Key Insights

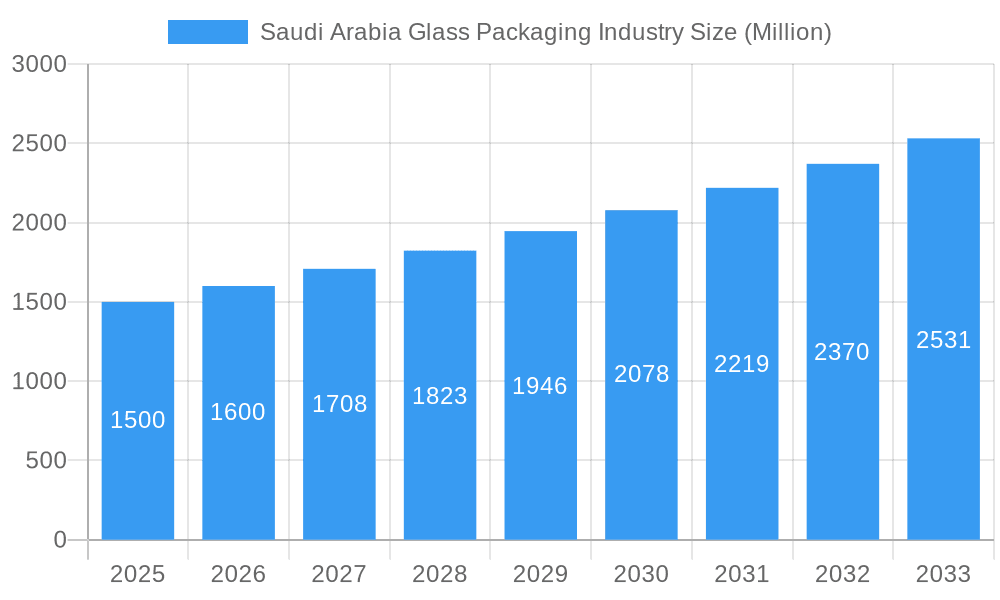

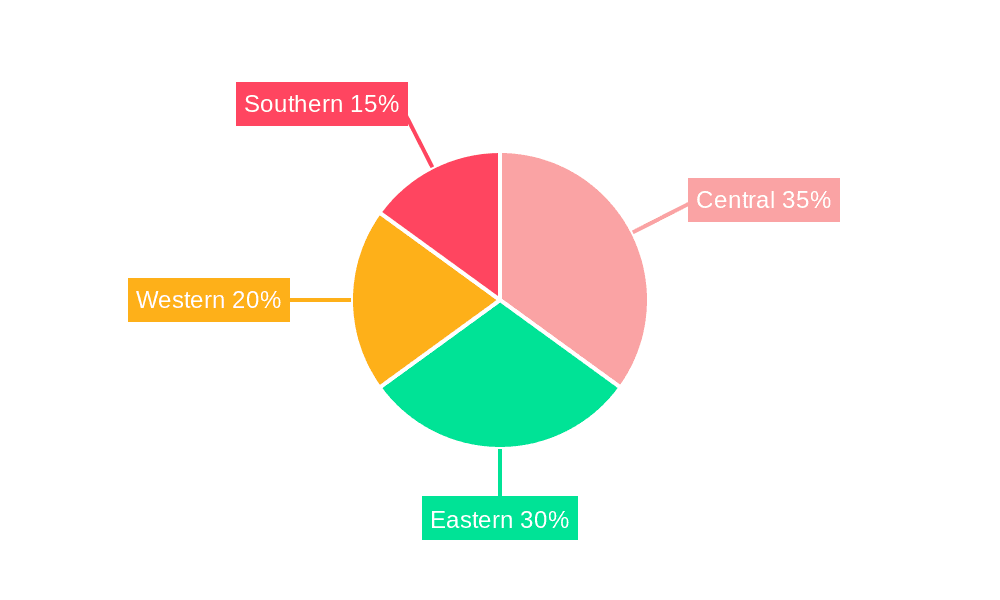

The Saudi Arabian glass packaging market, estimated at 96.5 million in 2025, is poised for significant expansion with a projected Compound Annual Growth Rate (CAGR) of 5.24% from 2025 to 2033. Key growth drivers include the rapidly expanding pharmaceutical and personal care sectors, which favor glass for its superior barrier properties, purity, and recyclability. Growing consumer demand for sustainable packaging solutions, aligning with global environmental consciousness, further bolsters glass adoption. While not explicitly detailed, the food and beverage industry's growth also contributes to this positive trend. Market challenges include fluctuating raw material costs, specifically soda ash and silica sand, and energy price volatility impacting production expenses. Competition from lower-cost alternatives like plastic is increasingly countered by consumer preference for eco-friendly and premium packaging. The market segmentation is led by bottles and containers, followed by vials and ampoules, primarily driven by their extensive use in pharmaceuticals and personal care. Regional demand is expected to be higher in Central and Eastern Saudi Arabia due to concentrated industrial and population hubs.

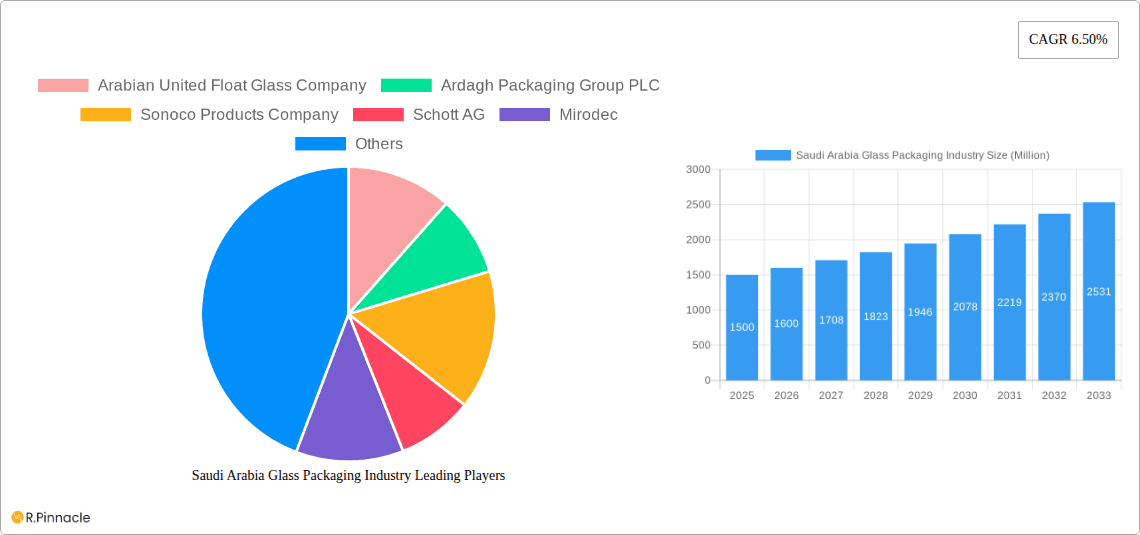

Saudi Arabia Glass Packaging Industry Market Size (In Million)

The forecast period (2025-2033) offers considerable opportunities for both international players such as Arabian United Float Glass Company, Ardagh Packaging Group PLC, Sonoco Products Company, and Schott AG, and local manufacturers like Zoujaj Glass and Obeikan Glass Company. Strategic investments in advanced manufacturing, capacity expansion, and innovative product development will be crucial for capitalizing on increasing demand. Collaborations and partnerships can accelerate market penetration and growth. Sustainable success will hinge on effectively managing energy and raw material costs, and prioritizing environmentally responsible manufacturing practices.

Saudi Arabia Glass Packaging Industry Company Market Share

Saudi Arabia Glass Packaging Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia glass packaging industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The study encompasses detailed segmentation by type (Bottles/Containers, Vials, Ampoules, Jars) and end-user vertical (Pharmaceuticals, Personal Care, Household Care, Agricultural, Other), providing a granular understanding of the market landscape. With a projected market value reaching xx Million by 2033, this report is an indispensable resource for navigating the complexities and capitalizing on the potential of this thriving market.

Saudi Arabia Glass Packaging Industry Market Structure & Innovation Trends

The Saudi Arabian glass packaging market exhibits a moderately concentrated structure, with key players like Arabian United Float Glass Company, Ardagh Packaging Group PLC, Sonoco Products Company, Schott AG, Mirodec, Zoujaj glass, Saudi Arabian Glass Company Ltd, Frigo Glass, and Obeikan Glass Company holding significant market share. However, the presence of numerous smaller players indicates a competitive landscape. Market share data for individual companies is not publicly available and is estimated at xx% for the top five companies combined. M&A activity in the sector has been relatively modest in recent years, with a total estimated deal value of xx Million over the past five years. Innovation is driven by the increasing demand for sustainable packaging solutions, advancements in glass manufacturing technologies, and the stringent regulatory framework concerning food safety and hygiene standards. The market also sees competition from substitute packaging materials like plastics, but glass maintains its dominance due to its inherent properties such as recyclability and inertness. The growing pharmaceutical and personal care sectors significantly influence the demand for specialized glass packaging, driving market growth.

Saudi Arabia Glass Packaging Industry Market Dynamics & Trends

The Saudi Arabia glass packaging market is experiencing robust growth, driven by several key factors. The burgeoning pharmaceutical sector, fueled by increasing healthcare spending and a growing population, is a major catalyst for market expansion. The rising disposable income amongst the population also fuels demand across various segments. Technological advancements such as lightweighting techniques and improved surface treatment methods are enhancing the functionality and appeal of glass packaging. Consumer preferences are shifting towards sustainable and eco-friendly options, further bolstering the demand for recyclable glass. The competitive landscape is characterized by both domestic and international players, leading to innovation and price competitiveness. The compound annual growth rate (CAGR) for the period 2025-2033 is estimated at xx%, reflecting the strong market momentum. Market penetration is high within the pharmaceutical and food & beverage sectors, with further opportunities anticipated in the cosmetics and personal care industries.

Dominant Regions & Segments in Saudi Arabia Glass Packaging Industry

The dominant region within the Saudi Arabia glass packaging industry is the Eastern region, primarily due to its established industrial infrastructure and proximity to major ports. The most prominent segments are:

- By Type: Bottles/Containers continue to be the largest segment, followed by vials, driven by the high demand from the pharmaceutical industry. Ampoules and Jars hold smaller but steadily growing market share.

- By End-user Vertical: The pharmaceutical industry is the largest end-user segment, owing to the robust growth of the sector and the inherent suitability of glass for drug packaging. The personal care industry contributes significantly as well, followed by household care and agricultural segments. Key drivers for the pharmaceutical segment include favorable government regulations promoting the domestic pharmaceutical manufacturing, high investment in healthcare infrastructure, and increasing demand for safe and effective drug delivery. Growth in the other segments is tied to overall economic development and increasing consumer spending.

Saudi Arabia Glass Packaging Industry Product Innovations

Recent innovations in the Saudi Arabia glass packaging industry include advancements in lightweighting technologies, enhancing product efficiency and reducing transportation costs. The development of specialty glass with improved barrier properties against oxygen and moisture is improving shelf life and product preservation. Furthermore, sustainable production methods and innovative designs focusing on recyclability and reduced environmental impact are gaining traction. These advancements reflect the industry's commitment to meeting evolving consumer demands and regulatory standards.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia glass packaging market comprehensively:

By Type: Bottles/Containers (xx Million in 2025, xx% CAGR), Vials (xx Million in 2025, xx% CAGR), Ampoules (xx Million in 2025, xx% CAGR), Jars (xx Million in 2025, xx% CAGR). Competitive dynamics vary across these segments, with specialized players dominating niche areas like ampoules.

By End-user Vertical: Pharmaceuticals (xx Million in 2025, xx% CAGR), Personal Care (xx Million in 2025, xx% CAGR), Household Care (xx Million in 2025, xx% CAGR), Agricultural (xx Million in 2025, xx% CAGR), Other (xx Million in 2025, xx% CAGR). The pharmaceutical segment is intensely competitive, while others offer diverse growth opportunities.

Key Drivers of Saudi Arabia Glass Packaging Industry Growth

Several factors drive the growth of the Saudi Arabia glass packaging industry:

- Government Initiatives: Investments in healthcare infrastructure and support for domestic pharmaceutical manufacturing have significantly boosted demand.

- Economic Growth: Rising disposable income and a growing population fuel demand for packaged goods across various sectors.

- Technological Advancements: Innovations in glass manufacturing and packaging technologies improve efficiency and sustainability.

Challenges in the Saudi Arabia Glass Packaging Industry Sector

The industry faces challenges including:

- Competition from Substitute Packaging: Plastics and other materials pose a competitive threat.

- Raw Material Costs: Fluctuations in energy and raw material prices impact production costs.

- Environmental Regulations: Meeting stringent environmental standards requires investment in sustainable practices. These factors contribute to an overall estimated xx% reduction in profit margins for some companies.

Emerging Opportunities in Saudi Arabia Glass Packaging Industry

Emerging opportunities include:

- Sustainable Packaging: Growing consumer preference for eco-friendly packaging opens avenues for innovative solutions.

- E-commerce Growth: The rise of e-commerce demands robust and safe packaging for online deliveries.

- Specialized Packaging: The demand for specialized glass packaging for niche products is on the rise.

Leading Players in the Saudi Arabia Glass Packaging Industry Market

- Arabian United Float Glass Company

- Ardagh Packaging Group PLC

- Sonoco Products Company

- Schott AG

- Mirodec

- Zoujaj glass

- Saudi Arabian Glass Company Ltd

- Frigo Glass

- Obeikan Glass Company

Key Developments in Saudi Arabia Glass Packaging Industry

- September 2022: Becton, Dickinson, and Company (BD) released the BD Effivax Glass Prefillable Syringe, setting a new standard for vaccination PFS and driving innovation in the pharmaceutical packaging sector.

- February 2022: Nahdi Medical Company's expansion plans into the UAE indicate significant growth potential for glass packaging within the wider GCC region.

Future Outlook for Saudi Arabia Glass Packaging Industry Market

The Saudi Arabia glass packaging industry is poised for continued growth, driven by strong economic fundamentals, technological advancements, and government support. Opportunities exist in sustainable packaging solutions, specialized applications, and expansion into new markets. The projected growth trajectory indicates substantial potential for market participants who can adapt to evolving consumer preferences and regulatory standards. The focus on sustainable practices and innovative product development will be crucial for maintaining a competitive edge in this dynamic market.

Saudi Arabia Glass Packaging Industry Segmentation

-

1. Type

- 1.1. Bottles/Containers

- 1.2. Vials

- 1.3. Ampoules

- 1.4. Jars

-

2. End-user Vertical

- 2.1. Pharmaceuticals

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Agricultural

- 2.5. Other End-user Vertical

Saudi Arabia Glass Packaging Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Glass Packaging Industry Regional Market Share

Geographic Coverage of Saudi Arabia Glass Packaging Industry

Saudi Arabia Glass Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Disposable Income and Integration in Premium Packaging; Commodity Value of Glass Increased with Recyclability

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations over Single-Use Plastic-based Packaging

- 3.4. Market Trends

- 3.4.1. Glass Bottles and Containers Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Glass Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bottles/Containers

- 5.1.2. Vials

- 5.1.3. Ampoules

- 5.1.4. Jars

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Pharmaceuticals

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Agricultural

- 5.2.5. Other End-user Vertical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian United Float Glass Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ardagh Packaging Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schott AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mirodec

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zoujaj glass

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Arabian Glass Company Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Frigo Glass*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Obeikan Glass Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Arabian United Float Glass Company

List of Figures

- Figure 1: Saudi Arabia Glass Packaging Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Glass Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Glass Packaging Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Glass Packaging Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Saudi Arabia Glass Packaging Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Glass Packaging Industry Revenue million Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Glass Packaging Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Saudi Arabia Glass Packaging Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Glass Packaging Industry?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the Saudi Arabia Glass Packaging Industry?

Key companies in the market include Arabian United Float Glass Company, Ardagh Packaging Group PLC, Sonoco Products Company, Schott AG, Mirodec, Zoujaj glass, Saudi Arabian Glass Company Ltd, Frigo Glass*List Not Exhaustive, Obeikan Glass Company.

3. What are the main segments of the Saudi Arabia Glass Packaging Industry?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.5 million as of 2022.

5. What are some drivers contributing to market growth?

Higher Disposable Income and Integration in Premium Packaging; Commodity Value of Glass Increased with Recyclability.

6. What are the notable trends driving market growth?

Glass Bottles and Containers Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Stringent Government Regulations over Single-Use Plastic-based Packaging.

8. Can you provide examples of recent developments in the market?

September 2022: A prefillable syringe (PFS) with new and tighter standards for processability, cosmetics, contamination, and integrity was released by Becton, Dickinson, and Company (BD). This PFS established a new level of performance for vaccination PFS. The innovative BD Effivax Glass Prefillable Syringe is developed in partnership with top pharmaceutical firms to address the complicated and changing requirements of vaccine manufacture. The introduction of BD Effivax Glass Prefillable Syringe strategically supports this expansion and will generate necessary savings in end-to-end manufacturing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Glass Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Glass Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Glass Packaging Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Glass Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence