Key Insights

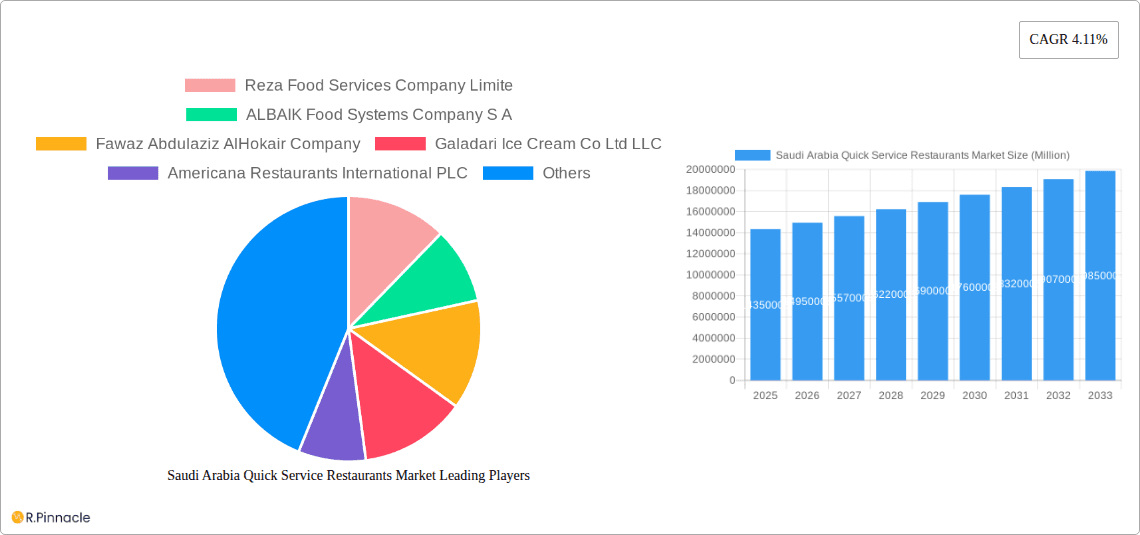

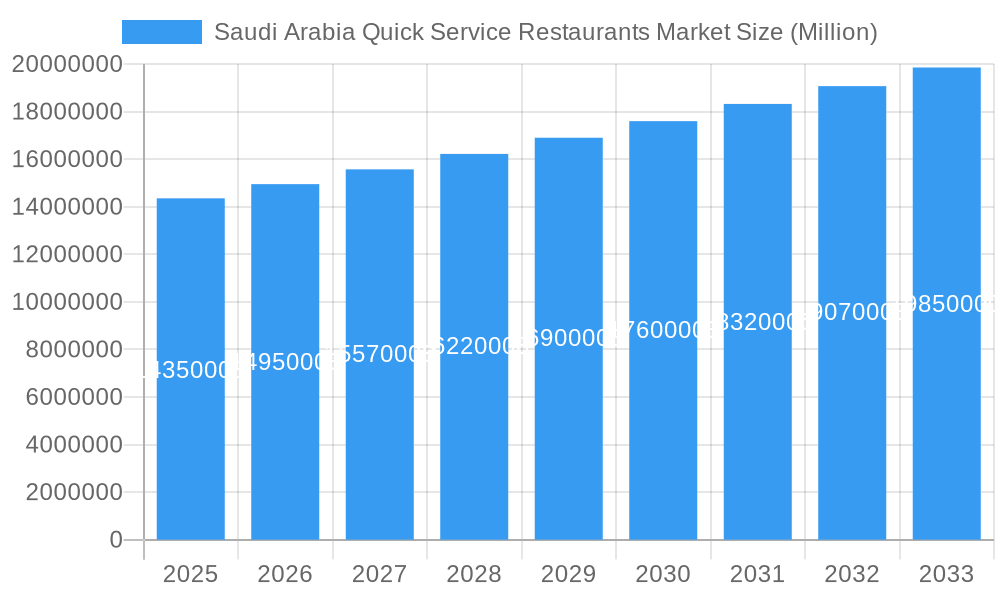

The Saudi Arabia Quick Service Restaurants (QSR) market is forecast to reach $20.87 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 11.6% from a base year of 2024. This expansion is driven by increasing disposable incomes, a young demographic prioritizing convenience, and the economic diversification initiatives of Saudi Vision 2030, which boost tourism and local dining expenditure. The market's diverse segments, including bakeries, burger outlets, and ice cream parlors, demonstrate varied consumer preferences, supported by both chain and independent establishments across leisure, retail, and travel locations.

Saudi Arabia Quick Service Restaurants Market Market Size (In Billion)

Future QSR market growth in Saudi Arabia will be shaped by innovation and strategic development. Potential challenges include rising health consciousness and fluctuating operational costs. Nevertheless, key players like Reza Food Services, ALBAIK Food Systems, and Americana Restaurants are driving market evolution through new offerings and collaborations. Digitalization, particularly online ordering and delivery services, is a crucial trend enhancing accessibility. Infrastructure and entertainment venue investments are expected to create further QSR opportunities, especially in retail and leisure settings.

Saudi Arabia Quick Service Restaurants Market Company Market Share

Saudi Arabia Quick Service Restaurants Market: Comprehensive Analysis and Future Forecast (2019–2033)

Unlock the full potential of the Saudi Arabian Quick Service Restaurants (QSR) market with this in-depth report. Designed for industry leaders, investors, and strategists, this analysis provides actionable insights into market structure, dynamics, dominant segments, and future growth trajectories. Leveraging high-ranking keywords like "Saudi Arabia QSR market," "Fast Food Saudi Arabia," "Restaurant Industry KSA," and "QSR market growth," this report is your essential guide to navigating this rapidly evolving landscape.

This report meticulously examines the Saudi Arabia Quick Service Restaurants Market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, building upon historical data from 2019–2024.

Saudi Arabia Quick Service Restaurants Market Market Structure & Innovation Trends

The Saudi Arabian Quick Service Restaurants (QSR) market exhibits a dynamic structure characterized by both consolidated players and a growing number of independent outlets. Market concentration is influenced by the significant presence of large international and regional chains, alongside robust domestic brands vying for market share. Innovation is primarily driven by evolving consumer preferences for healthier options, digital integration, and unique culinary experiences. Regulatory frameworks, while supportive of business growth, are increasingly focused on food safety, localization, and sustainability. Product substitutes, such as home cooking and traditional food stalls, exist but face increasing competition from the convenience and variety offered by QSRs. End-user demographics are diverse, encompassing a young, tech-savvy population with a high disposable income, fueling demand for accessible and affordable dining options. Mergers and acquisitions (M&A) activities are expected to increase as established players seek to expand their footprint and diversify their portfolios. For instance, strategic partnerships like the one between Nathan & Nathan KSA and Fawaz Abdulaziz Al Hokair & Sons signal a move towards accelerated growth and collaborative development. The estimated M&A deal value in the sector is projected to reach xx Million by 2028, indicating significant consolidation potential.

- Market Concentration: Moderately concentrated with key players holding substantial market share, but with room for independent growth.

- Innovation Drivers: Digitalization (delivery apps, AI), healthier menu options, plant-based alternatives, and unique fusion cuisines.

- Regulatory Frameworks: Emphasis on food safety standards, Saudization policies, and increasing attention to sustainable practices.

- Product Substitutes: Home-cooked meals, traditional eateries, and informal food vendors.

- End-User Demographics: Young population (18-45 years), digitally connected, urbanized, with a growing middle class.

- M&A Activities: Anticipated to rise, driven by market expansion and portfolio diversification strategies.

Saudi Arabia Quick Service Restaurants Market Market Dynamics & Trends

The Saudi Arabia Quick Service Restaurants (QSR) market is experiencing robust growth, propelled by a confluence of favorable economic, social, and technological factors. A key driver is the Kingdom's ambitious Vision 2030, which aims to diversify the economy and boost tourism and entertainment sectors, directly benefiting the food service industry. The rapidly growing young population, coupled with increasing disposable incomes, fuels a consistent demand for convenient and affordable dining solutions that QSRs excel at providing. Technological disruptions are profoundly reshaping the market. The widespread adoption of food delivery platforms and mobile ordering apps has not only expanded reach but also introduced new competitive dynamics, forcing QSRs to invest heavily in digital infrastructure and seamless customer experiences. The penetration of smartphones and high-speed internet across the Kingdom ensures that digital ordering and delivery remain at the forefront of consumer choices. Consumer preferences are continuously evolving. While value for money remains paramount, there is a discernible shift towards healthier menu options, including plant-based alternatives and calorie-conscious choices, compelling brands to innovate their offerings. Furthermore, the demand for ethnic and global cuisines continues to rise, encouraging QSRs to diversify their menus beyond traditional offerings. The competitive landscape is intensifying, characterized by aggressive expansion strategies from both international giants and agile local players. This competition is driving innovation in product development, pricing strategies, and customer engagement. The overall market penetration is estimated to be xx% of the total food service expenditure, with a projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period. Investments in digital transformation and a focus on delivering unique customer experiences will be critical for sustained success. The market is projected to reach a valuation of over xx Billion by 2033, reflecting its significant economic contribution. The rise of ghost kitchens and dark stores is also a notable trend, optimizing operational efficiency and delivery times.

Dominant Regions & Segments in Saudi Arabia Quick Service Restaurants Market

The Saudi Arabia Quick Service Restaurants (QSR) market is predominantly driven by its urban centers and popular consumer hubs. The Retail location segment consistently emerges as a leading area for QSR operations, owing to high foot traffic and accessibility. The Chained Outlets segment holds a significant market share, benefiting from brand recognition, standardized operations, and extensive marketing budgets. Key drivers for the dominance of Retail locations include their proximity to large consumer bases, shopping malls, and entertainment venues, offering unparalleled convenience for dine-in and takeaway options. The economic policies supporting retail development and infrastructure improvements further bolster the growth of QSRs in these areas.

Within the cuisine segments, Burger restaurants continue to command a substantial portion of the market, driven by their universal appeal and the presence of globally recognized brands. However, Meat-based Cuisines and Other QSR Cuisines, encompassing popular items like shawarma and grilled chicken, are experiencing rapid growth, catering to local tastes and preferences.

Leading Location Segment: Retail.

- Key Drivers: High foot traffic in malls and commercial areas, accessibility, and integration with other retail services.

- Dominance Analysis: Retail locations attract a diverse consumer base seeking convenient meal options while shopping or engaging in leisure activities. Major QSR chains heavily invest in prime retail spaces to maximize visibility and customer reach.

Dominant Outlet Type: Chained Outlets.

- Key Drivers: Brand equity, operational efficiency, marketing power, and supply chain management.

- Dominance Analysis: Established chains leverage their scale to offer competitive pricing and consistent quality, appealing to a broad demographic. Their aggressive expansion plans, often through franchising, solidify their market dominance.

Leading Cuisine Segment: Burger.

- Key Drivers: Global popularity, established brands, and continuous menu innovation.

- Dominance Analysis: The burger segment benefits from a strong existing customer base and the presence of major international fast-food chains that have a significant presence in Saudi Arabia.

High-Growth Cuisine Segments: Meat-based Cuisines and Other QSR Cuisines.

- Key Drivers: Localization of offerings, catering to traditional Saudi tastes, and increasing popularity of diverse international flavors.

- Dominance Analysis: These segments are capitalizing on the growing demand for authentic and flavorful quick meals, often featuring locally sourced ingredients and adapted recipes.

The growth in these segments is further amplified by favorable government initiatives aimed at boosting the F&B sector and promoting local entrepreneurship, contributing to an estimated market size of xx Million for these dominant segments by 2025.

Saudi Arabia Quick Service Restaurants Market Product Innovations

Product innovation in the Saudi Arabian QSR market is increasingly focused on catering to evolving consumer demands for health, variety, and convenience. Brands are actively developing and launching healthier menu options, including grilled proteins, fresh salads, and plant-based alternatives, to meet the growing health consciousness of the population. Technology plays a pivotal role, with advancements in food preparation and presentation enhancing the overall customer experience. Competitive advantages are being carved out through unique flavor profiles, locally inspired ingredients, and customizable meal options. The introduction of limited-time offers (LTOs) and seasonal menus also drives customer engagement and repeat business.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Saudi Arabia Quick Service Restaurants Market, encompassing detailed segmentation across Cuisine, Outlet Type, and Location.

- Cuisine: The market is segmented into Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, and Other QSR Cuisines. Each segment's growth potential and competitive landscape are analyzed, with projections indicating strong performance in Meat-based and Other QSR Cuisines due to localized preferences.

- Outlet: Segmentation includes Chained Outlets and Independent Outlets. Chained outlets are expected to maintain a dominant market share due to brand strength and expansion capabilities, projected to reach xx Million in market size by 2025.

- Location: The analysis covers Leisure, Lodging, Retail, Standalone, and Travel locations. Retail is identified as the most dominant location segment, driven by high consumer traffic and convenience, with projected growth to xx Million by 2025.

Key Drivers of Saudi Arabia Quick Service Restaurants Market Growth

The Saudi Arabian Quick Service Restaurants (QSR) market is propelled by several key drivers:

- Demographic Trends: A young, growing population with increasing disposable income and a preference for convenience fuels consistent demand.

- Economic Diversification: Vision 2030 initiatives are boosting tourism, entertainment, and business activity, leading to higher consumer spending on dining out.

- Technological Advancements: Widespread smartphone penetration and the popularity of food delivery apps have expanded reach and customer accessibility.

- Urbanization: Growing urban populations concentrate consumer bases, making QSR expansion more viable and efficient.

- Government Support: Favorable policies and investments in the F&B sector encourage new entrants and expansion of existing brands.

Challenges in the Saudi Arabia Quick Service Restaurants Market Sector

Despite robust growth, the Saudi Arabian QSR market faces several challenges:

- Intense Competition: A crowded marketplace with numerous international and local players leads to price wars and margin pressures.

- Rising Operational Costs: Increasing labor costs, rent, and ingredient prices can impact profitability.

- Evolving Consumer Health Consciousness: Demand for healthier options requires significant menu reformulation and ingredient sourcing adjustments, which can be costly and complex.

- Supply Chain Vulnerabilities: Reliance on imports for certain ingredients can lead to disruptions and price volatility.

- Regulatory Compliance: Adhering to evolving food safety standards and Saudization mandates requires continuous investment and adaptation.

Emerging Opportunities in Saudi Arabia Quick Service Restaurants Market

Emerging opportunities in the Saudi Arabian QSR market are abundant:

- Health and Wellness Focus: Developing and marketing innovative, healthy, and plant-based menu items presents a significant growth avenue.

- Digital Transformation: Leveraging AI, data analytics, and personalized marketing through apps to enhance customer loyalty and operational efficiency.

- Ghost Kitchens and Dark Stores: Expanding reach and reducing overhead costs through non-traditional service models.

- Niche Market Expansion: Targeting specific demographics or dietary needs (e.g., gluten-free, vegan) with specialized offerings.

- Localization of Global Brands: Adapting menus and marketing strategies to resonate more deeply with local tastes and cultural nuances.

Leading Players in the Saudi Arabia Quick Service Restaurants Market Market

- Reza Food Services Company Limite

- ALBAIK Food Systems Company S A

- Fawaz Abdulaziz AlHokair Company

- Galadari Ice Cream Co Ltd LLC

- Americana Restaurants International PLC

- Kudu Company For Food And Catering

- M H Alshaya Co WLL

- Herfy Food Service Company

- Apparel Group

- AlAmar Foods Company

Key Developments in Saudi Arabia Quick Service Restaurants Market Industry

- March 2023: Nathan & Nathan KSA partnered with Fawaz Abdulaziz Al Hokair & Sons, aiming to accelerate growth and develop future professional service opportunities throughout the Kingdom.

- February 2023: Alshaya Group inaugurated a new production facility in Saudi Arabia to produce freshly baked and packaged food for 400 Starbucks stores in the country.

- January 2023: Fawaz Abdulaziz AlHokair Company planned to set up around 45-50 new branches for Cinnabon and Mamma Bunz, and to expedite the expansion of its store network for existing brands like Crepe Affaire and Shawarma Al Muhalhel through a sub-franchise model.

Future Outlook for Saudi Arabia Quick Service Restaurants Market Market

The future outlook for the Saudi Arabian Quick Service Restaurants (QSR) market is exceptionally promising, poised for sustained and significant growth. The ongoing economic diversification efforts under Vision 2030 will continue to drive consumer spending power and fuel demand for convenient dining options. Technological integration will be a critical differentiator, with AI-powered personalization, advanced delivery logistics, and immersive digital ordering experiences becoming standard. The growing preference for healthier and more sustainable food choices will spur innovation in menu development, opening doors for brands that can authentically cater to these evolving needs. Strategic expansion into untapped regions and further leveraging the sub-franchise model will enable brands to rapidly scale their presence. By capitalizing on these growth accelerators, the Saudi Arabian QSR market is set to become an even more dynamic and lucrative landscape for both established and emerging players.

Saudi Arabia Quick Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Saudi Arabia Quick Service Restaurants Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Quick Service Restaurants Market Regional Market Share

Geographic Coverage of Saudi Arabia Quick Service Restaurants Market

Saudi Arabia Quick Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production

- 3.3. Market Restrains

- 3.3.1. Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia

- 3.4. Market Trends

- 3.4.1. The rising popularity of burgers among the younger population is leading to the expansion of fast-food chains across the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Quick Service Restaurants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reza Food Services Company Limite

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALBAIK Food Systems Company S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fawaz Abdulaziz AlHokair Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Galadari Ice Cream Co Ltd LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Americana Restaurants International PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kudu Company For Food And Catering

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M H Alshaya Co WLL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Herfy Food Service Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apparel Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AlAmar Foods Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Reza Food Services Company Limite

List of Figures

- Figure 1: Saudi Arabia Quick Service Restaurants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Quick Service Restaurants Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Cuisine 2020 & 2033

- Table 2: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 3: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Location 2020 & 2033

- Table 4: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Cuisine 2020 & 2033

- Table 6: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Outlet 2020 & 2033

- Table 7: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Location 2020 & 2033

- Table 8: Saudi Arabia Quick Service Restaurants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Quick Service Restaurants Market?

The projected CAGR is approximately 11.6%.

2. Which companies are prominent players in the Saudi Arabia Quick Service Restaurants Market?

Key companies in the market include Reza Food Services Company Limite, ALBAIK Food Systems Company S A, Fawaz Abdulaziz AlHokair Company, Galadari Ice Cream Co Ltd LLC, Americana Restaurants International PLC, Kudu Company For Food And Catering, M H Alshaya Co WLL, Herfy Food Service Company, Apparel Group, AlAmar Foods Company.

3. What are the main segments of the Saudi Arabia Quick Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production.

6. What are the notable trends driving market growth?

The rising popularity of burgers among the younger population is leading to the expansion of fast-food chains across the country.

7. Are there any restraints impacting market growth?

Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia.

8. Can you provide examples of recent developments in the market?

March 2023: Nathan & Nathan KSA partnered with Fawaz Abdulaziz Al Hokair & Sons. This partnership is expected to bring the expertise and resources of both companies together, accelerate the growth of the active customer bases of both groups, and support the development of future opportunities to provide unparalleled professional services to clients throughout the Kingdom.February 2023: Alshaya Group inaugurated a new production facility in Saudi Arabia to produce freshly baked and packaged food for 400 Starbucks stores in the country.January 2023: Fawaz Abdulaziz AlHokair Company planned to set up around 45-50 new branches, specifically for Cinnabon and Mamma Bunz. It is expected to expand the footprint of its home-grown concept, "Shawarma Al Muhalhel." Furthermore, the company is planning to expedite the expansion of its store network for existing brands, such as Cinnabon, Mamma Bunz, Crepe Affaire, and Shawarma Al Muhalhel, through a sub-franchise model.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Quick Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Quick Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Quick Service Restaurants Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Quick Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence