, aimed at fostering domestic biomanufacturing and attracting foreign investment, are key drivers of this growth.

Prepacked Chromatography Columns Market Product Innovations

The prepacked chromatography columns market is witnessing a wave of product innovations focused on enhancing performance, versatility, and ease of use. Companies are developing novel chromatography resins with improved binding capacities, higher selectivity, and better flow characteristics, enabling more efficient and faster purification of complex biomolecules. Innovations in column hardware and packing technologies are leading to more robust and reproducible packed columns. The development of prepacked columns for specific applications, such as the purification of viral vectors for gene therapies or the isolation of exosomes, demonstrates the market's responsiveness to emerging therapeutic modalities. These advancements provide competitive advantages by reducing process development times, minimizing manufacturing costs, and improving the purity of the final product, thereby enhancing their market fit within the rapidly evolving biopharmaceutical landscape.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global prepacked chromatography columns market, segmenting it by Resin Type, Volume Type, and End-user. The Resin Type segmentation includes Affinity, Ion Exchange, and Other Resin Types. The Volume Type segmentation covers Below 10 ml, 10-1000 ml, and Above 1000 ml. The End-user segmentation encompasses the Pharmaceutical and Biopharmaceutical Industry, Academic Research, and Other End-users.

- Resin Type: Affinity chromatography is projected to witness significant growth due to its high specificity in biologics purification. Ion Exchange and other resin types will also see steady expansion, driven by their versatility and specialized applications.

- Volume Type: The 10-1000 ml segment is expected to maintain its dominant position, while the Above 1000 ml segment will experience the fastest growth, reflecting the increasing scale of commercial biopharmaceutical production. The Below 10 ml segment will cater to the consistent demand from research and development activities.

- End-user: The Pharmaceutical and Biopharmaceutical Industry will continue to be the largest revenue-generating segment. Academic Research will show robust growth, fueled by increasing R&D investments. Other End-users represent a diversified segment with promising growth potential.

Key Drivers of Prepacked Chromatography Columns Market Growth

The prepacked chromatography columns market is propelled by several key drivers. The escalating demand for biopharmaceuticals, driven by the rising prevalence of chronic diseases and advancements in therapeutic modalities like monoclonal antibodies and gene therapies, is a primary growth accelerator. Technological advancements in chromatography resins, offering higher binding capacities and improved selectivity, are enhancing purification efficiency. Furthermore, the increasing focus on process intensification and single-use technologies in biopharmaceutical manufacturing favors the adoption of prepacked columns due to their convenience and reduced risk of cross-contamination. The need for faster drug development timelines and cost-effective manufacturing processes also significantly contributes to market expansion.

Challenges in the Prepacked Chromatography Columns Market Sector

Despite its robust growth, the prepacked chromatography columns market faces several challenges. High upfront costs associated with some advanced prepacked columns can be a deterrent for smaller research labs and emerging markets. The availability of a wide range of resin types and column formats can sometimes lead to complexity in selection and optimization for specific applications, posing a challenge for users seeking standardized solutions. Ensuring consistent quality and performance across different manufacturers and batches remains a critical concern for end-users, particularly in highly regulated industries. Supply chain disruptions and the need for specialized logistics for certain types of chromatography media can also present challenges.

Emerging Opportunities in Prepacked Chromatography Columns Market

The prepacked chromatography columns market presents several emerging opportunities. The rapid growth of cell and gene therapies is creating a significant demand for specialized prepacked columns capable of purifying complex biological entities like viral vectors and exosomes. The increasing adoption of continuous manufacturing processes in biopharmaceutical production offers a significant opportunity for integrated prepacked column solutions. Furthermore, the expansion of biopharmaceutical manufacturing in emerging economies, particularly in the Asia-Pacific region, presents substantial growth potential. The development of more sustainable and environmentally friendly chromatography materials and column designs also represents an emerging trend and opportunity.

Leading Players in the Prepacked Chromatography Columns Market Market

- Repligen Corporation

- Bio-Rad Laboratories Inc.

- Merck KGaA

- Danaher Corporation (Cytiva)

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Tosoh Corporation

- YMC Europe GmbH

- Astrea Bioseparations

- Proxcys BV

Key Developments in Prepacked Chromatography Columns Market Industry

- July 2022: Bio-Rad Laboratories launched EconoFit Low-Pressure Prepacked Chromatography Column Packs. This significantly enhances their product portfolio.

- June 2022: Bio-Rad Laboratories, Inc. launched CHT-prepacked Foresight Pro Columns. These columns are designed to support downstream process-scale chromatography applications across different stages of biological drug development and production.

Future Outlook for Prepacked Chromatography Columns Market Market

The future outlook for the prepacked chromatography columns market remains highly optimistic, driven by sustained innovation and increasing demand from the burgeoning biopharmaceutical sector. The market is expected to witness continued growth fueled by the development of advanced chromatography resins and column technologies that offer enhanced efficiency, selectivity, and scalability. The increasing adoption of prepacked columns in emerging therapeutic areas such as cell and gene therapies, and the expansion of biopharmaceutical manufacturing in the Asia-Pacific region, are anticipated to be significant growth accelerators. Strategic collaborations and mergers & acquisitions will likely continue to shape the market, leading to greater consolidation and expanded product offerings. The focus on process intensification and single-use technologies will further solidify the indispensable role of prepacked chromatography columns in modern bioprocessing, creating substantial market potential and strategic opportunities for key players.

Prepacked Chromatography Columns Market Segmentation

-

1. Resin Type

- 1.1. Affinity

- 1.2. Ion Exchange

- 1.3. Other Resin Types

-

2. Volume Type

- 2.1. Below 10 ml

- 2.2. 10-1000 ml

- 2.3. Above 1000 ml

-

3. End-user

- 3.1. Pharmaceutical and Biopharmaceutical Industry

- 3.2. Academic Research

- 3.3. Other End-users

Prepacked Chromatography Columns Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of the Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of the South America

Prepacked Chromatography Columns Market Regional Market Share

Geographic Coverage of Prepacked Chromatography Columns Market

Prepacked Chromatography Columns Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Process Development and Affordable Purification; Technological Advancements in Prepacked Chromatography Columns

- 3.3. Market Restrains

- 3.3.1. Technical Limitations of the Column

- 3.4. Market Trends

- 3.4.1. Affinity Segment Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Affinity

- 5.1.2. Ion Exchange

- 5.1.3. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Volume Type

- 5.2.1. Below 10 ml

- 5.2.2. 10-1000 ml

- 5.2.3. Above 1000 ml

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Pharmaceutical and Biopharmaceutical Industry

- 5.3.2. Academic Research

- 5.3.3. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. North America Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Affinity

- 6.1.2. Ion Exchange

- 6.1.3. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Volume Type

- 6.2.1. Below 10 ml

- 6.2.2. 10-1000 ml

- 6.2.3. Above 1000 ml

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Pharmaceutical and Biopharmaceutical Industry

- 6.3.2. Academic Research

- 6.3.3. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Europe Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Affinity

- 7.1.2. Ion Exchange

- 7.1.3. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Volume Type

- 7.2.1. Below 10 ml

- 7.2.2. 10-1000 ml

- 7.2.3. Above 1000 ml

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Pharmaceutical and Biopharmaceutical Industry

- 7.3.2. Academic Research

- 7.3.3. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Asia Pacific Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Affinity

- 8.1.2. Ion Exchange

- 8.1.3. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Volume Type

- 8.2.1. Below 10 ml

- 8.2.2. 10-1000 ml

- 8.2.3. Above 1000 ml

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Pharmaceutical and Biopharmaceutical Industry

- 8.3.2. Academic Research

- 8.3.3. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Middle East and Africa Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Affinity

- 9.1.2. Ion Exchange

- 9.1.3. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Volume Type

- 9.2.1. Below 10 ml

- 9.2.2. 10-1000 ml

- 9.2.3. Above 1000 ml

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Pharmaceutical and Biopharmaceutical Industry

- 9.3.2. Academic Research

- 9.3.3. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. South America Prepacked Chromatography Columns Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Affinity

- 10.1.2. Ion Exchange

- 10.1.3. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Volume Type

- 10.2.1. Below 10 ml

- 10.2.2. 10-1000 ml

- 10.2.3. Above 1000 ml

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Pharmaceutical and Biopharmaceutical Industry

- 10.3.2. Academic Research

- 10.3.3. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Repligen Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bio-Rad Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Danaher Corporation (Cytiva)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sartorius AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tosoh Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 YMC Europe GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Astrea Bioseparations

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Proxcys BV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Repligen Corporation

List of Figures

- Figure 1: Global Prepacked Chromatography Columns Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Prepacked Chromatography Columns Market Revenue (undefined), by Resin Type 2025 & 2033

- Figure 3: North America Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: North America Prepacked Chromatography Columns Market Revenue (undefined), by Volume Type 2025 & 2033

- Figure 5: North America Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2025 & 2033

- Figure 6: North America Prepacked Chromatography Columns Market Revenue (undefined), by End-user 2025 & 2033

- Figure 7: North America Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2025 & 2033

- Figure 8: North America Prepacked Chromatography Columns Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Prepacked Chromatography Columns Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Prepacked Chromatography Columns Market Revenue (undefined), by Resin Type 2025 & 2033

- Figure 11: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 12: Europe Prepacked Chromatography Columns Market Revenue (undefined), by Volume Type 2025 & 2033

- Figure 13: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2025 & 2033

- Figure 14: Europe Prepacked Chromatography Columns Market Revenue (undefined), by End-user 2025 & 2033

- Figure 15: Europe Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2025 & 2033

- Figure 16: Europe Prepacked Chromatography Columns Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Prepacked Chromatography Columns Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Prepacked Chromatography Columns Market Revenue (undefined), by Resin Type 2025 & 2033

- Figure 19: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 20: Asia Pacific Prepacked Chromatography Columns Market Revenue (undefined), by Volume Type 2025 & 2033

- Figure 21: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2025 & 2033

- Figure 22: Asia Pacific Prepacked Chromatography Columns Market Revenue (undefined), by End-user 2025 & 2033

- Figure 23: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Asia Pacific Prepacked Chromatography Columns Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Prepacked Chromatography Columns Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Prepacked Chromatography Columns Market Revenue (undefined), by Resin Type 2025 & 2033

- Figure 27: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Middle East and Africa Prepacked Chromatography Columns Market Revenue (undefined), by Volume Type 2025 & 2033

- Figure 29: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2025 & 2033

- Figure 30: Middle East and Africa Prepacked Chromatography Columns Market Revenue (undefined), by End-user 2025 & 2033

- Figure 31: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2025 & 2033

- Figure 32: Middle East and Africa Prepacked Chromatography Columns Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Prepacked Chromatography Columns Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Prepacked Chromatography Columns Market Revenue (undefined), by Resin Type 2025 & 2033

- Figure 35: South America Prepacked Chromatography Columns Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 36: South America Prepacked Chromatography Columns Market Revenue (undefined), by Volume Type 2025 & 2033

- Figure 37: South America Prepacked Chromatography Columns Market Revenue Share (%), by Volume Type 2025 & 2033

- Figure 38: South America Prepacked Chromatography Columns Market Revenue (undefined), by End-user 2025 & 2033

- Figure 39: South America Prepacked Chromatography Columns Market Revenue Share (%), by End-user 2025 & 2033

- Figure 40: South America Prepacked Chromatography Columns Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Prepacked Chromatography Columns Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 2: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Volume Type 2020 & 2033

- Table 3: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 4: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 6: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Volume Type 2020 & 2033

- Table 7: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 8: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 13: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Volume Type 2020 & 2033

- Table 14: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 15: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of the Europe Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 23: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Volume Type 2020 & 2033

- Table 24: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 25: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of the Asia Pacific Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 33: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Volume Type 2020 & 2033

- Table 34: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 35: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Resin Type 2020 & 2033

- Table 40: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Volume Type 2020 & 2033

- Table 41: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 42: Global Prepacked Chromatography Columns Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of the South America Prepacked Chromatography Columns Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prepacked Chromatography Columns Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Prepacked Chromatography Columns Market?

Key companies in the market include Repligen Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Danaher Corporation (Cytiva), Thermo Fisher Scientific Inc, Sartorius AG, Tosoh Corporation, YMC Europe GmbH, Astrea Bioseparations, Proxcys BV.

3. What are the main segments of the Prepacked Chromatography Columns Market?

The market segments include Resin Type, Volume Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Process Development and Affordable Purification; Technological Advancements in Prepacked Chromatography Columns.

6. What are the notable trends driving market growth?

Affinity Segment Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Technical Limitations of the Column.

8. Can you provide examples of recent developments in the market?

July 2022: Bio-Rad Laboratories launched EconoFit Low-Pressure Prepacked Chromatography Column Packs. This significantly enhances their product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prepacked Chromatography Columns Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prepacked Chromatography Columns Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prepacked Chromatography Columns Market?

To stay informed about further developments, trends, and reports in the Prepacked Chromatography Columns Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence