Key Insights

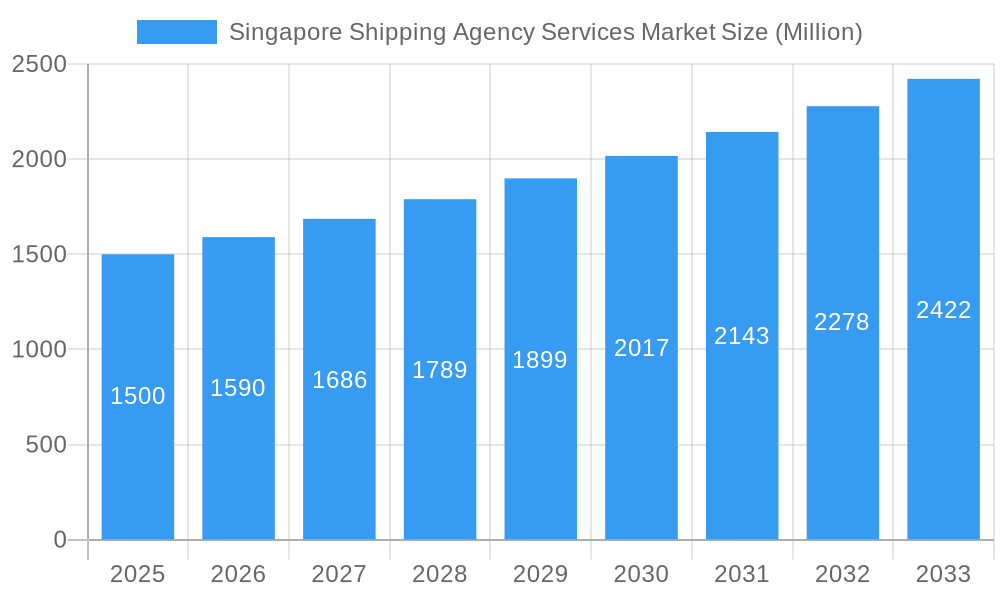

The Singapore Shipping Agency Services Market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033. The market size is estimated at $15.41 billion in 2025. This growth is underpinned by Singapore's pivotal role as a global maritime hub, driving international trade and attracting substantial shipping volumes. Increasing containerized cargo throughput, coupled with the demand for optimized logistics and efficient port operations, are key drivers across market segments. The market is segmented by service type (Port, Cargo, Charter, and others), application (Ship Owners and Lessees), and service offerings (Packaging, Shipping, Customs Clearance, Logistics Support, and ancillary services). Leading entities such as Nortrans, Golden Harvest Shipping Agency, and Straits Link Ship Agencies & Management Pte Ltd are instrumental in shaping market trends through strategic collaborations, technological integration, and specialization. A supportive regulatory environment and government initiatives for the maritime sector further fortify Singapore's competitive advantage.

Singapore Shipping Agency Services Market Market Size (In Billion)

Future market development will be influenced by sustained global trade momentum. Technological advancements, including the digitalization of shipping operations and port automation, are expected to enhance efficiency and reduce costs. Furthermore, the growing emphasis on sustainable shipping practices and adherence to environmental regulations will present both opportunities and strategic considerations for market participants. Competitive dynamics from regional players and potential geopolitical influences necessitate continuous strategic adjustments. The sustained success of Singapore's shipping agencies will depend on their capacity for innovation, technology adoption, and adaptability to the evolving global shipping landscape. This sector offers substantial growth potential for both established and emerging companies.

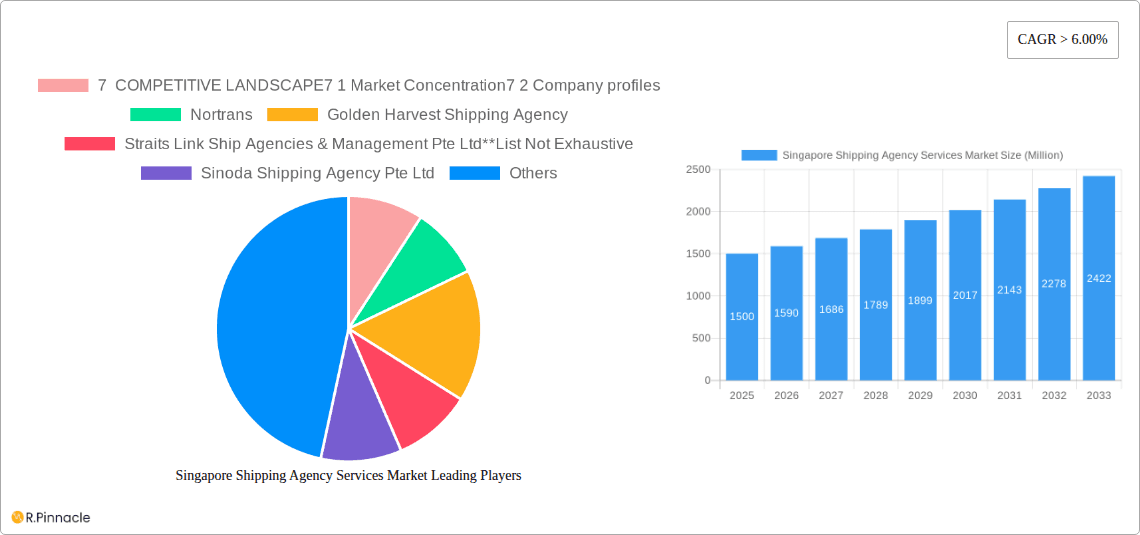

Singapore Shipping Agency Services Market Company Market Share

Singapore Shipping Agency Services Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Singapore Shipping Agency Services Market, offering actionable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a healthy CAGR of xx%.

Singapore Shipping Agency Services Market Structure & Innovation Trends

The Singapore shipping agency services market exhibits a moderately concentrated structure with the top 7 players holding approximately xx% of the market share in 2025. Market concentration is influenced by factors such as established players’ extensive network, technological capabilities, and strong client relationships. Innovation is driven by the need for enhanced efficiency, digitalization, and compliance with stringent regulatory frameworks. The market witnesses frequent M&A activities, with deal values averaging xx Million in recent years, further consolidating market power. Product substitutes, such as online freight booking platforms, exert moderate competitive pressure, while end-user demographics, primarily comprising ship owners, lessees, and cargo owners, are relatively stable.

- Market Concentration: Moderately concentrated, with top 7 players holding xx% market share (2025).

- Innovation Drivers: Efficiency gains, digitalization, regulatory compliance.

- Regulatory Frameworks: Stringent safety and environmental regulations.

- M&A Activity: Average deal value of xx Million.

Singapore Shipping Agency Services Market Dynamics & Trends

The Singapore Shipping Agency Services market is experiencing robust growth fueled by the nation's strategic position as a global maritime hub. Increasing global trade volumes, coupled with rising demand for efficient logistics solutions, are key drivers. Technological advancements, such as blockchain and AI-powered solutions, are transforming operations, optimizing supply chains, and enhancing transparency. Consumer preferences are shifting towards integrated, digitally enabled services, demanding higher levels of customization and responsiveness. Competitive dynamics are shaped by factors such as pricing strategies, service quality, and technological capabilities. Market penetration of digital solutions is steadily increasing, with an estimated xx% of shipping agencies adopting digital platforms by 2033.

Dominant Regions & Segments in Singapore Shipping Agency Services Market

Singapore dominates the regional landscape due to its robust port infrastructure, strategic location, and supportive government policies. Within the market segmentation:

- By Type: Port agency services lead the market due to high vessel traffic and the necessity for port-related services. Cargo agency services represent a significant segment, driven by increasing global trade. Charter agency services demonstrate steady growth alongside port and cargo agency, while "others" represent a smaller but expanding niche market.

- By Application: Ship owners constitute a substantial portion of the market, followed by lessees who utilize shipping agencies for operational efficiency.

- By Service: Shipping services and custom clearance services are crucial components, holding the largest share, followed by logistical support services and packaging services.

Key Drivers:

- Economic Policies: Singapore's pro-business environment and trade agreements.

- Infrastructure: World-class port infrastructure and connectivity.

- Government Initiatives: Support for logistics and maritime technology.

Singapore Shipping Agency Services Market Product Innovations

Recent product innovations focus on digitalization, integrating AI-powered solutions for optimized route planning, cargo management, and real-time tracking. Blockchain technology enhances transparency and security in documentation and payment processes. These advancements are aimed at improving efficiency, reducing operational costs, and providing enhanced customer experiences, leading to a stronger market fit and competitive advantage.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Singapore Shipping Agency Services Market across various segments:

- By Type: Port Agency, Cargo Agency, Charter Agency, Others. Each segment's growth trajectory, market size, and competitive dynamics are thoroughly examined.

- By Application: Ship Owner, Lessee. Growth projections and market share for each application are detailed.

- By Service: Packaging Services, Shipping Services, Custom Clearance Services, Logistical Support Services, Other Services. Detailed analysis of each service segment's market size, competitive dynamics and growth projections.

Key Drivers of Singapore Shipping Agency Services Market Growth

The market's growth is propelled by several factors: the burgeoning global trade, Singapore's strategic location as a major maritime hub, government initiatives promoting the maritime sector, and increasing adoption of advanced technologies such as AI and blockchain, which streamline operations and improve efficiency.

Challenges in the Singapore Shipping Agency Services Market Sector

The sector faces challenges such as intense competition, fluctuations in global trade volumes, stringent regulatory compliance requirements, and the need for continuous investments in technology to maintain a competitive edge. Rising fuel costs and potential supply chain disruptions pose additional concerns.

Emerging Opportunities in Singapore Shipping Agency Services Market

Emerging opportunities include the expanding e-commerce sector fueling demand for logistics solutions, the growing adoption of green shipping initiatives, and the potential for partnerships and collaborations to leverage specialized expertise and technology.

Leading Players in the Singapore Shipping Agency Services Market Market

- Nortrans

- Golden Harvest Shipping Agency

- Straits Link Ship Agencies & Management Pte Ltd

- Sinoda Shipping Agency Pte Ltd

- AlfaShip Agencies (Singapore) Pte Ltd

- Singapore Shipping Corporation Limited

- Capital Shipping Agency (S) Pte Ltd

- Singapore Maritime Services

- ASP Crew Management

- Trinity Shipping Agency (S) Pte Ltd

Key Developments in Singapore Shipping Agency Services Market Industry

- November 2022: Publication of SS 600:2022, a code of practice for bunkering, impacting operations and safety standards.

- April 2022: Singapore joins the Clydebank Declaration, committing to green shipping corridors, influencing future market practices and sustainability goals.

Future Outlook for Singapore Shipping Agency Services Market Market

The Singapore Shipping Agency Services Market is poised for continued growth, driven by robust global trade, technological advancements, and a supportive regulatory environment. Strategic partnerships, investments in digital technologies, and a focus on sustainable practices will be crucial for future success.

Singapore Shipping Agency Services Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Ship Owner

- 2.2. Lessee

-

3. Service

- 3.1. Packaging Services

- 3.2. Shipping Services

- 3.3. Custom Clearance Services

- 3.4. Logistical Support Services

- 3.5. Other Services

Singapore Shipping Agency Services Market Segmentation By Geography

- 1. Singapore

Singapore Shipping Agency Services Market Regional Market Share

Geographic Coverage of Singapore Shipping Agency Services Market

Singapore Shipping Agency Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing International Trade Driving the Market4.; Increasing online users driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Compliance Affecting the Market4.; High Competition in the Market

- 3.4. Market Trends

- 3.4.1. Raise in Harbor Activity Provides Opportunities for Shipping Agency Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ship Owner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Packaging Services

- 5.3.2. Shipping Services

- 5.3.3. Custom Clearance Services

- 5.3.4. Logistical Support Services

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nortrans

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Golden Harvest Shipping Agency

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Straits Link Ship Agencies & Management Pte Ltd**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sinoda Shipping Agency Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AlfaShip Agencies (Singapore) Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singapore Shipping Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Capital Shipping Agency (S) Pte Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Singapore Maritime Services

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ASP Crew Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Trinity Shipping Agency (S) Pte Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Singapore Shipping Agency Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Shipping Agency Services Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Shipping Agency Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Singapore Shipping Agency Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Singapore Shipping Agency Services Market Revenue billion Forecast, by Service 2020 & 2033

- Table 4: Singapore Shipping Agency Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Singapore Shipping Agency Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Singapore Shipping Agency Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Singapore Shipping Agency Services Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Singapore Shipping Agency Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Shipping Agency Services Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Singapore Shipping Agency Services Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, Nortrans, Golden Harvest Shipping Agency, Straits Link Ship Agencies & Management Pte Ltd**List Not Exhaustive, Sinoda Shipping Agency Pte Ltd, AlfaShip Agencies (Singapore) Pte Ltd, Singapore Shipping Corporation Limited, Capital Shipping Agency (S) Pte Ltd, Singapore Maritime Services, ASP Crew Management, Trinity Shipping Agency (S) Pte Ltd.

3. What are the main segments of the Singapore Shipping Agency Services Market?

The market segments include Type, Application, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.41 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing International Trade Driving the Market4.; Increasing online users driving the market.

6. What are the notable trends driving market growth?

Raise in Harbor Activity Provides Opportunities for Shipping Agency Services.

7. Are there any restraints impacting market growth?

4.; Regulatory Compliance Affecting the Market4.; High Competition in the Market.

8. Can you provide examples of recent developments in the market?

November 2022: The Singapore Standards Council (SSC), in collaboration with the industry and MPA, has published the SS 600:2022 edition on the Code of practice for bunkering by bunker tankers using tank gauging. Shipowners/ bunker buyers, charterers, operators, surveyors, and shipping agents are urged to adhere to the requirements and procedures of the latest standards, especially in the event of MFM metering system failure onboard the bunker tanker when their vessels call at Singapore for bunkering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Shipping Agency Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Shipping Agency Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Shipping Agency Services Market?

To stay informed about further developments, trends, and reports in the Singapore Shipping Agency Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence