Key Insights

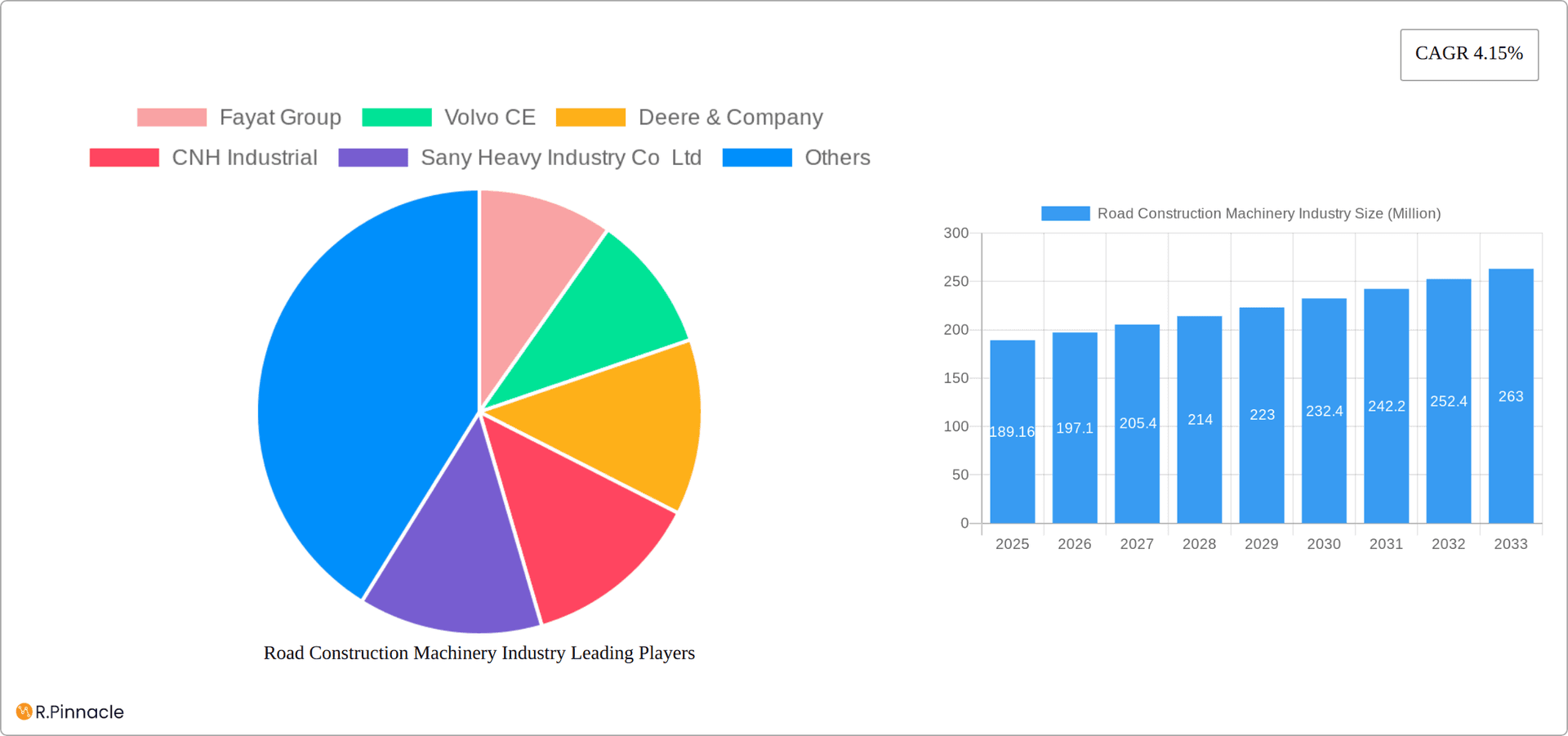

The global road construction machinery market, valued at $189.16 million in 2025, is projected to experience robust growth, driven by escalating infrastructure development projects worldwide. A Compound Annual Growth Rate (CAGR) of 4.15% from 2025 to 2033 indicates a significant expansion, fueled by increasing urbanization, expanding road networks, and government investments in transportation infrastructure, particularly in developing economies. Key market segments include motor graders, road rollers, wheel loaders, concrete mixers, and other specialized equipment. The demand for technologically advanced machines with enhanced efficiency and automation features is a prominent trend, alongside a growing focus on sustainable construction practices and reduced environmental impact. While the market faces challenges such as fluctuations in raw material prices and potential economic downturns, the long-term outlook remains positive, driven by persistent demand for efficient and reliable road construction equipment. Leading players like Caterpillar, Volvo CE, and Komatsu are leveraging technological advancements and strategic partnerships to maintain their market leadership. Regional variations exist, with North America and Asia Pacific expected to contribute significantly to market growth, fueled by substantial infrastructure projects and economic expansion.

Road Construction Machinery Industry Market Size (In Million)

The competitive landscape is characterized by both established multinational corporations and emerging regional players. Intense competition necessitates continuous innovation, strategic acquisitions, and a focus on providing customized solutions to meet diverse customer requirements. The market is also witnessing a shift towards rental and leasing models, offering flexibility to contractors and reducing upfront capital investment. Furthermore, the adoption of digital technologies, such as telematics and remote monitoring, is improving equipment management and optimizing operational efficiency. These factors collectively contribute to the dynamic and evolving nature of the road construction machinery market, presenting both opportunities and challenges for industry participants. Future growth will depend on ongoing infrastructure spending, technological advancements, and effective adaptation to evolving market dynamics.

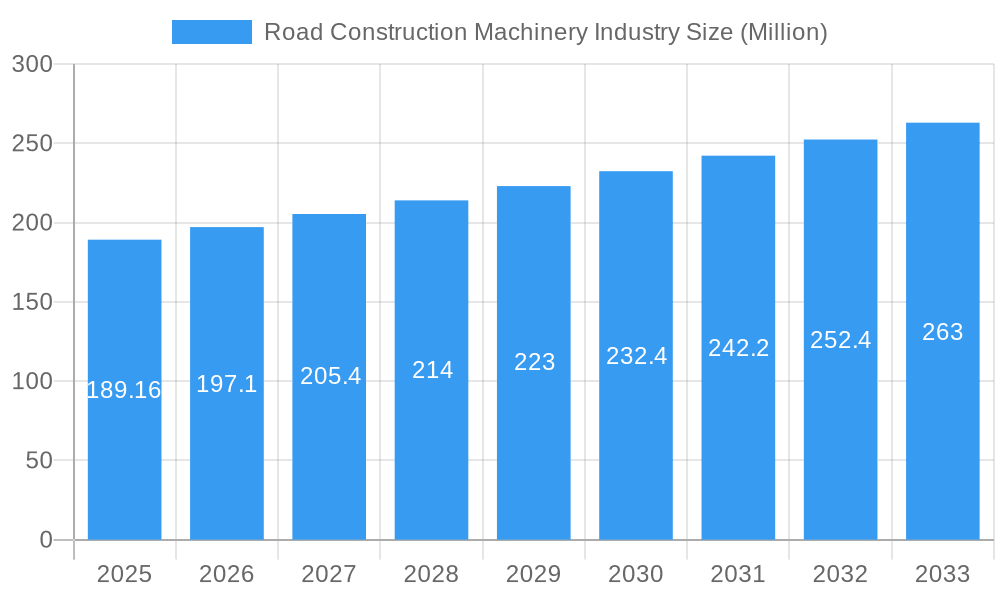

Road Construction Machinery Industry Company Market Share

Road Construction Machinery Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global road construction machinery industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking actionable insights into this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Road Construction Machinery Industry Market Structure & Innovation Trends

The road construction machinery industry is characterized by a concentrated market structure, dominated by key players such as Caterpillar Inc., Volvo Construction Equipment (Volvo CE), and Deere & Company. These industry giants hold a significant portion of the global market share, influencing pricing strategies, technological advancements, and overall market dynamics. However, a vibrant ecosystem of smaller, specialized manufacturers also contributes to innovation and competition within specific niches. This section delves into the forces shaping this landscape, examining innovation drivers, regulatory pressures, and the impact of mergers and acquisitions (M&A) activity.

Innovation is a key differentiator, driven by several factors including: the increasing demand for automation to enhance efficiency and safety; the push towards electrification to meet stringent emission regulations and reduce operational costs; and the rapid integration of digital technologies, such as telematics and remote operation, to optimize machine performance and fleet management. This technological evolution is reshaping the industry, creating opportunities for new entrants and forcing established players to adapt.

The regulatory landscape is increasingly stringent, with governments worldwide implementing stricter emission standards and safety regulations. This necessitates significant investments in research and development to meet these compliance requirements, driving innovation towards cleaner, safer, and more sustainable machinery.

Market consolidation through M&A activity has been significant in recent years, with several large deals totaling [Insert Updated Value] million over the past five years. This consolidation reflects the industry's maturity and the need for larger players to gain economies of scale, access new technologies, and expand their geographic reach. This activity impacts market concentration and competitive dynamics.

- Market Concentration: High, with the top 10 players holding approximately [Insert Updated Percentage]% market share.

- Innovation Drivers: Automation (Autonomous operation, AI-powered systems), Electrification (Battery-electric, hybrid-electric machines), Digitalization (Telematics, remote diagnostics, predictive maintenance, data analytics).

- Regulatory Framework: Stringent emission norms (Tier 4/Stage V and beyond), safety regulations (CE marking, OSHA compliance), and increasingly stringent fuel efficiency standards are driving technological advancements and reshaping the market.

- Product Substitutes: While limited in direct substitution, alternative construction methods (e.g., 3D printing, prefabricated components) pose a growing indirect threat.

- End-User Demographics: Government agencies (national and local), large-scale construction companies, private contractors, and specialized construction firms.

- M&A Activity: Significant consolidation continues, shaping the market structure and competitive landscape.

Road Construction Machinery Industry Market Dynamics & Trends

The road construction machinery market is poised for robust growth, projected to exhibit a CAGR of [Insert Updated CAGR]% during the forecast period (2025-2033). This growth is fueled by several key factors: robust global infrastructure development driven by government investment in transportation networks; rapid urbanization and the consequent need for efficient road systems; and the ongoing expansion of construction activity across both developed and emerging economies.

Technological disruptions are accelerating this growth trajectory. The rise of electric and autonomous machinery is not only improving sustainability but also enhancing productivity and reducing operational costs. This shift is profoundly impacting consumer preferences, with a growing demand for eco-friendly and technologically advanced equipment. Competitive dynamics remain intense, with companies focusing on differentiated product offerings, innovative financing options, and enhanced after-sales service to gain a competitive edge. Pricing strategies are also influenced by raw material costs, technological advancements, and global economic conditions.

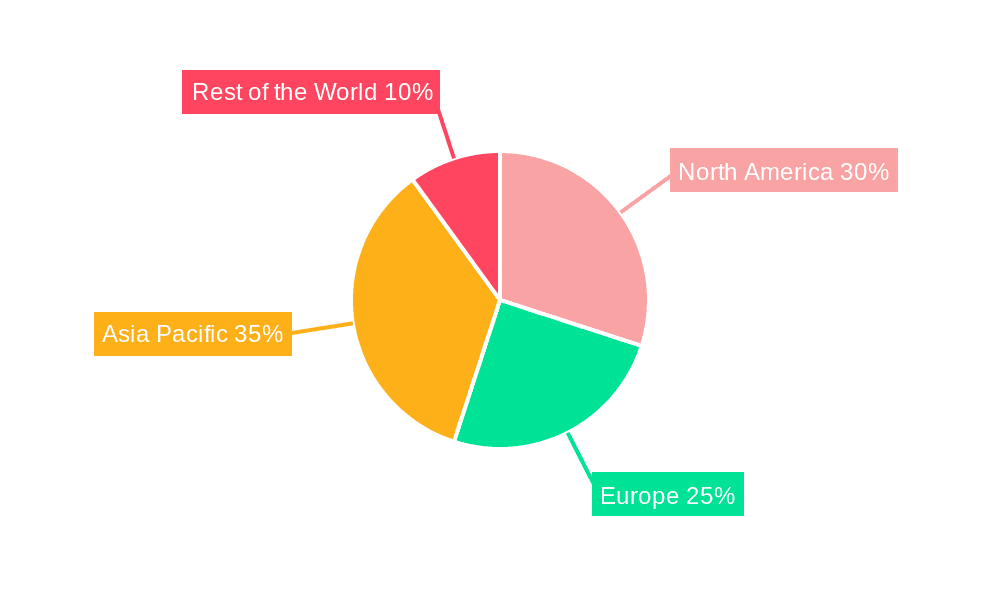

Dominant Regions & Segments in Road Construction Machinery Industry

This section identifies the leading regions and segments within the road construction machinery market. North America and Europe currently dominate, driven by robust infrastructure spending and advanced technological adoption. Within machine types, wheel loaders and road rollers constitute significant market segments.

- Key Drivers (North America & Europe): Strong government investments, well-established infrastructure, high technological adoption rates.

- Segment Dominance: Wheel loaders and road rollers enjoy the largest market share due to high demand in road construction and maintenance.

- Asia-Pacific Growth: Rapid urbanization and infrastructure development are fueling strong growth in this region.

Road Construction Machinery Industry Product Innovations

Recent years have witnessed significant product innovation, with a focus on enhancing efficiency, safety, and sustainability. Manufacturers are increasingly integrating advanced technologies, such as GPS guidance systems, automated controls, and electric powertrains, into their machinery. This is driving improved operational performance and reduced environmental impact, meeting evolving market demands for eco-friendly and intelligent solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the road construction machinery market, segmented by machine type and geography. The key machine types analyzed include: Motor Graders, Road Rollers, Wheel Loaders, Concrete Mixers, and Others (including excavators, backhoes, and other specialized equipment). Each segment's market size, growth projections, and competitive dynamics are examined in detail, offering granular insights into the market's structure and performance. The geographical segmentation provides region-specific breakdowns, highlighting key growth markets and regional variations in demand drivers.

- Motor Graders: Market size [Insert Updated Value] Million in 2025, expected growth of [Insert Updated Percentage]% by 2033.

- Road Rollers: Market size [Insert Updated Value] Million in 2025, expected growth of [Insert Updated Percentage]% by 2033.

- Wheel Loaders: Market size [Insert Updated Value] Million in 2025, expected growth of [Insert Updated Percentage]% by 2033.

- Concrete Mixers: Market size [Insert Updated Value] Million in 2025, expected growth of [Insert Updated Percentage]% by 2033.

- Others: Market size [Insert Updated Value] Million in 2025, expected growth of [Insert Updated Percentage]% by 2033.

Key Drivers of Road Construction Machinery Industry Growth

The sustained growth of the road construction machinery industry is driven by a confluence of factors. Increased government spending on infrastructure projects remains a primary driver, particularly in developing economies experiencing rapid urbanization and industrialization. This is complemented by the continuous development of more efficient and sustainable machinery, reducing operational costs and environmental impact. Furthermore, the growing demand for improved transportation networks, both in urban and rural areas, fuels demand for this critical equipment.

Challenges in the Road Construction Machinery Industry Sector

The industry faces challenges such as fluctuating raw material prices, stringent emission regulations impacting production costs, and intense competition among manufacturers. Supply chain disruptions and economic downturns can also significantly affect sales and profitability. These factors can impact the industry's overall growth trajectory, influencing the long-term outlook.

Emerging Opportunities in Road Construction Machinery Industry

Significant opportunities exist in emerging markets with burgeoning infrastructure development needs. The adoption of electric and autonomous machinery presents a key opportunity for growth. Furthermore, advancements in construction technologies and materials offer avenues for product innovation and market expansion.

Leading Players in the Road Construction Machinery Industry Market

- Fayat Group

- Volvo CE

- Deere & Company

- CNH Industrial

- Sany Heavy Industry Co Ltd

- Palfinger AG

- Wacker Neuson Group

- Caterpillar Inc

- Ammann Group

- Liebherr-International AG

- Komatsu Ltd

- Wirtgen Group

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Hitachi Sumitomo Heavy Industries Construction Cranes Co Ltd

- Terex Corporation

Key Developments in Road Construction Machinery Industry

- March 2023: Liebherr International AG launched its new mid-size wheel loader Xpower, featuring increased performance, enhanced safety systems, and improved operator comfort.

- September 2023: LiuGong introduced a new 21-tonne electric wheeled loader in Europe, showcasing the growing adoption of electric powertrains in the industry.

- January 2023: Tadano Limited launched a new TM-ZX1205HRS loader crane in Thailand, expanding its reach in the construction, road transportation, and logistics sectors.

Future Outlook for Road Construction Machinery Industry Market

The future outlook for the road construction machinery market remains positive, with continued growth expected driven by ongoing infrastructure development, technological innovation, and evolving regulatory landscapes. The increasing adoption of automation, electrification, and digitalization is transforming the industry, fostering greater efficiency, sustainability, and safety. Strategic partnerships, collaborations, and investments in research and development will be key for players to navigate this dynamic market and capitalize on emerging opportunities. The focus on sustainability and reducing the carbon footprint of construction projects will play an increasingly important role in shaping future industry trends and influencing market demand.

Road Construction Machinery Industry Segmentation

-

1. Machine Type

- 1.1. Motor Graders

- 1.2. Road Roller

- 1.3. Wheel Loaders

- 1.4. Concrete Mixer

- 1.5. Others

Road Construction Machinery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Road Construction Machinery Industry Regional Market Share

Geographic Coverage of Road Construction Machinery Industry

Road Construction Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Infrastructure Development and Highway Construction Activities to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor May Hamper the Market Expansion

- 3.4. Market Trends

- 3.4.1. The Motor Graders Segment is Expected to Register the Fastest Growth Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Road Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Motor Graders

- 5.1.2. Road Roller

- 5.1.3. Wheel Loaders

- 5.1.4. Concrete Mixer

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. North America Road Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machine Type

- 6.1.1. Motor Graders

- 6.1.2. Road Roller

- 6.1.3. Wheel Loaders

- 6.1.4. Concrete Mixer

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Machine Type

- 7. Europe Road Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machine Type

- 7.1.1. Motor Graders

- 7.1.2. Road Roller

- 7.1.3. Wheel Loaders

- 7.1.4. Concrete Mixer

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Machine Type

- 8. Asia Pacific Road Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machine Type

- 8.1.1. Motor Graders

- 8.1.2. Road Roller

- 8.1.3. Wheel Loaders

- 8.1.4. Concrete Mixer

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Machine Type

- 9. Rest of the World Road Construction Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machine Type

- 9.1.1. Motor Graders

- 9.1.2. Road Roller

- 9.1.3. Wheel Loaders

- 9.1.4. Concrete Mixer

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Machine Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Fayat Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Volvo CE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Deere & Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 CNH Industrial

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sany Heavy Industry Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Palfinger AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wacker Neuson Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Caterpillar Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ammann Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Liebherr-International AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Komatsu Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Wirtgen Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Zoomlion Heavy Industry Science and Technology Co Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hitachi Sumitomo Heavy Industries Construction Cranes Co Ltd*List Not Exhaustive

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Terex Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Fayat Group

List of Figures

- Figure 1: Global Road Construction Machinery Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Road Construction Machinery Industry Revenue (Million), by Machine Type 2025 & 2033

- Figure 3: North America Road Construction Machinery Industry Revenue Share (%), by Machine Type 2025 & 2033

- Figure 4: North America Road Construction Machinery Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Road Construction Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Road Construction Machinery Industry Revenue (Million), by Machine Type 2025 & 2033

- Figure 7: Europe Road Construction Machinery Industry Revenue Share (%), by Machine Type 2025 & 2033

- Figure 8: Europe Road Construction Machinery Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Road Construction Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Road Construction Machinery Industry Revenue (Million), by Machine Type 2025 & 2033

- Figure 11: Asia Pacific Road Construction Machinery Industry Revenue Share (%), by Machine Type 2025 & 2033

- Figure 12: Asia Pacific Road Construction Machinery Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Road Construction Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Road Construction Machinery Industry Revenue (Million), by Machine Type 2025 & 2033

- Figure 15: Rest of the World Road Construction Machinery Industry Revenue Share (%), by Machine Type 2025 & 2033

- Figure 16: Rest of the World Road Construction Machinery Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Road Construction Machinery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Road Construction Machinery Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: Global Road Construction Machinery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Road Construction Machinery Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 4: Global Road Construction Machinery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Road Construction Machinery Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 9: Global Road Construction Machinery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Road Construction Machinery Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 15: Global Road Construction Machinery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Road Construction Machinery Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 22: Global Road Construction Machinery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: South America Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Middle East and Africa Road Construction Machinery Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Road Construction Machinery Industry?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Road Construction Machinery Industry?

Key companies in the market include Fayat Group, Volvo CE, Deere & Company, CNH Industrial, Sany Heavy Industry Co Ltd, Palfinger AG, Wacker Neuson Group, Caterpillar Inc, Ammann Group, Liebherr-International AG, Komatsu Ltd, Wirtgen Group, Zoomlion Heavy Industry Science and Technology Co Ltd, Hitachi Sumitomo Heavy Industries Construction Cranes Co Ltd*List Not Exhaustive, Terex Corporation.

3. What are the main segments of the Road Construction Machinery Industry?

The market segments include Machine Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 189.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Infrastructure Development and Highway Construction Activities to Drive the Market.

6. What are the notable trends driving market growth?

The Motor Graders Segment is Expected to Register the Fastest Growth Between 2024 and 2029.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor May Hamper the Market Expansion.

8. Can you provide examples of recent developments in the market?

March 2023: Liebherr International AG launched its new mid-size wheel loader Xpower with increased performance due to new lift arms, more engine power, and optimized travel drive. The vehicle is also installed with intelligent assistance systems to increase safety and comfort for the operator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Road Construction Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Road Construction Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Road Construction Machinery Industry?

To stay informed about further developments, trends, and reports in the Road Construction Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence