Key Insights

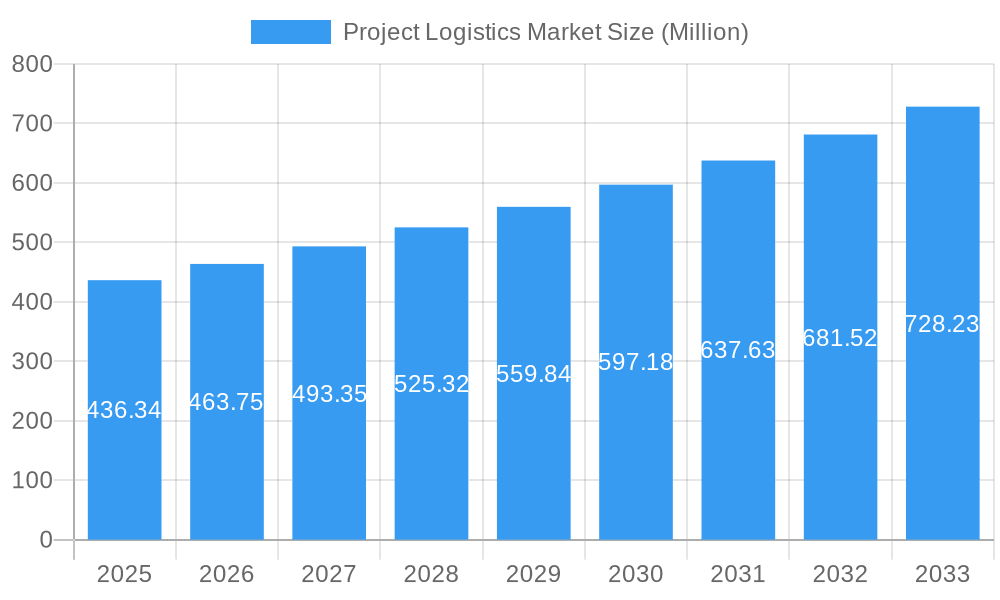

The global project logistics market, valued at $436.34 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.95% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning energy and infrastructure sectors, particularly in developing economies in Asia-Pacific and the Middle East, fuel significant demand for specialized transportation and handling of oversized and heavy cargo. Furthermore, the increasing complexity of global projects necessitates sophisticated inventory management and warehousing solutions, driving growth within the value-added services segment. The rise of e-commerce and globalization further contributes to market expansion, demanding efficient and reliable project logistics solutions for timely delivery of goods across borders. However, challenges such as geopolitical instability, fluctuating fuel prices, and stringent regulatory environments can act as potential restraints. The market is segmented by service (transportation, forwarding, inventory management and warehousing, other value-added services) and end-user (oil and gas, mining and quarrying, energy and power, construction, manufacturing, other end-users). Key players like DB Schenker, Kuehne + Nagel, and DHL are actively shaping the market landscape through strategic partnerships, technological advancements, and geographic expansion. The competitive landscape is characterized by a mix of large multinational corporations and specialized regional players.

Project Logistics Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, primarily fueled by sustained infrastructure development globally and the increasing adoption of digital technologies to optimize logistics operations. Expansion into emerging markets, coupled with strategic mergers and acquisitions within the industry, will further consolidate the market. Companies are investing in advanced technologies such as blockchain and IoT to enhance transparency and efficiency in their supply chains. Despite potential risks, the long-term outlook for the project logistics market remains positive, driven by the ongoing need for efficient and reliable handling of complex projects worldwide. The market's growth trajectory is likely to be influenced by global economic conditions and technological innovation. Specific regional growth rates will vary based on factors such as infrastructure investment, economic development, and regulatory frameworks.

Project Logistics Market Company Market Share

Project Logistics Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Project Logistics Market, offering valuable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report delivers a detailed understanding of market dynamics, key players, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Project Logistics Market Market Structure & Innovation Trends

The Project Logistics Market is characterized by a moderately concentrated structure, with several large global players and numerous smaller regional operators. Key players such as DB Schenker, Kuehne + Nagel International AG, and DHL hold significant market share, but smaller specialized firms also thrive. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the market.

Innovation is driven by technological advancements in transportation, tracking, and logistics management systems. Increased adoption of digital solutions for real-time monitoring, predictive analytics, and supply chain optimization is reshaping the industry. Regulatory frameworks concerning safety, environmental impact, and international trade significantly influence market operations. Product substitutes are limited, though alternative transport modes (rail vs. road) and warehousing solutions impact the choice of service.

Mergers and acquisitions (M&A) activity is considerable, driven by the need for companies to expand their global reach and service portfolio. Recent M&A deals, though not publicly disclosed in detail, indicate a cumulative value of approximately xx Million in the past five years. End-user demographics show a strong reliance on project logistics from Oil & Gas, Energy & Power, and Construction sectors, however diversification into manufacturing and other end-users is ongoing.

- Market Concentration: xx%

- Top 5 Players Market Share: xx%

- Estimated M&A Value (Last 5 years): xx Million

Project Logistics Market Market Dynamics & Trends

The Project Logistics Market is experiencing robust growth, fueled by increasing global infrastructure development, rising energy demand, and growth in manufacturing and industrial projects. Technological disruptions, including the Internet of Things (IoT), blockchain technology, and AI-powered analytics, are enhancing efficiency and transparency throughout the supply chain. Consumer preferences are shifting toward more sustainable and reliable logistics solutions, putting pressure on companies to adopt environmentally friendly practices and improve service quality.

Competitive dynamics are intense, characterized by price competition, service differentiation, and strategic partnerships. The market shows increasing consolidation as larger companies acquire smaller firms to gain access to new markets and technologies. The market is expected to maintain its growth trajectory driven by factors such as increased globalization, expanding trade, and a growing emphasis on just-in-time inventory management.

- CAGR (2025-2033): xx%

- Market Penetration (2025): xx%

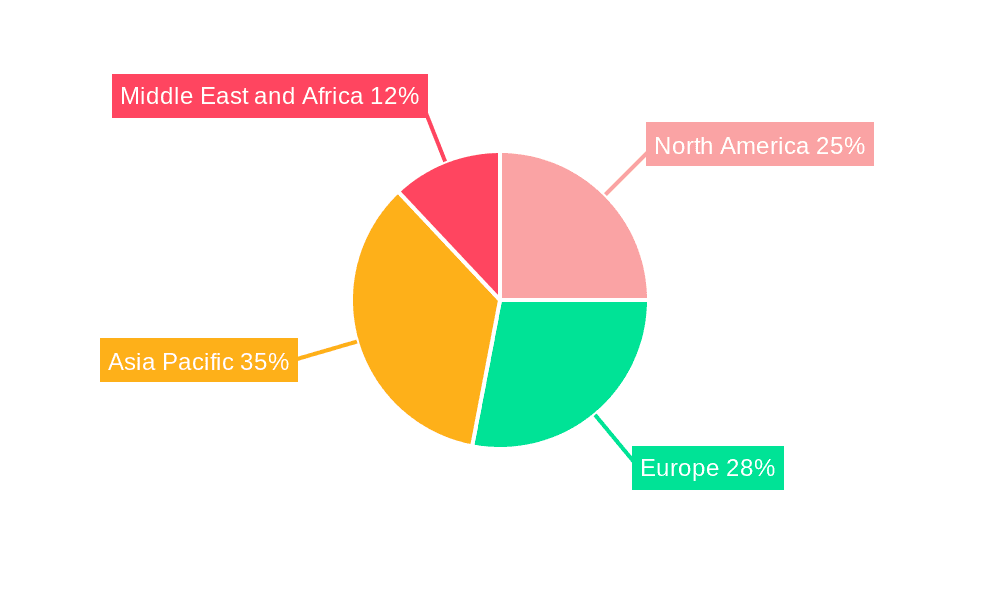

Dominant Regions & Segments in Project Logistics Market

The Asia-Pacific region dominates the Project Logistics Market, fueled by significant infrastructure projects and expanding industrial activities in countries like China and India. North America and Europe also hold substantial market share due to developed economies and established logistics networks. Within segments, Transportation accounts for the largest share, followed by Forwarding. The Oil & Gas, Mining & Quarrying, and Energy & Power sectors are the major end-users of project logistics services.

- Key Drivers in Asia-Pacific:

- Rapid infrastructure development

- Growing industrialization

- Government support for logistics infrastructure

- Key Drivers in North America:

- Robust energy sector

- Investments in renewable energy projects

- Well-developed logistics infrastructure

- Key Drivers in Europe:

- Ongoing infrastructure projects

- Focus on sustainability

- Strong manufacturing sector

Project Logistics Market Product Innovations

Recent innovations focus on improving efficiency, traceability, and safety in project logistics. This includes advanced tracking systems, specialized transport solutions for oversized cargo, and optimized warehousing solutions for project cargo. The use of digital twin technology enables better visualization and planning of complex logistics operations, enhancing efficiency and mitigating risks. These innovations offer significant competitive advantages by increasing speed, reducing costs, and improving overall customer satisfaction.

Report Scope & Segmentation Analysis

This report segments the Project Logistics Market by service type (Transportation, Forwarding, Inventory Management & Warehousing, Other Value-added Services) and end-user (Oil & Gas, Mining & Quarrying, Energy & Power, Construction, Manufacturing, Other). Each segment’s growth projection, market size, and competitive dynamics are analyzed separately. The Transportation segment shows the highest growth, driven by increasing demand for specialized transport solutions. The Oil & Gas sector remains the largest end-user, showing robust growth based on global energy demand.

Key Drivers of Project Logistics Market Growth

Several factors are driving growth in the project logistics market. The increasing globalisation of trade and investment necessitates efficient and reliable logistics solutions. Government regulations aimed at streamlining trade and promoting infrastructure projects are also influential. Technological advancements like IoT, AI, and blockchain enhance supply chain visibility and efficiency. Finally, the growing complexity of projects globally increases reliance on specialized logistics providers.

Challenges in the Project Logistics Market Sector

The Project Logistics Market faces significant challenges including geopolitical instability, trade wars, and disruptions to global supply chains. Stringent regulations related to safety, environmental concerns, and customs compliance increase operational complexities. Competition from established players and new entrants creates pricing pressure. Fluctuations in fuel prices and currency exchange rates also impact profitability. These factors can lead to increased costs and delays, affecting project timelines and budgets.

Emerging Opportunities in Project Logistics Market

The market presents significant opportunities for firms with innovative solutions. The rise of e-commerce and growing demand for last-mile delivery present opportunities for specialized services. Focus on sustainability and green logistics is an emerging trend. The development of advanced tracking and monitoring systems utilizing AI and IoT will improve efficiency and transparency, creating further market opportunities.

Leading Players in the Project Logistics Market Market

- EMO Trans

- SAL Heavy Lift GmbH

- FLS Transportation Services

- Crowley Logistics

- Highland Forwarding Inc

- Kinetix International Logistics

- Cole International Inc

- Hisiang Logistics Co Ltd

- Sea Cargo Air Cargo Logistics Inc

- Bati Grou

- DB Schenker

- Hellmann Worldwide Logistics

- Ceva Logistics

- Dako Worldwide Transport GmbH

- Deutsche Post DHL

- C H Robinson Worldwide Inc

- Rohlig Logistics

- Kuehne + Nagel International AG

- Agility Logistics

- Kerry Logistics

- Bollore Logistics

- Megalift Sdn Bhd

- CKB Logistics Group

- Rhenus Logistics

- Expeditors International of Washington Inc

- NMT Global Project Logistics

- Ryder System Inc

Key Developments in Project Logistics Market Industry

- August 2023: Aprojects Austria and Antwerp Metal Logistics successfully shipped heavy loads (reactor: 359 tons, condenser: 286 tons, stripper: 243 tons) directly onto an ocean vessel due to lack of sufficient shore cranes in Constanța. This highlights the need for specialized heavy-lift solutions.

- August 2023: Huisman secured a contract from Seaway7 for the delivery of a monopile installation spread for the jack-up vessel Seaway Ventus. This signifies the ongoing demand for specialized equipment and logistics services in the offshore wind energy sector.

Future Outlook for Project Logistics Market Market

The Project Logistics Market is poised for continued growth, driven by sustained global infrastructure investment and increasing complexity of industrial projects. Strategic partnerships, technological advancements, and a focus on sustainability will shape the future of the market. Companies with a strong digital presence and a commitment to innovation are well-positioned to capitalize on the numerous opportunities presented by this dynamic sector.

Project Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Forwarding

- 1.3. Inventory Management and Warehousing

- 1.4. Other Value-added Services

-

2. End User

- 2.1. Oil and Gas, Mining, and Quarrying

- 2.2. Energy and Power

- 2.3. Construction

- 2.4. Manufacturing

- 2.5. Other End Users

Project Logistics Market Segmentation By Geography

- 1. Asia Pacific

- 2. Americas

- 3. Europe

- 4. Middle East and Africa

Project Logistics Market Regional Market Share

Geographic Coverage of Project Logistics Market

Project Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Forwarding

- 5.1.3. Inventory Management and Warehousing

- 5.1.4. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and Gas, Mining, and Quarrying

- 5.2.2. Energy and Power

- 5.2.3. Construction

- 5.2.4. Manufacturing

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. Americas

- 5.3.3. Europe

- 5.3.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Asia Pacific Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Forwarding

- 6.1.3. Inventory Management and Warehousing

- 6.1.4. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and Gas, Mining, and Quarrying

- 6.2.2. Energy and Power

- 6.2.3. Construction

- 6.2.4. Manufacturing

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Americas Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Forwarding

- 7.1.3. Inventory Management and Warehousing

- 7.1.4. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and Gas, Mining, and Quarrying

- 7.2.2. Energy and Power

- 7.2.3. Construction

- 7.2.4. Manufacturing

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Forwarding

- 8.1.3. Inventory Management and Warehousing

- 8.1.4. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and Gas, Mining, and Quarrying

- 8.2.2. Energy and Power

- 8.2.3. Construction

- 8.2.4. Manufacturing

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Project Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Forwarding

- 9.1.3. Inventory Management and Warehousing

- 9.1.4. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Oil and Gas, Mining, and Quarrying

- 9.2.2. Energy and Power

- 9.2.3. Construction

- 9.2.4. Manufacturing

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 EMO Trans

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SAL Heavy Lift GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FLS Transportation Services Crowley Logistics Highland Forwarding Inc Kinetix International Logistics Cole International Inc Hisiang Logistics Co Ltd Sea Cargo Air Cargo Logistics Inc and Bati Grou

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DB Schenker

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hellmann Worldwide Logistics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ceva Logistics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dako Worldwide Transport GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deutsche Post DHL**List Not Exhaustive 6 3 Other Players in the Market

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 C H Robinson Worldwide Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rohlig Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Kuehne + Nagel International AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Agility Logistics

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kerry Logistics

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bollore Logistics

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Megalift Sdn Bhd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 CKB Logistics Group

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Rhenus Logistics

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Expeditors International of Washington Inc

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 NMT Global Project Logistics

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Ryder System Inc

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 EMO Trans

List of Figures

- Figure 1: Global Project Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 3: Asia Pacific Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: Asia Pacific Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 5: Asia Pacific Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: Asia Pacific Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Americas Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 9: Americas Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Americas Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Americas Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Americas Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Americas Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Europe Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Europe Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Project Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Project Logistics Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East and Africa Project Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East and Africa Project Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East and Africa Project Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Project Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Project Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Project Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Project Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Project Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Project Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Project Logistics Market?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Project Logistics Market?

Key companies in the market include EMO Trans, SAL Heavy Lift GmbH, FLS Transportation Services Crowley Logistics Highland Forwarding Inc Kinetix International Logistics Cole International Inc Hisiang Logistics Co Ltd Sea Cargo Air Cargo Logistics Inc and Bati Grou, DB Schenker, Hellmann Worldwide Logistics, Ceva Logistics, Dako Worldwide Transport GmbH, Deutsche Post DHL**List Not Exhaustive 6 3 Other Players in the Market, C H Robinson Worldwide Inc, Rohlig Logistics, Kuehne + Nagel International AG, Agility Logistics, Kerry Logistics, Bollore Logistics, Megalift Sdn Bhd, CKB Logistics Group, Rhenus Logistics, Expeditors International of Washington Inc, NMT Global Project Logistics, Ryder System Inc.

3. What are the main segments of the Project Logistics Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 436.34 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure.

6. What are the notable trends driving market growth?

Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

August 2023 - Aprojects Austria, a member of the Project Logistics Alliance, joined forces together with their long-trusted partner, Antwerp Metal Logistics, to ship heavy loads comprising: A reactor weighing 359 tons, a pool condenser weighing 286 tons and a stripper weighing 243 tons. Given the cargo’s weight, the only viable approach was to load it directly onto the ocean vessel using the vessel’s equipment, as no shore crane in Constanța had the capability to lift such heavy loads, even with multiple cranes working in tandem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Project Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Project Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Project Logistics Market?

To stay informed about further developments, trends, and reports in the Project Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence