Key Insights

The global security paper market, valued at $14.48 billion in 2025, is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 5.9% from 2025 to 2033. This growth is propelled by escalating demand for secure document solutions across critical sectors including banking and finance (currency, checks, payment cards), government (identification, tax stamps, ticketing), and specialized applications. Stringent global regulations and security protocols mandate the use of high-security paper, driving market demand. Innovations in security features such as watermarks, holograms, and specialized inks further contribute to market expansion. The proliferation of digital technologies, while presenting alternatives, indirectly bolsters the security paper market by necessitating robust physical document solutions to combat counterfeiting and fraud in digital transactions.

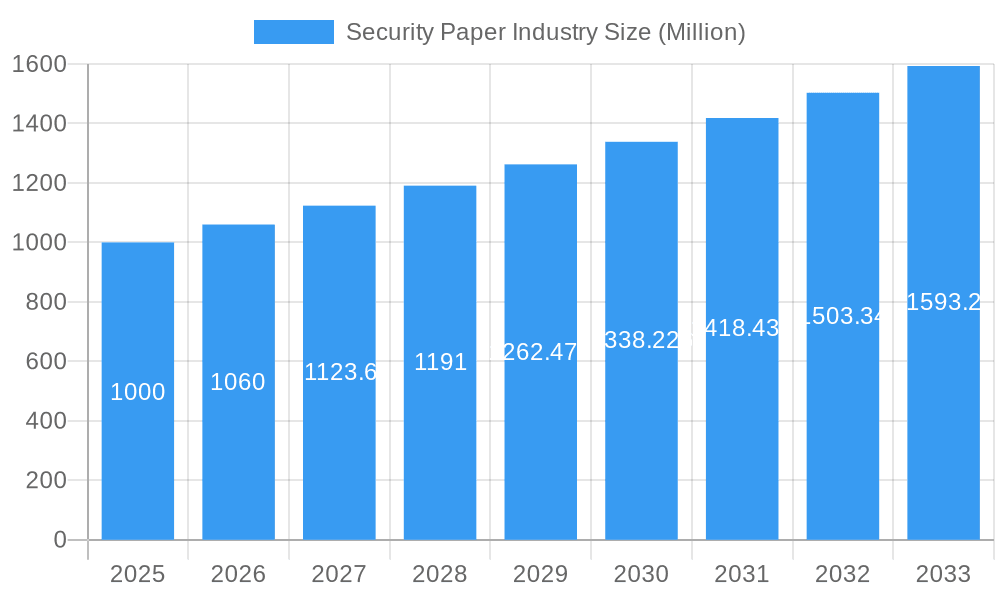

Security Paper Industry Market Size (In Billion)

Regional market dynamics indicate sustained dominance in North America and Europe due to established infrastructure and stringent security standards. However, the Asia-Pacific region is poised for substantial growth, fueled by rapid economic development and increasing populations in key markets like India and China, thereby elevating the demand for secure documents and financial instruments. Key market restraints involve the volatility of raw material prices, notably pulp and paper, and the potential disruption from emerging digital alternatives. Despite these challenges, the persistent focus on enhanced security and anti-counterfeiting measures strongly supports a sustained growth trajectory for the security paper market. Market segmentation by application, including currency paper and payment cards, underscores the sector's diverse opportunities, with currency paper and payment cards anticipated to maintain leading positions due to their substantial volume and critical security needs.

Security Paper Industry Company Market Share

Security Paper Industry Market Analysis: 2019-2033 Outlook

This in-depth report provides a comprehensive analysis of the global security paper industry, delivering critical insights for industry professionals, investors, and strategic planners. Focusing on market dynamics, innovation trends, and future growth projections, the report covers the period from 2019 to 2033, presenting historical data, current estimates, and future forecasts. The analysis includes key market participants such as Ceprohart SA, A1 Security Print Ltd, Fedrigoni Group, Papierfabrik Louisenthal GmbH, Domtar Corporation, Simpson Security Papers, Giesecke+Devrient Currency Technology GmbH, Drewsen Specialty Papers GmbH & Co KG, Ciotola SRL, and Infinity Security Papers Limited. The market size is projected to reach $XX billion by 2033.

Security Paper Industry Market Structure & Innovation Trends

The security paper market exhibits a moderately concentrated structure, with several major players holding significant market share. For example, Fedrigoni Group and Giesecke+Devrient Currency Technology GmbH command substantial portions of the global market, estimated at xx% and xx% respectively in 2025. Innovation is primarily driven by advancements in anti-counterfeiting technologies, including the integration of sophisticated security features like microprinting, watermarks, and optically variable inks. Stringent regulatory frameworks, particularly concerning currency and identity documents, significantly influence market growth and demand. The industry is also witnessing increasing adoption of digital alternatives, which act as substitutes to some extent. However, the persistent need for secure physical documents fuels demand. M&A activity in the sector has been moderate, with a few significant deals valued at over xx Million in the historical period (2019-2024), primarily focused on expanding geographical reach and product portfolios. The key end-user demographics include governments, financial institutions, and identification agencies.

Security Paper Industry Market Dynamics & Trends

The security paper market is projected to witness a CAGR of xx% during the forecast period (2025-2033). This growth is primarily propelled by factors such as the rising demand for secure documents across various sectors, including financial, governmental, and commercial. Technological disruptions, such as the adoption of advanced security features and digital printing techniques, are continuously reshaping the industry landscape. Consumer preference for enhanced security and durability is driving innovation. The competitive dynamics are largely shaped by pricing strategies, product differentiation, and technological leadership. Market penetration of advanced security features is increasing steadily, particularly in high-value applications like currency and passports. The estimated market size in 2025 is xx Million.

Dominant Regions & Segments in Security Paper Industry

The North American and European regions currently dominate the security paper market, driven by robust economies, stringent security regulations, and established printing industries. However, the Asia-Pacific region is expected to exhibit significant growth in the coming years due to rapid economic expansion and increasing demand for secure documents in developing economies.

- Key Drivers for North America: Strong regulatory environment, high per capita income, advanced printing infrastructure.

- Key Drivers for Europe: Mature market, stringent security regulations, presence of major players.

- Key Drivers for Asia-Pacific: Rapid economic growth, increasing demand for secure identification documents.

The Currency Paper/Bank Notes segment holds the largest market share, accounting for approximately xx% in 2025, followed by Payment Cards and Personal ID documents. This dominance is attributed to the inherent high-security requirements and large volumes associated with these applications. The growth in other segments like Ticketing and Stamp Paper is also substantial, with increasing demand for secure tickets in events and transportation, and increasing government requirements for secure stamp paper, respectively.

Security Paper Industry Product Innovations

Recent innovations include the incorporation of advanced security features like 3D holograms, thermochromic inks, and sophisticated watermarking techniques. These developments improve the resistance to counterfeiting and enhance the overall security of the documents. The focus is on developing cost-effective and environmentally friendly materials while maintaining high security levels, a key factor in driving market differentiation. New applications are constantly being explored, especially in the area of digital security features that can be seamlessly integrated into physical documents.

Report Scope & Segmentation Analysis

This report segments the security paper market based on application:

Currency Paper/Bank Notes: This segment is expected to grow at a CAGR of xx% during the forecast period. The market is characterized by high security requirements and significant competition among established players.

Payment Cards: This segment is witnessing robust growth due to the increasing adoption of cashless transactions and the need for fraud prevention. The market size for 2025 is projected at xx Million.

Cheques: While the overall usage of cheques is declining, there is still demand for secure cheque papers, particularly in specialized financial transactions.

Personal ID: This segment is driven by government initiatives to improve national security and identity management systems. Growth is expected to be driven by adoption of advanced security features.

Ticketing: Growth is propelled by the rise of events and the need for secure and tamper-proof tickets.

Stamp Paper: The market is driven by government regulations and the need for secure revenue collection mechanisms.

Other Applications: This segment encompasses various applications, including certificates, diplomas, and other secure documents.

Key Drivers of Security Paper Industry Growth

The growth of the security paper industry is primarily propelled by stringent government regulations mandating secure documents, the increasing prevalence of counterfeiting and fraud, and continuous technological advancements in anti-counterfeiting measures. The rising demand for secure financial instruments and identification documents also fuels market expansion. Economic growth in developing economies further boosts demand for secure paper products.

Challenges in the Security Paper Industry Sector

The security paper industry faces challenges such as the increasing adoption of digital alternatives, the rising cost of raw materials, and intense competition. Supply chain disruptions and regulatory hurdles in different regions also pose significant barriers to growth. The fluctuating price of raw materials, such as cotton, affects profit margins and necessitates strategic pricing strategies.

Emerging Opportunities in Security Paper Industry

Emerging opportunities include the development of new and innovative anti-counterfeiting technologies, expansion into emerging markets, and customization of security features for specific applications. The adoption of sustainable and eco-friendly manufacturing processes offers a compelling opportunity for businesses to gain a competitive edge and cater to increasing environmental concerns. There is also an increasing demand for customized security solutions tailored to meet specific client needs.

Leading Players in the Security Paper Industry Market

- Ceprohart SA

- A1 Security Print Ltd

- Fedrigoni Group

- Papierfabrik Louisenthal GmbH

- Domtar Corporation

- Simpson Security Papers

- Giesecke+Devrient Currency Technology GmbH

- Drewsen Specialty Papers GmbH & Co KG

- Ciotola SRL

- Infinity Security Papers Limited

Key Developments in Security Paper Industry

- January 2023: Fedrigoni Group launched a new range of sustainable security papers.

- June 2022: Giesecke+Devrient announced a strategic partnership to develop advanced security features.

- October 2021: A1 Security Print acquired a smaller competitor, expanding its market share. (Note: Further key developments are expected to be added before final report publication.)

Future Outlook for Security Paper Industry Market

The future outlook for the security paper market is positive, driven by ongoing technological advancements, increasing demand for secure documents, and stringent regulatory requirements. The industry is expected to witness continued innovation in anti-counterfeiting technologies and expansion into new applications. Strategic partnerships and acquisitions will likely shape the competitive landscape, while the emphasis on sustainability and environmentally friendly production methods will continue to gain traction.

Security Paper Industry Segmentation

-

1. Application

- 1.1. Currency Paper/Bank Notes,

- 1.2. Payment Cards

- 1.3. Cheques

- 1.4. Personal ID

- 1.5. Ticketing

- 1.6. Stamp Paper

- 1.7. Other Applications

Security Paper Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Security Paper Industry Regional Market Share

Geographic Coverage of Security Paper Industry

Security Paper Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Cases of Fraud and Counterfeiting; Growth in Tourism Increases the Demand for Visas and Passports

- 3.3. Market Restrains

- 3.3.1. ; Growth in Digitization

- 3.4. Market Trends

- 3.4.1. Currency to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Currency Paper/Bank Notes,

- 5.1.2. Payment Cards

- 5.1.3. Cheques

- 5.1.4. Personal ID

- 5.1.5. Ticketing

- 5.1.6. Stamp Paper

- 5.1.7. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Currency Paper/Bank Notes,

- 6.1.2. Payment Cards

- 6.1.3. Cheques

- 6.1.4. Personal ID

- 6.1.5. Ticketing

- 6.1.6. Stamp Paper

- 6.1.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Currency Paper/Bank Notes,

- 7.1.2. Payment Cards

- 7.1.3. Cheques

- 7.1.4. Personal ID

- 7.1.5. Ticketing

- 7.1.6. Stamp Paper

- 7.1.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Currency Paper/Bank Notes,

- 8.1.2. Payment Cards

- 8.1.3. Cheques

- 8.1.4. Personal ID

- 8.1.5. Ticketing

- 8.1.6. Stamp Paper

- 8.1.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Currency Paper/Bank Notes,

- 9.1.2. Payment Cards

- 9.1.3. Cheques

- 9.1.4. Personal ID

- 9.1.5. Ticketing

- 9.1.6. Stamp Paper

- 9.1.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Security Paper Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Currency Paper/Bank Notes,

- 10.1.2. Payment Cards

- 10.1.3. Cheques

- 10.1.4. Personal ID

- 10.1.5. Ticketing

- 10.1.6. Stamp Paper

- 10.1.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ceprohart SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A1 Security Print Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fedrigoni Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Papierfabrik Louisenthal GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Domtar Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Simpson Security Papers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Giesecke+Devrient Currency Technology GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Drewsen Specialty Papers GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ciotola SRL*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Infinity Security Papers Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ceprohart SA

List of Figures

- Figure 1: Global Security Paper Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Latin America Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Security Paper Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Security Paper Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa Security Paper Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Security Paper Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Security Paper Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Security Paper Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Germany Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: UK Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: India Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Security Paper Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Global Security Paper Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Security Paper Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Paper Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Security Paper Industry?

Key companies in the market include Ceprohart SA, A1 Security Print Ltd, Fedrigoni Group, Papierfabrik Louisenthal GmbH, Domtar Corporation, Simpson Security Papers, Giesecke+Devrient Currency Technology GmbH, Drewsen Specialty Papers GmbH & Co KG, Ciotola SRL*List Not Exhaustive, Infinity Security Papers Limited.

3. What are the main segments of the Security Paper Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.48 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Cases of Fraud and Counterfeiting; Growth in Tourism Increases the Demand for Visas and Passports.

6. What are the notable trends driving market growth?

Currency to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Growth in Digitization.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Paper Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Paper Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Paper Industry?

To stay informed about further developments, trends, and reports in the Security Paper Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence