Key Insights

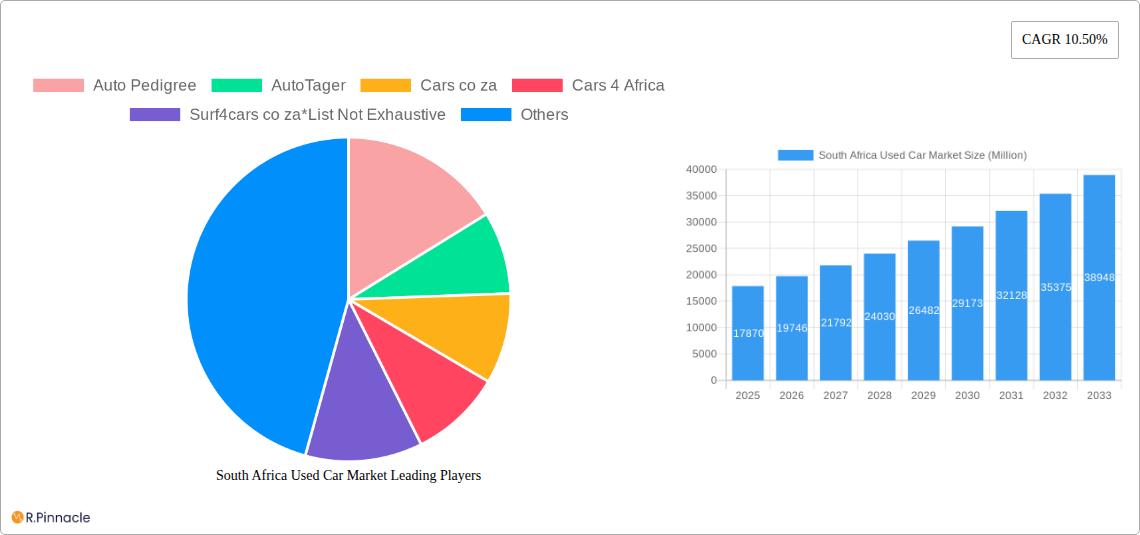

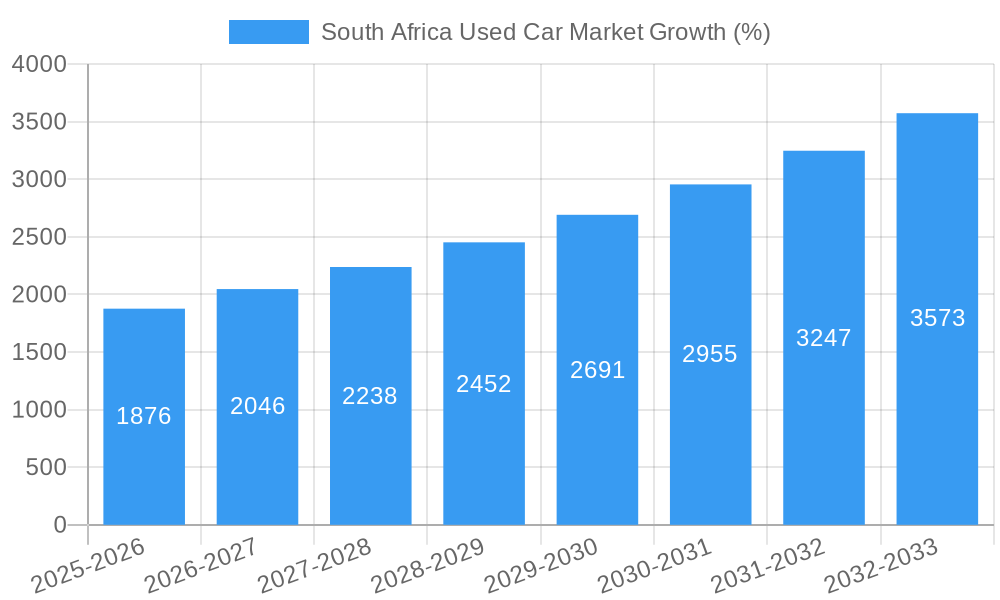

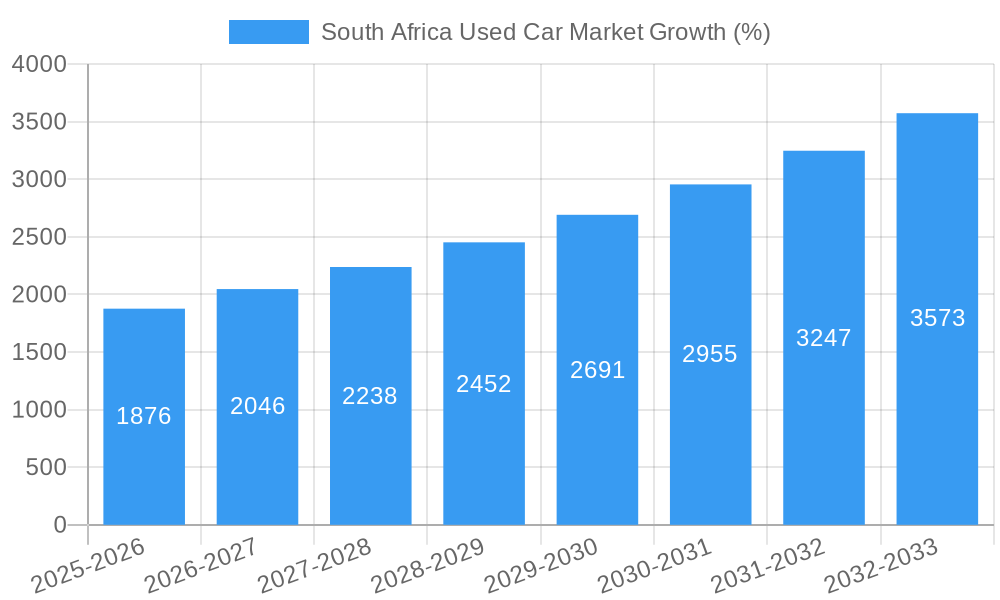

The South African used car market, valued at $17.87 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This expansion is driven by several factors. Firstly, the increasing affordability of used vehicles compared to new cars makes them an attractive option for a larger segment of the population, particularly in a developing economy like South Africa. Secondly, the rise of online used car marketplaces has significantly improved transparency and convenience for buyers, streamlining the purchasing process and boosting market activity. Thirdly, a growing middle class with increased disposable income fuels demand for personal transportation, contributing to the market's expansion. The market is segmented by vendor type (organized vs. unorganized), vehicle type (hatchbacks, sedans, SUVs, MPVs), fuel type (petrol, diesel, others), and booking type (online, offline). The organized sector, benefiting from established reputations and robust online presence, is expected to witness higher growth than its unorganized counterpart. SUVs and MPVs, driven by consumer preference for spaciousness and versatility, are predicted to be significant growth drivers within the vehicle type segment. While the online booking segment is experiencing rapid growth, the offline market continues to play a significant role, especially in rural areas and among older demographics. Challenges include fluctuating fuel prices and economic uncertainty which can impact consumer spending decisions.

The competitive landscape is dynamic, featuring both established players like AutoTrader South Africa and newer entrants leveraging technology for improved efficiency and reach. Companies like Auto Pedigree, AutoTager, and Autochek Africa are contributing to increased transparency and trust within the market through innovative inspection and verification services. Regional variations exist within South Africa, with urban centers generally exhibiting higher transaction volumes than rural areas. Further growth is expected in regions like Gauteng and Western Cape due to their higher population densities and economic activity. The market’s evolution is closely intertwined with broader economic trends in South Africa, infrastructure development, and evolving consumer preferences. Growth is therefore projected to continue although subject to macroeconomic shifts.

South Africa Used Car Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa used car market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025 market and forecasts extending to 2033. It meticulously examines market structure, dynamics, segmentation, key players, and future trends, empowering you to navigate this dynamic sector effectively. The report includes detailed financial projections, market sizing and segmentation analysis, and a thorough examination of market participants, including but not limited to Auto Pedigree, AutoTager, Cars.co.za, Cars 4 Africa, Surf4cars.co.za, We Buy Cars, Autochek Africa, AutoTrader South Africa, CarMag, and Cars.

South Africa Used Car Market Market Structure & Innovation Trends

This section analyzes the South African used car market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activity from 2019-2024. The report assesses the market share of major players and examines the value of significant mergers and acquisitions. It also explores the influence of technological advancements, government regulations, and evolving consumer preferences on market structure.

- Market Concentration: The report details the level of market concentration, identifying dominant players and assessing their market share. Data on market share will be provided for key players.

- Innovation Drivers: Analysis of factors driving innovation, including technological advancements (e.g., online platforms, vehicle inspection technologies), evolving consumer preferences, and regulatory pressures.

- Regulatory Frameworks: Examination of existing regulations impacting the used car market, including those related to vehicle safety, emissions, and consumer protection.

- Product Substitutes: Assessment of potential substitutes for used cars, including public transportation and ride-sharing services, and their impact on market demand.

- End-User Demographics: Analysis of the demographic profile of used car buyers in South Africa, considering factors such as age, income, and location.

- M&A Activities: Review of mergers and acquisitions in the South African used car market during the historical period (2019-2024), including deal values and their implications for market dynamics. The report will include at least XX Million USD in M&A deal value analysis.

South Africa Used Car Market Market Dynamics & Trends

This section provides a deep dive into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. It includes projections for Compound Annual Growth Rate (CAGR) and market penetration, using data collected from 2019 to 2024, to project to 2033.

(This section will contain approximately 600 words detailing market growth drivers, technological disruptions, consumer preferences and competitive dynamics including CAGR and market penetration analysis. Specific data will be incorporated into the full report.)

Dominant Regions & Segments in South Africa Used Car Market

This section identifies the leading regions and segments within the South African used car market based on vendor type (organized vs. unorganized), vehicle type (hatchbacks, sedans, SUVs, MPVs), fuel type (petrol, diesel, others), and booking type (online vs. offline).

- By Vendor Type: Analysis of the market share and growth potential of organized and unorganized vendors. The report will determine which vendor type is dominant and explain why.

- By Vehicle Type: Examination of the popularity and market size of different vehicle types, identifying the most dominant segment.

- By Fuel Type: Assessment of the market share of petrol, diesel, and other fuel types, highlighting any trends and shifts.

- By Booking Type: Comparison of online and offline booking channels, analyzing their market penetration and growth trajectories.

(This section will contain approximately 600 words using bullet points and paragraphs to analyze dominance across the aforementioned segments, including key drivers such as economic policies and infrastructure.)

South Africa Used Car Market Product Innovations

This section summarizes recent product developments and technological advancements shaping the used car market. It highlights innovations that offer competitive advantages and improve market fit.

(This section will contain approximately 100-150 words describing product developments, applications and competitive advantages, focusing on technological trends and market fit.)

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report and provides an overview of each segment's growth projections, market size, and competitive dynamics.

- By Vendor Type: Growth projections, market size, and competitive analysis for organized and unorganized vendors.

- By Vehicle Type: Growth projections, market size, and competitive analysis for hatchbacks, sedans, SUVs, and MPVs.

- By Fuel Type: Growth projections, market size, and competitive analysis for petrol, diesel, and other fuel types.

- By Booking Type: Growth projections, market size, and competitive analysis for online and offline bookings.

(This section will contain approximately 100-150 words with a paragraph per segment.)

Key Drivers of South Africa Used Car Market Growth

This section outlines the key factors driving growth in the South African used car market.

(This section will contain approximately 150 words using paragraphs or lists and focusing on technological, economic and regulatory factors with specific examples.)

Challenges in the South Africa Used Car Market Sector

This section discusses the challenges and restraints impacting the used car market in South Africa.

(This section will contain approximately 150 words in paragraph or list form, addressing regulatory hurdles, supply chain issues and competitive pressures with quantifiable impacts.)

Emerging Opportunities in South Africa Used Car Market

This section highlights emerging opportunities within the South African used car market.

(This section will contain approximately 150 words using paragraphs or lists, focusing on new markets, technologies or consumer preferences.)

Leading Players in the South Africa Used Car Market Market

This section profiles key players in the South African used car market.

- Auto Pedigree

- AutoTager

- Cars.co.za

- Cars 4 Africa

- Surf4cars.co.za

- We Buy Cars

- Autochek Africa

- AutoTrader South Africa

- CarMag

- Cars

Key Developments in South Africa Used Car Market Industry

This section details significant developments impacting the market.

- September 2023: Auto24, an Ivorian used car marketplace, announced its expansion into four new African markets: Morocco, Rwanda, Senegal, and South Africa.

- November 2023: Shekel Mobility secured USD 7 million in funding.

- April 2024: WeBuyCars announced its target of raising ~USD 420 million.

Future Outlook for South Africa Used Car Market Market

This section summarizes the future potential and strategic opportunities within the South African used car market.

(This section will contain approximately 150 words in paragraph form, focusing on future market potential and strategic opportunities.)

South Africa Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Others

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Vendor Type

- 4.1. Organized

- 4.2. Unorganized

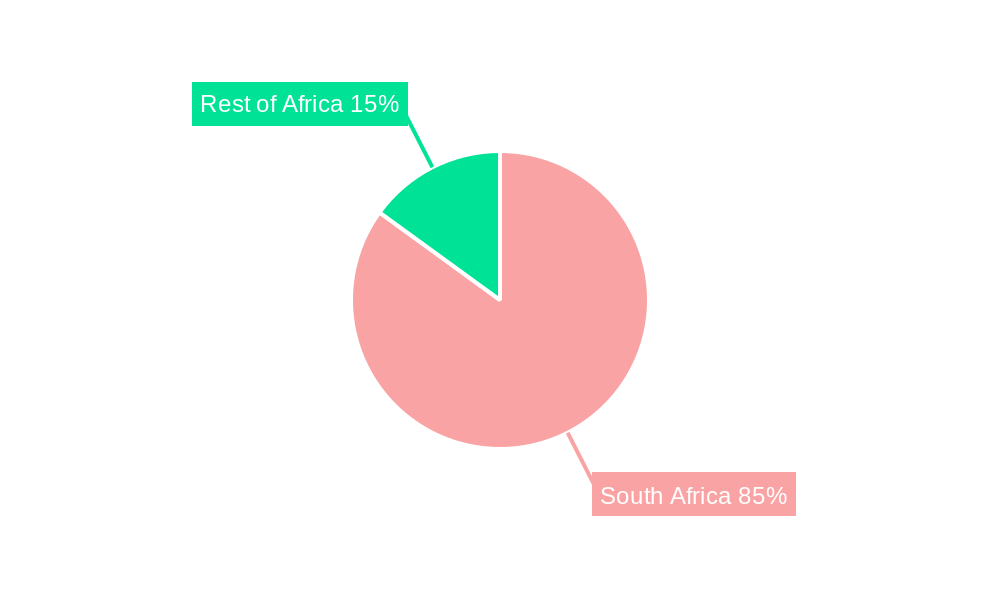

South Africa Used Car Market Segmentation By Geography

- 1. South Africa

South Africa Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Use of Online Platforms

- 3.3. Market Restrains

- 3.3.1. Stringent Governmental Regulations and Import Taxes Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. The Unorganized Segment Holds a Major Share in the South Africa Used Car Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vendor Type

- 5.4.1. Organized

- 5.4.2. Unorganized

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. South Africa South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Used Car Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Auto Pedigree

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 AutoTager

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cars co za

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cars 4 Africa

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Surf4cars co za*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 We Buy Cars

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Autochek Africa

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 AutoTrader South Africa

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CarMag

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cars

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Auto Pedigree

List of Figures

- Figure 1: South Africa Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: South Africa Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: South Africa Used Car Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 5: South Africa Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 6: South Africa Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South Africa Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa South Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan South Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda South Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania South Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya South Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa South Africa Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: South Africa Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: South Africa Used Car Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 17: South Africa Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 18: South Africa Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Used Car Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the South Africa Used Car Market?

Key companies in the market include Auto Pedigree, AutoTager, Cars co za, Cars 4 Africa, Surf4cars co za*List Not Exhaustive, We Buy Cars, Autochek Africa, AutoTrader South Africa, CarMag, Cars.

3. What are the main segments of the South Africa Used Car Market?

The market segments include Vehicle Type, Fuel Type, Booking Type, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.87 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Use of Online Platforms.

6. What are the notable trends driving market growth?

The Unorganized Segment Holds a Major Share in the South Africa Used Car Market.

7. Are there any restraints impacting market growth?

Stringent Governmental Regulations and Import Taxes Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2024: WeBuyCars, a South African used-car platform, announced its target of raising ZAR 7.8 billion (~USD 420 million) when its shares begin trading on the Johannesburg Stock Exchange (JSE). The company has issued 417,181,120 shares at a consideration of ZAR 18.75 per share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Used Car Market?

To stay informed about further developments, trends, and reports in the South Africa Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence