Key Insights

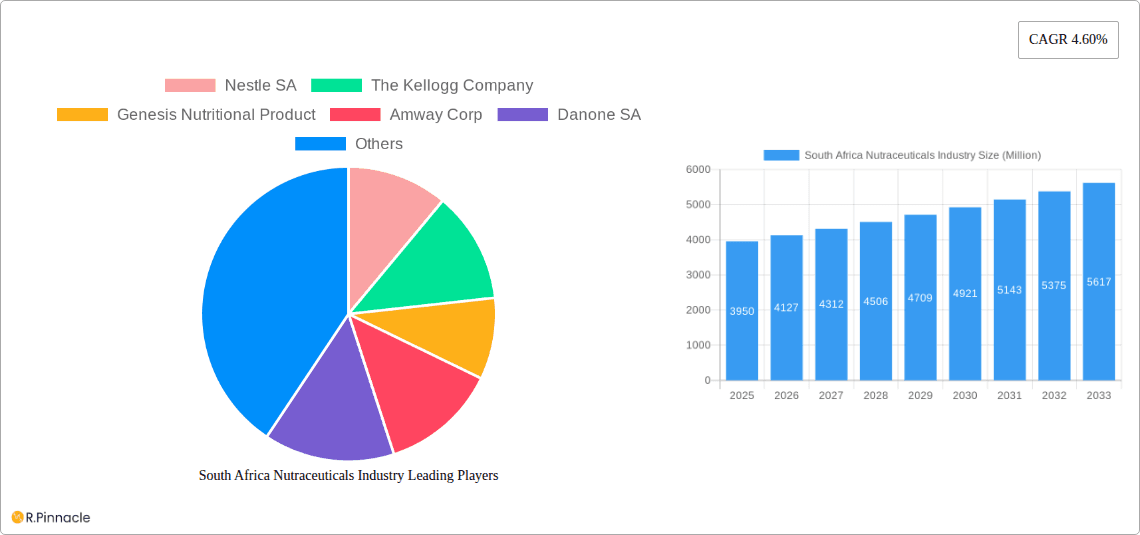

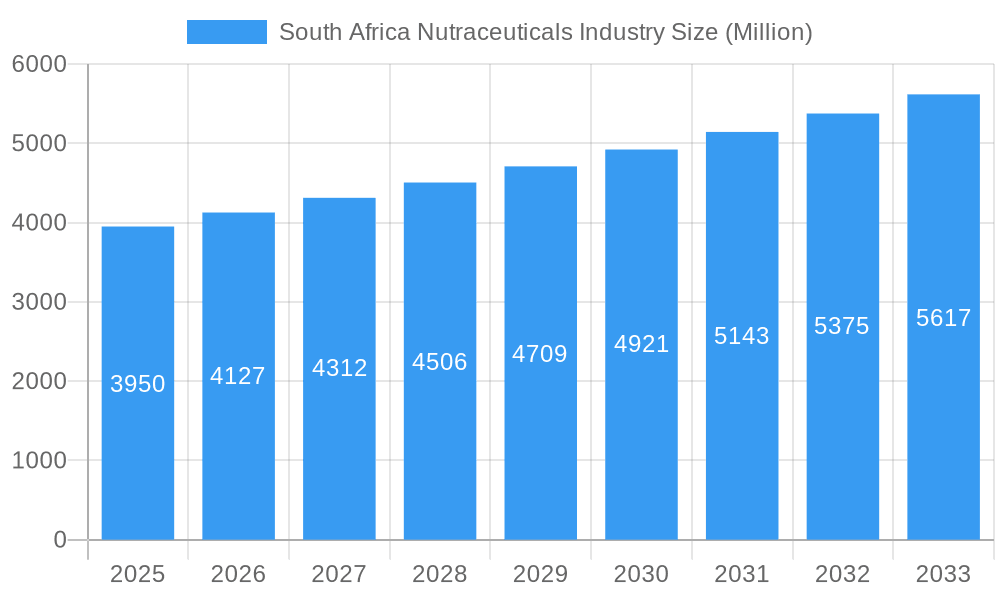

The South African nutraceuticals market, valued at $3.95 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.60% from 2025 to 2033. This expansion is driven by several key factors. Increasing health consciousness among South Africans, coupled with rising disposable incomes, fuels demand for functional foods and dietary supplements offering targeted health benefits. The prevalence of lifestyle diseases like diabetes and cardiovascular issues further stimulates the market, as consumers actively seek preventive and therapeutic options. Furthermore, the growing awareness of the importance of immunity and overall well-being, especially post-pandemic, significantly contributes to this upward trajectory. The market is segmented across various product categories, including vitamins and minerals, probiotics, herbal supplements, and sports nutrition products, each catering to specific consumer needs and preferences. Major players like Nestle SA, Kellogg's, and Danone SA, along with local and international brands, compete within this dynamic market, continuously innovating to meet evolving consumer demands. Government initiatives promoting healthier lifestyles also positively influence market growth.

South Africa Nutraceuticals Industry Market Size (In Billion)

While the market enjoys significant growth potential, challenges remain. Price sensitivity among a considerable portion of the population could hinder the market’s overall expansion for certain premium products. The regulatory landscape surrounding nutraceuticals in South Africa also plays a significant role, influencing product development and market entry for both domestic and international players. Competition, particularly from established food and beverage companies diversifying into the nutraceutical space, could intensify in the coming years. Effective marketing and communication strategies are therefore crucial for brands to communicate the value proposition of their products and build consumer trust and loyalty. The focus will be on natural, sustainably sourced ingredients, and transparent labeling to cater to the growing demands of discerning consumers.

South Africa Nutraceuticals Industry Company Market Share

This comprehensive report provides a detailed analysis of the South Africa nutraceuticals industry, offering invaluable insights for industry professionals, investors, and strategic planners. Leveraging rigorous research and data analysis spanning the period 2019-2033 (with a base year of 2025 and forecast period 2025-2033), this report illuminates market dynamics, growth drivers, and future opportunities. The report covers key segments, including production, consumption, import/export, and price trends, offering a granular understanding of this rapidly evolving market.

South Africa Nutraceuticals Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the South African nutraceuticals market, focusing on market concentration, innovation, regulations, and M&A activity. The market is characterized by a mix of multinational giants and local players. Key players include Nestle SA, The Kellogg Company, Genesis Nutritional Products, Amway Corp, Danone SA, Red Bull GmbH, Herbalife Nutrition, The Coca-Cola Company, Ascendis Health, GlaxoSmithKline PLC, and many others. The market share held by these companies varies considerably, with Nestle SA and The Kellogg Company likely holding a significant portion. However, accurate market share figures for each player require proprietary data analysis. M&A activity has been moderate, with deal values estimated in the tens of Millions of Rand annually, driving consolidation and reshaping the competitive dynamics. The regulatory framework is continuously evolving, impacting product approvals and labeling requirements. Innovation is driven by consumer demand for functional foods and supplements, leading to the development of new products with enhanced health benefits. The report also examines product substitutes, which are increasing with rising consumer interest in natural alternatives and homemade remedies.

- Market Concentration: Moderately concentrated, with a few large players dominating certain segments.

- Innovation Drivers: Consumer demand for functional foods, health & wellness trends, technological advancements.

- Regulatory Framework: Evolving regulations influence product development and marketing.

- Product Substitutes: Growing availability of natural and homemade alternatives.

- End-User Demographics: Growing middle class and aging population drive demand.

- M&A Activity: Moderate activity with deal values in the tens of Millions of Rands annually.

South Africa Nutraceuticals Industry Market Dynamics & Trends

The South African nutraceuticals market exhibits robust growth, driven by several key factors. Rising health consciousness among consumers, increased disposable incomes, and an aging population are fueling demand for nutritional supplements and functional foods. Technological advancements in product formulation and delivery systems further contribute to market expansion. The market's CAGR during the historical period (2019-2024) was xx%, and this is projected to continue its positive growth trajectory. Market penetration is highest in urban areas with a higher disposable income, reflecting affordability as a primary factor. The competitive landscape is dynamic, with both established players and new entrants vying for market share, leading to increased product diversity and innovation. However, challenges include economic fluctuations, fluctuating raw material prices and inconsistent consumer purchasing power that affect the industry's performance.

Dominant Regions & Segments in South Africa Nutraceuticals Industry

The report identifies key regional and segmental dominance within the South African nutraceutical market, utilizing data from production, consumption, import, export, and price trend analyses. Specific data for each area is detailed within the full report; this section summarizes key findings.

- Production Analysis: Gauteng province likely dominates due to infrastructure and established manufacturing capabilities.

- Consumption Analysis: Urban areas with higher disposable incomes show higher consumption rates.

- Import Market Analysis: xx Million Rand in value, with a majority of imports likely sourced from neighboring African countries and Asian nations.

- Export Market Analysis: xx Million Rand in value, with exports primarily to other African countries.

- Price Trend Analysis: Prices are moderately influenced by raw material costs and exchange rate fluctuations.

South Africa Nutraceuticals Industry Product Innovations

The South African nutraceutical market witnesses ongoing product innovation, with a focus on personalized nutrition, functional foods, and convenient formats. Technological advancements in extraction methods, encapsulation techniques, and delivery systems enhance product efficacy and appeal. Companies are increasingly leveraging digital platforms to reach target consumers and provide personalized recommendations. New products emphasize natural ingredients, organic certification, and sustainability.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation of the South African nutraceuticals market across various parameters. These segments are analyzed based on product type (vitamins, minerals, probiotics, etc.), distribution channel (pharmacies, supermarkets, online retailers), and consumer demographics. Each segment's market size, growth projections, and competitive dynamics are analyzed thoroughly. Specific values for each segment's market size and growth projections will be available within the full report.

Key Drivers of South Africa Nutraceuticals Industry Growth

Several factors contribute to the growth of the South African nutraceuticals industry. These include the rising prevalence of chronic diseases, increasing health awareness amongst consumers, expanding middle class with increased disposable incomes, and growing adoption of functional foods and dietary supplements. Government initiatives supporting health and wellness also contribute.

Challenges in the South Africa Nutraceuticals Industry Sector

The industry faces challenges, including stringent regulations, supply chain disruptions due to logistics and import/export issues, intense competition, and the fluctuating economic climate impacting consumer purchasing power. Counterfeit products pose another significant challenge, eroding consumer trust.

Emerging Opportunities in South Africa Nutraceuticals Industry

The South African nutraceuticals market presents lucrative opportunities. The expanding health and wellness market creates demand for specialized supplements and functional foods targeting specific needs. Growth in e-commerce and digital marketing enables wider reach, and the development of innovative products catering to niche segments presents strong potential.

Leading Players in the South Africa Nutraceuticals Industry Market

- Nestle SA

- The Kellogg Company

- Genesis Nutritional Products

- Amway Corp

- Danone SA

- Red Bull GmbH

- Herbalife Nutrition

- The Coca-Cola Company

- Ascendis Health

- GlaxoSmithKline PLC

Key Developments in South Africa Nutraceuticals Industry Industry

- 2022 Q4: Launch of a new probiotic supplement by Nestle SA.

- 2023 Q1: Acquisition of a local supplement manufacturer by Ascendis Health.

- 2023 Q3: Introduction of new regulations regarding labeling and marketing of supplements.

Future Outlook for South Africa Nutraceuticals Industry Market

The South African nutraceuticals market is poised for continued expansion driven by sustained growth in health consciousness, disposable incomes, and innovative product development. The market's growth will be influenced by economic stability and continued development of advanced products. Strategic partnerships and investments in research and development will be crucial for success.

South Africa Nutraceuticals Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Nutraceuticals Industry Segmentation By Geography

- 1. South Africa

South Africa Nutraceuticals Industry Regional Market Share

Geographic Coverage of South Africa Nutraceuticals Industry

South Africa Nutraceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Rising Healthcare Costs and Focus on Preventive Health Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Kellogg Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genesis Nutritional Product

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Red Bull GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Herbalife Nutrition

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascendis Health*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: South Africa Nutraceuticals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Nutraceuticals Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Africa Nutraceuticals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Nutraceuticals Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the South Africa Nutraceuticals Industry?

Key companies in the market include Nestle SA, The Kellogg Company, Genesis Nutritional Product, Amway Corp, Danone SA, Red Bull GmbH, Herbalife Nutrition, The Coca-Cola Company, Ascendis Health*List Not Exhaustive, GlaxoSmithKline PLC.

3. What are the main segments of the South Africa Nutraceuticals Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Rising Healthcare Costs and Focus on Preventive Health Management.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Nutraceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Nutraceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Nutraceuticals Industry?

To stay informed about further developments, trends, and reports in the South Africa Nutraceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence