Key Insights

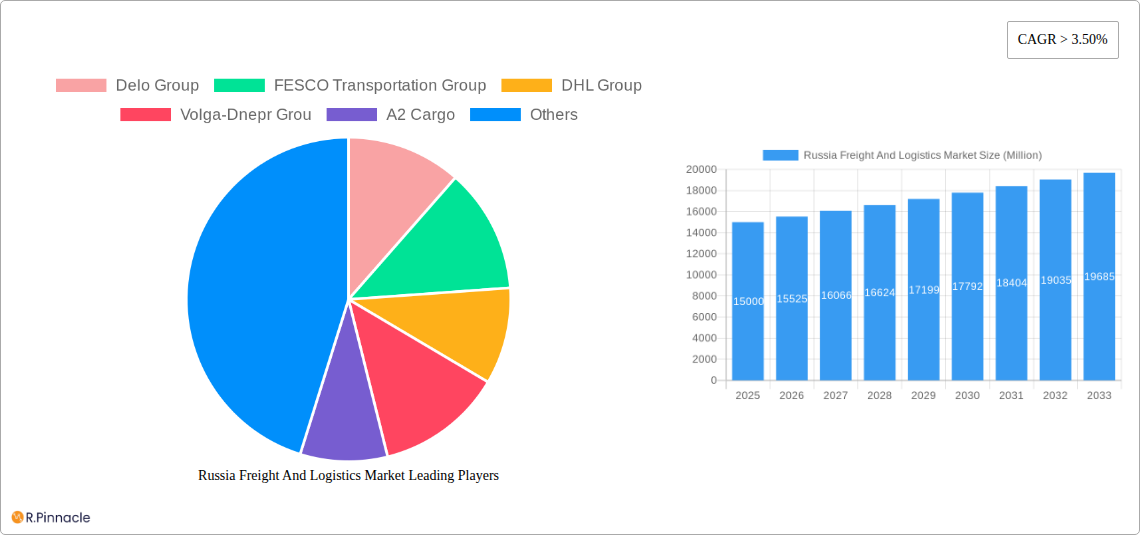

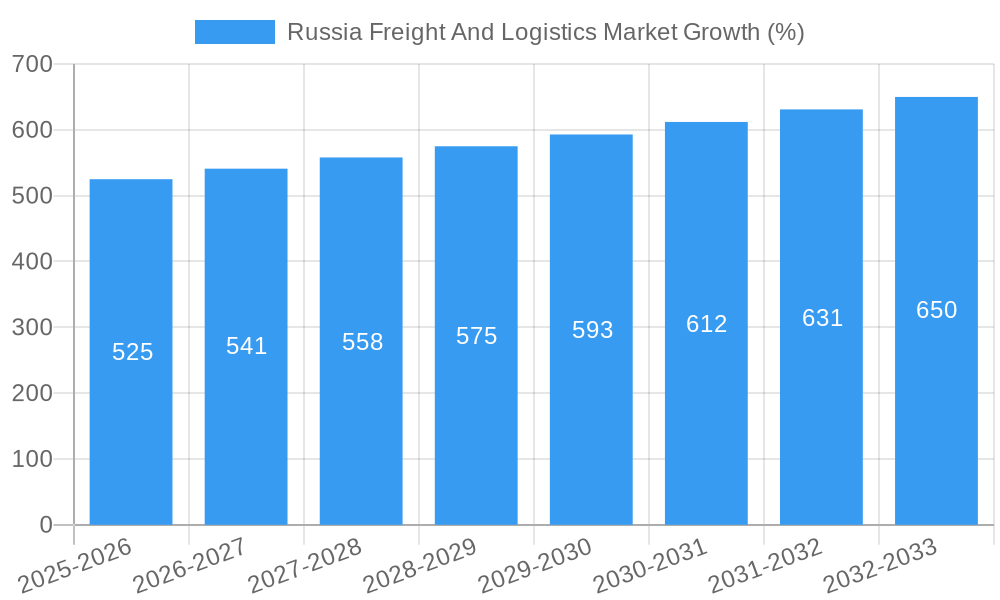

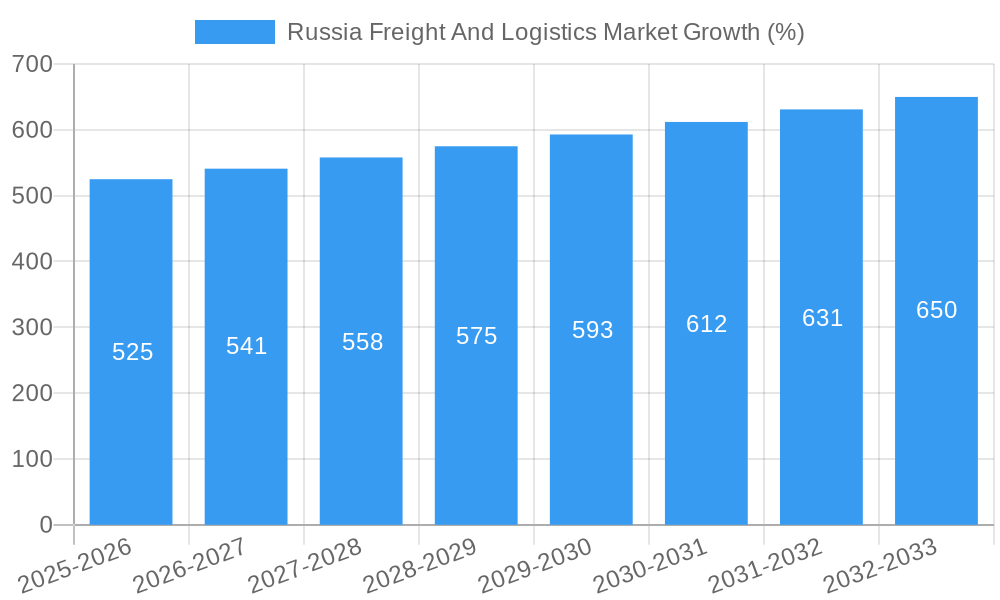

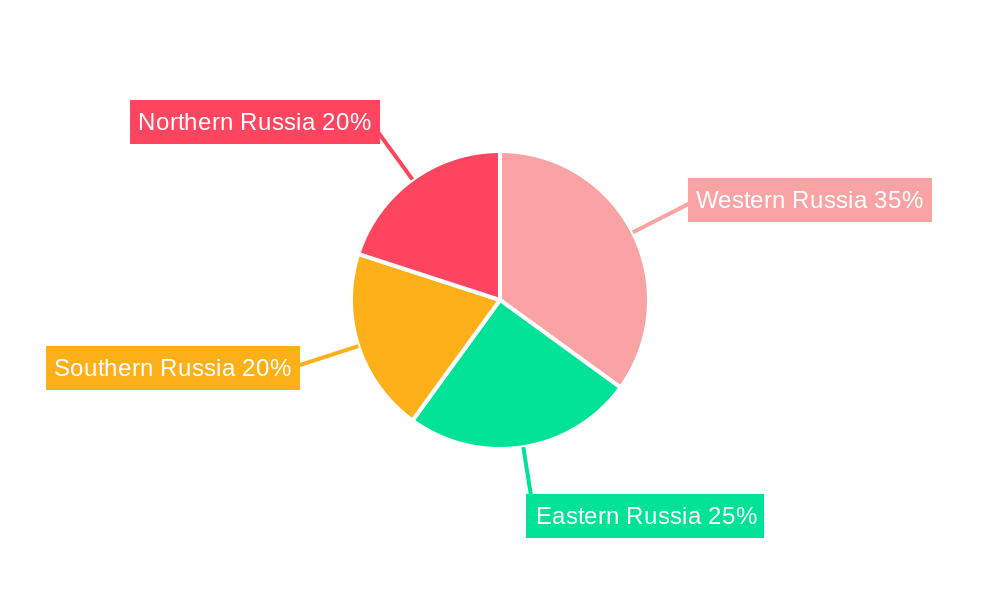

The Russia Freight and Logistics market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing volume of e-commerce and related last-mile delivery services is significantly boosting demand for efficient freight and logistics solutions. Secondly, Russia's substantial investments in infrastructure development, including improvements to its road, rail, and port networks, are streamlining transportation and reducing logistical bottlenecks. Thirdly, the growth of key sectors like manufacturing, construction, and oil and gas further contributes to the market's expansion. The market is segmented by temperature-controlled services, other services, and various end-user industries, including agriculture, fishing, construction, manufacturing, oil and gas, mining, wholesale and retail trade, and others. The logistics function is primarily categorized into courier, express, and parcel (CEP) services. Key players such as Delo Group, FESCO Transportation Group, DHL Group, and Volga-Dnepr Group are shaping the competitive landscape, leveraging their extensive networks and technological capabilities. Regional variations in market growth are expected, reflecting differences in economic activity and infrastructure development across Western, Eastern, Southern, and Northern Russia.

While the market presents significant opportunities, challenges remain. Geopolitical factors and potential sanctions can create uncertainty and impact the overall growth trajectory. Fluctuations in fuel prices and driver shortages can also affect operational costs and efficiency. Furthermore, the need for advanced technological adoption, such as implementing sophisticated supply chain management systems and enhancing digitalization efforts, is crucial for sustained market growth. Despite these challenges, the long-term outlook for the Russia Freight and Logistics market remains positive, driven by ongoing economic development and the increasing need for reliable and efficient logistics solutions to support diverse industry sectors. The market's size in 2025 is estimated to be significant, considering the CAGR and the presence of major global and domestic players. Further growth is anticipated as e-commerce penetration deepens and infrastructure investments continue.

Russia Freight & Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia Freight & Logistics Market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. Expect detailed breakdowns of market size (in Millions), CAGR projections, and competitive landscapes, enabling informed decision-making.

Russia Freight And Logistics Market Market Structure & Innovation Trends

The Russia freight and logistics market exhibits a moderately concentrated structure, with key players like Delo Group, FESCO Transportation Group, and DHL Group holding significant market share. Delo Group, for instance, is estimated to control xx% of the market in 2025, while FESCO holds approximately xx%. The market is characterized by ongoing innovation driven by technological advancements in areas such as digitalization, automation, and sustainable logistics solutions. Stringent regulatory frameworks, including those related to transportation safety and environmental regulations, significantly influence market operations. The presence of substitute transportation methods (e.g., pipelines for oil and gas) also impacts market dynamics. End-user demographics are diverse, encompassing various industries with varying transportation needs. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values totaling approximately xx Million in 2024. Key M&A activities include:

- The acquisition of [Company Name] by [Company Name] in [Year], valued at xx Million.

- Strategic partnerships and joint ventures are also prevalent.

Russia Freight And Logistics Market Market Dynamics & Trends

The Russia freight and logistics market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several key factors. The increasing demand for efficient and reliable transportation solutions across various end-user industries, including manufacturing, oil & gas, and retail, fuels market growth. Technological disruptions, particularly the adoption of advanced technologies such as blockchain for supply chain transparency and IoT for real-time tracking, are transforming the market landscape. Changing consumer preferences towards faster and more sustainable delivery options are also influencing market dynamics. Intense competition among established players and the emergence of new entrants are shaping the competitive dynamics. Market penetration of digital logistics platforms is expected to increase significantly, reaching xx% by 2033. Challenges such as geopolitical instability and sanctions impact overall growth projections, however, the market's inherent resilience and the ongoing need for logistics services are expected to mitigate the effect.

Dominant Regions & Segments in Russia Freight And Logistics Market

The Western Siberian Federal District and the Central Federal District are the dominant regions in the Russia freight and logistics market, owing to their significant industrial activity and robust infrastructure networks.

Key Drivers for Dominant Regions:

- Robust Infrastructure: Well-established road, rail, and waterway networks facilitate efficient transportation.

- High Industrial Concentration: Presence of major manufacturing hubs and industrial clusters drives high freight volumes.

- Government Support: Favourable government policies and investment in infrastructure development.

Dominant Segments:

- End-User Industry: Manufacturing, Oil & Gas, and Wholesale & Retail Trade are the largest segments, driven by high production volumes and extensive distribution networks.

- Logistics Function: Courier, Express, and Parcel (CEP) services are experiencing rapid growth due to the increasing demand for e-commerce and fast delivery options.

- Other Services: Value-added services such as warehousing, inventory management, and customs brokerage are gaining traction as businesses seek greater supply chain efficiency.

- Temperature Controlled: This segment is experiencing considerable growth driven by rising demand for pharmaceutical and food products.

The detailed analysis within the report provides a granular look at the market share of each segment and region.

Russia Freight And Logistics Market Product Innovations

The Russia freight and logistics market is witnessing significant product innovations, driven primarily by advancements in technology. The implementation of digital logistics platforms, GPS tracking systems, and automated warehousing solutions enhances efficiency and transparency in supply chain operations. The integration of blockchain technology improves traceability and security, while the use of AI and machine learning optimizes route planning and resource allocation. These innovations provide companies with significant competitive advantages, allowing them to offer faster, more reliable, and more cost-effective services.

Report Scope & Segmentation Analysis

This report segments the Russia freight and logistics market based on several key factors:

By Logistics Function: Courier, Express, and Parcel (CEP); Freight Forwarding; Contract Logistics; and Others. The CEP segment is projected to grow at xx% CAGR due to e-commerce growth.

By End-User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others. The Manufacturing segment accounts for the largest market share driven by high production volumes.

By Service Type: Temperature Controlled; and Other Services. The temperature-controlled segment experiences strong growth, driven by pharmaceutical and food transportation needs.

Each segment's growth trajectory is detailed within the report, along with projections for market size and competitive dynamics.

Key Drivers of Russia Freight And Logistics Market Growth

The growth of the Russia freight and logistics market is propelled by several factors. The expansion of e-commerce is driving demand for faster and more efficient delivery solutions, fostering growth in the CEP segment. Government initiatives aimed at improving infrastructure, particularly transportation networks, facilitate seamless movement of goods. Technological advancements, such as the adoption of AI and IoT, enhance operational efficiency and reduce costs. The growing importance of supply chain resilience and risk management drives investment in advanced logistics solutions.

Challenges in the Russia Freight And Logistics Market Sector

The Russia freight and logistics market faces several challenges. Geopolitical factors and sanctions create uncertainty and disrupt supply chains. Infrastructure limitations, particularly in remote regions, constrain efficient transportation. Fluctuations in fuel prices and currency exchange rates impact operational costs. Intense competition necessitates continuous innovation and cost optimization strategies to maintain profitability. Compliance with complex regulatory frameworks poses operational difficulties. Overall, these factors pose a considerable challenge to the ongoing development and sustainability of the market.

Emerging Opportunities in Russia Freight And Logistics Market

Several emerging opportunities are shaping the future of the Russia freight and logistics market. The growth of e-commerce and omnichannel retail creates significant demand for last-mile delivery solutions and enhanced logistics infrastructure. The increasing adoption of sustainable transportation solutions, such as electric vehicles and alternative fuels, opens up new market segments. The development of specialized logistics solutions tailored to specific industry needs presents a significant avenue for growth. Focus on enhancing supply chain transparency and visibility through technology implementation opens up opportunities to increase efficiency and improve customer service.

Leading Players in the Russia Freight And Logistics Market Market

- Delo Group

- FESCO Transportation Group

- DHL Group

- Volga-Dnepr Group

- A2 Cargo

- Sovtransavto Group

- Volga Shipping

- Eurosib Group

- Delko

- STS Logistics

Key Developments in Russia Freight And Logistics Market Industry

- November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies. This highlights increased demand for third-party logistics services.

- November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD). This demonstrates DHL’s commitment to strategic partnerships and brand building.

- February 2023: DHL Global Forwarding successfully implemented sustainable logistics solutions for Grundfos. This signals a growing focus on environmentally responsible logistics practices.

Future Outlook for Russia Freight And Logistics Market Market

The Russia freight and logistics market is poised for continued growth, driven by technological advancements, infrastructure development, and the expanding e-commerce sector. Strategic investments in digitalization, automation, and sustainable logistics solutions will shape the market's future. Opportunities abound in optimizing supply chains, improving efficiency, and leveraging new technologies to provide enhanced services. The market's ability to adapt to geopolitical challenges and regulatory changes will be crucial in determining its long-term trajectory and ultimate growth potential.

Russia Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Russia Freight And Logistics Market Segmentation By Geography

- 1. Russia

Russia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Western Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Delo Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FESCO Transportation Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DHL Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Volga-Dnepr Grou

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 A2 Cargo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sovtransavto Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Volga Shipping

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eurosib Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Delko

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 STS Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Delo Group

List of Figures

- Figure 1: Russia Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Freight And Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Russia Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Russia Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Russia Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 12: Russia Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Freight And Logistics Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Russia Freight And Logistics Market?

Key companies in the market include Delo Group, FESCO Transportation Group, DHL Group, Volga-Dnepr Grou, A2 Cargo, Sovtransavto Group, Volga Shipping, Eurosib Group, Delko, STS Logistics.

3. What are the main segments of the Russia Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2023: DHL Global Forwarding, the air and ocean freight specialist division of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD) for another four years. The premium and logistics partnership has been in place since the 2014-2015 winter season, and it includes logistics for all equipment during the seasons, along with the branding of sports equipment and clothing of athletes.November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Russia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence