Key Insights

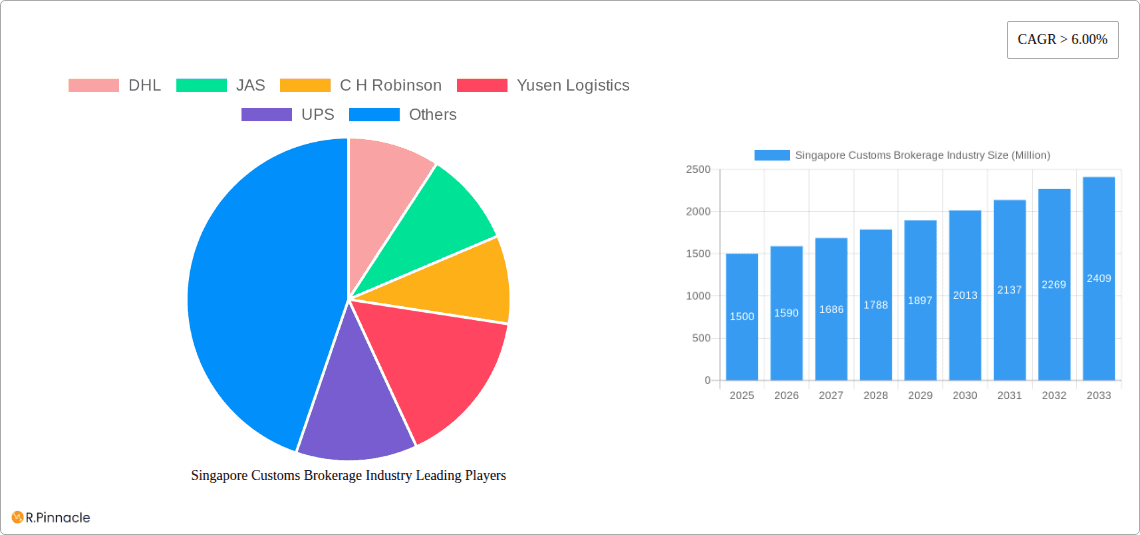

The Singapore customs brokerage industry, exhibiting a robust Compound Annual Growth Rate (CAGR) exceeding 6%, presents a lucrative market opportunity. Driven by Singapore's strategic position as a global trade hub and its commitment to streamlined logistics, the industry's value (estimated at $XX million in 2025) is projected to experience significant expansion through 2033. Key growth drivers include the increasing volume of international trade, the burgeoning e-commerce sector demanding efficient customs clearance, and the growing complexity of global trade regulations requiring specialized brokerage expertise. The industry is segmented by mode of transport – sea, air, and cross-border land transport – with sea freight likely dominating due to Singapore's major port. Leading players like DHL, FedEx, UPS, and Kuehne + Nagel compete fiercely, offering comprehensive services ranging from customs documentation to regulatory compliance. While the industry faces challenges such as fluctuating global trade volumes and evolving regulatory landscapes, the long-term outlook remains positive, fueled by Singapore's economic strength and its commitment to maintaining a seamless trade environment. The forecast period of 2025-2033 suggests a substantial increase in market value, influenced by the projected growth in global trade and increased demand for specialized logistics services within the region. Furthermore, technological advancements in customs brokerage, such as automation and digitalization, will likely enhance efficiency and contribute to the overall growth trajectory.

Singapore Customs Brokerage Industry Market Size (In Billion)

The competitive landscape is intense, with established multinational logistics giants vying for market share alongside smaller, specialized brokerage firms. This competition stimulates innovation and fosters a focus on providing value-added services that enhance efficiency and reduce costs for clients. Future growth will likely be influenced by government policies related to trade liberalization and digitalization initiatives aimed at simplifying customs procedures. The dominance of sea freight within the industry’s segmentation suggests a focus on port operations and related infrastructure will be crucial for industry participants seeking to maintain or increase market share. The analysis of the Singapore Customs Brokerage Industry points to significant opportunities for growth and innovation within this dynamic sector. Success will hinge on adapting to evolving regulatory requirements, leveraging technological advancements, and providing clients with efficient, reliable, and cost-effective customs brokerage solutions.

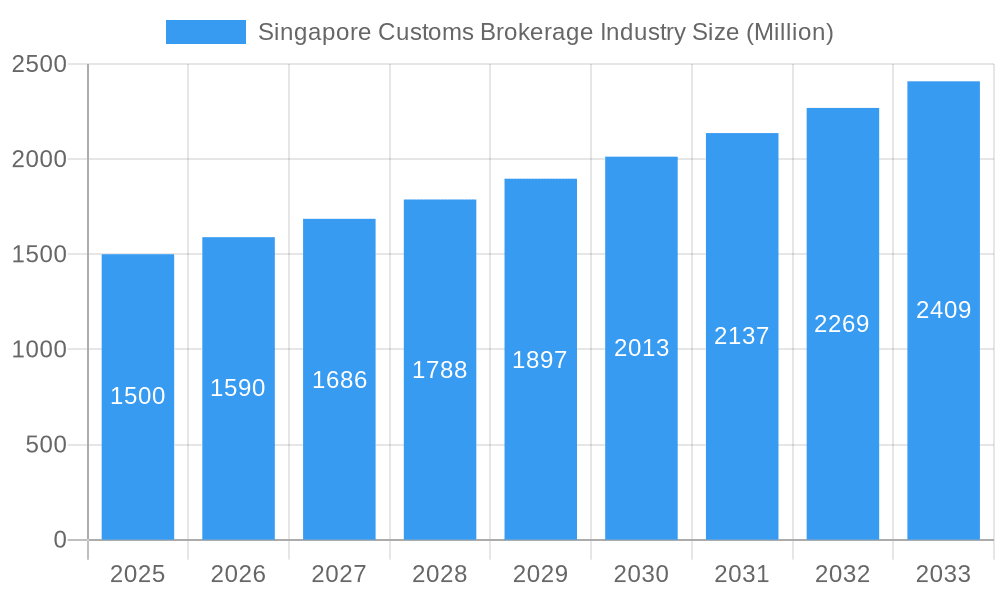

Singapore Customs Brokerage Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Singapore customs brokerage industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future trajectory. Benefit from detailed segmentation by mode of transport (Sea, Air, Cross-border Land Transport) and discover the key players shaping this dynamic landscape. Expect actionable data, including market size estimations in Millions, CAGR projections, and analyses of market share and M&A activities.

Singapore Customs Brokerage Industry Market Structure & Innovation Trends

This section provides a comprehensive analysis of the competitive dynamics within Singapore's vibrant customs brokerage market. We delve into market concentration, scrutinize the key drivers of innovation, and examine the evolving regulatory frameworks shaping the industry. Our analysis, spanning from 2019 to 2024, includes a detailed look at Merger and Acquisition (M&A) activities, highlighting their strategic importance and financial impact. The report identifies and quantifies the market share of leading established players such as DHL, FedEx, and Kuehne + Nagel, while also profiling agile emerging players like Janio. We aim to provide actionable insights into the value of recent M&A deals, estimated at xx Million, and understand their influence on market competition.

- Market Concentration Dynamics: We employ robust metrics, including the Herfindahl-Hirschman Index (HHI), to meticulously assess market concentration and provide a clear understanding of the competitive intensity.

- Pioneering Innovation Drivers: This segment explores the multifaceted factors propelling innovation, from cutting-edge technological advancements and stringent regulatory mandates to the ever-changing demands of customers. Specific case studies will showcase innovative solutions implemented by industry frontrunners.

- Navigating Regulatory Frameworks: An in-depth overview of the prevailing regulatory landscape is presented, detailing its implications for market participants. This includes licensing requirements, adherence to compliance standards, and analysis of recent policy shifts.

- Emerging Product Substitutes: We analyze potential alternative solutions that could impact traditional customs brokerage services and their subsequent influence on market dynamics.

- Key End-User Profiling: A detailed demographic analysis of the primary end-users of customs brokerage services is provided, encompassing their organizational size, industry verticals, and geographical reach.

- Strategic M&A Activities: A critical review of significant mergers and acquisitions during the historical period (2019-2024) is conducted, including an assessment of deal valuations and their strategic ramifications. The rationale behind these consolidations and their impact on market competition are thoroughly examined, with specific examples of M&A deals and their estimated values in Millions.

Singapore Customs Brokerage Industry Market Dynamics & Trends

This section delves into the market dynamics driving growth in the Singapore customs brokerage sector from 2019-2033. It examines market growth drivers, technological disruptions, and shifting consumer preferences, providing a comprehensive picture of the industry's evolution. The analysis will include projections for Compound Annual Growth Rate (CAGR) and market penetration rates for different segments. Specific factors driving market growth include:

- E-commerce Boom: The rapid growth of e-commerce and cross-border trade is analyzed for its impact on demand for customs brokerage services.

- Supply Chain Optimization: The increasing focus on supply chain efficiency and resilience is explored as a key driver.

- Technological Advancements: The adoption of technologies such as blockchain and AI is examined, along with its impact on efficiency and cost reduction.

- Government Initiatives: Relevant government policies and initiatives supporting trade and logistics are analyzed for their contribution to market growth.

- Competitive Dynamics: A detailed examination of the competitive landscape, including market share analysis and strategies employed by key players. The report will assess the impact of competition on pricing, service offerings, and overall market growth.

Dominant Regions & Segments in Singapore Customs Brokerage Industry

This section identifies the dominant regions and segments within the Singapore customs brokerage market. It provides a detailed analysis of the leading segment by mode of transport (Sea, Air, and Cross-border Land Transport), outlining the factors contributing to its dominance. This will include a comprehensive analysis of the market share of each segment and projections for future growth.

- Sea Freight: Analysis will focus on the volume of sea freight handled, the types of goods transported, and the key players operating in this segment.

- Key Drivers: Singapore's strategic location as a major port, robust port infrastructure, and government policies supporting maritime trade.

- Air Freight: Analysis will focus on the volume of air freight handled, the types of goods transported, and the key players operating in this segment.

- Key Drivers: Changi Airport's connectivity and advanced infrastructure, growth of express delivery services, and the handling of high-value goods.

- Cross-border Land Transport: Analysis will focus on the volume of goods transported via land routes, the types of goods transported, and the key players operating in this segment.

- Key Drivers: Improved land connectivity with neighboring countries, increasing cross-border trade, and the development of efficient land transport networks.

Singapore Customs Brokerage Industry Product Innovations

This section summarizes recent product developments and technological advancements within the industry. The analysis focuses on how technological trends are shaping the market and creating competitive advantages for industry players. Examples of technological advancements and their applications will be detailed, focusing on innovation in areas such as digital platforms and automated customs clearance procedures.

Report Scope & Segmentation Analysis

This comprehensive report strategically segments the Singapore customs brokerage market based on the primary modes of transport: Sea Freight, Air Freight, and Cross-border Land Transport. For each segment, we provide detailed growth projections, current market size estimations (in Millions), and a thorough analysis of competitive dynamics. Our forecast extends to the period of 2025-2033, offering a clear vision of future market potential.

- Sea Freight Dominance: This segment scrutinizes customs brokerage services integral to seaborne cargo operations. The report offers a detailed analysis of its market size, projected growth rate, and the prevailing competitive landscape. Forecasted market size for this segment from 2025 to 2033 is meticulously projected.

- Air Freight Agility: Focusing on customs brokerage services for air cargo, this segment mirrors the depth of analysis applied to sea freight. It outlines current market size, growth trajectory, and competitive intensity. Projections for the air freight segment's market size between 2025 and 2033 are provided.

- Cross-border Land Transport Efficiency: This segment covers the crucial customs brokerage services for goods traversing land routes. Similar to the other segments, it includes a detailed assessment of market size, growth rate, competitive dynamics, and forecasts for the period of 2025-2033.

Key Drivers of Singapore Customs Brokerage Industry Growth

Several factors contribute to the growth of Singapore's customs brokerage industry. These include:

- The increasing volume of international trade facilitated by Singapore's strategic location and robust infrastructure.

- Technological advancements in customs processing and supply chain management.

- Favorable government policies and initiatives supporting trade and logistics.

- Growing demand for efficient and reliable customs brokerage services from businesses of all sizes.

Challenges in the Singapore Customs Brokerage Industry Sector

The industry faces challenges such as:

- Increasing regulatory complexity and compliance costs.

- Supply chain disruptions and geopolitical uncertainties.

- Intense competition from both established and emerging players.

- Fluctuations in global trade volumes impacting demand. These fluctuations are quantified by analyzing historical data from 2019-2024.

Emerging Opportunities in Singapore Customs Brokerage Industry

The Singapore customs brokerage industry is a fertile ground for innovation and growth, presenting several compelling emerging opportunities:

- Niche Specialization: A burgeoning demand for highly specialized customs brokerage services, tailored to specific industries (e.g., pharmaceuticals, high-tech goods) or unique product categories, offers significant avenues for differentiation and value creation.

- E-commerce Expansion: The relentless rise of e-commerce, particularly cross-border e-commerce, is creating unprecedented new pathways and demands for agile and efficient customs brokerage solutions.

- Technological Integration for Enhanced Experience: Significant opportunities lie in leveraging advanced technologies to streamline operations, boost efficiency, and elevate the customer experience. This includes the strategic adoption of Artificial Intelligence (AI) and automation to optimize complex customs processes.

Leading Players in the Singapore Customs Brokerage Industry Market

- DHL

- JAS Forwarding Worldwide

- C.H. Robinson

- Yusen Logistics

- UPS

- FedEx Trade Networks

- M&P International Freight

- Kuehne + Nagel

- Janio Asia

- AP Moller - Maersk (SeaLand)

- Rhenus Logistics

- Geodis

- List Not Exhaustive

Key Developments in Singapore Customs Brokerage Industry Industry

- 2022 Q4: Introduction of a new automated customs clearance system by the Singapore Customs Authority, significantly improving processing times.

- 2023 Q1: Merger between two mid-sized customs brokerage firms, resulting in increased market consolidation. (xx Million deal value)

- 2024 Q2: Launch of a new digital platform by a major customs brokerage firm, enhancing service accessibility and customer engagement. (Further details on the impact will be given)

Future Outlook for Singapore Customs Brokerage Industry Market

The Singapore customs brokerage industry is on a trajectory of sustained growth, propelled by the ever-increasing volume of international trade, rapid technological advancements, and a supportive governmental policy environment. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key strategic imperatives for future success include the adept leveraging of emerging technologies, a focus on developing specialized niche services, and the consistent delivery of high-value-added services to clients. The burgeoning e-commerce sector and the continuous drive for enhanced supply chain efficiency will further fuel the industry's expansion and evolution.

Singapore Customs Brokerage Industry Segmentation

-

1. Mode of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-border Land Transport

Singapore Customs Brokerage Industry Segmentation By Geography

- 1. Singapore

Singapore Customs Brokerage Industry Regional Market Share

Geographic Coverage of Singapore Customs Brokerage Industry

Singapore Customs Brokerage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing need for simple and effective supply chain systems; Increase in demand for household appliances

- 3.3. Market Restrains

- 3.3.1. 4.; Drivers Availability

- 3.4. Market Trends

- 3.4.1. Singapore Surge in Imports and Exports Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Customs Brokerage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Robinson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 M&P International Freight

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Janio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SeaLand Maersk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rhenus Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Geodis**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Singapore Customs Brokerage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Singapore Customs Brokerage Industry Share (%) by Company 2025

List of Tables

- Table 1: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 2: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Mode of Transport 2020 & 2033

- Table 4: Singapore Customs Brokerage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Customs Brokerage Industry?

The projected CAGR is approximately 7.44%.

2. Which companies are prominent players in the Singapore Customs Brokerage Industry?

Key companies in the market include DHL, JAS, C H Robinson, Yusen Logistics, UPS, FedEx, M&P International Freight, Kuehne + Nagel, Janio, SeaLand Maersk, Rhenus Logistics, Geodis**List Not Exhaustive.

3. What are the main segments of the Singapore Customs Brokerage Industry?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing need for simple and effective supply chain systems; Increase in demand for household appliances.

6. What are the notable trends driving market growth?

Singapore Surge in Imports and Exports Driving the Market.

7. Are there any restraints impacting market growth?

4.; Drivers Availability.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Customs Brokerage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Customs Brokerage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Customs Brokerage Industry?

To stay informed about further developments, trends, and reports in the Singapore Customs Brokerage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence