Key Insights

The global rail pantograph market is projected for robust expansion, anticipating a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. Key drivers include ongoing railway infrastructure modernization and expansion worldwide, particularly in rapidly urbanizing and industrializing developing economies. The proliferation of high-speed rail networks demands advanced, reliable pantograph technologies for superior current collection at elevated speeds. This is further propelled by the increasing adoption of electric and hybrid trains, inherently reliant on efficient pantograph systems. Additionally, stringent safety regulations and the pursuit of enhanced energy efficiency are stimulating innovation in pantograph designs, focusing on improved aerodynamics and contact force control. The market is segmented by arm type (single arm, double arm), pantograph type (diamond, bow), and train type (high-speed, mainline, freight, metro). While industry leaders like Siemens Mobility and Alstom SA hold significant market share, specialized smaller companies are actively contributing to niche segments. The Asia-Pacific region, driven by substantial railway infrastructure investments in China and India, is expected to lead market growth. Robust competition is anticipated, with a focus on technological innovation, strategic alliances, and regional expansion.

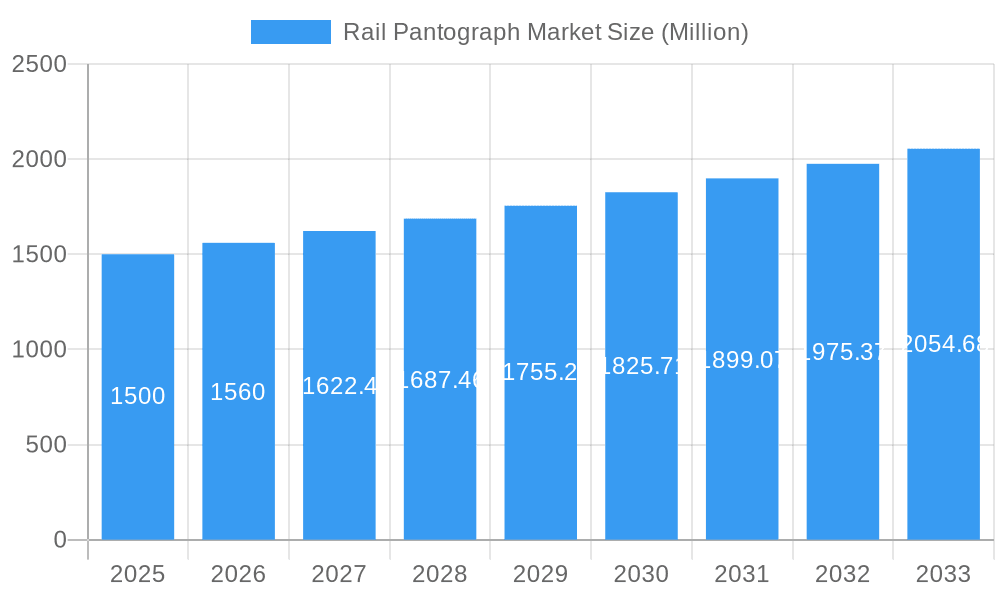

Rail Pantograph Market Market Size (In Billion)

The competitive landscape features established multinational corporations and agile specialized firms. Large corporations capitalize on extensive experience and global reach for major projects, while smaller entities focus on tailored solutions and niche market segments. Market consolidation, including potential mergers and acquisitions, is expected to foster further growth and innovation. Technological advancements, such as the integration of smart sensors and sophisticated control systems, will be pivotal. Manufacturers are prioritizing the development of lighter, more durable, and energy-efficient pantographs. The adoption of predictive maintenance techniques will enhance operational efficiency and minimize downtime, contributing to overall market expansion. Regional market dynamics will be shaped by governmental policies, infrastructure investment, and the pace of railway modernization across different global regions.

Rail Pantograph Market Company Market Share

Rail Pantograph Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Rail Pantograph Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The study period is 2019–2033, with 2025 as the base and estimated year, and 2025–2033 as the forecast period. The historical period covered is 2019–2024.

Rail Pantograph Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, including market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities. The report delves into the market share held by key players such as BARTELS GmBH, G&Z Enterprises Ltd, Flexicon Ltd, Austbreck Pty Ltd, Hitachi Ltd, Siemens Mobility, SCHUNK GmbH & Co KG, Alstom SA, KONI BV, and Wabtec Corporation (list not exhaustive). While precise market share figures are proprietary to the full report, the analysis reveals a moderately concentrated market with several significant players vying for dominance. Innovation is driven by the need for enhanced performance, reliability, and energy efficiency, shaped by evolving railway technologies and stringent safety regulations. The report examines the impact of M&A activities, assessing the value of significant deals and their influence on market consolidation and technological advancement. The analysis also includes a deep dive into regulatory frameworks influencing design, manufacturing, and deployment of rail pantographs, including standards and certifications needed for global operation and maintenance. Finally, the impact of substitute technologies and their market penetration is explored, showing the current and projected effect on the market share and product development strategies of the leading players.

Rail Pantograph Market Dynamics & Trends

This section explores the key factors driving market growth, technological advancements, evolving consumer preferences (railway operators and manufacturers), and the competitive dynamics within the rail pantograph industry. The report quantifies market growth using Compound Annual Growth Rate (CAGR) projections and analyzes market penetration rates for various pantograph types across different train segments. The analysis encompasses the influence of factors such as increasing global railway infrastructure development, modernization initiatives of existing railway networks (including electrification), the growing demand for high-speed rail, stringent environmental regulations promoting energy-efficient designs, and the rise of smart rail technologies, which demand better integration and performance of rail pantographs. Furthermore, the report details emerging trends such as the growing adoption of condition monitoring systems (as exemplified by Ricardo's Pan Mon system) and the shift towards lighter-weight, more durable, and advanced materials in pantograph construction. Competitive dynamics are evaluated by analyzing pricing strategies, technological innovation, product differentiation, and expansion strategies adopted by major players.

Dominant Regions & Segments in Rail Pantograph Market

This section identifies the leading regions, countries, and market segments within the rail pantograph market. The segmentation includes:

- By Arm Type: Single arm Pantograph, Double arm Pantograph

- By Pantograph Type: Diamond Shape, Bow type

- By Train Type: High Speed train, Mainline Train, Freight Train, Metro Train

The analysis uses a combination of qualitative and quantitative data to determine the dominant segments and regions. Key growth drivers for each segment are identified using bullet points. For example, high-speed rail expansion in Asia is a significant driver for the high-speed train segment, while increased freight transportation in North America fuels growth in the freight train segment. Detailed dominance analysis focuses on factors such as economic policies, infrastructure development, and technological advancements. Regional dominance is determined through assessment of market size, growth rate, and the concentration of key players and significant ongoing infrastructure projects.

Rail Pantograph Market Product Innovations

Recent advancements in rail pantograph technology include the development of improved current collection systems, the adoption of lightweight materials for reduced energy consumption, and the integration of smart sensors for predictive maintenance. These innovations address critical challenges such as wear and tear, energy efficiency, and operational reliability. Market fit is assessed through the analysis of adoption rates, cost-effectiveness, and the alignment of these technologies with the evolving needs of railway operators. The competitive landscape is shaped by the ability of manufacturers to introduce innovative products that meet these requirements, offering advantages in terms of performance, longevity, and maintenance costs.

Report Scope & Segmentation Analysis

This report comprehensively segments the rail pantograph market based on arm type (single arm, double arm), pantograph type (diamond, bow), and train type (high-speed, mainline, freight, metro). Each segment's growth projection, market size (in Million), and competitive dynamics are analyzed separately. For example, the high-speed train segment is expected to experience significant growth due to global investments in high-speed rail infrastructure, while the freight train segment is projected to exhibit steady growth driven by increased freight transportation volumes. The market size for each segment is detailed within the full report, showing the projected value for each segment for the forecast period. Competitive dynamics within each segment are assessed, highlighting the presence of major players and their market share.

Key Drivers of Rail Pantograph Market Growth

The rail pantograph market is driven by several key factors: Firstly, the increasing demand for improved railway infrastructure and modernization of existing networks globally stimulates high demand. Secondly, the surge in the adoption of high-speed rail systems necessitates advanced pantograph technologies capable of handling higher speeds and currents. Thirdly, stringent government regulations related to energy efficiency and environmental sustainability incentivize the development and adoption of more efficient pantograph designs. Lastly, the growing adoption of smart rail technologies and predictive maintenance systems are key drivers for innovation within the market.

Challenges in the Rail Pantograph Market Sector

Several challenges hinder the growth of the rail pantograph market. These include the high initial investment costs associated with the development and implementation of new technologies and infrastructure, supply chain disruptions impacting the availability of raw materials, and intense competition among established and emerging players in the market. Furthermore, stringent safety regulations and compliance requirements impose significant development and manufacturing hurdles. These challenges influence the market expansion and lead to variations in pricing and product development across the market segments and regions.

Emerging Opportunities in Rail Pantograph Market

Emerging opportunities lie in the development and deployment of next-generation pantographs incorporating advanced materials, smart sensors, and improved current collection systems. Expanding into new markets, particularly in developing economies undergoing rapid railway infrastructure expansion, presents significant growth potential. Furthermore, increased focus on predictive maintenance and condition monitoring systems opens up avenues for value-added services. Finally, new collaborative partnerships and R&D focused on enhancing energy efficiency and sustainability are expected to present substantial future opportunities.

Leading Players in the Rail Pantograph Market

- BARTELS GmBH

- G&Z Enterprises Ltd

- Flexicon Ltd

- Austbreck Pty Ltd

- Hitachi Ltd [Hitachi Ltd]

- Siemens Mobility [Siemens Mobility]

- SCHUNK GmbH & Co KG [SCHUNK GmbH & Co KG]

- Alstom SA [Alstom SA]

- KONI BV [KONI BV]

- Wabtec Corporation [Wabtec Corporation]

Key Developments in Rail Pantograph Market Industry

- March 2022: The Indian government announced plans to manufacture 400 new Vande Bharat Express trains, allocating INR 130 crores (approximately xx Million USD) for the project. This significantly boosts demand for rail pantographs in India.

- November 2021: Ricardo completed the rollout of its Pan Mon pantograph condition monitoring system across selected electrified routes in Scotland. This highlights the growing adoption of smart technologies in rail infrastructure.

Future Outlook for Rail Pantograph Market

The future of the rail pantograph market looks promising, driven by continued investment in railway infrastructure globally, the increasing adoption of high-speed rail, and the rising demand for energy-efficient and reliable transportation systems. Strategic partnerships, technological advancements, and the expansion into new and developing markets are key growth accelerators. The market is expected to witness significant growth in the coming years, driven by the factors previously mentioned and the ongoing modernization of existing railway infrastructure worldwide.

Rail Pantograph Market Segmentation

-

1. Arm Type

- 1.1. Single arm Pantograph

- 1.2. Double arm Pantograph

-

2. Pantograph Type

- 2.1. Diamond Shape

- 2.2. Bow type

-

3. Train Type

- 3.1. High Speed train

- 3.2. Mainline Train

- 3.3. Freight Train

- 3.4. Metro Train

Rail Pantograph Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the world

- 4.1. South America

- 4.2. Middle East and Africa

Rail Pantograph Market Regional Market Share

Geographic Coverage of Rail Pantograph Market

Rail Pantograph Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Growing Rail Electrification to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Arm Type

- 5.1.1. Single arm Pantograph

- 5.1.2. Double arm Pantograph

- 5.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 5.2.1. Diamond Shape

- 5.2.2. Bow type

- 5.3. Market Analysis, Insights and Forecast - by Train Type

- 5.3.1. High Speed train

- 5.3.2. Mainline Train

- 5.3.3. Freight Train

- 5.3.4. Metro Train

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the world

- 5.1. Market Analysis, Insights and Forecast - by Arm Type

- 6. North America Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Arm Type

- 6.1.1. Single arm Pantograph

- 6.1.2. Double arm Pantograph

- 6.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 6.2.1. Diamond Shape

- 6.2.2. Bow type

- 6.3. Market Analysis, Insights and Forecast - by Train Type

- 6.3.1. High Speed train

- 6.3.2. Mainline Train

- 6.3.3. Freight Train

- 6.3.4. Metro Train

- 6.1. Market Analysis, Insights and Forecast - by Arm Type

- 7. Europe Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Arm Type

- 7.1.1. Single arm Pantograph

- 7.1.2. Double arm Pantograph

- 7.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 7.2.1. Diamond Shape

- 7.2.2. Bow type

- 7.3. Market Analysis, Insights and Forecast - by Train Type

- 7.3.1. High Speed train

- 7.3.2. Mainline Train

- 7.3.3. Freight Train

- 7.3.4. Metro Train

- 7.1. Market Analysis, Insights and Forecast - by Arm Type

- 8. Asia Pacific Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Arm Type

- 8.1.1. Single arm Pantograph

- 8.1.2. Double arm Pantograph

- 8.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 8.2.1. Diamond Shape

- 8.2.2. Bow type

- 8.3. Market Analysis, Insights and Forecast - by Train Type

- 8.3.1. High Speed train

- 8.3.2. Mainline Train

- 8.3.3. Freight Train

- 8.3.4. Metro Train

- 8.1. Market Analysis, Insights and Forecast - by Arm Type

- 9. Rest of the world Rail Pantograph Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Arm Type

- 9.1.1. Single arm Pantograph

- 9.1.2. Double arm Pantograph

- 9.2. Market Analysis, Insights and Forecast - by Pantograph Type

- 9.2.1. Diamond Shape

- 9.2.2. Bow type

- 9.3. Market Analysis, Insights and Forecast - by Train Type

- 9.3.1. High Speed train

- 9.3.2. Mainline Train

- 9.3.3. Freight Train

- 9.3.4. Metro Train

- 9.1. Market Analysis, Insights and Forecast - by Arm Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BARTELS GmBH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 G&Z Enterprises Ltd *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flexicon Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Austbreck Pty Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hitachi Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens Mobility

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SCHUNK GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Alstom SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 KONI BV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wabtec Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 BARTELS GmBH

List of Figures

- Figure 1: Global Rail Pantograph Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 3: North America Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 4: North America Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 5: North America Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 6: North America Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 7: North America Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 8: North America Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 11: Europe Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 12: Europe Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 13: Europe Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 14: Europe Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 15: Europe Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 16: Europe Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 19: Asia Pacific Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 20: Asia Pacific Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 21: Asia Pacific Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 22: Asia Pacific Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 23: Asia Pacific Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 24: Asia Pacific Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the world Rail Pantograph Market Revenue (million), by Arm Type 2025 & 2033

- Figure 27: Rest of the world Rail Pantograph Market Revenue Share (%), by Arm Type 2025 & 2033

- Figure 28: Rest of the world Rail Pantograph Market Revenue (million), by Pantograph Type 2025 & 2033

- Figure 29: Rest of the world Rail Pantograph Market Revenue Share (%), by Pantograph Type 2025 & 2033

- Figure 30: Rest of the world Rail Pantograph Market Revenue (million), by Train Type 2025 & 2033

- Figure 31: Rest of the world Rail Pantograph Market Revenue Share (%), by Train Type 2025 & 2033

- Figure 32: Rest of the world Rail Pantograph Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the world Rail Pantograph Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 2: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 3: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 4: Global Rail Pantograph Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 6: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 7: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 8: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 13: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 14: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 15: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 22: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 23: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 24: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: China Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: India Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Japan Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Rail Pantograph Market Revenue million Forecast, by Arm Type 2020 & 2033

- Table 31: Global Rail Pantograph Market Revenue million Forecast, by Pantograph Type 2020 & 2033

- Table 32: Global Rail Pantograph Market Revenue million Forecast, by Train Type 2020 & 2033

- Table 33: Global Rail Pantograph Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: South America Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Rail Pantograph Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Pantograph Market?

The projected CAGR is approximately 12.87%.

2. Which companies are prominent players in the Rail Pantograph Market?

Key companies in the market include BARTELS GmBH, G&Z Enterprises Ltd *List Not Exhaustive, Flexicon Ltd, Austbreck Pty Ltd, Hitachi Ltd, Siemens Mobility, SCHUNK GmbH & Co KG, Alstom SA, KONI BV, Wabtec Corporation.

3. What are the main segments of the Rail Pantograph Market?

The market segments include Arm Type, Pantograph Type, Train Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3771.14 million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Growing Rail Electrification to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

In March 2022, Indian Government has announced the declaration plan to undertake indigenous manufacture of 400 new generation Vande Bharat express trains by allocating INR 130 crores in the recent budget for year 2022 -2023. Unlike a normal express train which is hauled by a detachable locomotive provided at one end of the train, the Vande Bharat series is provided by electric gear and trains draws it energy from over-head equipment through pantograph mounted on coaches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Pantograph Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Pantograph Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Pantograph Market?

To stay informed about further developments, trends, and reports in the Rail Pantograph Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence